Professional Documents

Culture Documents

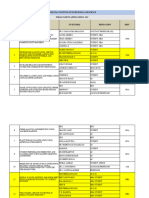

Building Trust in Management Accounting - Strategic Finance

Building Trust in Management Accounting - Strategic Finance

Uploaded by

ninaCopyright:

Available Formats

You might also like

- Esi Implementation Handbook 2020Document110 pagesEsi Implementation Handbook 2020planaowNo ratings yet

- Handbook of Operant Behavior - TextDocument701 pagesHandbook of Operant Behavior - TextBeto RV100% (1)

- Why Do Mergers FailDocument20 pagesWhy Do Mergers FailKal_C100% (2)

- Bloom's Taxonomy Questions - EnglishDocument5 pagesBloom's Taxonomy Questions - EnglishRichel R. Agripalo100% (4)

- BAI Business Agility Report 2020cDocument30 pagesBAI Business Agility Report 2020cMichael BianchiNo ratings yet

- Impact On InvestmentDocument9 pagesImpact On InvestmentRamanpreet SuriNo ratings yet

- Signavio White Paper - Contradictory Choices 2021s Challenges For Banking Financial Services InsuranceDocument11 pagesSignavio White Paper - Contradictory Choices 2021s Challenges For Banking Financial Services InsurancepipocaazulNo ratings yet

- The New-Age CFO: Driver of Real-Time Business: AuthorDocument10 pagesThe New-Age CFO: Driver of Real-Time Business: AuthorPawanNo ratings yet

- Corporate Governance Issues and How To Overcome ThemDocument6 pagesCorporate Governance Issues and How To Overcome ThemeliasNo ratings yet

- Research Paper On Revenue ManagementDocument4 pagesResearch Paper On Revenue Managementafmcueagg100% (1)

- PWC CBG TL One Pager April 2013Document2 pagesPWC CBG TL One Pager April 2013Sanath FernandoNo ratings yet

- Thesis On Investment AppraisalDocument6 pagesThesis On Investment AppraisalAmanda Summers100% (2)

- Financial Reporting CIMADocument3 pagesFinancial Reporting CIMAvchandra166No ratings yet

- WHSHXDocument5 pagesWHSHXJuan CruzNo ratings yet

- Intranet ROI White Paper 2020Document40 pagesIntranet ROI White Paper 2020Azimuddin MunshiNo ratings yet

- A Report in The ET Vanguard Investment Had Brought DownDocument7 pagesA Report in The ET Vanguard Investment Had Brought DownBhagyashree MohiteNo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument30 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editiongabrielthuym96j100% (19)

- FM Brand MarketingDocument23 pagesFM Brand MarketingMadhav ShenoyNo ratings yet

- Mastering Revenue Growth in M&ADocument7 pagesMastering Revenue Growth in M&ASky YimNo ratings yet

- Corporate Venturing ModelsDocument13 pagesCorporate Venturing Modelsmohammad90alhussaeiniNo ratings yet

- Managerial Accounting Research Paper SampleDocument5 pagesManagerial Accounting Research Paper Samplefysfs7g3100% (1)

- Cgma Finance Business PartneringDocument24 pagesCgma Finance Business Partneringkalina hNo ratings yet

- Finance Effectiveness Benchmark 2017Document72 pagesFinance Effectiveness Benchmark 2017aditya mishraNo ratings yet

- Business Modernization and The Role of Business FinanceDocument14 pagesBusiness Modernization and The Role of Business FinanceLeonor RhythmNo ratings yet

- Reputation and Transparency Lessons FromDocument7 pagesReputation and Transparency Lessons FromKatia PerezNo ratings yet

- Sample Thesis Financial AnalysisDocument5 pagesSample Thesis Financial AnalysisTye Rausch100% (2)

- BB Integration ChallengeDocument4 pagesBB Integration ChallengeJon KohNo ratings yet

- 12 New Trends in ManagementDocument18 pages12 New Trends in ManagementSaqib IqbalNo ratings yet

- Contemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaDocument5 pagesContemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaJERRALYN ALVANo ratings yet

- Financetransformation CPM WP 02 012021Document9 pagesFinancetransformation CPM WP 02 012021Charles SantosNo ratings yet

- Oracle CIMA ThoughtDocument24 pagesOracle CIMA ThoughtFirozNo ratings yet

- Accounting Research Paper Topics 2011Document6 pagesAccounting Research Paper Topics 2011cakwn75t100% (1)

- Business Driven Fraud Management Javelin 2017Document22 pagesBusiness Driven Fraud Management Javelin 2017Sidhu KaurNo ratings yet

- Topic For Research Paper Related To AccountingDocument8 pagesTopic For Research Paper Related To Accountingc9rbzcr0100% (1)

- FM WCM AssignmentDocument11 pagesFM WCM AssignmentAlen AugustineNo ratings yet

- Information Management in Financial ServicesDocument18 pagesInformation Management in Financial Servicesf1sh01No ratings yet

