Professional Documents

Culture Documents

06 Laboratory Exercise 1

06 Laboratory Exercise 1

Uploaded by

Praisen JoyCopyright:

Available Formats

You might also like

- Topic 6 - Bank ReconciliationRev (Students)Document26 pagesTopic 6 - Bank ReconciliationRev (Students)Romzi100% (1)

- Proof of CashDocument7 pagesProof of CashPeachy80% (5)

- Account Summary: Your Transaction DetailsDocument1 pageAccount Summary: Your Transaction Detailsdelfa100% (1)

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementZoie JulienNo ratings yet

- FABM2-MODULE 9 - With ActivitiesDocument7 pagesFABM2-MODULE 9 - With ActivitiesROWENA MARAMBANo ratings yet

- Module 1C - Bank ReconciliationDocument4 pagesModule 1C - Bank ReconciliationtoshirohanamaruNo ratings yet

- Bank Reconcilition NotesDocument6 pagesBank Reconcilition NotesNurul Hazirah ZulkifliNo ratings yet

- Ch#7 BANK RECONCILIATION STATEMENTDocument4 pagesCh#7 BANK RECONCILIATION STATEMENTeaglerealestate31No ratings yet

- Bank ReconciliationDocument19 pagesBank ReconciliationSheenaGaliciaNew100% (4)

- Bank Reconcillation StatementDocument22 pagesBank Reconcillation StatementZaid SiddiqueNo ratings yet

- Bank Reconciliation, Petty Cash & Voucher SystemDocument4 pagesBank Reconciliation, Petty Cash & Voucher SystemYellow CarterNo ratings yet

- Fabm2 Q2 M3 - 4Document9 pagesFabm2 Q2 M3 - 4Zeus MalicdemNo ratings yet

- INTERMEDIATE ACCOUNTING I Bank ReconciliationDocument3 pagesINTERMEDIATE ACCOUNTING I Bank ReconciliationMark Navida AgunaNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationopticalgridcivilNo ratings yet

- Cfas CashDocument5 pagesCfas CashGeelyka MarquezNo ratings yet

- Audit Form - Working Paper - PCFDocument18 pagesAudit Form - Working Paper - PCFIra YbanezNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationMary Jullianne Caile SalcedoNo ratings yet

- 6 Lesson Six Bank ReconciliationDocument4 pages6 Lesson Six Bank ReconciliationmeshackcheruiyottNo ratings yet

- Module 1b - Bank ReconDocument37 pagesModule 1b - Bank ReconChen HaoNo ratings yet

- Module 3Document5 pagesModule 3Simoun EnriqueNo ratings yet

- Finals FABM2 Lesson 2 Bank ReconciliationDocument4 pagesFinals FABM2 Lesson 2 Bank ReconciliationJasmine VelosoNo ratings yet

- Two-Date Bank ReconciliationDocument5 pagesTwo-Date Bank Reconciliationsweet ecstacyNo ratings yet

- Topic 6 - Bank ReconciliationRev (Students)Document32 pagesTopic 6 - Bank ReconciliationRev (Students)Novian Dwi RamadanaNo ratings yet

- Chapter 6 Bank ReconciliationRev StudentsDocument20 pagesChapter 6 Bank ReconciliationRev StudentsNemalai VitalNo ratings yet

- ACC 124 HO 5 Bank Reconciliation and Proof of Cash - 0Document4 pagesACC 124 HO 5 Bank Reconciliation and Proof of Cash - 0Lily Scarlett ChìnNo ratings yet

- Basic Instructions For A Bank Reconciliation Statement PDFDocument4 pagesBasic Instructions For A Bank Reconciliation Statement PDFAman KodwaniNo ratings yet

- CHAPTER 09.bank Reconciliation StatementsDocument10 pagesCHAPTER 09.bank Reconciliation StatementsZaid SiddiqueNo ratings yet

- (Studocu) Int Acc Chapter 3 - Valix, Robles, Empleo, MillanDocument4 pages(Studocu) Int Acc Chapter 3 - Valix, Robles, Empleo, MillanHufana, Shelley100% (1)

