Professional Documents

Culture Documents

Test 1 Suggested Solutions - 2022 UNISA - Level 2

Test 1 Suggested Solutions - 2022 UNISA - Level 2

Uploaded by

Jake poolCopyright:

Available Formats

You might also like

- Statement 011417 PDFDocument3 pagesStatement 011417 PDFKathleen MendegorinNo ratings yet

- Quiz Dealings in Properties TAXATIONDocument10 pagesQuiz Dealings in Properties TAXATIONAngela Nicole NobletaNo ratings yet

- Statement: Branch Details Your Current Details Period 2020 To 202Document6 pagesStatement: Branch Details Your Current Details Period 2020 To 202xxalias100% (1)

- Statement For Ufone # 03331213814: Account DetailsDocument4 pagesStatement For Ufone # 03331213814: Account DetailsMuhammad kabir jamilNo ratings yet

- Tax298 Chapter 5 Exemptions - Question Pack 2024Document14 pagesTax298 Chapter 5 Exemptions - Question Pack 2024kobus7532No ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Income Exempt From TaxDocument4 pagesIncome Exempt From TaxKartikNo ratings yet

- LU5 WorkbookDocument16 pagesLU5 Workbookprowess222No ratings yet

- CPAR Taxation PreweekDocument38 pagesCPAR Taxation PreweekAndrei Nicole RiveraNo ratings yet

- Pre-Week Batch 90 (TAX)Document12 pagesPre-Week Batch 90 (TAX)Elaine Joyce GarciaNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- MCQ On TDS, TCS & Advance TaxDocument15 pagesMCQ On TDS, TCS & Advance TaxPrakhar GuptaNo ratings yet

- 23 Tax JuneDocument16 pages23 Tax JunemistryankusNo ratings yet

- Adv Tax, TDS, TCS, Return Filing, Total Income - SolutionDocument8 pagesAdv Tax, TDS, TCS, Return Filing, Total Income - SolutionBharatbhusan RoutNo ratings yet

- Compiler Additional Questions For Nov 22 ExamsDocument18 pagesCompiler Additional Questions For Nov 22 ExamsRobertNo ratings yet

- Income Must Be Money or Convertible Into Money Nature of Trade)Document6 pagesIncome Must Be Money or Convertible Into Money Nature of Trade)HD DNo ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Cta Taxation of Individuals HWDocument6 pagesCta Taxation of Individuals HWEffie ChirembweNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- Tax SuggestedDocument28 pagesTax SuggestedHemaNo ratings yet

- South-Western Federal Taxation 2016 Comprehensive 39th Edition Solution Manual 1Document36 pagesSouth-Western Federal Taxation 2016 Comprehensive 39th Edition Solution Manual 1briancrosbyqfakzcndys100% (28)

- CUAC 408 Group Presentations 2021-1Document24 pagesCUAC 408 Group Presentations 2021-1ChidoNo ratings yet

- TAX 388 Exempt Income 2023 StudentDocument37 pagesTAX 388 Exempt Income 2023 StudentGimbaZANo ratings yet

- CA Ipcc Taxation Suggested Answers For Nov 2016Document16 pagesCA Ipcc Taxation Suggested Answers For Nov 2016Sai Kumar SandralaNo ratings yet

- Income Tax Divyastra CH 3 Exempt Income R 1Document6 pagesIncome Tax Divyastra CH 3 Exempt Income R 1Subraja KarthikeyanNo ratings yet

- Amendments May 2024 3Document18 pagesAmendments May 2024 3ukqrnnnjhfwsxqoykuNo ratings yet

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDocument25 pagesTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Instructions:: Question Paper Booklet CodeDocument16 pagesInstructions:: Question Paper Booklet CodeAnonymous yPWi8p3KkANo ratings yet

- Taxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For TheDocument4 pagesTaxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For Theswarna dasNo ratings yet

- South Western Federal Taxation 2017 Comprehensive 40Th Edition Hoffman Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2017 Comprehensive 40Th Edition Hoffman Solutions Manual Full Chapter PDFfred.henderson352100% (11)

- AF308 Second Semester 2020 Short Test TwoDocument3 pagesAF308 Second Semester 2020 Short Test TwoShayal ChandNo ratings yet

