Professional Documents

Culture Documents

Untitled 9

Untitled 9

Uploaded by

Mclovia Kyla TelenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled 9

Untitled 9

Uploaded by

Mclovia Kyla TelenCopyright:

Available Formats

BOOKKEEPING

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 1 of 75

COMPETENCIES:

• Basic competencies (20 hours)

• Common Competencies (24 hours)

• Core Competencies (248 hours)

1 Journalize transactions

2 Post transactions

3 Prepare trial balance

4 Prepare financial reports

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 2 of 75

ACCOUNTING OVERVIEW

Importance of Records

• By keeping records, the owner will have the ability to assess which

transactions provided him income and which transactions resulted to

expenses. He can also assess if he will have the ability to pay his debts

on time.

• In business arena, accounting is the language. It would not be easy to

account economic transactions without records. The records will tell

the story concerning the progress and position of the business.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 3 of 75

REPUBLIC ACT No. 9298

(Philippine Accountancy Act of

2004)

• The present law that governs the accounting in the

Philippines.

• As a whole accountants use rules, procedures, practice

and standards followed in the preparation and

presentation of financial statements known as

Generally Accepted Accounting Principles (GAAP).

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 4 of 75

ACCOUNTING

• “the process of identifying, measuring, communicating

economic information to permit informed judgment and

decision by users of the information”

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 5 of 75

Identifying

• The process of recognition and nonrecognition of

business activities as “accountable” events.

• Accountable events occur when it affects an entity’s

assets, liabilities and equity .

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 6 of 75

Measuring

• Process of assigning peso amounts to the accountable

economic transactions and events.

• In the Philippines, Philippine peso is the unit of

measuring accountable economic transactions.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 7 of 75

Communicating

• Process of preparing and distributing accounting reports

to possible users of accounting information.

• Implicit in the communication process are recording,

classifying and summarizing aspects of accounting.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 8 of 75

Recording

• Another name for recording is bookkeeping or

journalizing.

• It refers to writing business data such as economic

transactions and events on the books of the business

systematically.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 9 of 75

Classifying

• Similar items are grouped under a common

characteristics (assets, liabilities, equity or capital,

revenue and expenses)

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 10 of 75

Summarizing

• This is the preparation of financial statements which

include: the balance sheet, income statement, cash flow

statement, statement of changes in equity or statement

of recognized gains and losses and notes to financial

statements.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 11 of 75

Forms of Business Organization

• SINGLE PROPRIETORSHIP

• PARTNERSHIP

• CORPORATION

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 12 of 75

Forms of business

• Service provider- this business gives their

customers services instead of tangible products.

• Merchandising- commonly known as buy and sell

or trading business. The purchased products and the

products being sold are the same.

• Manufacturing- this kind of business buys raw

materials and transforms it into finished products.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 13 of 75

Accounting Assumptions

• These are the basic notions or fundamental premises on

which the accounting process is based.

• Also known as postulates.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 14 of 75

ACCRUAL and GOING

CONCERN

• Accrual Accounting means that income is recognized

when earned regardless of when received and expense

is recognized when incurred regardless of when paid.

• Going Concern this assumption looks on a business that

it will continue its operations for the foreseeable future.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 15 of 75

ACCOUNTING ENTITY

• Under this assumption, the business enterprise is

separate from the owners, managers and employees

who comprise the firm.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 16 of 75

TIME PERIOD

• This postulate requires that a business must present its

financial reports on financial position, performance and

cash flows for a “one year period”

● Calendar year- one year period that starts from Jan 1

and ends up December 31.

● Fiscal year

● Natural Year- one year period that ends when business

operations are at their lowest level of annual cycle.

➢ Sometimes, financial statements are made less than

one year ( semiannually or quarterly) for internal uses

or govt. requirements. This is called interim reporting

which uses interim period.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 17 of 75

MONETARY UNIT

• Imposes that financial statements must be stated in the

Philippine peso, any changes in the value of peso may

be ignored.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 18 of 75

ACCOUNTING PROCESS

(Accounting cycle)

• ANALYZING- transactions are checked if it affects

the elements of FS and if it can be measured reliably.

