Professional Documents

Culture Documents

Pradhan Mantri Formalisation of Micro Food Processing Enterprise Scheme

Pradhan Mantri Formalisation of Micro Food Processing Enterprise Scheme

Uploaded by

Alok GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pradhan Mantri Formalisation of Micro Food Processing Enterprise Scheme

Pradhan Mantri Formalisation of Micro Food Processing Enterprise Scheme

Uploaded by

Alok GuptaCopyright:

Available Formats

PRADHAN MANTRI FORMALISATION OF MICRO FOOD

PROCESSING ENTERPRISE SCHEME

Application View

Application Id : 1917022805871

Name : SHIV KUMAR

Mother Name : SEEMA

Father/Spouse Name : KANHAIYA LAL

Gender : MALE

Date of Birth : 20-Aug-1985

Residential Address CHIKANITOLA LALDIGGI MAHUARIYA MIRZAPUR UTTAR PRADESH 231001

City: MIRZAPUR

State : UTTAR PRADESH

District: MIRZAPUR

Block/Taluka : SADAR

PINCODE : 231001

Email Address : GUPTAJEE219@GMAIL.COM

Phone Number : 9336013953

Academic Qualification : 8TH PASS

Social Category : OBC

PAN Number : AKPPJ5765L

DETAILS ABOUT THE PROPOSED BUSINESS UNIT

Name of the Proposed Enterprise SHIV KUMAR

Address of the Proposed Business CHIKANITOLA LALDIGGI MAHUARIYA MIRZAPUR UTTAR PRADESH 231001

Unit

State : UTTAR PRADESH District: MIRZAPUR City: MIRZAPUR

Block/Taluka : SADAR PinCode : 231001

Type of Property Parental Number of New Employment the Proposed More than 10 workers

Enterprises will Generate

Nature of Operations to be Carried out in the Proposed Manual

Enterprises :

Total Available Land for Proposed Project(in Sq ft) :

Land Value of the Proposed Unit (In Rs/Sq ft) : 0

Personal Contribution Towards the Project(in %) : 10.00

Loan for Working Capital : Yes

Own Contribution on working capital (in %) : 20.00

PRODUCT DETAILS

Type of Proposed Product to be Manufactured : Food Products- Manufacturing

Type of Activities to be Involved while Manufacturing the Product SPICES GRAINDIG AND PACKING

If Food Product, is the Product Manufactured same as ODOP Identified by No

State for the District?

If No, Other ODOP Products : Spices (Chillies and Turmeric)

BANK DETAILS OF THE APPLICANT

Bank Name Branch Name IFSC Code Bank Account Number

ARYAVART GB-GOMTI NAGAR BR ARYAVART GB-GOMTI BKID0ARYAGB 12080100036087

NAGAR BR

MACHINERY DETAILS

Type of Machinery Quantity/Number of Units Rate/Unit (In Rs) Amount(In Rs.)

GRAINDER 2 243 486

PACKING MACHINE 1 340 340

Total: 826

OTHER FINANCIAL DETAILS

Preliminary & Pre-operative Cost (in Rs) : 1,740,000.00

Furniture & Fixtures (in Rs): 0.00

Contingency/Others/Miscellaneous (in Rs) 0.00

:

Working Capital Per Estimate : 1,740,000.00

SALES DETAILS

Type of Product Rate/Unit (In Number of Units of Amount(In Rs.)

Rs) Proposed Product Expected

SPICE POWER 240 20000 4,800,000

Total: 4,800,000

RAW MATERIALS

Name of the Raw Material Rate/Unit (In Reqd. Unit Amount(In

Rs) Rs.)

