Professional Documents

Culture Documents

IOM Airtel

IOM Airtel

Uploaded by

Mirza Aftab BaigOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IOM Airtel

IOM Airtel

Uploaded by

Mirza Aftab BaigCopyright:

Available Formats

Date : 17-Oct-2022

Subject : Approval for Integration with Airtel Payment Bank for BBPS and Airtel Merchant

counters.

TPWODL having consumers base of 22 lacs approx., out of which 16 lac consumers

live in rural areas.

Airtel Payments Bank is an Indian first payments bank with its headquarters in New

Delhi. The company is a subsidiary of Bharti Airtel. On 5 January 2022, it was

granted the scheduled bank status by Reserve Bank of India under second schedule of

RBI Act, 1934.

It was launched nationally in January 2017 to support the cashless revolution

promised by the Government of India. Airtel Payments Bank has 62 million engaged

users and serves them through its unique, digital technology and a retail-based

distribution network. The Bank has built a strong network of over 4500+ merchant

Background

points in TPWODL area. Airtel Payments Bank launched UPI enabled digital

payments to facilitate secure digital payments.

Airtel Payments Bank may offer following Services to TPWODL

1. Online Payment Gateway through BBPS platform: It will facilitate a cashless

society through migration of bill payments from cash to electronic channel.

2. Through Merchant: Customer make hassle free payment at his nearest outlet of

Airtel by paying directly to the merchant.

TPNODL has already done the agreement with Airtel Payment Bank

As TPWODL promoting all payments in Digital modes, it is proposed to have

collaboration with Airtel Payments Bank.

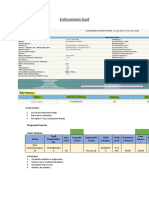

Transaction

Proposal For UPI-based payments and transfers, customers are not required to furnish their

bank details to enable transactions.

We have received below mentioned offer

Expected

Transactions in 12 Cost Total Cost

S. No. Particular months (Rs.) (Rs.)

1 BBPS 360000 2 720000

2 Offline 180000 5 900000

Benefit Customer want to pay through any BHIM UPI enabled app.

Increase the Digital payments at reasonable cost to TPWODL

Frauds could be reduced to nil by active monitoring and implementing of the risk

mitigation system.

The system reduces the cost for the TPWODL by providing e-bills.

Increase the security of collection along with accurate and fast reconciliations.

It will transform the cash mode of bill payment to automatic mode, along with

encouraging self-service mode of payment for Consumer.

For project with Airtel Payments Bank of their product and continue FY 2022-23

onwards after negotiation by joint team of Procurement and Pre-audit & Revenue

Collection Tam from Finance for Digital payment through feature phone users.

Management Budget essential yearly cost

Approval 1.For PG -BBPS: 30000 Transactions * Rs. 2 (Service Charged) * 12 Month

Requested for

=7.2 Lakh excluding GST.

2.For Offline: 15000 Transactions * Rs. 5 (Service Charged) * 12 Month =9.0

Lakh excluding GST.

Taxes extra on above mentioned charges

Initiator Mr. Himanshu Agarwal

Signature with HoG – Collection Backend

date

Forwarded by Mr. Kasarpatil R M

Signature with

Add. Chief RCM

date

Forwarded by Mr. Hemant Kumar Gupta

Signature with

Finance Controller

date

Forwarded by Mr. Sunil Kumar Sharma

Signature with Chief Commercial

date

Forwarded by Mr. Satish Kumar

Signature with Chief Finance Officer

date

Approved By Mr. Gajanan Kale

Signature with

Chief Executive Officer

date

You might also like

- IWT Conscious Spending Plan 2023Document12 pagesIWT Conscious Spending Plan 2023GEO654No ratings yet

- BilledStatements 8558 16-04-23 22.39Document2 pagesBilledStatements 8558 16-04-23 22.39Adish BhagwatNo ratings yet

- BA Finance Domain - Interview QuestionsDocument6 pagesBA Finance Domain - Interview QuestionsBharti Penumarthy50% (2)

- 3rd Quarter - BUS4 BlankDocument7 pages3rd Quarter - BUS4 BlankKian Barredo0% (1)