- BSCDocument8 pagesBSCHamdan IsmailNo ratings yet

- Chapter 1 Management Accounting Defined, Described, and Compared To Financial Accounting PDFDocument7 pagesChapter 1 Management Accounting Defined, Described, and Compared To Financial Accounting PDFfrieda20093835No ratings yet

- Accounting Principles - Talha Rabbani AB2Document16 pagesAccounting Principles - Talha Rabbani AB2Talha RabbaniNo ratings yet

- Term Paper of Financial ManagementDocument6 pagesTerm Paper of Financial Managementafmzmxkayjyoso100% (1)

- Post Enron WorldDocument20 pagesPost Enron WorlddigitalbooksNo ratings yet

- International Accounting Research Paper TopicsDocument7 pagesInternational Accounting Research Paper Topicskgtyigvkg100% (1)

- 7 Reasons Why Your Business Should Run On Cloud Accounting SoftwareDocument8 pages7 Reasons Why Your Business Should Run On Cloud Accounting SoftwareFarheenNo ratings yet

- Revenue-Generating Cios:: Smart Strategies To Grow The BusinessDocument15 pagesRevenue-Generating Cios:: Smart Strategies To Grow The BusinesspeterNo ratings yet

- Articleaboutpurchasingby Musab ALRuthiaDocument7 pagesArticleaboutpurchasingby Musab ALRuthiaMohan SethyNo ratings yet

- Value Creation ThinkingDocument55 pagesValue Creation ThinkingTran Ngan HoangNo ratings yet

- Intermediate Accounting Research PaperDocument5 pagesIntermediate Accounting Research Paperafmzjbxmbfpoox100% (1)

- Main TrendsDocument4 pagesMain TrendsHaritha SasankaNo ratings yet

- Financial Reporting Thesis PDFDocument6 pagesFinancial Reporting Thesis PDFUK100% (2)

- Overview of Managerial Accounting: 1.2 The Position of Management Accounting in The OrganizationDocument6 pagesOverview of Managerial Accounting: 1.2 The Position of Management Accounting in The OrganizationPrakash RawalNo ratings yet

- Managing IT as a Business: A Survival Guide for CEOsFrom EverandManaging IT as a Business: A Survival Guide for CEOsRating: 3 out of 5 stars3/5 (2)

- Ac 2020 14Document8 pagesAc 2020 14vcpc2008No ratings yet

- Tantangan Auditor Tahun 2019Document5 pagesTantangan Auditor Tahun 2019Nur Hidayati HusinNo ratings yet

- McKinsey - Perspectives of Digital BusinessDocument84 pagesMcKinsey - Perspectives of Digital Businessjavito6000No ratings yet

- Keeping Us InspiredDocument4 pagesKeeping Us InspiredbabanpNo ratings yet

- The Effect of Conflict Agency, Leverage, and Political Cost On Creative AccountingDocument7 pagesThe Effect of Conflict Agency, Leverage, and Political Cost On Creative AccountingEditor IJTSRDNo ratings yet

- Final Term Project 15-01-2020Document7 pagesFinal Term Project 15-01-2020Muhammad Umer ButtNo ratings yet

- Oliver Wyman Future of Finance Series Workforce Transformation Paper1Document17 pagesOliver Wyman Future of Finance Series Workforce Transformation Paper1rk_19881425No ratings yet

- How To Integrate Sustainability Into Business Strategy - 5 Key Steps - WSJDocument7 pagesHow To Integrate Sustainability Into Business Strategy - 5 Key Steps - WSJmicixa1588No ratings yet

- Reasons To Automate ExpensesDocument16 pagesReasons To Automate ExpensesBharat KhiaraNo ratings yet

- Research Paper Topics Related To AccountingDocument4 pagesResearch Paper Topics Related To Accountingegja0g11100% (1)

- Commercial Excellence: Slide 1 - Title SlideDocument8 pagesCommercial Excellence: Slide 1 - Title SlideMridul DekaNo ratings yet

- Planning Reporting: Financial AnalysisDocument5 pagesPlanning Reporting: Financial Analysisriz2010No ratings yet

- HRM Activities Using IT-enabled SystemsDocument26 pagesHRM Activities Using IT-enabled SystemsAnuj AggrawalNo ratings yet

- A Standardisation Study of The Raven's Coloured Progressive Matrices in GhanaDocument10 pagesA Standardisation Study of The Raven's Coloured Progressive Matrices in GhanaBen SteigmannNo ratings yet

- Draft Spec GSSW For Uploading Spec For 15 DaysDocument12 pagesDraft Spec GSSW For Uploading Spec For 15 DaysIou IouNo ratings yet

- 2022 ApplicationsDocument6 pages2022 ApplicationsDr. G. C. Vishnu Kumar Assistant Professor III - AERONo ratings yet

- Bayley Scales of Infant Development IIDocument2 pagesBayley Scales of Infant Development IIbutterflybaby04No ratings yet

