Professional Documents

Culture Documents

Nps Scheme - E (Tier-I)

Nps Scheme - E (Tier-I)

Uploaded by

Kolluri VenkataraoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nps Scheme - E (Tier-I)

Nps Scheme - E (Tier-I)

Uploaded by

Kolluri VenkataraoCopyright:

Available Formats

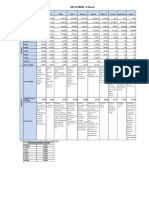

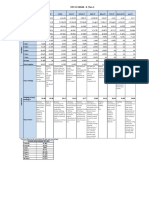

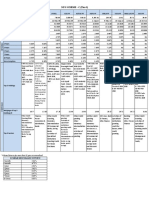

NPS SCHEME - E (Tier-I)

Particulars SBIPF LICPF UTIRSL ICICI PF KOTAK PF HDFC PF BIRLA PF TATA PF MAX LIFE PF Axis PF

Assets (Rs in crore ) 9,979.26 3,029.27 1,423.37 5,594.23 1,038.35 16,523.47 278.84 8.19 6.10 0.81

Scheme Inception Date 15-May-09 23-Jul-13 21-May-09 18-May-09 15-May-09 1-Aug-13 9-May-17 19-Aug-22 12-Sep-22 21-Oct-22

31-Oct-22 39.7601 30.7039 47.0766 47.6242 44.3230 36.1631 19.3709 10.366 9.7168 10.0054

NAV

52 Week High 39.7691 30.7039 47.0766 47.8512 44.4445 36.2352 19.4004 10.366 10.0000 10.0054

52 Week Low 33.4070 25.7882 39.5448 39.9622 37.0095 30.3948 16.3809 9.7677 9.1851 10.0000

3 Months 5.84% 5.97% 5.66% 5.92% 6.16% 5.73% 5.36% NA NA NA

6 Months 7.20% 7.71% 8.06% 6.59% 7.99% 7.34% 7.07% NA NA NA

1 Year 3.68% 4.91% 4.16% 2.96% 3.87% 3.17% 3.85% NA NA NA

2 Years 24.48% 27.77% 26.14% 26.18% 25.95% 25.89% 23.64% NA NA NA

RETURNS

3 Years 14.97% 16.09% 15.56% 15.89% 16.19% 16.18% 15.25% NA NA NA

5 Years 11.45% 11.18% 11.76% 12.03% 11.71% 12.54% 11.64% NA NA NA

7 Years 12.47% 12.06% 12.82% 12.73% 12.94% 13.59% NA NA NA NA

10 Years 13.20% NA 13.56% 13.36% 13.41% NA NA NA NA NA

Since Inception 10.79% 12.85% 12.20% 12.29% 11.69% 14.90% 12.82% 3.66% -2.83% 0.05%

Reliance Reliance Icici Bank Equity, (1) ICICI Bank ICICI Bank Ltd. Reliance Industries Reliance 1)Reliance 1. Reliance 1.ICICI

Industry Industries Reliance Industries Limited Reliance Ltd. Industries, Industries Industries Prudential

Limited, Ltd., Equity, (2) Reliance Industries Ltd. ICICI Bank Ltd ICICI Bank, Limited. Limited Overnight

Icici Equity, Icici Bank Infosys Tech Equity, Industries Infosys HDFC Bank Ltd HDFC Bank, 2)Icici Bank 2. Hdfc Bank Fund - Direct

Hdfc Bank Ltd., Ltd., Hdfc Bank Equity, Limited Technologies Ltd. Infosys Ltd Infosys Limited. Limited Plan - Growth

Infosys Hdfc Bank State Bank Of India (3) Infosys HDFC Bank Ltd Axis Bank Ltd Limited, Tata 3) Infosys 3. Icici Bank

Technologies Limited, Equity Limited Axis Bank Ltd Consultancy Limited. Limited

Infosys

Limited, (4) HDFC Bank Services 4) Axis 4. Infosys

Top 5 Holdings Technologies

Axis Bank Limited Overnight Limited

Ltd,

Equity (5) State Bank Of Fund - Direct 5. Housing

Larsen And

India Plan - Growth Development

Toubro Ltd

Option. Finance Corp

5) Bharti Airtel Limited

Limited.