• JOURNALIZING- Economic transactions are

recorded in journals upon transaction

• POSTING- recorded transactions are classified and

balances are computed.

• Unadjusted Trial balance- all account balances are

totaled to reflect equal debits and credits.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 19 of 75

5. ADJUSTING ENTRIES- Some account balances are

updated to reflect their true balances.

6. FINANCIAL STATEMENT PREPARATION-

7. CLOSING ENTRIES- All income statement accounts

are closed. This is why income statement accounts are

also called temporary accounts.

8. POST-CLOSING TRIAL BALANCE-

9. REVERSING ENTRIES

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 20 of 75

ELEMENTS OF FINANCAL STATEMENTS

• ASSET

• LIABILITIES

• EQUITY

• INCOME

• EXPENSES

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 21 of 75

ASSET

• Are valuable resources owned by the entity.

• Per framework, asset is a resource controlled by the

enterprise as a result of past events and from which

future economic benefits are expected to flow to the

enterprise.

• Cash, cash equivalents, accounts receivable, notes

receivable, inventories, prepaid expenses, property,

plant and equipment, investments, intangible assets and

other assets.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 22 of 75

LIABILITIES

• A present obligation of the enterprise arising from past

events, the settlement of which is expected to result in

an outflow from the enterprise of resources embodying

economic benefits.

• Include notes payable, accounts payable, accrued

liabilities, unearned revenues, mortgage payable, bonds

payable and other debts of the enterprise.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 23 of 75

EQUITY

• The residual interest in the assets of the enterprise after

deducting all its liabilities.

• Other names: capital, proprietorship, owner’s equity,

net worth.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 24 of 75

INCOME

• Increases in economic benefits during the accounting

period in the form of inflows or enhancements of assets

or decreases of liabilities that result in increases in

equity, other than those relating to contributions from

equity participants.

• Encompasses both revenue and gains.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 25 of 75

• REVENUE- arises in the course of the ordinary

activities of an enterprise and is referred to by variety

of different names including sales, fees, interest,

dividends, royalties and rent.

• GAINS- represent other items that meet the definition

of income and may, or may not, arise in the course of

the ordinary activities of an enterprise.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 26 of 75

EXPENSES

• Decreases in economic benefits during the accounting

period in the form of outflows or depletions of assets or

incurrences of liabilities that result in decreases in

equity, other than those relating to distributions to

equity participants.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 27 of 75

FUNDAMENTALS OF

BOOKEEPING

BOOKKEEPING- is the systematic and chronological

recording of business transaction or events.

• Transaction means exchange of values

• Values referred to are “value received” and “value

parted with”

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 28 of 75

THE DOUBLE ENTRY SYSTEM

• Accounting is based on a double-entry system which

means that the dual effects of a business transaction is

recorded.

• For every transaction, there must be one or more

accounts debited and one or more accounts credited.

• Each transaction affects at least two accounts.

• Total debits for a transaction must always equal the

total credits.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 29 of 75

Example

• When purchasing a car in cash amounting to P 100, 000

a person receives an automobile and pays cash.

Automobile 100, 000

Cash 100, 000

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 30 of 75

• The abbreviations for debit and credit are Dr. (from the

Latin debere) and Cr. (from the Latin credere),

respectively.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 31 of 75

The account

• Basic summary device of accounting.

• Detailed record of the increases, decreases and balance

of each element that appears in the entity’s financial

statements.

• The simplest form of the account is known as the “T”

account.

• The account has three parts as shown below:

Account Title

Left side or Debit Right side or Credit

side Side

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 32 of 75

The Accounting Equation

Basic accounting equation:

ASSETS= LIABILITIES + OWNER’S EQUITY

Algebraically, the ff. formula can be derived:

LIABILITIES = ASSETS - OWNER’S EQUITY

OWNER’S EQUITY = ASSETS - LIABILITIES

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 33 of 75

ASSETS= LIABILITIES + OWNER’S EQUITY

• Note that the assets are on the left side of the equation

opposite the liabilities and owner’s equity. This

explains why increases and decreases in assets are

recorded in the opposite manner as liabilities and

owner’s equity are recorded. The equation also

explains why liabilities and owner’s equity follow the

same rules of debit and credit.

