Professional Documents

Culture Documents

ABSLI Multiplier Fund

ABSLI Multiplier Fund

Uploaded by

Tanveer AhmadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABSLI Multiplier Fund

ABSLI Multiplier Fund

Uploaded by

Tanveer AhmadCopyright:

Available Formats

Multiplier Fund SFIN No.

ULIF01217/10/07BSLINMULTI109

About The Fund Date of Inception: 30-Oct-07

OBJECTIVE: To provide long-term wealth maximization by actively managing a well-diversified equity portfolio, predominantly comprising of

companies whose market capitalisation is close to Rs. 1000 crores and above.

STRATEGY: To build and actively manage a well-diversified equity portfolio of value and growth driven stocks by following a research driven investment

approach. The investments would be predominantly made in mid-cap stocks, with an option to invest 30% in large-cap stocks as well. While

appreciating the high risk associated with equities, the fund would attempt to maximize the risk-return pay-off for the long-term advantage of the

policyholders. The fund will also maintain reasonable level of liquidity.

NAV as on 29th October 2021: ` 56.5932 BENCHMARK: Nifty Midcap 100 & Crisil Liquid Fund Index

Asset held as on 29th October 2021: ` 2465.63 Cr FUND MANAGER: Mr. Bhaumik Bhatia

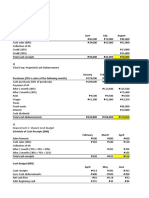

Multiplier BM Asset Allocation AUM (in Cr.)

MMI, Deposits,

CBLO & Others G-Secs

0.60% Equity

4.35% 2343.67 (95 %)

Equity Debt

95.05% 121.96 (5%)

Apr-16

Apr-18

Apr-15

Apr-17

Apr-19

Apr-20

Apr-21

Oct-14

Oct-15

Oct-16

Oct-17

Oct-18

Oct-19

Oct-20

Oct-21

SECURITIES Holding

Sectoral Allocation

GOVERNMENT SECURITIES 0.60%

0% Strips GOI 2061(MD 22/02/2027) 0.30% FINANCIAL SERVICES 12.54%

0% Strips GOI 2061(MD 22/08/2027) 0.29%

CAPITAL GOODS 10.36%

EQUITY 95.05%

Tata Power Company Limited 2.48% PHARMACEUTICALS 8.28%

Shriram Transport Finance Company Limited 2.36%

AUTOMOBILE 7.24%

Adani Total Gas Limited 2.34%

Crompton Greaves Consumer Electricals Limited 2.26% SOFTWARE / IT 6.76%

Fedral Bank Limited 2.12%

Bharat Forge Limited Fv 2 2.02% OIL AND GAS 5.79%

Zee Entertainment Enterprises Limited 2.01%

Voltas Limited 2.00% BANKING 5.76%

Max Financial Services Limited 1.79% MANUFACTURING 5.06%

Ashok Leyland Limited Fv 1 1.73%

Other Equity 73.95% POWER 4.34%

MMI, Deposits, CBLO & Others 4.35% CHEMICALS 3.21%

Rating Profile OTHER 30.67%

Fund Update:

Exposure to equities has decreased to 95.05% from 97.06% and MMI has

Sovereign increased to 4.35% from 2.94% on MOM basis.

100.00%

Multiplier fund is predominantly invested in high quality mid cap stocks and

maintains a well diversified portfolio with investments made across various

sectors.

Refer annexure for complete portfolio details.

19

Aditya Birla Sun Life Insurance Company Limited | adityabirlasunlifeinsurance.com

You might also like

- Allapacan Company Bought 20Document18 pagesAllapacan Company Bought 20Carl Yry BitzNo ratings yet

- Problem 1.6Document1 pageProblem 1.6SamerNo ratings yet

- Birla Insurance Individual Maximiser Fund December 2023Document1 pageBirla Insurance Individual Maximiser Fund December 2023sharmaoriginalNo ratings yet

- Eti 03 EngineTestingOverviewDocument1 pageEti 03 EngineTestingOverviewJames JosephNo ratings yet

- Disclosure Ulip Feb-2020Document60 pagesDisclosure Ulip Feb-2020pankarvi6No ratings yet

- Can All AMCs OutperformDocument30 pagesCan All AMCs OutperformGanesh CvNo ratings yet

- IFC Investment Portfolio SheetDocument28 pagesIFC Investment Portfolio Sheetmorrisonkaniu8283No ratings yet

