Professional Documents

Culture Documents

07 Chapter 4

07 Chapter 4

Uploaded by

dr_ashishverma0 ratings0% found this document useful (0 votes)

10 views26 pagesOriginal Title

07-chapter-4

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

10 views26 pages07 Chapter 4

07 Chapter 4

Uploaded by

dr_ashishvermaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 26

CHAPTER-4

INCENTIVES AND SUBSIDIES FOR

SMALL UNITS

different types of subsidies are quite effective in removing

all these constraints.

»

To Provide Competitive Strength and Growth: Some

incentives are made available by the government at the

time of promotion of business enterprises and some other

incentives are available for a comparatively long period

During this period, they are expected to improve their

competitive strength with existing units. For example,

reservation of items for small scale sector is meants for

improving the competitive strength of SSI units working

in the sector. Price preference, concessional finance etc.

also help SSI units in improving their competitive strenath

and growth.

Advantage of Incentives and Subsidies

5

Advantage of Incentives and subsidies are as follows

They motivates entrepreneurs to undertake new

entrepreneurial activities,

They stimulate the new and existing entrepreneurs to develop

their units in backward area districts and zero industries

districts.

They ensure uniformity in the development process of all

regions,

They encourage first generation entrepreneurs to work for

industrial development of the country.

They improve the competitive capacity of entrepreneurs to

face the competitive environment of the industry

7

6. They solve the problems of impediments and constraints

generally available before the entrepreneurs.

Problems of Incentives and Subsidies.

Incentives and Subsidies create the following problems:

1. entrepreneurs generally develop bogus units to avail

incentives and subsidies.

Incentives encourage incompetencies in business units, They

cover their inefficiency under the cover of incentives and

subsidies,

3. Incentives and subsidies encourage unavailable use of

resources employed in business units and they are just a drain

on public exchequer.

4. Incentives and subsidies develop favourism and rampant

corruption.

5. Incentives and subsidies have a demorali

ng effect on other

industrial units or efficient units.

A. Government Assistance

Following government

entrepreneurs.

ssistances are available to

(Technical Assistance: The SIDO through Small Industries

Service Institutes and Extension Centres Provides technical

assistance and guidance to the existing small industrialists

and the intending entrepreneurs. These institutes are

manned by experts in different fields/trades/industries like

mechanical, electrical, chemical engineering, electronics,

foundry and forging, blacksmithy, leather technology, glass

78

(ii)

and ceramics, wood working and joinery, sports goods,

industrial designing, industrial management and industrial

economics. These experts are required to visit various small

industries, study their problems on the spot and give

technical assistance and guidance. The NSIC has

established a Technology Transfer Centre (TTC) at Okhla

(Delhi) to upgrade technology in the changed economic

Seenario under economic reforms. At the enterprise level,

the primary concern is to assist small scale enterprises in

technology acquisition, adoption and upgradation through

its technology information and promotion services

Government has introduced the techno-economuic and

managerial consultancy service scheme under which Small

Industry Service Institute solves the technical problems of

entrepreneurs. Industrial Extension service has also been

introduced by the government to help small entrepreneurs.

There been introduced by the government to help small

entrepreneurs. There are 16 Service Institutes 5 Branch

Institute and 64 extension centres who are extending

technical assistance to the entrepreneurs.

Raw Material Assistance: Earlier small units were offered

assistance in the procurement of scarce and controlled raw

materials by the Small Industries Development Organisation

at the Central level and the Directorate of Industries at the

state level. Now, District Industries Centre is authorized to

Sponsor the SSI units for procuring scarce and controlled

raw materials. Now it is obligatory for the small scale units

to obtain registration certificate form the concerned

79

Directorate of Industries for procuring essential raw

materials. National Small Industries Corporation (NSIC) is

also helping SSI units in (a) supply under the off-the-shelf

basis; (b) import industries of raw materials; (c) providing

Scarce raw materials on priority basis; (d) supplies through

NSIC depots/ godowns.