- Monthly Current Affairs 2022 For January 82Document30 pagesMonthly Current Affairs 2022 For January 82rohan raiNo ratings yet

- FintechDocument6 pagesFintechParamNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Amit KheraDocument40 pagesBSE Limited National Stock Exchange of India Limited: Amit KheraNikhilNo ratings yet

- Airtel Payments BankDocument5 pagesAirtel Payments BankAcademic BunnyNo ratings yet

- Key Asks by The Payments IndustryDocument8 pagesKey Asks by The Payments IndustrySarthakNo ratings yet

- Monthly Beepedia September 2022Document129 pagesMonthly Beepedia September 2022Ashutosh KumarNo ratings yet

- English V - IPPB - NPCI Bharat BillPay Press Release - Dec 09122021 - Final Media VDocument3 pagesEnglish V - IPPB - NPCI Bharat BillPay Press Release - Dec 09122021 - Final Media VNikitaNo ratings yet

- Consumer Perception Towards Digital Payment ModeDocument8 pagesConsumer Perception Towards Digital Payment ModeSibiCk100% (1)

- Termsheet VelocityDocument4 pagesTermsheet VelocitysanjayNo ratings yet

- Varshitha (1HK19IS082) Online MoneyDocument22 pagesVarshitha (1HK19IS082) Online MoneyS VarshithaNo ratings yet

- EpaymentsDocument35 pagesEpaymentsHarshikaa SatyaNo ratings yet

- 2022 ReportDocument7 pages2022 Reportsneha.rs.imsarNo ratings yet

- Monthly Current Affairs 2023 For September 29Document29 pagesMonthly Current Affairs 2023 For September 29malgeram13No ratings yet

- BCG Google Digital Payments 2020 July 2016 - tcm21 39245 PDFDocument56 pagesBCG Google Digital Payments 2020 July 2016 - tcm21 39245 PDFIshan PadgotraNo ratings yet

- Local Case: MGT - 489 Sec: 07 Submitted To S.S.M Sadrul Huda (SSH2) Associate Professor Dept. of ManagementDocument7 pagesLocal Case: MGT - 489 Sec: 07 Submitted To S.S.M Sadrul Huda (SSH2) Associate Professor Dept. of ManagementThe TopTeN CircleNo ratings yet

- Proposal AgregatorDocument20 pagesProposal Agregatorvier emNo ratings yet

- One97 Communications Limited-Preliminary Interim Report (May-20-2022)Document52 pagesOne97 Communications Limited-Preliminary Interim Report (May-20-2022)jefcheung19No ratings yet

- Weekly Bulletin: MET-BytesDocument3 pagesWeekly Bulletin: MET-BytesMehul BariNo ratings yet

- Presentation For Viva: Sagar Srinivas Mandal HPGD/JL17/2564Document61 pagesPresentation For Viva: Sagar Srinivas Mandal HPGD/JL17/2564Mandal SagarNo ratings yet

- 3 5 46 850Document5 pages3 5 46 850suresh100% (1)

- BilledStatements 0910 17-10-22 16.51Document2 pagesBilledStatements 0910 17-10-22 16.51lenkapradipta2011No ratings yet

- FinalannualReport2012 13Document136 pagesFinalannualReport2012 13Mukesh GuptaNo ratings yet

- India'S Key To Success: Integration of Cbdcs Into The Payment Ecosystem by Abhijeet UpadhyayDocument2 pagesIndia'S Key To Success: Integration of Cbdcs Into The Payment Ecosystem by Abhijeet UpadhyayABHIJEET UPADHYAYNo ratings yet

- Monthly Digest August 2020 Eng 79Document33 pagesMonthly Digest August 2020 Eng 79Salil ShauNo ratings yet

- RBI Vision 2019-2021: The Way Forward: August 2019Document17 pagesRBI Vision 2019-2021: The Way Forward: August 2019hitesh ganvirNo ratings yet

- Monthly Digest February 2023 Eng 19Document35 pagesMonthly Digest February 2023 Eng 19Ayub ArshadNo ratings yet

- Monthly Digest January 2023 Eng 57Document35 pagesMonthly Digest January 2023 Eng 57Ayub ArshadNo ratings yet