• The logic of debiting and crediting is related to the

accounting equation.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 34 of 75

Illustration

Case 1:

Assume that Mr. Jomer Reyes invested P10, 000 cash as

initial capital for a vulcanizing business called Reyes

vulcanizing shop. The business also took charge of the P2,

000 payable of furniture and equipment it is using.

ASSETS= LIABILITIES + OWNER’S EQUITY

= P2, 000 + 10, 000

= P12, 000

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 35 of 75

Case 2:

Assume that Mr. Ruben Viray invested assets worth of P50, 000

for handicraft business. However, actual assets he invested is

only P40, 000.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 36 of 75

LIABILITIES = ASSETS - OWNER’S EQUITY

=P50, 000-P40, 000

=P10, 000

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 37 of 75

Case 3:

Assume that Mr. Nick Ligon gave cash and goods for a

buy and sell business amounting to P60, 000. However a

P5,000 notes payable by him to PNB is assume by the

business.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 38 of 75

OWNER’S EQUITY = ASSETS - LIABILITIES

=P60, 000-5,000

=P55, 000

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 39 of 75

FINANCIAL STATEMENTS

• The end product or main output of the financial

accounting process.

• The general-purpose FS is to provide information about

the financial position, financial performance and cash

flows of an entity that is useful to a wide range of users

in making economic decision.

• Also show the outcome of management’s stewardship

of the wealth entrusted to it.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 40 of 75

USERS OF FS

• Investors

• Employees

• Lenders

• Suppliers and other trade creditors.

• Customers

• Government and their agencies

• Public

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 41 of 75

Complete set of basic financial

statements

• Income Statement

• Balance Sheet

• Statement of Changes in equity

• Cash flow statement

• Notes comprising a summary of significant

accounting policies and explanatory notes.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 42 of 75

Income Statement

• A formal statement showing the financial performance

of the enterprise for a given period of time

• Presents income and expenses of the business.

• Nominal or temporary accounts.

• These accounts are all closed at the end of the period.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 43 of 75

Mr. Chit Manlunas established an advertising business on Dec.

1, 2017. For the whole month of December, below are the

pertinent data:

Total Service Revenues for the month is P10,110

The following are the expenses:

a. Advertising Expense P5,225

b. Rent Expense 400

c. Salaries Expense 800

d. other expenses 500

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 44 of 75

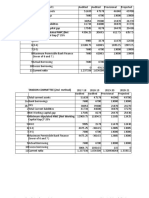

CHIT MANLUNAS

Income Statement

For the Period December 31, 2017

Service Revenue P10,110

Less: Expenses

Advertising Expenses P5,225

Rent Expenses 400

Salaries Expenses 800

Other Expenses 500 6,925

Net Income P3,185

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 45 of 75

BALANCE SHEET

• A formal statement showing the financial position of

the enterprise as of a particular date.

• Reflects the three elements of financial position namely,

assets, liabilities and capital.

• Real or permanent accounts.

• All accounts in the balance sheet are called real or

permanent accounts.

• These accounts are not closed at the end of the period.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 46 of 75

Mr. Chit Manlunas has the following information in his

journals as of Dec. 31, 2017:

Total Cash P5,235

Receivable from Customers 750

Delivery equipment for business 16,500

Tables, chairs and other fistures 1,950

Payable to Cyrex Commercial 250

Initial Capital of P22,000 decrease by personal

withdrawal of 1,000

Profit for the month 3,185

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 47 of 75

CHIT MANLUNAS

Balance Sheet

As of December 31, 2017

ASSETS

Cash P5,235

Accounts Receivable 750

Delivery equipment 16,500

Furniture and Fixture 1,950

Total Assets 24,435

LIABILITIES AND OWNER’S EQUITY

Liablilities

Accounts Payable- Cyrex P250

Owner’s Equity

Manlunas, Capital P22,000

Less: Withdrawal 1,000

P21,000

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 48 of 75

Exercises

• Mr. Paul Arancon started business by investing

P7,500 cash. In addition, the business assumes a

payable of Mr. Arancon amounting to P1,500.

• Mr. Samson Andres invested assets worth P20,000.

