Professional Documents

Culture Documents

CA Final Audit Nov 21 Amendments

CA Final Audit Nov 21 Amendments

Uploaded by

Aneek JainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Final Audit Nov 21 Amendments

CA Final Audit Nov 21 Amendments

Uploaded by

Aneek JainCopyright:

Available Formats

CA Final Audit Nov 2021 Amendments

INDEX

Sr.No. Amendment Topic Page no.

1. Company Audit 1-5

2. Bank Audit 6

3. Tax Audit 6-9

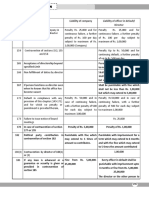

1. Company Audit

1.1 Changes in Penalty

Sr.no Section Penalty

1. 124 -Unpaid Dividend On Company- ₹ 100,000 and in On every officer of

Account case of continuing failure, with company-₹ 25,000 and in

a further penalty of ₹ 500 for case of continuing failure,

each day after the first during with a further penalty of ₹

which such failure continues, 100 for each day after the

subject to a maximum of ₹ first during which such

10,00,000 failure continues, subject to

a maximum of ₹ 2,00,000

2. 128- Books of account, If the managing director, the whole-time director in charge of

etc., to be kept by finance, the Chief Financial Officer or any other person of a

company company charged by the Board, contravenes such provisions,

such managing director, whole-time director in charge of

finance, Chief Financial officer or such other person of the

company shall be punishable with imprisonment for a term

Page | 1 By CA Sanidhya Saraf

CA Final Audit Nov 2021 Amendments

which may extend to one year or with fine which shall not be

less than fifty thousand rupees but which may extend to five lakh

rupees or with both.

3. 134- Financial If a company is in default in every officer of the company

statement, Board’s complying with the provisions who is in default shall be liable

report, etc of this section, the company to a penalty of ₹ 50,000

shall be liable to a penalty of

₹ 3,00,000 and

4. 140(3)- Removal, If the auditor does not comply with the provisions of sub-section

resignation of auditor (2), (The auditor who has resigned from the company shall file

and giving of special within a period of thirty days from the date of resignation, a

notice statement in the prescribed form (ADT-3) with the company

and the Registrar) he or it shall be liable to a penalty of ₹ 50,000

or an amount equal to the remuneration of the auditor,

whichever is less,

and in case of continuing failure, with further penalty of ₹ 500

for each day after the first during which such failure continues,

subject to a maximum of ₹ 2,00,000 five lakh rupees.

5. Section 143(15) -Fraud If any auditor, cost accountant or company secretary in

Reporting practice does not comply with the provisions of sub-section (12)

of section 143, he shall be liable to a penalty of ₹ 5,00,000 in case

of a listed company and a penalty of ₹ 1,00,000 in case of any

other company.

Imp note on Fraud Reporting - The auditor is also required to report under clause (x) of paragraph 3

of Companies (Auditor’s Report) Order, 2016 [CARO, 2016] on whether any fraud by the company or

any fraud on the Company has been noticed or reported during the year. If yes, the nature and the

amount involved is to be indicated. (CARO 2016 applicable for Nov 2021 Examination)

6. Section 147(1)- If any of the provisions of every officer of the company

Punishment for sections 139 to 146 (both who is in default shall be

contravention inclusive) is contravened, the punishable with

company shall be punishable imprisonment for a term

with fine which shall not be which may extend to one

less than ₹ 25,000 but which year or with fine which shall

may extend to ₹ 5,00,000 not be less than ₹ 10,000 but

and which may extend to one

lakh rupees, or with both

₹ 1,00,000

7. Section 147(2)- On Auditor-if section 139, On Auditor in case of

Punishment for section 143, section 144 or knowingly or wilfully with

contravention section 145 is contravened, the intention to deceive the

the auditor shall be punishable company or its shareholders or

with fine which shall not be less creditors or tax authorities-

than ₹ 25,000 but which may he shall be punishable with

extend to ₹ 5,00,000 or 4 times imprisonment for a term which

the remuneration of the auditor, may extend to one year and

whichever is less. with fine which shall not be

less than ₹ 50,000 but which

Page | 2 By CA Sanidhya Saraf

CA Final Audit Nov 2021 Amendments

may extend to ₹ 25,00,000 or

8 times the remuneration of

the auditor, whichever is less.