- TXZAF 2019 Dec ADocument8 pagesTXZAF 2019 Dec AKAH MENG KAMNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Tax (SEM. VI) 2019 PATTERNDocument4 pagesTax (SEM. VI) 2019 PATTERNganuNo ratings yet

- BIR Ruling (DA-335) 815-09Document5 pagesBIR Ruling (DA-335) 815-09Ren Mar CruzNo ratings yet

- South Western Federal Taxation 2016 Individual Income Taxes 39Th Edition Hoffman Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2016 Individual Income Taxes 39Th Edition Hoffman Solutions Manual Full Chapter PDFfred.henderson352100% (12)

- South-Western Federal Taxation 2016 Individual Income Taxes 39th Edition Hoffman Solutions Manual 1Document26 pagesSouth-Western Federal Taxation 2016 Individual Income Taxes 39th Edition Hoffman Solutions Manual 1alisha100% (53)

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- Q&A Selected Questions 2 1Document9 pagesQ&A Selected Questions 2 1Saddam HusseinNo ratings yet

- S3 3-TaxationDocument12 pagesS3 3-TaxationMartin NzamutumaNo ratings yet

- WHT & DtaDocument26 pagesWHT & Dtafaz watiNo ratings yet

- Cs Professional Income Tax Question Bank Part - 1 For Dec 21 & June 22Document64 pagesCs Professional Income Tax Question Bank Part - 1 For Dec 21 & June 22pande anujNo ratings yet

- 03 NP Chap 03 Income Exempt From Tax Additional Questions 2022Document6 pages03 NP Chap 03 Income Exempt From Tax Additional Questions 2022xgnz1630No ratings yet

- Paper7 Set1Document9 pagesPaper7 Set1meswetashaw96No ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- DT Smart WorkDocument15 pagesDT Smart WorkmaacmampadNo ratings yet

- M.B.A (2016 Pattern)Document39 pagesM.B.A (2016 Pattern)Radha ChoudhariNo ratings yet

- Chapter 10 - Incomes Which Do Not Form Part of Total Income - NotesDocument10 pagesChapter 10 - Incomes Which Do Not Form Part of Total Income - NotesRahul TiwariNo ratings yet

- Chapter 3 Employment Income BKAT2013Document82 pagesChapter 3 Employment Income BKAT2013Nurul AfiqahNo ratings yet

- EContent 3 2024 02 28 07 24 01 IFOSBBAHONSdocx 2024 02 26 10 21 57Document7 pagesEContent 3 2024 02 28 07 24 01 IFOSBBAHONSdocx 2024 02 26 10 21 57solanki YashNo ratings yet

- Document From Rajan®Document5 pagesDocument From Rajan®Anit LuckyNo ratings yet

- ACW291 CHP 9 Withholding Tax - 231117 - 153847Document33 pagesACW291 CHP 9 Withholding Tax - 231117 - 153847hemaram2104No ratings yet

- Paper-2 International Tax Practice-NOV 20Document22 pagesPaper-2 International Tax Practice-NOV 20dhawaljaniNo ratings yet

- CA Inter Tax A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter Tax A MTP 2 May 2024 Castudynotes Comabcdefgh1234567890101112No ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Mba 3 TaxDocument14 pagesMba 3 Taxkapil3518No ratings yet

- Paper 4 Taxation Nov 14 PDFDocument16 pagesPaper 4 Taxation Nov 14 PDFghsjgjNo ratings yet

- KEY WORDS - Income TaxationDocument23 pagesKEY WORDS - Income TaxationQueenVictoriaAshleyPrietoNo ratings yet

- ACW290 - Chap5 - Business IncomeDocument27 pagesACW290 - Chap5 - Business IncomeMERINANo ratings yet

- Taxation Unit 7 - Tutorial SolutionsDocument8 pagesTaxation Unit 7 - Tutorial SolutionshavengroupnaNo ratings yet

- Taxes and Duties at A Glance 2023-2024Document33 pagesTaxes and Duties at A Glance 2023-2024Jacob SangaNo ratings yet

- Bank Rec 1220 Jul-Dec 2021-1Document1 pageBank Rec 1220 Jul-Dec 2021-1Jake poolNo ratings yet

