Professional Documents

Culture Documents

viewNitPdf 4054643

viewNitPdf 4054643

Uploaded by

Rishik MittalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

viewNitPdf 4054643

viewNitPdf 4054643

Uploaded by

Rishik MittalCopyright:

Available Formats

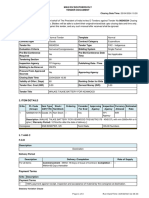

BHUSAWAL/DIV/CENTRAL RLY

TENDER DOCUMENT

Tender No: 93225735 Closing Date/Time: 21/12/2022 11:30

SR.DMM BSL acting for and on behalf of The President of India invites E-Tenders against Tender No 93225735 Closing

Date/Time 21/12/2022 11:30 Hrs. Bidders will be able to submit their original/revised bids upto closing date and time only.

Manual offers are not allowed against this tender, and any such manual offer received shall be ignored.

1. NIT HEADER

Bidding type Normal Tender Template Normal

Contract type Goods Contract Category Expenditure

Tender No 93225735 Tender Type Open - Indigenous

Evaluation Criteria Itemwise/Consigneewise Bidding System Single Packet

Pre-Bid Conference Pre-Bid Conference Date

No Not Applicable

Required Time

Tendering Section 93

Inspection Agency RITES Publishing Date / Time 30/11/2022 12:56

Bidding to be Done on IREPS

Procure From Approved

Yes Approving Agency CORE

Sources

Closing Date Time 21/12/2022 11:30

Validity of Offer ( Days) 90 Ranking Order for Bids Lowest to Highest

Tender Doc. Cost (INR) 0.00 Earnest Money (INR) 94390.00

Tender Title Hard drawn Copper Conductor

2. ITEM DETAILS

S.No. PL Code Item Type Stock / Ordering Consider Approving Inspection Currency Estimated

(Group) GST(Y/N) NonStock For Eval Agency Agency Allowed Rate

1 465508530026 Goods (Y) Non Stock --- Yes RITES INR

Description :Hard drawn Copper Conductor Stranded 37/2.25 mm for Feeder Wire, Cross Sectional Area 150

Sq. mm. conforming to RDSO Spec. no: TI/SPC/OHE HDCSCF/0030 (06/2003) or latest

Sr. Section Engineer(TD) [TD] Maharashtra 4600.00 Kg

Consignee

MALKAPUR MKD , CR

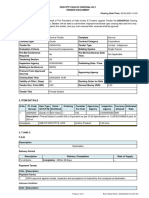

3. T AND C

F.O.R

Description

Destination

Delivery Period

Description Delivery /Completion Rate of Supply

For all items Completion : Within 30 Days ---

Payment Terms

S.No Description

Payment Terms

1 100% payment against receipt, inspection and acceptance of material by the consignee at destination.

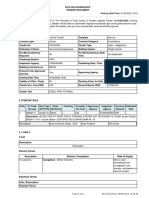

Statutory Variation Clause

Pa g e 1 o f 3 Ru n Da te/Time: 30 /11/2 0 2 2 12 :5 7:0 2

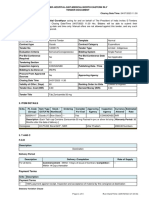

BHUSAWAL/DIV/CENTRAL RLY

TENDER DOCUMENT

Tender No: 93225735 Closing Date/Time: 21/12/2022 11:30

S.No Description

1 Statutory Variation in taxes and duties, or fresh imposition of taxes and duties by State/ Central Governments in

respect of the items stipulated in the contract (and not the raw materials thereof), within the original delivery

period stipulated in the contract, or last unconditionally extended delivery period shall be to Railways' account.

Only such variation shall be admissible which takes place after the submission of bid. No claim on account of

statutory variation in respect of existing tax/duty will be accepted unless the tenderer has clearly indicated in his

offer the rate of tax/duty considered in his quoted rate. No claim on account of statutory variation shall be

admissible on account of misclassification by the supplier/ contractor.

Standard Governing Conditions

S.No Description

1 IRS Conditions of Contract: The contract shall be governed by latest version (along with all correction slips) of

IRS conditions of contract, and all other terms and conditions incorporated in the tender documents.