- Qa QCDocument22 pagesQa QCAnnisa RahmatinaNo ratings yet

- 6e Lang2 Web 0610Document19 pages6e Lang2 Web 0610jian tongNo ratings yet

- M27COM CW1 Group Report Coursework BriefDocument7 pagesM27COM CW1 Group Report Coursework Briefvalmont reedemNo ratings yet

- IPE 470-Simulation On Reliability Systems PDFDocument14 pagesIPE 470-Simulation On Reliability Systems PDFNamra FatimaNo ratings yet

- Construction LawDocument45 pagesConstruction LawChandima SrimaliNo ratings yet

- Reflective Report Structure - Business StrategyDocument9 pagesReflective Report Structure - Business StrategyAlejandro CardonaNo ratings yet

- Biomedical Engineering by Atheena PandianDocument61 pagesBiomedical Engineering by Atheena PandianAtheena PandianNo ratings yet

- EUROlocal - The European Storehouse On The Local and Regional Dimensions of Lifelong LearningDocument2 pagesEUROlocal - The European Storehouse On The Local and Regional Dimensions of Lifelong LearningPASCAL International ObservatoryNo ratings yet

- WBASlidesDocument22 pagesWBASlidesRamji Rao RamijinniNo ratings yet

- EAPP Lesson 1Document8 pagesEAPP Lesson 1Desiree Campos SumocolNo ratings yet

- Face Detection by Image Discriminating: Master Thesis Intelligent Software Systems Thesis No: MCS-2006:08 August 2006Document35 pagesFace Detection by Image Discriminating: Master Thesis Intelligent Software Systems Thesis No: MCS-2006:08 August 2006Le Anh TuanNo ratings yet

- Zeithaml 2010 Vita AprilDocument24 pagesZeithaml 2010 Vita AprilKamran Ali AnsariNo ratings yet

- Kazami ADocument17 pagesKazami AsaqibNo ratings yet

- Hericel Chapter 3Document7 pagesHericel Chapter 3Mariel Garcia PajelmarianoNo ratings yet

- Sadam SSRNDocument2 pagesSadam SSRNSadam JamaldinNo ratings yet

- Newsfiles SCE Suppl 1 2Document43 pagesNewsfiles SCE Suppl 1 2XavierNo ratings yet

- Brochure Vehicle Body EnggDocument2 pagesBrochure Vehicle Body EnggKevin CarvalhoNo ratings yet

- Assessment of Arabic-English Translation Produced by Google TranslateDocument10 pagesAssessment of Arabic-English Translation Produced by Google TranslateMoh. Al-AnsiNo ratings yet

- Reliability, Validity & NormsDocument26 pagesReliability, Validity & NormsTiffany SyNo ratings yet

- 6 PsychophysicsDocument60 pages6 PsychophysicsKhae PadiernosNo ratings yet

- IESL PR PresentationDocument35 pagesIESL PR PresentationChamin SubhawickramaNo ratings yet

- Effective Reading Programs For Middle AnDocument33 pagesEffective Reading Programs For Middle Anraji letchumiNo ratings yet

Building Trust in Management Accounting - Strategic Finance

Building Trust in Management Accounting - Strategic Finance

Uploaded by

ninaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Building Trust in Management Accounting - Strategic Finance

Building Trust in Management Accounting - Strategic Finance

Uploaded by

ninaCopyright:

Available Formats

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

MAGAZINE TOPICS BLOGS ABOUT US

SEARCH STRATEGIC FINANCE

M A NAG E M E N T |

BUILDING TRUST IN MANAGEMENT ACCOUNTING

BY MARIO SPANICCIATI

June 1, 2019

43

There’s much about today’s business to be admired: rapid

innovation, stimulation of the economy, and the kind of

competition that leads to thought and leadership growth. But

today’s businesses also suffer from a credibility gap—that is, a lack

of trust among the world’s populations.

Mention Enron, WorldCom, or Lehman Brothers, and thousands of people

1 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

—including lawmakers and regulators—recall all too quickly how many lives

can be damaged by the actions of a poorly run organization. It’s no surprise

that business, and particularly big business, has a bad reputation in the eyes of

the general population. Comprehensive new controls were put in place

following the Enron disaster. That and other scandals led to passage of the

Sarbanes-Oxley Act of 2002 and the creation of the Public Company

Accounting Oversight Board (PCAOB).

Yet a 2017 Gallup report shows that since 2002, big business has been scoring

about a 20% confidence rating. And it isn’t unusual to see newspaper opinion

pages bemoaning the lack of honesty among businesses.

AN ECO IN THE NUMBERS FACTORY

Trust in the numbers—the data produced by the invoices, payments, and

expenses of any business—isn’t just an esoteric concept. It’s as real as the extra

costs in dollars, time, and even reputation that can be exacted when that data

goes wrong.