- ACCOUNTING 102 - Topic #3 "Proof of Cash"Document4 pagesACCOUNTING 102 - Topic #3 "Proof of Cash"CLEAR MELODY VILLARANNo ratings yet

- Bank ReconciliationDocument14 pagesBank Reconciliationnicolettecatamio015No ratings yet

- 6_Bank_Reconciliation Additional Notes and IllustrationDocument9 pages6_Bank_Reconciliation Additional Notes and IllustrationmeshackcheruiyottNo ratings yet

- FINACC1 - Bank Reconciliation and Proof of CashDocument2 pagesFINACC1 - Bank Reconciliation and Proof of CashJerico DungcaNo ratings yet

- Bank ReconciliationDocument15 pagesBank Reconciliationhay buhayNo ratings yet

- FAR1 - Bank Reconciliation and Proof of CashDocument2 pagesFAR1 - Bank Reconciliation and Proof of CashHoney MuliNo ratings yet

- Bank ReconciliationDocument26 pagesBank ReconciliationQuennie Kate RomeroNo ratings yet

- Module 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPADocument24 pagesModule 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPALucas BantilingNo ratings yet

- Module 2 - Bank Reconciliation - With Sample ExercisesDocument24 pagesModule 2 - Bank Reconciliation - With Sample ExercisesJudie Ellaine SumandacNo ratings yet

- Cash and Cash Equivalents 1Document22 pagesCash and Cash Equivalents 1Mark GilNo ratings yet

- 03 Bank ReconciliationDocument5 pages03 Bank ReconciliationalteregoNo ratings yet

- Bank Reconciliation Journal Entries - Double Entry BookkeepingDocument9 pagesBank Reconciliation Journal Entries - Double Entry BookkeepingMizanur RahmanNo ratings yet

- CWTS1-USA-B-SAPE InfographicDocument1 pageCWTS1-USA-B-SAPE InfographiccyriljunaicamaranquezNo ratings yet

- Fabm2 QTR.2 Las 7.1Document10 pagesFabm2 QTR.2 Las 7.1Trunks KunNo ratings yet

- Chapter 5 Bank Reconciliation StatementDocument2 pagesChapter 5 Bank Reconciliation StatementDeveender Kaur JudgeNo ratings yet

- Receivable FinancingDocument34 pagesReceivable FinancingmaryzeenNo ratings yet

- Receivable Financing CH14 by LailaneDocument30 pagesReceivable Financing CH14 by LailaneEunice BernalNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementMuhammad BilalNo ratings yet

- Chapter 3 Bank Recon Lecture StudentDocument5 pagesChapter 3 Bank Recon Lecture StudentAshlene CruzNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationZejkeara ImperialNo ratings yet

- Journal Entries For Bank ReconciliationDocument2 pagesJournal Entries For Bank ReconciliationAira Mae Quinones OrendainNo ratings yet

- Bank ReconciliationDocument27 pagesBank Reconciliationnaruto uzumakiNo ratings yet

- Bank ReconciliationDocument23 pagesBank ReconciliationJohn Anjelo MoraldeNo ratings yet

- Bank Reconciliations - 1Document9 pagesBank Reconciliations - 1ZAKAYO NJONYNo ratings yet

- Receivable Financing: Pledge, Assignment, and FactoringDocument30 pagesReceivable Financing: Pledge, Assignment, and FactoringJoy UyNo ratings yet

- Aa21 Afa Chapter 01 EnglishDocument12 pagesAa21 Afa Chapter 01 EnglishnafeesNo ratings yet

- Fabm2 - 8.2Document15 pagesFabm2 - 8.2Kervin GuevaraNo ratings yet

- Chap 9 - Proof of Cash Fin Acct 1 - Barter Summary Team PDFDocument7 pagesChap 9 - Proof of Cash Fin Acct 1 - Barter Summary Team PDFCarl James Austria100% (1)

- Dictioformula ProblemsDocument42 pagesDictioformula ProblemsEza Joy ClaveriasNo ratings yet