Capital of Mr. Andres is computed as P15,000

Required:Based on the above information, formulate the

accounting equation.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 49 of 75

3. From the data Paocial and Sons below, prepare a

simple balance sheet as of Dec31, 2017:

• Cash in Bank 2,500

• Receivable from customers 10,500

• Payable to Almaden Company 8,000

• Counters, chairs and tables 2,000

• Initial capital of P20,000 decrease by personal

withdrawal of 1,500

• Delivery Equipment worth 15,000

• Profit for the month 3,500

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 50 of 75

4. Based on the following information, prepare a simple

income statement of Johnny Diaz for the period Dec 1 to

December 31, 2017.

• Total Service Revenue for the month P10,000

• Supplies Expense 7,000

• Rent Expense 500

• Salaries 1,000

• Other Expenses 500

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 51 of 75

5. Below is information of Salarde Enterprises as of

December 31, 2017:

Cash P5,000

Accounts Receivable 15,000

Other Assets 5,000

Accounts Payable 10,000

Salarde, Capital ?

Required: Prepare the Balance Sheet.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 52 of 75

JOURNALIZING

• Expanded Accounting Equation:

ASSETS= LIABILITIES+ ORIGINAL CAPITAL+ADDITIONAL

INVESTMENT-WITHDRAWAL+INCOME-EXPENSES

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 53 of 75

AJPUAFCPR

Journal

• A general journal or simply journal is called book of

original entry.

• Some journals are Sales Journal, Purchase journal, Cash

Receipts journal, and Cash Payments journal.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 54 of 75

Normal Balance

This accounting terminology refers to the ordinary

balance of different accounts.

ACCOUNT NORMAL BALANCE

1 ASSETS DEBIT

2 LIABILITIES CREDIT

3 OWNER’S EQUITY CREDIT

4 INCOME CREDIT

5 EXPENSES DEBIT

6 DRAWING DEBIT

7 ACCUMULATED DEPRECIATION CREDIT

8 ALLOWANCE FOR CREDIT

DOUBTFUL ACCOUNTS

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 55 of 75

Rules of Debit-Credit (ALPIE RULE)

PARTICULAR IF DEBITED IF CREDITED

ASSETS INCREASE DECREASE

LIABILITIES DECREASE INCREASE

OWNER’S EQUITY DECREASE INCREASE

INCOME DECREASE INCREASE

EXPENSES INCREASE DECREASE

ACCOUNT NORMAL BALANCE

1 ASSETS DEBIT

2 LIABILITIES CREDIT

3 OWNER’S EQUITY CREDIT

4 INCOME CREDIT

5 EXPENSES DEBIT

6 DRAWING DEBIT

7 ACCUMULATED DEPRECIATION CREDIT

8 ALLOWANCE FOR DOUBTFUL CREDIT

A C C O U N T S

NOTICE T H A T N O R MAL BALANCES EASES IN THE

REFLECT INCR ACCOUNT

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 56 of 75

• Contra Accounts are exception from the ALPIE rule.

• Contra Accounts are accounts deducted from another

account.

• These are not offsetted rather it is presented below the

account from which it will be deducted from. (ex.

Drawings in the Balance Sheet)

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 57 of 75

PARTICULAR CREDIT DEBIT

DRAWING INCREASE DECREASE

-This account is debited when the owner of a sole

proprietorship withdraws asset/s to the business

for personal use.

This is deducted from the capital account.

2. ACCUMULATED DEPRECIATION DECREASE INCREASE

-fixed assets (except land) like furniture, building etc.

decreases in value as time goes by. This account

reflects the decline in value of such assets. This is

deducted in the related fixed asset/s.

3. Allowance for doubtful accounts DECREASE INCREASE

-This is an estimate by the owner on the amount of

accounts receivable (collectibles) that is uncertain to

be collected. This is deducted in the Accounts

Receivable.

Other contra accounts: purchase discounts, purchase returns and allowances,

Sales discount and sales returns and allowances.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 58 of 75

Chart of Accounts

• A bookkeeper needs a guide in recording business

transactions and events. A list of accounts used by the

bookkeeper is called a CHART OF ACCOUNTS

• This list consists ALL the accounts to be used in

recording all economic transactions with corresponding

code numbers that will be reflected as “folio”.