- Financial Services Infographic June 2020Document2 pagesFinancial Services Infographic June 2020Pratik MoreNo ratings yet

- CRISIL Mutual Fund Ranking December 2020Document48 pagesCRISIL Mutual Fund Ranking December 2020RANJITNo ratings yet

- November 2023 ICEA LION Income Fund Fact SheetDocument1 pageNovember 2023 ICEA LION Income Fund Fact SheetAndrew MuhumuzaNo ratings yet

- Time TechnoplastDocument8 pagesTime Technoplastagrawal.minNo ratings yet

- Chalet Hotels Idbi AnalysisDocument39 pagesChalet Hotels Idbi AnalysisAnirudha ThenganeNo ratings yet

- The Philippine Stock MarketDocument1 pageThe Philippine Stock MarketKim AlfredNo ratings yet

- Unit-Linked Fund: Balancer II (Open Fund)Document1 pageUnit-Linked Fund: Balancer II (Open Fund)sandeepNo ratings yet

- Unity Foods Detail ReportDocument40 pagesUnity Foods Detail ReportTayyaba RehmanNo ratings yet

- International Developed Equity Allocation FundDocument2 pagesInternational Developed Equity Allocation Fundb1OSphereNo ratings yet

- November 2023 ICEA LION Balanced Fund Fact SheetDocument1 pageNovember 2023 ICEA LION Balanced Fund Fact SheetAndrew MuhumuzaNo ratings yet

- Maceef FS202212Document10 pagesMaceef FS202212Guan JooNo ratings yet

- Pakistan by The Numbers: Budget May See Stock-Specific News, But COVID-19 Dynamics Still Drive The MarketDocument17 pagesPakistan by The Numbers: Budget May See Stock-Specific News, But COVID-19 Dynamics Still Drive The MarketmudasserNo ratings yet

- Listed Securities Database As of June 25 2024Document4 pagesListed Securities Database As of June 25 2024Polynne DiraNo ratings yet

- Revision Notes On Economy of J&K by Vidhya Tutorials.Document7 pagesRevision Notes On Economy of J&K by Vidhya Tutorials.MuzaFar100% (1)

- Global Equity Allocation FundDocument2 pagesGlobal Equity Allocation Fundb1OSphereNo ratings yet

- Infographic FinalDocument1 pageInfographic FinalKnowledge Equals PowerNo ratings yet

- Quant Tax Plan - Fact SheetDocument1 pageQuant Tax Plan - Fact Sheetsaransh saranshNo ratings yet

- IDFC Factsheet November 2020Document62 pagesIDFC Factsheet November 2020dali faceNo ratings yet

- Al Meezan Investment Management LTD.: Submitt Ed To Mr. Sikander IqbalDocument22 pagesAl Meezan Investment Management LTD.: Submitt Ed To Mr. Sikander IqbalSameer AsifNo ratings yet

- ICRON Mutual Fund Screener - June 2019Document20 pagesICRON Mutual Fund Screener - June 2019Nirav MasraniNo ratings yet

- B A Aurangabad Girish Singh Bisht Vikash Kumar Raghvendra Singh BIHDocument4 pagesB A Aurangabad Girish Singh Bisht Vikash Kumar Raghvendra Singh BIHVikash KumarNo ratings yet

- Alternative Investments: Myths & Misconceptions: Myth: Alternative Investments Are More Volatile Than StocksDocument8 pagesAlternative Investments: Myths & Misconceptions: Myth: Alternative Investments Are More Volatile Than Stockscotgr878No ratings yet

- The Philippine Stock Market: Net SellingDocument1 pageThe Philippine Stock Market: Net SellingAnne Chelsea Ramirez OritNo ratings yet

- What's Your Investing Personality?: Get The Basics RightDocument1 pageWhat's Your Investing Personality?: Get The Basics RightDharmendra JadejaNo ratings yet

- FMR Faaf SepDocument1 pageFMR Faaf SepAli RazaNo ratings yet

- Itc - Buy: Building A Profitable FMCG BusinessDocument13 pagesItc - Buy: Building A Profitable FMCG Businessagrawal.minNo ratings yet

- Key Features of Budget 2022-2023: February, 2022Document17 pagesKey Features of Budget 2022-2023: February, 2022Kshatrapati SinghNo ratings yet

- FRB 8 Acctg For FWL Waiver Rebate (Final)Document19 pagesFRB 8 Acctg For FWL Waiver Rebate (Final)cheezhen5047No ratings yet

