Professional Documents

Culture Documents

Fanime Sellers Permit

Fanime Sellers Permit

Uploaded by

Brian LiangOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fanime Sellers Permit

Fanime Sellers Permit

Uploaded by

Brian LiangCopyright:

Available Formats

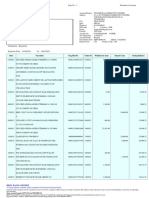

DISPLAY THIS PERMIT CONSPICUOUSLY AT THE PLACE OF BUSINESS FOR WHICH IT IS ISSUED

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

TEMPORARY SELLER’S PERMIT

PERMIT NUMBER

248486080 - 00002

PHIB

BRIAN LIANG EFFECTIVE DATE:

150 W SAN CARLOS ST May 26, 2022 thru May 31, 2022

SAN JOSE CA 95113-2005

YOU ARE REQUIRED TO OBEY ALL FEDERAL AND

IS HEREBY AUTHORIZED TO ENGAGE IN THE BUSINESS OF STATE LAWS THAT REGULATE OR CONTROL

SELLING TANGIBLE PERSONAL PROPERTY AT THE ABOVE YOUR BUSINESS. THIS PERMIT DOES NOT ALLOW

LOCATION. YOU TO DO OTHERWISE.

PLEASE RETAIN THIS DOCUMENT FOR YOUR

RECORDS.

THIS PERMIT IS VALID FOR THE PERIODS SHOWN AND IS NOT TRANSFERABLE.

FOR GENERAL TAX QUESTIONS, PLEASE CALL OUR CUSTOMER SERVICE CENTER AT 1-800-400-7115 (CRS:711).

FOR INFORMATION ON YOUR RIGHTS, CONTACT THE TAXPAYERS' RIGHTS ADVOCATE OFFICE AT 1-888-324-2798.

CDTFA-442-ST REV. 9 (2-22)

A MESSAGE TO OUR PERMIT HOLDER

As a permitee, you have certain rights and responsibilities under the Sales and Use Tax Law. For

assistance, we offer the following resources:

• Our website at www.cdtfa.ca.gov.

• Our toll-free Customer Service Center at 1-800-400-7115 (CRS:711). Customer service representatives

are available Monday through Friday from 8:00 a.m. to 5:00 p.m. (Pacific time), except state holidays.

As a permittee, you are expected to maintain the normal books and records of a prudent businessperson. You

are required to maintain these books and records for no less than four years, and make them available for

inspection by a California Department of Tax and Fee Administration (CDTFA) representative when requested.

You are also required to know and charge the correct sales or use tax rate, including any local and district taxes.

You must notify us if you are buying, selling, adding a location, or discontinuing your business; adding or

dropping a partner, officer, or member; or when you are moving any or all of your business locations. This permit

is valid only for the owner specified on the permit. A person who obtains a permit and ceases to do business, or

never commenced business, shall surrender their permit by immediately notifying CDTFA in writing at this

address: California Department of Tax and Fee Administration, Field Operations Division, P.O. Box 942879,

Sacramento, CA 94279-0047. You may also surrender the permit to a CDTFA representative.

If you would like to know more about your rights as a taxpayer, or if you are unable to resolve an issue with

CDTFA, please contact the Taxpayers' Rights Advocate Office for help by calling 1-888-324-2798 or by faxing

1-916-323-3319.

As authorized by law, information provided by an applicant for a permit may be disclosed to other government

agencies.

You might also like

- CPM - Guidant Corporation Shaping Culture Through Systems - ChristoperDocument19 pagesCPM - Guidant Corporation Shaping Culture Through Systems - ChristoperChrisNaga86% (7)

- Liberty Mutual FormsDocument3 pagesLiberty Mutual FormsdadavemysterNo ratings yet

- GTC Naturz Resources Pvt. LTD.: Bill of SupplyDocument1 pageGTC Naturz Resources Pvt. LTD.: Bill of SupplyGTC NaturzNo ratings yet

- Shikher - Mscu9891530Document1 pageShikher - Mscu9891530Ravi kantNo ratings yet

