Professional Documents

Culture Documents

IAM Numericals 2

IAM Numericals 2

Uploaded by

sanket patil0 ratings0% found this document useful (0 votes)

19 views31 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

19 views31 pagesIAM Numericals 2

IAM Numericals 2

Uploaded by

sanket patilCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 31

RS en Me el ok a ie ane nee

Q.2. Calculated the expected return of a portfolio “A” with the follow

a) Risk free rate of return 8% ng data

b) Expected return on market portfolio 12% i cca

) Market sensitivity index0.75

Gabitid saline a A> Opt RyCB)

7A Ce Be) B

v roftred. t

apt Yelum on hort = aa ala -8 60:95)

eB. + 47.(0-45)

is ps8}. biated 10 pil

= 9

P HH land Trou L3ipadi ag’ af

- 4

Se eee

Q.2. The following information is given: ———S

a) Risk free rate of return 8%

_ b) Expected rate of return on Dae portfolio 16%

¢) Beta o security 0.7

a the ojpected rok, OH Ei 01 tru se

~ ee

Let Hen.

Expected return on povifolie = Rp 4 CMa -Re)cB)

g

es bettie (93) ole -8 Hoa)

Spigimse i Cod

= 8h t+ 56%

are.

Aww + Sxbechidl shor ow fs -13.6'/,

6 aye

tet \p evvick ds \

3. From the following information, calculate the expected rate of return of a por

4d) Co-relation co-efficient of portfolio with the market 0.8% eee

¢) Market standard deviation 2.3%

aR EERREREE RRR -

4a) Risk free rate of return 12%

b) Expected return on market portfolio 18%

Standard deviation of an asset 2.8% -

-—

ae

ees Resale = Re + CMe- RD!

» %

me

=

ee

= phe Ce) -B7) Pe

SP pier ey 6.47)

ND Bet ORS D

ee al Fels,

+

i

i

q

- ik ete ju

Be 29 508 p siandsd dusahon of shok

Saas Saadeh chisiobiensy bt:

Basse.

Vas _oxhectid ohn on eyes is \a-82/.

__| a4. calculate the market.

a) standard deviation ofthe asset 2.5%

tb) Market standard deviation 2.0%

Risk free rate of return 139%

‘Above, what will

10%.

and the expected return on portfolio from the following data:

Gh expected return on market portfolio 25%

8 Correlation coeficient of portfolio with market 08%

be the expected return on portfolio if the portfolio beta is 0.5 and the risk free return is

Soutien

[ sxpecteck Return Qorifolie =

= REY Cp - Re) GB)

= \3ht CS. B/G)

Sea

u 2 ayes

[Be Set stole -x¢ cowrelation Qrehosen axel 2 mkt

ae ome b

Bat Sua toe =

a Q_sbally

GD kxfected cretion porttblie:

> Re Cma- RE) Cp].

= leh + Cig) -14) 8

¥f TE aes

= leh eas i,

2 lnS/,

rt ¢ 5 sand

dupors | nbec om ie a | ahi

Q.5. From the following information, calculate the exp

a) Risk free rate of return 8%

'b) Expected return on market portfolio 18%

¢) Standard deviation of an asset 2.8%

d) Market standard deviation 2.3 %

e) Co-relation co-efficient of portfolio with narket 0.8

rected rate of return of a portfolio:

a

»

gh © Cie) Bel) 1) “ed

= Bh retole CoP

Shr BEL

= Thay.

= SBP oY asceh., Corclansn” Seth

ela

Bo} worked) 2 >

é 5.5 ae :

(a : an) 4-9! Qe8 ee eg ; ;

: a ee

Q.6. An investor is seeking tne price to pay for a security whose standard deviation is 3%. ‘The

sj correlation coefficient for the security with the market is 0.8 and the market standard deviation is

sre urn from government securities Is 5.2% and from the market portfolio is 9.8%. What isthe

required rate of return?

2.2%.

