Professional Documents

Culture Documents

Sarda Energy and Minerals

Sarda Energy and Minerals

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sarda Energy and Minerals

Sarda Energy and Minerals

Uploaded by

Angel BrokingCopyright:

Available Formats

1QFY2012 Result Update | Steel

August 2, 2011

Sarda Energy and Minerals

Performance highlights

BUY

CMP Target Price `198 `259

12 months

4QFY11 245 31 12.8 9 % chg (qoq) 3.8 16.6 158bp 56.0

Particulars (` cr) Net sales EBITDA EBITDA margin (%) Adj. net profit

1QFY12 254 37 14.4 14

1QFY11 217 50 23.0 27

% chg (yoy) 17.2 (26.6) (857)bp (48.3)

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Steel 709 1.7 382/183 80311 10 18,110 5,467 SAEM.BO SEML@IN

Source: Company, Angel Research

For 1QFY2012, Sarda Energy and Minerals (SEML) reported net sales growth of 17.2% yoy to `254cr. However, adjusted net profit declined by 48.3% yoy to `14cr due to higher costs. We maintain our Buy rating on the stock. Ferro alloy segment drags SEMLs 1QFY2012 profitability: During 1QFY2012, SEMLs net sales grew by 17.2% yoy to `254cr due to higher realisation in the steel segment coupled with higher sales volume of billets, ingots and power. Blended steel realisation grew by 96.1% yoy to `33,036/tonne on account of improved product mix. EBITDA margin declined substantially by 857bp yoy to 14.4% mainly on account of higher raw-material costs. Thus, EBITDA declined by 26.6% yoy to `37cr. EBIT of the ferro alloys segment declined by 73.0% yoy to `7cr on account of lower realisation coupled with higher prices of key inputs. Interest costs for the quarter increased by 112.6% yoy to `6cr, owing to which adjusted net profit declined by 48.3% yoy to `14cr. Outlook and valuation: We continue to believe that SEML is well poised to benefit from a) backward integration into coal and iron ore, b) commercial production of pellets and c) increased power and ferro alloy production. Moreover, firm sponge iron and billet prices should lead to higher capacity utilisation in FY2012 and FY2013, thereby leading to higher sales volumes. A key catalyst for the stock would be restarting of its iron ore operations at Rajnandgaon. We recommend Buy with a target price of `259, valuing the stock at 5.5x FY2013E EV/EBITDA.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 66.5 7.2 7.0 19.3

Abs. (%) Sensex SEML

3m (4.7)

1yr 0.2

3yr 23.6 (36.0)

(25.8) (23.9)

Key financials (Standalone)

Y/E March (` cr) Net sales % chg Net profit % chg FDEPS (`) OPM (%) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2010 523 (44.9) 18 (89.0) 5.4 14.7 36.4 1.2 11.7 3.6 2.1 14.4

FY2011E 875 67.4 43 133.3 12.0 13.4 16.4 1.0 7.9 4.9 1.3 9.6

FY2012E 992 13.3 88 103.7 23.3 17.6 8.5 0.9 12.0 8.7 1.1 6.3

FY2013E 1,070 7.9 104 18.5 27.7 20.8 7.1 0.8 12.8 9.5 0.9 4.5

Bhavesh Chauhan

Tel: 022- 39357600 Ext: 6821 E-mail: Bhaveshu.chauhan@angelbroking.com

Please refer to important disclosures at the end of this report

Sarda Energy | 1QFY2012 Result Update

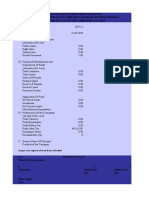

Exhibit 1: 1QFY2012 performance (Standalone)

Y/E March (` cr) Net sales Raw material % of net sales Power & Fuel % of net sales Staff cost % of net sales Other expenditure % of net sales Total expenditure % of net sales Operating profit OPM (%) Other operating income EBITDA EBITDA margins (%) Interest Depreciation Other income Exceptional items Profit before tax % of net sales Tax % of PBT Adj. Profit after tax