4. ELIGIBILITY CONDITIONS

Special Eligibility Criteria

S.No. Description Confirmation Remarks Documents

Required Allowed Uploading

1 Authorization Dealership Certificate may please be submitted alongwith Yes Yes Allowed

Bid. (Optional)

2 Item to be procured from CORE approved vendors or its authorized dealer Yes Yes Not Allowed

as per norms

5. COMPLIANCE CONDITIONS

Commercial-Compliance

S.No. Description Confirmation Remarks Documents

Required Allowed Uploading

1 Please enter the percentage of local content in the material being offered. No Yes Not Allowed

Please enter 0 for fully imported items, and 100 for fully indigenous items.

The definition and calculation of local content shall be in accordance with

the Make in India policy as incorporated in the tender conditions.

General Instructions

S.No. Description Confirmation Remarks Documents

Required Allowed Uploading

1 Material required at consignee address i.e. Malkapur and unloading of No No Not Allowed

material done by firm.

Other Conditions

S.No. Description Confirmation Remarks Documents

Required Allowed Uploading

1 Inspection of material to be carried out by RITES before supply of material No No Not Allowed

to consignee

2 est & warranty certificate of OEM to be submitted at the time of supply of Yes Yes Not Allowed

material to consignee.

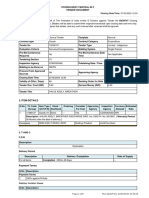

Special Conditions

S.No. Description Confirmation Remarks Documents

Required Allowed Uploading

Pa g e 2 o f 3 Ru n Da te/Time: 30 /11/2 0 2 2 12 :5 7:0 2

BHUSAWAL/DIV/CENTRAL RLY

TENDER DOCUMENT

Tender No: 93225735 Closing Date/Time: 21/12/2022 11:30

1 GST :- 1) All the bidders / tenderers should ensure that they are GST No No Not Allowed

compliant and their quoted tax structure / rates are as per the GST Law.

Firms must indicate its GST registration number along with their offer. 2) In

case the successful tenderer is not liable to be registered under

CGST/IGST/UTGST/SGST Act, The Railway shall deduct the applicable

GST from his / their bill under Reverse Charge Mechanism (RCM) and

deposit the same to the concerned tax authority. 3) The firm should

indicate the tariff code for claiming GST for the tendered item. 4) If the

tenderer quoted rate of taxes and levies like GST etc., less than the actual

prevailing on the date of opening of tender, request for amendment in

enhancement of rate subsequently will not be entertained and such

practice will be considered as unethical and noted in Railways record. 5)

The offer shall be evaluated based on the GST Rate as quoted by each

bidder and same will be used for determining the inter-se ranking. While

submitting offer, it shall be the responsibility of the bidder to ensure that

they quote correct GST rate and HSN number. 6) It shall be the

responsibility of the bidders to quote correct HSN no. corresponding GST

rate. The purchaser shall not be responsible for any misclassification of

HSN no. or incorrect GST rate, if qoted by the bidder. 7) Wherever, the

successful bidder invoices the goods at GST rate or HSN number which is

different from that incorporated in the Purchase order, payment shall be

made as per GST rate which is lower of the GST rate incorporated in the

Purchase order or billed. 8) Vendor is informed that she / he would be

required to adjust her / his basic price to the extent required by higher tax

bill as per invoice to match the all inclusive price as mentioned in the

Purchase order. 9) Any amendment to GST rate or HSN number in the

contract shall be as per the contractual conditions and statutory

amendments in the quoted GST rate and HSN number, under SVC

2 TDS clause: Indian Railways as recipient of goods & services shall deduct No No Not Allowed

TDS @ 2 % of the value of supplies wef 01.10.2018 where the total value of

the contract exceeds Rs 2,50,000/- in terms of section 51 of CGST Act

2017 and section 20 of IGST ACT 2017 as notified by CBIC Notfication No.

50/ 2018/Central Tax dated 13-9-18.

6. DOCUMENTS ATTACHED WITH TENDER

S.No. Document Name Document Description

1 3972195.pdf IMP CONDITION

2 3972188.pdf IRS CONDITION

This tender complies with Public Procurement Policy (Make in India) Order 2017, dated 15/06/2017, issued by

Department of Industrial Promotion and Policy, Ministry of Commerce, circulated vide Railway Board letter no.