1.2 Section 143(3)(j) -Duties of Auditor [4,5,6 newly added)

(j) such other matters as may be prescribed. Rule 11 of the Companies (Audit and Auditors) Rules,

2014 prescribes the other matters to be included in auditor’s report. The auditor’s report shall also

include their views and comments on the following matters, namely: -

(1) whether the company has disclosed the impact, if any, of pending litigations on its financial

position in its financial statement;

(2) whether the company has made provision, as required under any law or accounting standards,

for material foreseeable losses, if any, on long term contracts including derivative contracts;

(3) whether there has been any delay in transferring amounts, required to be transferred, to the

Investor Education and Protection Fund by the company.

Note: these below 3 points are also applicable for audit of Banks.

(4) (i) Whether the management has represented that, to the best of it’s knowledge and belief,

other than as disclosed in the notes to the accounts, no funds have been advanced or loaned or

invested (either from borrowed funds or share premium or any other sources or kind of funds)

by the company to or in any other person(s) or entity(ies), including foreign entities

(“Intermediaries”), with the understanding, whether recorded in writing or otherwise, that the

Intermediary shall, whether, directly or indirectly lend or invest in other persons or entities

identified in any manner whatsoever by or on behalf of the company (“Ultimate Beneficiaries”)

or provide any guarantee, security or the like on behalf of the Ultimate Beneficiaries;

(ii) Whether the management has represented, that, to the best of it’s knowledge and belief,

other than as disclosed in the notes to the accounts, no funds have been received by the company

from any person(s) or entity(ies), including foreign entities (“Funding Parties”), with the

understanding, whether recorded in writing or otherwise, that the company shall, whether,

directly or indirectly, lend or invest in other persons or entities identified in any manner

whatsoever by or on behalf of the Funding Party (“Ultimate Beneficiaries”) or provide any

guarantee, security or the like on behalf of the Ultimate Beneficiaries; and

(iii) Based on such audit procedures that the auditor has considered reasonable and

appropriate in the circumstances, nothing has come to their notice that has caused them to believe

that the representations under sub-clause (i) and (ii) contain any material mis-statement.

(5) Whether the dividend declared or paid during the year by the company is in compliance

with section 123 of the Companies Act, 2013.

(6) [Whether the company, in respect of financial years commencing on or after the 1st April,

2022,] has used such accounting software for maintaining its books of account which has a feature

of recording audit trail (edit log) facility and the same has been operated throughout the year for

all transactions recorded in the software and the audit trail feature has not been tampered with

and the audit trail has been preserved by the company as per the statutory requirements for

record retention.]

Page | 3 By CA Sanidhya Saraf

CA Final Audit Nov 2021 Amendments

Analysis of Points given under 4,5 and 6

4 (i)- The management of the company will give a representation to auditor that it has disclosed in the

notes to account any amount given as advance, loan or invested to any person including foreign entity

or provide any guarantee or security on behalf of third entity. It is an additional requirement to keep a

check on the funds of the company.

4 (ii)- The management of the company will give a representation to auditor that it has disclosed in the

notes to account any amount received as advance, loan or invested to any person including foreign

entity or provide any guarantee or security on behalf of third entity. It is an additional requirement to

keep a check on the funds of the company.

4(iii)-It is for the auditors to check the requirements of 4(i) and 4(ii) and ensure that

representation given by the management has no material mis-statement.

5. Auditor will ensure compliance of section 123 of Companies Act,2013 and accordingly report

on it.

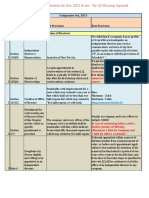

6. Audit Trail (Edit Log)- An audit trail is an organized record to trace the foundation of financial

data and provides sequential, documentary evidence of a series of events and is therefore used

to verify the accuracy of data and track transactions.