- ITC April 2021 Examiners CommentsDocument39 pagesITC April 2021 Examiners CommentsJake poolNo ratings yet

- IAS12Document40 pagesIAS12Myie Cruz-VictorNo ratings yet

- Estate Duty Act Chapter 23 - 03 - UpdatedDocument15 pagesEstate Duty Act Chapter 23 - 03 - UpdatedJake poolNo ratings yet

- Citizen PTR Receipt (2023-2024)Document1 pageCitizen PTR Receipt (2023-2024)AnmolBansalNo ratings yet

- 122918981824Document1 page122918981824CHRISTINE kawasiimaNo ratings yet

- Terms & Conditions - Smartemi (Dial An Emi) : Please Note ThatDocument2 pagesTerms & Conditions - Smartemi (Dial An Emi) : Please Note ThatSaurabh SharmaNo ratings yet

- Sample Commercial InvoiceDocument1 pageSample Commercial Invoiceserdar khanNo ratings yet

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- Welcome To My PresentationDocument11 pagesWelcome To My PresentationNa Omar FarukNo ratings yet

- CGT Tomanda AntokDocument1 pageCGT Tomanda AntokNvision PresentNo ratings yet

- Date Transaction Description Amount (In RS.)Document2 pagesDate Transaction Description Amount (In RS.)Sushma AshokNo ratings yet

- NDA All Mcqs 2024Document4 pagesNDA All Mcqs 2024Shailesh PandeyNo ratings yet

- Tax in Voice or 1192008 Ad 84977Document1 pageTax in Voice or 1192008 Ad 84977Pratibha MittalNo ratings yet

- Bonus QuizDocument4 pagesBonus QuizDin Rose GonzalesNo ratings yet

- ChallanDocument1 pageChallanShweta MauryaNo ratings yet

- On August 31 2015 The Rijo Equipment Repair Corp S Post ClosingDocument1 pageOn August 31 2015 The Rijo Equipment Repair Corp S Post ClosingMiroslav GegoskiNo ratings yet

- The Financial Act 2019 CompressedDocument71 pagesThe Financial Act 2019 CompressedTarifNo ratings yet

- PEDRO RELATIVO, ET AL., Defendants-AppellantsDocument3 pagesPEDRO RELATIVO, ET AL., Defendants-AppellantsErwin L BernardinoNo ratings yet

- AIS Lab - Chaps 7, 8, 9Document100 pagesAIS Lab - Chaps 7, 8, 9lyoniezenNo ratings yet

- Investment in Debt SecuritiesDocument21 pagesInvestment in Debt SecuritiesAlarich CatayocNo ratings yet

- Helvering V HorstDocument3 pagesHelvering V HorstKaren PascalNo ratings yet

- RBI Adapter SpecificationDocument4 pagesRBI Adapter Specificationpandu MNo ratings yet

- Pleted.20210122 20210221Document85 pagesPleted.20210122 20210221aizatiman665No ratings yet

- Duplichecker-Plagiarism-Bab (2,2)Document2 pagesDuplichecker-Plagiarism-Bab (2,2)Sarah MaharaniNo ratings yet

- Tax Codes To Use From 6 April 2021: For All EmployeesDocument1 pageTax Codes To Use From 6 April 2021: For All EmployeesAmritaShuklaNo ratings yet

- WL WL: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageWL WL: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)PranshuNo ratings yet

- Tax Invoice: S3948174-1 Gary Bailey La Fontanilla 97 14470 EL VISODocument1 pageTax Invoice: S3948174-1 Gary Bailey La Fontanilla 97 14470 EL VISOCarlos Sobral100% (1)

- Computation Part2Document4 pagesComputation Part2Jeane Mae BooNo ratings yet

- GST On Redevelopment Projects - Taxguru - inDocument4 pagesGST On Redevelopment Projects - Taxguru - inTejas SodhaNo ratings yet

Test 1 Suggested Solutions - 2022 UNISA - Level 2

Test 1 Suggested Solutions - 2022 UNISA - Level 2

Uploaded by

Jake poolOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test 1 Suggested Solutions - 2022 UNISA - Level 2

Test 1 Suggested Solutions - 2022 UNISA - Level 2

Uploaded by

Jake poolCopyright:

Available Formats

Integrity House, Corner Sam Nujoma & Bath Road

P.O. Box 1079, Causeway, Harare

TELEPHONE: 263-4-793950/471/252672

FASCIMILE: 263-4-706245

A member of IFAC and ECSAFA E-MAIL: administrator@icaz.org.zw

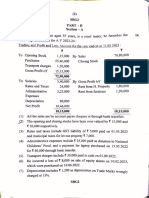

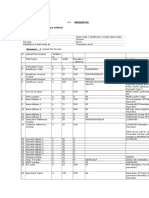

SUGGESTED SOLUTIONS

PAPER 1

ADVANCED ZIMBABWE TAXATION 2022

POSTGRADUATE DIPLOMA IN ADVANCED ACCOUNTING SCIENCES

CTA Level 2 [CAZ2]

TEST 1: 15 MARCH 2022

SUGGESTED SOLUTIONS MARKS

(i) (a) The ZW$64,000 paid for legal fees in respect of drafting and

defending a commercial contract is tax deductible in the hands of 2

Build Zimbabwe Limited since it was incurred in the production

of income and the services were not of a capital nature.

(b) The ZW$12,000 paid for appealing against an EMA penalty is

disallowed because it was not incurred in the production of 2

income but rather defending an illegality.

(ii) Fines and penalties are non-deductible because they are against 2

public policy and the income tax law can not cause the

punishment to be diminished by allowing their deductibility.

Therefore, the ZW$68,000 paid to EMA will be disallowed.

(iii) Build Zimbabwe Limited should account for the US$50,000 in the 3

2023 tax year of assessment. This is because as at 31 December

2022, BZL will not be unconditionally entitled to the income since

it will not have performed its obligation and the amount is

refundable if the contract is terminated.

(iv) Mansi Engineering (Pty) Ltd.’s income received from Build

Zimbabwe Limited is taxable in Zimbabwe, which is the true 4

source of the income since services were rendered in Zimbabwe

and Mzansi Engineering has a permanent establishment in

Zimbabwe. Mzansi Engineering may seek double taxation relief

in South Africa in terms of the double taxation treaty that exists

between Zimbabwe and South Africa.

(v) Engineer Jordan Nsingo’s remuneration earned from rendering

services in Zimbabwe is subject to PAYE in Zimbabwe

irrespective of the period he has spent in Zimbabwe because. 2

Zimbabwe is the true source of his remuneration income (s12

(1)(b)). Mzansi may seek relief in South Africa in terms of the

double taxation treaty that exists between Zimbabwe and South

Africa.

(vi) (a) The donation of ZW$2,000,000 to an orphanage home for the

destitute children is deductible in full in terms of s15(2) (r5) of the 2

Income Tax Act [Chapter 23:06]. The deduction is restricted to

ZW$6.5 million.

(b) The ZW$700,000 donation to Victoria Falls General Hospital is 2

allowable in full (limit is ZW$13 million) because the hospital is

operated by a local authority (s15(2) (r1).

(c) The donation for National Assembly Member’s celebrations is a 2

prohibited deduction and therefore is not tax deductible.

(vii) (a) The secondment of Thomas to oversea the project in Mozambique

will result in his remuneration being taxed in that country. 5

Thomas will be out of Zimbabwe for a continuous period of 300

days which falls outside the definition “temporary absence.”

(s12(1)(c). Therefore, his income will not be subject to PAYE in

Zimbabwe during that period.

(b) Tawanda’s remuneration is fully taxable in Zimbabwe since she

will remain ordinarily resident in the country throughout the 4

period in question. Her business trips’ expenses are not deemed

benefits in her hands since all her trips are strictly for business,

unless proven otherwise by the taxing authorities.

(viii) The ZW$30,000 paid by Tawanda to the Institute of Engineers of

Zimbabwe in respect of her professional membership fees is an 2

allowable deduction in the hands of Build Zimbabwe Limited in

terms of s15(2)(s).

(ix) The disposal of the company vehicle to Mrs Khumalo on

retirement does not have any PAYE consequences. Mrs Khumalo

retired at the age of 65 years and therefore, qualifies for an elderly 4

person’s exemption. An elderly person for tax purposes is a

person aged 55 years or above.