SPICE 130 10000 1,300,000

Total: 1,300,000

WAGES DETAILS

Type of Worker No. of Worker Wages Per Month Per Amount (In Rs)

Person (In Rs)

SKILLED 3 5,000 180,000

UNSKILLED 5 3,000 180,000

Total: 360,000

WORKING CAPITAL REQUIREMENTS FOR THE ENTERPRISE

Stock In Process (In Number of Days) 20

Finished Goods (In Number of Days) : 30

Receivable By (In Number of Days) : 30

MISCELLENEOUS EXPENDITURE

Repair and Maintenance (In %) : 1.00 Power and Fuel (In %) : 1.00

Other Overhead Expenses (In %): 1.00 Telephone Expenses (In %) : 1.00

Stationery & Postage (In %) : 1.00 Advertisement & Publicity (In %): 1.00

Building Rent per Month(In Rs.) : 0.00 Other Miscellaneous Expenditure (In %) 0.00

DEPRECIATION DETAILS

On Building (In %) : 10.00 On Machinery (In %) : 15.00

OTHER DETAILS

Loan Repayment Period (in Years) : 5.00 Project Implementation Period (In 4.00

Months):

Rate of Interest (In %): 11.00 Employment : 8.00

PROJECTED FINANCIAL

COST OF PROJECT

Land Land Value Ownership

LAND 0 OWN

Machinery Qty. Rate. Amt.(In Rs)

GRAINDER 2.00 243.00 486.00

PACKING MACHINE 1.00 340.00 340.00

Total 826.00

Preliminary & Pre- Furniture & Contingency/Oth Total Capital Working Capital

operative Cost Fixtures ers/Miscellaneou Expenditure

1,740,000.00 0.00 0.00 1,740,826.00 509,866.67

"Means of Financing(Term Loan)"

Own Contribution 10.00 % Rs 174,082.60

Bank Finance 90.00 %

Term Loan Rs 1,566,743.40

Govt. Subsidy 35.00 % Rs 609,289.10

Own Contribution 10.00 % Rs 174,082.60

Bank Finance 90.00 %

Term Loan Rs 1,566,743.40

Govt. Subsidy 35.00 % Rs 609,289.10

Means of Financing(Working Capital)

Own Contribution 20.00 % Rs 101,973.33

Bank Finance 80.00 %

Working Capital Rs 407,893.34

Term Loan

Year Opening Installment Closing Balance Interest

Balance

1 1566743.40 104449.56 1462293.84 172341.77

2 1462293.84 313348.68 1148945.16 160852.32

3 1148945.16 313348.68 835596.48 126383.97

4 835596.48 313348.68 522247.80 91915.61

5 522247.80 313348.68 208899.12 57447.26

6 208899.12 313348.68 0 22978.90

Working Capital

Year Opening Installment Closing Balance Interest

Balance

1 407,893.34 27,192.89 380,700.45 44,868.27

2 380,700.45 81,578.67 299,121.78 41,877.05

3 299,121.78 81,578.67 217,543.11 32,903.40

4 217,543.11 81,578.67 135,964.44 23,929.74

5 135,964.44 81,578.67 54,385.77 14,956.09

6 54,385.77 81,578.67 0.00 5,982.43

Statement Showing the Depreciation on Fixed Assets

WORK SHED

Particulars 1st Year 2nd Year 3rd Year 4th Year 5th Year

Opening 0.00 0.00 0.00 0.00 0.00

Balance

Depreciation 0.00 0.00 0.00 0.00 0.00

Closing 0.00 0.00 0.00 0.00 0.00

Balance

MACHINERY

Particulars 1st Year 2nd Year 3rd Year 4th Year 5th Year

Opening 826.00 702.10 596.79 507.27 431.18

Balance

Depreciation 123.90 105.31 89.52 76.09 64.68

Closing 702.10 596.79 507.27 431.18 366.50

Balance

TOTAL DEPRECIATION

Particulars 1st Year 2nd Year 3rd Year 4th Year 5th Year

WorkShed 0.00 0.00 0.00 0.00 0.00

Machinery 123.90 105.31 89.52 76.09 64.68

Total 123.90 105.31 89.52 76.09 64.68

Schedule of Sales Realization

DETAILS OF PROJECTED SALES

Particulars of Product Rate/Pair/Unit No. of Pair/Unit Amount in Rs

SPICE POWER 240 20,000.00 4,800,000.00

CAPACITY UTILIZATION OF SALES

Particulars 1st Year 2nd Year 3rd Year 4th Year 5th Year

CAPACITY 70.00 % 80.00 % 90.00 % 90.00 % 90.00 %

UTILIZATION

SALES / RECEIPTS 3360000.00 3840000.00 4320000.00 4320000.00 4320000.00

Raw Materials

Particulars Unit Rate/unit Reqd.Unit Amount in Rs.