Consider what can happen to an automobile maker when an error in design,

say for a steering gearbox, travels undiscovered through assembly and into

production. The error is finally discovered. The engineering group issues an

engineering change order (ECO). The production line, already under way, must

be stopped. Costs mount as the plant stops production. Time is wasted, and the

company’s reputation may also suffer.

Accountants like to compare the accounting function to a numbers factory.

The numbers (data) make up the disparate parts, and the accounting processes

connect and form the numbers into larger components that go into the final

products. These are the quarterly and year-end financial statements, which

2 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

are reported to the public. If a material error in the numbers is propagated

through to these reports, the resulting misstatement can do at least as much

harm, in the cost of reputation, as the ECO did to the automaker.

For the finance department, and for the enterprise as a whole, a material error

in accounting can also incur some serious penalties. Accounting staff may

have to redirect their efforts to find and correct the error. Ongoing processes

may have to stop and wait for the corrections. Labor costs jump up, other

reporting might be delayed, and the damage to the reputation of the

company’s officers can be significant.

Armanino LLP, one of the world’s largest independent accounting and

consulting firms, published a 2016 study to examine how the CFO can spend

less time on accounting management and more time on strategic value

(bit.ly/2PwDf6n). It shouldn’t be surprising that five out of the six

recommendations directly involve technology and processes:

• Standardize and improve processes.

• Drive improvement with technology.

• Provide effective key performance indicators (KPIs).

• Integrate technology.

3 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

• Provide accurate forecasting.

• Support growth and expansion.

The survey also found that 94% of CFO respondents feel they need better

technology skills and 64% are currently working on upgrading their skills. The

challenge isn’t just finding the time to learn but determining the best approach

in the quest for excellence in the numbers factory.

TRUST IN THE NUMBERS MATTERS

By establishing and maintaining internal and external trust in the numbers,

accounting organizations that can simultaneously deliver real-time and highly

4 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

accurate financials do more than avoid fines and other costly penalties. Those

that prioritize maintaining trust, both internally and externally, gain (and

retain) public confidence. This creates a significant competitive edge and has

the potential to achieve the following three benefits (see “Building Trust

Company-Wide” below for more):

Reduce the likelihood of damage to the organization’s brand and reputation.

The adage that “trust is gained in drops and lost in buckets” has never been

more apt. Organizations with years of steady performance can be damaged by

one (infinitely) shared tweet. Social media, a 24-hour news cycle, and

declining levels of privacy for both people and organizations also mean that

even small errors can quickly become big news.

Organizations can reduce the likelihood of this damage not by increasing

budgets for crisis management and lobbying, but by establishing and

maintaining protocols that prioritize trust. For the accounting organization,

this means improving both tools and processes to facilitate the

trustworthiness, transparency, and accuracy of every balance sheet.

Enable organizations to realize higher performance and increase access to

business opportunities. Organizations that are considered trustworthy have

better access to business opportunities and partnerships and, according to

research by Trust Across America, “[outperform] the S&P by 1.8 times”

(bit.ly/2ZD7vRJ).

The Trust Across America survey “What Causes Low Trust in Your

Organization?” also shows that organizations that prioritize building and

maintaining trust internally see lower employee turnover, attract higher-

quality employees, increase productivity, drive more innovation, and

experience long-term business success (bit.ly/2UWEGAH).

5 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

Equip leadership to make faster, more data-driven decisions. Rapid, real-

time decision-making capability pays off. Research by Bain & Company over a

10-year period of more than 1,000 companies discovered a “clear correlation

between decision effectiveness and business performance” (bit.ly/2ZB0NLG).

Yet the ability to make effective decisions depends on access to trustworthy

data, be it customer engagement statistics, return percentages, or the day-to-

day balance sheet. Accounting organizations that can deliver highly accurate

financial data in real time can help leadership make more informed, targeted,

and successful decisions.

6 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

FOUR WAYS TO BUILD TRUST

Nearly 70% of global business leaders and finance professionals claim their

organization has made a significant business decision based on inaccurate

7 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

financial data. Almost 22% of C-suite respondents say it takes up to 10 days

per month for their organization to identify errors and make adjustments,

potentially wasting as many as 114 days each year.

These findings are from a global survey commissioned by BlackLine of more

than 1,100 C-suite executives and finance professionals to gauge confidence

levels in financial data and the perceived impact of errors on the business

(bit.ly/2PtpLrW). The results reveal four essential ways that organizations can

build and maintain trust in today’s increasingly unpredictable, rapidly

changing business environment.

1. Deliver Accurate Data

Accountants have always held high levels of accuracy as a core value, but the

rapid pace of business and the demand for real-time financial information

have made it increasingly difficult for accountants to process the

extraordinary amount of data flowing through modern organizations.

A continued reliance on manual or outdated systems means tremendous

amounts of overtime are required to meet the competing demands of closing

the books both accurately and on time. According to the Society for Human

Resource Management (SHRM), overtime itself is a significant factor in poor

performance and increased errors.

