Professional Documents

Culture Documents

Model Curriculum: Goods & Services Tax (GST) Accounts Assistant

Model Curriculum: Goods & Services Tax (GST) Accounts Assistant

Uploaded by

Jay ThakerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Model Curriculum: Goods & Services Tax (GST) Accounts Assistant

Model Curriculum: Goods & Services Tax (GST) Accounts Assistant

Uploaded by

Jay ThakerCopyright:

Available Formats

Model Curriculum

Goods & Services Tax (GST) Accounts

Assistant

SECTOR : BANKING FINANCIAL SERVICES & INSURANCE

SUB-SECTOR: LENDING, FUND INVESTMENT & SERVICES,

PAYMENTS, BROKING, BFSI PROCESSING

OCCUPATION: FINANCE & ACCOUNTS

REF ID: BSC/Q0910

NSQF LEVEL: 4

Goods and Services Tax (GST) Accounts Assistant

Goods and Services Tax (GST) Accounts Assistant

TABLE OF CONTENTS

1. Curriculum ..................................................................................................... 4

2. Trainer Prerequisites ..................................................................................... 7

3. Criteria For Assessment Of Trainees .......................................................... 8

Goods and Services Tax (GST) Accounts Assistant

Goods & Services Tax

(GST) Accounts Assistant

Curriculum

This program is aimed at training candidates for the job of a “Goods & Services Tax (GST) Accounts

Assistant”, in the “BFSI” Sector/Industry and aims at building the following key competencies amongst

the learner.

Program Name Goods & Services Tax (GST) Accounts Assistant

Qualification Pack Name

BSC/Q0910

& Reference ID. ID

th

Version No. 1.0 Version Update Date 20 June, 2017

Pre-requisites to

Graduation in commerce or allied subject

Training

Training Outcomes After completing this programme, participants will be able to:

Compute tax liabilities namely GST, making to the Government,

filing of returns and maintaining records of the same for audit

purpose.

Fill the form and register under GST

Make payment electronically of such amount of tax liability.

Fill-up the tax return form in the prescribed format with relevant

transaction details.

File periodic GST Returns independently

Goods and Services Tax (GST) Accounts Assistant

This course encompasses 2 out of 2 National Occupational Standards (NOS) of “Goods and

Services Tax (GST) Accounts Assistant” Qualification Pack issued by “BFSI”.

Sr. Equipment

Module Key Learning Outcomes

No. Required

1 Understanding GST Describe Goods & Services with their White board,

Concepts cross linkages Marker,

Identify the Fundamental Concepts of Overhead

Theory Duration GST projector,

(hh:mm) Identify cases where CGST and SGST Laptop,

09:00 will work simultaneously Internet access

Practical Duration Explain how IGST is levied

(hh:mm) Identify whether a transaction is taxable

06:00 under CGST, IGST or SGST

Corresponding NOS

Code

BSC/N0910

2 Incidence of Taxation Identify the Incidence of Taxation White board,

Learn about Time of Supply of Goods Marker,

Theory Duration

Learn on Purpose of place of supply Overhead

(hh:mm)

Define Location of supplier of goods projector,

06:00 Laptop,

Define the recipient with respect to

supplies involving payment and supplies Internet access

Practical Duration

(hh:mm) not involving payment

04:00

Corresponding NOS

Code

BSC/N0910

3 Registration Outline the PAN based Registration White board,

Process, its rules, and the Purpose of Marker,

Theory Duration registration Overhead

(hh:mm) Explain single or separate registration projector,

06:00 for business vertical Laptop,

Identify whether registration should be Internet access

done centrally or selectively in each

Practical Duration state

(hh:mm) List the details to be furnished during

04:00 registration

Corresponding NOS Identify common mistakes made during

Code registration

BSC/N0911 Differentiate between Taxable Person

vs. Registered Person

Identify the Registration Timelines –

Migrations

Explain the benefits of registration

Demonstrate form filling with case

studies

4 Calculation of Tax Define Input Credit White board,

Liability Identify Input Tax Credit eligibility using Marker,

case studies Overhead

Explain the concept of reversal of VAT projector,

Define tax liability for Goods in Transit Laptop,

Goods and Services Tax (GST) Accounts Assistant

Sr. Equipment

Module Key Learning Outcomes

No. Required

Theory Duration Define Consideration Internet access

(hh:mm) Value transactions having non-

19:00 monetary consideration

Practical Duration

(hh:mm)