SPICE 0 130 10,000 1,300,000.00

Total 1,300,000.00

WAGES

Particulars No. of Worker Wages Per Month Amount (In Rs.)

3 5,000 180,000.00

5 3,000 180,000.00

Total 8 360000.0

Repairs and Maintenance Rs 48,000.00

Power and Fuel Rs 48,000.00

Other Overhead Expenses Rs 48,000.00

ADMINISTRATIVE EXPENSES

Telephone Expenses 48,000.00

Stationery & Postage 48,000.00

Advertisement & Publicity 48,000.00

Workshed Rent 0.00

Other Miscellaneous Expenses 0.00

Total 144,000.00

Capacity Utilization of Manufacturing & Administrative Expenses

Particulars 1st Year 2nd Year 3rd Year 4th Year 5th Year

Particulars 70.00 % 80.00 % 90.00 % 90.00 % 90.00 %

MANUFACTURING EXPENSES

Rawmaterials 910000.00 1040000.00 1170000.00 1170000.00 1170000.00

Wages 252000.00 288000.00 324000.00 324000.00 324000.00

Repairs & Maintenance 33600.00 38400.00 43200.00 43200.00 43200.00

Power & Fuel 33600.00 38400.00 43200.00 43200.00 43200.00

Other Overhead 33600.00 38400.00 43200.00 43200.00 43200.00

Expenses

ADMINISTRATIVE EXPENSES

Salary 0.00 0.00 0.00 0.00 0.00

Postage Telephone 33600.00 38400.00 43200.00 43200.00 43200.00

Stationery & Postage 33600.00 38400.00 43200.00 43200.00 43200.00

Advertisement & 33600.00 38400.00 43200.00 43200.00 43200.00

Publicity

Workshed Rent 0.00 0.00 0.00 0.00 0.00

Other Miscellaneous 0.00 0.00 0.00 0.00 0.00

Expenses

Total: 1363600.00 1558400.00 1753200.00 1753200.00 1753200.00

Assessment of Working Capital

Particulars Amount in Rs.

Sale 4800000.00

MANUFACTURING EXPENSES

Raw Material 1300000.00

Wages 360000.00

Repair & Maintenance 48000.00

Power & Fuel 48000.00

Other Overhead Expenses 48000.00

Production Cost 1804000.00

Administrative Cost 144000.00

Manufacturing Cost 1948000.00

Working Capital Estimate

Element of Working Capital No of Days Basis Amount in Rs.

0 0 Material Cost 0.00

Stock in process 20 Production Cost 120266.67

Finished goods 30 Manufacturing Cost 194800.00

Receivable by 30 Manufacturing Cost 194800.00

Total Working Capital Requirement Per Cycle 509866.67

Profit & Loss Account

Particulars 0 Year 1 Year 2 Year 3 Year 4 Year

Sales / Receipts 3360000.00 3840000.00 4320000.00 4320000.00

Total 3360000.00 3840000.00 4320000.00 4320000.00

MANUFACTURING EXPENSES

Rawmaterials 910000.00 1040000.00 1170000.00 1170000.00

Wages 252000.00 288000.00 324000.00 324000.00

Repairs & 33600.00 38400.00 43200.00 43200.00

Maintenance

Power & Fuel 33600.00 38400.00 43200.00 43200.00

Other Overhead 33600.00 38400.00 43200.00 43200.00

Expenses

Depreciation 123.90 105.31 89.52 76.09

Production Cost 1262923.90 1443305.31 1623689.52 1623676.09

ADMINISTRATIVE EXPENSES

Salary 0.00 0.00 0.00 0.00

Postage Telephone 33600.00 38400.00 43200.00 43200.00

Stationery & Postage 33600.00 38400.00 43200.00 43200.00

Advertisement & 33600.00 38400.00 43200.00 43200.00

Publicity

Workshed Rent 0.00 0.00 0.00 0.00

Other Miscellaneous 0.00 0.00 0.00 0.00

Expenses

Administrative 100800.00 115200.00 129600.00 129600.00

Cost

Interest on Bank credit

Term Loan 172341.77 160852.32 126383.97 91915.61

Working Capital 44868.27 41877.05 32903.40 23929.74

Cost of Sale 1580933.94 1761234.68 1912576.89 1869121.44

Net Profit Before Tax 1779066.06 2078765.32 2407423.11 2450878.56

Less Tax 0 0.00 0 0

Net Profit 1779066.06 2078765.32 2407423.11 2450878.56

Calculation of Debt Service Credit Ratio

Particulars 0 Year 1 Year 2 Year 3 Year 4 Year

Net Profit 1779066.06 2078765.32 2407423.11 2450878.56

Add :