For financial years commencing on or after the 1st April, 2022, company should use such

accounting software which has feature of recording audit trail. Enforcing the use of audit trail

for transactions recorded in accounting software by the government is a positive step in

restricting transaction fraud. Auditor will ensure proper implementation of such trail through

out the year and it must not be tampered. An audit trail feature comprising of the following:

1. Ability to record an audit trail of every transaction

2. Creating an audit log of each change made in the books of account,

3. Capture the details of changes (edits) such as date,

4. Ensure that no disablement of audit trail happens.

Accounting Software Example-ProfitBooks is completely free accounting software,

Profitbooks believes in transparent business and already has the audit trail feature. It will make

your task easier and save time. In addition to core accounting, ProfitBooks offers many useful

features not found in other traditional software. Some of them as listed below:

1. Powerful Inventory Management features

2. Invoicing with payment gateway integration

3. Expense Tracking

4. Support for multiple currencies

5. In-depth financial reporting

6. Audit Trail functionality

Page | 4 By CA Sanidhya Saraf

CA Final Audit Nov 2021 Amendments

Illustrative example of Audit trail

Note: - The Companies (Amendment) Act, 2017 effective 12-09-2018 inserted Section 197(16) of

the Companies Act, 2013 that requires as under:

“The auditor of the company shall, in his report under section 143, make a statement as to

whether the remuneration paid by the company to its directors is in accordance with the

provisions of this section, whether remuneration paid to any director is in excess of the limit laid

down under this section and give such other details as may be prescribed”.

As per Advisory issued by ICAI on 09-09-2019, the aforesaid reporting requirement for auditors of

public companies needs to be covered in auditor’s report under the Section “Report on Other Legal

and Regulatory Requirements”. (Learn the section of report-imp for MCQs) Accordingly, auditors

of public companies are advised to comply with the aforesaid reporting requirements in their auditor’s

reports.

Page | 5 By CA Sanidhya Saraf

CA Final Audit Nov 2021 Amendments

2. Bank Audit

2.1 Same reporting requirement -3 more points have been added as discussed above. - Rule 11 of

the Companies (Audit and Auditors) Rules, 2014

The auditor’s report shall also include their views and comments on the following matters. 3 more

points added (Loan advanced or taken, Dividend Sec 123 compliance, Audit trail throughout the

year) [Already discussed above] Section 143(3)(j)(4),(5) and (6)

3.Tax Audit

3.1 Revision of Tax Audit Report [Notification No.28/2021 dated 1.4.2021]

➢ Rule 6G- Forms 3CA/ 3CB and Form 3CD. The audit report furnished may be revised by the

person by getting revised report of audit from a chartered accountant, duly signed and verified

by such chartered accountant,

➢ if there is payment by such person after furnishing of report which necessitates recalculation

of disallowance under section 40 or section 43B.

➢ The said revised audit report has to be furnished before the end of the relevant assessment

year for which the report pertains. For example: For FY 2020-2021, relevant AY will be

2021-2022 and last date for such revised report would be 31st March,2022.

Note: Section 43B of the income tax act provides a list of expenses allowed as deduction under

the head ‘Income from business and profession’.

It states some expenses that can be claimed as deduction from the business income only in the

year of actual payment and not in the year when the liability to pay such expenses is

incurred.

Section 40 of IT Act,1961-Inadmissible deductions (Example Payment made without

deducting TDS)

3.2 Minor changes in Few Clauses

i) Clause 8A- (i) In PART –A for clause 8A, the following clause shall be substituted,

namely: - ―

8A Whether the assessee has opted for taxation under section 115BA/115BAA/115BAB/

*115BAC/ 115BAD? * Newly added

Note-Section 115BAC giving an option to individuals and HUF taxpayers to pay income tax at

lower rates.

Section 115BAD – A co-operative society resident in India shall have the option to pay tax at 22

per cent for assessment year 2021-22 onwards.

Page | 6 By CA Sanidhya Saraf

CA Final Audit Nov 2021 Amendments

ii) In PART-B, for clause 17, the following clause shall be substituted, namely: -

Clause 17. Where any land or building or both is transferred during the previous year for a

consideration less than value adopted or assessed or assessable by any authority of a State

Government referred to in section 43CAor 50C, please

Details of Consideration Value adopted or Whether provisions of second proviso to

property received or assessed or subsection (1) of section 43CA or fourth

accrued assessable proviso to clause (x)of sub-section (2) of

section 56 applicable? [Yes/No] .’’;

Note: Section 43CA- Stamp Duty Value of land and building to be taken as the full value of

consideration in respect of transfer, even if the same are held by the transferor as stock-in-trade

second proviso to subsection (1) of section 43CA - However, if the stamp duty value does not

exceed 110% of the consideration received or accruing then, such consideration shall be deemed

to be the full value of consideration for the purpose of computing profits and gains from transfer

of such asset.