- CH08 Bank ReconciliationDocument12 pagesCH08 Bank ReconciliationRose DionioNo ratings yet

- ABM FABM2 Q2 Wk3 LAS3Document11 pagesABM FABM2 Q2 Wk3 LAS3ayaNo ratings yet

- 05 Laboratory Exercise 1Document2 pages05 Laboratory Exercise 1Praisen JoyNo ratings yet

- Formulas in Business FinanceDocument4 pagesFormulas in Business FinancePraisen JoyNo ratings yet

- 07 Laboratory Exercise 1Document3 pages07 Laboratory Exercise 1Praisen JoyNo ratings yet

- 08 Quiz 1Document3 pages08 Quiz 1Praisen JoyNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesMaximuzNo ratings yet

- Faqs On Internet Banking Services (Ibs) For NrisDocument2 pagesFaqs On Internet Banking Services (Ibs) For NrisABMNo ratings yet

- Marketing of Financial Services NMIMS AssignmentDocument4 pagesMarketing of Financial Services NMIMS AssignmentN. Karthik UdupaNo ratings yet

- Check-Out Procedures: B.Sc. (HHA) / 2 Year/ Checkout ProceduresDocument10 pagesCheck-Out Procedures: B.Sc. (HHA) / 2 Year/ Checkout ProceduresAryan BishtNo ratings yet

- Business Banking Price ListDocument15 pagesBusiness Banking Price ListSARFRAZ ALINo ratings yet

- Mastering Personal Credit and Personal FudningDocument15 pagesMastering Personal Credit and Personal FudningAli Tarafdar, QFOPNo ratings yet

- Lecture Sheet of Final Syllabus: Negotiable Instruments Act, 1881Document4 pagesLecture Sheet of Final Syllabus: Negotiable Instruments Act, 1881Eshthiak HossainNo ratings yet

- Niam Knoll - TransUnion Personal Credit Report - 20200802Document4 pagesNiam Knoll - TransUnion Personal Credit Report - 20200802Bruce WaynneNo ratings yet

- Individual Assignment - On - COMPANY - STRATEGIC - ANALYSIS.Document14 pagesIndividual Assignment - On - COMPANY - STRATEGIC - ANALYSIS.Adanech100% (1)

- First American Bank's Donald Roubitcheck, Chief Financial Officer - Completed TARP - Use of Capital Survey, Donald Roubitchek CFO July 24, 2009Document3 pagesFirst American Bank's Donald Roubitcheck, Chief Financial Officer - Completed TARP - Use of Capital Survey, Donald Roubitchek CFO July 24, 2009larry-612445No ratings yet

- Account Details and Transaction History: Mohd Salleh Bin AmboDocument2 pagesAccount Details and Transaction History: Mohd Salleh Bin AmboMohd Salleh AmboNo ratings yet

- Nilson Report Issue 1169Document12 pagesNilson Report Issue 1169John Mulder100% (1)

- Sob Select 30 12 2022Document2 pagesSob Select 30 12 2022nishan1187No ratings yet

- Canara Bank Project ReportDocument16 pagesCanara Bank Project Reportsagar m100% (1)

- Currency Seasonal Patterns Free EbookDocument21 pagesCurrency Seasonal Patterns Free Ebookkh267aziziNo ratings yet

- Weekly ReportDocument4 pagesWeekly ReportAiane_Reyes_5594No ratings yet

- Daftar Bank Yang Ada Di Wilayah PontianakDocument4 pagesDaftar Bank Yang Ada Di Wilayah PontianakWindia SariNo ratings yet

- Seminar Questions Set III A-2Document3 pagesSeminar Questions Set III A-2fanuel kijojiNo ratings yet

- FRM & VIGILANCE OF BANK POLICY J&K BankDocument37 pagesFRM & VIGILANCE OF BANK POLICY J&K BankAnshul BishtNo ratings yet

- Akong'a, Cynthia J - The Effect of Financial Risk Management On The Financial Performance of Commercial Banks in KenyaDocument57 pagesAkong'a, Cynthia J - The Effect of Financial Risk Management On The Financial Performance of Commercial Banks in KenyaEsobiebi ChristabelNo ratings yet