Setahion

Enherted Coetern aa Ge iclio ~ RCM -De) cg)

fl = Sr (AS -SPDAE

= So) +@. crn

i = SDE 2S P\

E = 2\o+2V/)

x 18

ea ‘were correctly priced?

“A The following information i avallable in respect of security x and Y- .

security Beta expected return on security

22.00%

7 16 20.40% aa

FraRe uk trad cot aT vhs these sovuttes correctly iced, what oud De te Cae ee cecniialag Ps

mie. Shee Rew) a, as ent a

; gai). 2 Sve Reeve > peo = FE PpErO T

: \obp = 1S 204d > WR

e's 1s Res Sto]

ANS a Te

peste wi. Bp + B34]

Peiemnatie 4 fo 1 Nite coats:

22 Fs pair rake 2.0 x 22 = Ro 418

agetob F £6 RP Se

\|-60| = O.2Rp 60 2 0 2Reb

es Re eh Siig if ciency)

NGG 1 nite ‘ wep 4 ius Pepi

Ofte Ris Fla Hla seni one in

Gr Ro jy 2’).

(AS. Asan investment manager, You ae given the following information:

a

Tavesrent Tn eauly sores Trial pee) oWidends Om | Marketpricew [Beta]

Gnas [rey theend ofthe | factor

‘A. Cement Led. PG i veal Rs.)

steed. = : a 3s

Tiguor Ld a 2 os t

3 Government of nda bonds [3000 15 1008 a

Risk free rate of return may be taken at 14%

Required:-

{@) Expected rate of returns of portfolio for each individual investments us

(b) Average return cn the portfolio. 's using the CAPM.

En =| Bas BCR) Eas Ming ABC he)

deo’ C1233) = Meiplo HCD 23)

ta 23.864 Y. = 92.63).

iquer_ Ard. or

En of BCRP) q

Wp po-S C12. 33) Gp toa C 18RD.

= 20.165 9A Si e+ 9% Der

Q]|Morket Return = Pivik CO 160.

Tavestment i

ep WG +145 5100-31

4405"

= 26. 3B oI | na

QO. t\ 44 Veg

® non forbblie + 23566 +:22634 2016t26.2¢

fverege. Retur on BN Z

-:9. Your client is holding the following securities

Particulars of Cost (in Rs) Dividend/interest_] Market Price Beta A

Investment

Equity shares of _ | 10,000 1725 3,800 06 _

Gold Ltd, :

Equity sharesof | 15,000 7,000 16200 08 -

Silver Ltd, a

Equity shares of | 14,000 700 20,000 06

= Bronze td. : S

‘GO! Bonds. 36,000 3,600 35,500 2.0

Cond Average return on this portfolio is 15.7%, calculate: -

4) Expected rate of return in éach using CAPM.

~ ts bb). Risk free rate of return.

_ Boution. Investment Bividend) Zadeut Capita! om

{ Sapity Showy ef Gold Ho . 1925 : (200) ,

| Spatly shouraportvasid. 000 1200 |

Beily shows of Pronzcttd- Joo gooo |

| Gor: Moin 600 C1500)

Tefal. 7025 & S500

2 Witleadk + Capital Garas = To25+ 5500 =16:4D

Tapes Investment S000

te Rp > -Cut- Rp) (0-75)

IGF = Rpt Cb# - Re)loF7S) |

[5:7 = Rb _12:525 =| OF SRP «

15:9 = RE 0-26.ppr,

Ree JB *

Re + RoC B?

O| Ee-

2 pth th(o6)

JOS SEIDEL aged. H veut ; Aa

215.4 i

ihe: Pea Eade as Naa

= Ug. ash yh ‘ sca

agtt Oo @ pF.

= 6.47

=) ep

fio. she beta coefficient of Target Ltd. 1.4. The company ha been maintalning 8% rate of growth 9

dividends and ‘earnings. The last dividend paid was Rs. 4/- per share. Return on Government securities is ao

: Giidends orion market portfolio Is 15%. The current market price of one share of Target Lid is s.36/-

1 hat will be the equilibrium price per share of Target Limited?