14:00

Corresponding NOS

Code

BSC/N0911

5 Maintenance of Books Maintain different types of ledgers Marker,

& Records Prepare documents such as Invoice, Overhead

Credit Note and Debit Note. projector,

Theory Duration Identify the different types of returns Laptop,

(hh:mm) and their applicability to the business- Internet access

09:00 Monthly Returns, Quarterly Returns

Navigate the GST Websites-GSTN,

Practical Duration CBEC etc.

(hh:mm) File periodic returns online

15:00

Corresponding NOS

Code

BSC/N0911

6 Payment under GST Identify the Types of Payment, Modes Marker,

of Payment, Rules of Collection of Tax Overhead

Theory Duration Prepare different Challans, CPIN & CIN projector,

(hh:mm) Distinguish between TDS and TCS Laptop,

04:00 Identify cases for reversal of credit Internet access

Calculate tax based on various Case

Practical Duration studies

(hh:mm) Memorize the due dates for payment

04:00 List the Penalties for late payments

Demonstrate the process of online

Corresponding NOS

payment

Code

BSC/N0911

Total Duration Unique Equipment Required:

Laptop, white board, marker, projector, Internet Access

Theory Duration

53:00

Practical Duration

47:00

Grand Total Course Duration: 100 Hours, 0 Minutes

Goods and Services Tax (GST) Accounts Assistant

(This syllabus/ curriculum has been approved by BFSI Sector Skill Council of India)

Trainer Prerequisites

Sr.

No. Area Details

1 Description The person appointed by any company, is responsible for maintaining

records of accounts for the purpose of making preparing periodic reports

around GST from time to time. He is authorized to perform functions relating

to filling returns by the applicable due dates.

2 Personal The individual needs to have excellent understanding of accounting

Attributes processes. In addition to having problem solving skills, the individual must

be self-driven and organized with his work and act with integrity when

performing multiple tasks for the organization.

3 Minimum Graduation in commerce or allied subject.

Educational

Qualifications

4a Domain Certified for Job Role: “Goods & Services Tax (GST) Accounts Assistant”

Certification mapped to QP: “BSC/Q0910”. Minimum accepted score as per SSC

guideline is 80%.

4b Platform Recommended that the Trainer is certified for the Job Role: “Trainer”,

Certification mapped to the Qualification Pack: “MEP/Q0102”. Minimum accepted score

as per SSC guideline is 80%.

5 Experience Experience preferred but not mandatory

Goods and Services Tax (GST) Accounts Assistant

Criteria For Assessment Of Trainees

Job Role :GST Accounts Assistant

Qualification Pack :BSC/0910

Sector Skill Council BFSI Sector Skill Council

Guidelines for Assessment

1. Criteria for assessment for each Qualification Pack will be created by the Sector Skill Council. Each Performance

Criteria (PC) will be assigned marks proportional to its importance in NOS. SSC will also lay down proportion of

marks for Theory and Skills Practical for each PC.

2. The assessment for the theory part will be based on knowledge bank of questions created by the SSC.

3. Assessment will be conducted for all compulsory NOS, and where applicable, on the selected elective/option

NOS/set of NOS.

4. Individual assessment agencies will create unique question papers for theory part for each candidate at each

examination/training centre (as per assessment criteria below).

5. Individual assessment agencies will create unique evaluations for skill practical for every student at each

examination/training centre based on this criterion.

6. To pass the Qualification Pack, every trainee should score a minimum of 70% of aggregate marks to successfully

clear the assessment.