2015/RS(G)/779/5 dated 03/08/2017 and 27/12/2017 and amendments/ revisions thereof.

As a Tender Inviting Authority, the undersigned has ensured that the issue of this tender does not violate provisions of

GFR regarding procurement through GeM.

Digitally Signed By

Sr.DMM ( KARTIKEYA GADAKH SRDMM )

Pa g e 3 o f 3 Ru n Da te/Time: 30 /11/2 0 2 2 12 :5 7:0 2

You might also like

- Role Play Bill2lawDocument11 pagesRole Play Bill2lawapi-292450066No ratings yet

- The Fall of Enron - Case SolutionDocument5 pagesThe Fall of Enron - Case SolutionJyotirmoy ChatterjeeNo ratings yet

- Motivation LettersDocument3 pagesMotivation LettersAndrei CebotariNo ratings yet

- Document 6Document4 pagesDocument 6Tom PsyNo ratings yet

- viewNitPdf 4034977Document3 pagesviewNitPdf 4034977Raj DoshiNo ratings yet

- Due 30.12.2022 SchneiderDocument3 pagesDue 30.12.2022 SchneiderLove youNo ratings yet

- DIGITALDocument2 pagesDIGITALPalani Kumar ANo ratings yet

- Voltas Wheel RimDocument2 pagesVoltas Wheel Rimboobalan_shriNo ratings yet

- Tender No: 52205683B Closing Date/Time: 26/03/2022 11:00: 2. Item DetailsDocument4 pagesTender No: 52205683B Closing Date/Time: 26/03/2022 11:00: 2. Item DetailsMahesh SakpalNo ratings yet

- viewNitPdf 4541799Document3 pagesviewNitPdf 4541799dghosh76No ratings yet

- viewNitPdf 4465678Document5 pagesviewNitPdf 4465678Amish MehtaNo ratings yet

- viewNitPdf 3819122Document4 pagesviewNitPdf 3819122Prakash DwivediNo ratings yet

- 24viewNitPdf 3776225Document3 pages24viewNitPdf 3776225Mahesh SakpalNo ratings yet

- viewNitPdf 4051560Document4 pagesviewNitPdf 4051560Raj DoshiNo ratings yet

- viewNitPdf 4013598Document4 pagesviewNitPdf 4013598DharamrajNo ratings yet

- Hydraulic Jack With HandPumpDocument3 pagesHydraulic Jack With HandPumpAadil ModassirNo ratings yet

- viewNitPdf 4133031Document4 pagesviewNitPdf 4133031Praveen RajNo ratings yet

- Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredDocument2 pagesUpto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredChief Loco InspectorNo ratings yet

- viewNitPdf 4049000Document7 pagesviewNitPdf 4049000Rishik MittalNo ratings yet

- Wiper Motor Assembly With HandleDocument5 pagesWiper Motor Assembly With HandleBoobalan ShriNo ratings yet

- 31viewNitPdf 3781645Document3 pages31viewNitPdf 3781645Mahesh SakpalNo ratings yet

- viewNitPdf 4050180Document4 pagesviewNitPdf 4050180dghosh76No ratings yet

- viewNitPdf 4539984Document3 pagesviewNitPdf 4539984dghosh76No ratings yet

- 24viewNitPdf 3778951Document4 pages24viewNitPdf 3778951Mahesh SakpalNo ratings yet

- viewNitPdf 4431030Document3 pagesviewNitPdf 4431030advance electricalNo ratings yet

- No Bids Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredDocument3 pagesNo Bids Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredPRAYAGNo ratings yet

- 11.06.21 Pinionn 20 Teeth Qty. 79 Nos.Document5 pages11.06.21 Pinionn 20 Teeth Qty. 79 Nos.Mahendra Kr GaurNo ratings yet

- viewNitPdf 4054938Document6 pagesviewNitPdf 4054938Rishik MittalNo ratings yet

- Tender No: 38225014A Closing Date/Time: 28/05/2022 11:30: 2. Item DetailsDocument5 pagesTender No: 38225014A Closing Date/Time: 28/05/2022 11:30: 2. Item DetailsPrakash DwivediNo ratings yet

- Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredDocument4 pagesUpto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be Ignoredannayya.chandrashekar Civil EngineerNo ratings yet

- Tender No: 08226389 Closing Date/Time: 02/01/2023 10:30: 2. Item DetailsDocument4 pagesTender No: 08226389 Closing Date/Time: 02/01/2023 10:30: 2. Item DetailsANILNo ratings yet

- Bid Number: GEM/2021/B/645022 Dated: 23-12-2021: Item DetailsDocument4 pagesBid Number: GEM/2021/B/645022 Dated: 23-12-2021: Item DetailsDhiraj1 K iDigiNo ratings yet

- No Bids Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredDocument3 pagesNo Bids Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredAakash KoradiyaNo ratings yet

- Self Adhesive Waterproof Sticker CRW MCS EcorDocument4 pagesSelf Adhesive Waterproof Sticker CRW MCS Ecormaddy4uallNo ratings yet

- viewNitPdf 4023936Document4 pagesviewNitPdf 4023936Tamoghna DeyNo ratings yet

- viewNitPdf 4543532Document3 pagesviewNitPdf 4543532dghosh76No ratings yet

- AMM/DLS Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 28211014ADocument3 pagesAMM/DLS Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 28211014AANILNo ratings yet

- viewNitPdf 3069034 PDFDocument3 pagesviewNitPdf 3069034 PDFDinesh TaragiNo ratings yet

- viewNitPdf 4521482Document3 pagesviewNitPdf 4521482chayanNo ratings yet

- viewNitPdf 4536973Document6 pagesviewNitPdf 4536973n.tiwari1114No ratings yet

- Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredDocument4 pagesUpto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredVivek ShuklaNo ratings yet

- Top Side Bearer Liner Ner 20.12.21Document5 pagesTop Side Bearer Liner Ner 20.12.21Harsha GumballiNo ratings yet

- Rotomsg Spares BH LH RH Rocker Part NoDocument3 pagesRotomsg Spares BH LH RH Rocker Part Novenu MNo ratings yet

- viewNitPdf 3533334Document3 pagesviewNitPdf 3533334MANOJ KUMARNo ratings yet

- No Bids Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredDocument3 pagesNo Bids Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredOM MishraNo ratings yet

- Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredDocument5 pagesUpto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be Ignored1016035No ratings yet

- viewNitPdf 3279211Document3 pagesviewNitPdf 3279211kris27No ratings yet

- viewNitPdf 4537925Document3 pagesviewNitPdf 4537925dghosh76No ratings yet

- viewNitPdf 4278307Document4 pagesviewNitPdf 4278307TECHNICAL BOYNo ratings yet

- Upto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredDocument3 pagesUpto Closing Date and Time Only. Manual Offers Are Not Allowed Against This Tender, and Any Such Manual Offer Received Shall Be IgnoredANILNo ratings yet

- Hex HD Bolt M 20 X 130 - 24.05.24Document4 pagesHex HD Bolt M 20 X 130 - 24.05.24luv.wadhwa001No ratings yet

- viewNitPdf 4036432Document4 pagesviewNitPdf 4036432Raj DoshiNo ratings yet

- Gaskets EnquiryDocument3 pagesGaskets EnquiryBoobalan ShriNo ratings yet

- viewNitPdf 4483046Document8 pagesviewNitPdf 4483046pujadagaNo ratings yet

- Soft Surgical Paper Tape ADRA DIVDocument3 pagesSoft Surgical Paper Tape ADRA DIVmaddy4uallNo ratings yet

- Steel Pipe FittingsDocument6 pagesSteel Pipe FittingsRadhakrishnanNo ratings yet

- viewNitPdf 4371865Document4 pagesviewNitPdf 4371865Prem ShahiNo ratings yet

- 01.01.2020 - 80190015B - 1130Document4 pages01.01.2020 - 80190015B - 1130ANILNo ratings yet

- AMM/GMO Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 30211053Document3 pagesAMM/GMO Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 30211053skrgoelNo ratings yet

