Professional Documents

Culture Documents

Chapter 10 Financial Statements and Clos

Chapter 10 Financial Statements and Clos

Uploaded by

Loges WarryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 10 Financial Statements and Clos

Chapter 10 Financial Statements and Clos

Uploaded by

Loges WarryCopyright:

Available Formats

Chapter 10 – Financial Statements and Closing Entries for a Merchandising Business

TRUE/FALSE

1. The income statement is prepared before other financial statements.

ANS: T PTS: 1 OBJ: 1

2. The statement of owner’s equity is the last financial statement prepared.

ANS: F PTS: 1 OBJ: 1

3. The balance sheet lists the firm’s assets, liabilities, and owner’s equity as of a certain date.

ANS: T PTS: 1 OBJ: 1

4. The statement of owner’s equity shows the changes in the owner’s equity as of a certain date.

ANS: F PTS: 1 OBJ: 1

5. The Cost of Goods Sold section appears after the Operating Expenses section on a classified

income statement.

ANS: F PTS: 1 OBJ: 1

6. Gross profit is the profit before subtracting the operating expenses of the business.

ANS: T PTS: 1 OBJ: 1

7. Net sales is obtained by subtracting the amount of sales discounts and sales returns and allowances

from sales.

ANS: T PTS: 1 OBJ: 1

8. Gross profit is obtained by subtracting operating expenses from net sales.

ANS: F PTS: 1 OBJ: 1

9. Determining the cost of goods sold includes calculation of the net purchases.

ANS: T PTS: 1 OBJ: 1

10. The ending merchandise inventory is subtracted from the goods available for sale to obtain the

cost of goods sold.

ANS: T PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 1

11. Freight In would be subtracted from purchases to obtain the net purchases.

ANS: F PTS: 1 OBJ: 1

12. Interest expense is shown in the Operating Expenses section of a classified income statement.

ANS: F PTS: 1 OBJ: 1

13. The net income figure from the income statement is entered on the statement of owner’s equity

as a necessary part of updating the owner’s capital.

ANS: T PTS: 1 OBJ: 1

14. Current assets are listed on the balance sheet according to their size, with the largest monetary

balance listed first.

ANS: F PTS: 1 OBJ: 1

15. Plant assets are assets expected to be used in the business for more than one year.

ANS: T PTS: 1 OBJ: 1

16. Long-term liabilities are debts that will not come due for payment until at least 90 days after

preparation of the balance sheet.

ANS: F PTS: 1 OBJ: 1

17. Salaries payable and accounts payable are common examples of long-term liabilities.

ANS: F PTS: 1 OBJ: 1

18. The current ratio is the ratio of current assets to current liabilities.

ANS: T PTS: 1 OBJ: 1

19. Adjustments that appear on the work sheet must be journalized and then posted to the general

ledger.

ANS: T PTS: 1 OBJ: 2

20. Closing entries are dated as of the first day of the accounting period.

ANS: F PTS: 1 OBJ: 2

21. The Sales account, Purchases Discounts account, and Sales Discounts account are all debited in the

closing process.

ANS: F PTS: 1 OBJ: 2

© Paradigm Publishing, Inc. 2

22. The Purchases account, Sales Returns and Allowances account, and Sales Discounts account are all

credited in the closing process.

ANS: T PTS: 1 OBJ: 2

23. Once sdjustments for inventory have beeen posted and after the revenue and expenses have been

closed into the Income Summary account, the remaining balance represents either a net income or

a net loss.

ANS: T PTS: 1 OBJ: 2

24. The Income Summary account is involved in the adjusting entries for beginning and ending

merchandise inventory.

ANS: T PTS: 1 OBJ: 2

25. Net income is closed to the owner’s capital account as part of the closing process.

ANS: T PTS: 1 OBJ: 2

26. The balance in the owner’s drawing account is closed to the owner’s capital account as part of the

adjusting process.

ANS: F PTS: 1 OBJ: 2

27. The only accounts appearing on the post-closing trial balance are the permanent accounts, as the

temporary accounts have been closed.

ANS: T PTS: 1 OBJ: 3

28. The balance in the owner’s capital account appearing on the post-closing trial balance will likely

be the same as the prior beginning balance in the owner’s capital account.

ANS: F PTS: 1 OBJ: 3

29. The owner’s drawing account will appear on the post-closing trial balance.

ANS: F PTS: 1 OBJ: 3

30. An accrued expense occurs because the accounting period ends before the time the expense is due

for payment.

ANS: T PTS: 1 OBJ: 4

© Paradigm Publishing, Inc. 3

MULTIPLE CHOICE

1. Which of the following is not part of the Revenue section of the classified income statement?

a. Gross sales c. Purchases discounts

b. Sales returns and allowances d. Net sales

ANS: C PTS: 1 OBJ: 1

2. Below is selected information regarding the inventory and sales activities for Jack’s Widgets and

Wonders for the fiscal year.

Beginning Inventory $ 3,200 Gross Sales $68,500

Net Purchases 29,800 Sales Discounts 410

Ending Inventory 2,200 Sales Returns and Allowances 2,190

Net sales for the year is

a. $71,100. c. $65,900.

b. $68,900. d. $63,700.

ANS: C PTS: 1 OBJ: 1

3. Below is selected information regarding the inventory and sales activities for Jack’s Widgets and

Wonders for the fiscal year.

Beginning Inventory $ 3,200 Gross Sales $68,500

Net Purchases 29,800 Sales Discounts 410

Ending Inventory 2,200 Sales Returns and Allowances 2,190

Cost of goods sold for the year is

a. $24,400. c. $28,800.

b. $25,410. d. $30,800.