- MM Forgings: (Mmforg)Document6 pagesMM Forgings: (Mmforg)satyendragupta0078810No ratings yet

- Our Mission..... Your Growth: Team Code: JusticiaDocument28 pagesOur Mission..... Your Growth: Team Code: JusticiaParth KakadeNo ratings yet

- Motherson Sumi: Impressive Margin Profile, Sustenance Holds KeyDocument8 pagesMotherson Sumi: Impressive Margin Profile, Sustenance Holds KeyAnurag MishraNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAkshad KhedkarNo ratings yet

- IDFC Factsheet March 2021Document72 pagesIDFC Factsheet March 2021Karambir Singh DhayalNo ratings yet

- 03FMR - March 2021Document1 page03FMR - March 2021Ali RazaNo ratings yet

- Hul Wacc PDFDocument1 pageHul Wacc PDFutkNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- IIFL - BSE - Company Update - Upgrade To BUY - 20210325Document8 pagesIIFL - BSE - Company Update - Upgrade To BUY - 20210325Varun GoenkaNo ratings yet

- Adani Ports Investor Presentation - London NDR PDFDocument31 pagesAdani Ports Investor Presentation - London NDR PDFHarsh GuptaNo ratings yet

- Globus Spirits - IDirect - 200921 - EBRDocument4 pagesGlobus Spirits - IDirect - 200921 - EBREquity NestNo ratings yet

- Hoxton - Moderate Growth Model GBP Acc - FactsheetDocument7 pagesHoxton - Moderate Growth Model GBP Acc - FactsheetSivakumarPalanisamyGounderNo ratings yet

- CRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020Document48 pagesCRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2020MohitNo ratings yet

- A A+ Biharsharif Girish Singh Bisht Vikash Kumar None BIHDocument4 pagesA A+ Biharsharif Girish Singh Bisht Vikash Kumar None BIHVikash KumarNo ratings yet

- Majid Elite MENA Equity ADocument1 pageMajid Elite MENA Equity Avelvivek22No ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Cas Summary Report 2022 08 19 123504Document5 pagesCas Summary Report 2022 08 19 123504aman feriadNo ratings yet

- CRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2021Document52 pagesCRISIL Mutual Fund Ranking: For The Quarter Ended September 30, 2021winas30187No ratings yet

- Marcellus Little-Champs PresentationDocument17 pagesMarcellus Little-Champs PresentationqwertyNo ratings yet

- Relaxo Footwears: Resilient Performance Amid Challenging ScenarioDocument6 pagesRelaxo Footwears: Resilient Performance Amid Challenging ScenarioGuarachandar ChandNo ratings yet

- UBL Fund Manager's Report - February 2024Document49 pagesUBL Fund Manager's Report - February 2024aniqa.asgharNo ratings yet

- Little Champs PMS: An Investment Strategy For Indian Small Caps From Marcellus Investment ManagersDocument18 pagesLittle Champs PMS: An Investment Strategy For Indian Small Caps From Marcellus Investment Managerssubham mohantyNo ratings yet

- Assets Under Management of Mutual Fund Industry Years AUM (In Trillion)Document5 pagesAssets Under Management of Mutual Fund Industry Years AUM (In Trillion)pratikNo ratings yet

- Gati LTD Long Term RecommendationDocument43 pagesGati LTD Long Term RecommendationRishab taankNo ratings yet

- Initiating Coverage: Power Tillers To Steer Growth - Initiate With BUYDocument18 pagesInitiating Coverage: Power Tillers To Steer Growth - Initiate With BUYsarvo_44No ratings yet

- ICICI Action Construction EquipmentDocument7 pagesICICI Action Construction Equipmentsuman sekhar dekaNo ratings yet

- Cowin Certificate 16294419516407Document1 pageCowin Certificate 16294419516407Tanveer AhmadNo ratings yet

- Chest ProtocolsDocument82 pagesChest ProtocolsTanveer AhmadNo ratings yet

- Tanveer NewDocument2 pagesTanveer NewTanveer AhmadNo ratings yet

- KMC Manipal MBBS - Fees Structure - 20211213142300Document4 pagesKMC Manipal MBBS - Fees Structure - 20211213142300Tanveer AhmadNo ratings yet

- Physical Stock Report: Print Date Time: Page No.: Stock Type: From Date: WarehouseDocument10 pagesPhysical Stock Report: Print Date Time: Page No.: Stock Type: From Date: WarehouseAung Phyoe ThetNo ratings yet

