Professional Documents

Culture Documents

PB Survey

PB Survey

Uploaded by

TomTomCopyright:

Available Formats

You might also like

- Persuasive Speech Outline - Investing in Stock MarketDocument4 pagesPersuasive Speech Outline - Investing in Stock Marketalisa Ibrahim67% (3)

- CFSA Study GuideDocument312 pagesCFSA Study Guidehossainmz88% (8)

- JULIANNEDocument43 pagesJULIANNETomTomNo ratings yet

- Quizzes - Chapter 16 - Accounting For DividendsDocument7 pagesQuizzes - Chapter 16 - Accounting For DividendsAmie Jane Miranda75% (4)

- How To Read Your StatementDocument10 pagesHow To Read Your StatementprakashthamankarNo ratings yet

- Secrets of Successful TradersDocument42 pagesSecrets of Successful TradersPhil Kunjombe80% (5)

- CH 06Document3 pagesCH 06Minh Thu Võ NgọcNo ratings yet

- Vendor Scorecard TemplateDocument8 pagesVendor Scorecard TemplatechristinathomasNo ratings yet

- Fitch CLOs and Corporate CDOsRating Criteria PDFDocument57 pagesFitch CLOs and Corporate CDOsRating Criteria PDFantonyNo ratings yet

- SAP Collateral Management System (CMS): Configuration Guide & User ManualFrom EverandSAP Collateral Management System (CMS): Configuration Guide & User ManualRating: 4 out of 5 stars4/5 (1)

- What Hedge Funds Really Do An Introduction To Portfolio ManagementDocument148 pagesWhat Hedge Funds Really Do An Introduction To Portfolio ManagementtheEarth100% (8)

- Algorithmic Trading Survey - Hedge Fund 2023Document20 pagesAlgorithmic Trading Survey - Hedge Fund 2023Santosranger rangerNo ratings yet

- Algorithmic Trading Survey - Long-Only 2023Document23 pagesAlgorithmic Trading Survey - Long-Only 2023Santosranger rangerNo ratings yet

- Execution Management Systems Survey 2021Document18 pagesExecution Management Systems Survey 2021Santosranger rangerNo ratings yet

- 2022 04 04 Rosewood Hotels - Grading Spreadsheet MKM805 W2022Document3 pages2022 04 04 Rosewood Hotels - Grading Spreadsheet MKM805 W2022Dashmeet KaurNo ratings yet

- GCR Criteria for Rating Corporate Entities 2023 ESG CleanDocument23 pagesGCR Criteria for Rating Corporate Entities 2023 ESG Cleandamilolaamusan11No ratings yet

- Reward For FailureDocument32 pagesReward For FailureMohammedYousifSalihNo ratings yet

- BAIN BRIEF Fantastic ClaimsDocument12 pagesBAIN BRIEF Fantastic ClaimsziedttNo ratings yet

- SW Vendor Evaluation Matrix TemplateDocument4 pagesSW Vendor Evaluation Matrix TemplateDavid TingNo ratings yet

- APAC Algorithmic Trading Survey 2018Document9 pagesAPAC Algorithmic Trading Survey 2018Santosranger rangerNo ratings yet

- Chapter-6: Analysis of Profitability of IT Industry in IndiaDocument42 pagesChapter-6: Analysis of Profitability of IT Industry in IndiaAmir AhmedNo ratings yet

- Axis Bluechip Fund - Regular: HistoryDocument1 pageAxis Bluechip Fund - Regular: Historysatya1220No ratings yet

- Valuation For StartupsDocument39 pagesValuation For StartupsrabiadzNo ratings yet

- DCB - NBFC Model - Final V8 - 02042024Document34 pagesDCB - NBFC Model - Final V8 - 02042024Hement PawarNo ratings yet

- Portfolio Risk Management MatlabDocument31 pagesPortfolio Risk Management MatlabDani KouassiNo ratings yet

- Assessment BriefDocument9 pagesAssessment BriefAli RanaNo ratings yet

- I C R A Limited: Strictly ConfidentialDocument7 pagesI C R A Limited: Strictly ConfidentialNikhil ChaudaharyNo ratings yet

- Of Financial Debacles and Rating Agency Models - The HinduDocument4 pagesOf Financial Debacles and Rating Agency Models - The HinduManjot SinghNo ratings yet

- EDHEC Valuation Manual PDFDocument40 pagesEDHEC Valuation Manual PDFradhika1992No ratings yet

- Chapter 2 (Developing Marketing Strategies and Plans)Document29 pagesChapter 2 (Developing Marketing Strategies and Plans)Magued MamdouhNo ratings yet

- Sales Force Activities: Account Relationship ManagementDocument41 pagesSales Force Activities: Account Relationship ManagementAlrifai Ziad AhmedNo ratings yet

- 2 Ratio Analysis Financial Statement Analysis 1652097843303Document8 pages2 Ratio Analysis Financial Statement Analysis 1652097843303vroommNo ratings yet

- Dominion's Investor Presentation (3/25/19)Document126 pagesDominion's Investor Presentation (3/25/19)Lowell FeldNo ratings yet

- DK5739 CH9Document25 pagesDK5739 CH9Özer ÖktenNo ratings yet

- Financial Derivatives and Risk Management Interim ReportDocument5 pagesFinancial Derivatives and Risk Management Interim ReportPriyanka MajumdarNo ratings yet

- PMBOK 2-1 Alternatives Analysis-2Document5 pagesPMBOK 2-1 Alternatives Analysis-2esalamanca1No ratings yet

- SyngeneDocument12 pagesSyngeneIndraneel MahantiNo ratings yet

- Vendor Rating On GeM S v1.0Document6 pagesVendor Rating On GeM S v1.0kurt kNo ratings yet

- SPMBVDocument3 pagesSPMBVSridhanyas kitchenNo ratings yet

- Topic 5 - Overview: Licensing Exam Paper 1 Topic 5Document28 pagesTopic 5 - Overview: Licensing Exam Paper 1 Topic 5anonlukeNo ratings yet

- Topic 5 - Overview: Licensing Exam Paper 1 Topic 5Document23 pagesTopic 5 - Overview: Licensing Exam Paper 1 Topic 5Charlotte HoNo ratings yet

- Financial Analysis of Pharmaceuticals IndustryDocument12 pagesFinancial Analysis of Pharmaceuticals Industrymahmudhasan5051No ratings yet

- Chapter 5Document62 pagesChapter 5Naveen RamNo ratings yet

- Business Analysis and Valuation IFRS Text and Cases 3rd Edition Peek Solutions Manual instant download all chapterDocument33 pagesBusiness Analysis and Valuation IFRS Text and Cases 3rd Edition Peek Solutions Manual instant download all chapterletsqociofu100% (3)

- MA801-Guo 328226Document63 pagesMA801-Guo 328226Stephanie ShaNo ratings yet

- ValueResearchFundcard HDFCRetirementSavingsFund HybridEquityPlan RegularPlan 2019mar04Document4 pagesValueResearchFundcard HDFCRetirementSavingsFund HybridEquityPlan RegularPlan 2019mar04ChittaNo ratings yet

- Lecture 55 AssignmentDocument3 pagesLecture 55 AssignmentMuneeb UllahNo ratings yet

- 【第5期】MBB咨询case集训班-market entryDocument42 pages【第5期】MBB咨询case集训班-market entrySimmyNo ratings yet

- Online Trading of Reliance Money" Is The Record of Authentic Work Assigned byDocument13 pagesOnline Trading of Reliance Money" Is The Record of Authentic Work Assigned bySachin AwasthiNo ratings yet

- Aditya Birla Capital: Equentis Scale 1 2 3 4 5 Below Avg. Avg. Good Very Good ExcellentDocument2 pagesAditya Birla Capital: Equentis Scale 1 2 3 4 5 Below Avg. Avg. Good Very Good Excellentsayuj83No ratings yet

- Download Business Analysis and Valuation IFRS Text and Cases 3rd Edition Peek Solutions Manual all chaptersDocument33 pagesDownload Business Analysis and Valuation IFRS Text and Cases 3rd Edition Peek Solutions Manual all chaptersstukadiano100% (7)

- Assessing Mutual Fund Advisor Profitability: Should Boards Have Goals and Margin Expectations?Document17 pagesAssessing Mutual Fund Advisor Profitability: Should Boards Have Goals and Margin Expectations?s_ajay88No ratings yet

- Do Auditors React To Real Earnings ManagementDocument18 pagesDo Auditors React To Real Earnings ManagementAldi HidayatNo ratings yet

