Professional Documents

Culture Documents

Tokenisation Faqs 1221

Tokenisation Faqs 1221

Uploaded by

PAVAN kumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tokenisation Faqs 1221

Tokenisation Faqs 1221

Uploaded by

PAVAN kumarCopyright:

Available Formats

Tokenisation - Frequently Asked Questions(Save/Secure your Card )

With regards to RBI guideline on “Tokenisation-Card Transactions: permitting Card-on-file

Tokenisation (CoFT) services to enhance the safety and security of your Card Credentials.

Merchants are no longer allowed to store Credit Card details for your instant use, until you validate

them on the merchant website / mobile app. Therefore, your existing saved cards on merchant’s

website/ app will not be visible at the time of making payment. Refer to the RBI

Guideline:https://bit.ly/3Paio6u

Find enclose few items for detail understanding -

1. What is Tokenisation of cards?

➢ Tokenisation refers to replacement of actual card details with an alternate code called

the “token”, which shall be unique for a combination of card, token requestor (i.e. the

entity that accepts request from the customer for tokenisation of a card and passes it on

to the card network to issue a corresponding token) and merchant

2. What will change due to this?

➢ Domestic merchants will no longer be allowed to store your 16-digit card number, CVV

and Expiry date for processing of online transactions. This would further increase safety

and security for you. Therefore, you will not see your saved cards on the merchant

portal at the time of making a payment

3. What is the use and benefit of tokenisation?

➢ A tokenised card transaction provides better security as your card details are not

shared/stored with the merchant for transaction processing. Also tokens are stored on

merchants website/App so that you need not enter your card details for every

transaction

4. How can token be created?

➢ A token can be created by initiating a request on merchant website/App

➢ Merchant will forward the request to RBL Bank for validation.

➢ Post validation a unique token will be created by your card network Mastercard/Visa

➢ This unique token will be saved on the requester merchant for future transaction

5. Are the customer card details safe after tokenisation?

➢ Actual card data, token and other relevant details are stored in a secure mode by the

authorised card networks. Token requestor cannot store Primary Account Number

(PAN), i.e., card number, or any other card detail

Copyright RBL Bank Ltd.

6. Is there any limit for number of tokens that can be created for a card?

➢ No there is no limit for token creation

➢ Each token created will be unique for every merchant for every card

➢ Cardmember can create multiple tokens for different merchants for a single card

➢ Cardmember car use multiple cards for token creation on a single merchant

7. How does the process of registration for a tokenisation request work?

➢ The registration for the tokenisation request is done only with explicit consent through

additional factor of authentication (AFA) and not by way of a forced/default/automatic

selection of check box, button etc. Customer will be given a choice of selecting the use

card

8. Is Tokenisation mandatory?

➢ No. Tokenisation is not mandatory, but we encourage to tokenise your cards for

enhanced security and easy checkout process on merchant website/App

9. Is there any impact on POS and Contactless transactions?

➢ No, there will be no change for customer for processing POS and Contactless

transactions

10. Will my card number be visible on merchant website post Tokenisation?

➢ No, only last 4 digit of your RBL Credit Card will be visible on merchant website post

Tokenisation as merchants are not allowed to store complete card number

11. Are there any charges for Tokenisation?

➢ No, there are no charges applicable for Tokenisation service. An amount of Rs. 2 will be

debited for token creation but will be reversed to your account and will not be billed to

you

12. Can a card issuer refuse tokenisation of a particular card?

➢ Based on risk perception, etc., card issuers may decide whether to allow cards issued by

them to be registered by a token requestor / merchant

Copyright RBL Bank Ltd.