Crux: If stamp duty value exceeds 110% of consideration- Stamp Duty Value will be full value of

consideration for the purpose of computing profits and gains from transfer of such asset.

If stamp duty value does not exceed 110% of consideration- Consideration value will be full value

of consideration for the purpose of computing profits and gains from transfer of such asset.

Example 1: Consideration Paid for Building held as stock- 120 Lakhs

Stamp Duty Value on date of registration – 130 Lakhs

Calculate Consideration value for section 43CA?

Page | 7 By CA Sanidhya Saraf

CA Final Audit Nov 2021 Amendments

Answer: Since 110 % of 120 Lakhs will be 132 Lakhs and Stamp duty value is 130 Lakhs which means

that stamp duty value does not exceeds 110% of consideration, hence Consideration value (120

Lakhs) will be full value of consideration for the purpose of computing profits and gains from transfer

of such asset. Clause 17 reporting in last column – YES

Example 2: Consideration Paid for Building held as stock- 120 Lakhs

Stamp Duty Value on date of registration – 150 Lakhs

Calculate Consideration value for section 43CA?

Answer: Since 110 % of 120 Lakhs will be 132 Lakhs and Stamp duty value is 150 Lakhs which means

that stamp duty value exceeds 110% of consideration, hence Stamp Duty Value on date of

registration – 150 Lakhs will be full value of consideration for the purpose of computing profits and

gains from transfer of such asset. Clause 17 reporting in last column - NO

Note: Section 56(2)(x) fourth proviso- [Provided also that in case of property being referred to in the

second proviso to sub-section (1) of section 43CA, the provisions of sub-item (ii) of item (B) shall have

effect as if for the words "ten per cent", the words "twenty per cent" had been substituted;

iii) In PART-B, Clause 18: Particulars of depreciation allowable as per the Income-tax Act, 1961

in respect of each asset or block of assets, as the case may be, in the following form.

For sub-clauses (ca) and (cb), the following sub-clauses, shall be substituted namely:-

“(ca) Adjustment made to the written down value under section 115BAC/115BAD (for assessment

year 2021-2022 only)……

(cb) Adjustment made to written down value of Intangible asset due to excluding value of goodwill

of a business or profession

Clause 18 Depreciation on Goodwill of a Business or Profession Not Allowed and to be taxed as

Capital Gains on transfer: Finance Bill, 2021 has amended the provisions of Income Tax Act,

1961 (“Act”) to disallow depreciation on the goodwill of a business or a profession. Depreciation

on self-generated goodwill is not allowed under the Income Tax Act.

With this amendment, depreciation on acquired or purchased Goodwill of a business or

profession cannot be claimed from 01.02.2021. Goodwill is expressly excluded from the block of

‘Intangible Assets’. Further, a deduction for the amount paid for acquiring Goodwill shall be

allowed on sale of Goodwill.

(cc) Adjusted written down value… ”;

iv) In PART-B, for in clause 32, for sub-clause (a)- Details of brought forward loss or depreciation

allowance, the following sub-clause shall be substituted, namely: -

(a) Details of brought forward loss or depreciation allowance, in the following manner,

to the extent available:

Page | 8 By CA Sanidhya Saraf

CA Final Audit Nov 2021 Amendments

Serial Assessment Nature of Amount as All Amount as adjusted Amounts as Remarks

Number Year loss/ returned* losses/allowances not by assessed

allowance (in (in allowed under section withdrawal of (give

rupees) rupees) 115BAA/ additional reference to

115BAC/115BAD depreciation on relevant

account of opting for order)

taxation under

section

115BAC/115BAD^

(1) (2) (3) (4) (5) (6) (7) (8)

Note: *If the assessed depreciation is less and no appeal pending then take assessed.

^To be filled in for assessment year 2021-2022 only.’’

Example of Clause 18 and 32 –

Co-operative society, resident in India, can opt for concessional rate of tax @25.168% [i.e.,

tax@22% plus surcharge@10% plus health and education cess (HEC)@4%] under section

115BAD in respect of its total income computed without giving effect to deduction under section

10AA, 32AD, 33AB, 33ABA, 35(1)(ii)/(iia)/(iii), 35(2AA), 35AD, 35CCC, additional depreciation

under section 32(1)(iia), deductions under Chapter VI-A (other than section 80JJAA) etc. and set

off of loss and depreciation brought forward from earlier years relating to the above deductions.

