Professional Documents

Culture Documents

5.BIR Form 2316 (CertificationWaiver)

5.BIR Form 2316 (CertificationWaiver)

Uploaded by

MARKOI SHOWOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5.BIR Form 2316 (CertificationWaiver)

5.BIR Form 2316 (CertificationWaiver)

Uploaded by

MARKOI SHOWCopyright:

Available Formats

Date:

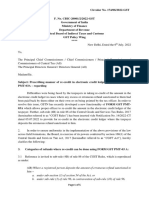

TO: EXL, Human Resource Department

CERTIFICATION

This is to certify that I, Mr./Ms. _________________________, of legal age, ________(civil status), with postal

address at _________________________________ and presently employed with EXL Service Philippines, Inc.,

as ______________ (position), with TIN ________________ certify that I was not able to submit my Certificate of

Income Tax on Compensation (BIR Form No. 2316) from my previous employer due to the following reason/s:

Please check reason/s:

______ No previous employer for 2022 (prior to employment in EXL Service Philippines, Inc)

______Certificate of Income Tax Withheld on Compensation (BIR Form No. 2316) was not available from my

previous employer.

I further certify that whatever taxes due from me as a result of my failure to submit the above documents to EXL

Service Philippines, Inc. will be borne by me and I will pay directly to the Bureau of Internal Revenue (BIR) upon

filing of my Income Tax Return (ITR) for the year 2022.

Upon signing of this certification, I also acknowledge that my tax exemption code, for payroll purposes, shall remain

as Zero (Z) Exemption, unless the following have been complied with as required by the Company pursuant to

BIR Rulings, to change my tax code exemption:

Sec 2.80 of RR2-98 – Failure to file Application for Registration (BIR Form 1902) or Certificate of

Update of Exemption and of Employer’s and Employee’s Information (BIR Form 2305)

a. Where an employee, in violation of these regulations, either fails or refuses to file the BIR Form 1902

together with the required attachments, the employer shall withhold the taxes prescribed under the

Schedule of Zero Exemption of the Revised Withholding Tax Table.

b. In case of failure to file the BIR Form 2305 together with the attachments, the employer shall withhold

the taxes based on the reported personal exemptions existing prior to change of status and without

reflecting any change.

Submission of approved BIR Forms as proof of approved BIR Forms as proof of tax exemption.

Sept.

Signed this _____ day of ____, 2022.

Conforme:

Printed Name and Signature

You might also like

- Letter Request For Closure of Business - BIRDocument1 pageLetter Request For Closure of Business - BIRyakyakxx78% (9)

- Instructions For Form 941: (Rev. March 2021)Document20 pagesInstructions For Form 941: (Rev. March 2021)Btakeshi1No ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- BIR 2316 Waiver FormDocument1 pageBIR 2316 Waiver FormErold John Salvador BuenaflorNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Seminar On Withholding TaxesDocument99 pagesSeminar On Withholding TaxesLeilani Delgado Moselina0% (1)

- PDF W2Document1 pagePDF W2John LittlefairNo ratings yet

- Employee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezDocument2 pagesEmployee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezLaurence Erex GomezNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- IT Declaration Form April 2023 To March 2024.Document3 pagesIT Declaration Form April 2023 To March 2024.partha.uneesolutionsNo ratings yet

- Bir 2316 Submission Waiver 2022Document1 pageBir 2316 Submission Waiver 2022John Jason Narsico AlbrechtNo ratings yet

- Tax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Document16 pagesTax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Nikhil PahariaNo ratings yet

- MW 507Document2 pagesMW 507anon-650325100% (1)

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- SECTION 2.58. Returns and Payment of Taxes Withheld at SourceDocument5 pagesSECTION 2.58. Returns and Payment of Taxes Withheld at SourceStevenkyNo ratings yet

- Rdao 05-01Document3 pagesRdao 05-01cmv mendoza100% (1)

- Crs FormDocument6 pagesCrs Form- EmslieNo ratings yet

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- SFL Controlling Person FormDocument2 pagesSFL Controlling Person FormSyed SaqlainNo ratings yet

- Week - 2 Assignment BDocument3 pagesWeek - 2 Assignment BJulan Calo CredoNo ratings yet

- Salient Features of RA 9504Document2 pagesSalient Features of RA 9504Estudyante BluesNo ratings yet

- Pre Employment RequirementsDocument14 pagesPre Employment Requirementsqqutty pioNo ratings yet

- Revisiting The Rules On Claiming Withholding Tax CreditsDocument3 pagesRevisiting The Rules On Claiming Withholding Tax Creditsarnelo sarmientoNo ratings yet

- Annex B-1 RR 11-2018Document1 pageAnnex B-1 RR 11-2018Jennilyn Eve ReyegNo ratings yet

- Disability Assistance PDFDocument3 pagesDisability Assistance PDFRamesh BNo ratings yet

- Pension Form (Pensioner)Document3 pagesPension Form (Pensioner)telepk100% (1)

- Employee's Withholding Exemption and County Status CertificateDocument2 pagesEmployee's Withholding Exemption and County Status CertificateAparajeeta GuhaNo ratings yet

- LC 10 2019 Final CircularDocument3 pagesLC 10 2019 Final CircularVikkivikram VikramNo ratings yet