7. In case of unsuccessful completion, the trainee may seek reassessment on the Qualification Pack.

Compulsory NOS

Total Marks: GST Account Assistant - 150

Marks Allocation

BSC/N0910 : Identifying GST Taxable Event – 50

BSC / N0911: Maintaining GST Records and Filing GST Returns - 100

Total Skills

Theory

Assessment outcomes Assessment Criteria for outcomes Marks Out Of Practical

(150)

PC1. Recognise the applicability of SGST, CGST

and IGST

PC2. Define the concept of supply

PC3. Differentiate between taxable and non-

taxable supply

50 20 30

PC4. Define the taxable event with respect to

supply of goods

PC5. Identify the place of supply so as to

decide the applicability of the tax

PC6. Define what is meant by the location of

supplier of goods

PC1. List down the registration process for

25 10 15

single or separate business

Goods and Services Tax (GST) Accounts Assistant

PC2. Note down the details to be furnished

during the registration

PC3. Differentiate between taxable person

verses registered person

PC4. Understand the benefits of registration

PC5. Register an Assessee under GST

Independently

PC6. Identify instances for eligibility of input

credit

PC7. Identify set-offs under GST wherever

applicable

25 10 15

PC8. Identify in detail carry over credit, capital

goods credit, embedded credits etc.

PC9. Differentiate between consideration and

valuation

PC10. Maintain the different types of ledgers

PC11. Prepare different types of periodic 25 10 15

returns to be filed

PC12. File Returns Online

PC13. List the different types of payment, due

dates, modes of payment with rules and

collection of tax, penalties etc.

PC14. Differentiate on TDS versus TCS 25 10 15

PC15. Calculate the amount of tax payable

PC24. Make the payment online

Total 150 150 60 90

Goods and Services Tax (GST) Accounts Assistant

You might also like

- Jabsco 15780-0000 Parts ListDocument2 pagesJabsco 15780-0000 Parts ListClarence Clar100% (1)

- Business Requirements For : Revision HistoryDocument16 pagesBusiness Requirements For : Revision HistoryVenkata Madhusudana Reddy BhumaNo ratings yet

- BPLS M&E Form 1Document4 pagesBPLS M&E Form 1Rosalie T. Orbon-TamondongNo ratings yet

- Indonesian Tax Localization UpdatesDocument53 pagesIndonesian Tax Localization UpdatesAnas Andriana Yusup100% (3)

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- MC BSC Q0301 Business CorrespondentDocument9 pagesMC BSC Q0301 Business CorrespondentFasih Ahmad100% (1)

- MC BSC Q0201 Equity Dealer V2 30 05 17Document9 pagesMC BSC Q0201 Equity Dealer V2 30 05 17Roshan JainNo ratings yet

- c899444c9d09c9beca2696374d7e12f9Document1 pagec899444c9d09c9beca2696374d7e12f9Romer EnajeNo ratings yet

- New BPLS Compliance Montitoring FormDocument1 pageNew BPLS Compliance Montitoring FormDann Dansoy100% (1)

- Advance Tally Erp9Document3 pagesAdvance Tally Erp9Kalpesh SutharNo ratings yet

- Q8101 Accounts ExecutiveDocument12 pagesQ8101 Accounts ExecutiveRoshan JainNo ratings yet

- Digital Compliance: Platform From SAPDocument9 pagesDigital Compliance: Platform From SAPsiddharthadeepakNo ratings yet

- E-Invoice System: User Manual - Bulk Generation & Cancellation ToolDocument23 pagesE-Invoice System: User Manual - Bulk Generation & Cancellation Toolsuman.neel59386100% (1)

- Bpls and BpcoDocument2 pagesBpls and BpcoJoeren EvardoneNo ratings yet

- GST Scope Post Release DocumentDocument22 pagesGST Scope Post Release DocumentRajesh KumarNo ratings yet