(iii) Cash Scheme: Government provides cash assistance under

self-employment scheme to rural youths. Similarly, cash

assistance is also made available to scheduled

castes/scheduled tribes and women entrepreneurs

Gy) Supply of Machinery and Equipment on Hire-Purchase

Basi:

An entrepreneur is required to purchase machinery

etc. for launching new industrial units or for expansion of

the existing plant. If his financial position permits, he

Purchases machinery on his own, otherwise he can procure

it from the National Small Industries Corporation or State

level Small Industries Corporations. These corporations

ensure supply of indigenous and imported machinery (the

value of which would not exceed Rs. 3crore inclusive of the

value of machinery and equipment already installed) on

easy financial terms, mainly targeted at first generation

entrepreneurs, women entrepreneurs, weaker sections, the

handicapped and ex-servicemen, Besides, they also arrange

machinery and equipments on lease basis. They

Provide100% finance to facilitate SSIs in diversification and

technology upgradation. Entrepreneurs can also avail tax

rebate on full year rentals

80

(¥) Marketing Assistance: The success of small entrepreneurs

is generally governed by the ability and efficiency of these

units in marketing their products, For the Purpose of

marketing assistance, small units are required to get

registered themselves with the NSIC. The objectives of the

marketing programme of NSIC are as under: (a) ensure fair

margin to producers of goods; (b) standardization and

quality control with testing facilities: (c) market products

under common brand name;(d) provide Publicity to SSI

Products; (e) upgrade technology by supplying

Sophisticated machinery and equipment. Besides, for the

supply of goods of government and public enterprises, SSIs

registered under the single point registration scheme with

NSIC are given the following facilities: (a) issue of tender

forms/Sets free of cost; (b) advance intimation of tenders

issued by DGS &D; (c) exemption from Payment of earnest

money; (d) waiver so security deposit upto the monetary

limits for which the units is registered: (©) issue of

Competency certificate in case the value of an order exceeds

the monetary limit after due verification.

(i Assistance to Small Entreprenuers: ‘The NSIC has

developed five financial centres at New Delhi, Mumbai,

Ahamadabad, Banglore and Goa to provide finance to small

entrepreneurs for activities relating to marketing bills

discounting, raw materials purchases and exports, To train

and equip the first generation entrepreneurs, government

has developed various training institutes in the field of

entrepreneurial activities/ entrepreneurship development

at

Programmes. The NISIET (Hyderabad), NIESSBUD(New

Delhi) and integrated Training Centre( Industries)

(Nilokhert) are the main training institutes which function

under the administrative control of SIDO.

(Rural Industrial Project Assistance: The SIDBI has

assigned a very crucial role in the identification of viable

and self-sustaining SSIs in rural and semi-rural areas. These

units are expected to provide an intensive thrust to address

the problems of rural unemployment, urban migration,

under-utilisation of physical resources and skills of the rural

areas. The Rural Industries Programme (RIP) of SIDBI

Provides a cohesive and integrated package of basic inputs

like information, motivation, training and credit, backed by

appropriate technology and market linkages.

For the purpose, SIDBI has identified implementing

agencies such as NGOs, development professionals,

technical consultancy organizations (TCO), and these are

assigned the task of developing RIP at a fee given by the

bank. The implementing agency either by itself or by

networking with appropriate agencies provides the

following professional services; (a) identification and

motivation of potential entrepreneurs in the rural areas; (b)

identifying potential investment opportunities for these

entrepreneurs; (c) facilitating skill upgradation: (d) assisting

in securing finance from banks and other lending

institutions; (¢) helping entrepreneurs in selection, sourcing,

installation and operation of machinery; (f) arranging

market support wherever necessary and (g) guiding

82

entrepreneurs till their units commence commercial

production.

SIDBI meets part of the manpower costs of the

implementing agency, mainly in the form f performance fee

which is linked to units actually grounded by identified

ural entrepreneurs. in deserving cases, the Bank even

Provides startup expenses. Further, the Bank extends credit

Support by way oif refinance through PLIs.