Source: Company, Angel Research

1QFY12 254 170 67.0 4 1.4 9 3.6 34 13.6 217 85.6 37 14.4 37 14.4 6 14 2 (3) 16 6.1 5 29.4 14

1QFY11 217 131 60.7 1 0.4 7 3.5 27 12.5 167 77.0 50 23.0 50 23.0 3 14 1 (14) 21 9.5 7 33.2 27

yoy % 17.2 29.4 273.4 23.4 27.6 30.2 (26.6) (26.6) 112.6 6.2 181.0 (24.6) (33.4) (48.3)

FY2011 875 579 66.2 10 1.2 31 3.5 137 15.7 758 86.6 117 13.4 117 13.4 15 58 20 7 71 8.1 22 30.6 43

FY2010 523 369 70.6 4 0.8 19 3.7 53 10.2 446 85.3 77 14.7 77 14.7 13 39 7 45 77 14.8 14 18.1 18

yoy % 67.4 57.1 131.8 58.7 157.4 69.9 52.7 52.7 19.4 48.5 173.2 (8.3) 54.7 133.5

Exhibit 2: Quarterly production volume

(tonnes) Sponge iron Billets+ ingots Ferro alloys Power (mn units) Pellet Wire rods

Source: Company, Angel Research

3QFY10 51,561 4,951 11,630 110 -

4QFY10 59,112 3,168 13,522 104 -

1QFY11 50,329 2,218 14,463 104 54,615 -

2QFY11 59,353 23,864 15,994 104 18,741 4,003

3QFY11 51,466 26,624 16,195 112 45,848 12,899

4QFY11 57,995 28,133 14,580 148 54,464 23,355

1QFY12 61,914 23,425 13,876 140 56,144 9,979

yoy % 23.0 956.1 (4.1) 33.9 2.8 -

qoq % 6.8 (16.7) (4.8) (5.6) 3.1 (57.3)

August 2, 2011

Sarda Energy | 1QFY2012 Result Update

Exhibit 3: Quarterly sales volume

(tonnes) Sponge Iron Billets+ingots Ferro alloys Power (mn units) Wire rods Pellet Source: Company, Angel Research 3QFY10 45,206 4,957 11,252 38 4QFY10 54,298 2,564 11,525 21 1QFY11 51,229 5,104 13,800 21 2QFY11 32,832 17,078 15,217 3 1,932 3QFY11 23,937 11,644 16,441 7 13,881 4QFY11 30,579 5,611 16,016 42 19,037 3,705 1QFY12 39,356 9,716 14,622 40 12,237 15,671 yoy % (23.2) 90.4 6.0 92.7 qoq % 28.7 73.2 (8.7) (5.1) (35.7) 323.0

Exhibit 4: Quarterly segment-wise sales performance

(` cr) Steel Ferro Alloys Others Less: Intersegment Net sales Source: Company, Angel Research 3QFY10 72 65 18 (0) 155 4QFY10 94 75 9 (0) 178 1QFY11 95 113 10 (0) 218 2QFY11 99 103 1 (2) 200 3QFY11 109 105 15 (15) 214 4QFY11 139 92 15 (2) 245 1QFY12 162 79 14 (1) 254 yoy % 70.8 (30.2) 44.5 1,100.7 16.7 qoq % 16.5 (14.9) (1.6) (26.4) 3.8

Exhibit 5: Quarterly segment-wise EBIT performance

(` cr) Steel Ferro Alloys EBIT 3QFY10 1 22 23 4QFY10 10 21 30 1QFY11 16 26 43 2QFY11 4 14 17 3QFY11 11 9 19 4QFY11 18 6 24 1QFY12 22 7 29 yoy % 35.1 (73.0) (31.8) qoq % 23.4 18.8 22.3

Source: Company, Angel Research

Revenue growth driven by higher steel sales

During the quarter, SEMLs net sales grew by 17.2% yoy to `254cr due to higher realisation in the steel segment coupled with higher sales volume of billets, ingots and power. Blended steel realisation grew by 96.1% yoy to `33,036/tonne on account of improved product mix. Billets and ingots sales volumes increased by 90.4% yoy to 9,716 tonnes, while ferro alloy sales volume grew by 6.0% yoy to 14,622 tonnes in 1QFY2012. Power sales volume also increased by 92.7% yoy to 40mn units. The company also sold 15,671 tonnes of pellets in 1QFY2012. However, sponge iron sales volume declined by 23.2% yoy to 39,356 tonnes, as SEML used sponge iron captively in its steel billets production.