Weigtage of top 5

33.19 0.32 31.36 33.44 32.91 32.62 33.41 26.82 30.67 100.00

PORTFOLIO

Holdings,%

Monetary Banks, It - Monetary 1. Monetary Monetary 1)Monetary Oil & Gas, 1) Financial 1. Banking 1.Management

Intermediation Software, Intermediation Of intermediation of intermidiation of intermediation of Bank & Services 2. FMCG Of Mutual

Of Commercial Oil & Gas Commercial Banks, commercial com bank commercial banks, Finance, 2) Healthcare 3. IT Funds

Banks, Saving Saving Banks. Postal banks, saving Manufacture of saving banks. It 3) Oil, Gas &

Banks. Savings Bank, banks, postal other petroleum postal savings bank Consumable

Postal,Writing , Writing , Modifying, savings. n.e.c. and discount Fuels

Modifying, Testing Of Computer 2. Writing , Writing , houses

modifying, testing

Testing Of Program To Meet The modifying, 2)Manufacture of

of computer

Computer Needs Of A Particular testing of other petroleum

program.

Program To Client Excluding Web- computer n.e.c. (includes

Top 3 Sectors 3. Manufacture of

Meet The Page Designing, program to meet manufacture of

other petroleum

Need,Manufact Manufacture Of the needs of a petroleum jelly,

n.e.c.

Other Petroleum particular client micro-crystalline

N.E.C. excluding web- petroleum wax,

page designing slack wax,

ozokerite, lignite

wax, petroleum

coke, petroleum

bitumen and other

residues of

* Scheme Returns for more than 01 year are annualised

SCHEME BENCHMARK RETURN

3 month 5.47%

6 month 5.94%

1 year 4.42%

2 years 27.10%

3 years 16.92%

5 Years 12.85%

7 Years 13.48%

10 Years 13.67%

You might also like

- Full Financial Hotel Excel SheetDocument128 pagesFull Financial Hotel Excel SheetPaul100% (2)

- Bookmap MasterclassDocument378 pagesBookmap MasterclassThierry100% (5)

- Specimen H1 Econs Paper 1Document1 pageSpecimen H1 Econs Paper 1tengkahsengNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)SRIKANTA ROUTNo ratings yet

- SCHEME - E (Tier-I) - 0Document1 pageSCHEME - E (Tier-I) - 0krishnaNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)VenkateshMedidiNo ratings yet

- Nps Scheme - E (Tier-Ii)Document1 pageNps Scheme - E (Tier-Ii)VenkateshMedidiNo ratings yet

- Scheme E - Tier IIDocument1 pageScheme E - Tier IIRaghu MNo ratings yet

- Scheme E2 - 2Document1 pageScheme E2 - 2SanjayNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)glorymatrixNo ratings yet

- SCHEME - A (Tier-I) - 0Document1 pageSCHEME - A (Tier-I) - 0krishnaNo ratings yet

- Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedsatishNo ratings yet

- Scheme A - 9Document1 pageScheme A - 94296tNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)Kolluri VenkataraoNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- Investment Approach Key Features & Portfolio AttributesDocument3 pagesInvestment Approach Key Features & Portfolio AttributesAkash JoshiNo ratings yet

- Mutual Fund AssignmentDocument2 pagesMutual Fund Assignmentmodakronit23No ratings yet