B. Government incentives

@

(ii)

Following are the incentives available to the small units:

Subsidy Relating to Investment: Government has initiated

different scheme of investment subsidy for the benefits of so

that they may be encouraged to establish more and more SSI

units. These schemes are capital investment subsidy,

transport’ subsidy, power generators subsidy, special

investment schemes for women entrepreneurs, provision for

Seed capital, subsidy for technical/ feasibility study ete.

Besides, being an apex bank for SSI sector, the SIDBI is also

arranging equity type assistance scheme e.g. seed capital

scheme, National Equity Fund scheme, single window

scheme to provide both term loan and working capital,

Venture capital fund with a corpus of Rs. 80 crores etc. to

accelerate the pace of investment in small scale sector.

Export/Import Subsidies and Boundaries: 100 percent

export-oriented units (EOUs) and units in the export

Processing zones (EPZs) enjoy a package of incentives and

facilities, which include duty free imports of all types of

83

(iv)

Ww)

capital goods, raw material, and consumables in addition to

tax holidays against export. As per the Budget 2000-2001

under section 10-A of the Income-tax holiday, for a 10 year

period. Similarly, Section 10-B of the Income-tax provides

for a ten-year tax holiday in respect of newly established

hundred percent export-oriented units.

Subsidy Relating to Research and Development: To

encourage continuous research and development activities in

the small scale sector, government provides subsidy. A

Provision of Rs. 50 crores has been made in the budget 2000-

91 for Technology Information Forecasting and Assessment

Council. Besides, another provision of Rs. 50 crores has also

been made in the budget for launching New Millennium

Indian Technology Leadersiup Initiative. The Government

has already approved a modernisation project of Rs. 75 crores

for the patent office and strive to remove all impediments

related with the project.

Subsidy Relating to Taxes: Central Government as well as

State Government are trying to encourage entrepreneurs

through tax subsidy schemes enabling them to accelerate the

Pace of establishment of Industrial units. These are

exemption from estate duty, tax relief to NRIs, rebate in

income-tax, interest-free sales tax loan, sales tax subsidy

exemption from sales tax etc.

Subsidy Relating to Resources: Small Industries need

infrastructural facilities and government is trying to provide

these facilities at subsidised rates. Subsudy for purchase of

84

wi)

testing tools, subsidy for industrial estates and parks,

allotment of land and bi\uildings at concessional rates, supply

of water at concessional rated, arrangement of developed or

constructed production sheds, arrangement of raw materials

at concessional rates or controlled rates are some of the

important subsidies which are available to the small scale

units.

Capital subsidy Scheme for Technology Upgradation: In

November,2000, the Central Government has introduced a

capital subsidy scheme for small scale industries styled

“credit linked capital subsidy scheme for technology

upgradation of the small scale industries” a 12 percent back

ended capital subsidy will be admissible on loans and

advanced to SSI units by the scheduled commercial banks/

designated state financial corporations.

The scheme would be in operation for five years

beginning October!, 2000 to September 30,2005 or till the

Sanction of capital subsidy by the nodal agency SIDBI

reached Rs. 600 crore whichever was earlier. The scheme

tate technology upgradation by induction of

Proven technologies in respect of specified products/sub-

Sectors. This would apply to the introduction of the latest

technology, improvement of _ productivity, quality of

Production and environmental conditions and included

installation of improved techniques as well as anti-pollution

measures and energy conservation. However, replacement of

the existing equipmenttechnology with the same equipment

or technology would not qualify for the scheme and it was

85

also not applicable to units going for upgradation with second

hand machinery.

Entrepreneurs availing of this scheme should not avail

of any other benefit including interest subsidy under any

other scheme of the Central Government and should have

Competent management to carry out the upgradation

Programme and manage the unit subsequently. For

calculation of subsidy, a maximum loan amount of Rs. § lakh

Should be considered for tiny units with investment in plant

and machinery of less than Rs. 10 lakhs. Similarly, a

maximum loan ceiling of Rs. 20 lakhs is allowed for subsidy

calculation for tiny units with investment in plant and

machinery ceiling for calculation of subsidy would be Rs. 40

lakhs for investment in plant and machinery above Rs 25

lakhs.