- Ch02-Cash Inflow OutFlowDocument45 pagesCh02-Cash Inflow OutFlowismat arteeNo ratings yet

- Moroz IlonaDocument1 pageMoroz IlonaСергей АлексеевичNo ratings yet

- Ch-2 FRONT OFFICE (ACCOUNTING)Document11 pagesCh-2 FRONT OFFICE (ACCOUNTING)DawaNo ratings yet

- Basu and Dutta Journal EntriesDocument7 pagesBasu and Dutta Journal EntriesAranya Haldar100% (2)

- Cambridge Ordinary LevelDocument12 pagesCambridge Ordinary LevelAlexNo ratings yet

- RamishDocument14 pagesRamishpradeep swatiNo ratings yet

- Updated - Note On NeobanksDocument38 pagesUpdated - Note On NeobanksAnirudh SoodNo ratings yet

- Chapter 2 AccountingDocument12 pagesChapter 2 Accountingmoon loverNo ratings yet

- 0151xxxxxxxx6295 - 2023 12 01Document6 pages0151xxxxxxxx6295 - 2023 12 01George GeranisNo ratings yet

06 Laboratory Exercise 1

06 Laboratory Exercise 1

Uploaded by

Praisen JoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

06 Laboratory Exercise 1

06 Laboratory Exercise 1

Uploaded by

Praisen JoyCopyright:

Available Formats

BMSH2003

Preparing Monthly Bank Reconciliation Statement using MS Excel

Bank Reconciliation

Objectives:

At the end of the exercise, the students will be able to:

Use MS Excel to prepare a monthly bank reconciliation statement.

Equipment:

• Computer installed with MS Excel

Basic Principle/s:

A bank reconciliation is a statement that brings into agreement the cash balance per book and cash balance

per bank (Valix, 2017). A bank reconciliation is an analysis of the items and amounts that result in the cash

balance reported in the bank statement (balance per bank statement) to differ from the balance of the cash

account in the ledger (balance per books). The adjusted cash balance determined in the bank reconciliation

is reported on the balance sheet. It is usually prepared monthly as banks provide their clients bank

statements at the end of every month.

A bank statement is a monthly report of the bank to the depositor showing (Valix, 2017):

a) the cash balance per bank at the beginning;

b) the deposits made by the depositor and acknowledged by the bank;

c) the checks drawn by the depositor and paid by the bank; and

d) the daily cash balance per bank during the month

Procedures:

1. Open MS Excel and use a new workbook.

2. Rename the new sheet as ‘Bank Reconciliation’.

3. Analyze the following problem:

The following cash balances are available for Imogen Company for the month ended June 30, 201A.

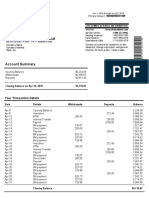

Cash balance per bank statement, June 30, 201A P124,611.50

Cash balance per books, June 30, 201A 124,379.40

The bank statement disclosed the following information:

a. Charges by bank included a returned customer’s check for P1,381.40 because of insufficient funds

(NSF) and service charge for June of P150.

b. Credits by the bank included a customer’s note for P12,000 plus interest of P120 that was collected

on June 29, 201A.

A review of the company records disclosed the following information:

a. A deposit of P11,428.70 made on June 29, 201A did not appear on the bank statement.

b. Customer’s checks totaling P3,274.00 were still on hand on June 30,201A awaiting deposit.

c. The following company checks were still outstanding as of June 30, 201A:

Check #0157823 P2,632.50

Check #0157827 1,471.80

Check #0157830 961.90

d. Check #0157805 for P912.00 in payment of a creditor account and included with canceled checks

in the bank statement has been erroneously recorded as P192.00.

06 Laboratory Exercise 1 *Property of STI

Page 1 of 3

BMSH2003

4. You are required to do the following: Prepare a bank reconciliation statement for Imogen

Company as of June 30, 201A. Use the three (3) forms of bank reconciliation.