(x) A subsidised loan of above ZW$8,000 or US$100 is a deemed

benefit in the hands of the recipient employee. Tim Nhamo is

deemed to have enjoyed a benefit amounting to the difference

between the stipulated rate (LIBOR +15%) and the interest he 4

actually paid on the loan. The value of his benefit, which will be

added to his gross income for PAYE purposes, will be (100,000 x

(1% +15%) – (100,000 x 10%) = ZW$6,000.

TOTAL 40

You might also like

- Statement 011417 PDFDocument3 pagesStatement 011417 PDFKathleen MendegorinNo ratings yet

- Quiz Dealings in Properties TAXATIONDocument10 pagesQuiz Dealings in Properties TAXATIONAngela Nicole NobletaNo ratings yet

- Statement: Branch Details Your Current Details Period 2020 To 202Document6 pagesStatement: Branch Details Your Current Details Period 2020 To 202xxalias100% (1)

- Statement For Ufone # 03331213814: Account DetailsDocument4 pagesStatement For Ufone # 03331213814: Account DetailsMuhammad kabir jamilNo ratings yet

- Tax298 Chapter 5 Exemptions - Question Pack 2024Document14 pagesTax298 Chapter 5 Exemptions - Question Pack 2024kobus7532No ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Income Exempt From TaxDocument4 pagesIncome Exempt From TaxKartikNo ratings yet

- LU5 WorkbookDocument16 pagesLU5 Workbookprowess222No ratings yet

- CPAR Taxation PreweekDocument38 pagesCPAR Taxation PreweekAndrei Nicole RiveraNo ratings yet

- Pre-Week Batch 90 (TAX)Document12 pagesPre-Week Batch 90 (TAX)Elaine Joyce GarciaNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- MCQ On TDS, TCS & Advance TaxDocument15 pagesMCQ On TDS, TCS & Advance TaxPrakhar GuptaNo ratings yet

- 23 Tax JuneDocument16 pages23 Tax JunemistryankusNo ratings yet

- Adv Tax, TDS, TCS, Return Filing, Total Income - SolutionDocument8 pagesAdv Tax, TDS, TCS, Return Filing, Total Income - SolutionBharatbhusan RoutNo ratings yet

- Compiler Additional Questions For Nov 22 ExamsDocument18 pagesCompiler Additional Questions For Nov 22 ExamsRobertNo ratings yet

- Income Must Be Money or Convertible Into Money Nature of Trade)Document6 pagesIncome Must Be Money or Convertible Into Money Nature of Trade)HD DNo ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Cta Taxation of Individuals HWDocument6 pagesCta Taxation of Individuals HWEffie ChirembweNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- Tax SuggestedDocument28 pagesTax SuggestedHemaNo ratings yet

- South-Western Federal Taxation 2016 Comprehensive 39th Edition Solution Manual 1Document36 pagesSouth-Western Federal Taxation 2016 Comprehensive 39th Edition Solution Manual 1briancrosbyqfakzcndys100% (28)

- CUAC 408 Group Presentations 2021-1Document24 pagesCUAC 408 Group Presentations 2021-1ChidoNo ratings yet

- TAX 388 Exempt Income 2023 StudentDocument37 pagesTAX 388 Exempt Income 2023 StudentGimbaZANo ratings yet

- CA Ipcc Taxation Suggested Answers For Nov 2016Document16 pagesCA Ipcc Taxation Suggested Answers For Nov 2016Sai Kumar SandralaNo ratings yet

- Income Tax Divyastra CH 3 Exempt Income R 1Document6 pagesIncome Tax Divyastra CH 3 Exempt Income R 1Subraja KarthikeyanNo ratings yet

- Amendments May 2024 3Document18 pagesAmendments May 2024 3ukqrnnnjhfwsxqoykuNo ratings yet

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDocument25 pagesTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Instructions:: Question Paper Booklet CodeDocument16 pagesInstructions:: Question Paper Booklet CodeAnonymous yPWi8p3KkANo ratings yet

- Taxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For TheDocument4 pagesTaxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For Theswarna dasNo ratings yet

- South Western Federal Taxation 2017 Comprehensive 40Th Edition Hoffman Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2017 Comprehensive 40Th Edition Hoffman Solutions Manual Full Chapter PDFfred.henderson352100% (11)

