Professional Documents

Culture Documents

LLP October 18

LLP October 18

Uploaded by

M/s L K Maheshwari & Co BHOPALOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LLP October 18

LLP October 18

Uploaded by

M/s L K Maheshwari & Co BHOPALCopyright:

Available Formats

Skip to Main Content A+ A-

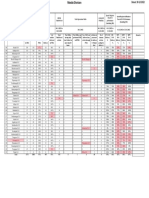

Goods and Services Tax H K KRISHI SUVIDHA

23AAHFH6844A1ZQ

Dashboard Returns GSTR-1 B2CS English

7 - B2C (Others) HELP

ADD RECORD IMPORT EWB DATA

Processed Records

Records Per Page :

10

Place of Rate Total Integrated Central tax State/UT Cess Applicable Actions

Supply (%) Taxable Tax (₹) (₹) Tax (₹) (₹) percentage(%)

(Name Value

of

State)

Madhya

18 29,60,131.57 0.00 2,66,411.84 2,66,411.84 0.00 -

Pradesh

Madhya

12 10,732.15 0.00 643.93 643.93 0.00 -

Pradesh

Madhya

28 1,299.13 0.00 181.88 181.88 0.00 -

Pradesh

Madhya

5 22,69,355.07 0.00 56,733.88 56,733.88 0.00 -

Pradesh

BACK

© 2018-19 Goods and Services Tax Network Site Last Updated on 16-12-2022

Designed & Developed by GSTN

Site best viewed at 1024 x 768 resolution in Microsoft Edge, Google Chrome 49+, Firefox 45+ and Safari 6+

You might also like

- Hindustan Unilever RBSDocument6 pagesHindustan Unilever RBSJwalit VyasNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument2 pagesGoods & Service Tax (GST) - User DashboardM/s L K Maheshwari & Co BHOPALNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument2 pagesGoods & Service Tax (GST) - User Dashboardkasim shekNo ratings yet

- Goods & Services Tax (GST) - GSTR2B122Document2 pagesGoods & Services Tax (GST) - GSTR2B122rauniyar97No ratings yet

- Goods & Service Tax (GST) - Buy Best E Scooters InvoicesDocument1 pageGoods & Service Tax (GST) - Buy Best E Scooters InvoicesPrabhat TejaNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument2 pagesGoods & Service Tax (GST) - User DashboardPrahlad JhaNo ratings yet

- Goods & Service Tax (GST) - R.K Engineering InvoicesDocument1 pageGoods & Service Tax (GST) - R.K Engineering InvoicesPrabhat TejaNo ratings yet

- Bill 108376076708047264836597531Document1 pageBill 108376076708047264836597531Priyanshu UpadhyayNo ratings yet

- Goods & Service Tax (GST) - Sprint Wheels InvoicesDocument1 pageGoods & Service Tax (GST) - Sprint Wheels InvoicesPrabhat TejaNo ratings yet

- Bill 99612594247046716908790020 3Document1 pageBill 99612594247046716908790020 3Priyanshu UpadhyayNo ratings yet

- DRC by Cash Ladger DT 5-2-2020Document1 pageDRC by Cash Ladger DT 5-2-2020pratyushkushwaha064No ratings yet

- Goods & Service Tax (GST) - Buy Best e Scooter Invocie 1200Document3 pagesGoods & Service Tax (GST) - Buy Best e Scooter Invocie 1200Prabhat TejaNo ratings yet

- VCCEdgeDocument1 pageVCCEdgeTanyaNo ratings yet

- Bill 99612594247046716908790020 3Document1 pageBill 99612594247046716908790020 3Priyanshu UpadhyayNo ratings yet

- As MLM FRESH RSVP - Hollard Life Solutions MLM Roadshow - 11 - 29 April 2024 (CE-FE-110424)Document1 pageAs MLM FRESH RSVP - Hollard Life Solutions MLM Roadshow - 11 - 29 April 2024 (CE-FE-110424)lovetksmNo ratings yet

- Laxmi Timber 2 BillDocument1 pageLaxmi Timber 2 BillAcma Renu SinghaniaNo ratings yet

- Goods and Services Tax: 4A, 4B, 6B, 6C - B2B, SEZ, DE InvoicesDocument1 pageGoods and Services Tax: 4A, 4B, 6B, 6C - B2B, SEZ, DE Invoicesgurdyal672No ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- Goods and Services Tax: B2B Invoices - Receiver-Wise-SummaryDocument2 pagesGoods and Services Tax: B2B Invoices - Receiver-Wise-SummaryVaibhav JainNo ratings yet

- Bill 99612594247046716908790020 3 PDFDocument1 pageBill 99612594247046716908790020 3 PDFPriyanshu UpadhyayNo ratings yet

- SmartwatchDocument1 pageSmartwatchAnjan KumarNo ratings yet

- 2425 - 293 - Invoice - DK Studio - 2200Document1 page2425 - 293 - Invoice - DK Studio - 2200aditi.logicraysNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash Memoharishankar chourasiyaNo ratings yet