However, the maximum amount for calculation of

Subsidy would be limited to the actual investment if it is less

than the ceiling specified for calculation of subsidy. Some of

the sectors covered by the scheme are leather and leather

Products, including footwear and garments, food processing.

IT (hardware), drugs and pharmaceuticals, auto-parts and

components, toys, dyes and intermediaries, handtools and

foundries, ferrous and cast-iron.

Excise Duty Exemption: The most important incentive for

Small Scale units is the excise duty concessions. However, it

Was watered down by MODVAT (modified value added Tax)

and the reduction in in excise duty rates. In the era of

86

Protection, large companies had to pay very high levels of

duty and excise weaivers and concessions afforded small

firms in automatic price advantage over large firms, As a

sresult of the fall in excise duty rates and MODVAT the

relative difference in the tax burden for large and small

companies has declined \. Large companies can claim

MODVAT benefits on inputs and capital goods so that the

casting effect of excise duty taxation is factored out, For

many commodities, especially consumer goods, the rates of

excise duty have also fallen. In this liberalization process,

small firms were the losers on this account.

Now, the Government has increased the excise duty

&xemption limit from Rs. 50 lakhs to Rs. 1 crores, This is the

second increase in excise exemption limit since 19980 when

the Government increased the limit from Rs. 30 lakh. In

Practice, the government will incur some losses due to

increased exemption limit but it is worth it,

However, due to this modification, any small scale unit

where the inputs do not attract excise duty would find itself

Priced out of the market once its sales exceed Rs. 1 crore

Consequently, if a small scale unit wishes to utilize its idle

Plant capacity beyond the turnover of Rs. 1 crore, it would

have no option but to undertake clandestine sales fro which the

puts would also have to be procured from the parallel

Sconomy. The policy effectively prohibits any incentive for the

growth of the unit

87

Indigenous manufacturers of raw materials (especially in

the small scale sector) would find themselves at a disadvantage

since the reduction of duty on imports would render them non-

competitive. A small unit which sells its products to a large

seale unit and therefore has a derived demand for its products,

does not enjoy any price advantage on account of excise

exemption since large scale units are also covered under the

MODVAT-Scheme. Similarly, the practice of multiple

sourcing by the parent unit may make it impossible for the

ancillary unit to achieve sales of Rs. 1 crore if the parent unit is

the lone buyer and in the case the ancillary unit does not have a

multiple product mix. If it does, then the product meant for the

market may not be saleable on account of incidence of excise

duty which is linked to the total sales

Fiscal Incentives for small Scale Industries in Budget 2000-2001

For the betterment of SSI sector, Government has made the

following provisions in the Budget 2000-2001:

1

The requirement of providing coillateral security is a major

bottleneck to the flow of bank credit to very small units. RBI

has recently issued instructions to dispense with the collateral

requirement for loans up to Rs. | lakhs. The limit is further

increased for the tiny sector from Rs. I lakhs to Rs. 5 lakh.

The existing composite !oan scheme of SIDBI and banks

helps small borrowers by providing working capital and term

loans through a single window. To promote credit flow to

small borrowers, the composite loan limit is being increased

from Rs. 5 lakh to Rs. 10 lakh,

88

Public sector banks have been instructed to accelerate their

programme of SSI branch

to ensure that every district and

SSI clusters within districts are served by at least one

specialized SSI bank branch. Furthermore, to improve the

quality of banking services, SSI branches are being asked to

obtain ISO certification.

A new central scheme with regard to credit guarantee scheme

for SSI has been formulated and a provision for Rs. 100 crore

has been made in the budget The scheme will be

implemented through SIDBI and will cover loans uptp Rs. 10

lakhs from the n\banking sector. The guaranteed loans will be

scrutanised and will be tradeable in the secondary debt

market,

SIDBI operated the National Equity Fund Scheme under

which equity support is provided for projects upto Rs. 15

lakh. To further help SSI entrepreneurs, this limit is raised fro

Rs. 15 lakh to Rs. 25 lakh,

SIDBI is presently administering the technology development

modernisation fund scheme for assisting _ technology

development and modernisation of SSI. units. The scheme has

certain coincessional features including interest at prime

lending rate for direct assistance and refinancing at 2% below

Prime rate for indirect finance. The operation of this scheme

is being extended by another 3 years.