- AF308 Second Semester 2020 Short Test TwoDocument3 pagesAF308 Second Semester 2020 Short Test TwoShayal ChandNo ratings yet

- TXZAF 2019 Dec ADocument8 pagesTXZAF 2019 Dec AKAH MENG KAMNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Tax (SEM. VI) 2019 PATTERNDocument4 pagesTax (SEM. VI) 2019 PATTERNganuNo ratings yet

- BIR Ruling (DA-335) 815-09Document5 pagesBIR Ruling (DA-335) 815-09Ren Mar CruzNo ratings yet

- South Western Federal Taxation 2016 Individual Income Taxes 39Th Edition Hoffman Solutions Manual Full Chapter PDFDocument36 pagesSouth Western Federal Taxation 2016 Individual Income Taxes 39Th Edition Hoffman Solutions Manual Full Chapter PDFfred.henderson352100% (12)

- South-Western Federal Taxation 2016 Individual Income Taxes 39th Edition Hoffman Solutions Manual 1Document26 pagesSouth-Western Federal Taxation 2016 Individual Income Taxes 39th Edition Hoffman Solutions Manual 1alisha100% (53)

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- Q&A Selected Questions 2 1Document9 pagesQ&A Selected Questions 2 1Saddam HusseinNo ratings yet

- S3 3-TaxationDocument12 pagesS3 3-TaxationMartin NzamutumaNo ratings yet

- WHT & DtaDocument26 pagesWHT & Dtafaz watiNo ratings yet

- Cs Professional Income Tax Question Bank Part - 1 For Dec 21 & June 22Document64 pagesCs Professional Income Tax Question Bank Part - 1 For Dec 21 & June 22pande anujNo ratings yet

- 03 NP Chap 03 Income Exempt From Tax Additional Questions 2022Document6 pages03 NP Chap 03 Income Exempt From Tax Additional Questions 2022xgnz1630No ratings yet

- Paper7 Set1Document9 pagesPaper7 Set1meswetashaw96No ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- DT Smart WorkDocument15 pagesDT Smart WorkmaacmampadNo ratings yet

- M.B.A (2016 Pattern)Document39 pagesM.B.A (2016 Pattern)Radha ChoudhariNo ratings yet

- Chapter 10 - Incomes Which Do Not Form Part of Total Income - NotesDocument10 pagesChapter 10 - Incomes Which Do Not Form Part of Total Income - NotesRahul TiwariNo ratings yet

- Chapter 3 Employment Income BKAT2013Document82 pagesChapter 3 Employment Income BKAT2013Nurul AfiqahNo ratings yet

- EContent 3 2024 02 28 07 24 01 IFOSBBAHONSdocx 2024 02 26 10 21 57Document7 pagesEContent 3 2024 02 28 07 24 01 IFOSBBAHONSdocx 2024 02 26 10 21 57solanki YashNo ratings yet

- Document From Rajan®Document5 pagesDocument From Rajan®Anit LuckyNo ratings yet

- ACW291 CHP 9 Withholding Tax - 231117 - 153847Document33 pagesACW291 CHP 9 Withholding Tax - 231117 - 153847hemaram2104No ratings yet

- Paper-2 International Tax Practice-NOV 20Document22 pagesPaper-2 International Tax Practice-NOV 20dhawaljaniNo ratings yet

- CA Inter Tax A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter Tax A MTP 2 May 2024 Castudynotes Comabcdefgh1234567890101112No ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Mba 3 TaxDocument14 pagesMba 3 Taxkapil3518No ratings yet

- Paper 4 Taxation Nov 14 PDFDocument16 pagesPaper 4 Taxation Nov 14 PDFghsjgjNo ratings yet

- KEY WORDS - Income TaxationDocument23 pagesKEY WORDS - Income TaxationQueenVictoriaAshleyPrietoNo ratings yet

- ACW290 - Chap5 - Business IncomeDocument27 pagesACW290 - Chap5 - Business IncomeMERINANo ratings yet

- Taxation Unit 7 - Tutorial SolutionsDocument8 pagesTaxation Unit 7 - Tutorial SolutionshavengroupnaNo ratings yet

