Professional Documents

Culture Documents

Choose The Form of Business Enterprise

Choose The Form of Business Enterprise

Uploaded by

Sadia MujeebOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Choose The Form of Business Enterprise

Choose The Form of Business Enterprise

Uploaded by

Sadia MujeebCopyright:

Available Formats

Choose the form of business enterprise

Trading Limited Limited Economic

Sole trader partnership partnership company association

Swedish Companies Registration Office no. 10e, 2013-07-01

Legal entity No Yes Yes Yes Yes

Number of Only 1 person At least 2 people At least 2 people At least 1 person At least 3 people

owners or enterprises or enterprises or enterprise or enterprises

Owner liability The business operator The partnership can The partnership can The company can enter The association can

is personally liable enter into agreements, enter into agreements, into agreements and is enter into agreements

for the agreements but if it cannot pay its but if it cannot pay liable for its debts. and is liable for its

entered into and for the debts, the partners are its debts, the general debts.

debts of the enterprise. liable. partner is liable.

Capital No No General partner: no At least SEK 50,000. Yes, in the form of

requirement Limited partners: at a cash or work invest-

least SEK 1 ment.

Representatives The sole trader The partners The general partner The board of directors The board of directors

Registration With the Swedish Tax With the Swedish With the Swedish With the Swedish With the Swedish

Agency and possibly Companies Registration Companies Registration Companies Registration Companies Registration

the Swedish Companies

Tax Agency Tax Agency Tax Agency Tax Agency

Name protection In the county In the county In the county Nationwide Nationwide

Form of taxation F or FA tax The partnership: F tax The partnership: F tax The company: F tax The association: F tax

(FA tax for income from Partners: SA tax (spe - Partners: SA tax (spe - The owners: A tax The members: A tax

both the business and cial debited A tax) cial debited A tax) (employees) (employees)

employment)

Taxation The business operator Partners are taxed Partners are taxed The company is taxed The association is taxed

is taxed for the surplus for their part of the for their part of the on its profit (corpora - on its profit (corpora -

(income tax + social partnership’s surplus partnership’s surplus tion tax). The owners tion tax). The members

security contributions). (income tax + social (income tax + social are taxed on salary are taxed on salary

security contributions). security contributions). withdrawn and possible taken out and possible

dividends (income tax + dividends (income tax +

possible gains tax). possible gains tax).

Annual report Only annual accounts If the trading partner - If the limited partner - All limited companies An annual report must

and auditor ship has a legal entity ship has a legal entity must file an annual be prepared and

of a certain size as a of a certain size as a report with the Swedish an auditor must be

co-owner, the partner - co-owner, the partner - Companies Registration appointed.

ship must appoint an ship must appoint an

accountant and submit accountant and submit Small companies may

an annual report to the an annual report to the choose not to have an

Swedish Companies Swedish Companies auditor.

Allocation of Normally only to As per agreement if As per agreement if Profit can be allocated Profit can be divided

profit and loss the business owner. such an agreement such an agreement to the shareholders in between the members

Exceptions are spouses exists. Equal distribu - exists. If no agreement the form of a dividend. in the form of a bonus.

and cohabitants with tion otherwise. exists and the partners

mutual children. cannot agree on the al-

location, the issue must

be decided in court.

Income as the Surplus The surplus for the The surplus for the Salary withdrawn Salary withdrawn

basis of sickness partners individually. partners individually.

benefits

Qualifying period 1, 7, 14, 30, 60 or 90 1, 7, 14, 30, 60 or 90 1, 7, 14, 30, 60 or 90 1 day 1 day

days days days

Starting Up a Business

You might also like

- Abdullah Ali Business Account: Green Brothers GLA Limited Company 08-71-99 06703548 GBPDocument4 pagesAbdullah Ali Business Account: Green Brothers GLA Limited Company 08-71-99 06703548 GBPkeogh takako100% (2)

- Assesment Notice 2017Document1 pageAssesment Notice 2017Shounak KossambeNo ratings yet

- Card and Merchant Management - 20200617Document42 pagesCard and Merchant Management - 20200617Tedh Shin100% (3)