- in Asset Accounting (FI-AA) in Integration With Accounts Payable (FI-AP), But Without Reference To A Purchase OrderDocument5 pagesin Asset Accounting (FI-AA) in Integration With Accounts Payable (FI-AP), But Without Reference To A Purchase OrdersiddharthNo ratings yet

- F-90 Asset Acquisition With VendorDocument5 pagesF-90 Asset Acquisition With Vendorsunil23456100% (2)

- Geneva OverviewDocument54 pagesGeneva OverviewNishant KumarNo ratings yet

- Accounts Executive - Statutory Compliance QP and NOS - Final PDFDocument25 pagesAccounts Executive - Statutory Compliance QP and NOS - Final PDFSrinath GandraNo ratings yet

- Configuration Lists FICODocument43 pagesConfiguration Lists FICOLuciano MeiraNo ratings yet

- OBYC - GBB - Transaction Keys - SCNDocument7 pagesOBYC - GBB - Transaction Keys - SCNanilvishaka7621No ratings yet

- Subcontracting Process - Jobwork in GSTDocument6 pagesSubcontracting Process - Jobwork in GSTsuku_mca0% (1)

- Solaris SCSAIDocument24 pagesSolaris SCSAIsrinivasNo ratings yet

- STODocument4 pagesSTOSachin BhalekarNo ratings yet

- STO Configuration For GST: PurposeDocument6 pagesSTO Configuration For GST: PurposeTirupatirao Bashyam100% (1)

- BPLODocument3 pagesBPLOJane Bonggo100% (1)

- ACCOUNTANCY (Code No. 055) (2020-21)Document18 pagesACCOUNTANCY (Code No. 055) (2020-21)Bharti JindalNo ratings yet

- CBS and Postal DepartmentDocument49 pagesCBS and Postal DepartmentK V Sridharan General Secretary P3 NFPENo ratings yet

- Se Uk Functionality OverviewDocument30 pagesSe Uk Functionality OverviewgnicollNo ratings yet

- Tutorial 3 ACCTDocument10 pagesTutorial 3 ACCTKhánh Linh CaoNo ratings yet

- MC BSC Q0101 Life Insurance AgentDocument9 pagesMC BSC Q0101 Life Insurance AgentRoshan JainNo ratings yet

- GST ManualDocument42 pagesGST ManualMallu LoharNo ratings yet

- Online Webinar Broucher Carrier in AccountingDocument12 pagesOnline Webinar Broucher Carrier in AccountingShradha Rohan BayasNo ratings yet

- DCS - Status of Account ModuleDocument6 pagesDCS - Status of Account ModuleTejas ThakorNo ratings yet

- SAP Fi QuestionnaireDocument18 pagesSAP Fi Questionnairejitinmangla970No ratings yet

- CBS Promotions April - 2024Document16 pagesCBS Promotions April - 2024bapparocksNo ratings yet

- Avina SAP FICO On Hana ContentDocument15 pagesAvina SAP FICO On Hana ContentMcLarenNo ratings yet

- Interview QuestionsDocument20 pagesInterview Questionsjay koshtiNo ratings yet

- AFM HandoutDocument9 pagesAFM HandoutDivyanshu GuptaNo ratings yet

- Sap FiDocument6 pagesSap FiGlobal SolutionNo ratings yet

- Service TaxDocument26 pagesService Taxyagnesh211733No ratings yet

- E-Invoicing - at A GlanceDocument10 pagesE-Invoicing - at A Glancew2vijayNo ratings yet

- CBSE Class 11 Accountancy Syllabus 2023 24Document7 pagesCBSE Class 11 Accountancy Syllabus 2023 24vaibhavmenon6No ratings yet

- AccountancyDocument16 pagesAccountancyKatyani SinghNo ratings yet

- ACCOUNTANCY (Code No. 055)Document16 pagesACCOUNTANCY (Code No. 055)Jayanth KumarNo ratings yet

- SAP MM-FI Integration Concepts PDFDocument29 pagesSAP MM-FI Integration Concepts PDFChandolu SravyaNo ratings yet