• The accountant or the bookkeeper may add other

accounts he may find appropriate in the chart

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 59 of 75

Code # ASSET ACCOUNTS Code # INCOME ACCOUNTS

1 Cash 71 Service Revenue

3 Accounts Receivable 73 Rent Income

5 Unused Supplies

6 Marketable Securities EXPENSE ACCOUNTS

8 Land 82 Salaries Expense

9 Building 83 Commissions

10 Furniture and Fixtures 84 Travelling expenses

11 Equipment 85 Advertising Expense

12 Machinery 86 Representation Expense

13 Other Assets 87 Utilities Expense

LIABILITY ACCOUNTS 88 Supplies Expense

52 Accounts Payable 90 Heat, Light and Water

53 Tax payable 91 Taxes

54 Accrued Salaries 92 Insurance Expense

55 Loans Payable 93 Repairs and Maintence

56 Bond Payable 94 Rent Expense

EQUITY ACCOUNTS 95 Depreciation Expense

61 Penduko Capital

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 60 of 75

SIMPLE vs. COMPOUND ENTRY

Assume transactions below are provided with

corresponding entries.

Jan 2, 2018- Mr. Penduko invests an initial capital of

P5,000 for a trading business

Jan 2, 2018- Mr. Penduko contributed P6,000 worth of

tables and chairs for office use.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 61 of 75

Simple Entry

Date Particulars F Debit Credit

2008

Jan 2 Cash 1 P5,000

Penduko, Capital 61 P5,000

To record initial investment of owner

Furniture and Fixtures 10 6,000

Penduko, Capital 61 6,000

To record initial investment of owner

Compound Entry

Date Particulars F Debit Credit

2008

Jan 2 Cash 1 P5,000

Furniture and Fixture 10 6,000

Penduko, Capital 61 P11,000

To record initial investment of owner

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 62 of 75

• A simple journal entry contains one account debited and

one account credited while compound journal entry

contains three or more accounts. Either entry is

accepted and will have the same effect.

• Note: Debit figure/s must always be equal to credit

figure/s

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 63 of 75

On Dec. 1, 2004, Mateo Roa opened a videotape rental store, Oro Video, by investing

P250, 000 cash from his personal savings account. During the month of December, the

following transactions took place:

Dec. 1- Acquired supplies on account, P67, 000

4- Acquired Videotapes costing P235,000 on account

5- Paid P85, 000 to creditors

8- Received P78,000 cash from ACA Video for rental fees

11- Billed Video City for Video rentals, 105,000

16- Paid salaries 65,000

17- Collected 77,000 from video city

23- Roa withdrew 47,000 from the business

24- Paid rent for the month 41,500

30- Paid utilities bill for the month 17,500

Required: Journalize the transactions using the following accounts:

123-Cash, 234-Accounts Receivable, 345-Supplies, 456-Videotapes, 567-Accounts

Payable

And 678- Roa, Capital.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 64 of 75

Answers:

Journalizing ORO VIDEO transactions

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 65 of 75

Journalizing Exercises: (Refer to slide 60 for the account titles

to be used)

Transaction1- Pedro Penduko decides to open an internet

café. On September 2, 2008, he invests P300,000 cash in

the business which he names Panday Online.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep. 2 Cash 1 P300,000

Penduko, Capital 61 P300,000

Investment by owner

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 66 of 75

Transaction 2- On Sep. 4, 2008, Panday Online purchases

computer equipment for P140,000 cash.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep. 4 Equipment 11 P140,000

Cash 1 P140,000

Purchase of equipment for cash

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 67 of 75

Transaction 3- On September 5, 2008 Panday Online

purchases computer paper and other supplies expected to

last several months from Crown Bookstore for P32,000.

Crow Bookstore agrees to allow Panday Online to pay to

pay this bill in October, a month later.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep. 5 Supplies 5 P32,000

Accounts Payable 52 P32,000

Purchase of supplies on credit

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 68 of 75

Transaction 4- On Sept. 17, 2008 Panday Online

Receives P24,000 cash from customers for typing

services it has provided.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep17 Cash 1 P24,000

Service Revenue 71 P24,000

Services rendered for cash

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 69 of 75

Transaction 5- Panday Online receives a bill for P5,000

from Sunstar newspaper on Sept 19, 2008 for advertising

the opening of its business but postpones payment of the

bill until a later date.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep19 Advertising Expense 85 P5,000

Accounts Payable 52 P5,000

Purchase of advertising on credit

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 70 of 75

Transaction 6- Panday Online provides printing and

online services of P70,000 for customers on Sep 20,2008.