August 2, 2011

Sarda Energy | 1QFY2012 Result Update

Exhibit 6: Quarterly revenue trend

300 250 200 154 102 174 217 200 214 245 254 160 140 120 100 80 60 40 20 0 (20)

(` cr)

100 50 0

2QFY10

3QFY10

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

Net revenue (LHS)

yoy change (RHS)

Source: Company, Angel Research

Ferro alloy segment drags SEMLs 1QFY2012 profitability

EBITDA margin declined substantially by 857bp yoy to 14.4% mainly on account of higher raw-material costs, which, as a percentage of net sales, increased to 67.0% (60.7% in 1QFY2011). Thus, EBITDA declined by 26.6% yoy to `37cr. EBIT of the ferro alloys segment declined by 73.0% yoy to `7cr on account of lower realisation coupled with higher prices of key inputs.

Exhibit 7: Quarterly EBITDA trend

60 50 40 31 35 21 50 37 25 20 31 16 6 15 10 5 0

(` cr)

20 10 0

2QFY10

3QFY10

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

EBITDA (LHS)

EBITDA margin (RHS)

Source: Company, Angel Research

Interest costs drag net profit even lower

Interest costs for the quarter increased by 112.6% yoy to `6cr, owing to which adjusted net profit declined by 48.3% yoy to `14cr.

August 2, 2011

1QFY12

(%)

30

1QFY12

(%)

150

Sarda Energy | 1QFY2012 Result Update

Exhibit 8: Quarterly net profit trend

30 25 20 15 10 5 0 (5) (10) (4) 1 13 17 9 5 14 27 14 12 10 8 6 4 2 0 (2) (4) (6)

(` cr)

2QFY10

3QFY10

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

Adj. Net profit(LHS)

Adj. Net margin (RHS)

Source: Company, Angel Research

Investment rationale

Captive iron ore mine expected to restart soon: In the recent past, SEML has not been able to procure iron ore from its captive mine at Rajnandgaon on account of Naxal activity in the region. Although there is lack of clarity on the timeline for the re-commencement of this mine, we believe commencement of production from iron ore should result in significant savings. Pellet production to lower raw-material costs: SEML started commercial production of its 0.6mn tonne pellet plant in April 2010 and, over the last six months, structural problems have also been successfully resolved. Moreover, domestic prices of iron ore and pellets have risen sharply in the past one year. Hence, we expect significant cost savings for the company on account of captive pellet production. Power capacity to increase: SEML plans to set up a greenfield power plant of 350MW at Raigarh in two phases. The company has already acquired 250 acres. Although the public hearing is already complete, the consent to establish is pending yet. We have not factored the financial estimates from this power plant in our forecast model, as there are a few regulatory hurdles to be cleared.

August 2, 2011

1QFY12

(%)

Sarda Energy | 1QFY2012 Result Update

Outlook and valuation

We continue to believe that SEML is well poised to benefit from a) backward integration into coal and iron ore, b) commercial production of pellets and c) increased power and ferro alloy production. Moreover, firm sponge iron and billet prices should lead to higher capacity utilisation in FY2012 and FY2013, thereby leading to higher sales volumes. A key catalyst for the stock would be restarting of its iron ore operations at Rajnandgaon. We recommend Buy on the stock with a target price of `259, valuing the stock at 5.5x FY2013E EV/EBITDA. We have lowered our profitability estimates for FY2011 and FY2012 to account for rising iron ore prices and lower margins in the ferro alloy segment.