- Group Assigment - FM - Group 10 - Week 3Document18 pagesGroup Assigment - FM - Group 10 - Week 3Yahya SudrajatNo ratings yet

- Interest Rate Policy May 20pdfDocument6 pagesInterest Rate Policy May 20pdfAzhagendra MadhanNo ratings yet

- AbhishekMevawala - Jay Bharat Maruti LTD - 18020841062Document11 pagesAbhishekMevawala - Jay Bharat Maruti LTD - 18020841062RtrAbhishekMevawalaNo ratings yet

- (012821) (020421) Krakatau Steel (B) - Global CompetitionDocument6 pages(012821) (020421) Krakatau Steel (B) - Global CompetitionYani RahmaNo ratings yet

- Competition in Rating AgenciesDocument31 pagesCompetition in Rating AgenciesMOUBIJNo ratings yet

- Auditing and Assurance Services - EditedDocument3 pagesAuditing and Assurance Services - EditedcamaratactivewritersNo ratings yet

- Question Bank: JMD TutorialsDocument11 pagesQuestion Bank: JMD TutorialsGrishma MoreNo ratings yet

- Predicting Lifetime Value and Unlock Profitable Growth 1685561021Document47 pagesPredicting Lifetime Value and Unlock Profitable Growth 1685561021p5rggy9hhrNo ratings yet

- GE 9 Cell MatrixDocument22 pagesGE 9 Cell MatrixAnonymous f8tAzEb3oNo ratings yet

- Mergers and Acquisitions Playbook July 2021Document29 pagesMergers and Acquisitions Playbook July 2021bg2gbNo ratings yet

- 3bsa-Tos 1S2223Document44 pages3bsa-Tos 1S2223Mary Joy Jessa Santiago BernardinoNo ratings yet

- Credit Securitisations and Derivatives: Challenges for the Global MarketsFrom EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsNo ratings yet

- Fair Lending Compliance: Intelligence and Implications for Credit Risk ManagementFrom EverandFair Lending Compliance: Intelligence and Implications for Credit Risk ManagementNo ratings yet

- FCM 10 R 0Document16 pagesFCM 10 R 0TomTomNo ratings yet

- DOE Build4ScaleDocument25 pagesDOE Build4ScaleTomTomNo ratings yet

- Untitled 1Document2 pagesUntitled 1TomTomNo ratings yet

- Military Aircraft Operations and Optics by Derek JohnsonDocument338 pagesMilitary Aircraft Operations and Optics by Derek JohnsonTomTomNo ratings yet

- ADA515510Document6 pagesADA515510TomTomNo ratings yet

- A Brief History of NORAD (Current As of March 2014)Document42 pagesA Brief History of NORAD (Current As of March 2014)TomTomNo ratings yet

- GICustodySurvey2019 OnlineDocument10 pagesGICustodySurvey2019 OnlineTomTomNo ratings yet

- Economic Outlook: Converging HigherDocument19 pagesEconomic Outlook: Converging HigherTomTomNo ratings yet

- From Global Custodian Prime Brokerage Survey 2022 pg71Document1 pageFrom Global Custodian Prime Brokerage Survey 2022 pg71TomTomNo ratings yet

- Noise: How To Overcome The High, Hidden Cost of Inconsistent Decision MakingDocument1 pageNoise: How To Overcome The High, Hidden Cost of Inconsistent Decision MakingTomTomNo ratings yet

- Drowning in Cash, Money Markets Seek Another Life Raft From FedDocument2 pagesDrowning in Cash, Money Markets Seek Another Life Raft From FedTomTomNo ratings yet

- A Slice O F: MMR EditionDocument20 pagesA Slice O F: MMR EditionTomTomNo ratings yet

- PPT - 58549 - SAP MC - For - Life Sciences - Factsheet - EN PDFDocument1 pagePPT - 58549 - SAP MC - For - Life Sciences - Factsheet - EN PDFTomTomNo ratings yet

- Potential Targets in The Discovery of New Hair Growth Promoters For Androgenic AlopeciaDocument20 pagesPotential Targets in The Discovery of New Hair Growth Promoters For Androgenic AlopeciaTomTomNo ratings yet

- Pages From Nutritional Supplements in Sports and Exercise by Mike Greenwood, Matthew B. Cooke, Tim Ziegenfuss, Douglas S. Kalman, Jose AntonioDocument2 pagesPages From Nutritional Supplements in Sports and Exercise by Mike Greenwood, Matthew B. Cooke, Tim Ziegenfuss, Douglas S. Kalman, Jose AntonioTomTomNo ratings yet

- Cmmi v2 0 Slides 180509082920Document164 pagesCmmi v2 0 Slides 180509082920TomTom100% (1)

- Zacks Sector Industry Mapping SchemeDocument4 pagesZacks Sector Industry Mapping SchemeTomTomNo ratings yet

- 11 ReferencesDocument21 pages11 ReferencestouffiqNo ratings yet

- CH10Document20 pagesCH10superuser10100% (1)

- Bamboo Welcome Pack PDFDocument26 pagesBamboo Welcome Pack PDFOlubodun AgbalayaNo ratings yet

- Chap009newDocument28 pagesChap009newNguyễn Cẩm HươngNo ratings yet

- Dissertation Synopsis Project Report OnDocument5 pagesDissertation Synopsis Project Report OnBerkshire Hathway coldNo ratings yet

- Signal Script Exchange Big - SL SL Open Low Dyn - Atp LTP HighDocument33 pagesSignal Script Exchange Big - SL SL Open Low Dyn - Atp LTP HighSriheri DeshpandeNo ratings yet

- Stocks and BondsDocument15 pagesStocks and BondsKobe Bullmastiff0% (1)

- Answer: Sales Shares Net Profit Margin Dividend Payout Ratio P/E Ratio Forecasting P8-1Document6 pagesAnswer: Sales Shares Net Profit Margin Dividend Payout Ratio P/E Ratio Forecasting P8-1Kristo Febrian Suwena -No ratings yet

- Issue ManagementDocument194 pagesIssue ManagementBubune KofiNo ratings yet

- Chapter 6 ParcorDocument4 pagesChapter 6 ParcorFeona Mae MartinezNo ratings yet

- Impact of Foreign Institutional Investment (FII) On Indian Stock MarketDocument7 pagesImpact of Foreign Institutional Investment (FII) On Indian Stock MarketDr. Sangeeta SahniNo ratings yet

- Exercises: Set B: InstructionsDocument4 pagesExercises: Set B: InstructionsRabie HarounNo ratings yet

- Online Trading Academy - Course CurriculumDocument4 pagesOnline Trading Academy - Course Curriculumscreen1 recordNo ratings yet

- Classic Trading CourseDocument16 pagesClassic Trading CourseRajesh7358No ratings yet

- A Guide To The Nyse MarketplaceDocument36 pagesA Guide To The Nyse MarketplaceHome ParkNo ratings yet

- 54 Punjab National BankDocument200 pages54 Punjab National BankmailabhikeshNo ratings yet

- ACCT10002 Tutorial 8 ExercisesDocument5 pagesACCT10002 Tutorial 8 ExercisesJING NIENo ratings yet

- Dhanush GowravDocument4 pagesDhanush GowravDhanush GowravNo ratings yet

- Ashkenazi CompaniesDocument1 pageAshkenazi CompaniesAbd AL Rahman Shah Bin Azlan ShahNo ratings yet

- Intacc2 - Assignment 3Document4 pagesIntacc2 - Assignment 3KHAkadsbdhsgNo ratings yet

- Multiple ChoiceDocument6 pagesMultiple ChoicelllllNo ratings yet

- CHAPTER 16 - DIVIDENDS - Problem 3 - Computations - Page 597-599Document9 pagesCHAPTER 16 - DIVIDENDS - Problem 3 - Computations - Page 597-599Penelope PalconNo ratings yet

- Wissal Ben Letaifa 2016 Study of Dividend Policies in Periods Pre and Post - MergerDocument4 pagesWissal Ben Letaifa 2016 Study of Dividend Policies in Periods Pre and Post - MergerismailNo ratings yet

- Jim O?Shaughnessy: What Now Works On Wall Street: February 28, 2012 by Katie SouthwickDocument4 pagesJim O?Shaughnessy: What Now Works On Wall Street: February 28, 2012 by Katie SouthwickpankajsinhaNo ratings yet

PB Survey

PB Survey

Uploaded by

TomTomOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PB Survey

PB Survey

Uploaded by

TomTomCopyright:

Available Formats

[ S U R V E Y | P R I M E B R O K E R A G E ]

The

2021

PRIME

BROKERAGE

SURVEY

Fund Services Annual 2021 globalcustodian.com 81

[ S U R V E Y | P R I M E B R O K E R A G E ]

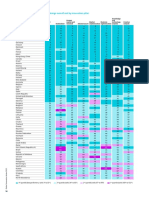

T

his is the second year where

the prime brokerage survey

AN

ANCHOR

was completed under lockdown

conditions and results are broadly similar

in aggregate. One or two categories, notably

Client Services and Technology, show an

uptick that might be expected as both clients

and providers became more comfortable

over the year with new ways of working.