The Khadi and Village Industries Commission (KVIC) has

been playing a very important role as an instrument to

generate large scale employment in the rural areas with low

89

become more competitive. For intensifying marketing efforts,

the KVIC will introduce a common brand name for its

Products and also setup a professionally managed marketing

company for domestic as well as export marketing.

New Incentives and Sub:

ies for Small Scale Sector

The primary responsibility to develop village and small

industries in the ‘States/UTs rests with the Tespective State/UT

Governments. However, the Government of India announces, from

time to time, various incentive scheme/eoncessions and support

Services for promotion of industries, Particularly in industrially

backward areas and other special regions with the intention of

reducing regional imbalances. The Package of incentives and

facilities currently available from the Central Government are

discussed hereunder.

Fiscal incentives are provided in the form of exemptions,

rebate, refund or postponement ofddirect or indirect taxes leviable on

Production of profits, besides special tax concessions. Such

Excise duty (iv) Exemption from Sales Tax (¥) Tax holiday for new

1. Tax incentives/Concessions/Deduction from profits and gains

@ IT Section 80-HH-20 per cent for 10 years for industries

to be set up under the Factories Act in backward areas,

80

(ii)

(iii)

(iv)

(wv)

IT Section 80-HHA-20 Per cent for lo years for SSI units

to be set up in rural accas

IT Section 80-1- 20 per cent for 7 to 9 years for SSI units

to be set up under Factories Act, 25 per cent for 11 years

in case of cooperative societies, 35 percent for

companies.

IT Section 80-14-25 per cent for 10 years for industries

to be set up under Factories Act, 100 per cent for $ years

and 25 percent of their profits(30 per cent for

Companies) for a period of 10 years,

IT Section 80-IB-the small scale units commencing

Production between April 01, 1995 and March 31,2000

are allowed a deduction of 25 percent of their Profits(30

Per cent for Companies) for a period of 10 years,

2. Incentives for exports including duty drawbacks

The following tax incentives on exports are offered by the

Government :

(i)

Gi

(iii)

(iv)

(vy)

Deduction in respect of profits and gains from projects

Outside India (Section 80-HHB)

Peduction in respect of earnings in convertible foreign

exchange (80-HHD).

deduction for consultancy exports (80-0).

Ten Year Tax Holiday for newly established industrial

undertaking in the Free Trade Zones, or Electronic

91

Hardware Technology Parks and Software Technology

Parks (See. 10-A).

(vi) Ten Tear Tax Holiday for newly established 100 percent

Export Oriented Undertaking ( Section 10-B),

(Wii) Duty drawback facilities are provided in two ways:

G) Drawback of the

Whole of import duty on imported

articles, components and raw materials, and excise

duty paid on exisable components used in the

manufacture of the product when it is exported.

Gi) Drawback of 90percent of duty paid on imported

article when it is exported,

3-Exemptions and preferential treatment from excise duties

For SSIs having clearances in the preceding financial year not

exceeding Rs. 30 million, the present rates of excise duty are as

under :

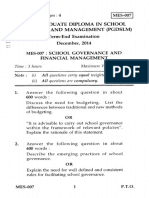

Clearances Rates ofDuty for} Rates ofDuty for |

| SSIs Avail SSIs Avail Modvat

MOdvat Credit Credit

Not exceeding Rs. 10 Nil | 80% of Normal

| Million | tare

Rs. 10t0 30 million | Normal Normal

|

Pn 4 _ a=)

[Goods for capital Nil Nil

consumption | |

Note: Commodity specific exemption for small scale units

namely, articles of plastics/cosmetics and toilet preparation,

tread rubber, air conditioning and refrigeration machinery and

/Parts have been merged with the General Seq Exemption |

Scheme with effect from April 01.2000, |

ba

92

4. Modvat Credit

Modvat credit is allowed at the rate if 100 per cent of duty paid

on inputs, be it excise duty or special duty or additional duty of

customs. It also covers capital goods purchased and used by the

manufacturers,

5. Exemption from Sales Tax

@ No liability under State Sales Tax, Law for import of

the goods into or export of goods out of the territory

of India.