ANS: D PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 4

4. Below is selected information regarding the inventory and sales activities for Jack’s Widgets and

Wonders for the fiscal year.

Beginning Inventory $ 3,200 Gross Sales $68,500

Net Purchases 29,800 Sales Discounts 410

Ending Inventory 2,200 Sales Returns and Allowances 2,190

Gross profit for the year is

a. $35,100. c. $43,490.

b. $32,900. d. $46,700.

ANS: A PTS: 1 OBJ: 1

5. Which of the following is not used in the calculation of net purchases?

a. Purchase returns c. Freight in

b. Beginning inventory d. Purchase discounts

ANS: B PTS: 1 OBJ: 1

6. The information below pertains to selected information regarding the Modoc Blanket Company’s

inventory accounts for the fiscal year.

Beginning Inventory $ 1,600 Purchases Discounts $ 500

Purchases 84,000 Freight In 300

Purchases Returns and 3,200 Ending Inventory 900

Allowances

Net purchases for the fiscal year were

a. $87,700. c. $82,200.

b. $88,000. d. $80,600.

ANS: D PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 5

7. The information below pertains to selected information regarding the Modoc Blanket Company’s

inventory accounts for the fiscal year.

Beginning Inventory $ 1,600 Purchases Discounts $ 500

Purchases 84,000 Freight In 300

Purchases Returns and 3,200 Ending Inventory 900

Allowances

Cost of goods sold for the 2002 fiscal year is

a. $80,600. c. $81,300.

b. $81,500. d. $82,200.

ANS: C PTS: 1 OBJ: 1

8. The calculation for gross profit is

a. Gross Sales – Net Sales.

b. Net Sales – Cost of Goods Sold.

c. Gross Sales – Operating Expenses.

d. Cost of Goods Sold – Operating Expenses.

ANS: B PTS: 1 OBJ: 1

9. Operating Expenses can be broken down into

a. selling expenses and general or administrative expenses.

b. cost of goods sold and general expenses.

c. miscellaneous expenses and income taxes.

d. general expenses and interest expenses.

ANS: A PTS: 1 OBJ: 1

10. Which of the following would be considered a selling expense?

a. Cost of Goods Sold c. Interest Expense

b. Sales Discounts d. Depreciation Expense—Display Fixtures

ANS: D PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 6

11. Listed below are selected account balances for G. Gill Apparel Stores for the fiscal year ending

January 31, 2008.

Advertising Expense $ 750

Cost of Goods Sold 82,500

Depr.—Exp. Store Equipment 1,800

Depr.—Exp. Office Equipment 1,200

General Insurance Expense 600

Interest Expense 1,750

Merchandise Inventory 15,300

Net Sales 175,500

Office Salaries Expense 18,000

Office Supplies Expense 250

Rent Expense 3,600

Selling Salaries Expense 45,000

Store Supplies Expense 800

Utilities Expense 2,400

From the accounts listed above, determine the selling expense for the fiscal year.

a. $49,400 c. $47,600

b. $48,350 d. $63,700

ANS: B PTS: 1 OBJ: 1

12. Listed below are selected account balances for G. Gill Apparel Stores for the fiscal year ending

January 31, 2008.

Advertising Expense $ 750

Cost of Goods Sold 82,500

Depr.—Exp. Store Equipment 1,800

Depr.—Exp. Office Equipment 1,200

General Insurance Expense 600

Interest Expense 1,750

Merchandise Inventory 15,300

Net Sales 175,500

Office Salaries Expense 18,000

Office Supplies Expense 250

Rent Expense 3,600

Selling Salaries Expense 45,000

Store Supplies Expense 800

Utilities Expense 2,400

From the accounts listed above, determine the administrative expenses for the fiscal year.

a. $26,050 c. $28,400

b. $27,800 d. $22,450

ANS: A PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 7

13. Listed below are selected account balances for G. Gill Apparel Stores for the fiscal year ending

January 31, 2008.

Advertising Expense $ 750

Cost of Goods Sold 82,500

Depr.—Exp. Store Equipment 1,800

Depr.—Exp. Office Equipment 1,200

General Insurance Expense 600

Interest Expense 1,750

Merchandise Inventory 15,300

Net Sales 175,500

Office Salaries Expense 18,000

Office Supplies Expense 250

Rent Expense 3,600

Selling Salaries Expense 45,000

Store Supplies Expense 800

Utilities Expense 2,400

What are the total operating expenses for G. Gill for the fiscal year?

a. $93,000 c. $74,400

b. $77,700 d. $70,150

ANS: C PTS: 1 OBJ: 1

14. Listed below are selected account balances for G. Gill Apparel Stores for the fiscal year ending

January 31, 2008.

Advertising Expense $ 750

Cost of Goods Sold 82,500

Depr.—Exp. Store Equipment 1,800

Depr.—Exp. Office Equipment 1,200

General Insurance Expense 600

Interest Expense 1,750

Merchandise Inventory 15,300

Net Sales 175,500

Office Salaries Expense 18,000

Office Supplies Expense 250

Rent Expense 3,600

Selling Salaries Expense 45,000

Store Supplies Expense 800

Utilities Expense 2,400

What is the income from operations for the fiscal year?

a. $ 74,400 c. $ 18,600

b. $101,100 d. $ 16,850

ANS: C PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 8

15. Watanabe Cake and Candies was charged $3,750 in interest for a loan from a bank. This amount

will be shown on the income statement as

a. Interest Income in the Administrative section.

b. Interest Expense in the Selling Expenses section.

c. Interest Expense in the Other Income and Expenses section.

d. Interest Income in the Revenue section.