Overall, however, none of the changes, up

or down, is outside the scope of what might IN THE

STORM

expect from year to year (See figure 1).

Figure 2 meanwhile lists aggregate category

scores from best to worst. It is encouraging

that in a time of relative turmoil, respondents

appear to have a degree of confidence in the

Asset Safety provided by their primes.

At the other end of the list, we find – not

for the first time – Consulting and Capital

Introductions. The former may well have

been tested more than usual over the past 18

Despite a second year of lockdown and economic uncertainty,

months as funds attempt to navigate their client assessment of their prime brokers seems to have stabilised.

way through an unfamiliar economic and

market environment, while the latter often

seems to leave clients wanting more, though Fig. 1: Year-on-year comparison

whether this is because of overpromising

Category Average Score Average Score Previous Year Difference

on the part of providers or unrealistic

expectations on the part of the hedge funds Asset Safety 6.24 6.27 -0.02

is unclear. Either way, it seems that these are Capital Introductions 5.31 5.47 -0.16

two areas where competitive differentiation Client Services 6.18 5.88 0.29

might be easier to demonstrate by those Consulting 5.65 5.69 -0.04

providers who have done well in these Delta 1, Swaps and Financing 5.92 5.86 0.06

categories.

Fixed Income 5.66 5.88 -0.22

Analysis of the individual provider ratings

Foreign Exchange Prime Brokerage 5.99 5.94 0.04

can be found on the following pages.

A guide to how to make the most of the Future Relationship 5.80 5.90 -0.10

accompanying tables and charts is on Listed Derivatives 5.89 5.84 0.05

Page 96. Operations 6.01 5.85 0.17

OTC Clearing 5.88 5.98 -0.10

Fig. 2: Category scores from best to worst Risk Management 5.89 5.62 0.27

Category Average Score Stock Borrowing and Lending 5.92 5.90 0.03

Asset Safety 6.24 Technology 5.69 5.50 0.20

Client Services 6.18 Trading and Execution 6.11 5.83 0.28

Trading and Execution 6.11 Overall average 5.88 5.83 0.05

Operations 6.01

Foreign Exchange Prime Brokerage 5.99 Methodology

Stock Borrowing and Lending 5.92 The prime brokerage survey asked clients to assess the Ten responses are the minimum sample number

Delta 1, Swaps and Financing 5.92 services that they receive from their Prime Brokers. required to assess a service provider sufficiently for full

The same service categories as last year have been category results to be published. Individual responses are

Listed Derivatives 5.89

retained and respondents were asked only one quanti- weighted for the size of the respondent as measured by

Risk Management 5.89 fiable rating question per category. This related to the assets under management.

OTC Clearing 5.88 overall service level per category and was done through Scores in any individual service area that attract fewer

Future Relationship 5.80 a sliding scale from ‘Unacceptable’ to ‘Excellent’. In some than three responses are excluded from the calculations.

categories, a number of optional qualifying questions were Where a provider has recorded three or more responses

Technology 5.69

posed to add colour as well as an optional comment box per category, average scores can be made available to the

Fixed Income 5.66 per category. provider concerned for internal use. More granular analyses

Consulting 5.65 The published results use Global Custodian’s convention- than are published may also be available to providers.

Capital Introductions 5.31 al seven-point scale familiar to readers of the magazine For more information on bespoke reports, please contact

(where 1=Unacceptable and 7=Excellent). beenish.hussain@globalcustodian.com.

Overall average 5.88

82 Global Custodian Fund Services Annual 2021

[ S U R V E Y | P R I M E B R O K E R A G E ]

ABN AMRO Clearing

A

BN Amro Clearing’s DNA, history and success Year-on-Year Comparison*

revolve around the market making and hedge fund Category 2021 2020 Difference

communities. This means being a core service

Asset Safety 5.84 6.42 -0.57

provider in equity derivatives, quant strategies, CTA,

relative value and long-short equity. The prime brokerage Capital Introductions 5.00 5.50 -0.50

team also seeks to support early-stage fund managers in Client Services 5.50 5.72 -0.22

their quest for growth. Consulting 5.13 6.00 -0.88

Last year was one of the Dutch bank’s busiest years, Delta 1, Swaps and Financing 6.31 5.55 0.76

clearing a record 5.3 billion trades and growing in client

Fixed Income 5.67 5.55 0.12

numbers. However, it has spent the past 12 months

reviewing the investment banking division, including its Foreign Exchange Prime Brokerage 5.09 5.75 -0.66

derivatives clearing arm, after it incurred a ¤200 million loss Listed Derivatives 6.00 6.08 -0.08

from a US hedge fund client in March 2020. Operations 5.83 5.61 0.22

ABN Amro Clearing has made several enhancements to its

OTC Clearing 5.17 6.17 -1.00

global execution desk with the addition of further markets,

exchanges and systematic internalisers. The bank has Risk Management 6.06 5.27 0.79

also gone live with a new synthetics platform, leveraging Stock Borrowing and Lending 5.25 4.58 0.67

advanced cloud-based technology to provide increased Technology 5.36 4.86 0.51

flexibility and customisation for fund wrappers and reporting. Trading and Execution 6.00 5.60 0.40

The improvements made to its platform are reflected in

TOTAL 5.65 5.65 0.00

the scores, including Trading and Execution (6.00), Risk

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

Management (6.06), and Delta 1, Swaps and Financing (6.31).

“Risk management is one of the best qualities by ABN and

hopefully they will keep up the good work,” said one Dutch- Spread of Opinion (%)

based hedge fund client. Weak 2% N/A 2%

That being said, ABN Amro Clearing didn’t improve on last

year’s average score, and fell short in both the global and peer Satisfactory 18%

group average. Service areas that brought down its ratings Excellent 26%

include Asset Safety (5.84), Capital Introductions (5.00),

Consulting (5.13), Foreign Exchange Prime Brokerage (5.09),

and OTC Clearing (5.17) – the latter of which has been a

traditional strength for the Dutch prime broker. However, all

these category scores remain in the Good range (5.00-5.99).

“The product scope can be a bit better as it does appear very

Good 20%

limited right now,” explained another client.

Very Good 32%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Delta 1, Swaps and Financing 6.6 6.6

Risk Management 2.9 3.5 6.0

Listed Derivatives 1.8 -1.5 5.5

Stock Borrowing and Lending -11.4 -12.6 5.0

OTC Clearing -12.1 -13.0

4.5 ABN AMRO Clearing Peer Group Average Global Average

Foreign Exchange Prime Brokerage -15.0 -13.9

4.0

ns

ces

ing

es

ons

ring

nt

ng

ogy

on

AGE

ty

com

rag

ncin

me

ativ

ctio

ndi

afe

cuti

sult

ervi

rati

l

Clea

R

o

e

age

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

Tech

Con

nt S

Ope

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

Fund Services Annual 2021 globalcustodian.com 83

[ S U R V E Y | P R I M E B R O K E R A G E ]

BNP Paribas

B

NP Paribas is in the final phases of its two-year Year-on-Year Comparison

project of integrating Deutsche Bank’s prime Category 2021 2020 Difference

brokerage and electronic equities businesses. This

Asset Safety 6.25 6.28 -0.03

has included bringing on several of the German bank’s top

prime brokerage executives, including Ashley Wilson who Capital Introductions 5.00 6.10 -1.10

was appointed head of prime services. Client Services 6.33 6.45 -0.11

The onboarding of Deutsche Bank’s clients representing Consulting 5.80 6.36 -0.56

$200 billion in assets is also expected to be completed by Delta 1, Swaps and Financing 6.57 5.96 0.61

the end of this year, when BNP Paribas will then roll out the

Fixed Income 5.75 6.48 -0.73

new prime services division. The new division is also set to

become more closely linked with Exane, BNP Paribas’ equity Foreign Exchange Prime Brokerage 6.75 6.48 0.27

brokerage business. Listed Derivatives 5.83 6.24 -0.40

With the Deutsche Bank business, BNP Paribas propels Operations 6.56 6.38 0.18

itself into the next tier of the prime brokerage rankings,

OTC Clearing 6.63 6.42 0.21

where its scores exceed the average of its peers in all areas

Risk Management 5.94 5.94 0.00

bar Capital Introduction (5.00) and Technology (6.14).

