Professional Documents

Culture Documents

Income Tax Project by Kislay SInha, 11 - A, Roll No 14

Income Tax Project by Kislay SInha, 11 - A, Roll No 14

Uploaded by

Jr.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Project by Kislay SInha, 11 - A, Roll No 14

Income Tax Project by Kislay SInha, 11 - A, Roll No 14

Uploaded by

Jr.Copyright:

Available Formats

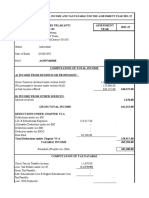

"Calculating annual income tax of Mr.

Pranav Si

2020-21. Pranav is a 42 years old Indian citizen

amounts to 7,59,989/- inr (exclusive of HRA ).

in EPF, 15,000/- in NSC and 10,599/- inr in LIC. H

fees of his two sons. He always preaches holy ri

also donated 11,000/- in Clear Ganga Fund. "

Gross income 759,989

Less Standard Deduction 50,000

Balance : 709,989

Deductions under section 80C : 21799

15000

10599

42599

Total : 89997

Balance : 619,992

Deductions under 80G : 11,000

Balance : 608,992

Taxable income : 608,992

Now according to the Income tax slab:

Percentages Amount Total Amount

Income tax : 0 250000 0

5 250000 12500

20 108992 21798.4

12500

Balance : 46798.4

Health and education cess 4% on 46789.4 1871.936

Total Income Tax : 48670.336

me tax of Mr. Pranav Sinha for the financial year

years old Indian citizen whose annual income

nr (exclusive of HRA ). He deposited 21,799/- inr

and 10,599/- inr in LIC. He paid 42,599/- as tution

always preaches holy river 'Ganga' that's why he

Clear Ganga Fund. "

You might also like

- Ca Ipcc Taxation Guideline Answer For May 2016 ExamDocument8 pagesCa Ipcc Taxation Guideline Answer For May 2016 Examileshrathod0No ratings yet

- Income Tax Calculator FY 2023-24Document2 pagesIncome Tax Calculator FY 2023-24anil.ramamurthy1988No ratings yet

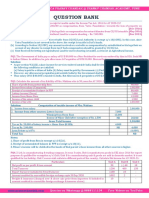

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument4 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- 1967 - 202223 - REVISED - Revised 1 - Statement of IncomeDocument2 pages1967 - 202223 - REVISED - Revised 1 - Statement of IncomeSmita desaiNo ratings yet

- TAX Quiz 2Document10 pagesTAX Quiz 2Ednalyn CruzNo ratings yet

- ComputationDocument3 pagesComputationRuloans VaishaliNo ratings yet

- Taxation Class Test 3Document6 pagesTaxation Class Test 3ap.quatrroNo ratings yet

- BIR Form Quarterly Tax Returns: INSTRUCTION: Refer To Chapter 14 of Your Book in Answering The Requirements BelowDocument6 pagesBIR Form Quarterly Tax Returns: INSTRUCTION: Refer To Chapter 14 of Your Book in Answering The Requirements Belowdianne caballeroNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Taxation Class Test 2Document5 pagesTaxation Class Test 2ap.quatrroNo ratings yet

- Double TaxationDocument10 pagesDouble TaxationMintuNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Ashok COMPUTATION 2019-20Document2 pagesAshok COMPUTATION 2019-20SHIFAZ SULAIMANNo ratings yet

- Chapter 12 - Computation of Total Income and Tax Payable - NotesDocument54 pagesChapter 12 - Computation of Total Income and Tax Payable - NotesDivya nraoNo ratings yet

- Taxation CLass Test 1Document6 pagesTaxation CLass Test 1ap.quatrroNo ratings yet

- MGAD65 Midterm Review Take-UpDocument4 pagesMGAD65 Midterm Review Take-Upavaxuan0329No ratings yet

- Notice of Assessment 2021 03 22 15 36 05 837221Document4 pagesNotice of Assessment 2021 03 22 15 36 05 837221Joseph HudsonNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument8 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- TDS Calculation on Salary FinalDocument2 pagesTDS Calculation on Salary FinalKowsar HossainNo ratings yet

- Examiner Comments-Summer 2017Document12 pagesExaminer Comments-Summer 2017Mahendar BhojwaniNo ratings yet

- Devender Com 2Document2 pagesDevender Com 2fq2x74xk6zNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- PGBP Part 2 SolutionDocument14 pagesPGBP Part 2 SolutionDhruv SetiaNo ratings yet

- Taxation Material 4Document36 pagesTaxation Material 4Shaira BugayongNo ratings yet

- ComputationDocument1 pageComputationbirpal singhNo ratings yet

- 10-ZamboangaCityWD2018 Part2-Observations and RecommDocument45 pages10-ZamboangaCityWD2018 Part2-Observations and RecommBaliv MozamNo ratings yet

