Professional Documents

Culture Documents

4 5879525209899272176 PDF

4 5879525209899272176 PDF

Uploaded by

YaredOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 5879525209899272176 PDF

4 5879525209899272176 PDF

Uploaded by

YaredCopyright:

Available Formats

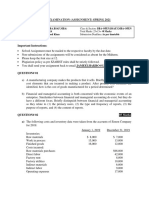

Assignment for Cost and Management Accounting I

ADMAS UNIVERSITY, MEGENAGNA ADEBABAY CAMPUS, DEPARTMENT OF ACCT & FIN

Cost & Management Accounting-I Group Assignment

1. Brody Company makes industrial cleaning solvents. Various chemicals, detergent, and water

are mixed together and then bottled in 10-gallon drums. Brody provided the following

information for last year:

Raw materials purchases $250,000

Direct labor 140,000

Depreciation on factory equipment 45,000

Depreciation on factory building 30,000

Depreciation on headquarters building 50,000

Factory insurance 15,000

Property taxes:

Factory 20,000

Headquarters 18,000

Utilities for factory 34,000

Utilities for sales office 1,800

Administrative salaries 150,000

Indirect labor salaries 156,000

Sales office salaries 90,000

Beginning balance, Raw Materials 124,000

Beginning balance, WIP 124,000

Beginning balance, Finished Goods 84,000

Ending balance, Raw Materials 102,000

Ending balance, WIP 130,000

Ending balance, Finished Goods 82,000

Last year, Brody completed 100,000 units. Sales revenue equaled $1,200,000, and Brody paid a

sales commission of 5 percent of sales.

Required:

1. Calculate the direct materials used in production for last year.

2. Calculate total prime cost.

3. Calculate total conversion cost.

4. Prepare a cost of goods manufactured statement for last year. Calculate the unit product cost.

5. Prepare a cost of goods sold statement for last year.

6. Prepare an income statement for last year. Show the percentage of sales that each line item

represents

Job order costing

2. Assume that the following transactions were received from the record of Almda Textile Factory for

the month of June, 2014.

a. Purchase of materials (Direct and indirect) Br. 89,000 on account

b. Materials sent to mfg plant floor – Direct materials Br. 81,000, indirect materials Br. 4000

c. Manufacturing wages incurred : Direct Br. 39,000, Indirect Br. 15,000

d. Payment of Total manufacturing payroll for the month Br. 54,000

e. Additional manufacturing overhead costs incurred during the month consists of utilities and repairs

Br. 25,000 and accumulated depreciation on factory plant Br. 50,000

f. Allocation of manufacturing OH to production Br. 80,000

g. Goods costing Br. 188,000 were completed during the period

h. Goods costing Br. 180,000 were sold on account for Br. 220,000

i. The factory incurred the following nonmanufacturing expenses last month: Br. 2, 000 commissions

to sales agent, Br. 1,000 advertising expenses, Br. 3,000 depreciation on office equipment and Br.

1,500 other selling and administrative expenses.

Instruction: Prepare the necessary Journal entries from the above information.

Admas University Page | 1

Assignment for Cost and Management Accounting I

3. H2M manufacturing company uses job order costing system. The company uses machine hours to

apply overhead cost to jobs. At the beginning of 2012, the company estimated that 150,000 machine

hours would be worked and $900,000 overhead cost would be incurred during 2012.

The balances of raw materials, work in process (WIP), and finished goods at the beginning of 2012

were as follows:

Raw materials: $40,000

Work in process: $30,000

Finished goods: $60,000

H2M manufacturing company recorded the following transactions during 2012:

a) Raw materials purchased on account, $820,000.

b) Raw materials were requisitioned for use in production, $760,000 ($720,000 direct materials and

$40,000 indirect materials).

c) Direct labor, $150,000; indirect labor, $220,000; sales commission, $180,000; and administrative

salaries, $400,000.

d) Sales travel costs were $34,000.

e) Utility costs incurred in the factory, $86,000.

f) Advertising expenses were $360,000.

g) Depreciation for the year was $700,000 ($560,000 relates to factory and $140,000 relates to selling

and administrative activities).

h) Insurance expired during the year, $20,000 ($14,000 relates to factory operations and $6,000 relates

to selling and administrative activities).

i) Fine manufacturing company worked 160,000 machine hours. Manufacturing overhead was applied

to production.

j) Goods costing $1,800,000 were completed during the year.

k) The goods costing $1,740,000 were sold to customers for $3,000,000.