Foreign Exchange Prime Brokerage (6.75) led the Stock Borrowing and Lending 5.90 6.16 -0.26

way as its highest scoring category, followed by OTC Technology 5.61 5.85 -0.24

Clearing (6.63), and Delta 1, Swaps and Financing (6.57). Trading and Execution 6.14 6.05 0.09

Respondents also name-checked their Client Services (6.33)

TOTAL 6.07 6.23 -0.16

and Operations (6.56) representatives, which were praised

for their “high level of touch and coordination throughout

the platform.”

Only one UK-based fund manager was particularly vocal Spread of Opinion (%)

in their dissatisfaction with BNP Paribas’s financing, trading N/A 16%

and risk management services: “Structure and management

of the financing business leaves a lot to be desired.”

On the whole, clients were extremely happy with the level Satisfactory 14% Excellent 31%

of service from the French bank, and were likely to continue

their service relationship with them. “We have been with

BNP for over 10 years and have had a great relationship.

The team we have in place is second to none and what

they provide allows us to rest easily,” a US fund manager

respondent said. Very Good 35%

Good 4%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

OTC Clearing 12.8 10.4

Foreign Exchange Prime Brokerage 12.7 6.5 6.0

Delta 1, Swaps and Financing 11.0 9.3 5.5

Listed Derivatives -1.0 2.0 5.0

Technology -1.4 -1.8

4.5 BNP Paribas Peer Group Average Global Average

Capital Introductions -5.9 -0.2

4.0

ns

ces

ing

es

ons

ring

ent

ng

logy

on

AGE

ty

om

rag

ncin

ativ

ctio

ndi

afe

cuti

sult

ervi

em

rati

Clea

R

o

e

c

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

g

Tech

Con

nt S

Ope

a

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

84 Global Custodian Fund Services Annual 2021

[ S U R V E Y | P R I M E B R O K E R A G E ]

BTIG Prime Brokerage

T

he 2021 survey sees a welcome return from New Year-on-Year Comparison

York-based BTIG. The prime broker partners with Category 2021 2020 Difference

emerging and established funds to build long-term

Asset Safety 6.62 n/a n/a

relationships, providing them access to global equity

trading via an in-house institutional and outsource trading Capital Introductions 6.14 n/a n/a

desk, as well as an electronic trading platform. The firm Client Services 6.32 n/a n/a

has also established introducing broker relationships with Consulting 6.25 n/a n/a

Goldman Sachs and BNY Mellon’s Pershing, with the Delta 1, Swaps and Financing 4.67 n/a n/a

option to hold assets at both custodians in a multi-prime

Fixed Income 7.00 n/a n/a

broker model.

Like the rest of the industry, the pandemic brought a Foreign Exchange Prime Brokerage 6.33 n/a n/a

renewed focus on client service and technology. BTIG claims Listed Derivatives 6.43 n/a n/a

it was able to pivot seamlessly to a remote solution and Operations 6.59 n/a n/a

leverage its high-level technology to minimise the impact on

OTC Clearing 6.67 n/a n/a

its operations and ensure connectivity with clients.

Risk Management 6.00 n/a n/a

BTIG received the highest level of Excellent responses

out of all the providers featured in the survey. It received Stock Borrowing and Lending 6.33 n/a n/a

top marks in Fixed Income (7.00), while also achieving high Technology 6.04 n/a n/a

scores across OTC Clearing (6.67), Trading and Execution Trading and Execution 6.62 n/a n/a

(6.62) and Asset Safety (6.62). Its strategy to provide state-

TOTAL 6.31 n/a n/a

of-the art electronic trading solutions has paid off through

several positive client comments.

“Trading and execution are flawless,” said one client.

“Electronic trading team is responsive and help,” explained Spread of Opinion (%)

another. Very Weak 1% N/A 1%

It received several plaudits for Capital Introduction (6.14), Satisfactory 10%

significantly beating both the global and peer group average.

Good 4%

One client commended BTIG for making introductions to

many different pools of capital. Another said: “Cap intro

staff always provides valuable insights into the state of the

asset raising market. They seem to be in touch with a pool of Excellent 55%

investors that aren’t with the other primes.”

Delta 1, Swaps and Financing (4.67) was the one area that

brought down BTIG’s overall scores.

Very Good 29%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Fixed Income 23.6 27.3

Capital Introductions 15.5 22.5 6.0

OTC Clearing 13.5 11.1 5.5

Client Services 2.3 6.4 5.0

Risk Management 1.9 1.8

4.5 BTIG Peer Group Average Global Average

Delta 1, Swaps and Financing -21.1 -22.3

4.0

ns

ces

ing

es

ons

ring

nt

ng

ogy

on

AGE

ty

com

rag

ncin

me

ativ

ctio

ndi

afe

cuti

sult

ervi

rati

l

Clea

R

o

e

age

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

Tech

Con

nt S

Ope

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

Fund Services Annual 2021 globalcustodian.com 85

[ S U R V E Y | P R I M E B R O K E R A G E ]

Cantor Fitzgerald

C

antor Fitzgerald is another prime broker that has Year-on-Year Comparison*

made a strong return to the survey, with over half Category 2021 2020 Difference

of hedge fund respondents rating the firm either

Asset Safety 6.13 n/a n/a

Excellent or Very Good across categories.

Over the past two years, the firm has made a major push in Capital Introductions 4.47 n/a n/a

Europe, while also expanding services to include outsourced Client Services 6.36 n/a n/a

trading. The results have been an increase in the number and Consulting 5.29 n/a n/a

quality of clients on its prime services platform. Delta 1, Swaps and Financing 5.90 n/a n/a

Capital Introduction (4.77) was the one area that Cantor

Fixed Income 5.81 n/a n/a

did fall noticeably short, however, the New York-based

firm is making efforts to improve this. In March, Cantor Foreign Exchange Prime Brokerage n/a n/a n/a

decided to outsource its capital introduction functions, such Listed Derivatives 5.67 n/a n/a

as arranging capital raising meetings and events for hedge Operations 5.77 n/a n/a

funds, to specialist Layton Road Group. Cantor will also be

OTC Clearing 5.93 n/a n/a

able to tap Layton Road’s portfolio of investors best suited

for its range of small and mid-sized hedge fund clients. Risk Management 5.53 n/a n/a

With this move, clients are optimistic that it can bounce Stock Borrowing and Lending 5.76 n/a n/a

back. “The new Layton Road partnership is an improvement Technology 5.59 n/a n/a

on the old model, and we have seen more relevant flow Trading and Execution 6.28 n/a n/a

recently,” highlighted one UK-based client.

TOTAL 5.73 n/a n/a

Respondents were also particularly vocal in their praise

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

for Cantor’s Client Service (6.36) and Operations (5.77).

“Client service at Cantor has always been great. Reachable,

responsive, informative and flexible. They tend to make it Spread of Opinion (%)

feel like a partnership,” one client commended. Very Weak 1% N/A 7%

Clients do think that Cantor can improve its Technology Weak 2%

(5.59) and its capabilities for Delta 1, Swaps and Financing

(5.90). “Would like better financing terms for repo. Much Excellent 38%

Satisfactory 14%

of our book cannot be priced,” said one client, while

another added, “I believe PB can improve on the accuracy

of their reporting data compared to what happened in the

market. They have made considerable improvements, but

there are a few more controls in their reporting that can be Good 13%

introduced.”