- Paycheck Protection Program: Business Legal Name ("Borrower") DBA or Tradename, If ApplicableDocument3 pagesPaycheck Protection Program: Business Legal Name ("Borrower") DBA or Tradename, If ApplicableJanon Fisher100% (2)

- Www-Besttaxinfo-InDocument8 pagesWww-Besttaxinfo-Insukantabera215No ratings yet

- Form 10 Abstention Verification in Respect of Sickness BenefitDocument2 pagesForm 10 Abstention Verification in Respect of Sickness BenefitsaravanaperumalNo ratings yet

- Waiver For Non SubmissionDocument1 pageWaiver For Non SubmissionJayson BongulanNo ratings yet

- Income Payee's Sworn Declaration of Gross Receipts or SalesDocument1 pageIncome Payee's Sworn Declaration of Gross Receipts or SalesApril Lynn Ursal-BelciñaNo ratings yet

- Circular / Office OrderDocument10 pagesCircular / Office OrderrockyrrNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Langford Market Corp Form W-2Document4 pagesLangford Market Corp Form W-2sohcuteNo ratings yet

- Signature & Seal of The Head of Office Signature & Seal of The Head of DepartmentDocument4 pagesSignature & Seal of The Head of Office Signature & Seal of The Head of DepartmentIbrahimGorgageNo ratings yet

- BIR Forms and Deadlines (STRATAXMAN)Document7 pagesBIR Forms and Deadlines (STRATAXMAN)Juday MarquezNo ratings yet

- Annex E - TCC-GOCC - Sworn ApplicationDocument1 pageAnnex E - TCC-GOCC - Sworn ApplicationanabuaNo ratings yet

- Application For Tax Compliance Verification Certificate Non-Individual TaxpayersDocument1 pageApplication For Tax Compliance Verification Certificate Non-Individual TaxpayersYvonne Jane TanateNo ratings yet

- 145905Document1 page145905Tarun GodiyalNo ratings yet

- ESI Form 5 - Half Yearly ReturnDocument6 pagesESI Form 5 - Half Yearly ReturnAshim Agarwal100% (1)

- Week 3: I. Refunds or Tax Credits On Input TaxDocument2 pagesWeek 3: I. Refunds or Tax Credits On Input TaxFatima Zaida JahaniNo ratings yet

- Revenue Memorandum Circular 1-2003Document6 pagesRevenue Memorandum Circular 1-2003Basille QuintoNo ratings yet

- Benefits of GST ImplementationDocument6 pagesBenefits of GST ImplementationMinhans SrivastavaNo ratings yet

- Employer Specail Wage Report Social-Security-Form-SSA-131Document2 pagesEmployer Specail Wage Report Social-Security-Form-SSA-131DellComputer99No ratings yet

- Us W-2 2015 PDFDocument7 pagesUs W-2 2015 PDFkevsNo ratings yet

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoNo ratings yet

- Module 1-Business RenewalDocument4 pagesModule 1-Business RenewalKhitz CryztyNo ratings yet

- std686 PDFDocument2 pagesstd686 PDFnmkeatonNo ratings yet

- Pension Papers SuperanuationDocument19 pagesPension Papers SuperanuationNaeem RaoNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayerscharmedbytinnieNo ratings yet

- BE2012 Guidebook 2Document84 pagesBE2012 Guidebook 2Nur Rasyidah Ab HalimNo ratings yet

- Employer Tax Credits - Internal Revenue ServiceDocument4 pagesEmployer Tax Credits - Internal Revenue Servicenujahm1639No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Authorization Letter JaniceDocument1 pageAuthorization Letter JaniceMARKOI SHOWNo ratings yet

- Authorization Letter OCADocument1 pageAuthorization Letter OCAMARKOI SHOWNo ratings yet

- Zenith WPS OfficeDocument1 pageZenith WPS OfficeMARKOI SHOWNo ratings yet

- Resignation Letter 1Document1 pageResignation Letter 1MARKOI SHOWNo ratings yet

- 3Gov'tEnlistment Checklist - May 2018Document1 page3Gov'tEnlistment Checklist - May 2018MARKOI SHOWNo ratings yet

- Memorandum of Agreement - AgentDocument9 pagesMemorandum of Agreement - AgentMARKOI SHOWNo ratings yet

- ICE Traditional Life Reviewer v1.0Document18 pagesICE Traditional Life Reviewer v1.0MARKOI SHOWNo ratings yet

- Fillable - Business Loan Application FormDocument1 pageFillable - Business Loan Application FormMARKOI SHOWNo ratings yet

- Crisis ManagementDocument28 pagesCrisis ManagementMARKOI SHOWNo ratings yet

- Qualifications Summary:: Ipil Red Cross Subchapter Ipil Zamboanga SibugayDocument2 pagesQualifications Summary:: Ipil Red Cross Subchapter Ipil Zamboanga SibugayMARKOI SHOWNo ratings yet

- Marx Resume For Sales and MarketingDocument3 pagesMarx Resume For Sales and MarketingMARKOI SHOWNo ratings yet

- Skills: Marx Christian SorinoDocument2 pagesSkills: Marx Christian SorinoMARKOI SHOWNo ratings yet