- Taxes and Duties at A Glance 2023-2024Document33 pagesTaxes and Duties at A Glance 2023-2024Jacob SangaNo ratings yet

- Bank Rec 1220 Jul-Dec 2021-1Document1 pageBank Rec 1220 Jul-Dec 2021-1Jake poolNo ratings yet

- ITC April 2021 Examiners CommentsDocument39 pagesITC April 2021 Examiners CommentsJake poolNo ratings yet

- IAS12Document40 pagesIAS12Myie Cruz-VictorNo ratings yet

- Estate Duty Act Chapter 23 - 03 - UpdatedDocument15 pagesEstate Duty Act Chapter 23 - 03 - UpdatedJake poolNo ratings yet

- Citizen PTR Receipt (2023-2024)Document1 pageCitizen PTR Receipt (2023-2024)AnmolBansalNo ratings yet

- 122918981824Document1 page122918981824CHRISTINE kawasiimaNo ratings yet

- Terms & Conditions - Smartemi (Dial An Emi) : Please Note ThatDocument2 pagesTerms & Conditions - Smartemi (Dial An Emi) : Please Note ThatSaurabh SharmaNo ratings yet

- Sample Commercial InvoiceDocument1 pageSample Commercial Invoiceserdar khanNo ratings yet

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- Welcome To My PresentationDocument11 pagesWelcome To My PresentationNa Omar FarukNo ratings yet

- CGT Tomanda AntokDocument1 pageCGT Tomanda AntokNvision PresentNo ratings yet

- Date Transaction Description Amount (In RS.)Document2 pagesDate Transaction Description Amount (In RS.)Sushma AshokNo ratings yet

- NDA All Mcqs 2024Document4 pagesNDA All Mcqs 2024Shailesh PandeyNo ratings yet

- Tax in Voice or 1192008 Ad 84977Document1 pageTax in Voice or 1192008 Ad 84977Pratibha MittalNo ratings yet

- Bonus QuizDocument4 pagesBonus QuizDin Rose GonzalesNo ratings yet

- ChallanDocument1 pageChallanShweta MauryaNo ratings yet

- On August 31 2015 The Rijo Equipment Repair Corp S Post ClosingDocument1 pageOn August 31 2015 The Rijo Equipment Repair Corp S Post ClosingMiroslav GegoskiNo ratings yet

- The Financial Act 2019 CompressedDocument71 pagesThe Financial Act 2019 CompressedTarifNo ratings yet

- PEDRO RELATIVO, ET AL., Defendants-AppellantsDocument3 pagesPEDRO RELATIVO, ET AL., Defendants-AppellantsErwin L BernardinoNo ratings yet

- AIS Lab - Chaps 7, 8, 9Document100 pagesAIS Lab - Chaps 7, 8, 9lyoniezenNo ratings yet

- Investment in Debt SecuritiesDocument21 pagesInvestment in Debt SecuritiesAlarich CatayocNo ratings yet

- Helvering V HorstDocument3 pagesHelvering V HorstKaren PascalNo ratings yet

- RBI Adapter SpecificationDocument4 pagesRBI Adapter Specificationpandu MNo ratings yet

- Pleted.20210122 20210221Document85 pagesPleted.20210122 20210221aizatiman665No ratings yet

- Duplichecker-Plagiarism-Bab (2,2)Document2 pagesDuplichecker-Plagiarism-Bab (2,2)Sarah MaharaniNo ratings yet

- Tax Codes To Use From 6 April 2021: For All EmployeesDocument1 pageTax Codes To Use From 6 April 2021: For All EmployeesAmritaShuklaNo ratings yet

- WL WL: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageWL WL: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)PranshuNo ratings yet

- Tax Invoice: S3948174-1 Gary Bailey La Fontanilla 97 14470 EL VISODocument1 pageTax Invoice: S3948174-1 Gary Bailey La Fontanilla 97 14470 EL VISOCarlos Sobral100% (1)

- Computation Part2Document4 pagesComputation Part2Jeane Mae BooNo ratings yet

- GST On Redevelopment Projects - Taxguru - inDocument4 pagesGST On Redevelopment Projects - Taxguru - inTejas SodhaNo ratings yet