To maintain the trust of leadership, stakeholders, and shareholders,

organizations must find ways to reduce and even eliminate the possibility of

human error. How? By streamlining outdated, clunky, manual processes and

giving accounting professionals updated tools that help them maintain high

levels of accuracy, even as the pace of business accelerates.

8 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

2. Centralize Key Functions

It’s difficult to achieve meaningful transparency with legacy accounting

systems because these systems make it difficult to quickly identify mistakes

and discrepancies.

BlackLine’s global study found that 55% of respondents were “not completely

confident” that they could identify financial errors in advance of reporting. Of

those, 26% were concerned “over errors that they know must exist, but of

which they have no visibility.”

Transparency’s value in accounting and finance goes beyond increasing the

visibility of errors and improving the accuracy of statements (see “Building

Trust between Accounting and Finance” for more). Transparency also helps

build trust externally, which, in turn, leads to large-scale business benefits.

Studies show that organizations with increased organizational transparency:

Benefit from a reduced cost of capital. In the Journal of Accounting, Auditing

& Finance, Mary E. Barth and Katherine Schipper state that “increased

reporting transparency provides evidence of an association between

transparency and cost of capital” (bit.ly/2GFPjz4). According to “Cost of

capital and earnings transparency” by Barth, Yaniv Konchitchki, and Wayne R.

Landsman, when an organization provides more transparency within financial

statements, that organization experiences a lower cost of capital, primarily

due to the fact that “uncertainty regarding the value of its equity may be

lower” (bit.ly/2GvD3A2).

Increase sales. In another study cited in a Harvard Business Review article by

Ryan W. Buell, making the costs and processes of various products

transparent, including the amount of markup, led to a dramatic jump in sales.

By providing full operational transparency for one product, a wallet,

9 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

researchers were able to increase sales by 26% (bit.ly/2IFnqtn).

Increase stakeholder confidence. Research compiled by Harvard Business

School showed that increasing the levels of operational transparency within

government agencies positively influenced citizen attitudes toward

government. Revealing the “hidden work” increased the self-reported level of

trust by 14% (hbs.me/2WcwMQB).

Accounting organizations can address the need for more transparency by

transitioning from outdated and often manual accounting operations that

hamper visibility to more centralized, modern processes and solutions.

Instead of using and storing spreadsheets on multiple servers (or with multiple

accountants), organizations can create a central location for all close data and

operations. Centralizing key accounting functions—reconciliations, task

assignment and management, journal entries, and analysis—enables a more

holistic approach to the financial close process and ensures immediate, real-

time visibility into all activities.

3. Enable Efficiency and Accuracy

Numerous studies have demonstrated how trust increases efficiency.

Researchers from the International Monetary Fund (IMF) and Duke University

found that employees who trusted each other were more willing to expend

effort and less likely to “monitor” the behavior of others, thus becoming more

efficient in their roles (bit.ly/2PsVSbg).

Lee Caraher, founder and CEO of Double Forte, a national public relations and

digital media agency, also correlates inefficiency with a lack of trust, stating,

“When we don’t trust our colleagues, we develop muscle memory that drives

inefficiency up—preparing for others to drop the ball” (bit.ly/2IVm90A).

10 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

Less has been written about the reverse statement, how efficiency itself

increases trust. From an accounting and finance perspective, efficiency

enables the timely completion of key processes and the delivery of data

crucial to decision making.

Accounting teams that can be more efficient—without compromising

accuracy—can better support the controller, the CFO, the CEO, and external

stakeholders. Efficiency within accounting drives trust because it enables

others to do their jobs and accomplish key tasks on time. But efficiency is hard

to achieve when accounting professionals are dependent on manual

accounting processes and outdated tools.

By streamlining repetitive activities like data entry and increasing the use of

automation, organizations can see improved efficiency and simultaneously

increase trust in accounting teams, processes, and data.

4. Build a Culture of Accountability

According to the U.S. Office of Personnel Management, organizations with a

culture of accountability—an environment where employees take ownership

for results—see improved employee performance, as well as commitment to

work, morale, and satisfaction (bit.ly/2DzUzlV). These organizations also see

greater trust internally, between both individuals and teams. How can

organizations build a culture of accountability within the accounting

function? It requires more than a segregation of duties.

First, leaders must have an engaged view into who is performing what and

when to more quickly identify errors and challenges, rebalance workloads,

and, most critically, offer support, including both constructive feedback and

11 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

praise.

Second, individuals must be able to take real ownership of and have equal

visibility into their tasks and activities as well as performance standards and

timelines for completion.

START WITH EMPOWERING ACCOUNTANTS

In an age when trust in public and private institutions is on the decline,

organizations that can create and maintain trustworthiness have a tremendous

competitive edge. It can be argued that establishing that trust starts with the

numbers.

After all, for both internal and external stakeholders, it’s the numbers—not the

brand, the boilerplate, or the press release—that deliver immediate and

actionable insight. Numbers are the first tangible indicator of success and the

first indicator of challenges to come.