Hence, if any Co-operative society opts for section 115BAD,:Lets say additional depreciation on

a machine taken ₹ 5,00,000 , Block of assets now is ₹ 25,00,000 and brought forward loss - ₹

2,00,000 now it will be reversed and added back to block of asset.

Reporting under 3CD

✓ Clause 18 (ca) - ₹ 5,00,000 (Additional depreciation will be reversed)

✓ Clause 18 (cc)-Adjusted WDV of block- ₹ 25 Lakhs +5 Lakhs = ₹ 30 Lakhs

✓ Clause 32 Column 5 - ₹ 2,00,000 All losses/allowances not allowed under section 115BAA/

115BAC/115BAD

✓ Clause 32 Column 6 - ₹ 5,00,000 Amount as adjusted by withdrawal of additional depreciation

on account of opting for taxation under section115BAC/115BAD

(v) In PART-B, clause 36 shall be omitted.

Page | 9 By CA Sanidhya Saraf

You might also like

- Chase Auto TemplateDocument4 pagesChase Auto TemplateHillarie Meenach0% (1)

- Micro Finance Sacco Software Features PDFDocument4 pagesMicro Finance Sacco Software Features PDFdavid5441100% (2)

- Liabilty of AuditorDocument6 pagesLiabilty of AuditorKetan BhoirNo ratings yet

- Sugar Methodology PDFDocument12 pagesSugar Methodology PDFDeepak DharmarajNo ratings yet

- FR PDF 301020201304011912Document6 pagesFR PDF 301020201304011912nanak.sewaniiNo ratings yet

- GM Test Series: Auditing and AssuranceDocument10 pagesGM Test Series: Auditing and AssuranceAryanAroraNo ratings yet

- Amendments in CA Final Law For Nov 2018-2Document22 pagesAmendments in CA Final Law For Nov 2018-2RashikaNo ratings yet

- Section Name Section No. As Per New Companies Act, 2013 Section No. As Per Old Companies Act, 1956Document5 pagesSection Name Section No. As Per New Companies Act, 2013 Section No. As Per Old Companies Act, 1956Rohan KhatriNo ratings yet

- Advance Audit and Professional Ethics Amendment NotesDocument38 pagesAdvance Audit and Professional Ethics Amendment NotesSnehaNo ratings yet

- Some Important Penalties For CA Inter LawDocument5 pagesSome Important Penalties For CA Inter Lawmattabrhmdoodlemaster2000No ratings yet

- PenaltiesDocument4 pagesPenaltiesAneek JainNo ratings yet

- Inter Penalty Amendments Nov 2021Document7 pagesInter Penalty Amendments Nov 2021The ProCANo ratings yet

- Important Penalties For Cs Executive JUNE 2020 New Syllabus: About The AuthorDocument9 pagesImportant Penalties For Cs Executive JUNE 2020 New Syllabus: About The Authorarti chowdhryNo ratings yet

- Law PenaltyDocument36 pagesLaw PenaltyVanshika BhedaNo ratings yet

- Auditors PPT FinalDocument31 pagesAuditors PPT FinalSri V N Prakash Sharma, Asst. Professor, Management & Commerce, SSSIHLNo ratings yet

- Auditors PPT FinalDocument31 pagesAuditors PPT Finaldewashish mahatha100% (1)

- CA Final Law Amendments Dec 21 - Except IBCDocument18 pagesCA Final Law Amendments Dec 21 - Except IBCShruthi SNo ratings yet

- Final LawDocument35 pagesFinal LawSakshiK ChaturvediNo ratings yet

- Penalites Chart by Darshan Khare 1.pdf 1Document5 pagesPenalites Chart by Darshan Khare 1.pdf 1Pankaj PathakNo ratings yet

- 74 Paper 6AuditingandAssuranceDocument31 pages74 Paper 6AuditingandAssurancesrishasaravana21No ratings yet

- Important Penalties in Company LawDocument9 pagesImportant Penalties in Company LawLokesh RoongtaNo ratings yet

- CA Inter Auditing RTP Nov22Document30 pagesCA Inter Auditing RTP Nov22tholkappiyanjk14No ratings yet

- WWW - Edutap.co - In: Chapter X of Companies Act - Audit and Auditors Sections 140 To 142Document11 pagesWWW - Edutap.co - In: Chapter X of Companies Act - Audit and Auditors Sections 140 To 142Suvojit DeshiNo ratings yet