- Unit VDocument30 pagesUnit VmhaNo ratings yet

- Chapter-15 Partnership Accounts PDFDocument20 pagesChapter-15 Partnership Accounts PDFTarushi Yadav , 51BNo ratings yet

- Ita Sir Kashif Adeel Full NotesDocument533 pagesIta Sir Kashif Adeel Full Notesuroojfatima21299No ratings yet

- Lec 3 AFM Types of CorporationsDocument47 pagesLec 3 AFM Types of CorporationsJunaidNo ratings yet

- S3 PartnershipsDocument46 pagesS3 PartnershipsmotheomoroaswiNo ratings yet

- LLP Registration Ministry of Corporate Affairs Partnership RegistrationDocument19 pagesLLP Registration Ministry of Corporate Affairs Partnership Registrationaman dwivediNo ratings yet

- EMBA Notes - US Compay FormationDocument4 pagesEMBA Notes - US Compay FormationGloria TaiNo ratings yet

- The Nature of PartnershipDocument75 pagesThe Nature of PartnershipLahari GadhamsettyNo ratings yet

- Registering A Company in Latvia Fact Sheet 2021Document2 pagesRegistering A Company in Latvia Fact Sheet 2021Sri KanthNo ratings yet

- Partnership Vs CorporationDocument2 pagesPartnership Vs CorporationRosee D.No ratings yet

- Business Law A2 Mai Huong (Recovered)Document6 pagesBusiness Law A2 Mai Huong (Recovered)Mai HươngNo ratings yet

- Companies Act, 2013: Legal Aspects of Business Prof. Mehek KapoorDocument15 pagesCompanies Act, 2013: Legal Aspects of Business Prof. Mehek KapoorAman jaiNo ratings yet

- Sole Proprietor Vs LLP Vs General Partnership Vs Company in MalaysiaDocument4 pagesSole Proprietor Vs LLP Vs General Partnership Vs Company in MalaysiaJonathan TengNo ratings yet

- Financial Accounting S - 1Document36 pagesFinancial Accounting S - 1Gagan Deep SinghNo ratings yet

- Chapter 12Document42 pagesChapter 12Ivo_Nicht100% (4)

- Company Vs LLP Vs PartnershipDocument18 pagesCompany Vs LLP Vs PartnershipkapilNo ratings yet

- Guide English.Document39 pagesGuide English.Shubhank PariharNo ratings yet

- Constitution Des SocietesDocument5 pagesConstitution Des SocietesMendrika RandriamaheninaNo ratings yet

- CHAPTER 12 Partnerships Basic Considerations and FormationsDocument9 pagesCHAPTER 12 Partnerships Basic Considerations and FormationsGabrielle Joshebed AbaricoNo ratings yet

- Xii Accounts NOTESDocument13 pagesXii Accounts NOTESNavin PatidarNo ratings yet

- Sample 222Document31 pagesSample 222prathamcomputer15No ratings yet

- Business Structure: Partnership: DefinitionDocument6 pagesBusiness Structure: Partnership: DefinitionStephen VillanteNo ratings yet

- Chapter 4Document24 pagesChapter 4John DoeNo ratings yet

- Notes On Week 6 - PartnershipDocument9 pagesNotes On Week 6 - PartnershipChristy CaneteNo ratings yet

- Limited Liability Partnership: Prepared byDocument12 pagesLimited Liability Partnership: Prepared byAbrar HussainNo ratings yet

- Types of Business Entities: 5. Company Limited Liability Partnership (LLP) General Partnership Sole ProprietorshipDocument4 pagesTypes of Business Entities: 5. Company Limited Liability Partnership (LLP) General Partnership Sole Proprietorshipsiti nadhirahNo ratings yet

- Accountancy Academic Organization: PartnershipDocument21 pagesAccountancy Academic Organization: PartnershipNatalie SerranoNo ratings yet

- CHP 12Document59 pagesCHP 12Usmän Mïrżä100% (1)

- Legal Forms of Business OrganizationDocument17 pagesLegal Forms of Business OrganizationNabeel SafdarNo ratings yet

- Advanced Accounting Unit 5Document42 pagesAdvanced Accounting Unit 5mubarek oumerNo ratings yet