Depreciation 123.90 105.31 89.52 76.09

TOTAL - A 1779189.96 2078870.63 2407512.63 2450954.65

Payments :

On Term Loan :

Interest 172341.77 160852.32 126383.97 91915.61

Installment 104449.56 313348.68 313348.68 313348.68

On Working Capital

Interest 44868.27 41877.05 32903.40 23929.74

TOTAL - B 321659.60 516078.05 472636.05 429194.03

Average D.S.C.R 5.53 4.03 5.09 5.71

Balance Sheet

Particulars 0 Year 1 Year 2 Year 3 Year 4 Year

LIABILITIES

Promoters Capital 276055.93 276055.93 276055.93 276055.93

Profit 1779066.06 2078765.32 2407423.11 2450878.56

Term Loan 1566743.40 1462293.84 1148945.16 835596.48

Working Capital 407893.34 380700.45 299121.78 217543.11

Current Liabilities 0 0 0 0

Sundry Creditors 0 0 0 0

Total 4029758.73 4197815.54 4131545.98 3780074.08

ASSETS

Gross Fixed Assets 826.00 702.10 596.79 507.27

Less : Depreciation 123.90 105.31 89.52 76.09

Net Fixed Assets 702.10 596.79 507.27 431.18

Preliminary & Pre- 1740000 1305000 978750 734062.5

Op. Expenses

Current Assets 407893.34 380700.45 299121.78 217543.11

Cash in Bank/Hand 3621163.29 3816518.30 3831916.93 3562099.79

Total 4029758.73 4197815.54 4131545.98 3780074.08

Cash Flow Statement

Particulars 0 Year 1 Year 2 Year 3 Year 4 Year

Net Profit 1779066.06 2078765.32 2407423.11 2450878.56

Add : Depreciation 123.90 105.31 89.52 76.09

Term Loan 1566743.40 1462293.84 1148945.16 835596.48

Working Capital Loan 407893.34 380700.45 299121.78 217543.11

Promoters Capital 225069.27 0.00 0.00 0.00

Total 3978895.97 3921864.92 3855579.57 3504094.24

Total Fixed Capital 1740826 1740826 1740826 1740826

Repayment of Term 104449.56 313348.68 313348.68 313348.68

Loan

Repayment of WC 27192.89 81578.67 81578.67 81578.67

Loan

Current Assets 407893.34 380700.45 299121.78 217543.11

Total 539535.79 775627.80 694049.13 612470.46

Opening Balance 0 3439360.18 6585597.30 9747127.74

Surplus 3439360.18 3146237.12 3161530.44 2891623.78

Closing Balance 3439360.18 6585597.30 9747127.74 12638751.52

Break Even Point and Ratio Analysis

Particulars 0 Year 1 Year 2 Year 3 Year 4 Year

Fixed Cost 273265.67 276157.63 256073.49 221591.70

Variable Cost 1307792.17 1485182.36 1656592.92 1647605.83

Total Cost 1581057.84 1761339.99 1912666.41 1869197.53

Sales 3360000.00 3840000.00 4320000.00 4320000.00

Contribution (Sales- 2052207.83 2354817.64 2663407.08 2672394.17

VC)

B.E.P in % 13.32 11.73 9.61 8.29

Break Even Sales in 447407.24 450330.12 415346.75 358209.19

Rs.