ANS: C PTS: 1 OBJ: 1

16. Neal Construction sold equipment that was no longer being used. How will this be reported on the

income statement?

a. As Other Income in the Other Income and Expenses section.

b. As a reduction in Depreciation Expense in Operating Expenses section.

c. As Miscellaneous Sales in the Revenue section.

d. It would only show up on the balance sheet as an increase to Cash.

ANS: A PTS: 1 OBJ: 1

17. Listed below is selected information from the account balances for Kini’s Asian Sauces for the

fiscal year ended December 31, 2007.

Cash $ 3,500 Owner’s Drawing $

1,900

Net Income 8,600 Owner’s Capital, January 1

16,250

What amount will be reported in the statement of owner’s equity at December 31, 2007?

a. $26,750 c. $22,950

b. $26,450 d. $14,350

ANS: C PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 9

18. From the following selected data from Altadena Hobby Shop’s Classified Balance Sheet,

determine both the current and total assets.

Cash $9,500 Other Current Assets $ 36

Accounts Receivable 820 Equipment 820

Inventory 400 Accumulated Depreciation 370

a. Current Assets are $9,500, and Total Assets are $11,946.

b. Current Assets are $10,756, and Total Assets are $11,206.

c. Current Assets are $10,356, and Total Assets are $11,576.

d. Current Assets are $10,720, and Total Assets are $11,206.

ANS: B PTS: 1 OBJ: 1

19. On the classified balance sheet, current assets are listed in what order?

a. Alphabetically c. According to stability

b. Largest to smallest d. According to liquidity

ANS: D PTS: 1 OBJ: 1

20. The current ratio is used to analyze a company’s

a. ability to pay its current obligations.

b. ability to generate a profit in the current year.

c. current ability to continue in business.

d. current gross profit percentage.

ANS: A PTS: 1 OBJ: 1

21. Listed below is selected information from the classified balance sheet for Artz Company.

Cash $21,500 Accounts Payable $ 11,409

Accounts Receivable 2,191 Salaries Payable 5,575

Inventory 5,514 Other Current Liabilities 8,676

Property, Plant, and 3,346 Long-Term Notes 11,500

Equipment Payable

What is the working capital for Artz Company?

a. $10,091 c. $3,545

b. $6,891 d. $1,377

ANS: C PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 10

22. Listed below is selected information from the classified balance sheet for Artz Company.

Cash $21,500 Accounts Payable $11,409

Accounts Receivable 2,191 Salaries Payable 5,575

Inventory 5,514 Other Current Liabilities 8,676

Property, Plant, and Equipment 3,346 Long-Term Notes 11,500

Payable

What is Artz Company’s current ratio (rounded to two decimal places)?

a. 1.88 to 1 c. 1.72 to 1

b. 1.14 to 1 d. 1.03 to 1

ANS: B PTS: 1 OBJ: 1

23. A classified income statement includes all of the following sections except

a. Other Income and Expenses. c. Owner’s Equity.

b. Gross Profit. d. Cost of Goods Sold.

ANS: C PTS: 1 OBJ: 1

24. Cost of goods sold is equal to

a. ending merchandise inventory plus beginning merchandise inventory minus net

purchases.

b. beginning merchandise inventory minus net purchases plus ending merchandise

inventory.

c. beginning merchandise inventory plus net purchases minus ending merchandise

inventory.

d. ending merchandise inventory plus net purchases minus beginning merchandise

inventory.

ANS: C PTS: 1 OBJ: 1

25. Net purchases appear in the

a. Owner’s Equity section of the balance sheet.

b. Revenue section of the income statement.

c. Current Assets section of the balance sheet.

d. Cost of Goods Sold section of the income statement.

ANS: D PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 11

26. If purchases for the current period are $500, purchases returns and allowances are $50, and freight

in is $30, net purchases amount to

a. $500. c. $420.

b. $550. d. $480.

ANS: D PTS: 1 OBJ: 1

27. If beginning merchandise inventory is $20, net purchases for the current period are $50, and

ending merchandise inventory is $10, cost of goods sold is

a. $50. c. $20.

b. $60. d. $70.

ANS: B PTS: 1 OBJ: 1

28. Which of the following is not considered to be a general expense under the Operating Expenses

section of the income statement?

a. Insurance Expense c. Depreciation Expense—Office Equipment

b. Office Salaries Expense d. Interest Expense

ANS: D PTS: 1 OBJ: 1

29. Which of the following is not considered to be a selling expense under the Operating Expenses

section of the income statement?

a. Store Supplies Expense c. Sales Salaries Expense

b. Sales Discounts d. Advertising Expense

ANS: B PTS: 1 OBJ: 1

30. Current assets typically include

a. store equipment. c. accounts payable.

b. land. d. accounts receivable.

ANS: D PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 12

31. Under which section of the balance sheet would the Accumulated Depreciation—Office Equipment

account appear?

a. Current Assets c. Plant Assets

b. Current Liabilities d. Owner’s Equity

ANS: C PTS: 1 OBJ: 1

32. Gross profit is obtained by

a. adding net sales and the cost of goods sold.

b. adding the selling expenses and the general expenses.

c. subtracting the cost of goods sold from the net sales.

d. subtracting the operating expenses from the net sales.

ANS: C PTS: 1 OBJ: 1

33. Net sales is obtained by

a. adding sales returns and allowances and sales discounts to operating expenses.

b. adding sales discounts to net purchases.

c. subtracting sales returns and allowances and sales discounts from sales.

d. adding sales discounts to sales.