Exhibit 9: Key assumptions

(` cr) Net sales EBITDA EBITDA margin (%) PBT PAT PAT margin (%) Earlier estimates FY12 953 205 21.5 145 102 10.7 FY13 1,013 244 24.1 177 124 12.3 Revised estimates FY12 992 174 17.6 125 88 8.9 FY13 1,070 222 20.8 148 104 9.7 Upgrade/(downgrade) (%) FY12 4.1 (15.0) (394)bp (13.8) (13.8) (184)bp FY13 5.6 (8.9) (331)bp (16.2) (16.2) (254)bp

Source: Bloomberg, Angel Research

Exhibit 10: EV/EBITDA

3,500 3,000 2,500

(` cr)

2,000 1,500 1,000 500 0 Apr-03Feb-04Dec-04Oct-05Aug-06Jun-07 Apr-08Feb-09Dec-09Oct-10Aug-11 2x 5x 8x 11x 14x

Source: Bloomberg, Angel Research

August 2, 2011

Sarda Energy | 1QFY2012 Result Update

Exhibit 11: P/E band

1,000 800 600

(`)

400 200 0 Apr-03Jan-04Oct-04 Jul-05 Apr-06Jan-07Oct-07 Jul-08 Apr-09Jan-10Oct-10 Jul-11

5x 10x 15x 20x

Source: Bloomberg, Angel Research

Exhibit 12: P/BV band

900 800 700 600

(`)

500 400 300 200 100 0 Apr-02 Mar-03 Feb-04 Jan-05 Dec-05Nov-06Oct-07 Sep-08Aug-09 Jul-10 Jun-11

1x 2x 3x 4x

Source: Bloomberg, Angel Research

Exhibit 13: Recommendation summary

Companies SAIL Tata Steel JSW Steel Bhushan Steel Monnet Ispat GPIL SEML CMP Target price Reco. (`) 118 564 674 375 494 157 198 (`) 139 Buy 799 Buy 947 Buy - Neutral - Neutral 225 Buy 259 Buy Mcap Upside (` cr) 48,677 54,095 15,045 7,961 3,180 497 709 18 42 40 44 31 P/E (x) 11.1 8.2 7.7 9.1 11.9 3.8 8.5 8.8 6.5 5.9 9.1 8.8 2.9 7.1 P/BV (x) 1.2 1.3 0.9 1.4 1.3 0.6 0.9 1.1 1.1 0.7 1.2 1.2 0.5 0.8 EV/EBITDA (x) 7.9 6.6 5.1 8.1 11.9 3.9 6.3 6.0 6.0 4.2 7.1 8.3 2.9 4.5 RoE (%) 11.2 17.2 12.7 16.1 11.8 17.6 12.0 12.8 18.6 14.7 14.0 15.3 19.4 12.8 RoCE (%) 9.2 11.8 10.9 8.6 7.5 13.8 8.7 10.9 13.1 13.0 7.9 10.1 17.0 9.5 (%) FY12E FY13E FY12E FY13E FY12E FY13E FY12E FY13E FY12E FY13E

Source: Company, Angel Research

August 2, 2011

Sarda Energy | 1QFY2012 Result Update

Profit & Loss Statement (Standalone)

Y/E March (` cr) Gross sales Less: Excise duty Net Sales Other operating income Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Share in profit of Associates Recurring PBT % chg Extraordinary Inc/(Expense) PBT (reported) Tax (% of PBT) PAT (reported) Add: Share of earnings of asso. Less: Minority interest (MI) Extraordinary Expense/(Inc.) PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E 703 (78) 625 625 71.6 456 384 61 11 168 145.3 26.9 22 146 217.3 23.4 12 5 3.6 139 174.1 139 18 12.8 121 121 121 185.1 19.4 35.6 35.4 1,032 (83) 949 949 51.8 726 618 91 17 223 32.4 23.5 28 195 33.4 20.6 5 4 1.9 194 39.6 (45) 149 26 17.4 123 123 168 38.7 17.7 49.4 49.0 556 (33) 523 523 (44.9) 446 369 58 19 77 (65.6) 14.7 39 38 (80.6) 7.3 13 7 22.4 32 (83.3) 45 77 14 18.1 63 63 18 (89.0) 3.5 5.4 5.4 946 (71) 875 875 67.4 758 579 148 31 117 52.7 13.4 58 60 56.9 6.8 15 20 31.0 64 97.6 6.5 71 21 29.8 50 50 43 133.3 4.9 12.0 12.0 1,072 (80) 992 992 13.3 817 661 131 26 174 48.7 17.6 48 126 112.1 12.7 23 22 17.5 125 95.0 125 37 29.8 88 88 88 103.7 8.9 24.5 23.3 1,156 (87) 1,070 1,070 7.9 847 678 141 28 222 27.7 20.8 74 148 17.5 13.9 24 24 16.2 148 18.5 148 44 29.8 104 104 104 18.5 9.7 29.0 27.7