Break Even Units 1864.20 1876.38 1730.61 1492.54

Current Ratio 1.17 0.64 0.54 0.43

Net Profit Ratio 52.95 % 54.13 % 55.73 % 56.73 %

I/We hereby declare that

All information furnished by me/ us above in this Application/ Business plan & Project

report/Appendix/Annexure/Statements and other papers/ documents enclosed are true and correct to the best of

my/ our knowledge and belief;

I/we have no borrowing arrangements for the applicant enterprise/unit and the associate concerns with any other

bank/FI/ NBFC/ Institution, etc except as indicated in the application;

There are no arrears of statutory dues and no government enquiries/ proceedings/ prosecution/ legal action are

pending/ initiated against the enterprise/ unit/ associate concerns/ promoters/ directors/ partners/ proprietor except

as indicated in the application;

You might also like

- Akshay PatraDocument1 pageAkshay PatraTANAY PUROHITNo ratings yet

- Ginger and Garlic Paste PDFDocument3 pagesGinger and Garlic Paste PDFAnonymous jZQgtdFgRK67% (3)

- Pradhan Mantri Formalisation of Micro Food Processing Enterprise SchemeDocument9 pagesPradhan Mantri Formalisation of Micro Food Processing Enterprise SchemeAlok GuptaNo ratings yet

- Umesh Kumar PmfmeDocument10 pagesUmesh Kumar PmfmeABUBAKARNo ratings yet

- Manjunatha TVDocument10 pagesManjunatha TVShilpa RNo ratings yet

- ManjulaDocument10 pagesManjulaShilpa RNo ratings yet

- Pradhan Mantri Formalisation of Micro Food Processing Enterprise SchemeDocument11 pagesPradhan Mantri Formalisation of Micro Food Processing Enterprise Schemeroyp85639No ratings yet

- Alok Dubhey 2Document11 pagesAlok Dubhey 2Anjali SharmaNo ratings yet

- Sham Sundar LADocument10 pagesSham Sundar LAShilpa RNo ratings yet

- Pavithra AppDocument10 pagesPavithra Appmahimahesha123No ratings yet

- Screenshot 2023-01-11 at 6.02.24 PMDocument54 pagesScreenshot 2023-01-11 at 6.02.24 PMmanisha tikkiNo ratings yet

- Business PlannDocument5 pagesBusiness PlannAuwalu Yahaya B. AYBNo ratings yet

- New Super DJDocument11 pagesNew Super DJCA Mohit AgrawalNo ratings yet

- ColgateDocument1 pageColgatekokila infraltdNo ratings yet

- Project Report On Poultry Farming BHOG PURDocument29 pagesProject Report On Poultry Farming BHOG PURpj singhNo ratings yet

- Pay Slip FormatDocument1 pagePay Slip FormatNiraj JaiswalNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicesmarty sdNo ratings yet

- Rabyte Technologies LLP: Purchase OrderDocument1 pageRabyte Technologies LLP: Purchase Orderanoop yadavNo ratings yet

- Bill 1391 PDFDocument1 pageBill 1391 PDFDeep GuptaNo ratings yet

- PI - Ravindra SinghDocument1 pagePI - Ravindra Singharyansingh4517No ratings yet

- Shesha SooryaDocument11 pagesShesha SooryaShilpa RNo ratings yet

- BJD EnterprisesDocument1 pageBJD EnterprisesMohan RajNo ratings yet

- Aptus Value Housing Finance India LTD: Salary Slip For The Month of February - 2023Document1 pageAptus Value Housing Finance India LTD: Salary Slip For The Month of February - 2023msathish7428100% (1)

- Sanwariya Stone Trading Co.Document12 pagesSanwariya Stone Trading Co.PUNEET JAINNo ratings yet

- SPICESDocument18 pagesSPICESGokul CNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceSuraj KumarNo ratings yet

- Tax Invoice: Sri Murugan Home Appliances #613 (22-23) 04/01/2023Document1 pageTax Invoice: Sri Murugan Home Appliances #613 (22-23) 04/01/2023RajeshNo ratings yet

- HGDocument1 pageHGsurbhi yadavNo ratings yet

- Item Material Qty Uom Customer Material No Material Description Hsn/Sac Unit Price Total Taxable Amt CGST Sgst/Utgst Igst GST Cess Discount Amt Rate (%) Rate (%) Rate (%) Rate (%)Document2 pagesItem Material Qty Uom Customer Material No Material Description Hsn/Sac Unit Price Total Taxable Amt CGST Sgst/Utgst Igst GST Cess Discount Amt Rate (%) Rate (%) Rate (%) Rate (%)Jay ShahNo ratings yet

- Parts Invoice - 2022-12-01T114656.716Document1 pageParts Invoice - 2022-12-01T114656.716C RamakrishnaNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceMR. MU.No ratings yet

