Professional Documents

Culture Documents

Bubble History - Debt, The Markets and The Economy

Bubble History - Debt, The Markets and The Economy

Uploaded by

BisserOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bubble History - Debt, The Markets and The Economy

Bubble History - Debt, The Markets and The Economy

Uploaded by

BisserCopyright:

Available Formats

Bubble history Debt, the markets and the economy Jun 17th 2010, 9:41 by Buttonwood The Economist

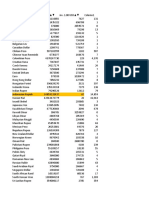

WHEN we talk about bubbles, we tend to think of recent history but in fact this is an age-old phenomenon. (Note to patient readers; this is a long post because it is a condensed version of my BCA speech.) Asset bubbles and rising debt levels go together. And it is not just government debt we have to worry about. US private sector debt has increased as a proportio n of GDP from around 60% in the early 1950s to almost 300% at its peak. Some increase in debt may have been inevitable as societies became more sophisti cated. Many would say a certain degree of debt is beneficial since it allows ind ividuals and companies to smooth their consumption over the cycle. Others would say it doesn t matter. In aggregate, the world owes the money to itself ; debt is just an accounting issue. A family is no poorer if a wife lends money to her husband, or vice versa. Another rationale is that asset prices have also been rising so that one needs to look at both sides of the balance sheet; it is net, not gross, debt that matters. But that is wrong. Gross debt levels matter because, as is well known, the value of debt is fixed in nominal terms while the value of assets can fluctuate. High gross debt levels thus create a number of flash points when creditors start to doubt the value of their collateral, and when the debts have to be rolled over. These crisis points are now rippling through the system; first US homeowners, th en investors in structured products, then banks, and now sovereigns. It is no coincidence that this massive debt explosion has coincided with the end of the Bretton Woods system of the early 1970s. This destroyed the final link t o gold and crucially, removed the balance of payments constraint from the concer ns of economic policymakers, at least in the developed world. The author Richard Duncan compiled this chart from IMF data showing the growth i n foreign exchange reserves since the end of Bretton Woods. From modest origins, they climbed above $1 trillion in the early 1970s before accelerating to almost $7 trillion in recent years. It is his contention that these reserves allowed s urplus countries to expand their money supplies, while the deficit countries wer e not forced to cut back. It was true that, in the main, developed countries found that they could run def icits without being punished by the markets. Indeed, eventually, they found that they could depreciate their exchange rates without being penalised by their cre ditors in the form of higher yields. This was an easy option in the short-term. But it was a bit like the 25-year old who boasts that smoking, drinking and over eating hasn't harmed him; the bad habits will catch up with him eventually. Floating exchange rates gave countries an escape valve was very important because attitudes were changing in t policy. As one contemplates today s massive fiscal o remember that Keynesianism was virtually discredited r prime minister, Jim Callaghan, said after the 1970s. And that another area of governmen deficits, it seems incredible t in the mid-1970s. A Labou

"We used to think that you could spend your way out of recession and increase em ployment by cutting taxes and boosting government spending. I tell you in all ca ndour that that option no longer exists and that in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inf

lation into the economy, followed by a higher level of unemployment as the next step." He was describing what used to be known as the stop-go cycle, in which governmen ts entered office eager to expand the economy (think of the Barber boom in the e arly 1970s) only to slam on the brakes as inflation rose. One could describe it as the Keynesian ratchet in which each turn seemed to bring higher inflation. After a chaotic 1970s, the wolrd came up with a new system, based on the use of monetary policy. Inflation would be tamed by an independent central bank, and m onetary policy would be used to limit the exzcesses of the cycle. The system app eared to work brilliantly. It delivered the great moderation, two decades of ste ady growth with generally declining inflation and very mild recessions. There wa s an enormous boom in the financial markets, as lower inflation allowed nominal yields on bonds and equities (and thus capital values) to rise substantially. And so we turn to Hyman Minsky who argued that these periods of moderation lead eventually to speculation and crisis. Rising asset prices encourage people to bo rrow money and buy assets, most obviously in the housing market. Initially, peop le take out loans where they can meet both interest and capital repayments; then they take out loans where they can only meet the interest; in the final Ponzi s tage (for which read subprime) they cannot even meet the interest payments but n eed rising prices to service the debt (essentially by flipping the asset). It is my contention that we switched from a Keynesian ratchet to a monetary ratc het. Lower rates encouraged more borrowing and higher asset prices; when those p rices faltered, central banks worried about a repeat of the debt deflation of th e 1930s so they slashed rates to help markets recover. This became known as the Greenspan put after 1987, the first time it was clearly used but it was used man y times, arguably most egregiously in 1998 after the collapse of LTCM. The end game of this process seems clear in retrospect, even though it may not h ave been at the time. Valuations were driven to historically unprecedented level s, first in shares in 2000 and then in housing in 2006. And interest rates have reached the event horizon of zero. Let us think about that for a moment. The Bank of England was set up in 1694. Fo r the next 300 years which included world wars, the Great Depression, a century or so of alternating deflation and inflation between 1815 and 1914, and the bank never previously felt the need to reduce rates below 2%. And this is combined w ith a fiscal deficit which, relative to GDP, is unknown outside world wars; one in four of the pounds spent by the British government is borrowed from the marke ts. Even with all that, the Bank of England has been obliged to add QE on top. If zero rates and huge deficits were the answer to mankind s problems, we would have discovered this long ago. After all, governments would be delighted to borrow a s much as they can for as little as possible. What the authorities are clearly trying to do is to wind up one more round of th e ratchet. If asset prices are higher, balance sheets will look healthy; if inte rest rates are low, borrowers can service their debts. Indeed, the Bank of Engla nd doesn t think British house prices are too high, even though they are well above historical averages relative to incomes; they are rational when compared to real interest rates. But who has been setting real interest rates? The bank, of cour se, at both the short (and via QE) at the long end. This may be an early sign that central banks are falling into their old habits. Bubbles are very hard intellectually to deal with. Those who ride the bubble loo k smart; those who try to buck it, like the late Tony Dye, get fired. The bubble will often accompany a growing economy, rising corporate profits and rising tax revenues; governments, regulators and central banks tend to feel that all is we