- Comapny QuestionsDocument36 pagesComapny QuestionsvinodNo ratings yet

- Audit and AssuranceDocument15 pagesAudit and AssuranceJones MaryNo ratings yet

- An Overview Relating To Audit Under The Companies Act, 1956Document8 pagesAn Overview Relating To Audit Under The Companies Act, 1956Siva KumarNo ratings yet

- Auditors Qualification 2.1Document39 pagesAuditors Qualification 2.1Sayraj Siddiki AnikNo ratings yet

- CA Final Company Law Amendment Nov 2021Document12 pagesCA Final Company Law Amendment Nov 2021Aneek JainNo ratings yet

- Unit 5 - Audit - CGDocument57 pagesUnit 5 - Audit - CGRalfNo ratings yet

- 14 - Company Audit Unit 1Document30 pages14 - Company Audit Unit 1Belgium PropertiesNo ratings yet

- Chapter 10Document48 pagesChapter 10garimamittalNo ratings yet

- Bhubaneswar 24012016 Session IDocument49 pagesBhubaneswar 24012016 Session ILovely LeninNo ratings yet

- Supplement For: Executive Programme (Old Syllabus)Document17 pagesSupplement For: Executive Programme (Old Syllabus)janardhan CA,CSNo ratings yet

- Auditing Trs by IcapDocument53 pagesAuditing Trs by IcapArif AliNo ratings yet

- An Overview Relating To Audit Under The Companies Act, 1956Document7 pagesAn Overview Relating To Audit Under The Companies Act, 1956Shreya RaoNo ratings yet

- Liabilities of An AuditorDocument4 pagesLiabilities of An AuditorAbhimanyu SethNo ratings yet

- Audit and Auditors PresentationDocument14 pagesAudit and Auditors PresentationGeo P BNo ratings yet

- Companies Act 2017 Significant Amendments, May 2020: Smart Decisions. Lasting ValueDocument24 pagesCompanies Act 2017 Significant Amendments, May 2020: Smart Decisions. Lasting ValueMuhammad IrshadNo ratings yet

- AUDITORDocument7 pagesAUDITORAKSHAY SHINGADENo ratings yet

- Companies Act 2013 Raising The Bar On Governance - KPMGDocument49 pagesCompanies Act 2013 Raising The Bar On Governance - KPMGManjunath ShettigarNo ratings yet

- Company AuditDocument76 pagesCompany Auditpandu ranga raoNo ratings yet

- 66606bos53774 cp10Document76 pages66606bos53774 cp10Pooja BhadrikeNo ratings yet

- Auditing Unit-3Document11 pagesAuditing Unit-3swethaswetty06No ratings yet

- Audit and AuditorsDocument14 pagesAudit and AuditorsRehanbhikanNo ratings yet

- The Company Audit: Learning OutcomesDocument75 pagesThe Company Audit: Learning OutcomesVineet KumarNo ratings yet

- An Act To Require Employers in Industrial Establishments Formally To Define Conditions of Employment Under ThemDocument9 pagesAn Act To Require Employers in Industrial Establishments Formally To Define Conditions of Employment Under ThemSakshi ChandraNo ratings yet

- The Company AuditDocument59 pagesThe Company AuditVinay Kumar VermaNo ratings yet

- Appointment and Remuneration of Managerial PersonnelDocument37 pagesAppointment and Remuneration of Managerial Personnelriteshsharda767No ratings yet

- The Institute of Chartered Accountants of Bangladesh Professional Stage: Knowledge Level Additional Sheet - Concept of and Need For AssuranceDocument4 pagesThe Institute of Chartered Accountants of Bangladesh Professional Stage: Knowledge Level Additional Sheet - Concept of and Need For AssuranceShahid MahmudNo ratings yet

- Audit and Auditors Audit and Auditors Audit and Auditors Audit and AuditorsDocument12 pagesAudit and Auditors Audit and Auditors Audit and Auditors Audit and AuditorsgayathrisicwaiNo ratings yet

- Criminal Liability of Directors Under Company Law in IndiaDocument11 pagesCriminal Liability of Directors Under Company Law in IndiaRajeNo ratings yet

- Company Audit MaterialDocument22 pagesCompany Audit Materialbipin papnoi100% (2)