“Unlocking the value of information and financial data is much more

important than routine reporting, and if done well, a key competitive

advantage,” says Tony Klimas, principal and Global Performance Improvement

Finance Leader at EY. “Yet many companies still haven’t implemented

technology to enable this capability, despite the many advances in automation

and cloud-based solutions, which reduce the required investment and time to

implement. It is time for businesses to treat their financial data like an asset

and invest in the technology, tools and people to turn information and data

into strategic insights.”

And if trust starts with the numbers, then organizations must prioritize

improving the processes that enable trustworthy balance sheets. This means

12 sur 13 23/10/2021, 20:20

Building Trust in Management Accounting - Strategic Finance https://sfmagazine.com/post-entry/june-2019-building-trust-in-managem...

giving accounting professionals the technology that empowers them to

simultaneously practice the core values of accuracy, efficiency, and

transparency and keep up with the ever-increasing pace of business.

Mario Spanicciati is the chief strategy officer, Strategic Alliances,

at BlackLine.

0

43

No Comments

SF MAGAZINE TOPICS TOPICS

CURRENT ISSUE CARL MENCONI CASE WRITING LEADERSHIP & CAREERS

PAST ISSUES COMPETITION MANAGEMENT

PAST ISSUES ARCHIVE ETHICS MEASUREMENT

GOVERNANCE REPORTING

IMA SMALL BUSINESS

IMA PULSE

ABOUT SF MEDIA KIT FOR ADVERTISERS

BLOGS

ABOUT IMA IMA COOKIE POLICY

IMA MOMENTS SF EDITORIAL GUIDELINES & IMA PRIVACY POLICY

IMA PULSE SUBMISSIONS IMA TERMS AND CONDITIONS

SF TECHNOTES CONTACT US

SUBSCRIBE

© 2015 - 2021, Institute of Management 10 Paragon Drive, Suite 1, Montvale, NJ (800) 638-4427 or +1 (201) 573-9000

Accountants, Inc. 07645-1760

13 sur 13 23/10/2021, 20:20

You might also like

- Esi Implementation Handbook 2020Document110 pagesEsi Implementation Handbook 2020planaowNo ratings yet

- Handbook of Operant Behavior - TextDocument701 pagesHandbook of Operant Behavior - TextBeto RV100% (1)

- Why Do Mergers FailDocument20 pagesWhy Do Mergers FailKal_C100% (2)

- Bloom's Taxonomy Questions - EnglishDocument5 pagesBloom's Taxonomy Questions - EnglishRichel R. Agripalo100% (4)

- BAI Business Agility Report 2020cDocument30 pagesBAI Business Agility Report 2020cMichael BianchiNo ratings yet

- Impact On InvestmentDocument9 pagesImpact On InvestmentRamanpreet SuriNo ratings yet

- Signavio White Paper - Contradictory Choices 2021s Challenges For Banking Financial Services InsuranceDocument11 pagesSignavio White Paper - Contradictory Choices 2021s Challenges For Banking Financial Services InsurancepipocaazulNo ratings yet

- The New-Age CFO: Driver of Real-Time Business: AuthorDocument10 pagesThe New-Age CFO: Driver of Real-Time Business: AuthorPawanNo ratings yet

- Corporate Governance Issues and How To Overcome ThemDocument6 pagesCorporate Governance Issues and How To Overcome ThemeliasNo ratings yet

- Research Paper On Revenue ManagementDocument4 pagesResearch Paper On Revenue Managementafmcueagg100% (1)

- PWC CBG TL One Pager April 2013Document2 pagesPWC CBG TL One Pager April 2013Sanath FernandoNo ratings yet

- Thesis On Investment AppraisalDocument6 pagesThesis On Investment AppraisalAmanda Summers100% (2)

- Financial Reporting CIMADocument3 pagesFinancial Reporting CIMAvchandra166No ratings yet

- WHSHXDocument5 pagesWHSHXJuan CruzNo ratings yet

- Intranet ROI White Paper 2020Document40 pagesIntranet ROI White Paper 2020Azimuddin MunshiNo ratings yet

- A Report in The ET Vanguard Investment Had Brought DownDocument7 pagesA Report in The ET Vanguard Investment Had Brought DownBhagyashree MohiteNo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument30 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editiongabrielthuym96j100% (19)

- FM Brand MarketingDocument23 pagesFM Brand MarketingMadhav ShenoyNo ratings yet

- Mastering Revenue Growth in M&ADocument7 pagesMastering Revenue Growth in M&ASky YimNo ratings yet

- Corporate Venturing ModelsDocument13 pagesCorporate Venturing Modelsmohammad90alhussaeiniNo ratings yet

- Managerial Accounting Research Paper SampleDocument5 pagesManagerial Accounting Research Paper Samplefysfs7g3100% (1)