ANS: C PTS: 1 OBJ: 1

34. All of the following are operating expenses except

a. Depreciation Expense—Store Equipment.

b. Insurance Expense.

c. Sales Discounts.

d. Salaries Expense.

ANS: C PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 13

35. Which of the following shows the correct order for preparation of the financial statements at the

end of the accounting period?

a. Statement of owner’s equity, balance sheet, income statement

b. Income statement, statement of owner’s equity, balance sheet

c. Income statement, balance sheet, statement of owner’s equity

d. Balance sheet, income statement, statement of owner’s equity

ANS: B PTS: 1 OBJ: 1

36. Working capital is total

a. current assets minus total current liabilities.

b. current assets plus total current liabilities.

c. expenses plus revenues.

d. liabilities minus total assets.

ANS: A PTS: 1 OBJ: 1

37. Current ratios of four companies are provided below. Select the current ratio of the company that

is in the best position to meet its short-term obligations.

a. 1.31 to 1 c. 2.3 to 1

b. 2.1 to 1 d. 1.4 to 1

ANS: C PTS: 1 OBJ: 1

38. Which of the following equations is true?

a. Sales Returns and Allowances + Sales Discounts = Net Sales

b. Purchases + Purchase Returns and Allowances = Net Purchases

c. Net Sales + Cost of Goods Sold = Gross Profit

d. Net Sales + Sales Discounts + Sales Returns and Allowances = Sales

ANS: D PTS: 1 OBJ: 1

39. The Income Summary account is closed to

a. Expenses. c. Owner’s Drawing.

b. Revenue. d. Owner’s Capital.

ANS: D PTS: 1 OBJ: 2

© Paradigm Publishing, Inc. 14

40. The Sales account is

a. credited during the closing process.

b. debited during the closing process.

c. not closed at the end of the accounting period.

d. debited during the adjusting process.

ANS: B PTS: 1 OBJ: 2

41. During the closing process, the Sales Discounts and Purchases Discounts accounts are

a. credited and debited, respectively. c. debited and debited, respectively.

b. debited and credited, respectively. d. credited and credited, respectively.

ANS: A PTS: 1 OBJ: 2

42. Beginning and ending merchandise inventory are

a. debited and credited, respectively, during the adjusting process.

b. credited and debited, respectively, during the closing process.

c. debited and credited, respectively, during the closing process.

d. credited and debited, respectively, during the adjusting process.

ANS: D PTS: 1 OBJ: 2

43. The entry to close the Sales Discounts account involves a debit to

a. Sales Discounts and a credit to Sales.

b. Sales and a credit to Sales Discounts.

c. Sales Discounts and a credit to Income Summary.

d. Income Summary and a credit to Sales Discounts.

ANS: D PTS: 1 OBJ: 2

© Paradigm Publishing, Inc. 15

44. The entry to close the owner’s drawing account involves a debit to the

a. Income Summary account and a credit to the owner’s drawing account.

b. owner’s drawing account and a credit to the owner’s capital account.

c. owner’s capital account and a credit to the owner’s drawing account.

d. owner’s drawing account and a credit to the Income Summary account.

ANS: C PTS: 1 OBJ: 2

45. Which of the following accounts is not closed?

a. Purchases c. Accumulated Depreciation

b. Sales Discounts d. Depreciation Expense

ANS: C PTS: 1 OBJ: 2

46. A debit balance in the owner’s drawing account on the post-closing trial balance would indicate

that

a. the company made a profit for the year.

b. an error was made in the closing process.

c. the company had a loss for the year.

d. the closing process is complete.

ANS: B PTS: 1 OBJ: 3

47. Which of the following accounts will not appear on a post-closing trial balance?

a. Sales c. Land

b. Store Supplies d. Accounts Payable

ANS: A PTS: 1 OBJ: 3

© Paradigm Publishing, Inc. 16

48. Frank’s Custom Fencing accrued $12,000 of wages on November 30, the end of the accounting

period. On December 4, $20,000 in wages were paid. If reversing entries are used, what is the

entry that Frank’s Custom Fencing made on December 1?

a. Debit Salaries Expense $8,000; credit Salaries Payable $8,000

b. Debit Salaries Payable $12,000; credit Cash $12,000

c. Debit Salaries Expense $20,000; credit Salaries Payable $20,000

d. Debit Salaries Payable $12,000; credit Salaries Expense $12,000

ANS: D PTS: 1 OBJ: 4

49. The reversing entry for accrued salaries of $500 involves a debit to

a. Income Summary and a credit to Salaries Expense for $500.

b. Salaries Expense and a credit to Salaries Payable for $500.

c. Salaries Payable and a credit to Cash for $500.

d. Salaries Payable and a credit to Salaries Expense for $500.

ANS: D PTS: 1 OBJ: 4

50. Reversing entries are

a. required entries.

b. identical to the adjusting entries made to record accrued expenses.

c. entries that complicate the bookkeeping for transactions that involve accrued

expenses.

d. made on the first day of the new accounting period.

ANS: D PTS: 1 OBJ: 4

SHORT ANSWER

1. Where does Interest Expense appear on the income statement?

ANS:

Interest Expense appears at the bottom of the income statement in the Other Expenses section.

PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 17

2. Why is Interest Expense not included in the calculation of Income from Operations?

ANS:

Interest expense is considered the cost of borrowing money, not a cost of operating the business.

PTS: 1 OBJ: 1

3. What is gross profit?

ANS:

Gross profit is calculated as Net Sales less Cost of Goods Sold.