- AY2022-23 KALLA PUTHIYAVEETTIL REHANA RUKSANA-ASFPR0552F-ComputationDocument3 pagesAY2022-23 KALLA PUTHIYAVEETTIL REHANA RUKSANA-ASFPR0552F-ComputationSourabh PunshiNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Taxaation 2Document4 pagesTaxaation 2M CNo ratings yet

- 1663274292-Tax Cals-1Document1 page1663274292-Tax Cals-1Kriti GandhiNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- EWTDRAFTDocument9 pagesEWTDRAFTMarkie GrabilloNo ratings yet

- Ponugoti Manga Itr 2022Document4 pagesPonugoti Manga Itr 2022Neduri Kalyan SrinivasNo ratings yet

- 2nd Page Computation FY 20-21Document2 pages2nd Page Computation FY 20-21naveen kumarNo ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Btax - Plq1-Answer KeyDocument6 pagesBtax - Plq1-Answer KeyJohn Victor Mancilla MonzonNo ratings yet

- Taxation Nyama AssignmentDocument14 pagesTaxation Nyama AssignmentTakudzwa BenjaminNo ratings yet

- Tutanes, Ma. Angelita 3BAM5ADocument2 pagesTutanes, Ma. Angelita 3BAM5AMaxGel De VeraNo ratings yet

- UntitledDocument3 pagesUntitledVAIBHAV ARORANo ratings yet

- Evernew LTD (Basic) : Cfap 1: A A F RDocument1 pageEvernew LTD (Basic) : Cfap 1: A A F R.No ratings yet

- CTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceDocument12 pagesCTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceNamita BhattNo ratings yet

- Icag Past QuestionDocument5 pagesIcag Past QuestionAdam AliuNo ratings yet

- Old Tax Regime Estimated Annual IncomeDocument4 pagesOld Tax Regime Estimated Annual IncomeThiruppathirajanNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- Practice Exam SOLUTIONS - Vol 2 (2020)Document49 pagesPractice Exam SOLUTIONS - Vol 2 (2020)Ledger PointNo ratings yet

- Accounting For Income Taxes: Item Description Level of Difficulty Time (Minutes)Document24 pagesAccounting For Income Taxes: Item Description Level of Difficulty Time (Minutes)ezanswersNo ratings yet

- Chapter 6 - Section 2 The Baldwin Company: An Example: Year 1 Year 2 Year 3Document11 pagesChapter 6 - Section 2 The Baldwin Company: An Example: Year 1 Year 2 Year 3Meghana ErapagaNo ratings yet

- PDF - 14-12-22 10-24-17 PDFDocument2 pagesPDF - 14-12-22 10-24-17 PDFGourav sheelNo ratings yet

- TY ProfitsfromBusinessDocument9 pagesTY ProfitsfromBusinessVansh ChouhanNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Drafting - Dec 2018Document119 pagesDrafting - Dec 2018rk_19881425No ratings yet

- 1519732537814Document1 page1519732537814vinod kumarNo ratings yet

- AY2020-21 NARASIMHAMOORTHY RANGAIAH LAKKUPA-AFOPN5099M-ComputationDocument4 pagesAY2020-21 NARASIMHAMOORTHY RANGAIAH LAKKUPA-AFOPN5099M-ComputationNarasimhamoorthy L RNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1Document8 pagesChapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1ghzNo ratings yet

- Chapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDocument12 pagesChapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDrew BanlutaNo ratings yet

- DT Economics Class XIIDocument1 pageDT Economics Class XIIJr.No ratings yet

- C AshishDocument5 pagesC AshishJr.No ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Adobe Scan 13 Mar 2022Document16 pagesAdobe Scan 13 Mar 2022Jr.No ratings yet

- 24.01.2022 10 Maths Post Mid Term 2021-22Document1 page24.01.2022 10 Maths Post Mid Term 2021-22Jr.No ratings yet

- Class XI Term II March2022 - 220215 - 004129Document2 pagesClass XI Term II March2022 - 220215 - 004129Jr.No ratings yet

- 17.01.2022 11 Applied Maths Post Mid Term 2021-22Document1 page17.01.2022 11 Applied Maths Post Mid Term 2021-22Jr.No ratings yet

- Khelo India Fitness Assessment TestDocument3 pagesKhelo India Fitness Assessment TestJr.No ratings yet

- Constant Funtion PROJECT BY KISLAY SINHA, 14, 11 - ADocument3 pagesConstant Funtion PROJECT BY KISLAY SINHA, 14, 11 - AJr.No ratings yet

- Annuity Project by Kislay Sinha, 14, 11 - ADocument2 pagesAnnuity Project by Kislay Sinha, 14, 11 - AJr.No ratings yet

- Water Bill ProjectDocument3 pagesWater Bill ProjectJr.No ratings yet

- GST PROJECT of Applied Mathematics Class 11Document3 pagesGST PROJECT of Applied Mathematics Class 11Jr.No ratings yet

- M01 Government Budget and The Economy PPTDocument18 pagesM01 Government Budget and The Economy PPTJr.No ratings yet

- PE Project FileDocument15 pagesPE Project FileJr.No ratings yet