Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

88 viewsFinancial Statement With Adjustments Questions

Financial Statement With Adjustments Questions

Uploaded by

ManjulaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 50 Ms Excel Assignments PDF For PracticeDocument30 pages50 Ms Excel Assignments PDF For PracticeManjula67% (6)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Barriers To CommunicationDocument10 pagesBarriers To CommunicationManjulaNo ratings yet

- BC - Sem I - MaterialDocument25 pagesBC - Sem I - MaterialManjulaNo ratings yet

- MBA FT Business Communication 1 Sem I-1Document11 pagesMBA FT Business Communication 1 Sem I-1ManjulaNo ratings yet

- Session 5 - BC - FC - Oct 13, 2022Document8 pagesSession 5 - BC - FC - Oct 13, 2022ManjulaNo ratings yet

- Communication SkillsDocument47 pagesCommunication SkillsManjulaNo ratings yet

- Session 3 - BC - FC - Oct 11, 2022Document22 pagesSession 3 - BC - FC - Oct 11, 2022ManjulaNo ratings yet

- Percentage Basic To AdvancedDocument56 pagesPercentage Basic To AdvancedManjulaNo ratings yet

- Null 1Document5 pagesNull 1ManjulaNo ratings yet

- Introduction To CommunicationDocument16 pagesIntroduction To CommunicationManjulaNo ratings yet

- Ratio Basic To AdvancedDocument26 pagesRatio Basic To AdvancedManjulaNo ratings yet

- Ms ExcelDocument55 pagesMs ExcelManjulaNo ratings yet

- 1000 Puzzles Series Set 31 With AnnoDocument9 pages1000 Puzzles Series Set 31 With AnnoManjulaNo ratings yet

- 1000 Puzzles Series Set 35 With AnnoDocument12 pages1000 Puzzles Series Set 35 With AnnoManjulaNo ratings yet

- AverageDocument38 pagesAverageManjula100% (1)

- 1000 Puzzles Series Set 33 With AnnoDocument7 pages1000 Puzzles Series Set 33 With AnnoManjulaNo ratings yet

- 3 Tally Prime Course Annex - 1 Bill EntryDocument34 pages3 Tally Prime Course Annex - 1 Bill EntryManjulaNo ratings yet

- Test 3 Tax SolutionsDocument17 pagesTest 3 Tax SolutionsManjulaNo ratings yet

- 1000 Puzzles Series Set 30 With AnnoDocument7 pages1000 Puzzles Series Set 30 With AnnoManjulaNo ratings yet

- 1000 Puzzles Series Set 32 With AnnoDocument17 pages1000 Puzzles Series Set 32 With AnnoManjulaNo ratings yet

- 1000 Puzzles Series Set 26 With AnnoDocument9 pages1000 Puzzles Series Set 26 With AnnoManjulaNo ratings yet

Financial Statement With Adjustments Questions

Financial Statement With Adjustments Questions

Uploaded by

Manjula0 ratings0% found this document useful (0 votes)

88 views12 pagesOriginal Title

Financial Statement with Adjustments Questions

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

88 views12 pagesFinancial Statement With Adjustments Questions

Financial Statement With Adjustments Questions

Uploaded by

ManjulaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 12

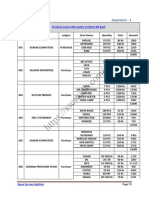

Problem 5 The following Trial Balance has been extracted from the books of Shri Santosh Kumar on

31st March 20X2:

Bei

‘The following additional information is available:

@

)

©

@

e

Stock on 31st March 20X2 was Rs 30,800,

Depreciation is to be charged on Plant and Machinery at $% pa. and Fumiture and Fixtures at

6% p.a. Loose Tools are revalued at Rs 16,000,

Provision for Doubtful debts is to be maintained at 5% on Sundry Debtors,

Remuneration of Rs 2,000 paid to Mr B. Barua, a temporary employee, stands debited to his personal

account and it is to be corrected.