Would you advice purchasing the share? a

equilibrium price is a smaximum price echicth th

—

imuedor is ends to pay

SQ Tem

Solution Expected) Resurra of Tareget Abd é toil Bi Gnd),

Toh BV NE H/,

= Y Fils

ket i Puieg.

Po i 1 Soa 4.93

oF = 2/108) -oiog Vo *

Po Ne

Ol? 0.03 = $32 Semmes Kons

fo

4 jel 19% srohern pantie. tay ay PAs,

2é'-9

Prswel Since the 2g willbeivina pri te ke 48/2 py

$d spies asta“ pyter ts Pa Bel _4p er er

Slaw, as ik R anhubrtod

1 nee ;

a 6) 7

FF. 62. The risk free rate of returns 9%. The expected rate of return onthe market portfolio fs 13%. The

‘expected rate of growth for the dividend of firm A is 73, The last dividend paid on the equity stock of

Firm Aas Rs. 2.00/-. The beta of firm A’s equity stock is 12.

(a) Whatis the equilibrium price of the equity stock of firm A?

(b) How would the equilibrium price change when:

() the inflation prentium increases by 2%;

(ii) the expected growth rate increases by 3%;

(il) he bets of exuity ries to13 =

ee —

Po

RRs 95) Given |

Lei. feel es [rngee 22. C09) Se

£h (Given). 5 :

|

IT

i 2__ Given) ECE

4 Ret (Rn Pe) Bi) Wee- 22 +4.

i 29% CIspeGh) Kal

i = 9+ 4/Q.2)

/ Bd = 13:87.

=i

ee <8 84) i

a

2 ; HL) Eps Re +BCQq

i [ Shige es O-15E™) al

ONBBES WCHOD) 4 00+ OFF

someon sb gh =\sRe iy .

As eye = 2b

fe.

os yo

‘foe SlAt

; =r Dos [I%fr

a 1h 42% 2 1% -

eg» Nhe tees

ane

see ‘wants to invest an amount of Rs.520 lakhs and had approached his portfolio manager.

“ine portfolio manager has advised Mr. Fedup to invest inthe following manner:

= Moderate | Better Go

aS | Moderate] 0d a

“Amount (Rs. in lakhs) 60) 80 100) ee

[Beta 0.50 1.00 0.80 1.20 1.50

You are required to advise Mr.Fedup in regard tothe following using CAPM.

{i) Expected return on the portfolio, ifthe Government securities are at 89 and the NIFTY

yielding 10%.

(i. Advisabllity of replacing security ‘Better’ with NIFTY,

pias a

Solutio

oiva

Med 60 . 0:50 | 0-0

Better] | g | O15 | boo | o150 |

Geod. | fotos! [fe aya 2. pase | U.,

Neko aha | Owe dgem en ae

Eobamces Sorat

i ae <4

Exped Redarn on Poriblio=s Re + BCRm Re).

Seias| = Sht W25SCl0 48)

eeeRoOUSl/.

hisiindilferent to snake an vestmnesih wither In

Eps RPy BOR Bie

bat = a yes ees

= 10+

gos: )\ zbeettol-t Byte wpe 2

p= ee 7

ee ae ee

lou ae pee.

Stocks A & B have the following historical returns

TE,

3

am Stock A’s return (in 96) jock B's return (in %)

es ae

2010 55 aa 3

ie , [ou 5.82 ae a

wee 28.30. 71.16 = | —4

ooo pid pas cei eae ig hapa 208 teh

Bere a oe ciedabd rate of edn HeREN your om Sooo sears oe ee eae ne

sveraceretum onthe porta rng he peat <=

Bolt po Bi glo! |

ck A BF inne Se —

eat sath) | Prebam tn Sx ead baw

oo& C12-24 ose | DAD fowl

Looq 23.65) | 2 oo 4235. 7

Qo\0 25.45 | 6.26 | $94

oem aeea| oe ae

2%) Do | } 2-20) eS

TTéfat.o1 >} ea

: a) . {Ze Reture is

2008 CE 00) 6.29 Loo. !

oq fl edt9. 55.) atria hema 1

Zaidrily ovisndde 09) Loutr O20 8.808

201) |. 20 O28 nooe :

24 Qe le oo 2 —

Rou (OSs wee el 17

=

se ts [6-202'7.