- CAH 801 English 38th Edition IDDocument2 pagesCAH 801 English 38th Edition IDitoitNo ratings yet

- Auditing ChapterDocument9 pagesAuditing ChapterWania HaqNo ratings yet

- Appointment, Powers, Duties and Liabilities of The Auditor Appointment QualificationsDocument20 pagesAppointment, Powers, Duties and Liabilities of The Auditor Appointment QualificationsJawahar KumarNo ratings yet

- Guidance Note For SEBI SOP CircularDocument8 pagesGuidance Note For SEBI SOP CircularRajeev BhambriNo ratings yet

- Auditing - Final Bba: Chapter V - Company AuditDocument14 pagesAuditing - Final Bba: Chapter V - Company AuditVinay Kumar VermaNo ratings yet

- Appointment, Remunaration, Powers, Duties and Liabilities of The Auditor Appointmentand Audit of Share Capital and Pre-Incroparation ProfitDocument22 pagesAppointment, Remunaration, Powers, Duties and Liabilities of The Auditor Appointmentand Audit of Share Capital and Pre-Incroparation Profitirshad_cbNo ratings yet

- PDF 4 CL (1) - RemovedDocument7 pagesPDF 4 CL (1) - Removedanisharawat2007No ratings yet

- PDF 4 CLDocument24 pagesPDF 4 CLanisharawat2007No ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- SCMPE ABC Analysis Nov 2022 by CA Purushottam AggarwalDocument2 pagesSCMPE ABC Analysis Nov 2022 by CA Purushottam AggarwalAneek JainNo ratings yet

- AMA Theory Compilation For June 2020 ExamsDocument51 pagesAMA Theory Compilation For June 2020 ExamsAneek JainNo ratings yet

- SCMPE ABC Analysis For May 2022 by CA Purushottam AggarwalDocument3 pagesSCMPE ABC Analysis For May 2022 by CA Purushottam AggarwalAneek JainNo ratings yet

- Economic Laws 6D Challenge Day 1 - Suggested AnsDocument8 pagesEconomic Laws 6D Challenge Day 1 - Suggested AnsAneek JainNo ratings yet

- 1.5 Days Planner CA Final Law Nov 21Document2 pages1.5 Days Planner CA Final Law Nov 21Aneek JainNo ratings yet

- Nov 20 MCQ AuditDocument2 pagesNov 20 MCQ AuditAneek JainNo ratings yet

- Extra Questions For Nov 22 ExamsDocument13 pagesExtra Questions For Nov 22 ExamsAneek JainNo ratings yet

- CA FINAL LAW Additional Questions May 2021Document108 pagesCA FINAL LAW Additional Questions May 2021Aneek JainNo ratings yet

- Economic Laws 6D Summary File May 2022 & Onwards 220414 101205Document102 pagesEconomic Laws 6D Summary File May 2022 & Onwards 220414 101205Aneek JainNo ratings yet

- CA Final Company Law Amendment Nov 2021Document12 pagesCA Final Company Law Amendment Nov 2021Aneek JainNo ratings yet

- CA Final Eco Law 6D Amendments Nov 2022 by CA Sanidhya Saraf 1Document4 pagesCA Final Eco Law 6D Amendments Nov 2022 by CA Sanidhya Saraf 1Aneek JainNo ratings yet

- CA Final Audit Challenge - Nov 22 - 220914 - 104426Document2 pagesCA Final Audit Challenge - Nov 22 - 220914 - 104426Aneek JainNo ratings yet

- Compiled by CA Sanidhya Saraf: Case Study Digest Chapterwise Compilation (Eco - Laws 6D)Document6 pagesCompiled by CA Sanidhya Saraf: Case Study Digest Chapterwise Compilation (Eco - Laws 6D)Aneek JainNo ratings yet

- New CHP - PMDocument9 pagesNew CHP - PMAneek JainNo ratings yet

- CaroDocument10 pagesCaroAneek JainNo ratings yet

- FR Nov22 ABC, LDR & Exam TipsDocument4 pagesFR Nov22 ABC, LDR & Exam TipsAneek JainNo ratings yet

- PenaltiesDocument4 pagesPenaltiesAneek JainNo ratings yet

- LimitsDocument6 pagesLimitsAneek JainNo ratings yet

- Kraft Heinz Discussion Questions - MARKETINGDocument3 pagesKraft Heinz Discussion Questions - MARKETINGtrangnha1505No ratings yet