Cash amounting to P30,000 is received from customers,

and the balance of P40,000 is billed to customers on

account.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep20 Cash 1 P30,000

Accounts Receivable 3 40,000

Service Revenue 71 P70,000

Services rendered for cash and credit.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 71 of 75

Transaction 7- Expenses paid in cash for Sept 28, 2008

are store rent, P12,000, Salaries of employees, P18,000

and utilities P4,000.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep28 Rent Expense 94 P12,000

Salaries Expense 82 18,000

Utilities Expense 87 4,000

Cash 1 P34,000

Payment of expenses.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 72 of 75

Transaction 8- On Sept. 28, 2008, Panday Online pays its

Sunstar newspaper advertising bill of P5,000 in cash.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep28 Account Payable 52 P5,000

Cash 1 P5,000

Payment of accounts payable.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 73 of 75

Transaction 9- The sum of P12,000 in cash is received on

Sep 29,2008 from customers who have previously been

billed for services in transaction 6.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep29 Cash 1 P12,000

Accounts Receivable 3 P12,000

Payment from customer with existingaccount.

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 74 of 75

Transaction 10- On Sept 30, 2008 Pedro Penduko

withdraws P26,000 in cash from the business for his

personal use.

GENERAL JOURNAL J1

DATE PARTICULARS F DEBIT CREDIT

2008

Sep30 Penduko, Drawings 62 P26,000

Cash 1 P26,000

Withdrawal of cash by owner

https://cdn.fbsbx.com/v/t59.2708-21/41364667_599082750493712_34880424554738…eJTfBxk8IcAeQAxJizw&oh=1b3c6430e2a455f5a2ccb2a8da4f337a&oe=5BB4F9B2&dl=1 02/10/2018, 1P19 PM

Page 75 of 75

You might also like

- Ebook Principles of Managerial Finance 16Th Edition Chad J Zutter Scott B Smart Online PDF All ChapterDocument69 pagesEbook Principles of Managerial Finance 16Th Edition Chad J Zutter Scott B Smart Online PDF All Chapterjohn.ward443100% (9)

- Requirements Management: A Practice GuideFrom EverandRequirements Management: A Practice GuideRating: 3.5 out of 5 stars3.5/5 (2)

- Software AquisitionDocument12 pagesSoftware AquisitionJherico Gabriel B. OcomenNo ratings yet

- Untitled 9 PDFDocument18 pagesUntitled 9 PDFJade Lyn LopezNo ratings yet

- Evolution of Business Policy and StrategyDocument33 pagesEvolution of Business Policy and StrategyKarlayaanNo ratings yet

- GGNBBDocument47 pagesGGNBBKarlayaanNo ratings yet

- Agency Problems and Accountability of Corporate Managers and StockholdersDocument16 pagesAgency Problems and Accountability of Corporate Managers and StockholdersMarie Mallare CortezNo ratings yet

- Bots, Algorithms, and The Future of The Finance FunctionDocument6 pagesBots, Algorithms, and The Future of The Finance FunctionIsaac E. ChabléNo ratings yet

- Business Process Blueprint Finance: ProjectDocument62 pagesBusiness Process Blueprint Finance: ProjectSaravanaRaajaaNo ratings yet

- Introduction To Strategic Management: Prepared By: Alexander G. CortezDocument21 pagesIntroduction To Strategic Management: Prepared By: Alexander G. CortezCarla ZanteNo ratings yet

- Management Information Systems For MFIs HandbookDocument222 pagesManagement Information Systems For MFIs HandbookGaivs Ivlivs Caesar NeriaNo ratings yet

- Nation'S Foremost Cpa Review Inc.: Set A Management Advirosy Services First Pre-BoardDocument10 pagesNation'S Foremost Cpa Review Inc.: Set A Management Advirosy Services First Pre-BoardAlyssah Grace EllosoNo ratings yet