Required:

1. Prepare journal entries, T-accounts and income statement from the above information.

2. Prepare a journal entry to close the balance in manufacturing overhead account (over or under

applied manufacturing overhead) to cost of goods sold.

4. 2C Company uses job-order costing. It applies overhead cost to jobs on the basis of direct labor-

hours. The following transactions took place during the year:

a) $300,000 of raw materials were purchased on account

b) Raw materials were issued into production: $90,000 direct materials and $40,000 indirect materials

c) Labor costs incurred: $40,000 direct, $130,000 indirect, sales commissions $50,000, administrative

salaries $100,000

d) Utility costs for the factory were $60,000

e) Depreciation recorded was $300,000 (70% related to factory; 30% related to administrative offices)

f) Manufacturing overhead of $715,000 was applied to production. Actual direct labor-hours incurred

were 22,000.

g) Jobs costing $300,000 were completed and transferred into the finished goods inventory.

h) Jobs with a cost of $150,000 were sold on account for $200,000.

i) Closed the under/over applied overhead for the year.

Required: Prepare the necessary journal entries and summarize their balance using T-Account

5. QRS Company has two support departments (Administration and Janitorial) and three producing

departments (Fabricating, Assembly, and Finishing). Costs and activities are as follows:

Administration Janitorial Fabricating Assembly Finishing

Direct costs ..................... $50,000 $30,000 $40,000 $50,000 $25,000

Number of employees ..... 10 30 40 20

Square feet ..................... 2,000 10,000 28,000 15,000

Direct labor hours ............ 5,000 6,000 2,000

Administrative services are allocated based on the number of employees; janitorial services are

allocated based on square footage. Overhead rates for the three producing departments are based on

direct labor hours.

Admas University Page | 2

Assignment for Cost and Management Accounting I

Required:

Determine the overhead application rates for the producing departments using each of the three

allocation methods:

A. Direct allocation method

B. Sequential allocation method

C. Reciprocal allocation method

Process costing

6. Suppose that Peace Corporation, chemical manufacturing Company, has two production departments

using sequential production flow: the Mixing Department and the Bottling Department. In the

Mixing Department direct material consisting ingredient chemicals is added at the beginning of the

production process. Direct labor and manufacturing overhead costs are incurred evenly throughout the

production process. Predetermined overhead rate is used in the mixing department using direct labor

cost as a cost allocation base and at 125% overheads per $1 direct labor cost. The following table

presents the summary activity performed in Mixing Department during March. The direct material

and conversion costs listed under beginning work in process section represent the work done during February.

Work in process, March 1: 20,000 Units

Direct material, 100% Complete, cost of* $50,000

Conversion costs, 10% Complete, cost of* 7,200

Balance in work in process, March 1* $57,200

Units started in March 30,000 Units

Units completed during March and transferred out of the Mixing department 40,000 Units

Work in process, March 31: 10,000 Units

Direct material, 100% Complete

Conversion costs, 50% Complete

Costs incurred During March:

Direct material $90,000

Conversion costs:

Direct labor $86,000

Applied Manufacturing Overhead** 107,500

Total Conversion Costs $193,500

*These costs were incurred during the month of February

**Overhead is allocated at 125% of Direct Labor cost

Required: prepare the cost production report based on FIFO and Weighted Average method and record

the necessary Entries.

Accounting for spoilage under process costing

7. Anzio Co. manufactures a wooden recycling container in its Forming Department. Direct materials

for this product are introduced at the beginning of the production cycle. At the start of production, all

direct materials required to make one output unit are bundled in a single kit. Conversion costs are

added evenly during the cycle. Some units of this product are spoiled as a result defects only

detectable at inspection of finished units. Normally spoiled units are 10% of the goods output.

Summary of data for July 2004 are:

Physical Units for July 2004

Work in Process, beginning inventory (July 1) 1,500 units

Direct Materials (100% complete)

Conversion costs (60% complete)

Started during July 8,500 units

Completed and transferred out during July 7,000 good units

Work in Process, ending inventory (July 31) 2,000 units

Direct Materials (100% complete)

Conversion costs (50% complete)

Total Costs for July 2004

Admas University Page | 3

Assignment for Cost and Management Accounting I

Work in process, beginning inventory

Direct materials (1,500 equivalent units * Br. 8) Br. 12,000

Conversion costs (900 equivalent units * Br.10) 9,000 Br. 21,000

Direct materials costs added during July 76,500

Conversion costs added during July 89,100

Total costs to account for Br.186, 600

Required: prepared the cost of production report using FIFO and weighted average Method and

record the necessary entry

8. Assume that the Dream Corporation has two processing departments using sequential production

flow: the Cleaning Department and the Milling Department. In the Cleaning Department direct

material is introduced in the production process at the beginning of the production process.