PTS: 1 OBJ: 1

4. What is the difference between gross profit and net income?

ANS:

Gross profit is Net Sales less Cost of Goods Sold. Net income is Gross Profit less the operating

expenses of the business (plus or minus any other income or other expenses).

PTS: 1 OBJ: 1

5. What is a current asset?

ANS:

Currents assets consist of cash and assets that will be sold, converted to cash, or used up within one

year. Examples are accounts receivable, supplies, and prepaid insurance.

PTS: 1 OBJ: 1

6. What is a plant asset?

ANS:

Plant assets are assets that are expected to be used in the business for more than one year.

PTS: 1 OBJ: 1

7. What is working capital?

ANS:

Working capital is the amount by which current assets exceed current liabilities.

PTS: 1 OBJ: 1

8. In the closing entry that closes revenue (sales), what other accounts are also closed?

ANS:

Along with Sales, we close any other income statement accounts that have a credit balance.

PTS: 1 OBJ: 2

© Paradigm Publishing, Inc. 18

9. In a service business, the second closing entry is made to close expenses. How does this entry

differ in a merchandising business?

ANS:

In a merchandising business, this entry will also close the other income statement accounts that

have a debit balance. This will include purchases, sales returns and allowances, and sales discounts.

PTS: 1 OBJ: 2

10. What account is credited when we adjust for accrued salaries?

ANS:

We credit Salaries Payable when adjusting for accrued salaries.

PTS: 1 OBJ: 2

PROBLEM

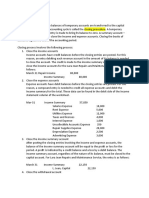

1. Prepare the Cost of Goods Sold section of a classified income statement for Whites’ Automotive

Sales for the year ended December 31, 20X3, based on the following information:

ANS:

PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 19

2. Prepare a classified income statement for Whittier’s Office Equipment for the year ended

December 31, 20X1, using the following condensed account balances:

ANS:

PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 20

3. Prepare a classified balance sheet for Mervin’s Auto Parts as of December 31, 20X2, based on the

following account balances:

ANS:

PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 21

4. Prepare a statement of owner’s equity for Charlie’s Shoes for the year ended December 31, 20XX,

based on the following information:

ANS:

PTS: 1 OBJ: 1

5. For each independent situation below, compute the missing numbers.

ANS:

PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 22

6. Based on the following balances, calculate (a) the working capital and (b) the current ratio.

a. Working capital = ___________________________

b. Current ratio = ___________________________

ANS:

PTS: 1 OBJ: NA

© Paradigm Publishing, Inc. 23

7. Prepare adjusting entries in general journal form for Farmington Fabrics for the year ended

December 31, 20X3, based on the following data:

a. Salaries accrued at year-end, $1,350.

b. Ending merchandise inventory, $12,750.

c. Insurance expired during the current year, $2,650.

d. Depreciation on the office equipment for the current year, $3,000.

e. Beginning merchandise inventory,$17,100.

f. Depreciation on the store equipment for the current year, $6,000.

ANS:

General Journal Page 1

Date Account Title Debit Credit

Adjusting Entries

a. 20X3

Dec. 31 Salaries Expense 1,350

Salaries Payable 1,350

b. 31 Merchandise Inventory 12,750

Income Summary 12,750

c. 31 Insurance Expense 2,650

Prepaid Insurance 2,650

d. 31 Depr. Exp.—Office Equipment 3,000

Accum. Depr.—Office Equipment 3,000

e. 31 Income Summary 17,100

Merchandise Inventory 17,100

f. 31 Depr. Exp.—Store Equipment 6,000

Accum. Depr.—Store Equipment 6,000

PTS: 1 OBJ: 2

© Paradigm Publishing, Inc. 24

8. Prepare closing entries in general journal form for Silkie’s Hosiery as of December 31, 20XX,

using the following account balances. Assume that the Income Summary account has a credit

balance of $10,000 after adjusting for the beginning and ending merchandise inventory.

ANS:

General Journal Page 1

Date Account Title Debit Credit

Closing Entries

20X3

Dec. 31 Sales 952,000

Purchases Returns and Allowances 16,500

Purchases Discounts 19,500

Income Summary 988,000

31 Income Summary 902,000

Purchases 490,000

Sales Returns and Allowances 25,000

Sales Discounts 32,000

Sales Salaries Expense 120,000

Office Salaries Expense 89,000

Utilities Expense 60,000

Depreciation Expense—Equipment 39,000

Rent Expense 36,000

Insurance Expense 9,000

Interest Expense 2,000

31 Income Summary 96,000

Jasmine Turner, Capital 96,000

31 Jasmine Turner, Capital 10,000

Jasmine Turner, Drawing 10,000

PTS: 1 OBJ: 2

© Paradigm Publishing, Inc. 25

9. Prepare a post-closing trial balance for Samantha’s Jewelry as of December 31, 20X2, using the

following account balances. You will need to compute the amount of net income for the current

year in order to determine the ending balance of the owner’s capital account.

ANS:

© Paradigm Publishing, Inc. 26

PTS: 1 OBJ: 3

10. Prepare the adjusting entry and the reversing entry for $850 of accrued salaries for the year ended

December 31, 20X1.

ANS:

PTS: 1 OBJ: 4

ESSAY

1. Assume that you are teaching an accounting course. At one class session, you hear the students

using the terms gross profit and net income interchangeably. You make a note to talk to them

about the difference between these terms during the next class session. How will you explain the

difference between the two terms?

ANS:

Gross profit is the difference between net sales and cost of goods sold. Net income, however, is the

difference between gross profit and operating expenses plus other income (if any) and less other

expenses (if any).