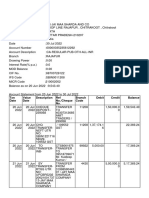

5. Refer to Figures 1-3 for the sample formats of the bank reconciliation statement. This can also be

found in 06 Handout 1. Note that these formats can be changed depending on the given values.

ABC Company

Bank Reconciliation Statement

December 31, 201A

Unadjusted balance per bank Pxxx

Add: Receipts not yet deposited/Deposit in transit Pxxx

Erroneous charge by bank xxx xxx

Less: Outstanding checks xxx

Erroneous credit by bank xxx xxx

Adjusted bank balance Pxxx

Unadjusted balance per books

Add: Note collected by bank xxx

Interest earned xxx

Overstated disbursements recorded in the books xxx

Understated receipts recorded in the books xxx xxx

Less: NSF check returned xxx

Bank service charge xxx

Understated disbursements recorded in the books xxx

Overstated receipts recorded in the books xxx xxx

Adjusted book balance Pxxx

Figure 1. Adjusted balances method

ABC Company

Bank Reconciliation Statement

December 31, 201A

Balance per bank statement Pxxx

Add: Deposits in transit Pxxx

NSF check returned xxx

Bank service charge xxx xxx

Total xxx

Less: Outstanding checks xxx

Note collected by bank xxx

Interest earned xxx xxx

Balance per books Pxxx

Figure 2. Bank balance to book balance

ABC Company

Bank Reconciliation Statement

December 31, 201A

Balance per books Pxxx

Add: Note collected by bank Pxxx

Interest earned xxx

Outstanding checks xxx xxx

Total xxx

Less: Deposits in transit xxx

NSF check returned xxx

Bank service charge xxx xxx

Balance per bank statement Pxxx

Figure 3. Book balance to bank balance

06 Laboratory Exercise 1 *Property of STI

Page 2 of 3

BMSH2003

6. Prepare the heading:

a. Select cells A1-D1, merge, and type ‘Imogen Company’.

b. Select cells A2-D2, merge, and type ‘Bank Reconciliation Statement’.

c. Select and merge cells A3-D3 for the date.

7. Afterward, use amounts given above to prepare the bank reconciliation statement under adjusted

balances method.

8. After preparing the adjusted balances method, prepare the heading again for the bank balance to

book balance method and book balance to bank balance method.

9. Design your own bank reconciliation statement.

10. Save the file.

Rubric for scoring:

CRITERIA PERFORMANCE INDICATORS POINTS

Neatness and The spreadsheet has exceptional formatting, and the information is well-

20

Organization organized.

The spreadsheet formulas are well-developed and will correctly determine the

Formulas 30

needed information.

Titles, Labels, and

The spreadsheet contains clearly labeled rows and columns. 10

Headings

The spreadsheet meets all the necessary requirements to interpret the result of

Content 40

the operation.

TOTAL 100

References

Valix, C. T. (2017). Financial Accounting Vol. 1. Manila: GIC Enterprises & Co., Inc.

06 Laboratory Exercise 1 *Property of STI

Page 3 of 3

You might also like

- Topic 6 - Bank ReconciliationRev (Students)Document26 pagesTopic 6 - Bank ReconciliationRev (Students)Romzi100% (1)

- Proof of CashDocument7 pagesProof of CashPeachy80% (5)

- Account Summary: Your Transaction DetailsDocument1 pageAccount Summary: Your Transaction Detailsdelfa100% (1)

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementZoie JulienNo ratings yet

- FABM2-MODULE 9 - With ActivitiesDocument7 pagesFABM2-MODULE 9 - With ActivitiesROWENA MARAMBANo ratings yet

- Module 1C - Bank ReconciliationDocument4 pagesModule 1C - Bank ReconciliationtoshirohanamaruNo ratings yet

- Bank Reconcilition NotesDocument6 pagesBank Reconcilition NotesNurul Hazirah ZulkifliNo ratings yet

- Ch#7 BANK RECONCILIATION STATEMENTDocument4 pagesCh#7 BANK RECONCILIATION STATEMENTeaglerealestate31No ratings yet