August 2, 2011

Sarda Energy | 1QFY2012 Result Update

Balance Sheet (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Share Warrants Minority Interest Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 295 100 196 95 22 174 21 36 117 53 121 1 434 331 121 210 255 20 382 98 66 218 123 259 1 745 498 147 352 355 73 352 35 199 118 57 295 1,075 692 243 449 273 50 725 224 198 302 110 615 1 1,388 827 291 536 188 50 797 278 198 321 73 725 1 1,500 967 365 602 103 50 937 407 198 332 74 863 1 1,619 30 179 208 209 17 434 34 367 402 0.5 323 19 745 34 479 513 533 28 1,075 36 656 692 637 59 1,388 36 732 767 673 59 1,500 36 823 859 701 59 1,619 FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E

August 2, 2011

Sarda Energy | 1QFY2012 Result Update

Cash flow statement (Standalone)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments (Inc.)/Dec. in loans and adv. Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E 139 22 (76) (11) 12 63 (196) 1 (0) (196) 86 114 1 11 187 55 44 98 149 28 (1) 47 22 201 (234) (52) (73) (359) 94 12 (15) 97 (61) 96 35 77 39 33 (7.7) 16 126 (133) 6.2 71.5 (55) (36) 12 13.7 (61) 9 15 25 71 58 (185) 21 (77) 20 20 91.8 177.4 12 257 200 25 224 125 48 (56) 37 80 (50) (50) 36.5 13 24 54 224 278 148 74 (9) 44 169 (55) (55) 27.5 13 15 129 278 407

August 2, 2011

10

Sarda Energy | 1QFY2012 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV/Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio (%) Asset turnover (x) RoIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating RoE Returns (%) RoCE (Pre-tax) Angel RoIC (Pre-tax) RoE Turnover ratios (x) Asset Turnover (Gross Block) Inventory (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) 0.5 1.3 12.1 0.9 2.0 42.5 0.8 5.7 3.0 0.6 3.5 3.9 0.5 2.3 5.5 0.3 1.3 6.2 2.0 142 40 69 60 2.3 59 7 3 47 0.9 150 10 40 80 1.3 163 18 40 74 1.3 150 18 40 90 1.2 150 18 40 86 24.8 28.1 39.8 21.4 23.9 26.9 3.6 3.8 11.7 4.9 5.4 7.9 8.7 10.6 12.0 9.5 12.2 12.8 23.4 87.2 1.2 24.5 4.0 0.5 35.7 20.6 82.6 1.2 19.8 0.9 0.9 36.3 7.3 81.9 0.5 3.1 2.1 0.8 3.8 6.8 70.2 0.8 3.8 1.9 0.6 4.9 12.7 70.2 0.8 7.4 2.5 0.5 10.0 13.9 70.2 0.9 8.6 2.5 0.3 10.6 35.6 35.4 42.1 3.0 118.1 49.4 49.0 57.6 3.0 150.8 5.4 5.4 16.8 3.0 165.8 12.0 12.0 28.1 3.0 193.1 24.5 23.3 37.9 3.0 214.1 29.0 27.7 49.8 3.0 239.6 5.6 4.7 1.7 1.5 1.4 5.3 1.2 4.0 3.4 1.3 1.5 1.2 5.0 1.0 36.4 11.7 1.2 1.5 2.1 14.4 1.1 16.4 7.0 1.0 1.5 1.3 9.6 0.8 8.5 5.2 0.9 1.5 1.1 6.3 0.7 7.1 4.0 0.8 1.5 0.9 4.5 0.6 FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E