- Cgma Finance Business PartneringDocument24 pagesCgma Finance Business Partneringkalina hNo ratings yet

- Finance Effectiveness Benchmark 2017Document72 pagesFinance Effectiveness Benchmark 2017aditya mishraNo ratings yet

- Business Modernization and The Role of Business FinanceDocument14 pagesBusiness Modernization and The Role of Business FinanceLeonor RhythmNo ratings yet

- Reputation and Transparency Lessons FromDocument7 pagesReputation and Transparency Lessons FromKatia PerezNo ratings yet

- Sample Thesis Financial AnalysisDocument5 pagesSample Thesis Financial AnalysisTye Rausch100% (2)

- BB Integration ChallengeDocument4 pagesBB Integration ChallengeJon KohNo ratings yet

- 12 New Trends in ManagementDocument18 pages12 New Trends in ManagementSaqib IqbalNo ratings yet

- Contemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaDocument5 pagesContemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaJERRALYN ALVANo ratings yet

- Financetransformation CPM WP 02 012021Document9 pagesFinancetransformation CPM WP 02 012021Charles SantosNo ratings yet

- Oracle CIMA ThoughtDocument24 pagesOracle CIMA ThoughtFirozNo ratings yet

- Accounting Research Paper Topics 2011Document6 pagesAccounting Research Paper Topics 2011cakwn75t100% (1)

- Business Driven Fraud Management Javelin 2017Document22 pagesBusiness Driven Fraud Management Javelin 2017Sidhu KaurNo ratings yet

- Topic For Research Paper Related To AccountingDocument8 pagesTopic For Research Paper Related To Accountingc9rbzcr0100% (1)

- FM WCM AssignmentDocument11 pagesFM WCM AssignmentAlen AugustineNo ratings yet

- Information Management in Financial ServicesDocument18 pagesInformation Management in Financial Servicesf1sh01No ratings yet

- BSCDocument8 pagesBSCHamdan IsmailNo ratings yet

- Chapter 1 Management Accounting Defined, Described, and Compared To Financial Accounting PDFDocument7 pagesChapter 1 Management Accounting Defined, Described, and Compared To Financial Accounting PDFfrieda20093835No ratings yet

- Accounting Principles - Talha Rabbani AB2Document16 pagesAccounting Principles - Talha Rabbani AB2Talha RabbaniNo ratings yet

- Term Paper of Financial ManagementDocument6 pagesTerm Paper of Financial Managementafmzmxkayjyoso100% (1)

- Post Enron WorldDocument20 pagesPost Enron WorlddigitalbooksNo ratings yet

- International Accounting Research Paper TopicsDocument7 pagesInternational Accounting Research Paper Topicskgtyigvkg100% (1)

- 7 Reasons Why Your Business Should Run On Cloud Accounting SoftwareDocument8 pages7 Reasons Why Your Business Should Run On Cloud Accounting SoftwareFarheenNo ratings yet

- Revenue-Generating Cios:: Smart Strategies To Grow The BusinessDocument15 pagesRevenue-Generating Cios:: Smart Strategies To Grow The BusinesspeterNo ratings yet

- Articleaboutpurchasingby Musab ALRuthiaDocument7 pagesArticleaboutpurchasingby Musab ALRuthiaMohan SethyNo ratings yet

- Value Creation ThinkingDocument55 pagesValue Creation ThinkingTran Ngan HoangNo ratings yet

- Intermediate Accounting Research PaperDocument5 pagesIntermediate Accounting Research Paperafmzjbxmbfpoox100% (1)

- Main TrendsDocument4 pagesMain TrendsHaritha SasankaNo ratings yet

- Financial Reporting Thesis PDFDocument6 pagesFinancial Reporting Thesis PDFUK100% (2)

- Overview of Managerial Accounting: 1.2 The Position of Management Accounting in The OrganizationDocument6 pagesOverview of Managerial Accounting: 1.2 The Position of Management Accounting in The OrganizationPrakash RawalNo ratings yet

- Managing IT as a Business: A Survival Guide for CEOsFrom EverandManaging IT as a Business: A Survival Guide for CEOsRating: 3 out of 5 stars3/5 (2)

- Ac 2020 14Document8 pagesAc 2020 14vcpc2008No ratings yet

- Tantangan Auditor Tahun 2019Document5 pagesTantangan Auditor Tahun 2019Nur Hidayati HusinNo ratings yet

- McKinsey - Perspectives of Digital BusinessDocument84 pagesMcKinsey - Perspectives of Digital Businessjavito6000No ratings yet

- Keeping Us InspiredDocument4 pagesKeeping Us InspiredbabanpNo ratings yet

- The Effect of Conflict Agency, Leverage, and Political Cost On Creative AccountingDocument7 pagesThe Effect of Conflict Agency, Leverage, and Political Cost On Creative AccountingEditor IJTSRDNo ratings yet

- Final Term Project 15-01-2020Document7 pagesFinal Term Project 15-01-2020Muhammad Umer ButtNo ratings yet