- Bill 99612594247046716908790020 3Document1 pageBill 99612594247046716908790020 3Priyanshu UpadhyayNo ratings yet

- Moneycontrol VedantaDocument1 pageMoneycontrol VedantaJaskeerat SinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoShivam bohemia raja harzaiNo ratings yet

- ABC Company Balance Sheet For The Period Ended in PesoDocument41 pagesABC Company Balance Sheet For The Period Ended in Pesojosh lunarNo ratings yet

- S K Construction Trading 2021Document3 pagesS K Construction Trading 2021SPM CONSTECHNo ratings yet

- PAGSDocument24 pagesPAGSAndre TorresNo ratings yet

- Bill 111212431958887007036333365Document1 pageBill 111212431958887007036333365ashish15dixNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument1 pageGoods & Service Tax (GST) - User Dashboardpratyushkushwaha064No ratings yet

- Lic June 2021Document1 pageLic June 2021Rajanikant PandeyNo ratings yet

- Invoice 1Document1 pageInvoice 1ramos.jeffNo ratings yet

- Kainantu Urban Local Level Governmen: Village Service Grant - AdministrationDocument1 pageKainantu Urban Local Level Governmen: Village Service Grant - AdministrationMichael MotanNo ratings yet

- Analytics CloudDocument1 pageAnalytics CloudAbhijit SarkarNo ratings yet

- The Heights of ReadershipDocument1 pageThe Heights of Readershipspartan sportNo ratings yet

- Od330616893652144200 1Document2 pagesOd330616893652144200 1sontoshroy7368No ratings yet

- Tengah Bulan Driver Periode 1 - 15 Maret 2022Document4 pagesTengah Bulan Driver Periode 1 - 15 Maret 2022Asep Ali Muhamad RamdanNo ratings yet

- Reliance 2Document3 pagesReliance 2probin royNo ratings yet

- Invoice OR2301228571Document2 pagesInvoice OR2301228571Subhajit BhoiNo ratings yet

- Daily Revenue Report DT Business Bay: 02 March 2021Document1 pageDaily Revenue Report DT Business Bay: 02 March 2021Jeric VendiolaNo ratings yet

- Listed Companies Highlights: Financial FocusDocument1 pageListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsNo ratings yet

- Credit Note 001Document1 pageCredit Note 001Nisant RajNo ratings yet

- Dalmia Bharat Sugar Bill No. 21 PDFDocument3 pagesDalmia Bharat Sugar Bill No. 21 PDFsanjayNo ratings yet

- Xtreme Neckband InvoiceDocument1 pageXtreme Neckband Invoicegemop56660No ratings yet

- Invoice Oo1 OctDocument1 pageInvoice Oo1 OctUbuntu AakashNo ratings yet

- Invoice TemplateDocument1 pageInvoice TemplateUrpi Samara CNo ratings yet

- LM 3272 23-24Document1 pageLM 3272 23-24BhupendraNo ratings yet

- H.G. Group of Compnay Pvt. Ltd. Ghorahi-15, Dang Key Ratios and IndicatorsDocument16 pagesH.G. Group of Compnay Pvt. Ltd. Ghorahi-15, Dang Key Ratios and IndicatorsChandra Prakash PandeyNo ratings yet

- 09 September 2023.10.01Document4 pages09 September 2023.10.01amnrsNo ratings yet

- Emp Adj Ledger ReportDocument2 pagesEmp Adj Ledger ReportHimanshu AggarwalNo ratings yet

- Cas Summary Report 2022 08 19 123504Document5 pagesCas Summary Report 2022 08 19 123504aman feriadNo ratings yet

- AlkatechDocument2 pagesAlkatechswamiNo ratings yet

- Bill 12428172Document1 pageBill 12428172saksham tripathiNo ratings yet

- 281 Kainantu Urban Local Level Government 281: Prepared By: Rosita Ben Tubavai A/financial ControllerDocument1 page281 Kainantu Urban Local Level Government 281: Prepared By: Rosita Ben Tubavai A/financial ControllerMichael MotanNo ratings yet

- Medak 16Document1 pageMedak 16Hyderabad Postal RegionNo ratings yet

- ElectronicCreditLedger SepDocument1 pageElectronicCreditLedger Sepddnc gstNo ratings yet

- All ARN of Refund ApplicationDocument1 pageAll ARN of Refund Applicationbangladesh highcommissionNo ratings yet

- Tax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacAashima sharmaNo ratings yet

- Speed Changers, Drives & Gears World Summary: Market Values & Financials by CountryFrom EverandSpeed Changers, Drives & Gears World Summary: Market Values & Financials by CountryNo ratings yet

- AFMS NHAI-AFMSDocument1 pageAFMS NHAI-AFMSM/s L K Maheshwari & Co BHOPALNo ratings yet

- Impact of GST On Indian Railways: PreambleDocument24 pagesImpact of GST On Indian Railways: PreambleM/s L K Maheshwari & Co BHOPALNo ratings yet