F e bs l

Ade. Cen 4. #45 qa

B. Cees 3}

Xtock Ae ae. fia. (e-o ia

a0 E19. 94)x (0-5) + 0.5)0-5) | a, Cat 2D —

93.64%0:5] +1955 KoG |. 21622

010 | [85 a5 x05 [+ [4401 x05 a

oad 0.51 ¢| [-20x0-6\ - 3-5)

065] t Letibxe SI. 24-43

S)0

What isthe expected return (percentage) on it’s portfolio?

‘What would be its expected return if she quadrupled her investment in Grizzle rest:

_zverything else the same? aurants while leaving

a and Group invest the following sums of money in common stocks having expected returns D

[Seeuney Amount Invested = xe

Morck Drug $6,000 Expected Return

Kota chemicals $11,000, ish ———

Fazio Electronics $9,000 is Z

Northern california utility 7 | $7,000, ee j

Grizzle Restaurants $5,000 oe

__.[ Pharlap Oit $13,000 ae

[Excell Corporation 9,000, aa aoe

Rrcborton | S*becbed Return |

nite

008

GELeL F148

AS 09 (|S

eaten

* Of Box limited performs relatively well to other stocks during recessionary periods. The

Limited, en the other hand, does well during growth periods. Both the stocks are currently

Rs.100/- per share. The assessment of the rupee return (dividend plus price) of these stocks

year are as follows:

rs Economiccondition

High growth Low growth | __ Stagnation Recession

03 O.8

02 O41

‘on Box 100, 110 120 140,

‘on Cox, 150 130 90. 60.

the expected return and standard deviation of investing:

(2) Rs.1,000 in the equity stock of Box Limited

Rs.1,000 in the equity stock of CoxLimited

Rs.500 each in the equity stock of box Limited and Cox Limited

Lm

S:

Jjooo} <0.3 | 300 9) | '1500

Woon}. 4%0 > || 1300 _

2000} 10.2 2400 | Joo"

po SO.) | FOO 600

ey 4420»

i fr o0 his 0 F

Rhy BRP) = lor1.2CS

Rabies a0 27 x

res

Cc SSS)

a

Vane D0or FO =1G0) On

Cereoustn F750 +650=1200 O'4

Stagnation 600+450=1050 0-2

Receasion . TOOt 200: Jooo O:!

Standard Gemindene Bore

Sa. JSeoa¢-

SD =Jo

245 > ooo NEES

480 a5 ‘ no A900

210 CNS) \adas 2645

lOO C165) 27225 oa:

ie gos

6, An aggressive mutual fund promises an expected return of 16% with # possible volatility (standard

Geviation) of 20%. On the other hand, a conservative mutual fund promises an expected return of 13%

and volatility of 15%. =

Required:

ta) Which fund would you like to invest in?

{b) Would you like to invest in both if you have money

(6) Assuming you can borraw money from your provident fund at an opportunity cost ‘of 10%, a

which fund would you invest your money in?

the _visk e7 nvertor, However Piauclon ce,

Suggest that an vest ent IS acl J

an laggrenive 3 a, Pd Feffead 1 Invest

jin an aggresives: crmtual fant

Or Is paefiond ge e jw both Tha fusacls 04 | gga

2) phersiiahon. preligoat es am fhe Bick. 2

ee “3 sn aN: sia a =

se Te

Loom pfudda ors

curities D, E and F have the following characteristics with respect to expected return, standard

(© B) op) (ae) 2

Vie ElwOcm Dll) YGr:

+(e DY COSP YE EWE Cad) (vay.Gtor

. See SS E

2256 + 0.04 /410*

a\ 42

+O 4h eh,

sha Taste |

: @ Return _on P is

& P Limited has an expected return of 22% and a standard deviation of 40%. Q Limited has an ee

>xpected return of 24% and a standard deviation of 38%. P Limited has a beta of 0.86 and Q Limited has

& beta of 1.24. The correlation between the returns ofP & Cis 0.72. The standard deviation of the |

market is 20%. Re a

(2) Is investing in Q better than investing in P? =

(b) Ifyou invest 30% in C and 70%in P, what is the expected rate of return and the portfolio standard

deviation?

{c) Whats the market portfolios expected return and how much isthe risk free rate? a

(d) Whatis the beta ofthe portfolio ifs weight is 70 percent and a's weight is 2037

(e) Whats the correlation between P & the market and Q& the market?

sae 4%

e: on. Gis 24lo. cotthn. Standard des iatio

a 407. 2-38! Tied ee p Trvesbective. of the viedure_ a

Investors & colll be preferred) ever Pas tt hos meg n

Rox “isk ~~ Gompaud Ho stock P.. Jet

Hed Retusn on Tortfolia . 10:22) (CoFe)¥ Co 2n)(6- 36).

Bi nOn226 Wo 22-6)

( OPEC) WORE EP) CoP)Grg oo)

= Go)? .¢0:4¥ + G8)* (o-

2 FRAIL IC + 459 CAR

POSE CIS73. 602 . Oost

ies aus

ao it ts Go 8e >

Take = REPRE Clit) SS seh

as Dh + Rp B-38) RRs eae 3)

Ret 5-26 Lo-86) Ide8t 1255

22 - G52

8.0 0k pitas wb!

i2iplag + Mes 22

ee

dis a consumer goods company, which earns expected return of 12% on its existing

ons subject to standard deviation of 20%. The company is owned by a family and the family has

er Investment, New projects under consideration and the new uprojetis expected togve

fect kel to aceount for 25% of 12's operations. XYZ has ented a tity function to

The function is as under: -

‘only if total utility goes up. Evaluate the prc

D perections-

ew ear

aes Vubtlity = 1OoR€

yoo x12 7

. Operaren .

Bonet pie 4

a,

-EFE1S% .

Sree A) ate ater

See oe techn eneh - aati

a mena ——— *

#, “a,

Corveloiten ,

Cr oC)

Zand on the market po

\ Probability = Return on C Ltd. Return in the market

occurrence ae (°6) a is

0

Condition of economy

(ee 15 10

a. 14 6 ae

ia i 26 7 s

— |

() “Le | 92. You are presented with the following information concerning the returns on the shares of C Ltd 7

rtfolio according to the various condition of the economy re

; pS

The current risk free interest rate is 9%. .

~ Calculate: , a

ta} Fhe

efficients between the security and the market. —

(b) The correlation co

(c) The beta of the security.

(8) casual Ws muperbed Relurn 2 Btewdond dovrinlor 4 cud § mauet =

—- | a) Gmeadabane CRORES gupacted Rekuun of Ud, under CHEM Model Y be > 4! —

Soe eG) CP)

= Cove iC ;

__[EeSisionlerobabitity[Retuyn [FE ZRima Deviation | (WD) | a

fs B56 On

Be

a en

; _ ———_—}_Q.23. The following are the returns of share S and market M for the last six years:- oe ty,

© a Year 3 _.__ReturnonSasa% Return on Masa % \

re | 18 : 15 |

lel Ze 9 | 7

ae aaa ie :

|. ae : weeOl2 : is

Hf ee ) : pee 12 7 | es

er. (a) Calculate the covariance and correlation coefficient of the returns.

(b} Betermihe the beta coefficient ofS.