Very Good 25%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Client Services 3.0 1.1

Trading and Execution 2.7 1.0 6.0

Fixed Income 2.6 -0.5 5.5

Risk Management -6.1 -5.6 5.0

Consulting -6.4 -5.2

4.5 Cantor Fitzgerald Peer Group Average Global Average

Capital Introductions -15.9 -18.4

4.0

ns

ces

ing

es

ons

ring

ent

ng

logy

on

E

ty

om

g

ncin

RAG

ativ

ctio

era

ndi

afe

cuti

sult

ervi

em

rati

Clea

o

c

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

g

Tech

Con

nt S

Ope

a

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

86 Global Custodian Fund Services Annual 2021

[ S U R V E Y | P R I M E B R O K E R A G E ]

Cowen Prime Services

C

owen was one of the top-performing prime brokers Year-on-Year Comparison*

in the 2020 survey, where it excelled in several core Category 2021 2020 Difference

service offerings. This time around, its scores fell just

Asset Safety 6.15 6.44 -0.30

short of last year’s stellar performance, though areas where

Cowen did beat its 2020 ratings include Capital Introduction Capital Introductions 5.37 5.33 0.04

(5.37), Fixed Income (5.69), and Technology (5.71). Client Services 6.16 6.36 -0.20

With more responses than any other provider, the firm’s Consulting 5.91 6.57 -0.66

scores generally followed the global and peer group average, Delta 1, Swaps and Financing 5.92 6.67 -0.75

while still outperforming in several categories, including

Fixed Income 5.69 5.50 0.19

Consulting (5.91), Listed Derivatives (6.23), and OTC

Clearing (6.19). Foreign Exchange Prime Brokerage 5.94 6.55 -0.60

With some banks scaling back their Capital Introduction Listed Derivatives 6.23 6.61 -0.38

and Consulting capabilities, Cowen believes these are Operations 6.09 6.48 -0.38

areas where it can drive significant value for emerging

OTC Clearing 6.19 6.67 -0.48

fund manager and family office clients. “The Cowen Prime

Services team has done a great job providing me with highly Risk Management 5.85 6.17 -0.33

targeted introductions for my niche strategy,” highlights one Stock Borrowing and Lending 5.88 6.04 -0.16

US hedge fund client. Technology 5.71 5.69 0.02

Cowen has also had to revise its collateral models since Trading and Execution 6.20 6.36 -0.16

the collapse of family office Archegos Capital Management

Overall average 5.95 6.26 -0.31

in March. The firm said it has since updated its risk-based

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

margin models that allows it to accommodate clients, which

it claims is a major accomplishment. As a result of this

proactive approach to Risk Management (5.85), clients Spread of Opinion (%)

responded kindly. “Cowen has integrated very well with our Very Weak 1% N/A 6%

risk management process,” one US hedge fund client noted. Weak 2%

Trading and Execution (6.20) is where Cowen has made

Satisfactory 8%

significant enhancements over the past year, which include Excellent 41%

an expansion of its FX and fixed income outsourced trading

desks into new asset classes such as credit. However, some

respondents felt there is still room for improvement. “Cowen Good 17%

are only limited to EZE Software trading execution systems

whereas our firm are both IRESS and Bloomberg integrated,”

said one respondent. Another highlighted, “Some of the

algos seem ready for a refresh.”

Very Good 25%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Listed Derivatives 5.7 2.3

OTC Clearing 5.3 4.2 6.0

Consulting 4.7 6.1 5.5

Stock Borrowing and Lending -0.7 -2.1 5.0

Foreign Exchange Prime Brokerage -0.8 0.4

4.5 Cowen Prime Services Peer Group Average Global Average

Asset Safety -1.6 -1.4

4.0

ns

ces

ing

es

ons

ring

nt

ng

ogy

on

AGE

ty

com

rag

ncin

me

ativ

ctio

ndi

afe

cuti

sult

ervi

rati

l

Clea

R

o

e

age

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

Tech

Con

nt S

Ope

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

Fund Services Annual 2021 globalcustodian.com 87

[ S U R V E Y | P R I M E B R O K E R A G E ]

Goldman Sachs

U

nsurprisingly, Goldman Sachs was one of the Year-on-Year Comparison*

few prime broker of Archegos that escaped any Category 2021 2020 Difference

major losses to its business following the family

Asset Safety 6.47 6.38 0.08

office’s collapse. David Solomon, the bank’s CEO, said on

an investor call in April that it had taken “prompt action” Capital Introductions 5.33 5.86 -0.52

during the firesale of Archegos’s portfolio. “We identified Client Services 5.43 5.22 0.21

the risk early and took prompt action consistent with the Consulting 5.67 5.56 0.11

terms of our contract with the client [Archegos],” Solomon Delta 1, Swaps and Financing 5.93 6.14 -0.21

said.

Fixed Income 5.41 5.42 -0.01

Following the Archegos scandal, the bank reported record

hedge fund balances in the first quarter of the year as Foreign Exchange Prime Brokerage 7.00 6.08 0.92

equities financing revenues soared 65% year-on-year to Listed Derivatives 5.75 5.84 -0.09

just over $1.1 billion. With Credit Suisse looking to cut a Operations 5.26 5.38 -0.12

significant portion of its prime brokerage client book, it

OTC Clearing 6.38 5.64 0.74

presents a huge opportunity for Goldman Sachs to further

solidify its spot as one of the top providers. Risk Management 6.69 5.49 1.20

“You’ve obviously seen open expressions by other firms Stock Borrowing and Lending 5.82 6.03 -0.21

who are looking to reduce down their prime business. We Technology 5.78 5.12 0.66

are going the other way. We want to grow that business,” Trading and Execution 6.13 5.66 0.47

said Stephen Scherr, chief financial officer, Goldman Sachs

TOTAL 5.86 5.68 0.18

in July.

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

Its approach to the events in March is reflected in the

scores, where it beat last year’s results for Risk Management

(6.69) by 120 basis points, in addition to Asset Safety Spread of Opinion (%)

(6.47), Technology (5.78) and Trading and Execution (6.13). N/A 21%

“Trading has been excellent all around, from competitive

pricing, algos offered and best execution,” said one large US

hedge fund client. Excellent 30%

Moreover, the US investment bank recorded a perfect 7.00 Satisfactory 14%

for FX Prime Brokerage, beating the global and peer group

average for this category by a huge margin.

Where it did fall short in comparison to its large banking

peers was in Client Services (5.43) and Operations (5.26),

where one client noted they have experienced problems and

delays with responses to enquiries. Another client claimed Very Good 22%

that the bank “ignores smaller clients.”

Good 13%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Foreign Exchange Prime Brokerage 16.9 10.4

Risk Management 13.6 13.4 6.0

OTC Clearing 8.5 6.3 5.5

Fixed Income -4.4 -1.6 5.0

Client Services -12.0 -8.6

4.5 Goldman Sachs Peer Group Average Global Average

Operations -12.5 -8.2

4.0

ns

ces

ing

es

ons

ring

ent

ng

logy

on

E

ty

om

rag

ncin

RAG

ativ

ctio

ndi

afe

cuti

sult

ervi

em

rati

Clea

o

e

c

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

g

Tech

Con

nt S

Ope

a

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

88 Global Custodian Fund Services Annual 2021

[ S U R V E Y | P R I M E B R O K E R A G E ]

Interactive Brokers

I

nteractive Brokers (IB) makes its first appearance in Year-on-Year Comparison

the survey in well over five years. According to Preqin, Category 2021 2020 Difference

the firm ranks as one of the top 10 prime brokers and

Asset Safety 5.92 n/a n/a

serves as the predominant prime broker for hedge funds

with less than $50 million in assets under management, Capital Introductions 4.20 n/a n/a

largely due to its appeal of having the lowest margin rates Client Services 5.69 n/a n/a

and zero custody fees. Consulting 4.40 n/a n/a

It also boasts having a one-stop-shop with a fully integrated Delta 1, Swaps and Financing 6.00 n/a n/a

OMS/EMS solution that includes order management,

Fixed Income 6.29 n/a n/a

trading, research, risk management, operations, reporting,

compliance tools, clearing and execution. Foreign Exchange Prime Brokerage 5.00 n/a n/a

With its average score of 5.75, IB’s return to the survey Listed Derivatives 6.56 n/a n/a

indicates a client set that is pleased with the service it Operations 6.00 n/a n/a

receives, but with a few areas that dip into the merely

OTC Clearing 6.17 n/a n/a

satisfactory. The firm fell below the peer group and global

Risk Management 5.83 n/a n/a

average in Capital Introductions (4.20), Consulting (4.40),

and FX Prime Brokerage (5.00). Stock Borrowing and Lending 6.27 n/a n/a

Its score for Client Services (5.69) would have been higher, Technology 6.25 n/a n/a

but for a few respondents. One UK client suggested that Trading and Execution 6.31 n/a n/a