ll, and that the wisdom of their policies is being amply demonstrated. But it is surely very hard to argue now that the right thing for central banks t o do about bubbles is to ignore them, on the grounds that it is easy to clean up after they burst. The cost of the financial sector crisis has been enormous; ne ver mind the actual bail-out, think of the lost tax revenues. Surely it is clear that the monetary expansion of the last 30 years led to asset price, not consumer price, inflation perhaps because the rise of China and sout h-east Asia represented a massive deflationary shock for the manufactured goods sector. The fundamental contradiction at the heart of the recovery is that the markets a re dependent on the governments for support, but many governments are also depen dent on the markets. The European debt crisis has shown there is a limit to the extent that markets will be willing to finance government deficits, and also a l imit to the extent that politicians want to be dependent on markets. European co untries, with Germany in the intellectual lead, are now acting to withdraw the s timulus. Eventually, one would expect the US to be forced, by political rather t han financial pressures, to follow suit. Given that economies may have to slam on the fiscal brakes, and that interest ra tes are already near zero, central banks may be forced into other means of boost ing the economy, in particular quantitative easing or QE. I confess to being rat her cynical about QE. We know of occasions in history when it didn t work (Japan) an d we know when it resulted in hyperinflation (the Weimar republic). We don t know of any occasions when it definitely did work. And we know it is a tactic that is ancient. The Emperor Nero was short of a few denarii to pay his soldiers so he created some more by debasing the currency. In effect he financed his deficit by printing money, just as the Bank of England h as bought 200 billion of gilts from a country with a 157 billion deficit. Of course, Nero didn t have any economists to give his actions a sophisticated spin. But were his actions really that different? I am not arguing that we are heading for hyperinflationary hell. But I think we have in the course of this long debt boom started to confuse claims on wealth wi th wealth itself. And I think that has been a further negative effect of the bub ble mentality. Indeed, just to provoke you, how about thinking of the last 40 years as one long bubble, in which fiat money has led to asset price inflation. Before you dismis s the idea, think about this; with gold at $1250 an ounce, the dollar has lost 9 7% of its purchasing power in terms of what used to be though of as "real money" since 1971. The Romans took 200 years to achieve the same effect, cutting the a mount of silver in their copins by 96%. Progress! Go back to the early 18th century and there was another experiment with fiat mon ey conducted by John Law on behalf of the French regent. Law was hired to improv e the regent s finances and believed that a shortage of currency was holding back Fr ench growth. His clever scheme combined QE, subprime lending and an emerging mar kets fund. A new bank was formed, Banque Generale, and the regent decreed that taxes could be paid in notes issued by the bank, effectively making them legal tended. Meanw hile, the Compagnie l Occident was created to exploit the trading opportunities in t he Mississippi basin, the emerging market of its day. Banque Generale lent inves tors the money to buy shares in this great opportunity and the money raised from the issue was used to repay the monarchy s debts. In short, money was created via a roundabout fashion to buy government bonds; an exact description of QE.