Conversion costs are incurred evenly throughout the production process. According to past

experience of the company normal spoilage accounts 10% of good units completed and transferred

out. The following table presents the summary activity performed in Cleaning Department during

May.

Work in process, May 1: 1,000 Units

Direct material, 100% Complete, cost of* $4,000

Conversion costs, 80% Complete, cost of* 400

Balance in work in process, May 1* $4,400

Units started in May 9,000 Units

Units completed during May and transferred out of the Cleaning department 7,400 Units

Work in process, May 31: 1,600 Units

Direct material, 100% Complete

Conversion costs, 25% Complete

Costs incurred During May:

Direct material $27,000

Conversion costs $48,000

*These costs were incurred during the month of April

Required:

i. Determine the amount of normal and abnormal spoilage, and

ii. Show the treatment of both using weighted average and First-in, First-out methods of process

costing and pass the necessary journal entries

Instruction:

Select 2 Questions from(Q1-Q4)

Select 6 or 7

Question no.5 and 8 mandatory.

Total Question=5

Admas University Page | 4

You might also like

- Gripping GAAP 2019 - ServiceDocument1,285 pagesGripping GAAP 2019 - ServiceCindy Petersen86% (14)

- Notes From Walmart AcademyDocument6 pagesNotes From Walmart AcademyLisa Hoheisel50% (2)

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- IBEX Global Parañaque SWOT AnalysisDocument2 pagesIBEX Global Parañaque SWOT AnalysisPUPT-JMA VP for AuditNo ratings yet

- Chapter 4-Exercises-Managerial AccountingDocument3 pagesChapter 4-Exercises-Managerial AccountingSheila Mae LiraNo ratings yet

- NormalDocument2 pagesNormalPatrisha0% (2)

- Exercises - Job Order CostingDocument7 pagesExercises - Job Order CostingJericho DupayaNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- Acctg201 Exercises2Document18 pagesAcctg201 Exercises2sarahbeeNo ratings yet

- 505 - Week 4 Cont Threaded DiscussionDocument12 pages505 - Week 4 Cont Threaded DiscussionbilalNo ratings yet

- IAS 36 Impairment of AssetsDocument22 pagesIAS 36 Impairment of AssetsZeeshan Mahmood100% (1)

- Assignment One and TwoDocument5 pagesAssignment One and Twowalelign yigezawNo ratings yet

- Cost I AssignmentDocument7 pagesCost I AssignmentibsaashekaNo ratings yet

- Worksheet1-Basics & COGSDocument5 pagesWorksheet1-Basics & COGSmohsinmustafa.2001No ratings yet

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- Tutorial 3 - Process CostingDocument5 pagesTutorial 3 - Process Costingsouayeh wejdenNo ratings yet

- C. (I), (Ii) and (Iv) OnlyDocument17 pagesC. (I), (Ii) and (Iv) OnlyTrương Đỗ Linh XuânNo ratings yet

- Chapter 3 ExamplesDocument2 pagesChapter 3 ExamplesAli Gökay BozokNo ratings yet

- Cost Accounting Quiz 1Document4 pagesCost Accounting Quiz 1Mary Joanne Tapia33% (3)

- Midterm Exam Solution Fall 2012Document13 pagesMidterm Exam Solution Fall 2012Daniel Lamarre100% (4)

- Problem 1:: Job Order CostingDocument4 pagesProblem 1:: Job Order CostingTrina Mae BarrogaNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingTrina Mae BarrogaNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingHeide PalmaNo ratings yet

- Job Order CostingDocument9 pagesJob Order CostingApple BaldemoroNo ratings yet

- Cost AccountingDocument59 pagesCost AccountingMuhammad UsmanNo ratings yet

- HOMEWORK 002 (HW002) Cost Accounting and Control Compute in Good Form and Answer Each Required Question Double Rule and Encircle Final Figure AnswerDocument6 pagesHOMEWORK 002 (HW002) Cost Accounting and Control Compute in Good Form and Answer Each Required Question Double Rule and Encircle Final Figure AnsweraltaNo ratings yet

- Final Managerial 2016 SolutionDocument10 pagesFinal Managerial 2016 SolutionRanim HfaidhiaNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- ACCT505 Practice Quiz 1Document6 pagesACCT505 Practice Quiz 1Michael GuyNo ratings yet

- Direct Materials Direct Labor: Exercise 2 - Job Order Cost SheetDocument7 pagesDirect Materials Direct Labor: Exercise 2 - Job Order Cost SheetNile Alric AlladoNo ratings yet