- Pu Side Bearer Pad Ner 20.12.21Document5 pagesPu Side Bearer Pad Ner 20.12.21Harsha GumballiNo ratings yet

- viewNitPdf 4177915Document3 pagesviewNitPdf 4177915Mohit SinghNo ratings yet

- 30viewNitPdf 3776390Document6 pages30viewNitPdf 3776390Mahesh SakpalNo ratings yet

- viewNitPdf 4309803Document4 pagesviewNitPdf 4309803Rahul MannaNo ratings yet

- PK - 9Document26 pagesPK - 9Rennya Lily KharismaNo ratings yet

- CompanyDocument17 pagesCompanypriya wanjariNo ratings yet

- The Structural Engineer October 2023Document60 pagesThe Structural Engineer October 2023mrswcecivilNo ratings yet

- What To Look For in A Term SheetsDocument23 pagesWhat To Look For in A Term SheetsAnonymous 0hYUyCs3No ratings yet

- MIB 11 London Global Business Operations Outline and Key LearningsDocument3 pagesMIB 11 London Global Business Operations Outline and Key LearningsMik MimNo ratings yet

- Principles of Accounting Past Paper 1Document6 pagesPrinciples of Accounting Past Paper 1Muhannad AliNo ratings yet

- ALR Calculator IIDocument39 pagesALR Calculator IIlucnesNo ratings yet

- Consumer Buying BehaviourDocument5 pagesConsumer Buying BehaviourSalmanNo ratings yet

- Compliance Checklist - Appointment - Removal of A DirectorDocument6 pagesCompliance Checklist - Appointment - Removal of A DirectorApoorva SinghNo ratings yet

- 29HC202403102800Document1 page29HC202403102800ramanujamsrinivas576No ratings yet

- Danaharta Annual Report 2000Document136 pagesDanaharta Annual Report 2000az1972100% (2)

- Provisional Sum As Delay EventDocument10 pagesProvisional Sum As Delay EventGary LoNo ratings yet

- WIP Scrap TransactiondDocument2 pagesWIP Scrap Transactiondvinksin4No ratings yet

- 03 Books of Original Entry and Ledgers (I)Document16 pages03 Books of Original Entry and Ledgers (I)YU TaktakNo ratings yet

- Metro Manila Shopping Mecca Corp. v. Ms. Liberty M. ToledoDocument1 pageMetro Manila Shopping Mecca Corp. v. Ms. Liberty M. ToledoJezenEstherB.PatiNo ratings yet

- Afa Bcomph 2nd Sem 2018Document4 pagesAfa Bcomph 2nd Sem 2018har22092003No ratings yet

- Technological Process Chain - Mould MakingDocument36 pagesTechnological Process Chain - Mould MakingMrLanternNo ratings yet

- Assistant Facilities ManagerDocument2 pagesAssistant Facilities ManagerLindaniNo ratings yet

- Chapter 1: Introduction: A. Company BackgroundDocument30 pagesChapter 1: Introduction: A. Company Backgroundwangyu roqueNo ratings yet

- Scott Anthony An Excerpt From The SILVER LINING1Document4 pagesScott Anthony An Excerpt From The SILVER LINING1fischertNo ratings yet

- Analysis of Case Study of Colgate PrecisionDocument3 pagesAnalysis of Case Study of Colgate PrecisionVivek GuptaNo ratings yet

- Garment Manufacturing Process Flow From Buyer To ShipmentDocument27 pagesGarment Manufacturing Process Flow From Buyer To Shipmenttallraj50% (2)

- Beverages IndustryDocument19 pagesBeverages IndustryJasmandeep brarNo ratings yet

- Project Report - The Saraswat Co-Op Bank LTD - by Pahal SatvilkarDocument6 pagesProject Report - The Saraswat Co-Op Bank LTD - by Pahal SatvilkarPRALHADNo ratings yet

- Disaster Recovery Plan TemplateDocument27 pagesDisaster Recovery Plan TemplateZainal ArifinNo ratings yet

- Alfalah Savings Plan FORM REVISED 11022021 2Document2 pagesAlfalah Savings Plan FORM REVISED 11022021 2Ali SharifiNo ratings yet