- Chapter 1 - PartnershipDocument19 pagesChapter 1 - PartnershipSri Renugha Kaliaasan100% (1)

- Key Differences Between Sole Proprietorship and Joint Hindu Family Firm - A Comparison ChartDocument6 pagesKey Differences Between Sole Proprietorship and Joint Hindu Family Firm - A Comparison ChartVarun KocharNo ratings yet

- CH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Document12 pagesCH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Laksh KhannaNo ratings yet

- Business LawDocument21 pagesBusiness LawUMAR FAROOQ TIPUNo ratings yet

- 11am Small Business Tax WorkshopDocument86 pages11am Small Business Tax WorkshopnowayNo ratings yet

- Partnership-Accounting 5a21e9361723ddd448361182Document31 pagesPartnership-Accounting 5a21e9361723ddd448361182Jason Cabrera0% (1)

- Chapter 9 The Organization Plan Group 3Document52 pagesChapter 9 The Organization Plan Group 3Riel Mancera, RM, RN, USRN, NP, MANNo ratings yet

- Business VenturesDocument15 pagesBusiness VenturesgrimmythicalNo ratings yet

- Entity ComparisonDocument3 pagesEntity Comparisoncthunder_1No ratings yet

- Corporate StructureDocument2 pagesCorporate StructureAanchal BhatiaNo ratings yet

- Partnership Firm CHP 6 STD 11Document5 pagesPartnership Firm CHP 6 STD 11Md. Affan SaquibNo ratings yet

- Advanced AccountingDocument191 pagesAdvanced AccountingSalih AkadarNo ratings yet

- Partnership: Basics: DefinitionsDocument13 pagesPartnership: Basics: DefinitionsShiv PatelNo ratings yet

- Partnership ActDocument5 pagesPartnership ActAhmad Ali AmjadNo ratings yet

- How To Start A Business in Canada - Step by Step Guide - BDC - CaDocument8 pagesHow To Start A Business in Canada - Step by Step Guide - BDC - CaIgor MirandaNo ratings yet

- Forms of Business Organizations - Comparative ChartsDocument6 pagesForms of Business Organizations - Comparative ChartsVineetha Chowdary GudeNo ratings yet

- Mercentile Law Assignment 4Document5 pagesMercentile Law Assignment 4SUMIT MITTALNo ratings yet

- 74621bos60479 FND cp10 U1Document40 pages74621bos60479 FND cp10 U1Shyam ShelkeNo ratings yet

- Fundamental of PartnershipDocument179 pagesFundamental of PartnershipAyush KarNo ratings yet

- Business Law & Practice FINAL NOTESDocument129 pagesBusiness Law & Practice FINAL NOTESZohair SadiNo ratings yet

- Accounting For Partnership-FinalDocument14 pagesAccounting For Partnership-Finalgetnet5195No ratings yet

- Fund PartnershipDocument179 pagesFund PartnershipKaranveer VohraNo ratings yet

- Topic 8Document22 pagesTopic 8Victor AjraebrillNo ratings yet

- PartnershipDocument7 pagesPartnershipCezanne Pi-ay EckmanNo ratings yet

- What Is A Business/Organisation? : Royal Society For The Protection of BirdsDocument8 pagesWhat Is A Business/Organisation? : Royal Society For The Protection of Birdsmark lee ryderNo ratings yet

- Chapter 1 2023Document106 pagesChapter 1 202323a7510168No ratings yet

- XII Accountancy Notes All Chapters MR - Mohan H BaksaniDocument176 pagesXII Accountancy Notes All Chapters MR - Mohan H BaksaniALAY SINGHNo ratings yet

- UNIT 18 Company LawDocument14 pagesUNIT 18 Company LawRaven471No ratings yet

- Meaning, Natur & Rights of PartnerDocument1 pageMeaning, Natur & Rights of Partneraditya aggarwalNo ratings yet

- Class 1 GrammarDocument21 pagesClass 1 GrammarSadia MujeebNo ratings yet

- Business Operator Tax Guide - Everything You Need To Know About Tax in Small Businesses - Accountor GroupDocument7 pagesBusiness Operator Tax Guide - Everything You Need To Know About Tax in Small Businesses - Accountor GroupSadia MujeebNo ratings yet