Unexpired insurance was Rs 400,

Required Prepare Trading and Profit and Loss Account for the year ended 31st March 20X2 and a

Balance Sheet as on that date.

Problem 6 The following Trial Balance extracted from the books of a Merchant Mr Nageswara Rao

(on 31.03.20X2.

@

©

©

@

©

wo

®

‘Stock on hand on 31.03.20X2 Rs 3,250.

Depreciate Buildings @ 5% p.a.; Fumiture @ 10% pa; Motor Vehicles @ 20% pa.

Rs 85 is due for interest on Bank Overdraft.

Salaries Rs 300 and Taxes Rs 200 are outstanding,

Insurance Premium amounting Rs 100 prepaid.

‘One-third of the commission received is in respect of work to be done next year.

‘Write off a further sum of Rs 100 as bad debts from Debtors and create provision for Doubtful

Debts @ 5% on debtors.

Required Prepare a Trading and Profit and Loss Account and the Balance Sheet.

Problem 7 From the Trial Balance of Mr A as given on next page, prepare a Trading and Profit and

Loss Ale for the year ending 31st March 20X2 and a Balance Sheet as on that date

Sales

Retums

Loans at 12% (on 1,7.20X1)

Creditors

Discount

Capital

(@) Wages include Rs 2,000 for erection of new machinery on 1.4.20X1.

(©) Stock on 3st March 20X2 was Rs 40,925,

(© Provide depreciation on machinery @ 5% p.a.

(@) Salaries unpaid Rs 800.

(©) Half the amount of Shyam’s bills is irrecoverable,

(A) Create a provision at 5% on other debiors.

(@) Rent paid up to 31st July 20X2.

(Insurance unexpired Rs 300.

Problem 8 — Prepare Trading and Profit and Loss Account and Balance Sheet from the following particulars

as at 31st March 20X2:

Trial Balance

Particulars ‘Dr. (Rs)

Bills Receivable & Bills Payable.

Collected Sales Tax...

Further, you are required to take into consideration the following information:

(@ Salary Rs 100 and taxes Rs 400 are outstanding but insurance Rs $0 prepaid.

() Commission amounting to Rs 100 has been received in advance for work to be done next year.

(©) Interest accrued on investments Rs 210.

(4) Provision for Doubiful Debts is to be maintained at 20%.

(e) Depreciation on furniture is to be charged at 10% pa.

(A) Stock on 31st March 20X2 was valued at Rs 4,500.

(g) A fire occurred on 25 March 20X2 in the godown and stock of the value of Rs 1,000 was destroyed.

It was fully insured and the insurance company admitted the claim in full.

Problem 9

From the following balances taken from the Ledger of Shri Krishna on 31st March 20X2,

prepare the Trading and Profit and Loss Account for the year ended 31st March 20X2 and the Balance

Sheet as at 31st March 20X2 of Shri Krishna:

[ 7 7

‘Sundry Creditors 19,000 | Bad Debts: 100

aun 18000 Loan tom Rar 2500

Income Tax 1,028 | Sundry Debtors 9,500

toove Teas 1000 vesments 500

Cash at Bark 16220| Proven for Cows Deis 100

Sindy Expenses *920| Pont & Rats 0

wank Ie (Cr) 75 | Fume 3.00

Porcaaee 17.0 | Sick (14.20%) a3

wages ‘0.000

Cargo twas ‘a0

Sales 1.85000

Woot Van ‘2800

Cash in and ‘xe

Adjustments to be taken into account

@

(0)

©

@

©

en)

‘Write off further Rs 300 as bad out of Sundry Debtors and create a Provision for Doubtful Debis

at 20% on Debtors.

Dividends accrued and due on Investments is Rs 135, Rates paid in advance Rs 100 and wages

owing Rs 450.

On 31.3.20X2 stock was valued at Rs 15,000 and Loose Tools were valved at Rs 800,

Write off 5 per cent for depreciation on Buildings and 40 per cent on Motor Van,

Provide for interest at 12 per cent per annum due on Loan taken on 1.6.20X1.

Income tax paid has to be treated as Drawings.