- Bank ReconciliationDocument19 pagesBank ReconciliationSheenaGaliciaNew100% (4)

- Bank Reconcillation StatementDocument22 pagesBank Reconcillation StatementZaid SiddiqueNo ratings yet

- Bank Reconciliation, Petty Cash & Voucher SystemDocument4 pagesBank Reconciliation, Petty Cash & Voucher SystemYellow CarterNo ratings yet

- Fabm2 Q2 M3 - 4Document9 pagesFabm2 Q2 M3 - 4Zeus MalicdemNo ratings yet

- INTERMEDIATE ACCOUNTING I Bank ReconciliationDocument3 pagesINTERMEDIATE ACCOUNTING I Bank ReconciliationMark Navida AgunaNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationopticalgridcivilNo ratings yet

- Cfas CashDocument5 pagesCfas CashGeelyka MarquezNo ratings yet

- Audit Form - Working Paper - PCFDocument18 pagesAudit Form - Working Paper - PCFIra YbanezNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationMary Jullianne Caile SalcedoNo ratings yet

- 6 Lesson Six Bank ReconciliationDocument4 pages6 Lesson Six Bank ReconciliationmeshackcheruiyottNo ratings yet

- Module 1b - Bank ReconDocument37 pagesModule 1b - Bank ReconChen HaoNo ratings yet

- Module 3Document5 pagesModule 3Simoun EnriqueNo ratings yet

- Finals FABM2 Lesson 2 Bank ReconciliationDocument4 pagesFinals FABM2 Lesson 2 Bank ReconciliationJasmine VelosoNo ratings yet

- Two-Date Bank ReconciliationDocument5 pagesTwo-Date Bank Reconciliationsweet ecstacyNo ratings yet

- Topic 6 - Bank ReconciliationRev (Students)Document32 pagesTopic 6 - Bank ReconciliationRev (Students)Novian Dwi RamadanaNo ratings yet

- Chapter 6 Bank ReconciliationRev StudentsDocument20 pagesChapter 6 Bank ReconciliationRev StudentsNemalai VitalNo ratings yet

- ACC 124 HO 5 Bank Reconciliation and Proof of Cash - 0Document4 pagesACC 124 HO 5 Bank Reconciliation and Proof of Cash - 0Lily Scarlett ChìnNo ratings yet

- Basic Instructions For A Bank Reconciliation Statement PDFDocument4 pagesBasic Instructions For A Bank Reconciliation Statement PDFAman KodwaniNo ratings yet

- CHAPTER 09.bank Reconciliation StatementsDocument10 pagesCHAPTER 09.bank Reconciliation StatementsZaid SiddiqueNo ratings yet

- (Studocu) Int Acc Chapter 3 - Valix, Robles, Empleo, MillanDocument4 pages(Studocu) Int Acc Chapter 3 - Valix, Robles, Empleo, MillanHufana, Shelley100% (1)

- ACCOUNTING 102 - Topic #3 "Proof of Cash"Document4 pagesACCOUNTING 102 - Topic #3 "Proof of Cash"CLEAR MELODY VILLARANNo ratings yet

- Bank ReconciliationDocument14 pagesBank Reconciliationnicolettecatamio015No ratings yet

- 6_Bank_Reconciliation Additional Notes and IllustrationDocument9 pages6_Bank_Reconciliation Additional Notes and IllustrationmeshackcheruiyottNo ratings yet

- FINACC1 - Bank Reconciliation and Proof of CashDocument2 pagesFINACC1 - Bank Reconciliation and Proof of CashJerico DungcaNo ratings yet

- Bank ReconciliationDocument15 pagesBank Reconciliationhay buhayNo ratings yet

- FAR1 - Bank Reconciliation and Proof of CashDocument2 pagesFAR1 - Bank Reconciliation and Proof of CashHoney MuliNo ratings yet

- Bank ReconciliationDocument26 pagesBank ReconciliationQuennie Kate RomeroNo ratings yet

- Module 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPADocument24 pagesModule 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPALucas BantilingNo ratings yet