(i) Export Sales have been exempted from levy of sales

tax under Central Sales Tax Act,1957.

6. Other Incentives

(a) Capital Investment Subsidy

Capital Investment Subsidy Scheme 1957 has been notified on

June 01,1998 under the Prime Minister's new initiatives for the

North Eastern Region. Under the Capital Investment Subsidy

Scheme, subsidy at the rate of 15 percent investment in plant and

machinery subject to a maximum ceiling of Rs. 3 million is payable

‘o industry located in the growth centres and to new industrial units

and or their substantial expansion in other identified areas in the

North Eastern Region. The Scheme is operated through the

respective State Governments.

(b) Transport Subsidy

The transport Subsidy Scheme was introduced in July 1971 to

Promote industries in hilly, remote and inaccessible areas. The

Scheme is applicable to the State of Himanchal Pradesh & K the

North Eastern Strates, Sikkim. Union Terrutories of Andman &

93

Nocobar Island and Lakshadweep. Darjeeling District ofWest

Bengal and eight hill districts of the Uttar Pradesh(which now fall in

the newly created Uttaranchal State) Comprising Almora, Chamoli,

Dehradun, Nainital, Pauri Garhwal, Pithoragarh, Tehri Garhwal and

Uttar Kashi, Under the scheme, a subsidy ranging from 50 percent

to90 per cent is admissible on transport costs incurred on the

movement of raw materials and finished goods from designated rail

heads/parts upto the location of the industrial units and vice-versa.

The Scheme has been extended upto March 31,2007

(©) Incentives for Electronics and Information Technology

@ The electronics industry, except aerospace and defence

electronics, has been fully delicensed,

(i) Export earnings from information ‘Technology (aT)

products not to be taxed.

(ii) Depreciation of IT products to be allowed at 60 per cent.

Gv) Unites located in Electronics Hardware Technology

Parks (EHTP) and Software Technology Parks (STP)

have been exempted from payment of corporate income

tax for 10 years,

(¥) Income derived by foreign companies as divided and

interest would be taxed at the rate of 20 per cent

(vi) The payment in the form of royalty and technical service

fee to be taxed at 30 per cent

(vil) Under section 8-HHE of the Income Tax Act, definition

of Computer Software has been widened to include

transmission of data.

94

(viii)

(ix)

Exemption of withholding tax on interest on external

commercial borrowings has been extended to the It

sector,

The tariff levels are being brought in line withy the

average international levels in a [phased manner.

Fiscal incentives announced in the Union Budget 2001-02

(i)

(ii)

(ii)

(iv)

(vy)

(vi)

(vii)

The Central Value Added Tax (CENVAT) retained at 16

per cent.

Three rates of special excise duty, i.e. 8 per cent, 16 per

cent and 24 per cent reduced to a single rate of 16 per

cent.

8 per cent special excise duty abolished In glazed tiles,

mattresses and articles of bedding carpets and floor

coverings, painted convas, studio back cloth ete.

linoleum and textiles wall covering etc. scooters and

motorcycles and taxies,

The special excise duty on aerated soft drinks, soft drink

concentrate reduced to 16 per cent,

Products of SSI units exempted from excise duty upto

Rs. 10 million.

Excise duty exemption withdrawn in respect of cotton

yarn, ball or roller bearings, arms and ammunition for

Private use.

Excise duty rates rationalized on matches 50 paise for

band made sector Rs. | middle sector, Rs. 2 for semi

95

mechanized sector and Rs. 3 for mechanized sector per

100 boxes of 50 sticks each.