Interactive Brokers mishandled the Brexit transition which

TOTAL 5.75 n/a n/a

had a detrimental effect on its account. “We were left in the

dark about issues possibly affecting our account and we were

not able to operate in an acceptable way for almost three

months. We were completely frustrated by this because it Spread of Opinion (%)

hindered our business and the relationship with our clients.” Very Weak 1% N/A 15%

Yet the firm can take solace in the fact that it beat the

industry average for several key service areas that generate Weak 3%

significant revenues. These include Listed Derivatives (6.56), Excellent 26%

Fixed Income (6.29), Stock Borrowing and Lending (6.27),

Technology (6.25) and Trading and Execution (6.31). “Fully

automated, wide diversity of products,” said one US-based Satisfactory

fund manager. 18%

Good 20% Very Good 17%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Listed Derivatives 11.3 14.6

Fixed Income 11.0 14.3 6.0

Technology 9.8 9.4 5.5

Foreign Exchange Prime Brokerage -16.5 -21.1 Interactive Brokers

5.0

Peer Group Average

Capital Introductions -21.0 -16.2

4.5 Global Average

Consulting -22.1 -24.0

4.0

ns

ces

ing

es

ons

ring

nt

ng

ogy

on

AGE

ty

com

rag

ncin

me

ativ

ctio

ndi

afe

cuti

sult

ervi

rati

l

Clea

R

o

e

age

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

Tech

Con

nt S

Ope

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

Fund Services Annual 2021 globalcustodian.com 89

[ S U R V E Y | P R I M E B R O K E R A G E ]

J.P. Morgan

W

ith 61.5% of respondents for J.P. Morgan Year-on-Year Comparison*

returning from last year’s survey, the bank has Category 2021 2020 Difference

seen its overall average score rise higher up the

Asset Safety 6.28 6.23 0.05

Good scale (5.00-5.99).

Although this is below the global average, the bank Capital Introductions 4.85 4.64 0.21

surpasses the average at a category level in OTC Clearing, Client Services 5.78 5.12 0.66

Consulting and Delta 1, Swaps and Financing for both the Consulting 5.94 5.18 0.76

global sample and against a peer group average for the Delta 1, Swaps and Financing 6.03 5.56 0.47

largest primes.

Fixed Income 5.72 5.52 0.20

In common with many of its peers, the bank’s score for

Cap Intro is relatively low, remaining, as last year, in merely Foreign Exchange Prime Brokerage 4.71 5.00 -0.29

Satisfactory range (4.00-4.99). Whether this is a judgment Listed Derivatives 5.69 6.00 -0.31

on the quality of the actual service received or possibly a Operations 5.16 5.04 0.12

result of unrealistic expectations in the current climate, is

OTC Clearing 6.45 6.38 0.08

up for debate.

The two other relatively low scoring categories, Operations Risk Management 5.50 4.79 0.71

and Foreign Exchange Prime Brokerage, do come in for Stock Borrowing and Lending 5.55 5.74 -0.19

criticism from a few, mostly smaller, clients. Regarding Technology 5.48 4.77 0.71

Operations, one client laments the fact that “It’s become very Trading and Execution 5.52 5.25 0.27

clear that we’re no longer a priority client. Queries typically

TOTAL 5.60 5.37 0.22

will go unanswered for days regardless of the urgency

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

assigned by the client. When we finally get responses, they

are unhelpful and lack thought.”

Another provides a mixed review, on the one hand damning Spread of Opinion (%)

the FX prime brokerage service – “We are extremely Weak 14% Excellent 14%

disappointed in the lack of personal service we receive

from JPM, not being a big player in this market we expect a

little more help which we don’t receive” – and on the other

praising the banks offering for Listed Derivatives (“We are

very happy with the service we receive from JPM”). Very Good

Satisfactory

One European client is complimentary about the bank’s 29% 14%

electronic trading capability; less so about its manual trading.

Overall, the spread of opinion from J.P. Morgan’s response

pool is relatively wide. Of all the ratings at a category level,

Excellent, Very Good and Weak attract an equal proportion

(14%) with Good and Satisfactory registering just 30% each.

Good 29%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

OTC Clearing 9.8 7.5

Consulting 5.2 2.6 6.0

Delta 1, Swaps and Financing 1.9 0.4 5.5

Trading and Execution -9.7 -6.9 5.0 J.P. Morgan

Operations -14.2 -10.0 Peer Group Average

4.5

Global Average

Foreign Exchange Prime Brokerage -21.3 -25.7

4.0

ns

ces

ing

es

ons

ring

ent

ng

logy

on

E

ty

om

rag

ncin

RAG

ativ

ctio

ndi

afe

cuti

sult

ervi

em

rati

Clea

o

e

c

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

g

Tech

Con

nt S

Ope

a

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

90 Global Custodian Fund Services Annual 2021

[ S U R V E Y | P R I M E B R O K E R A G E ]

Lazarus Capital Partners

L

azarus Capital Partners stands out in this year’s Year-on-Year Comparison

cohort for a few reasons. Based in Australia, it Category 2021 2020 Difference

focuses primarily on hedge fund managers with

Asset Safety 6.50 n/a n/a

AUM of up to $5 billion. In its first appearance on the

Global Custodian PB survey, it has made an impressive Capital Introductions 6.50 n/a n/a

entrance with all category scores in Very Good territory Client Services 6.68 n/a n/a

(6.00-6.99) with exception of Listed Derivatives and Consulting 6.39 n/a n/a

Technology in the upper fives. Delta 1, Swaps and Financing 6.50 n/a n/a

For its highest scoring category, Client Service, the firm

Fixed Income 6.33 n/a n/a

receives numerous plaudits from participating clients.

“Lazarus Capital Partners is a high touch business, allowing Foreign Exchange Prime Brokerage 6.67 n/a n/a

full coverage during operating hours without any delays Listed Derivatives 5.60 n/a n/a

in response times. All personnel are highly trained and Operations 6.42 n/a n/a

communicate effectively,” says one.

OTC Clearing 6.00 n/a n/a

Bucking the trend in the survey as a whole, Capital

Risk Management 6.68 n/a n/a

Introduction is one of the areas where LCP distinguishes

itself. “Lazarus Capital Partners have been more than Stock Borrowing and Lending 6.38 n/a n/a

capable when it comes to delivering capital introductions for Technology 5.78 n/a n/a

our funds. They understand our business and our funds, and Trading and Execution 6.72 n/a n/a

as a consequence they have consistently been able to identify

TOTAL 6.39 n/a n/a

and introduce [us] to the right ‘fit’ investor,” says one client.

The firm itself has had a strong risk focus over the past

year. “Prior to the COVID sell-off in February 2020, we

made efforts to ensure that our clients were adequately Spread of Opinion (%)

collateralised, which served the business and our clients Satisfactory 2% N/A 2%

well as there was minimal forced deleveraging and they were Good 8%

able to hold their positions through the selloff and into the

recovery,” the firm explains. “Since then, the frequency of Excellent 48%

our risk committee meetings has increased from monthly

to weekly, systems have been developed to provide clients

with daily updates of their portfolio values and collateral

adequacy, and we have enhanced our pre-existing risk

management processes.” This is clearly paying off. According

to one client, “The quality of risk management at Lazarus is

one of the main reasons for using them.”

Very Good 40%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Capital Introductions 22.3 n/a

Risk Management 13.6 n/a 6.0

Consulting 13.1 n/a 5.5

OTC Clearing 2.1 n/a 5.0

Technology 1.5 n/a Peer Group Average

4.5 Lazarus Capital Partners Global Average Data was not available to

review Peer Group Average

Listed Derivatives -5.0 n/a

4.0

ns

ces

ing

es

ons

ring

nt

ng

ogy

on

AGE

ty

com

rag

ncin

me

ativ

ctio

ndi

afe

cuti

sult

ervi

rati

l

Clea

R

o

e

age

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

Tech

Con

nt S

Ope

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

Fund Services Annual 2021 globalcustodian.com 91

[ S U R V E Y | P R I M E B R O K E R A G E ]