- Module 2 - Bank Reconciliation - With Sample ExercisesDocument24 pagesModule 2 - Bank Reconciliation - With Sample ExercisesJudie Ellaine SumandacNo ratings yet

- Cash and Cash Equivalents 1Document22 pagesCash and Cash Equivalents 1Mark GilNo ratings yet

- 03 Bank ReconciliationDocument5 pages03 Bank ReconciliationalteregoNo ratings yet

- Bank Reconciliation Journal Entries - Double Entry BookkeepingDocument9 pagesBank Reconciliation Journal Entries - Double Entry BookkeepingMizanur RahmanNo ratings yet

- CWTS1-USA-B-SAPE InfographicDocument1 pageCWTS1-USA-B-SAPE InfographiccyriljunaicamaranquezNo ratings yet

- Fabm2 QTR.2 Las 7.1Document10 pagesFabm2 QTR.2 Las 7.1Trunks KunNo ratings yet

- Chapter 5 Bank Reconciliation StatementDocument2 pagesChapter 5 Bank Reconciliation StatementDeveender Kaur JudgeNo ratings yet

- Receivable FinancingDocument34 pagesReceivable FinancingmaryzeenNo ratings yet

- Receivable Financing CH14 by LailaneDocument30 pagesReceivable Financing CH14 by LailaneEunice BernalNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementMuhammad BilalNo ratings yet

- Chapter 3 Bank Recon Lecture StudentDocument5 pagesChapter 3 Bank Recon Lecture StudentAshlene CruzNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationZejkeara ImperialNo ratings yet

- Journal Entries For Bank ReconciliationDocument2 pagesJournal Entries For Bank ReconciliationAira Mae Quinones OrendainNo ratings yet

- Bank ReconciliationDocument27 pagesBank Reconciliationnaruto uzumakiNo ratings yet

- Bank ReconciliationDocument23 pagesBank ReconciliationJohn Anjelo MoraldeNo ratings yet

- Bank Reconciliations - 1Document9 pagesBank Reconciliations - 1ZAKAYO NJONYNo ratings yet

- Receivable Financing: Pledge, Assignment, and FactoringDocument30 pagesReceivable Financing: Pledge, Assignment, and FactoringJoy UyNo ratings yet

- Aa21 Afa Chapter 01 EnglishDocument12 pagesAa21 Afa Chapter 01 EnglishnafeesNo ratings yet

- Fabm2 - 8.2Document15 pagesFabm2 - 8.2Kervin GuevaraNo ratings yet

- Chap 9 - Proof of Cash Fin Acct 1 - Barter Summary Team PDFDocument7 pagesChap 9 - Proof of Cash Fin Acct 1 - Barter Summary Team PDFCarl James Austria100% (1)

- Dictioformula ProblemsDocument42 pagesDictioformula ProblemsEza Joy ClaveriasNo ratings yet

- CH08 Bank ReconciliationDocument12 pagesCH08 Bank ReconciliationRose DionioNo ratings yet

- ABM FABM2 Q2 Wk3 LAS3Document11 pagesABM FABM2 Q2 Wk3 LAS3ayaNo ratings yet

- 05 Laboratory Exercise 1Document2 pages05 Laboratory Exercise 1Praisen JoyNo ratings yet

- Formulas in Business FinanceDocument4 pagesFormulas in Business FinancePraisen JoyNo ratings yet

- 07 Laboratory Exercise 1Document3 pages07 Laboratory Exercise 1Praisen JoyNo ratings yet

- 08 Quiz 1Document3 pages08 Quiz 1Praisen JoyNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesMaximuzNo ratings yet

- Faqs On Internet Banking Services (Ibs) For NrisDocument2 pagesFaqs On Internet Banking Services (Ibs) For NrisABMNo ratings yet

- Marketing of Financial Services NMIMS AssignmentDocument4 pagesMarketing of Financial Services NMIMS AssignmentN. Karthik UdupaNo ratings yet

- Check-Out Procedures: B.Sc. (HHA) / 2 Year/ Checkout ProceduresDocument10 pagesCheck-Out Procedures: B.Sc. (HHA) / 2 Year/ Checkout ProceduresAryan BishtNo ratings yet