- Oliver Wyman Future of Finance Series Workforce Transformation Paper1Document17 pagesOliver Wyman Future of Finance Series Workforce Transformation Paper1rk_19881425No ratings yet

- How To Integrate Sustainability Into Business Strategy - 5 Key Steps - WSJDocument7 pagesHow To Integrate Sustainability Into Business Strategy - 5 Key Steps - WSJmicixa1588No ratings yet

- Reasons To Automate ExpensesDocument16 pagesReasons To Automate ExpensesBharat KhiaraNo ratings yet

- Research Paper Topics Related To AccountingDocument4 pagesResearch Paper Topics Related To Accountingegja0g11100% (1)

- Commercial Excellence: Slide 1 - Title SlideDocument8 pagesCommercial Excellence: Slide 1 - Title SlideMridul DekaNo ratings yet

- Planning Reporting: Financial AnalysisDocument5 pagesPlanning Reporting: Financial Analysisriz2010No ratings yet

- HRM Activities Using IT-enabled SystemsDocument26 pagesHRM Activities Using IT-enabled SystemsAnuj AggrawalNo ratings yet

- A Standardisation Study of The Raven's Coloured Progressive Matrices in GhanaDocument10 pagesA Standardisation Study of The Raven's Coloured Progressive Matrices in GhanaBen SteigmannNo ratings yet

- Draft Spec GSSW For Uploading Spec For 15 DaysDocument12 pagesDraft Spec GSSW For Uploading Spec For 15 DaysIou IouNo ratings yet

- 2022 ApplicationsDocument6 pages2022 ApplicationsDr. G. C. Vishnu Kumar Assistant Professor III - AERONo ratings yet

- Bayley Scales of Infant Development IIDocument2 pagesBayley Scales of Infant Development IIbutterflybaby04No ratings yet

- Qa QCDocument22 pagesQa QCAnnisa RahmatinaNo ratings yet

- 6e Lang2 Web 0610Document19 pages6e Lang2 Web 0610jian tongNo ratings yet

- M27COM CW1 Group Report Coursework BriefDocument7 pagesM27COM CW1 Group Report Coursework Briefvalmont reedemNo ratings yet

- IPE 470-Simulation On Reliability Systems PDFDocument14 pagesIPE 470-Simulation On Reliability Systems PDFNamra FatimaNo ratings yet

- Construction LawDocument45 pagesConstruction LawChandima SrimaliNo ratings yet

- Reflective Report Structure - Business StrategyDocument9 pagesReflective Report Structure - Business StrategyAlejandro CardonaNo ratings yet

- Biomedical Engineering by Atheena PandianDocument61 pagesBiomedical Engineering by Atheena PandianAtheena PandianNo ratings yet

- EUROlocal - The European Storehouse On The Local and Regional Dimensions of Lifelong LearningDocument2 pagesEUROlocal - The European Storehouse On The Local and Regional Dimensions of Lifelong LearningPASCAL International ObservatoryNo ratings yet

- WBASlidesDocument22 pagesWBASlidesRamji Rao RamijinniNo ratings yet

- EAPP Lesson 1Document8 pagesEAPP Lesson 1Desiree Campos SumocolNo ratings yet

- Face Detection by Image Discriminating: Master Thesis Intelligent Software Systems Thesis No: MCS-2006:08 August 2006Document35 pagesFace Detection by Image Discriminating: Master Thesis Intelligent Software Systems Thesis No: MCS-2006:08 August 2006Le Anh TuanNo ratings yet

- Zeithaml 2010 Vita AprilDocument24 pagesZeithaml 2010 Vita AprilKamran Ali AnsariNo ratings yet

- Kazami ADocument17 pagesKazami AsaqibNo ratings yet

- Hericel Chapter 3Document7 pagesHericel Chapter 3Mariel Garcia PajelmarianoNo ratings yet

- Sadam SSRNDocument2 pagesSadam SSRNSadam JamaldinNo ratings yet

- Newsfiles SCE Suppl 1 2Document43 pagesNewsfiles SCE Suppl 1 2XavierNo ratings yet

- Brochure Vehicle Body EnggDocument2 pagesBrochure Vehicle Body EnggKevin CarvalhoNo ratings yet

- Assessment of Arabic-English Translation Produced by Google TranslateDocument10 pagesAssessment of Arabic-English Translation Produced by Google TranslateMoh. Al-AnsiNo ratings yet

- Reliability, Validity & NormsDocument26 pagesReliability, Validity & NormsTiffany SyNo ratings yet

- 6 PsychophysicsDocument60 pages6 PsychophysicsKhae PadiernosNo ratings yet

- IESL PR PresentationDocument35 pagesIESL PR PresentationChamin SubhawickramaNo ratings yet

- Effective Reading Programs For Middle AnDocument33 pagesEffective Reading Programs For Middle Anraji letchumiNo ratings yet