- Feasibility Study KPI OTC-EF01-01 V1.10 (Number of Lines Matched Per OTC FTE)Document8 pagesFeasibility Study KPI OTC-EF01-01 V1.10 (Number of Lines Matched Per OTC FTE)Paul DeleuzeNo ratings yet

- TCS Overview Solution Implementation QueriesDocument13 pagesTCS Overview Solution Implementation QueriesAmit Shinde100% (1)

- LGU:IMELDA Province: Zamboanga Sibugay: I. Compliance To Revised BPLS StandardsDocument2 pagesLGU:IMELDA Province: Zamboanga Sibugay: I. Compliance To Revised BPLS StandardsLemuel MejaresNo ratings yet

- Tax Procedure Migration: Taxinj - TaxinnDocument14 pagesTax Procedure Migration: Taxinj - Taxinnpal singhNo ratings yet

- QP BSC-Q0910 Goods & Services Tax (GST) Accounts Assistant V2 27-6-17Document15 pagesQP BSC-Q0910 Goods & Services Tax (GST) Accounts Assistant V2 27-6-17Jayant SoniNo ratings yet

- Accountancy SrSec 2022-23Document16 pagesAccountancy SrSec 2022-23Commerce VIVEKNo ratings yet

- Retail Payable Invoice: Solution Design DocumentDocument11 pagesRetail Payable Invoice: Solution Design DocumentVikas SinghNo ratings yet

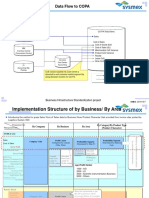

- Data Flow To COPA: Business Infrastructure Standardization ProjectDocument3 pagesData Flow To COPA: Business Infrastructure Standardization ProjectT SAIKIRANNo ratings yet

- Accountancy SrSec 2023-24Document16 pagesAccountancy SrSec 2023-24sarathsivadamNo ratings yet

- Dynamic QR Code User GuideDocument7 pagesDynamic QR Code User Guidevinil vkNo ratings yet

- Sap-Fi/Co: Part 1: Enterprise StructureDocument4 pagesSap-Fi/Co: Part 1: Enterprise StructureSURYANo ratings yet

- UserManual BulkE InvoicegenerationtoolDocument13 pagesUserManual BulkE InvoicegenerationtoolDr. Yashodhan JoshiNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument18 pagesACCOUNTANCY (Code No. 055) : RationaleAditya GawdeNo ratings yet

- One Year Diploma CourseDocument3 pagesOne Year Diploma Coursekirtibansal2004No ratings yet

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationFrom EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationNo ratings yet

- Sap Companies in AhmedabadDocument2 pagesSap Companies in AhmedabadJay ThakerNo ratings yet

- Laboratory Assistant (Pathology)Document8 pagesLaboratory Assistant (Pathology)Jay ThakerNo ratings yet

- Federation UniversityDocument2 pagesFederation UniversityJay ThakerNo ratings yet

- Instapdf - in Ielts Syllabus 700Document16 pagesInstapdf - in Ielts Syllabus 700Jay ThakerNo ratings yet

- Certificate Course in E-COMMERCEDocument9 pagesCertificate Course in E-COMMERCEJay ThakerNo ratings yet

- Advance Import Export ManagementDocument13 pagesAdvance Import Export ManagementJay ThakerNo ratings yet

- Custom Clereance (Junior Executive)Document9 pagesCustom Clereance (Junior Executive)Jay ThakerNo ratings yet

- VDRLDocument4 pagesVDRLfarazhussainkhanNo ratings yet

- 0547 s06 TN 3Document20 pages0547 s06 TN 3mstudy123456No ratings yet

- Dsm-5 Icd-10 HandoutDocument107 pagesDsm-5 Icd-10 HandoutAakanksha Verma100% (1)

- Elrc 4507 Unit PlanDocument4 pagesElrc 4507 Unit Planapi-284973023No ratings yet