- CITIBANKDocument7 pagesCITIBANKSreeramNo ratings yet

- Banking Current JanuaryDocument115 pagesBanking Current JanuaryManpreet PuniaNo ratings yet

- ISM Project Airtel Money Mbile BankingDocument26 pagesISM Project Airtel Money Mbile BankingSrijan SrivastavaNo ratings yet

- Empowering Payments: Digital India On The Path of RevolutionDocument39 pagesEmpowering Payments: Digital India On The Path of RevolutionRonica DashNo ratings yet

- Smart PayDocument30 pagesSmart PayJeevan Kumar100% (1)

- AGS TransactDocument19 pagesAGS TransactneelvqNo ratings yet

- Mera Bill Mera Adhikar Scheme DetailsDocument7 pagesMera Bill Mera Adhikar Scheme DetailsThe United IndianNo ratings yet

- Paytm ResultsDocument11 pagesPaytm ResultsAbfdsdfsAggfhgNo ratings yet

- Fintech Unit 1Document23 pagesFintech Unit 1neha1No ratings yet

- Monthly Digest July 2021 Eng 54Document34 pagesMonthly Digest July 2021 Eng 54Max MahoneNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 1st-8th September 2023Document49 pagesBeepedia Weekly Current Affairs (Beepedia) 1st-8th September 2023Sakshi RaneNo ratings yet

- APFFB Cohort 7 Group 1 Capstone Project - Integrated Blockchain For E-Invoice TReDS and GST For B2B TransactionsDocument18 pagesAPFFB Cohort 7 Group 1 Capstone Project - Integrated Blockchain For E-Invoice TReDS and GST For B2B TransactionsakshayibsNo ratings yet

- Full Fledge CP Project Work-In-Progress-1Document50 pagesFull Fledge CP Project Work-In-Progress-1Eldorado OSNo ratings yet

- Fintech Laws and Regulations 2023Document19 pagesFintech Laws and Regulations 2023PREX WEXNo ratings yet

- Monthly Digest July 2020 Eng 96 PDFDocument34 pagesMonthly Digest July 2020 Eng 96 PDFVeeresh IreniNo ratings yet

- QPAY - ConsultingDocument14 pagesQPAY - ConsultingmayurNo ratings yet

- Payments Newsletter: Demystifying The Merchant Acquiring BusinessDocument8 pagesPayments Newsletter: Demystifying The Merchant Acquiring BusinessRazak RadityoNo ratings yet

- Corporate Presentation-PDLDocument38 pagesCorporate Presentation-PDLopparasharNo ratings yet

- MobikwikDocument14 pagesMobikwikapi-556903190No ratings yet

- 2020 Payment Systems Oversight Annual Report November 19 2021Document41 pages2020 Payment Systems Oversight Annual Report November 19 2021Fuaad DodooNo ratings yet

- Group B 4 - WAC II PresentationDocument30 pagesGroup B 4 - WAC II Presentationp23ramanNo ratings yet

- Infibeam Investor PresentationDocument31 pagesInfibeam Investor PresentationdeepeshNo ratings yet

- A Study On Digital Payments in India With Perspective of Consumer S AdoptionDocument10 pagesA Study On Digital Payments in India With Perspective of Consumer S AdoptionIron ManNo ratings yet

- 546 PDFDocument10 pages546 PDFIron ManNo ratings yet

- BilledStatements 1938 13-09-22 20.04Document3 pagesBilledStatements 1938 13-09-22 20.04Lolugu Srinivasa raoNo ratings yet

- BI Fast AnalysisDocument3 pagesBI Fast Analysisyoshiharu.harano1726No ratings yet

- MIS Report (Akshat Jain)Document17 pagesMIS Report (Akshat Jain)Thanks DoshiNo ratings yet

- Group8-Fintech-Digital PaymentsDocument19 pagesGroup8-Fintech-Digital PaymentsNikita ShahNo ratings yet

- Paytm Case StudyDocument11 pagesPaytm Case StudyShriraj BamneNo ratings yet

- Payment Trends 2021 - PWCDocument25 pagesPayment Trends 2021 - PWCH.K. BorahNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Jiten SahuDocument36 pagesJiten SahuMirza Aftab BaigNo ratings yet