Cc) Car te Ynpeted RUA under Cory model Yo Me Rp > H'/,

RAF ON Sosa >. ahh

Sa op anenaner pape

Probability | Sb:

j2i-c0 | 20%

:

Zxpecded Return > DS4/6 = 94-00

IP. Doce ee he)

Oe.

UE

=> Ss D eS

a:

ALA /A

Qu

\

Deviadior’ (Deviolken)) SD |

9.00 Sl .00 | 13.5

10.00. 100-00, ‘16. 6F

£94 020) 4. 361-00| 6 GF

C9) .0).. 4.00 0.64

a | Ort ty Gale

of market i is 40% and the expec ed market eturn is Wy he 1 risk fr ree

e co-va ance of retugns ice the market and otha shares of ABC Ltd. over the same

e. expected return undér CAPM model.

en

i

;

i

€

&

:

4

tO

"

= ee

4. You are able ‘to both borrow and lend at the |

; expected return of 15% and a Standard deviation of 21%. De rmine the expected return and (es

1 deviations of the following portfolios: (aaa. |

isk-free rate of 9%. The market portfolio of SECUTities cy

os

is invested in the risk free asset. ae

urd is invested in the risk free asset and two thirds in the. a

wealth is invested in the market portfolio, Furthermore, you

V eal ‘h to invest inthe market portfolio. aed tg

i

We CRiskfree ) tn '

eT The osoute) be

needed to meet tax and dividend payments and to finance further capital expenditure in several months

time, they have been invested in a small portfolio of short term equity investments. Details of the

EE Sart folin which consists of ee in four listed UK companies are as follows: - |

Last dividend | Expected returnin

= pany Number of Betaequity | Market price

shares held es share PiLuwyield % market perception

ee ~ 60,000 Be aes 19.50

Divina! aaa 80,000 ae Rs.2.92 —

Fe TOO cee |. Rs.2.17 17:50

Cr =

1,25,000 Rs.3.14 3. ae 23.00

©

o<3 Q.25. Better Luck Limited has been enjoying a substantial net cash inflow, and until the surplus funds are

—

agen

Ry er market return is about 19% and the risk free rate is 11% p.a.

(a) } ‘on the basis of the data) calculate the risk of Better Luck limited’s short term investment

vartfolio relative to that of the market (portfolio beta).

wy) Recommend, with reasons, wheter Better Luck limited should change the composition of its +e

| portfolio. |

a ig Tic meee hi le Ha A ale armenia”

3 F , ene

oS — Npeeeg Niece he une Marner mera aegis ee a

Company No, ot Shaves M.P C= ») a Q ae Prob. . (Zeta ony ree

| Os 60,000 A 24 9 6 Reptioia:.0 0-22 |.\6 G2

— Oso 2.28 OAS

——a 000 0.20.” 0,40 3

POO COO! 3s. 2 ato 21 > .5A-

8 - ==. 2. ae 3,42; 900 B.3b Ls | pos

1, ee \.00 herr ts

Freed GAMMA ES |

Babeted = Moret Percebtion edision

Wy) fo Cie) = 20:28 ai

Ute mereeCa 26 = 2424 —— : 2 og

WW): a (0:40) =(8.20 00 Het

rite pee ec oe” 22-00 ‘ |

E | |

i

x _

© a Q.28. Six portfolios experienced the following results during a7 year period: - .

.

~ Standard deviation Correlation with market

os . 27.0 0.81 =

0.65

0.98 =a

0.75

- Rank these portfolios using

| (a) Sharpe’s method —reward to variability; and : —

(b)treynor’s method-reward to-volatility.and.explain differences. : 5

Geolitie) gpa. calc) Twrow's Measure ef fibha ee

grgreiror eee

ne Veuy ors Medes,

5-240] © | 6.2810

5-42.49) | }2-92

9.38|@ | |).60o1@

O.\5 as —|20-0d X 19.40

0) 14-33| @ |13.o}

OMe

Mrarpee Tndec js to be usecl or Treynors= imolex is te

ke used aebonds on whether the shitas at narchous

| er in the Seéa.jie. Stock 's Net listeak tr the Market

—" 4 == 4 Ss : j

eee 6 itted in the maorkelOs <

i : : 2 |

If the stock ''s iste in achive. market, Tremors

_ Imor liskd In an achive Trakel, Sherpel_felex

a eae ee

cere

eraser 4

srtfolios experienced the following result¢ during a 7- year period:

Correlation with the

market returns (r)

Average Annual return

Standard Deviation

>

75 0.840 |

a | eos

ae aime

20 3 0.750

0.600

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Resume Subham KumarDocument1 pageResume Subham Kumarsanket patilNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- IAM Numericals 1Document9 pagesIAM Numericals 1sanket patilNo ratings yet

- AIS Question BankDocument11 pagesAIS Question Banksanket patilNo ratings yet

- Duration & ConDocument63 pagesDuration & Consanket patilNo ratings yet

- Finance Elective Tri V Batch 2021-23Document12 pagesFinance Elective Tri V Batch 2021-23sanket patilNo ratings yet

- FA NotesDocument11 pagesFA Notessanket patilNo ratings yet

- PGDM D - Corp ValDocument2 pagesPGDM D - Corp Valsanket patilNo ratings yet

- JD - Credit ManagerDocument2 pagesJD - Credit Managersanket patilNo ratings yet

- Interview Shortlist - N L DalmiaDocument1 pageInterview Shortlist - N L Dalmiasanket patilNo ratings yet

- Ia & M NldimsrDocument107 pagesIa & M Nldimsrsanket patilNo ratings yet

- Associate - Risk Monitoring (Mid Market)Document2 pagesAssociate - Risk Monitoring (Mid Market)sanket patilNo ratings yet

- Critical Analysis Of: Multiple Regression ModelDocument12 pagesCritical Analysis Of: Multiple Regression Modelsanket patilNo ratings yet

- SM Consolidated 2021-23batchDocument176 pagesSM Consolidated 2021-23batchsanket patilNo ratings yet

- Relative ValuationDocument22 pagesRelative Valuationsanket patilNo ratings yet

- Asian Paints DCF ValuationDocument64 pagesAsian Paints DCF Valuationsanket patilNo ratings yet

- JD - MT - TechnicalDocument1 pageJD - MT - Technicalsanket patilNo ratings yet

- ValuationDocument18 pagesValuationsanket patilNo ratings yet

- JD - Financial Advisory - Trainee, Advisor, Sr. AdvisorDocument3 pagesJD - Financial Advisory - Trainee, Advisor, Sr. Advisorsanket patilNo ratings yet

- PGDM QP Cval Set 1Document2 pagesPGDM QP Cval Set 1sanket patilNo ratings yet

- Monte Carlo Fashions Ltd. Forecast - UPDATEDDocument26 pagesMonte Carlo Fashions Ltd. Forecast - UPDATEDsanket patilNo ratings yet

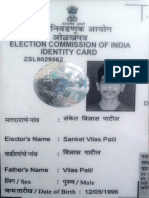

- Voters ID - Sanket PatilDocument2 pagesVoters ID - Sanket Patilsanket patilNo ratings yet

- Other Methods of ValuationDocument6 pagesOther Methods of Valuationsanket patilNo ratings yet

- Antiragging FormDocument2 pagesAntiragging Formsanket patilNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelsanket patilNo ratings yet

- Guidelines For Filling Online Antiragging Form 1Document1 pageGuidelines For Filling Online Antiragging Form 1sanket patilNo ratings yet

- 733pgdm QP Cval Set 1Document3 pages733pgdm QP Cval Set 1sanket patilNo ratings yet

- Sanket Patil Draft1Document1 pageSanket Patil Draft1sanket patilNo ratings yet

- JD For ESG AnalystDocument2 pagesJD For ESG Analystsanket patilNo ratings yet

- Ticket 31 OctDocument2 pagesTicket 31 Octsanket patilNo ratings yet