PTS: 1 OBJ: 1

2. You are the owner of a business. Your accountant tells you that your working capital is $10,000.

Is this good or bad? Explain.

ANS:

Knowing that we have $10,000 in working capital does not give us a full measure of the firm’s

liquidity. To more accurately measure liquidity, we need to know more. We need to calculate the

current ratio.

For example, if we have $100,000 in current assets and $90,000 in current liabilities, we would

have $10,000 in working capital. However, our current ratio would only be 1.11 to 1 (100,000 ÷

90,000). This means that we may not be able to meet our short-term obligations.

But suppose that we have $20,000 in current assets and $10,000 in current liabilities. We

would still have $10,000 in working capital. However, our current ratio would be 2 to 1 (20,000 ÷

10,000). This would indicate that we are in a very good position to meet our short-term

obligations.

We have $10,000 in working capital in both examples above. However, as illustrated, we need

to know the ratio between current assets and current liabilities in order to evaluate liquidity. This

is why we use the current ratio.

PTS: 1 OBJ: 1

© Paradigm Publishing, Inc. 27

3. Assume that the business where you work, Finley Company, was recently flooded. Unfortunately,

most of the recovered accounting records were not legible. However, you did find the following

general journal entries for 20X1. Is it possible to construct an income statement from this

information? Why or why not?

ANS:

The general journal entries recovered are the closing entries for the accounting period. These

entries show the revenue, costs, and expenses as well as net income for the period. A simple

income statement can be constructed if the detail of the Cost of Goods Sold section is not needed.

Although the third closing entry makes it possible for us to calculate what the balance in Income

Summary must have been after adjusting for inventories, this entry alone does not give us a value

for beginning and ending inventory. We will need to know the beginning and ending balances in

merchandise inventory to prepare a detailed Cost of Good Sold section of the income statement.

If only the ending inventory balance is available, the beginning inventory can be derived.

PTS: 1 OBJ: 2

4. Suppose that the junior bookkeeper in your office sends you an e-mail asking if it is necessary to

reverse adjusting entries. She says that she feels it is an extra step that is just a waste of time. How

would you answer her question?

ANS:

Reversing entries are not necessary, but they can be helpful. For example, reversing the adjusting

entries for accrued expenses allows the accountant to make routine entries when the accrued

expenses are paid in the next accounting period. Even though reversing entries take a little more

time now, they will save time later because the accountant does not have to look back at the

previous period to see how much of a payment relates to that period and how much relates to the

current period.

PTS: 1 OBJ: 4

© Paradigm Publishing, Inc. 28

5. Assume that you are an accountant for a small software company. One day, you are planning to

have lunch with a friend who works at another software company. She comes to your office just as

you are completing financial statements for your firm. She tells you that she is curious about how

your firm is doing and asks to see the financial statements. How should you respond to this

request?

ANS:

Anyone who does accounting work for a business has a responsibility to keep its financial

information confidential. It is unethical to show private records and reports to outsiders.

PTS: 1 OBJ: NA

© Paradigm Publishing, Inc. 29

You might also like

- 2024 Becker CPA Financial (FAR) Mock Exam AnswersDocument28 pages2024 Becker CPA Financial (FAR) Mock Exam AnswerscraigsappletreeNo ratings yet

- Business Plan EditedDocument24 pagesBusiness Plan EditedEduardo Anerdez87% (15)

- Gitman Chapter 3 SolutionDocument21 pagesGitman Chapter 3 SolutionNauman Iqbal75% (4)

- Financial Accounting ChapterDocument23 pagesFinancial Accounting Chapterronnel100% (1)

- Ratio Analysis Activity - Answer KeyDocument4 pagesRatio Analysis Activity - Answer KeyLysss Epssss100% (1)

- English Grammar Diagnostic Test With Answers PDFDocument5 pagesEnglish Grammar Diagnostic Test With Answers PDFLoges Warry0% (1)

- Chapter 22-Performance Evaluation For Decentralized OperationsDocument25 pagesChapter 22-Performance Evaluation For Decentralized OperationsCNo ratings yet

- Chapter 4-Completing The Accounting Cycle: True/FalseDocument27 pagesChapter 4-Completing The Accounting Cycle: True/FalseJhopel Casagnap EmanNo ratings yet

- Full Download Financial Management Theory and Practice 2nd Edition Brigham Test BankDocument33 pagesFull Download Financial Management Theory and Practice 2nd Edition Brigham Test Bankjosephkvqhperez100% (36)

- Corporate Finance 3rd Edition Graham Test BankDocument18 pagesCorporate Finance 3rd Edition Graham Test BankRoderick RonidelNo ratings yet

- Accounting Information For Business Decisions 1st Edition Cunningham Test Bank DownloadDocument9 pagesAccounting Information For Business Decisions 1st Edition Cunningham Test Bank DownloadMarilyn Clayton100% (23)

- Accounting For Merchandising BusinessDocument27 pagesAccounting For Merchandising Businessarnel barawedNo ratings yet

- Accounting For Merchandising Operations Chapter 6 Test Questions PDFDocument31 pagesAccounting For Merchandising Operations Chapter 6 Test Questions PDFDe Torres JobelNo ratings yet

- Preparing Financial Statements: (International Stream)Document13 pagesPreparing Financial Statements: (International Stream)Jerahmeel JalalNo ratings yet

- Jam QaDocument7 pagesJam QaVinluan JeromeNo ratings yet

- Audit of Receivables 1Document3 pagesAudit of Receivables 1Jeffrey Perez0% (2)