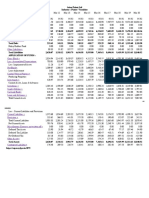

- Enforcement FundDocument2 pagesEnforcement FundMirza Aftab BaigNo ratings yet

- Enforcmenet FG Data 11.10.22Document122 pagesEnforcmenet FG Data 11.10.22Mirza Aftab BaigNo ratings yet

- Estimate AllocationDocument1 pageEstimate AllocationMirza Aftab BaigNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part ARohan SalokheNo ratings yet

- Unilever Business Valuation - UCSDDocument11 pagesUnilever Business Valuation - UCSDsloesp100% (1)

- Tokyo, Japan (April 11, 2014) - As Announced in A Release Dated April 7, 2014, Pursuant To ADocument9 pagesTokyo, Japan (April 11, 2014) - As Announced in A Release Dated April 7, 2014, Pursuant To AnarayanasamNo ratings yet

- 2020 02 16 - 18 26 09Document1 page2020 02 16 - 18 26 09Gene AngcaoNo ratings yet

- Chapter 1 Audit of Cash and Cash Equivalents PDFDocument129 pagesChapter 1 Audit of Cash and Cash Equivalents PDFCasey Mae NeriNo ratings yet

- Annual Report For FY 2018-2019 PDFDocument154 pagesAnnual Report For FY 2018-2019 PDFhukaNo ratings yet

- Pre-Eliminary ImplementationDocument10 pagesPre-Eliminary Implementationyosdi harmenNo ratings yet

- ICDR Regulations For SMEsDocument4 pagesICDR Regulations For SMEsShubham MundraNo ratings yet

- Monzo Bank Statement 2020 12 01-2020 12 31 8417Document27 pagesMonzo Bank Statement 2020 12 01-2020 12 31 8417Vitor BinghamNo ratings yet

- Assignment 2 FIN435.5 Group 2Document10 pagesAssignment 2 FIN435.5 Group 2shaikat joyNo ratings yet

- Bai Type Code GuideDocument31 pagesBai Type Code Guideswathipotla100% (1)

- Torts CasesDocument45 pagesTorts CasesMary Therese Gabrielle EstiokoNo ratings yet

- Additional Problems On BudgetingDocument3 pagesAdditional Problems On BudgetingRommel CruzNo ratings yet

- A Study On Cash Management Analysis OF NMB BankDocument10 pagesA Study On Cash Management Analysis OF NMB Bankmanoj sahNo ratings yet

- Raji BF Statement of HoldingDocument23 pagesRaji BF Statement of HoldingBild Andhra PradeshNo ratings yet

- Financial Management Case 2: Modi Rubber vs. Financial InstitutionsDocument28 pagesFinancial Management Case 2: Modi Rubber vs. Financial InstitutionsGaurav Agarwal100% (1)

- Infrastructure Sector & Infrastructure Policy: Is There A Big Boost?Document18 pagesInfrastructure Sector & Infrastructure Policy: Is There A Big Boost?Sameer RajaNo ratings yet

- Chapter 10Document44 pagesChapter 10Rifai RifaiNo ratings yet

- Cash Voucher (SA)Document1 pageCash Voucher (SA)malvikNo ratings yet

- 13 Structure of The Investment IndustryDocument20 pages13 Structure of The Investment IndustrySenthil Kumar KNo ratings yet

- History of Fiat MoneyDocument5 pagesHistory of Fiat MoneyMau TauNo ratings yet

- TPM - Kumala Hadi - Chapter 7 Optimal Risky PortfoliosDocument38 pagesTPM - Kumala Hadi - Chapter 7 Optimal Risky PortfoliosErlin KetnaNo ratings yet

- Freddie Mac AccountingDocument2 pagesFreddie Mac AccountingKusum MachalNo ratings yet

- BetaDocument3 pagesBetaDwi LinggarniNo ratings yet

- P TS4FI 1909 Final - UpdatedDocument42 pagesP TS4FI 1909 Final - Updatedpratiksha100% (2)

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Seminar On Retail BankingDocument28 pagesSeminar On Retail BankingIla JoshiNo ratings yet

- Carbon BlackDocument28 pagesCarbon BlackHabtu AsratNo ratings yet