(vili) Accelerated depreciation at the rate of 56 per cent on

plant and machinery purchased under the technology

upgradation fund scheme announced for weaving

Processing and government sector of textile industry

(ix) Basie customs duty on specialized textile machines

reduced to 5 per cent and on silk waste, cotton waste and

flax to 15 per cent

Measures taken for development of North Eastern Region

In order to accelerate the setting up of SSI units in North

Eastern Region, several steps have been taken by the government.

These special incentives for the NER are given annexure 3.3.

Incentives and Subsidies Policies at State Level

The State Government formulate their respective policies for

development of industries in general and small scale industries in

particular

and also implement the incentive schemes through the District

Industries Centres and other Departments and Corporations set up

for this purpose, They provide technical and other support services

to SSIs. The main areas of support and facilities are listed below.

@ Respective Industrial Development and Investment

Corporations to develop and manage industrial areas

Gi) Finaneial support services by State Financial

Corporations.

96

(ii) Technical guidance by technical Consultancy

Organisations

(iv) Infrastructure development through Training Institutions.

(¥) Infrastructure development by the concerned corporation.

(vi) Export promotion by small Industries and Export

Corporations.

(vii) Single window assistance by District Industries Centres.

Apart from these, the State governments also offer a range of

incentives for providing an impetus to industrialization. Incentives to

SSI are provided mainly by way of provision of land and developed

plots/sheds in industrial estates on easy terms, capital subsidy on

investment(in selected areas), subsidy on power generating sets,

exemptions/ deferment on sales tax and stamp duty, water supply at

reduced rates, seed capital assistance, relief on electricity duty,

Interest’ subsidy, financial assistance for preparation ofproject

reports, subsidy for obtaining technical know-how, subsidy for

testing the products in approved test houses, etc. All these

Concessions are not uniform in all the States/Uts; their nature,

contents, quantum and periodicity vary from State to State

Development Scheme for Industrially Backward Areas

The Department of Industrial Policy and Promotion, Ministry

of Commerce and Industry is implementing the following important

schemes for the development of industrially backward areas in the

country.

1. Growth Centre Scheme: Under this scheme 71 growth

centres are to be developed throughout the country

97

which would be provided with basic infrastructure

facilities like power, water, _tele-communication,

sewage efficient disposal etc. enabling them to attract

industries. The growth centres approved by the

Government of India are to be developed by the State

Governments with a central assistance component of

Rs. 10 crore per acre (Rs. 15 crore in the case of North

Eastern Region). 68 growth centres have been approved

so far. The scheme introduced in 1988 has been

extended to the 9"" five-year Plan period.

Transport Subsidy Scheme : This scheme was

introduced in July,1971 to promote Industries in hilly,

remote and inaccessible areas. Under the scheme,

subsidy ranging from 50%-90% is admissible on

transport cost incurred on movement of raw materials

and finished goods from designated rail heads/ ports

upto the location of the Industrial units and vice-versa

for a period of five years from the date of

coOmmencement of commercial production. The

scheme is applicable to all industrial units (except

plantations, refineries and power generation units)

irrespective of their size, located in the North Eastern

region.

Capital Investment Subsidy Scheme: Under this

scheme, a subsidy @ 15% of the investment in plant

and machinery subject to maximum of Rs. 30 lakh

would be admissible to industries located in the growth

centres and in new industrial units and/ or their

98

substantial expansion in other identified areas in the

North-Eastern Region. The scheme is operated through

the agency of the State Government. The North Eastern

Development financial Corporation (N

FC) has been

designated as the nodal agency to release subsidy to the

eligible units on

basis of recommendations of the

state level committee/ State Government. The Scheme

was notified in 1998,

Central Interest Subsidy Scheme: Under this scheme,

notified on 19-2-99, interest subsidy @ 3% on the

working capital loan would be payable to the new

industrial units in the north eastern Region for a period

of 10 years after the unit goes into production.