- 5322150311Document276 pages5322150311Nikita GuptaNo ratings yet

- CHP 3 - Innovation, Performance - Change MGTDocument20 pagesCHP 3 - Innovation, Performance - Change MGTArif RyanNo ratings yet

- FICO Course ContentDocument4 pagesFICO Course ContentManas MaharanaNo ratings yet

- BBP - Fico - V 2.0Document206 pagesBBP - Fico - V 2.0Subhash Reddy100% (1)

- Callisto Network WP 1.6Document25 pagesCallisto Network WP 1.6Manan ShahNo ratings yet

- Me LINKSDocument5 pagesMe LINKSShaheen ShaikNo ratings yet

- MPBF Other MethodsDocument10 pagesMPBF Other Methodskaren sunilNo ratings yet

- SITXFIN001 Learner GuideDocument45 pagesSITXFIN001 Learner Guidesunil bhadelNo ratings yet

- Course Outline NYSU3Document2 pagesCourse Outline NYSU3Mark Romeo GalvezNo ratings yet

- 7717 - Manual Cash Management PDFDocument70 pages7717 - Manual Cash Management PDFkoos_engelbrechtNo ratings yet

- Manual On CAS For PACSDocument96 pagesManual On CAS For PACSShishir ShuklaNo ratings yet

- Accounting For Non AccountantsDocument66 pagesAccounting For Non Accountantsআম্লান দত্ত100% (1)

- Aite Matrix Evaluation Investment and Fund Accounting Systems ReportDocument25 pagesAite Matrix Evaluation Investment and Fund Accounting Systems ReportVijayavelu AdiyapathamNo ratings yet

- Gelinas-Dull 8e Chapter 16 Revised September 2009Document27 pagesGelinas-Dull 8e Chapter 16 Revised September 2009micaerguizaNo ratings yet

- 2q and 1h 2022 Results ReportDocument101 pages2q and 1h 2022 Results ReportlukaNo ratings yet

- 2.1 LAP - BRE AutomationDocument32 pages2.1 LAP - BRE Automationgupta_pankajkr5626No ratings yet

- (Hooker and Monas, 2008) Shoestring Venture - The Startup BibleDocument532 pages(Hooker and Monas, 2008) Shoestring Venture - The Startup BibleLock TidfaNo ratings yet

- Acct Information System-ShegerDocument97 pagesAcct Information System-Shegerwendmagegn.gebremeskelNo ratings yet

- Old FormatDocument4 pagesOld Formatapi-244053115No ratings yet

- Chapter 123456789for SoftbindDocument101 pagesChapter 123456789for SoftbindJoshua Alfonso PablicoNo ratings yet

- Strategyand Transform Your Banks Operations ModelDocument14 pagesStrategyand Transform Your Banks Operations ModelParth AgrawalNo ratings yet

- Accounting I & IV ChapterDocument219 pagesAccounting I & IV ChapterKeks Maslačak100% (1)

- Sacoo BidsDocument8 pagesSacoo BidsdawitNo ratings yet

- BSBSMB406 - Student Assessment Task 2Document6 pagesBSBSMB406 - Student Assessment Task 2Sid SharmaNo ratings yet

- Zhuo Hu 684 Part 3Document32 pagesZhuo Hu 684 Part 3huzhuoNo ratings yet

- India's BOPDocument12 pagesIndia's BOPVinayak BaliNo ratings yet

- Aula 1Document19 pagesAula 1Rafaela LopesNo ratings yet

- PRe 6 MaterialsDocument15 pagesPRe 6 MaterialsV-Heron BanalNo ratings yet

- Mixed Use JK PDFDocument9 pagesMixed Use JK PDFAnkit ChaudhariNo ratings yet

- Working Capital ManagementDocument78 pagesWorking Capital ManagementPriya GowdaNo ratings yet

- CA Intermediate Paper-7ADocument238 pagesCA Intermediate Paper-7AAnand_Agrawal19100% (1)