- Latest List of Imported Items Available For Indigenisation Uploaded at OFB Website On 04-05-2020Document22 pagesLatest List of Imported Items Available For Indigenisation Uploaded at OFB Website On 04-05-2020M/s L K Maheshwari & Co BHOPALNo ratings yet

- 1566905444nit Bllskol0051920Document20 pages1566905444nit Bllskol0051920M/s L K Maheshwari & Co BHOPALNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument2 pagesGoods & Service Tax (GST) - User DashboardM/s L K Maheshwari & Co BHOPALNo ratings yet

- AIChE Journal - 2020 - Zhao - Waste High Density Polyethylene Recycling Process Systems For Mitigating Plastic PollutionDocument25 pagesAIChE Journal - 2020 - Zhao - Waste High Density Polyethylene Recycling Process Systems For Mitigating Plastic PollutionAhmet AltunNo ratings yet

- There's No Pill For This - IntroductionDocument4 pagesThere's No Pill For This - IntroductionChelsea Green PublishingNo ratings yet

- 24 Solar TermsDocument98 pages24 Solar TermsWei Yu LowNo ratings yet

- Power Electronics Project TitlesDocument4 pagesPower Electronics Project Titlesvmurali.infoNo ratings yet

- Ch9 2021 2Document19 pagesCh9 2021 2muhiafrancis975No ratings yet

- Metodo Hach HierroDocument6 pagesMetodo Hach HierroJESSICA VANESSA ARISMENDI AVILEZNo ratings yet

- 61cm InfoDocument4 pages61cm InfoHow to do anything By HimanshuNo ratings yet

- Tilt TableDocument2 pagesTilt TablenikhilNo ratings yet

- Wachemo UniversityDocument48 pagesWachemo UniversityMarshet yohannes100% (1)

- Faisal Hasan Hasib (Blue)Document2 pagesFaisal Hasan Hasib (Blue)Rashedur RahmanNo ratings yet

- L3D2-Asking Sentences and Telling SentencesDocument20 pagesL3D2-Asking Sentences and Telling SentencesFaye PongasiNo ratings yet

- Criminalistics Compilation Notes - 2Document215 pagesCriminalistics Compilation Notes - 2Ldrrmo IpilNo ratings yet

- Dressmaking 9 - Q2 - Module-2Document21 pagesDressmaking 9 - Q2 - Module-2Judith Bernadez-EspenidoNo ratings yet

- New Microsoft Word Document Tofik ProposalDocument12 pagesNew Microsoft Word Document Tofik ProposalenbakomNo ratings yet

- Slug LowDocument13 pagesSlug LowDr Mohammed AzharNo ratings yet

- Assembly BuildingDocument1 pageAssembly BuildingHarshit RajNo ratings yet

- Reconsidering Mary of BethanyDocument18 pagesReconsidering Mary of BethanyGeorgeAbhayanandOicNo ratings yet

- 1st Periodical Test in IctDocument3 pages1st Periodical Test in IctWander Mary81% (16)

- The Elusive Chemical Potential PDFDocument12 pagesThe Elusive Chemical Potential PDFbonesisaliveNo ratings yet

- CloudEngine 7800&6800&5800 V100R005 (C00&C10) Configuration Guide - Ethernet SwitchingDocument637 pagesCloudEngine 7800&6800&5800 V100R005 (C00&C10) Configuration Guide - Ethernet SwitchingAlexander VasquezNo ratings yet

- Samsung UA55KU7000 55 Inch 139cm Smart Ultra HD LED LCD TV User ManualDocument18 pagesSamsung UA55KU7000 55 Inch 139cm Smart Ultra HD LED LCD TV User ManualGuruprasad NagarajasastryNo ratings yet

- Oil Pressure Transmission PT2509Document3 pagesOil Pressure Transmission PT2509Trisna TeaNo ratings yet

- Adélia TrabalhoDocument9 pagesAdélia TrabalhoAmador Ambriz ZondaNo ratings yet

- Employees Satisfaction in Indian Oil Corporation LimitedDocument14 pagesEmployees Satisfaction in Indian Oil Corporation LimitedBharat Makkar100% (1)

- Strategic Management Case Study: Prepared by Group #1 Emba14BDocument39 pagesStrategic Management Case Study: Prepared by Group #1 Emba14BKalyaniDudhane-PawadeNo ratings yet

- Memory Addressing and Instruction FormatsDocument9 pagesMemory Addressing and Instruction Formatsrobern ndoloNo ratings yet

- Vine-Vpdc Report As of Feb. 3, 2022Document9 pagesVine-Vpdc Report As of Feb. 3, 2022Elbert Ryan OcampoNo ratings yet

- Ca3 Week1 ModuleDocument16 pagesCa3 Week1 ModuleKate Serrano ManlutacNo ratings yet

- Revised Esl Resume Dli May 28 2020Document3 pagesRevised Esl Resume Dli May 28 2020api-521981536No ratings yet