Comprehensice Insurance Scheme: This scheme

notified on 14-7-99 envisages reimbursement of

insurance premium to all industrial units set up in the

North-Eastern regions after 24" December 1997 and

included in fire policy (as per All India 2Fire Tariff(

The insured party shall pay initial premium which shall

be reimbursed by the nodal insurance company out of

revolving fund maintained by the company. funds for

this revolving fund shall be contributed by the

Department of Industrial Policy & Promotion. The

scheme will remain effective for a period of 10 years

i.e. upt0 13.7.2009,

Integrated Infrastructure Development Scheme

The office of the Development Commissioner(Small

99

Seale Industries), Ministry of Small Scale Industries

&Agro and Rural Industries is also implementing the

Integrated Infrastructure Development scheme(IID).

The Scheme introduced in 1994 envisages development

of infrastructural facilities for location of industries in

rural/ backward areas. Under the scheme 52 IID centres

have been sanctioned in various states.

State Policies for Assistance ana Incentives

The very size and dispersed nature of the small sector implies

that the onus of promotion and development rests mainly on State

Governments and institutions. The central policy framework act as a

Suiding principle in this rgard. Small units are encouraged to register

with the District Industries Centre which helps them avail of the

various incentives and direct support programmes of the central and

State Governments. The important aspects of state policies are:

ai).

Gi)

(iii)

(iv)

Development and management of industrial areas by the

industrial development and investment corporations.

Capital investment subsidy ranging from 15 to 25 percent

on fixed investment subject to an outer ceiling) to new

units.

Sales tax exemptions/deferment to units for 5 to 10 years,

limited by fixed capital investment as well as tax

liabilities.

Incentives/subsidies for using power derived from

alternative energy sources

100

(vy)

(vi)

(vii)

(viii)

(ix)

(x)

Special assistance programme for women and weaker

sections.

Seed capital/margin money assistance scheme on soft

terms,

Underwriting costs on feasibility studies/consultancy for

modernisation, technology ungradation.

Empowered commiices at the districv/state level tp

accord clearances and settle disputes.

Higher incentives to set up pioneer units in

backward/zero industry districts

Equity participation by state corporations in joint/assisted

sector projects

In this way incentives and subsidies have been playing a

crucial role in the development of small scale sector in India.

seeker

101

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mes 007Document4 pagesMes 007dr_ashishvermaNo ratings yet

- Mes 004Document4 pagesMes 004dr_ashishvermaNo ratings yet

- Population Growth and Agricultural Development in KenyaDocument3 pagesPopulation Growth and Agricultural Development in Kenyadr_ashishvermaNo ratings yet

- 06 Chapter 3Document25 pages06 Chapter 3dr_ashishvermaNo ratings yet

- 03 ContentDocument4 pages03 Contentdr_ashishvermaNo ratings yet

- Mes 005Document4 pagesMes 005dr_ashishvermaNo ratings yet

- PragsfrDocument1 pagePragsfrdr_ashishvermaNo ratings yet

- Data Base IciciDocument1 pageData Base Icicidr_ashishvermaNo ratings yet

- 08 Chapter 5Document27 pages08 Chapter 5dr_ashishvermaNo ratings yet

- Fdi FDocument40 pagesFdi Fdr_ashishvermaNo ratings yet

- 05 Chapter 2Document32 pages05 Chapter 2dr_ashishvermaNo ratings yet

- 10 Chapter4Document42 pages10 Chapter4dr_ashishvermaNo ratings yet

- 04 Chapter 1Document22 pages04 Chapter 1dr_ashishvermaNo ratings yet

- 12 Chapter6Document28 pages12 Chapter6dr_ashishvermaNo ratings yet

- Chapter 1Document14 pagesChapter 1dr_ashishvermaNo ratings yet

- 11 Chapter5Document21 pages11 Chapter5dr_ashishvermaNo ratings yet

- Tax Angle IVCJ 3Document11 pagesTax Angle IVCJ 3dr_ashishvermaNo ratings yet

- SWOT AnalysisDocument5 pagesSWOT Analysisdr_ashishvermaNo ratings yet