Problem 10 The following is the tial balance or Shri Ram at 31st March 20X2 and it is desired to

prepare final accounts showing the results of the transactions of the year:

i Paricaiars ‘Or. (Ra) | Cr (Fs)

'6,000/ 41,000

51,000 =

2,600 =

48,000 =

12,000 =

45,000

‘400

6.500

150,000

14,000

2.13500

7.200 —

9300) 5,500

6,000 -

1,380 =

‘The following adjustments are to be made:

(a) Stock—3ist March 20X2 Rs 52,000

(6) Rent due but not paid, 31st March 20X2 Rs 2,000

(©) Lighting due but not paid, 31st March 20X2 Rs 300

(4) Insurance paid in advance Rs 100

(©) Depreciation—to be written off

Plant and Machinery @ 33-1/3%

Office Fumiture @ 10%

Motor Van @ 33-1/3

(A) The provision for doubtful debts has to be increased to Rs 3,000.

(s) Discounts at 2-1/2% (Two and half per cent) on Debtors and Creditors are to be provided,

Problem 11 From the following figures extracted from the books of Shri Govind, you are required to

prepare a Trading and Profit and Loss Account for the year ended 31st March 20X2 and a Balance Sheet

as on that date after making the necessary adjustments

1 he Re

Sin Govind's capital | 2,28,800 | Stock 1.4.20x1 32,500

Shri Govinds drawings 19,200 | Wages 35,200

Plant and Machinery 99,000 Sundry creditors 44,000

Freehold property 66,000 | Postage and Telegrams 1,540

Purchases 41.10,000 | Insurance 1.760

Returns outwards | "1,400 | @as and fuel 2.870

Salaries | 13200 Bad debis ‘660

Office expenses | 2,750 | Office rent 2,860

Office furniture 5,500 | Freight. 2,900

Discount Ac (Or) 1,820 | Loose tools 2,200

Sundry debtors | 29,260 | Factory lighting 1,100

Loan to Sin Krishna @ 10% pa. | ——_44,000 Provision for Doubttul Debts 880

‘balance on 1.4.20X1 | Interet on foan to Shri Krishna 1,100

‘Cash at bank | 29.260 | Cash in hand 2,640

Bil payable __5500 | Sales 291,440

Adjustments. :

(@ Stock on 31st March 20X2 was valued at Rs 72,600.

(6) A new machine was installed during the year costing Rs 15,400 but it was not recorded in the

books as on payment was made for it, Wages Rs 1,100 paid for its erection have been debited

to wages account.

(©) Depreciate Plant and Machinery by 33-1/3%

Furniture by 10%

Frechold property by 6%.

(4) Loose tools were valued at Rs 1,760 on 31.3.20X2

(©) Of the Sundry Debtors Rs 660 are bad and should be written off.

(A) Maintain a provision of 5% on Sundry debtors for doubtful debis

(e) ‘The manager is entitled to a commission of 10% of the net profits after charging such commission.

Problem 12 On 31st March 20X2 the following Trial Balance has been extracted from the books of

Prepare Trading and Profit and Loss Account for the year ending on 31st March 20X2 and a Balance

Sheet as on that date after considering the following matters:

@

©

©

@

©

wo

®

@)

®

Depreciate Land and Building at 5% p.a. and Motor Vehicles at 15% p.a.

Goods costing Rs 600 were sent to a customer on sale or return for Rs 700 on 30th March 20X2

and has been recorded in the books as actual sales.

Salaries amounting to Rs 700 and Rates amounting to Rs 400 are duc.

AA fire broke out on 1 April 20X2 destroying goods worth Rs 200.

‘The Provision for Doubiful Debts is to be brought up to 5% on Sundry debtors.

Stock in hand on 31st March 20X2 was valued at Rs 6.250,

Goods costing Rs 500 were taken away by the proprietor for his personal use, no entry has been

‘made in the books of accounts.

Prepaid insurance amounted to Rs 175.

Provide for manager's commission at 5% on net profit after charging such Commission.