- Level 3 Student Book Unit 1Document12 pagesLevel 3 Student Book Unit 1Bassem MohamedNo ratings yet

- Opl 3 DatabaseDocument19 pagesOpl 3 Databasedeep_sorari7No ratings yet

- Inv 86227 From REPLICATOR DEPOT INC. 1792 PDFDocument1 pageInv 86227 From REPLICATOR DEPOT INC. 1792 PDFAnonymous 5CcoKmhNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document30 pagesIndividual Account Opening Form: (Demat + Trading)ONE STEP for othersNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document21 pagesIndividual Account Opening Form: (Demat + Trading)Akshara KaraleNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document29 pagesIndividual Account Opening Form: (Demat + Trading)AkshathNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document29 pagesIndividual Account Opening Form: (Demat + Trading)Paras SinghNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document23 pagesIndividual Account Opening Form: (Demat + Trading)anaparthi naveenNo ratings yet

- Valuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCDocument12 pagesValuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCCecil PearsonNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document22 pagesIndividual Account Opening Form: (Demat + Trading)Ashneet KaurNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document31 pagesIndividual Account Opening Form: (Demat + Trading)zenith view filmsNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document22 pagesIndividual Account Opening Form: (Demat + Trading)Shreevathsa NsNo ratings yet

- Brandon AndersonDocument2 pagesBrandon AndersonbrandoncrimefighterNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document22 pagesIndividual Account Opening Form: (Demat + Trading)Senthamizhan NandhakumarNo ratings yet

- CSC Naseeb RazaDocument3 pagesCSC Naseeb RazaMuhammad Naseeb RazaNo ratings yet

- PDFDocument2 pagesPDFbala kNo ratings yet

- Account Opening Form For Non Individuals IDBIDocument8 pagesAccount Opening Form For Non Individuals IDBISR TechnologiesNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument18 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRahul GuptaNo ratings yet

- AY2021-22 NAGENDER GATTU-BYVPG0689K-Computation-1Document2 pagesAY2021-22 NAGENDER GATTU-BYVPG0689K-Computation-1forty oneNo ratings yet

- Tax Invoice: OriginalDocument12 pagesTax Invoice: OriginalMuzammil SayedNo ratings yet

- Groww Stock Account Opening FormDocument21 pagesGroww Stock Account Opening FormSatyadipNo ratings yet

- Transactions History: Statement of Account 027310100092293 For The Period of ToDocument3 pagesTransactions History: Statement of Account 027310100092293 For The Period of ToSrikanthNo ratings yet

- MCA21 - Company Master DetailsDocument1 pageMCA21 - Company Master DetailsHimanshu ThakkarNo ratings yet

- Equity Trading and Demat Account Opening FormDocument21 pagesEquity Trading and Demat Account Opening FormABHISHEK M JOGURNo ratings yet

- Amount of Tax WithheldDocument1 pageAmount of Tax WithheldMelody Frac ZapateroNo ratings yet

- Valuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCDocument12 pagesValuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCinsert edgy username hereNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document26 pagesIndividual Account Opening Form: (Demat + Trading)Annu KashyapNo ratings yet

- Statement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitDocument3 pagesStatement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitKumar ManojNo ratings yet

- Kyb Motorcycle Suspension India Pvt. LTD.: Pay Slip Cum Time Card Form-25B For The Month of May 2021Document1 pageKyb Motorcycle Suspension India Pvt. LTD.: Pay Slip Cum Time Card Form-25B For The Month of May 2021Praveen kumarNo ratings yet

- SalarySlip Oct 2021Document1 pageSalarySlip Oct 2021shreyas kotiNo ratings yet

- Invoice: Your Payment Is Much Appreciated This Is Computer Generated Document and No Signature RequiredDocument2 pagesInvoice: Your Payment Is Much Appreciated This Is Computer Generated Document and No Signature RequiredUmmi MaryamNo ratings yet

- Helpline 0141-3532000 7230044001, 7230044002: Bikaner Electricity Supply LimitedDocument1 pageHelpline 0141-3532000 7230044001, 7230044002: Bikaner Electricity Supply LimitedHimanshuNo ratings yet