- Business Banking Price ListDocument15 pagesBusiness Banking Price ListSARFRAZ ALINo ratings yet

- Mastering Personal Credit and Personal FudningDocument15 pagesMastering Personal Credit and Personal FudningAli Tarafdar, QFOPNo ratings yet

- Lecture Sheet of Final Syllabus: Negotiable Instruments Act, 1881Document4 pagesLecture Sheet of Final Syllabus: Negotiable Instruments Act, 1881Eshthiak HossainNo ratings yet

- Niam Knoll - TransUnion Personal Credit Report - 20200802Document4 pagesNiam Knoll - TransUnion Personal Credit Report - 20200802Bruce WaynneNo ratings yet

- Individual Assignment - On - COMPANY - STRATEGIC - ANALYSIS.Document14 pagesIndividual Assignment - On - COMPANY - STRATEGIC - ANALYSIS.Adanech100% (1)

- First American Bank's Donald Roubitcheck, Chief Financial Officer - Completed TARP - Use of Capital Survey, Donald Roubitchek CFO July 24, 2009Document3 pagesFirst American Bank's Donald Roubitcheck, Chief Financial Officer - Completed TARP - Use of Capital Survey, Donald Roubitchek CFO July 24, 2009larry-612445No ratings yet

- Account Details and Transaction History: Mohd Salleh Bin AmboDocument2 pagesAccount Details and Transaction History: Mohd Salleh Bin AmboMohd Salleh AmboNo ratings yet

- Nilson Report Issue 1169Document12 pagesNilson Report Issue 1169John Mulder100% (1)

- Sob Select 30 12 2022Document2 pagesSob Select 30 12 2022nishan1187No ratings yet

- Canara Bank Project ReportDocument16 pagesCanara Bank Project Reportsagar m100% (1)

- Currency Seasonal Patterns Free EbookDocument21 pagesCurrency Seasonal Patterns Free Ebookkh267aziziNo ratings yet

- Weekly ReportDocument4 pagesWeekly ReportAiane_Reyes_5594No ratings yet

- Daftar Bank Yang Ada Di Wilayah PontianakDocument4 pagesDaftar Bank Yang Ada Di Wilayah PontianakWindia SariNo ratings yet

- Seminar Questions Set III A-2Document3 pagesSeminar Questions Set III A-2fanuel kijojiNo ratings yet

- FRM & VIGILANCE OF BANK POLICY J&K BankDocument37 pagesFRM & VIGILANCE OF BANK POLICY J&K BankAnshul BishtNo ratings yet

- Akong'a, Cynthia J - The Effect of Financial Risk Management On The Financial Performance of Commercial Banks in KenyaDocument57 pagesAkong'a, Cynthia J - The Effect of Financial Risk Management On The Financial Performance of Commercial Banks in KenyaEsobiebi ChristabelNo ratings yet

- Ch02-Cash Inflow OutFlowDocument45 pagesCh02-Cash Inflow OutFlowismat arteeNo ratings yet

- Moroz IlonaDocument1 pageMoroz IlonaСергей АлексеевичNo ratings yet

- Ch-2 FRONT OFFICE (ACCOUNTING)Document11 pagesCh-2 FRONT OFFICE (ACCOUNTING)DawaNo ratings yet

- Basu and Dutta Journal EntriesDocument7 pagesBasu and Dutta Journal EntriesAranya Haldar100% (2)

- Cambridge Ordinary LevelDocument12 pagesCambridge Ordinary LevelAlexNo ratings yet

- RamishDocument14 pagesRamishpradeep swatiNo ratings yet

- Updated - Note On NeobanksDocument38 pagesUpdated - Note On NeobanksAnirudh SoodNo ratings yet

- Chapter 2 AccountingDocument12 pagesChapter 2 Accountingmoon loverNo ratings yet

- 0151xxxxxxxx6295 - 2023 12 01Document6 pages0151xxxxxxxx6295 - 2023 12 01George GeranisNo ratings yet