Problem 13 The following Trial Balance of Shri Om, as on 31st March 20X2, You are requested to

‘Prepare the Trading and Profit and Loss Account for the year ended 31st March 20X2 and a Balance

Sheet as on that date after making the necessary adjustment:

Briiitstttitiiies

as

iis

The following adjustments are 10 be made:

(@) Stock on 31st March 20X2 was valued at Rs 7,25,000.

(@) A Provision for Doubtful Debts is to be created to the extent of 5 per cent on Sundry Debiors

(©) Depreciate—Furniture and Fittings by 10%, Motor Car by 20%.

(@) Shri Om had withdrawn goods worth Rs 25,000 during the year

(€) Sales include goods worth Rs 75,000 sent out to Shanti & Company on approval and remaining

‘unsold on 31st March 20X2. The cost of the goods was Rs 50,000.

(A) The Salesmnen were entitled to a Commission of 5% on total sales,

(g) Debtors include Rs 25,000 bad debts.

(h) Printing and Stationery expenses of Rs 55,000 relating to 20X0-20X1 had not been provided in

that year but was paid in this year by debiting outstanding liabilities.

(i) Purchases include purchase of Furniture worth Rs 50,000.

Problem 14 From the following trial balance and additional information prepare. Trading and Profit

‘and Loss Account of Mr Bharat Tulsian for the year ended 31st March 20X2 and Balance Sheet as on

Dr. (Rs)

10% Loan from Amir Chand (on 1.7.20X1).. en =

12% Loan to Garb Chand (on 1.8.20X1).. | 2,00,000

410,000

297,300

150,000

15,37,000

4,000

5,000

2,80,000

3,000

1,800

5,000

10,000

5,000|

87,500

65,000

5,900|

25,686,500

Additional Information

@)

©

©

@

©

wn

@

(hy

o

gv)

®

Closing Stock at market price as at 31st March 20X2 was Rs 61,500. However its cost was Rs 80,000.

‘A machine costing Rs 20,000 was purchased on Ist July 20X1. Wages Rs 1,000 for its erection

have been debited to Wages Account. Provide depreciation on Plant and Machinery @ 10% p.a.

Sundry Debiors include an amount of Rs 5,000 due from a customer who has become insolvent.

Maintain the provision for doubtful debts @ 10% and for discount @ 2% on debtors. Also create

a reserve for discount on creditors @ 2%.

Dividend accrued and due on investments Rs 500.

Loose Tools were valued at Rs 4,000.

Credit Purchase Invoice amounting to Rs 4,000 had been omitted from the books.

Received eredit purchase invoice of Rs 6,000 on 27th March 20X2 but the goods were not received

till the end of the accounting year.

‘The salesmen were entitled to a commission of 5% on total sales. The sales manager is entitled

to commission of 1% on Gross Profit

Sales include goods worth Rs 75,000 sent out to Mr Clever on approval and remaining unsold on

3st March 20X2, The cost of such goods was Rs 50,000,

Fire occurred on 23rd March 20X2 and Goods costing Rs 10,000 (Selling Price Rs 15,000) were

destroyed. The insurance company accepted claim for 60% only and paid the claim money on 10th

‘Apeil 20X2.

Investments include shares of X Ltd. purchased for Rs 3,000-and it was decided to write off this

investment as the company is under liquidation,

Problem 15 From the following tral balance and additional information of Mr Tushar Tulsian, a proprietor.

Prepare Trading, Profit and Loss Account for the year ending on 31st March 20X2 and the Balance Sheet

a at that date:

Particulars ‘Br. Balance] Cr. Balanca|

Rs Rs

11,000 6,500

Debtors (including Shyam's dishonoured bils of RS 800)...

267,628

(@) Wages include (i) a sum of Rs 4,000 spent on the erection of a cycle shed for employees and

customers, (ii) Rs 2,000 for erection of new machinery on 1.1.20X2.

(b) Provide 5% depreciation on machinery and building.

(©) Remuneration of Rs 2,000 paid to Sh B. Barua, a temporary employee, stands debited to his personal

account.