- Lupin Invoice 053Document1 pageLupin Invoice 053Sachin MahadikNo ratings yet

- Ayurvedic MedicineDocument29 pagesAyurvedic Medicineakki_6551No ratings yet

- Invoive FormatDocument1 pageInvoive Formatbhaskaraenterprises2019100% (1)

- Sanket SafetyDocument1 pageSanket SafetyManoj GaikwadNo ratings yet

- Business Plan: Capital StructureDocument4 pagesBusiness Plan: Capital StructureNitin Gupta0% (1)

- Tax Invoice: Bharat Auto Agency Hero Insurance Broking India Private LimitedDocument1 pageTax Invoice: Bharat Auto Agency Hero Insurance Broking India Private Limitedbharauthero barautNo ratings yet

- Modi Infra and Energy: 1 12 % 4,000.00 LTR Bio Diesel 382600 68.00 272000.00Document1 pageModi Infra and Energy: 1 12 % 4,000.00 LTR Bio Diesel 382600 68.00 272000.00Vinit KumarNo ratings yet

- Pawansut Infra Developers Private Limited: Tax InvoiceDocument1 pagePawansut Infra Developers Private Limited: Tax InvoiceNitesh kr mishraNo ratings yet

- Entrepreneurship Project: (Nott)Document16 pagesEntrepreneurship Project: (Nott)Dharmender SinghNo ratings yet

- Accounting VoucherDocument1 pageAccounting Voucherrajendrawork1803No ratings yet

- Tax InvoiceDocument1 pageTax Invoicesa4314256No ratings yet

- Non TaxableDocument1 pageNon TaxableShyam SundarNo ratings yet

- Payslip Oct 2023 PDFDocument1 pagePayslip Oct 2023 PDFgirishponnadi12No ratings yet

- Invoice - 2023-09-20T165658.772Document2 pagesInvoice - 2023-09-20T165658.772Surendra PanwarNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceriddhmarketingNo ratings yet

- Accounting Voucher PDFDocument1 pageAccounting Voucher PDFsachin OshoNo ratings yet

- Rahul KumarDocument3 pagesRahul Kumarahmedzeeshan474No ratings yet

- Hygree 1Document3 pagesHygree 1viksha12No ratings yet

- Project Profile On Mini Flour Mill UnitDocument10 pagesProject Profile On Mini Flour Mill UnitGolden Shower தமிழ்No ratings yet

- Old PDFDocument1 pageOld PDFAsis SahooNo ratings yet

- Invoice: Bathula Tirumala RaoDocument1 pageInvoice: Bathula Tirumala Raoarifuz786No ratings yet

- Payslip July 2019Document1 pagePayslip July 2019Raja guptaNo ratings yet

- Entrepreneur Project ReportDocument16 pagesEntrepreneur Project ReportDharmender Singh100% (1)

- United NDTDocument1 pageUnited NDTKrishnakumar RNo ratings yet

- Project ReportDocument29 pagesProject ReportMonu PrajapatiNo ratings yet

- Rachana Project On Boutiqu PDFDocument8 pagesRachana Project On Boutiqu PDFvalkyre010No ratings yet

- Tax InvoiceDocument1 pageTax Invoiceyugalk333No ratings yet

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryFrom EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNo ratings yet

- Soaps & Detergents World Summary: Market Values & Financials by CountryFrom EverandSoaps & Detergents World Summary: Market Values & Financials by CountryNo ratings yet

- Pradhan Mantri Formalisation of Micro Food Processing Enterprise SchemeDocument9 pagesPradhan Mantri Formalisation of Micro Food Processing Enterprise SchemeAlok GuptaNo ratings yet

- GO63F3858D678210: Abhishek Verma Nirmala Verma Nandlal Verma XXXXXX DirectDocument1 pageGO63F3858D678210: Abhishek Verma Nirmala Verma Nandlal Verma XXXXXX DirectAlok GuptaNo ratings yet

- Aadhaar No.: State IdDocument1 pageAadhaar No.: State IdAlok GuptaNo ratings yet

- RelevantDocument 2022151603221538693Document1 pageRelevantDocument 2022151603221538693Alok GuptaNo ratings yet