- WWW Verksamt Se Web International Starting Get Started BusinDocument4 pagesWWW Verksamt Se Web International Starting Get Started BusinSadia MujeebNo ratings yet

- App Skatteverket Se Rakna Skatt Client Skut SkatteutrakningDocument1 pageApp Skatteverket Se Rakna Skatt Client Skut SkatteutrakningSadia MujeebNo ratings yet

- ProjectyahooDocument867 pagesProjectyahooSadia MujeebNo ratings yet

- Aib (Ni) : Cash Flow PlannerDocument10 pagesAib (Ni) : Cash Flow PlannerCHRISTINE GALANGNo ratings yet

- Monthly Statement: This Month's SummaryDocument4 pagesMonthly Statement: This Month's SummaryNishantNo ratings yet

- Reliance Retail Limited Tax Invoice: Original For RecipientDocument1 pageReliance Retail Limited Tax Invoice: Original For Recipienthp936868No ratings yet

- Sales Invoice: Invoice From Shipping FromDocument1 pageSales Invoice: Invoice From Shipping FromGiancarlos SanchezNo ratings yet

- MEDITECH - MEDITECH Statement 20191128 PDFDocument49 pagesMEDITECH - MEDITECH Statement 20191128 PDFLion Micheal OtitolaiyeNo ratings yet

- Finance ProcessesDocument8 pagesFinance ProcessesKushal SharmaNo ratings yet

- Issuing Bank Swift MT760Document2 pagesIssuing Bank Swift MT760dewokarsono1965No ratings yet

- Internal Audit ManualDocument11 pagesInternal Audit ManualAnudeep ReddyNo ratings yet

- Wire Reciept For DaveDocument9 pagesWire Reciept For DaveNicoleNo ratings yet

- 1.14 Networks: Intranet Local Log Onto Network Card Satellite Server Terminals WAN (Wide Area Network)Document2 pages1.14 Networks: Intranet Local Log Onto Network Card Satellite Server Terminals WAN (Wide Area Network)EDWARD LUIS HUAYLLASCO CARLOSNo ratings yet

- Mr. Anggi PDFDocument2 pagesMr. Anggi PDFsusi gloryNo ratings yet

- Ac GST Credit NoteDocument1 pageAc GST Credit NoteSudip SinghNo ratings yet

- OpTransactionHistory11 23Document7 pagesOpTransactionHistory11 23PRABHAT SRIVASTAVNo ratings yet

- Fruit VendorDocument3 pagesFruit VendorKumar Abhishek SinghNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument33 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepuspesh.bhushanNo ratings yet

- Package One - Lowering The Personal Income Tax - #TaxReformNowDocument4 pagesPackage One - Lowering The Personal Income Tax - #TaxReformNowJarwikNo ratings yet

- Indirect Tax - Customs DutyDocument22 pagesIndirect Tax - Customs Dutyshiva977No ratings yet

- QUIZ 2 MKM v.23Document3 pagesQUIZ 2 MKM v.23Ronnalene Cerbas Glori0% (1)

- Vikas Jain: Account Statement - Account StatementDocument16 pagesVikas Jain: Account Statement - Account Statementvikas jainNo ratings yet

- Tax InvoiceDocument1 pageTax InvoicenirajNo ratings yet

- Due Date Telephone Number Amount Payable: GstinDocument5 pagesDue Date Telephone Number Amount Payable: Gstinsdebbyml.mhNo ratings yet

- Form GST RFD - 11Document3 pagesForm GST RFD - 11Sitaram MeenaNo ratings yet

- The Punjab Sales Tax On Services Act 2012Document77 pagesThe Punjab Sales Tax On Services Act 2012Muhammad imran LatifNo ratings yet

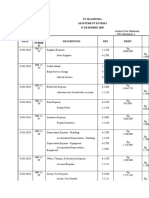

- PT SejahteraDocument2 pagesPT Sejahtera202010415109 ADITYA FIRNANDONo ratings yet

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- Online Payment SystemDocument1 pageOnline Payment SystemAnonymous 6KWNHZPVINo ratings yet

- HDFC StetementDocument3 pagesHDFC StetementKaran KaranNo ratings yet