- Prosedur Perhitungan, Pemungutan, Pencatatan, Penyetoran, Dan Pelaporan PPH Pasal 22 Atas Penjualan Bahan Bakar Di Pt. ABCDocument11 pagesProsedur Perhitungan, Pemungutan, Pencatatan, Penyetoran, Dan Pelaporan PPH Pasal 22 Atas Penjualan Bahan Bakar Di Pt. ABCwiwi pratiwiNo ratings yet

- Minimum Wage Letter 2015Document4 pagesMinimum Wage Letter 2015sophbeauNo ratings yet

- Client As Manufacturing !!! MM (P2P) Finance SD (O2C) Costing Sales Procurement Stores Utilities R & D IT One Doc Is One Entry Rent Ac DR To Bank Ac .CRDocument6 pagesClient As Manufacturing !!! MM (P2P) Finance SD (O2C) Costing Sales Procurement Stores Utilities R & D IT One Doc Is One Entry Rent Ac DR To Bank Ac .CRsapeinsNo ratings yet

- Human PotentialDocument5 pagesHuman PotentialLuisitoNo ratings yet

- Final Report of Daniel The End 2Document77 pagesFinal Report of Daniel The End 2Daniel TsegayeNo ratings yet

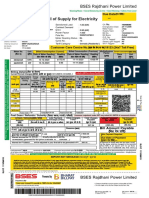

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDocument2 pagesBill of Supply For Electricity: BSES Rajdhani Power LimitedPriya SharmaNo ratings yet

- The Ban On Plastic Bags in KenyaDocument4 pagesThe Ban On Plastic Bags in KenyaSheila ChumoNo ratings yet

- Shein Vi Grp2Document5 pagesShein Vi Grp2Pamela Nicole AlonzoNo ratings yet

- The Most Popular Ways To Describe Organizational Plans Are BreadthDocument6 pagesThe Most Popular Ways To Describe Organizational Plans Are BreadthMuhammad RafiNo ratings yet

- Maritime Freight Transport - E15Document22 pagesMaritime Freight Transport - E15Anuradha KoswaththaNo ratings yet

- Making Every Drop Count 1Document3 pagesMaking Every Drop Count 1bhabi 03No ratings yet

- AWS Consulting Partner Journey diagram-FINALDocument1 pageAWS Consulting Partner Journey diagram-FINALT MNo ratings yet

- Preliminary Examination G12 Gas TrendsDocument3 pagesPreliminary Examination G12 Gas TrendsJoyce Dela Rama JulianoNo ratings yet

- 1st PUC Business Studies Feb 2018Document2 pages1st PUC Business Studies Feb 2018Lokesh RaoNo ratings yet

- Effect of Corporate Governance On The Financial Performance of CommercialDocument17 pagesEffect of Corporate Governance On The Financial Performance of CommercialMichelle Angela RaphaNo ratings yet

- VISTA LAND AND LIFESCAPES INC FinalDocument9 pagesVISTA LAND AND LIFESCAPES INC Finalmarie crisNo ratings yet

- Trading PracticesDocument2 pagesTrading PracticesRocio FernándezNo ratings yet

- DESRI Associate FTEDocument2 pagesDESRI Associate FTEeverydimension123No ratings yet

- Nature and Scope Strategic ManagementDocument4 pagesNature and Scope Strategic Managementritumahawal71% (7)

- Chapter 21Document16 pagesChapter 21Tin ManNo ratings yet

- Motivation Letter For PHDDocument2 pagesMotivation Letter For PHDlivealone boyNo ratings yet

- 2K20-MBA-LAV SHARMA - INTERNSHIP - EditedDocument24 pages2K20-MBA-LAV SHARMA - INTERNSHIP - EditedLav SharmaNo ratings yet

- Financial Literacy and Investor AwarenessDocument3 pagesFinancial Literacy and Investor AwarenessRishabh KhichiNo ratings yet

- Chapter 2 - Test BankDocument25 pagesChapter 2 - Test Bankapi-253108236100% (5)

- Assignment On Labour Law PDFDocument11 pagesAssignment On Labour Law PDFTwokir A. Tomal100% (1)

- Retail MerchandisingDocument27 pagesRetail MerchandisingAniruddha ShringarpureNo ratings yet