August 2, 2011

11

Sarda Energy | 1QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Sarda Energy No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

August 2, 2011

12

You might also like

- Accounting Texts and Cases Ch. 12 SolutionDocument9 pagesAccounting Texts and Cases Ch. 12 SolutionFeby Rahmawati100% (2)

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Accounting Cycle of A Merchandising BusinessDocument54 pagesAccounting Cycle of A Merchandising BusinessKim Flores100% (1)

- Jackson Automotive Systems Company MarketDocument8 pagesJackson Automotive Systems Company MarketKirtiKishanNo ratings yet

- Mid - Term Review - Winter 2022Document5 pagesMid - Term Review - Winter 2022hiralhshethNo ratings yet

- Jeizel Concepcion PR 4-1 To 4-5Document7 pagesJeizel Concepcion PR 4-1 To 4-5Concepcion Family100% (2)

- Sarda Energy and MineralsDocument12 pagesSarda Energy and MineralsAngel BrokingNo ratings yet

- Sarda Energy and Minerals: Performance HighlightsDocument12 pagesSarda Energy and Minerals: Performance HighlightsAngel BrokingNo ratings yet

- Sterlite Industries: Performance HighlightsDocument13 pagesSterlite Industries: Performance HighlightsAngel BrokingNo ratings yet

- National Aluminium Result UpdatedDocument12 pagesNational Aluminium Result UpdatedAngel BrokingNo ratings yet

- Sarda Energy 4Q FY 2013Document12 pagesSarda Energy 4Q FY 2013Angel BrokingNo ratings yet

- Sarda Energy, 30th January 2013Document12 pagesSarda Energy, 30th January 2013Angel BrokingNo ratings yet

- Sterlite Industries: Performance HighlightsDocument13 pagesSterlite Industries: Performance HighlightsAngel BrokingNo ratings yet

- Sterlite Industries Result UpdatedDocument12 pagesSterlite Industries Result UpdatedAngel BrokingNo ratings yet

- Prakash Industries: Performance HighlightsDocument11 pagesPrakash Industries: Performance HighlightsAngel BrokingNo ratings yet

- Sterlite Industries: Performance HighlightsDocument12 pagesSterlite Industries: Performance HighlightsAngel BrokingNo ratings yet

- Godawari Power 4Q FY 2013Document10 pagesGodawari Power 4Q FY 2013Angel BrokingNo ratings yet

- Godawari Power & Ispat: Performance HighlightsDocument10 pagesGodawari Power & Ispat: Performance HighlightsAngel BrokingNo ratings yet

- Godawari Power, 12th February 2013Document10 pagesGodawari Power, 12th February 2013Angel BrokingNo ratings yet

- Godawari Power & Ispat: Performance HighlightsDocument10 pagesGodawari Power & Ispat: Performance HighlightsAngel BrokingNo ratings yet

- Prakash Industries, 12th February, 2013Document11 pagesPrakash Industries, 12th February, 2013Angel BrokingNo ratings yet

- Godawari Power, 1Q FY 2014Document10 pagesGodawari Power, 1Q FY 2014Angel BrokingNo ratings yet

- Electrosteel 4Q FY 2013Document11 pagesElectrosteel 4Q FY 2013Angel BrokingNo ratings yet

- National Aluminium Result UpdatedDocument12 pagesNational Aluminium Result UpdatedAngel BrokingNo ratings yet

- Tata Sponge Iron (TSIL) : Performance HighlightsDocument11 pagesTata Sponge Iron (TSIL) : Performance HighlightsAngel BrokingNo ratings yet

- JSW Steel: Performance HighlightsDocument13 pagesJSW Steel: Performance HighlightsAngel BrokingNo ratings yet

- Monnet Ispat: Performance HighlightsDocument13 pagesMonnet Ispat: Performance HighlightsAngel BrokingNo ratings yet