- Key Tenets To Reduce Risks While Investing in EquitDocument8 pagesKey Tenets To Reduce Risks While Investing in EquitdigthreeNo ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- Bajaj Fin Serv NfoDocument26 pagesBajaj Fin Serv NfosonalNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- Nps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedshrikanhaiyyaNo ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- Company 1 Company 2 Company 3 Company 4: SectorDocument27 pagesCompany 1 Company 2 Company 3 Company 4: SectorAlba GlenNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- JP Morgan FundsDocument118 pagesJP Morgan FundsArmstrong CapitalNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- MO BOP-One-Pager Oct'22Document3 pagesMO BOP-One-Pager Oct'22Himanshu TamrakarNo ratings yet

- India's 3PL 2018 - Based On Service: Freight Forwarding 2.78Document20 pagesIndia's 3PL 2018 - Based On Service: Freight Forwarding 2.78Adithya PrabuNo ratings yet

- 11 Chapter5Document122 pages11 Chapter5hareshNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- ACE - Fundtech LargeCap BA-FOTMDocument16 pagesACE - Fundtech LargeCap BA-FOTMMotilal Oswal Financial ServicesNo ratings yet

- Short Term Funds Comparision - Fund CompareDocument7 pagesShort Term Funds Comparision - Fund CompareANmolNo ratings yet

- Cresent CottonDocument6 pagesCresent CottonIhsan danishNo ratings yet

- Annual Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument3 pagesAnnual Returns - Mutual Fund Screener Mutual Fund Screening and Analysis Toolashish singhNo ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- DAFNA FactSheetDocument2 pagesDAFNA FactSheetfxarb098No ratings yet

- Scheme A 1 July 2021Document1 pageScheme A 1 July 2021amar srinivasNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- SCHEME - G (Tier-I) - 0Document1 pageSCHEME - G (Tier-I) - 0krishnaNo ratings yet

- MO NTDOP One Pager Oct'22Document3 pagesMO NTDOP One Pager Oct'22Himanshu TamrakarNo ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceDessiree ChenNo ratings yet

- Small Cap FundsDocument91 pagesSmall Cap FundsArmstrong CapitalNo ratings yet

- Corporate Finance: Group 10Document16 pagesCorporate Finance: Group 10Ankit saurabhNo ratings yet

- SmallcapsDocument5 pagesSmallcapsmoulikjoshimcaNo ratings yet

- GSPANN - Attrition DataDocument12 pagesGSPANN - Attrition DataakashtNo ratings yet

- Mirae Asset Emerging Bluechip Fund-2Document1 pageMirae Asset Emerging Bluechip Fund-2Saurabh KothariNo ratings yet

- Perkembangan Kredit UMKM Dan MKM Mar 2017 - NPLDocument2 pagesPerkembangan Kredit UMKM Dan MKM Mar 2017 - NPLharmudapNo ratings yet

- Fund Performance Individual JuneDocument4 pagesFund Performance Individual JuneSai Deepak NNo ratings yet

- Q1 Target Vs Ach FY 24-25 - TFPPLDocument8 pagesQ1 Target Vs Ach FY 24-25 - TFPPLMukul BansalNo ratings yet

- Suggested PortfoloDocument7 pagesSuggested Portfolospurkayastha_1No ratings yet

- Monthly Performance Report: MonthDocument16 pagesMonthly Performance Report: Monthkumarprasoon99No ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Risk and Return Analysis: 10 Prominent Large Cap Mutual FundsDocument38 pagesRisk and Return Analysis: 10 Prominent Large Cap Mutual FundsAman JainNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)Kolluri VenkataraoNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- Nps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Document1 pageNps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Kolluri VenkataraoNo ratings yet

- Table of Benefits For The Quarter 1.10.21 To 31.12.21-1Document3 pagesTable of Benefits For The Quarter 1.10.21 To 31.12.21-1Kolluri VenkataraoNo ratings yet

- 6 Rectification of ErrorsDocument33 pages6 Rectification of Errorsniraj jainNo ratings yet

- 1) Budgeting Basics - IntroductionDocument20 pages1) Budgeting Basics - IntroductionAngelo HuligangaNo ratings yet