- Subrata Dhara Paytm StatementDocument2 pagesSubrata Dhara Paytm StatementShúbhám ChoúnipurgéNo ratings yet

- Motor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceDocument2 pagesMotor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceAbhisek KumarNo ratings yet

- Commodities Account Opening Form: Document Significance PAGE(s)Document39 pagesCommodities Account Opening Form: Document Significance PAGE(s)17-478 lingeswarNo ratings yet

- AccountStatement 5215Document3 pagesAccountStatement 5215Raghu RamanNo ratings yet

- Keenan Green - Pardon and Parole LetterDocument1 pageKeenan Green - Pardon and Parole Lettersavannahnow.comNo ratings yet

- Customer Details: GST NO.:24AAFCA3788D1ZSDocument2 pagesCustomer Details: GST NO.:24AAFCA3788D1ZSMojilo GujjuNo ratings yet

- RichardZurita 2019 03 01 PDFDocument1 pageRichardZurita 2019 03 01 PDFRic ZurNo ratings yet

- 2806 Ludhiana Dec 2022Document1 page2806 Ludhiana Dec 2022Randhir ChaubeyNo ratings yet

- Wage CalculatorDocument3 pagesWage CalculatorPoppy LooksNo ratings yet

- Private & ConfidentialDocument2 pagesPrivate & Confidentialapi-3701571No ratings yet

- Equity Trading and Demat Account Opening FormDocument15 pagesEquity Trading and Demat Account Opening FormTuleshwar singh paikraNo ratings yet

- Invoice 10116-0 PDFDocument2 pagesInvoice 10116-0 PDFMilton GarageNo ratings yet

- Groww Stock Account Opening FormDocument12 pagesGroww Stock Account Opening FormAbdulla ThajilaNo ratings yet

- Unit Holder Previleges: Account Statement 3192455114 Folio NumberDocument2 pagesUnit Holder Previleges: Account Statement 3192455114 Folio NumberDheeraj SharmaNo ratings yet

- Employee Details For RazorpayX PayrollDocument8 pagesEmployee Details For RazorpayX PayrollDeepak kumar M RNo ratings yet

- Commodities Account Opening Form: Document Significance PAGE(s)Document40 pagesCommodities Account Opening Form: Document Significance PAGE(s)Krishna Kiran VyasNo ratings yet

- Neustar (Rodney Joffe Co) FPDS Search - Contract AwardsDocument139 pagesNeustar (Rodney Joffe Co) FPDS Search - Contract AwardsFile 411No ratings yet

- Invoice #183Document1 pageInvoice #183VictorNo ratings yet

- Tax Invoice: Original For RecipientDocument6 pagesTax Invoice: Original For RecipientHarshal KolheNo ratings yet

- V K Sharma (5229)Document1 pageV K Sharma (5229)Vikas Kumar SharmaNo ratings yet

- Statement of Account: L036G SBI Contra Fund - Regular Plan - Growth NAV As On 28/09/2021: 194.6193Document4 pagesStatement of Account: L036G SBI Contra Fund - Regular Plan - Growth NAV As On 28/09/2021: 194.6193Soumya Ranjan Mohanty PupunNo ratings yet

- JunioDocument56 pagesJunioDianA mMNo ratings yet

- 1579589569513Document2 pages1579589569513Manish ChopraNo ratings yet

- EDocument13 pagesESudipta Ghosh0% (1)

- Powered & Maintained by NSDL E-Governance Infrastructure LTD.© 2015 NSDL E-GovDocument4 pagesPowered & Maintained by NSDL E-Governance Infrastructure LTD.© 2015 NSDL E-GovEr Aniket HarekarNo ratings yet

- Trading & Demat Account Opening Form and Power of Attorney: Application NoDocument35 pagesTrading & Demat Account Opening Form and Power of Attorney: Application NoMad AnshumanNo ratings yet

- Pe Tutorial 4 PDFDocument7 pagesPe Tutorial 4 PDFkibrom atsbhaNo ratings yet

- A Lesson Plan in Geography 1Document5 pagesA Lesson Plan in Geography 1Flora Mae DemaalaNo ratings yet