- Monnet Ispat: Performance HighlightsDocument12 pagesMonnet Ispat: Performance HighlightsAngel BrokingNo ratings yet

- Electrosteel Castings: Performance HighlightsDocument12 pagesElectrosteel Castings: Performance HighlightsAngel BrokingNo ratings yet

- Tata Sponge Iron Result UpdatedDocument11 pagesTata Sponge Iron Result UpdatedAngel BrokingNo ratings yet

- Monnet Ispat Result UpdatedDocument12 pagesMonnet Ispat Result UpdatedAngel BrokingNo ratings yet

- National Aluminium: Performance HighlightsDocument12 pagesNational Aluminium: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India Result UpdatedDocument10 pagesGraphite India Result UpdatedAngel BrokingNo ratings yet

- Sterlite, 1Q FY 2014Document13 pagesSterlite, 1Q FY 2014Angel BrokingNo ratings yet

- Prakash Industries 4Q FY 2013Document11 pagesPrakash Industries 4Q FY 2013Angel BrokingNo ratings yet

- GIPCL Result UpdatedDocument11 pagesGIPCL Result UpdatedAngel BrokingNo ratings yet

- Prakash Industries, 1Q FY 2014Document11 pagesPrakash Industries, 1Q FY 2014Angel BrokingNo ratings yet

- Coal India: Performance HighlightsDocument10 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- Shree Cement: Performance HighlightsDocument10 pagesShree Cement: Performance HighlightsAngel BrokingNo ratings yet

- JSW Steel 4Q FY 2013Document13 pagesJSW Steel 4Q FY 2013Angel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument14 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- Monnet Ispat 4Q FY 2013Document12 pagesMonnet Ispat 4Q FY 2013Angel BrokingNo ratings yet

- Moil 2qfy2013Document10 pagesMoil 2qfy2013Angel BrokingNo ratings yet

- Hindalco, 1Q FY 2014Document12 pagesHindalco, 1Q FY 2014Angel BrokingNo ratings yet

- NMDC 1qfy2013ruDocument12 pagesNMDC 1qfy2013ruAngel BrokingNo ratings yet

- Electrosteel Casting, 1Q FY 2014Document11 pagesElectrosteel Casting, 1Q FY 2014Angel BrokingNo ratings yet

- Exide Industries: Performance HighlightsDocument12 pagesExide Industries: Performance HighlightsAngel BrokingNo ratings yet

- MOIL Result UpdatedDocument10 pagesMOIL Result UpdatedAngel BrokingNo ratings yet

- Hindustan Zinc, 1Q FY 2014Document11 pagesHindustan Zinc, 1Q FY 2014Angel BrokingNo ratings yet

- GIPCL Result UpdatedDocument11 pagesGIPCL Result UpdatedAngel BrokingNo ratings yet

- JK Lakshmi Cement: Performance HighlightsDocument10 pagesJK Lakshmi Cement: Performance HighlightsAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- CESC Result UpdatedDocument11 pagesCESC Result UpdatedAngel BrokingNo ratings yet

- Steel Authority of India Result UpdatedDocument13 pagesSteel Authority of India Result UpdatedAngel BrokingNo ratings yet

- GIPCL, 12th February, 2013Document10 pagesGIPCL, 12th February, 2013Angel BrokingNo ratings yet

- Hindustan Zinc Result UpdatedDocument11 pagesHindustan Zinc Result UpdatedAngel BrokingNo ratings yet

- Performance Highlights: Company Update - Capital GoodsDocument13 pagesPerformance Highlights: Company Update - Capital GoodsAngel BrokingNo ratings yet

- Graphite India: Performance HighlightsDocument11 pagesGraphite India: Performance HighlightsAngel BrokingNo ratings yet

- JSW Steel: Performance HighlightsDocument14 pagesJSW Steel: Performance HighlightsAngel BrokingNo ratings yet

- Sail 1Q FY 2014Document11 pagesSail 1Q FY 2014Angel BrokingNo ratings yet

- Hindustan Zinc Result UpdatedDocument11 pagesHindustan Zinc Result UpdatedAngel BrokingNo ratings yet