- Ent300 Case StudyDocument17 pagesEnt300 Case StudyAlya DiyanahNo ratings yet

- Ammen Case-Study3Document2 pagesAmmen Case-Study3JackNo ratings yet

- Final ReportDocument29 pagesFinal Reportapi-644830595No ratings yet

- Notification For Engagement of Part-Time Consultants in DVCDocument7 pagesNotification For Engagement of Part-Time Consultants in DVCSomu SenNo ratings yet

- Reporter End of Life: Product Release Date Begin 180-Day Support Period End of Maintenance/End of SupportDocument2 pagesReporter End of Life: Product Release Date Begin 180-Day Support Period End of Maintenance/End of SupportmewiteNo ratings yet

- Status of Test - Blank FormxlsDocument36 pagesStatus of Test - Blank FormxlsKyndree PadsingNo ratings yet

- Requirement 1: Shazam Cash BudgetDocument4 pagesRequirement 1: Shazam Cash BudgetVixen Aaron EnriquezNo ratings yet

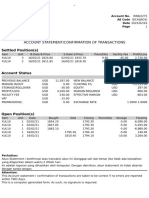

- Account Statement/Confirmation of Transactions: Settled Position(s)Document1 pageAccount Statement/Confirmation of Transactions: Settled Position(s)mohammad qadafiNo ratings yet

- Bangalore Metallurgy in AIM BrochureDocument7 pagesBangalore Metallurgy in AIM Brochurebhavesh solankiNo ratings yet

- An Education Service Business Plan: Prepared by Martin Kam Lo Tel: +959400303477 Year 2015Document55 pagesAn Education Service Business Plan: Prepared by Martin Kam Lo Tel: +959400303477 Year 2015rico vanNo ratings yet

- Implementing Hyperion in Multiple Geographies Anjula Sengar and Canan Akkan AMOSCADocument23 pagesImplementing Hyperion in Multiple Geographies Anjula Sengar and Canan Akkan AMOSCAsriuae1982No ratings yet

- Ostensible AuthorityDocument4 pagesOstensible AuthorityAgitha GunasagranNo ratings yet

- Marketing of Halal Products in Saudi ArabiaDocument14 pagesMarketing of Halal Products in Saudi ArabiaAmer Al-moqiadNo ratings yet

- Solar Off-Grid SchemeDocument19 pagesSolar Off-Grid SchemeLawrence GeorgeMannanNo ratings yet

- Sabi V SaharaDocument2 pagesSabi V SaharasahilNo ratings yet

- Afa Ii Assignment IiDocument2 pagesAfa Ii Assignment Iiworkiemelkamu400100% (1)

- Data Warehouse Data Mining Lecture PlanDocument1 pageData Warehouse Data Mining Lecture PlanAnkit ChoukotiyaNo ratings yet

- A Khulna BARAK BANKDocument1 pageA Khulna BARAK BANKogaNo ratings yet

- Evolution of Project ManagementDocument14 pagesEvolution of Project ManagementSUSHANT S JOSHI100% (1)

- Giaa 0919Document146 pagesGiaa 0919Zaa ZahrohNo ratings yet

- Additional Notes - Chapter 5 - Overview of Risk and ReturnDocument7 pagesAdditional Notes - Chapter 5 - Overview of Risk and ReturnPaupauNo ratings yet

- Hemant Vijay Pandya: Non-Banking Financial Company An OverviewDocument32 pagesHemant Vijay Pandya: Non-Banking Financial Company An OverviewHashmi SutariyaNo ratings yet

- MAT Feb-2019 Registration Form: Personal ParticularsDocument2 pagesMAT Feb-2019 Registration Form: Personal ParticularsNikita ChandukaNo ratings yet

- Success Factor Technology and Product Development: Enercon MagazineDocument16 pagesSuccess Factor Technology and Product Development: Enercon MagazineTuan DzungNo ratings yet

- 237.esponcilla v. Bagong Tanyag 529 SCRA 654Document8 pages237.esponcilla v. Bagong Tanyag 529 SCRA 654Trebx Sanchez de GuzmanNo ratings yet

- Noosa Boathouse - Employee Handbook 2021Document42 pagesNoosa Boathouse - Employee Handbook 2021Raj GaneshNo ratings yet

- Anindya Chaudhuri EPW-2016 Policy StudiesDocument10 pagesAnindya Chaudhuri EPW-2016 Policy StudiesKanooni SalahNo ratings yet