(@) Sundry creditors include an amount of Rs 5,500 received from Rabul and credited to his account.

‘The amount was written off as a bad debt in the previous year

(©) Gooris costing Rs 500 were taken by the proprietor for his personal use but no entry has been made

in the books of accounts.

(A) Goorls costing Rs 600 were sent to a customer on sale or return for Rs 700 on 30th March 20X2

‘and has been recorded in the books as actual sale.

(e) A fire ocewrred on 25th March 20X2 in the godown and stock of Rs 1,000 was destroyed, it was

fully insured but the insurance company admitted the claim to the extent of 60% only.

(a) Half the amount of Shyam’s bill is irecoverable.

(i) Create a provision of 5% on other debiors.

(j) 0% of Printing and Advertising is to be carried forward as a charge in the following year.

(8) One third of the commission received is in respect of work to be done next year.

(1) Rent has been paid for 11 month but has been received for 13 months.

(m) Included amongst the Debtors is Rs 3,000 due from Ram and included among the Creditors Rs 1,000

due to him.

(n) Provide for Personal Income Tax @ 10% of Net Profit in excess of Rs 50,000.

(0) Stock in hand on 31st March was valued at Rs 111,888.

(p) Manager is entitled to a commission of 5% on Net Profit after charging his commission.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 50 Ms Excel Assignments PDF For PracticeDocument30 pages50 Ms Excel Assignments PDF For PracticeManjula67% (6)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Barriers To CommunicationDocument10 pagesBarriers To CommunicationManjulaNo ratings yet

- BC - Sem I - MaterialDocument25 pagesBC - Sem I - MaterialManjulaNo ratings yet

- MBA FT Business Communication 1 Sem I-1Document11 pagesMBA FT Business Communication 1 Sem I-1ManjulaNo ratings yet

- Session 5 - BC - FC - Oct 13, 2022Document8 pagesSession 5 - BC - FC - Oct 13, 2022ManjulaNo ratings yet

- Communication SkillsDocument47 pagesCommunication SkillsManjulaNo ratings yet

- Session 3 - BC - FC - Oct 11, 2022Document22 pagesSession 3 - BC - FC - Oct 11, 2022ManjulaNo ratings yet

- Percentage Basic To AdvancedDocument56 pagesPercentage Basic To AdvancedManjulaNo ratings yet

- Null 1Document5 pagesNull 1ManjulaNo ratings yet

- Introduction To CommunicationDocument16 pagesIntroduction To CommunicationManjulaNo ratings yet

- Ratio Basic To AdvancedDocument26 pagesRatio Basic To AdvancedManjulaNo ratings yet

- Ms ExcelDocument55 pagesMs ExcelManjulaNo ratings yet

- 1000 Puzzles Series Set 31 With AnnoDocument9 pages1000 Puzzles Series Set 31 With AnnoManjulaNo ratings yet

- 1000 Puzzles Series Set 35 With AnnoDocument12 pages1000 Puzzles Series Set 35 With AnnoManjulaNo ratings yet

- AverageDocument38 pagesAverageManjula100% (1)

- 1000 Puzzles Series Set 33 With AnnoDocument7 pages1000 Puzzles Series Set 33 With AnnoManjulaNo ratings yet

- 3 Tally Prime Course Annex - 1 Bill EntryDocument34 pages3 Tally Prime Course Annex - 1 Bill EntryManjulaNo ratings yet

- Test 3 Tax SolutionsDocument17 pagesTest 3 Tax SolutionsManjulaNo ratings yet

- 1000 Puzzles Series Set 30 With AnnoDocument7 pages1000 Puzzles Series Set 30 With AnnoManjulaNo ratings yet

- 1000 Puzzles Series Set 32 With AnnoDocument17 pages1000 Puzzles Series Set 32 With AnnoManjulaNo ratings yet

- 1000 Puzzles Series Set 26 With AnnoDocument9 pages1000 Puzzles Series Set 26 With AnnoManjulaNo ratings yet