- Muhammad Fauzi-855677765-Fizz Hotel Lombok-HOTEL - STANDALONEDocument1 pageMuhammad Fauzi-855677765-Fizz Hotel Lombok-HOTEL - STANDALONEMuhammad Fauzi AndriansyahNo ratings yet

- Synchronous Alternators: Three-Phase BrushlessDocument5 pagesSynchronous Alternators: Three-Phase BrushlessĐại DươngNo ratings yet

- Gábor Vékony - Dacians, Romans, RumaniansDocument254 pagesGábor Vékony - Dacians, Romans, RumaniansTinuszka67% (3)

- JTB Unitization Gas Project: Electrical Equipment/ Tools Inspection ChecklistDocument1 pageJTB Unitization Gas Project: Electrical Equipment/ Tools Inspection ChecklistAK MizanNo ratings yet

- Dungeon 190Document77 pagesDungeon 190Helmous100% (4)

- Jatiya Kabi Kazi Nazrul Islam UniversityDocument12 pagesJatiya Kabi Kazi Nazrul Islam UniversityAl-Muzahid EmuNo ratings yet

- The Ezekiel Cycle of 500 YearsDocument1 pageThe Ezekiel Cycle of 500 YearsOtis Arms100% (1)

- Analisis Pemetaan (Jadual Kenalpasti Cu Wa)Document5 pagesAnalisis Pemetaan (Jadual Kenalpasti Cu Wa)En AzermieyNo ratings yet

- $50SAT - Eagle2 - Communications - Release Version V1 - 2Document25 pages$50SAT - Eagle2 - Communications - Release Version V1 - 2Usman ShehryarNo ratings yet

- Adam Weeks ResumeDocument3 pagesAdam Weeks ResumeAdam WeeksNo ratings yet

- Relatorio Mano JulioDocument7 pagesRelatorio Mano JulioProGeo Projetos AmbientaisNo ratings yet

- Software Engineering. Specification, Implementation, VerificationDocument186 pagesSoftware Engineering. Specification, Implementation, Verificationazariel.rodrigo100% (1)

- Final Simple Research (BS CRIM. 1-ALPHA)Document5 pagesFinal Simple Research (BS CRIM. 1-ALPHA)Julius VeluntaNo ratings yet

- UNIT HistoryDocument2 pagesUNIT HistorySanders StephenNo ratings yet

- Nursing Care PlanDocument4 pagesNursing Care PlanPutra AginaNo ratings yet

- The Little Magazine RamRamDocument5 pagesThe Little Magazine RamRamJasdeep SinghNo ratings yet

- A Short Version of The Big Five Inventory (BFI-20) : Evidence On Construct ValidityDocument22 pagesA Short Version of The Big Five Inventory (BFI-20) : Evidence On Construct ValidityBagas IndiantoNo ratings yet

- Questionnaire For Technical AssistantDocument4 pagesQuestionnaire For Technical AssistantHabtamu Ye Asnaku LijNo ratings yet

- Fs Tco Battery Diesel Delivery Trucks Jun2022Document3 pagesFs Tco Battery Diesel Delivery Trucks Jun2022The International Council on Clean TransportationNo ratings yet

- Dbms Lab Dbms Lab: 23 March 202Document12 pagesDbms Lab Dbms Lab: 23 March 202LOVISH bansalNo ratings yet

- Semantically Partitioned Object Sap BW 7.3Document23 pagesSemantically Partitioned Object Sap BW 7.3smiks50% (2)

- Feasibility of Ethanol Production From Coffee Husks: Biotechnology Letters June 2009Document6 pagesFeasibility of Ethanol Production From Coffee Husks: Biotechnology Letters June 2009Jher OcretoNo ratings yet

- Drama Bahasa InggrisDocument24 pagesDrama Bahasa InggrisCahyo Yang bahagiaNo ratings yet

- Neuro TR Brochure - EN CompressedDocument8 pagesNeuro TR Brochure - EN CompressedJanam KuNo ratings yet

- 4 Thematic Analysis TemplateDocument19 pages4 Thematic Analysis Templateapi-591189885No ratings yet