- Procter & Gamble Company: Examining Product DecisionsDocument8 pagesProcter & Gamble Company: Examining Product Decisionsshivam kumarNo ratings yet

- Which Type of Benchmarking Is The Company Using?Document20 pagesWhich Type of Benchmarking Is The Company Using?Aslam SiddiqNo ratings yet

- Analysis of Systematic Investment Plan and Lump Sum InvestmentDocument6 pagesAnalysis of Systematic Investment Plan and Lump Sum InvestmentshanedsouzaNo ratings yet

- Valencia FBT Chapter 6 5th EditionDocument8 pagesValencia FBT Chapter 6 5th EditionJacob AcostaNo ratings yet

- US Internal Revenue Service: 2006p1212 Sect I-IiiDocument173 pagesUS Internal Revenue Service: 2006p1212 Sect I-IiiIRSNo ratings yet

- Sample Resolution Annual-BudgetDocument4 pagesSample Resolution Annual-BudgetJaymart C. EstradaNo ratings yet

- Twitter @ProdigalTrader Telegram @prodigaltrader Return in TradiDocument1 pageTwitter @ProdigalTrader Telegram @prodigaltrader Return in Tradiবলবো নাNo ratings yet

- PaySlip (October)Document2 pagesPaySlip (October)karansharma690No ratings yet

- Introduction To InvestmentDocument12 pagesIntroduction To Investmentyusnifarina100% (1)

- Bangladesh Companies Act, 1994Document47 pagesBangladesh Companies Act, 1994Amin HoqNo ratings yet

- Benefits and Impact of The Proposed Tax Reform To The People and The GovernmentDocument12 pagesBenefits and Impact of The Proposed Tax Reform To The People and The GovernmentGretchen CanedoNo ratings yet

- Important Terms in Managerial EconomicsDocument14 pagesImportant Terms in Managerial EconomicsVrkNo ratings yet

- 10 Borrowing CostsDocument12 pages10 Borrowing CostsEJ EugenioNo ratings yet

- NIRC Amendments Up To 2016Document3 pagesNIRC Amendments Up To 2016jusang16No ratings yet

- Engg Econ Lecture 3.2 - Present WorthDocument27 pagesEngg Econ Lecture 3.2 - Present WorthCharles DemaalaNo ratings yet

- Improving Performance With Strategies That Manage Strategies - David BeanDocument13 pagesImproving Performance With Strategies That Manage Strategies - David BeanaadbosmaNo ratings yet

- The Functional Design and Application of Computerized Accounting System in The University Financial ManagementDocument5 pagesThe Functional Design and Application of Computerized Accounting System in The University Financial ManagementKathrina RoxasNo ratings yet

- Quiz On Audit of CashDocument11 pagesQuiz On Audit of CashY JNo ratings yet

- CIMA 2010 Syllabus: The Definitive Paper by Paper GuideDocument24 pagesCIMA 2010 Syllabus: The Definitive Paper by Paper Guidetharshantharan88No ratings yet

- Acct Statement XX7076 11112022Document1 pageAcct Statement XX7076 11112022A.R GOPINo ratings yet

- Hsslive-XI ACCOUNTING WITH AFS - ANSWERKEY - RAMESH VPDocument6 pagesHsslive-XI ACCOUNTING WITH AFS - ANSWERKEY - RAMESH VPrehankedhenNo ratings yet

- Ontrac Coin Presentation-3Document11 pagesOntrac Coin Presentation-3Cacapit and FamillyNo ratings yet

- Service Tax and Vat Problems By-BharathDocument3 pagesService Tax and Vat Problems By-BharathrajdeeppawarNo ratings yet

- Raji BF Statement of HoldingDocument23 pagesRaji BF Statement of HoldingBild Andhra PradeshNo ratings yet

- Annual Audit Plan Template - Revised Version 2011Document36 pagesAnnual Audit Plan Template - Revised Version 2011Jasim Baloch100% (1)