- Control Theory Concepts For Modeling Uncertainty in Enzyme Kinetics of Biochemical NetworksDocument11 pagesControl Theory Concepts For Modeling Uncertainty in Enzyme Kinetics of Biochemical NetworksLjubisa MiskovicNo ratings yet

- UA Fall 2017Document236 pagesUA Fall 2017Charles CearleyNo ratings yet

- Annotated Assigment 1 ECON1194B - Huynh Tuan Khai - s3926685 1Document5 pagesAnnotated Assigment 1 ECON1194B - Huynh Tuan Khai - s3926685 1Tue NgoNo ratings yet

- Lesson Plan ABMDocument3 pagesLesson Plan ABMSatish Varma0% (1)

- Acharya Nagarjuna University: Examination Application FormDocument2 pagesAcharya Nagarjuna University: Examination Application FormMaragani MuraligangadhararaoNo ratings yet

- Manual - Leapton Mono 665 - LP210-M-66-MHDocument13 pagesManual - Leapton Mono 665 - LP210-M-66-MHnogumoNo ratings yet

- Sub-Project Proposal: Municipality of Kabayan Barangay TAWANGANDocument6 pagesSub-Project Proposal: Municipality of Kabayan Barangay TAWANGANpres carap60% (5)

- JFFS3 Design Issues: Artem B. BityutskiyDocument36 pagesJFFS3 Design Issues: Artem B. Bityutskiyolena1000000No ratings yet

- SHRM HandbookDocument72 pagesSHRM HandbookVineeth Radhakrishnan100% (1)

- Team EkowDocument4 pagesTeam EkowDavid Ekow NketsiahNo ratings yet

- PA4600 & PA6000 User Manual - Rev GDocument53 pagesPA4600 & PA6000 User Manual - Rev GjatzireNo ratings yet

- Opium 160604163652Document14 pagesOpium 160604163652roberto cabungcagNo ratings yet

- NCM 205 LabDocument4 pagesNCM 205 LabAlthea Meg MasicampoNo ratings yet

- Analyses of Hidrodynamic Radial Forces On Centrifugal PumpDocument9 pagesAnalyses of Hidrodynamic Radial Forces On Centrifugal PumpAvstron D'AgostiniNo ratings yet

- Archimedes: Leon Kalashnikov 6-1Document3 pagesArchimedes: Leon Kalashnikov 6-1LeoNo ratings yet

- Comparative and SuperlativeDocument2 pagesComparative and SuperlativeKH AzzaNo ratings yet

- HSEC-B-09: Group Standard H3 - Manual Tasks and Workplace Ergonomics ManagementDocument3 pagesHSEC-B-09: Group Standard H3 - Manual Tasks and Workplace Ergonomics ManagementJohn KalvinNo ratings yet

- 510TS-G2 EngelskDocument2 pages510TS-G2 EngelskzumbulNo ratings yet

- Nurse Sarah QuizzesDocument39 pagesNurse Sarah QuizzesAYANAMI T PASCUANo ratings yet

- Statistics Final Pre TestDocument4 pagesStatistics Final Pre TestLorienelNo ratings yet

- School Zone DatabaseDocument18 pagesSchool Zone DatabaseActionNewsJaxNo ratings yet

- Rev A - XLTEK Neuroworks EEG Review Quick Guide-ENDocument1 pageRev A - XLTEK Neuroworks EEG Review Quick Guide-ENmacrufoNo ratings yet

- SL - No Description of Activity Inspection by Records Remark SUB Vendor Vendor Oif/Tpia 1 2 3Document1 pageSL - No Description of Activity Inspection by Records Remark SUB Vendor Vendor Oif/Tpia 1 2 3Suraj ShettyNo ratings yet

- Crushing It With YouTubeDocument30 pagesCrushing It With YouTubeEdwin Cuba Huamani100% (1)

- Owners Manual Cayman PCNADocument284 pagesOwners Manual Cayman PCNASzigyarto Alex-MihaiNo ratings yet