- Cost Sheet - ProblemsDocument3 pagesCost Sheet - Problemssasirekha02758No ratings yet

- Tugas Individual 345Document7 pagesTugas Individual 345Mochamad PutraNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Afar CostDocument9 pagesAfar CostDiana Faye CaduadaNo ratings yet

- Financial Statements ER Problem 2 SolutionDocument11 pagesFinancial Statements ER Problem 2 SolutionSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- Qualifying Exam Reviewer 2017 - CostDocument12 pagesQualifying Exam Reviewer 2017 - CostAdrian Francis100% (1)

- BSA QualifyingReviewer-6 PDFDocument12 pagesBSA QualifyingReviewer-6 PDFQueen ElleNo ratings yet

- Practice Questions - Class Excercises 2Document12 pagesPractice Questions - Class Excercises 2ChristineNo ratings yet

- Accounting QuestionDocument8 pagesAccounting QuestionMusa D Acid100% (1)

- Job Costing and Overhead ER PDFDocument16 pagesJob Costing and Overhead ER PDFShaira VillaflorNo ratings yet

- EssayDocument3 pagesEssayConstantinos ConstantinouNo ratings yet

- Epektos Part 1Document4 pagesEpektos Part 1Melvin MendozaNo ratings yet

- Acctg15 Job-Order QuizDocument3 pagesAcctg15 Job-Order QuizJemar Murillo DalaganNo ratings yet

- EXERCISECHAPTER2Document8 pagesEXERCISECHAPTER2Bạch ThanhNo ratings yet

- Midterm No. One Review: The Equivalent Units of Production For Conversion Costs WereDocument5 pagesMidterm No. One Review: The Equivalent Units of Production For Conversion Costs WereEric AgudeloNo ratings yet

- Ma. Lyn Bren BS-Entrep 2B Applying Learned ConceptsDocument7 pagesMa. Lyn Bren BS-Entrep 2B Applying Learned Concepts2B Ma. Lyn BrenNo ratings yet

- Cost & MGT Acc I WorksheetDocument4 pagesCost & MGT Acc I Worksheetfekadegebretsadik478729No ratings yet

- Answers Homework # 14 Cost MGMT 3Document9 pagesAnswers Homework # 14 Cost MGMT 3Raman ANo ratings yet

- ACCT 2022 - FS First-Exam-ADocument6 pagesACCT 2022 - FS First-Exam-AMr MDRKHMNo ratings yet

- SunwayTes Management Accountant Progress Test 2Document13 pagesSunwayTes Management Accountant Progress Test 2FarahAin FainNo ratings yet

- BUSN 2110 Assignment 2Document3 pagesBUSN 2110 Assignment 2Fresh & Fit Fitness And RecreationNo ratings yet

- Mid Term Exam - Cost Accounting With AnswerDocument5 pagesMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDONo ratings yet

- 05.16.2023 ASSIGNMENT Activity Problem With Theories-Process Costing and JOB Order Costing - With ANSWER KEYDocument11 pages05.16.2023 ASSIGNMENT Activity Problem With Theories-Process Costing and JOB Order Costing - With ANSWER KEYAngel Cil RuleteNo ratings yet

- Job Order QuizDocument6 pagesJob Order QuizJohn Elly Cadigoy CoproNo ratings yet

- Cost Accounting #2 PDFDocument3 pagesCost Accounting #2 PDFSYED ABDUL HASEEB SYED MUZZAMIL NAJEEB 13853No ratings yet

- ACCG 2000 Week 3 Homework Questions PDFDocument3 pagesACCG 2000 Week 3 Homework Questions PDF张嘉雯No ratings yet

- Auditing Theory SummaryDocument53 pagesAuditing Theory SummaryguhilingprincejohnNo ratings yet

- 8408 Cost Accounting Past Paper 2019Document23 pages8408 Cost Accounting Past Paper 2019Fazila FaheemNo ratings yet

- Ma As2Document6 pagesMa As2Omar AbidNo ratings yet

- JIT CostingDocument2 pagesJIT CostinghellokittysaranghaeNo ratings yet

- rESEARCH QUESTIONS FbiDocument35 pagesrESEARCH QUESTIONS FbiBOOMERBADNo ratings yet

- Session+6+PQs+Process+Costing PDFFDocument10 pagesSession+6+PQs+Process+Costing PDFFatty lesNo ratings yet