- Fi PVR BBP 02Document8 pagesFi PVR BBP 02K KUMAR JENANo ratings yet

- Exact Globe UserGuide On FinancialsDocument188 pagesExact Globe UserGuide On Financialsaluaman100% (9)

- ENGLISH01 GAP0 Technical Tool 101Document222 pagesENGLISH01 GAP0 Technical Tool 101shanizam ariffinNo ratings yet

- Micro Finance PolicyDocument85 pagesMicro Finance PolicyBelkis RiahiNo ratings yet

- Debt Recovery AgentDocument4 pagesDebt Recovery AgentTulchha RamNo ratings yet

- Branches of Accounting: Module 2 - Fabm-1Document5 pagesBranches of Accounting: Module 2 - Fabm-1KISHANo ratings yet

- Sample C0A Report - Format For RecommendationsDocument20 pagesSample C0A Report - Format For RecommendationsLolita CalaycayNo ratings yet

- 17 Things You Should Be Doing Right Now To Reduce Outstanding Accounts ReceivableDocument28 pages17 Things You Should Be Doing Right Now To Reduce Outstanding Accounts ReceivablecharrisedelarosaNo ratings yet

- Investor Presentation - Q2tmbDocument32 pagesInvestor Presentation - Q2tmbDhanush Kumar RamanNo ratings yet

- State Bank of IndiaDocument30 pagesState Bank of IndiaSahil ChhibberNo ratings yet

- 1.1 2 1.2 Objectives of The Study 2 1.3 Methodology of The Study 2 1.4 3Document66 pages1.1 2 1.2 Objectives of The Study 2 1.3 Methodology of The Study 2 1.4 3Tamim SikderNo ratings yet

- Accounting Assignment 1Document18 pagesAccounting Assignment 1Shafiya RazickNo ratings yet

- Vite Os Shadow 01282014Document28 pagesVite Os Shadow 01282014tabbforumNo ratings yet

- Launching A Digital Tax Administration Transformation: What You Need to KnowFrom EverandLaunching A Digital Tax Administration Transformation: What You Need to KnowNo ratings yet

- Construction Quantity Surveying: A Practical Guide for the Contractor's QSFrom EverandConstruction Quantity Surveying: A Practical Guide for the Contractor's QSRating: 5 out of 5 stars5/5 (2)

- Incident Management Process Guide For Information TechnologyFrom EverandIncident Management Process Guide For Information TechnologyNo ratings yet

- FranchisingDocument11 pagesFranchisingMclovia Kyla TelenNo ratings yet

- Telen KFCDocument3 pagesTelen KFCMclovia Kyla TelenNo ratings yet

- Life Insurance-WPS OfficeDocument10 pagesLife Insurance-WPS OfficeMclovia Kyla TelenNo ratings yet

- Microeconomics Midterm ExamDocument2 pagesMicroeconomics Midterm ExamMclovia Kyla TelenNo ratings yet

- Telen CVDocument1 pageTelen CVMclovia Kyla TelenNo ratings yet

- Finalexquestionaire - SOCSCI 219 FINALDocument3 pagesFinalexquestionaire - SOCSCI 219 FINALMclovia Kyla TelenNo ratings yet

- Microeconomics ExamDocument4 pagesMicroeconomics ExamMclovia Kyla TelenNo ratings yet

- Telen, Mclovia Kyla AnswerDocument5 pagesTelen, Mclovia Kyla AnswerMclovia Kyla TelenNo ratings yet

- Introduction To Economics 1Document47 pagesIntroduction To Economics 1Mclovia Kyla TelenNo ratings yet

- ReferenceDocument235 pagesReferenceMclovia Kyla TelenNo ratings yet

- Sanchez Ses Perdevquiz1Document2 pagesSanchez Ses Perdevquiz1Mclovia Kyla TelenNo ratings yet

- Detailed Franchise Business Plan ExampleDocument6 pagesDetailed Franchise Business Plan ExampleMclovia Kyla TelenNo ratings yet

- Checklist For Squat ExerciseDocument3 pagesChecklist For Squat ExerciseMclovia Kyla TelenNo ratings yet

- Geological Processes AND Hazards: Prepared By: Group 4Document18 pagesGeological Processes AND Hazards: Prepared By: Group 4Mclovia Kyla TelenNo ratings yet