- GAIL India: Performance HighlightsDocument12 pagesGAIL India: Performance HighlightsAngel BrokingNo ratings yet

- ACC Result UpdatedDocument10 pagesACC Result UpdatedAngel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument15 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- Sesa Goa: Performance HighlightsDocument12 pagesSesa Goa: Performance HighlightsAngel BrokingNo ratings yet

- Iron & Steel Scrap Wholesale, Processors & Dealers Revenues World Summary: Market Values & Financials by CountryFrom EverandIron & Steel Scrap Wholesale, Processors & Dealers Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Zimsec - Nov - 2016 - Ms 3Document9 pagesZimsec - Nov - 2016 - Ms 3Wesley KisiNo ratings yet

- (Download PDF) Advanced Financial Accounting 12th Edition Christensen Solutions Manual Full ChapterDocument77 pages(Download PDF) Advanced Financial Accounting 12th Edition Christensen Solutions Manual Full Chaptermunzirmeffo100% (7)

- Auditing Problem Test Bank 1 AnsDocument9 pagesAuditing Problem Test Bank 1 AnsJayson CerradoNo ratings yet

- FAR610 Consolidated Cashflow Past Semester FinalexamDocument18 pagesFAR610 Consolidated Cashflow Past Semester FinalexamANIS SYAKIRAH ADHWA MAHDILLAHNo ratings yet

- BUS 20 S18 Testable Concepts & Study TopicsDocument2 pagesBUS 20 S18 Testable Concepts & Study TopicsoctavioNo ratings yet

- Return On Average Tangible Common Shareholders Equity (ROTCE)Document4 pagesReturn On Average Tangible Common Shareholders Equity (ROTCE)leaortiz1403No ratings yet

- Schedule III Financial StatementsDocument21 pagesSchedule III Financial StatementsKunal DixitNo ratings yet

- PPE QuestionsDocument10 pagesPPE QuestionsJohn Ibrahim James MohammadNo ratings yet

- UNIT II Final Account CollegeDocument36 pagesUNIT II Final Account CollegeyogeshNo ratings yet

- CAPE Accounting 2013 U1 P1 PDFDocument9 pagesCAPE Accounting 2013 U1 P1 PDFBradlee SinghNo ratings yet

- Financial Performance AnalysisDocument110 pagesFinancial Performance AnalysisNITHIN poojaryNo ratings yet

- Balance Sheet of Tech MahindraDocument3 pagesBalance Sheet of Tech MahindraPRAVEEN KUMAR M 18MBR070No ratings yet

- Accounts List Summary Jawaban Kasus Graha Mandiri Safitri Kls XI Ak 2Document2 pagesAccounts List Summary Jawaban Kasus Graha Mandiri Safitri Kls XI Ak 2ekaratihNo ratings yet

- Nestle - Financial Statement Analysis ComponentDocument5 pagesNestle - Financial Statement Analysis ComponentKanishk MehrotraNo ratings yet

- Acca f7 Notes j15Document276 pagesAcca f7 Notes j15opentuitionID100% (3)

- Answer Key Chapter 4Document2 pagesAnswer Key Chapter 4Emily TanNo ratings yet

- INSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetDocument13 pagesINSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetMac Ferds100% (2)

- FA2 - Mock PaperDocument9 pagesFA2 - Mock PaperLinh ThuyNo ratings yet

- Accounting Principles MCQDocument8 pagesAccounting Principles MCQSmile AliNo ratings yet

- Merged RTP - CA Foundation AccountsDocument124 pagesMerged RTP - CA Foundation AccountsAkash AjayNo ratings yet

- Practice Quiz - Review of Working CapitalDocument9 pagesPractice Quiz - Review of Working Capitalcharisse nuevaNo ratings yet

- Paper 1 Advanced AccountingDocument576 pagesPaper 1 Advanced AccountingExcel Champ60% (5)

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- Summary Revaluation and Impairment of PPEDocument2 pagesSummary Revaluation and Impairment of PPEGerry SajolNo ratings yet