- HRM YafetDocument6 pagesHRM YafetYaredNo ratings yet

- Business LetterDocument1 pageBusiness LetterYaredNo ratings yet

- L.C.T Group WorkDocument6 pagesL.C.T Group WorkYaredNo ratings yet

- Assignment 1Document2 pagesAssignment 1YaredNo ratings yet

- AccountingDocument8 pagesAccountingYared100% (1)

- Individual Assignment1Document1 pageIndividual Assignment1YaredNo ratings yet

- 4 - Case Study - The IMF and Ukraine's Economic CrisisDocument2 pages4 - Case Study - The IMF and Ukraine's Economic CrisisAhmerNo ratings yet

- Growth Strategy: What Are Growth Strategies?Document4 pagesGrowth Strategy: What Are Growth Strategies?Vedant RajNo ratings yet

- Basic Accounting Terms: Name-Ritumbra Chilwal CLASS - 11 Subject - AccountancyDocument66 pagesBasic Accounting Terms: Name-Ritumbra Chilwal CLASS - 11 Subject - AccountancyAashray BehlNo ratings yet

- Brealey - Principles of Corporate Finance - 13e - Chap17 - SMDocument14 pagesBrealey - Principles of Corporate Finance - 13e - Chap17 - SMShivamNo ratings yet

- MH-01-BR-1820 - (Insurance) Bajaj Ok NewDocument5 pagesMH-01-BR-1820 - (Insurance) Bajaj Ok NewAnil SharmaNo ratings yet

- Question Bank: Sr. No. QuestionsDocument2 pagesQuestion Bank: Sr. No. QuestionsNisarg ChauhanNo ratings yet

- Week 9 Tutorial Questions SolutionsDocument4 pagesWeek 9 Tutorial Questions SolutionsAnthony LiangNo ratings yet

- Corporate Law ProjectDocument16 pagesCorporate Law ProjectMukul Singh RathoreNo ratings yet

- How Loyalty Programs Boost Revenue: and How To Measure ItDocument10 pagesHow Loyalty Programs Boost Revenue: and How To Measure ItSanam100% (1)

- A Study On Service Quality Measurement and Its Impact in Opting Insurance CompaniesDocument21 pagesA Study On Service Quality Measurement and Its Impact in Opting Insurance CompaniesPallavi PalluNo ratings yet

- New Venture Creation Important QuestionDocument39 pagesNew Venture Creation Important QuestionSahib RandhawaNo ratings yet

- Division Hosha/Gabad LetterDocument1 pageDivision Hosha/Gabad LetterJonathan KaleNo ratings yet

- Chapter Five: Life and Health InsuranceDocument36 pagesChapter Five: Life and Health InsuranceMewded DelelegnNo ratings yet

- Account Statement - 2020 09 01 - 2022 12 01 - Es Es - 458dcbDocument6 pagesAccount Statement - 2020 09 01 - 2022 12 01 - Es Es - 458dcbLaurentiu Catalin NeagoeNo ratings yet

- Corporations: Organization, Capital Stock Transactions, and DividendsDocument64 pagesCorporations: Organization, Capital Stock Transactions, and DividendsDesta MaldinaNo ratings yet

- 179153-2010-Re Ownership Structure of A Land-Owning20210424-12-123uo6lDocument5 pages179153-2010-Re Ownership Structure of A Land-Owning20210424-12-123uo6lFlois SevillaNo ratings yet

- Taco 0067596020700018Document1 pageTaco 0067596020700018Meera CompanyNo ratings yet

- KTT TELEX CODE PAYMENT (Signed)Document4 pagesKTT TELEX CODE PAYMENT (Signed)ChristianMNo ratings yet

- Shriram Group PresentationDocument36 pagesShriram Group Presentationchoudharyankush731No ratings yet

- Ethics & CSR CH 5 & 6Document34 pagesEthics & CSR CH 5 & 6Lamaro HololoNo ratings yet

- Annual Report 12-13Document55 pagesAnnual Report 12-13Venkat Narayan RavuriNo ratings yet

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofDocument9 pagesSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofMOHAMMED KHAYYUMNo ratings yet

- Test Bank For Marketing Strategy 5th Edition FerrellDocument6 pagesTest Bank For Marketing Strategy 5th Edition FerrellMargaret Abernethy100% (35)

- Home Office and Branch AccountingDocument7 pagesHome Office and Branch AccountingRujean Salar AltejarNo ratings yet

- Hoover Digest, 2022, No. 4, FallDocument224 pagesHoover Digest, 2022, No. 4, FallHoover InstitutionNo ratings yet

- Course Title: International Trade FinanceDocument4 pagesCourse Title: International Trade FinanceYash MittalNo ratings yet