You might also like

- Hacking Point of Sale: Payment Application Secrets, Threats, and SolutionsFrom EverandHacking Point of Sale: Payment Application Secrets, Threats, and SolutionsRating: 5 out of 5 stars5/5 (1)

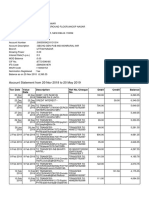

- Statement Closing Date 08/12/2020: Payment InformationDocument4 pagesStatement Closing Date 08/12/2020: Payment Informationadrian mayo100% (1)

- Account # 0306977871: Lifegreen CheckingDocument8 pagesAccount # 0306977871: Lifegreen CheckingAmanda ConryNo ratings yet

- Faqs TokenisationDocument2 pagesFaqs TokenisationAbiy MulugetaNo ratings yet

- Card On-File Tokenization (Debit/Credit and Prepaid Cards)Document3 pagesCard On-File Tokenization (Debit/Credit and Prepaid Cards)Govind ChaharNo ratings yet

- 300922-Faq Coft VerDocument4 pages300922-Faq Coft VermanojghorpadeNo ratings yet

- FAQ TOKENISATION Equitas 30092022Document3 pagesFAQ TOKENISATION Equitas 30092022Suresha SureshNo ratings yet

- Annexure-1-FAQ-Circular Tokenization For CardsDocument3 pagesAnnexure-1-FAQ-Circular Tokenization For Cardsjuhi sananNo ratings yet

- Faqs For Tokenization: (Additional Factor Authentication, Eg: Otp)Document2 pagesFaqs For Tokenization: (Additional Factor Authentication, Eg: Otp)PANTHER GAMINGNo ratings yet

- Sbi Virtual Card FaqDocument7 pagesSbi Virtual Card FaqIshan ShahNo ratings yet

- Bo de Thi CK EPaymentDocument7 pagesBo de Thi CK EPaymentNguyên Đoàn Thị KhánhNo ratings yet

- E-Payment ExamDocument5 pagesE-Payment ExamNguyễn Vân AnhNo ratings yet

- HLB Faq en PDFDocument26 pagesHLB Faq en PDFMohd AzhariNo ratings yet

- Tokenisation Product FeaturesDocument2 pagesTokenisation Product FeaturesAkshay SharmaNo ratings yet

- ICICI Multi Wallet - FAQsDocument3 pagesICICI Multi Wallet - FAQsIndrawati DeviNo ratings yet

- Debit Card Issuance Policy 2022 23 - 19july20221 PDFDocument15 pagesDebit Card Issuance Policy 2022 23 - 19july20221 PDFRaj MalhotraNo ratings yet

- DEBIT - CARD - USER GUIDE - and - MITC - 2023-24Document18 pagesDEBIT - CARD - USER GUIDE - and - MITC - 2023-24mohan SNo ratings yet

- GuideDocument26 pagesGuideJaikishan KumaraswamyNo ratings yet

- Dispelling The Myths of Using A Credit Card On The InternetDocument3 pagesDispelling The Myths of Using A Credit Card On The InternetFlaviub23No ratings yet

- Instruction 3 4 Unit 5Document6 pagesInstruction 3 4 Unit 5Hồ Tú UyênNo ratings yet

- 170323-Annex D FAQ English Website 2023Document9 pages170323-Annex D FAQ English Website 2023Abhijith AnandNo ratings yet

- Assignment RahulDocument6 pagesAssignment RahulRahul Gupta RoyNo ratings yet

- Electronic Payment SystemsDocument36 pagesElectronic Payment Systemsjoe_inba100% (1)

- Tokenization SummaryDocument3 pagesTokenization SummaryTarang DoshiNo ratings yet

- E Commerce 6Document15 pagesE Commerce 6premaNo ratings yet

- Corporation Bank Credit CardsDocument7 pagesCorporation Bank Credit CardsSuriya KJ100% (1)

- Debit Card GuideDocument26 pagesDebit Card GuidemeghrajtodwalNo ratings yet

- EMV Frequently Asked Questions For MerchantsDocument16 pagesEMV Frequently Asked Questions For Merchantsvanitha gunasekaranNo ratings yet

- Online Transaction Authorization Form: D D M M Y Y Y YDocument2 pagesOnline Transaction Authorization Form: D D M M Y Y Y YTasneef ChowdhuryNo ratings yet

- SBMMastercard Platinum Debitcards Termsand Conditionsv 3 OctDocument9 pagesSBMMastercard Platinum Debitcards Termsand Conditionsv 3 Octamankumar1462727No ratings yet

- ATM Verification Work byDocument2 pagesATM Verification Work bymaelmango0No ratings yet