Investors bought shares because of the promise of a high dividend. But the Missi ssippi delta was a swamp with no prospect of generating any actual earnings. So the key was to keep pushing up prices; this was achieved by the offer of new sha res which investors could buy with only a small deposit. The scheme faltered when some chose to take profits. So Law resorted to guarante eing to buy the shares at a set price (think of the TARP) involving the creation of more money. When people doubted the value of the bank notes, the company bou ght the bank (think Fannie Mae and Freddie Mac) to keep the system going. Eventu ally the whole thing collapsed some four years after it started. Now I am not trying to suggest that, in the last forty years, the global economy has not become a lot wealthier. Clearly one can point to three great changes in productivity; the entry of the communist world into the capitalist system; the use of technology to spread information and reduce frictional costs; and the ent ry of women into the developed world workforce. But I think it is possible to argue that the development of the bubble mentality has distorted monetary policy, led to the rise of an overpowerful rent-seeking financial sector, and in the Anglo-Saxon economies, led to the excessive focus o f investment in housing. Some of this wealth may prove illusory and just like Jo hn Law, attempts to prop up asset prices that have lost relationship with the we alth of the underlying economy, may end up being a failure.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Study of Global Political Economy John Ravenhill Chapter 1Document27 pagesThe Study of Global Political Economy John Ravenhill Chapter 1Shreeya VatsaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Actives Unlocked The ETF AdvantageDocument11 pagesActives Unlocked The ETF Advantagebenjamin walshNo ratings yet

- Ag EconomicsDocument102 pagesAg EconomicsWaren Lloren100% (1)

- MSC - Fi Dar ForecastingDocument5 pagesMSC - Fi Dar ForecastingMoud KhalfaniNo ratings yet

- Econ282 F11 PS5 AnswersDocument7 pagesEcon282 F11 PS5 AnswersVishesh GuptaNo ratings yet

- Ibmd 2021Document1,056 pagesIbmd 2021SatyaNo ratings yet

- 9708 w13 Ms 21 PDFDocument5 pages9708 w13 Ms 21 PDFTan Chen WuiNo ratings yet

- ISQ - ECO102 - Summer 2022 - Course OutlineDocument4 pagesISQ - ECO102 - Summer 2022 - Course OutlineRakibul HasanNo ratings yet

- The Asian Debt-And-Development Crisis of 1997-?: Causes and ConsequencesDocument19 pagesThe Asian Debt-And-Development Crisis of 1997-?: Causes and ConsequencesSaddam AwanNo ratings yet

- Kotak India Daily - 281223 - EBRDocument98 pagesKotak India Daily - 281223 - EBRDeepul WadhwaNo ratings yet

- CHAPTER 14 PowerPoint Presentation 1-1Document22 pagesCHAPTER 14 PowerPoint Presentation 1-1Cyrine EliasNo ratings yet

- Applied Research MethodsDocument5 pagesApplied Research MethodsM.Azeem SarwarNo ratings yet

- English (En) : Home News Index Useful Links Paper/PDF VersionDocument28 pagesEnglish (En) : Home News Index Useful Links Paper/PDF VersionGee LeeNo ratings yet

- Solution To Continuing Case ProblemDocument3 pagesSolution To Continuing Case ProblemlauraNo ratings yet

- Module 3 The International Monetary SystemDocument37 pagesModule 3 The International Monetary SystemEirene VizcondeNo ratings yet

- Economic Factors Affecting The Volatility of Exchange Rate in TanzaniaDocument5 pagesEconomic Factors Affecting The Volatility of Exchange Rate in TanzaniaInternational Journal of Arts, Humanities and Social Studies (IJAHSS)No ratings yet

- Malaysia 2H2022 Market Outlook 268447Document123 pagesMalaysia 2H2022 Market Outlook 268447Lim Chau LongNo ratings yet

- Tutorial 4 QuestionsDocument4 pagesTutorial 4 QuestionsNguyễn Thùy Linh 1TC-20ACNNo ratings yet

- Teks Economic EnglishDocument2 pagesTeks Economic EnglishRiri GustinNo ratings yet

- 1st Session Economic FactorsDocument30 pages1st Session Economic FactorsazeyhyNo ratings yet

- 1.5 WorksheetDocument5 pages1.5 WorksheetZid RangerNo ratings yet

- According To Napier 10 2022Document11 pagesAccording To Napier 10 2022Gustavo TapiaNo ratings yet

- IDE ECN 1215 Take Home Test 3Document3 pagesIDE ECN 1215 Take Home Test 3isaacNo ratings yet

- Macroeconomics Term Paper FreeDocument7 pagesMacroeconomics Term Paper Freeafdtszfwb100% (1)

- ProductivityDocument2 pagesProductivityLina SimbolonNo ratings yet

- Relationships Among Inflation, Interest Rates, and Exchange RatesDocument13 pagesRelationships Among Inflation, Interest Rates, and Exchange RatesibrahimNo ratings yet

- Number Word IPA Sound Vietnamese: Ə Prɑ K.SƏ - Mət.liDocument40 pagesNumber Word IPA Sound Vietnamese: Ə Prɑ K.SƏ - Mət.liBa LamNo ratings yet

- Trade BackTestDocument8 pagesTrade BackTestDriez 1No ratings yet

- International Financial Management Mid Term Exam Answer All QuestionsDocument4 pagesInternational Financial Management Mid Term Exam Answer All QuestionsLisa BellNo ratings yet

- Effects of Inflation AlchianDocument18 pagesEffects of Inflation AlchianCoco 12No ratings yet