Morgan Stanley

J

ust over 73% of respondents for Morgan Stanley also Year-on-Year Comparison*

rated the bank in 2020. They have helped it recover Category 2021 2020 Difference

from last year’s relative dip. Once again the bank

Asset Safety 6.30 6.42 -0.12

records all category scores in Very Good territory (6.00-

6.99). It also outperforms in all service areas compared to Capital Introductions 6.06 5.75 0.31

both average global scores and its peer group of large prime Client Services 6.39 6.09 0.30

brokers that it regards as its main competitors. Consulting 6.31 5.94 0.37

Where Morgan Stanley most pulls ahead of its peer Delta 1, Swaps and Financing 6.69 6.27 0.42

group is in the area of Capital Introductions. “Very strong

Fixed Income 6.09 5.58 0.51

team. The weekly, monthly, and quarterly market colour

reports they put together are substantive and very much Foreign Exchange Prime Brokerage 6.50 5.25 1.25

appreciated,” says one client. “The proactive outreach Listed Derivatives 5.92 5.81 0.11

to provide customised content by phone and email is Operations 6.25 5.72 0.53

differentiated. Whenever we have a question, the response

OTC Clearing 6.24 5.95 0.29

is immediate and always accompanied by a willingness to

jump on a call. The annual fall hedge fund conference this Risk Management 6.14 6.02 0.12

year was virtual and exceptional. We’ve done a fair number Stock Borrowing and Lending 6.19 6.23 -0.04

of these and the preparation before and smooth running day Technology 6.39 5.89 0.51

of were second to none.” Trading and Execution 6.52 6.04 0.48

Delta 1, Swaps and Financing is the bank’s highest scoring

TOTAL 6.28 5.94 0.34

category (6.69). It is also the area where the highest

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

percentage of respondents – over 70% – award it the top

mark of 7.00. “Access to markets and low financing terms is

most important,” says one Hong Kong-based client. Spread of Opinion (%)

Client comments in other areas are also positive, Very Weak 1% N/A 6%

reflecting the high scores. “Morgan Stanley offers excellent Weak 1%

client service and has been a great partner for us in all Satisfactory 4%

capacities,” says one. Trading and Execution, meanwhile is Good 10% Excellent 49%

described as “Excellent all round, from competitive pricing,

algos offered, and best execution.” As to the future, another

client declares, “Morgan Stanley has been a great partner

for us and I look forward to expanding our business with

them in 2021/2022.”

Very Good 29%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Capital Introductions 14.1 21.0

Delta 1, Swaps and Financing 13.1 11.4 6.0

Technology 12.3 12.0 5.5

Client Services 3.4 7.5 5.0

Asset Safety 0.9 0.5

4.5 Morgan Stanley Peer Group Average Global Average

Listed Derivatives 0.5 3.6

4.0

ns

ces

ing

es

ons

ring

ent

ng

logy

on

AGE

ty

om

rag

ncin

ativ

ctio

ndi

afe

cuti

sult

ervi

em

rati

Clea

R

o

e

c

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

g

Tech

Con

nt S

Ope

a

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

92 Global Custodian Fund Services Annual 2021

[ S U R V E Y | P R I M E B R O K E R A G E ]

Pershing

“A

s the world continues to evolve and adapt around Year-on-Year Comparison*

the impacts of the global pandemic, alternative Category 2021 2020 Difference

asset managers too have had to pivot to an

Asset Safety 6.57 6.58 0.00

environment of ongoing change,” says Pershing. “With

many firms changing the way they do business – from Capital Introductions 5.32 5.14 0.18

remote work to virtual operations and due diligence, to Client Services 6.44 6.42 0.02

capital raising – hedge funds are taking a closer look at Consulting 4.93 6.18 -1.25

their counterparty relationships, placing a greater value on Delta 1, Swaps and Financing 5.61 6.05 -0.44

risk management and overall value proposition, in addition

Fixed Income 6.00 6.08 -0.08

to their core services.” Both Risk Management and Asset

Safety scores for Pershing are slightly up on last year and Foreign Exchange Prime Brokerage 6.65 6.17 0.48

comfortably in Very Good range. Listed Derivatives 5.88 6.42 -0.55

Pershing’s highest score and the area where it most Operations 6.38 6.31 0.08

exceeds both global and peer group averages is Foreign

OTC Clearing 5.87 6.35 -0.48

Exchange Prime Brokerage (6.65), though one client argues

for some reorganisation, saying: “We would prefer to be able Risk Management 6.11 5.98 0.13

to execute bulk FX trades at a single rate through NETX360 Stock Borrowing and Lending 6.42 6.05 0.38

and then allocate to our separate Funds, as opposed to the Technology 5.85 5.75 0.10

current setup, which only allows individual FX trades per Trading and Execution 6.30 5.90 0.39

fund to be done through the platform.”

TOTAL 6.03 6.09 -0.06

By contrast, Consulting has fallen from Very Good to

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

Satisfactory, though one respondent finds the “consulting

team at Pershing very helpful and informed of latest trends

and technology.” Spread of Opinion (%)

When it comes to Capital Introductions (5.32), the firm N/A 11%

itself notes that, “We launched a Cap Intro webcast series in

2020 to bring investor insights directly to managers in the

new virtual environment. These events provide managers Satisfactory 11% Excellent 44%

a unique opportunity to hear directly from allocators and

fellow managers their views on a hot topic impacting the

alternative investments industry.”

This appears to have had a positive effect on client Good 10%

perception, with one commenting that, “Pershing Prime

cap intro has been very proactive in reaching out to assist

us. I am very impressed with the team and the introduction

they can make, also with the industry updates and

Very Good 24%

programs they offer.”

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Foreign Exchange Prime Brokerage 11.1 12.4

Stock Borrowing and Lending 8.4 6.9 6.0

Operations 6.2 3.7 5.5

Listed Derivatives -0.3 -3.5 5.0

Delta 1, Swaps and Financing -5.3 -5.2

4.5 Pershing Peer Group Average Global Average

Consulting -12.7 -11.5

4.0

ns

ces

ing

es

ons

ring

nt

ng

ogy

on

AGE

ty

com

rag

ncin

me

ativ

ctio

ndi

afe

cuti

sult

ervi

rati

l

Clea

R

o

e

age

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

Tech

Con

nt S

Ope

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

Fund Services Annual 2021 globalcustodian.com 93

[ S U R V E Y | P R I M E B R O K E R A G E ]

TD Securities

A

lthough only a fifth of TD Securities’ response pool Year-on-Year Comparison*

this year are returnees from 2020, the firms overall Category 2021 2020 Difference

score is similar to last year, with the bulk of

Asset Safety 6.36 6.33 0.03

category scores as well as overall average in Very Good

territory (6.00-6.99). Capital Introductions 6.04 6.47 -0.43

In the last 12 months, says the bank, the dislocation Client Services 6.76 6.86 -0.10

that arose out of COVID-19 has presented lots of Consulting 5.67 6.50 -0.83

opportunities for managers with growth in a variety of areas Delta 1, Swaps and Financing 6.23 6.00 0.23

including Municipals bonds, Convertible bonds, SPACs,

Fixed Income 4.86 6.33 -1.48

Cannabis, and Event Driven. “Additionally, we have seen a

lot of the conversation in 2021 around shorts as well as Foreign Exchange Prime Brokerage 5.50 5.00 0.50

leverage, and we believe with our thoughtful risk framework Listed Derivatives 6.27 6.00 0.27

we will continue to offer long-term and stable solutions for Operations 6.43 6.17 0.27

our clients.”

OTC Clearing 6.00 6.00 0.00

Innovations from TD Securities in the past 12 months

include a new version of its portfolio margin methodology, Risk Management 6.00 5.00 1.00

allowing it to service more managers. “Additionally,” says the Stock Borrowing and Lending 6.43 6.17 0.27

firm, “we have expanded our capital introduction team as Technology 5.73 5.75 -0.02

well as stock loan team.” Trading and Execution 6.29 6.60 -0.31

Capital Introductions (6.04) is the category where TD most

TOTAL 6.04 6.12 -0.08

exceeds the global average and peer group average scores.

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

One client is effusive in its praise for this service, albeit in

a backhanded way: “Amazing service, and they probably

work harder as they are smaller or growing. The actual Cap Spread of Opinion (%)

Intro team seems lazy or was to me; the Prime side works N/A 9%

extremely hard and makes up for that.” Weak 2%

Although Consulting is not one of the firm’s highest rated

service areas (5.67), it is well regarded by at least one client

Satisfactory 14%

who praises the “excellent breadth and experience on the

Excellent 50%

team. Hope to see them expand the group.”

Looking ahead, TD expects there to be “greater scrutiny

to shorting as well as the synthetic market in general. Good 8%

Continuing as we have before, we are in regular

conversations with both the regulatory managers and

our internal risk team in efforts to mitigate such risks in

the market.”