- FAR ReviewDocument9 pagesFAR ReviewJude Vincent VittoNo ratings yet

- Ratio Analysis: FM1 Activities and Quizzes Page 1Document3 pagesRatio Analysis: FM1 Activities and Quizzes Page 1132345usdfghjNo ratings yet

- Acc 142 p3 Exam Set A 1Document10 pagesAcc 142 p3 Exam Set A 1Vincenzo CassanoNo ratings yet

- Easy Round 1 Point Each Theory - 10 Seconds Problem - 15 SecondsDocument8 pagesEasy Round 1 Point Each Theory - 10 Seconds Problem - 15 Secondsby ScribdNo ratings yet

- Level 1 Questions FinalDocument10 pagesLevel 1 Questions FinalExequielCamisaCrusperoNo ratings yet

- MidtermDocument12 pagesMidtermCsb Finance100% (3)

- Á Ï° ° а CH 04Document31 pagesÁ Ï° ° а CH 04Cooper89No ratings yet

- Chapter 2Document22 pagesChapter 2Jhopel Casagnap EmanNo ratings yet

- TB21Document33 pagesTB21Aiden Pats100% (1)

- Hancock9e Testbank ch06Document18 pagesHancock9e Testbank ch06杨子偏No ratings yet

- Chapter 5Document18 pagesChapter 5Jhopel Casagnap EmanNo ratings yet

- P1 Kaplan Q PDFDocument76 pagesP1 Kaplan Q PDFLidiya KhadjibayevaNo ratings yet

- Accounting For Merchandising Operations - Chapter 6 Test QuestionsDocument31 pagesAccounting For Merchandising Operations - Chapter 6 Test QuestionsNoyb71% (7)

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- 2A. Financial Statement AnalysisDocument116 pages2A. Financial Statement AnalysisHitesh AgaleNo ratings yet

- The Immaterial Cost of The Leasehold Shall Be Amortized Over The LifeDocument3 pagesThe Immaterial Cost of The Leasehold Shall Be Amortized Over The Lifeelsana philipNo ratings yet

- Cma Esp Additional Practice Questions Part 2 FinalDocument175 pagesCma Esp Additional Practice Questions Part 2 FinalPattyNo ratings yet

- Examination Question and Answers, Set D (True or False), Chapter 15 - Statement of Cash FlowDocument1 pageExamination Question and Answers, Set D (True or False), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Unit 2 - Essay QuestionsDocument8 pagesUnit 2 - Essay QuestionsJaijuNo ratings yet

- Partnership Operation Quiz 1 Combined OnlineDocument7 pagesPartnership Operation Quiz 1 Combined OnlineZyka SinoyNo ratings yet

- Final Round - 1ST - QDocument6 pagesFinal Round - 1ST - QwivadaNo ratings yet

- E-Book - Final Accounts - PDF OnlyDocument34 pagesE-Book - Final Accounts - PDF OnlyAshish GuptaNo ratings yet

- Dry RunDocument5 pagesDry RunMarc MagbalonNo ratings yet

- TB21 PDFDocument33 pagesTB21 PDFJi WonNo ratings yet

- 1st Year Answer Key Online Quiz 2021 1st WaveDocument9 pages1st Year Answer Key Online Quiz 2021 1st Wavegigi meiNo ratings yet

- MODULE 7 and 8 ACCDocument3 pagesMODULE 7 and 8 ACCnorie jane pacisNo ratings yet

- CmaDocument175 pagesCmasmarzooqNo ratings yet

- Financial Statements Presentation - Learner Copy v1Document63 pagesFinancial Statements Presentation - Learner Copy v1Hirschmitha GeneshNo ratings yet

- Fabm1 Grade-11 Qtr4 Module5 Week-5Document6 pagesFabm1 Grade-11 Qtr4 Module5 Week-5Crestina Chu BagsitNo ratings yet

- NCR CUP 1 ELIMINATION ROUND and CLINCHERDocument9 pagesNCR CUP 1 ELIMINATION ROUND and CLINCHERMich ClementeNo ratings yet

- FSW-Cash Flow 070218Document8 pagesFSW-Cash Flow 070218March AthenaNo ratings yet

- Unit Number/ Heading Learning Outcomes: Intermediate Accounting Iii (Ae 17) Learning Material: Single EntryDocument5 pagesUnit Number/ Heading Learning Outcomes: Intermediate Accounting Iii (Ae 17) Learning Material: Single EntrySandia EspejoNo ratings yet

- Closing EntriesDocument13 pagesClosing EntriesAlliyah Manzano CalvoNo ratings yet

- Final Exam Adv Acctg2 - 1st Sem Sy2012-2013Document19 pagesFinal Exam Adv Acctg2 - 1st Sem Sy2012-2013John Paul LappayNo ratings yet

- Practical Accounting TwoDocument25 pagesPractical Accounting TwoJoseph SalidoNo ratings yet

- QUIZ 2. MC - Before Chap5Document9 pagesQUIZ 2. MC - Before Chap5minhhquyetNo ratings yet

- BAC 111 Final Exams With QuestionsDocument8 pagesBAC 111 Final Exams With Questionsjanus lopezNo ratings yet

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BNo ratings yet

- Final Examination AK (60 COPIES)Document9 pagesFinal Examination AK (60 COPIES)Sittie Ainna A. UnteNo ratings yet

- FA Objectives (Batch B)Document16 pagesFA Objectives (Batch B)ssreemurugNo ratings yet

- Quiz in ELEC 01 (Inventory Estimation)Document3 pagesQuiz in ELEC 01 (Inventory Estimation)djanine cardinalesNo ratings yet