- DIY GREENHOUSE by KMS - ChangelogDocument4 pagesDIY GREENHOUSE by KMS - Changeloglm pronNo ratings yet

- Brief Background and OverviewDocument2 pagesBrief Background and OverviewCamille MarieNo ratings yet

- The Featinian Issue 2 2011-2012Document12 pagesThe Featinian Issue 2 2011-2012Saxs Gabrielle Peralta SantosNo ratings yet

- Stevenson12e Preface PDFDocument31 pagesStevenson12e Preface PDFLukas OstjenNo ratings yet

- No Tears For TiersDocument4 pagesNo Tears For Tiersapi-143406529No ratings yet

- Asset To LiabDocument25 pagesAsset To LiabHavanaNo ratings yet

- Biographical SketchDocument10 pagesBiographical SketchAngeloLorenzoSalvadorTamayoNo ratings yet

- CV - Nicolas - Barabasqui Berlin - 230109 - 170104Document4 pagesCV - Nicolas - Barabasqui Berlin - 230109 - 170104Ricardo MelaNo ratings yet

- Combustion Products From Ventilation Controlled Fires - Thesis PDFDocument321 pagesCombustion Products From Ventilation Controlled Fires - Thesis PDFYuri SanchezNo ratings yet

- NOMAC - Red Stone - Briding Program - Rev 03Document53 pagesNOMAC - Red Stone - Briding Program - Rev 03tlhalefangmogoengtermNo ratings yet

- 9286 Ds Opsycom PFPDocument2 pages9286 Ds Opsycom PFPamir11601No ratings yet

- Trophy Urban Core Property: Houston, TexasDocument25 pagesTrophy Urban Core Property: Houston, Texasbella grandeNo ratings yet

- Form 5 ElectrolysisDocument2 pagesForm 5 ElectrolysisgrimyNo ratings yet

- CGL PRE 2023 English All SetsDocument314 pagesCGL PRE 2023 English All Setskumarmohit0203No ratings yet

- UntitledDocument22 pagesUntitledMoniNo ratings yet

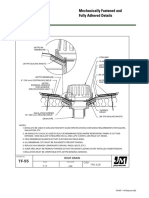

- JM Mechanically Fastened and Adhered Details UltraGard TPO Roof Drain New Construction Detail Drawing B18270Document1 pageJM Mechanically Fastened and Adhered Details UltraGard TPO Roof Drain New Construction Detail Drawing B18270michael jan tubongbanuaNo ratings yet

- Proposal Writing-Final PresentationDocument16 pagesProposal Writing-Final PresentationPhirum KuntheaNo ratings yet

- The School As A Learning Environment.Document9 pagesThe School As A Learning Environment.Genevie Villahermosa QuirogaNo ratings yet

- S4-4 Damping Paper TakedaDocument26 pagesS4-4 Damping Paper TakedaRonald Omar García RojasNo ratings yet

- كيميا فيزيائية 9Document5 pagesكيميا فيزيائية 9Reem ShammerNo ratings yet

- CAEG Question Bank With SolutionsDocument24 pagesCAEG Question Bank With Solutionssksnjgaming100% (1)

- BTS Power ManagementDocument21 pagesBTS Power ManagementSam FicherNo ratings yet

- EntropyDocument21 pagesEntropycusgakungaNo ratings yet

- Parts - Used: VendorsDocument27 pagesParts - Used: VendorsDanno NNo ratings yet

- ILRAP HandbookDocument40 pagesILRAP Handbooknaren_3456No ratings yet

- Data Science HindiDocument29 pagesData Science HindiSyed Bilal Armaan100% (2)

- Questionmark PerceptionDocument4 pagesQuestionmark PerceptionRenatoNo ratings yet

- Azure Labs v4.4Document63 pagesAzure Labs v4.4Anand Vishwanathan100% (2)

- Parts of The House and FurnitureDocument1 pageParts of The House and FurnitureJOSE MARIA ARIGUZNAGA ORDUÑANo ratings yet

- The Importance of Mineral Elements For Humans, Domestic Animals and Plants: A ReviewDocument3 pagesThe Importance of Mineral Elements For Humans, Domestic Animals and Plants: A ReviewMaricel Canlas MacatoNo ratings yet