Very Good 17%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Capital Introductions 13.7 10.3

Client Services 9.4 7.4 6.0

Stock Borrowing and Lending 8.6 7.1 5.5

Consulting 0.3 1.7 5.0 TD Securities

Foreign Exchange Prime Brokerage -8.1 -7.0 Peer Group Average

4.5

Global Average

Fixed Income -14.2 -16.8

4.0

ns

ces

ing

es

ons

ring

ent

ng

logy

on

AGE

ty

om

rag

ncin

ativ

ctio

ndi

afe

cuti

sult

ervi

em

rati

Clea

R

o

e

c

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

g

Tech

Con

nt S

Ope

a

OTC

eB

Man

Fixe

Ass

ed D

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

94 Global Custodian Fund Services Annual 2021

[ S U R V E Y | P R I M E B R O K E R A G E ]

Wells Fargo Prime Services

A

lmost 70% of respondents for Wells Fargo also rated Year-on-Year Comparison*

the bank in 2020. Despite a small dip in overall Category 2021 2020 Difference

average from Very Good to the upper end of Good

Asset Safety 6.09 6.74 -0.65

range, the fall seems to be attributable to drops in one or

two specific areas: notably, OTC Clearing (4.86), and Stock Capital Introductions 5.57 5.63 -0.05

Borrowing and Lending (5.50). Client Services 6.50 6.29 0.21

That said, client comment on both of these areas is Consulting 6.67 5.65 1.02

positive. Regarding OTC Clearing, one client says, “Wells Delta 1, Swaps and Financing 5.38 6.00 -0.62

Fargo’s account reps have consistently made our lives

Fixed Income 6.00 6.25 -0.25

easier by following up with counterparties on our behalf

and ensuring that settlement issues are minimised.” On Foreign Exchange Prime Brokerage n/a n/a n/a

Stock Borrowing and Lending, another notes, “The stock Listed Derivatives 6.70 5.88 0.83

loan portal is user friendly and easy to use. Also, the stock Operations 6.45 6.36 0.09

loan desk is responsive and overall does a great job for

OTC Clearing 4.86 6.33 -1.48

our firm.” Another does, however, have a gripe about the

technology underpinning the service, suggesting that, “Wells’ Risk Management 5.50 6.15 -0.65

borrowing/lending technology is not as automated as our Stock Borrowing and Lending 5.50 6.31 -0.81

other prime, making it a bit more cumbersome to use.” Technology 5.61 5.93 -0.32

Where the bank can be most pleased with client feedback Trading and Execution 6.09 6.51 -0.42

is in Consulting, which has recorded a huge rise from

TOTAL 5.92 6.15 -0.24

5.65 to 6.67. It is also 18% above the global average and

*Rounding to two decimal places may result in minor discrepancies in the Difference column of up to 0.01.

19.6% above the average for its mid-tier peers. “The Wells

consulting team has been helpful on a number of occasions

in recent years, particularly helping us with vendor selection Spread of Opinion (%)

(e.g., marketing/graphic design firms, back/middle-office Very Weak 1% N/A 17%

partners, etc.),” notes one client.

Wells itself points to recent enhancements in its electronic

execution capabilities following the 2020 launch of the Weak 2%

Excellent 40%

“Daytona” platform: “The platform gives us a suite of

execution products to meet the needs of all segments of the Satisfactory

quantitative community ranging from low latency / co- 8%

location to high-touch outsourced trading. Additionally, we

continue to build out operational infrastructure and expand

our client product offering to make Wells Fargo more

Good 9%

competitive with full service prime brokers. This is a gradual

progression of a multi-year buildout that began years ago.”

Very Good 23%

Percentage +/- Global Average (Top/Bottom 3) Provider Scores Versus Global Average and Peer Group Average

Vs Global Vs Peer Group 7.0

Category (%) (%)

6.5

Consulting 18.0 19.6

Listed Derivatives 13.7 10.0 6.0

Operations 7.2 4.7 5.5

Stock Borrowing and Lending -7.2 -8.5 5.0

Delta 1, Swaps and Financing -9.0 -9.0 Wells Fargo Prime Services

4.5

Peer Group Average Global Average

OTC Clearing -17.3 -18.2

4.0

ns

ces

ing

ed D n/a) ge

es

ons

ring

nt

ng

ogy

on

AGE

ty

com

ncin

me

ativ

ctio

( ra

ndi

afe

cuti

sult

ervi

rati

l

Clea

R

o

e

age

Fina

d In

AVE

rok

d Le

et S

eriv

odu

Exe

Tech

Con

nt S

Ope

OTC

eB

Man

Fixe

Ass

g an

Intr

and

and

Clie

rim

Risk

ital

List

win

aps

ing

ge P

Cap

orro

Trad

, Sw

han

ck B

ta 1

Exc

Del

Sto

eign

For

Fund Services Annual 2021 globalcustodian.com 95

[ S U R V E Y | P R I M E B R O K E R A G E ]

Others

Several providers failed to

garner enough responses for

How to read the provider charts and tables

a full assessment, but a few Year-on-Year Comparison spectrum. Again, as a general rule, it is

broad observations are worth This table presents the results by fairly unusual for any one respondent’s

category for each provider on a scale scores across all categories to deviate

making beyond the impact from 1 (Unacceptable) to 7 (Excellent) significantly from one category to the

of the Archegos collapse alongside the previous year’s results next. Outliers at that level are very

and the difference between them. As much the exception.

on one or two directly (and a general rule, any score above 5.00

well reported elsewhere). is considered Good, even if it repre- Provider Scores Versus Global Average

sents a decline year-on-year. Scores in and Peer Group Average

Satisfactory range (4.00-4.99) suggest This line graph provides an at-a-glance

that respondents do not see the quality indication of how a provider’s results

of a particular service as a deal-breaker compare to both a global average

but believe there is ample room for and a peer group average as well as

Bank of America Merrill Lynch improvement. Anything below that the extent to which it exceeds or

BAML gets top scores for Foreign should be regarded as a negative view. undershoots these averages in each

Exchange Prime Brokerage, OTC Clearing Apart from the individual category particular category.

and Listed Derivatives. Conversely, scores, some indication of changes in

Consulting and Cap Intro are only in sentiment can be gleaned from shifts Percentage +/- Global Average

Satisfactory territory. in the number of category scores falling (Top/Bottom 3)

Regarding the latter, one respondent in each broad segment. This table amplifies the results of

says, “Their funding isn’t great, intros the previous graph by indicating the

are stale relative to other banks; has had Spread of opinion (%) percentage outperformance and

turnover.” This pie chart presents the propor- underperformance of a provider in its

tion of votes in each rating segment top three and bottom three categories

aggregated across all categories. This in terms of deviation from the global

Credit Suisse provides an indication at a glance average. In practice, almost all rated

While Asset Safety attracts high scores of how the bulk of respondents feel providers, including those whose over-

from a limited response pool, Risk about the bulk of services as well as all result sits in the bottom quartile,

Management is rated Very Weak. suggesting whether respondents seem have at least one or two service areas

“Obviously Credit Suisse has had their to share a common experience or if in which their clients have rated them

Risk Management issues, being in the there is a mixture of views across the above the pack.

news way too much,” says one client.

The same respondent is, however,

complimentary about the FX Prime

Brokerage service. “We are extremely Barclays appetite perspective to ensure the leverage

happy with the service we receive. The As with many providers, Consulting and extended is still appropriate. There is an

one-on-one contact really helps a firm Capital Introductions are the bank’s expectation that more regular and more

like ours that do not have a huge presence lowest scores, though overall, those dynamic margining will be forthcoming

in the FX markets.” clients who have responded seem happy from prime brokers to their clients,” says

to envisage a continued relationship. the firm.

In terms of its own services, IG Prime

Nomura highlights several changes over the

Before curtailing its involvement in this IG Prime past year, including: platform

year’s survey after an encouraging start, While IG Prime has not received sufficient improvements to both IG’s proprietary

Nomura had actually garnered some responses for analysis, it has provided some DMA platform as well as external

impressive category scores. “Both the useful comment on market conditions platforms, such as Bloomberg EMSX;

sales coverage and the middle-office through the provider questionnaire. “Post OMS improvements resulting in higher

support are great!” says one Hong Kong- the Archegos event, all prime brokers have order capacities and lower latencies

based asset manager. had deep dives on their business from a risk through APIs.

96 Global Custodian Fund Services Annual 2021

You might also like

- Persuasive Speech Outline - Investing in Stock MarketDocument4 pagesPersuasive Speech Outline - Investing in Stock Marketalisa Ibrahim67% (3)