- Merchant BankingDocument50 pagesMerchant BankingthensureshNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Consumer and Business Buyer Behavior FaqDocument35 pagesConsumer and Business Buyer Behavior FaqLoges WarryNo ratings yet

- Hubungan Antara Perilaku Menyimak Akun Tik Tok BasDocument9 pagesHubungan Antara Perilaku Menyimak Akun Tik Tok BasLoges WarryNo ratings yet

- Petronas Group of Companies 2021Document7 pagesPetronas Group of Companies 2021Loges WarryNo ratings yet

- English Grammar Exercises With Answers 3400Document440 pagesEnglish Grammar Exercises With Answers 3400Loges Warry100% (4)

- Form Two Poems With AnswersDocument20 pagesForm Two Poems With AnswersJayalalidha Vesovalingam88% (17)

- Eproceeding Isych 2021Document226 pagesEproceeding Isych 2021Loges WarryNo ratings yet

- Kya Hua Tera Wada Official LyricsDocument2 pagesKya Hua Tera Wada Official LyricsLoges WarryNo ratings yet

- English Grammar PDFDocument5 pagesEnglish Grammar PDFLoges WarryNo ratings yet

- Mankind Pharma Limited RHPDocument588 pagesMankind Pharma Limited RHPArmeet ChhatwalNo ratings yet

- Accounting For Income Tax..Document11 pagesAccounting For Income Tax..kalyanshreeNo ratings yet

- Assignment 1 13032021 121200pmDocument9 pagesAssignment 1 13032021 121200pmSagar SinghNo ratings yet

- 6 Cash Flow StatementDocument255 pages6 Cash Flow StatementJaskaran KharoudNo ratings yet

- Mittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Document6 pagesMittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Shubham KuberkarNo ratings yet

- Profit & Loss Statement Details Amt Amt AmtDocument2 pagesProfit & Loss Statement Details Amt Amt AmtcyruskuleiNo ratings yet

- Cfas MidtermDocument192 pagesCfas MidtermIamkitten 00No ratings yet

- 12 Accountancy Accounting For Partnership Firms Fundamentals Impq 3Document5 pages12 Accountancy Accounting For Partnership Firms Fundamentals Impq 3Adam ZakriNo ratings yet

- AFAR-01 (Partnership Formation and Operations)Document6 pagesAFAR-01 (Partnership Formation and Operations)Ruth RodriguezNo ratings yet

- Lecture Notes: Afar de Leon/De Leon/De Leon/Tan 2901-Partnerships Batch: October 2020Document12 pagesLecture Notes: Afar de Leon/De Leon/De Leon/Tan 2901-Partnerships Batch: October 2020RAVEN REI GARCIANo ratings yet

- The Real Effects of A New Accounting Standard The Case of IFRS 15 Revenue From Contracts With CustomersDocument31 pagesThe Real Effects of A New Accounting Standard The Case of IFRS 15 Revenue From Contracts With Customersaccount.oswald.o.20No ratings yet

- Migrating From Classic GL To NewGLDocument8 pagesMigrating From Classic GL To NewGLtifossi6665No ratings yet

- Fundamentals of Accountancy, Business, and Management 2Document31 pagesFundamentals of Accountancy, Business, and Management 2Honey ShenNo ratings yet

- Deferred Tax Ias 12Document22 pagesDeferred Tax Ias 12Jawad Akbar KhanNo ratings yet

- CH 02 Financial Statements, Cash Flow, and Taxes: Cengage Learning Testing, Powered by CogneroDocument70 pagesCH 02 Financial Statements, Cash Flow, and Taxes: Cengage Learning Testing, Powered by CogneroSamuel DebebeNo ratings yet

- Far - Mock BoardDocument11 pagesFar - Mock BoardKial PachecoNo ratings yet

- Basic AccoDocument27 pagesBasic AccoJasmine ActaNo ratings yet

- ACT 201 Chapter 6Document48 pagesACT 201 Chapter 6Sadia ShithyNo ratings yet

- Adv Acc Chapter4Document13 pagesAdv Acc Chapter4Reanne Claudine LagunaNo ratings yet

- XLS092 XLS EnG Tire City RaghuDocument48 pagesXLS092 XLS EnG Tire City RaghuNaveen KumarNo ratings yet

- Soal Teori:: Petunjuk: Kerjakan SOAL TEORI Dan SOAL PRAKTIKA Pada Kolom Jawaban Yang Tersedia !!Document6 pagesSoal Teori:: Petunjuk: Kerjakan SOAL TEORI Dan SOAL PRAKTIKA Pada Kolom Jawaban Yang Tersedia !!irma purnama ningrumNo ratings yet

- 0450 s09 QP 1Document25 pages0450 s09 QP 1AnuNairNo ratings yet

- Accounting Principles (BUS 505)Document71 pagesAccounting Principles (BUS 505)S. M. Fahmidunnabi 2035150660No ratings yet

- Mgac CustomDocument123 pagesMgac CustomJoana TrinidadNo ratings yet

- 2 Partnership OperationDocument2 pages2 Partnership OperationMichael CayabyabNo ratings yet

- Partnership A Level ClassifiedDocument3 pagesPartnership A Level ClassifiedArShadNo ratings yet

- CH 09Document69 pagesCH 09Navindra Jaggernauth100% (1)

- PandL Account Presentation - FinalDocument21 pagesPandL Account Presentation - Finalapi-3712367No ratings yet

- Cost AssignmentDocument6 pagesCost AssignmentBella RonahNo ratings yet