- SBM Niyo Global HandbookDocument6 pagesSBM Niyo Global HandbookDEBADYUTI MAITINo ratings yet

- BDO Debit Card Terms and ConditionsDocument6 pagesBDO Debit Card Terms and ConditionsEjay ReyesNo ratings yet

- TK Pay CardDocument4 pagesTK Pay Carddestructive dreamNo ratings yet

- Unicity International, Inc.: Your Unicity Awards VISA® Prepaid Card Usage GuideDocument18 pagesUnicity International, Inc.: Your Unicity Awards VISA® Prepaid Card Usage GuideBart Hohles100% (2)

- Online RR Registration Form To The Branch Manager State Bank of India .Document3 pagesOnline RR Registration Form To The Branch Manager State Bank of India .Anonymous ZGcs7MwsLNo ratings yet

- KDCC Bank ATM Debit Card ApplicationDocument4 pagesKDCC Bank ATM Debit Card ApplicationramNo ratings yet

- HSBC India Debit Card GuideDocument28 pagesHSBC India Debit Card GuideRintomrNo ratings yet

- Faqs (Frequently Asked Questions) :: 1.) What Is Otp (One Time Password) ??Document3 pagesFaqs (Frequently Asked Questions) :: 1.) What Is Otp (One Time Password) ??meetacooldudeNo ratings yet

- AssignmentDocument2 pagesAssignmentRajalingamNo ratings yet

- Frequently Asked Questions For DCB Prepaid CardsDocument4 pagesFrequently Asked Questions For DCB Prepaid Cardsbhadrichandu961No ratings yet

- SBM MasterCard Platinum Debit CardDocument6 pagesSBM MasterCard Platinum Debit CardEm's RandriaNo ratings yet

- FAQ-MemberInspection 240919Document5 pagesFAQ-MemberInspection 240919Tushar GuptaNo ratings yet

- PK Debit Card Leaflet 1Document8 pagesPK Debit Card Leaflet 1szsoomroNo ratings yet

- TokenisationDocument2 pagesTokenisationAbiy MulugetaNo ratings yet

- Banking ApplicationsDocument4 pagesBanking Applicationsapi-270602999No ratings yet

- Chapter 3: The Electronic Wallet 3.1. Introduction To E-WalletDocument11 pagesChapter 3: The Electronic Wallet 3.1. Introduction To E-WalletHoàng Mii100% (2)

- DC Usage Guide TNC - 30.09.2022Document5 pagesDC Usage Guide TNC - 30.09.2022SowjanyaNo ratings yet

- BillDocument11 pagesBillRahul SharmaNo ratings yet

- Credit & Debit CardDocument42 pagesCredit & Debit CardRimna Prakash100% (1)

- Intro To EMVDocument15 pagesIntro To EMVLokesh100% (2)

- Meezan Bank Debit Cards Usage Guidelines: Active ActiveDocument6 pagesMeezan Bank Debit Cards Usage Guidelines: Active ActiveSulman KNo ratings yet

- Single Currency Usage GuideDocument8 pagesSingle Currency Usage Guideprayas sarkarNo ratings yet

- Online PaymentDocument25 pagesOnline PaymentSwetha Pattipaka100% (2)

- NCMC Rupay Contactless/Offline Debit Cards: Frequently Asked QuestionsDocument5 pagesNCMC Rupay Contactless/Offline Debit Cards: Frequently Asked Questionskaipsaini9813190No ratings yet

- Forex Card-HandBookDocument22 pagesForex Card-HandBookAyman NadeemNo ratings yet

- Client Account MaintenanceDocument18 pagesClient Account MaintenanceNirajanNo ratings yet

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeFrom EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersFrom EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersNo ratings yet

- Evaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersFrom EverandEvaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Standard EmiDocument1 pageStandard EmiPAVAN kumarNo ratings yet

- Quiz-HeatDocument10 pagesQuiz-HeatPAVAN kumarNo ratings yet

- CDS SET-1 - MergedDocument175 pagesCDS SET-1 - MergedPAVAN kumarNo ratings yet

- Damati Plastics BrochureDocument23 pagesDamati Plastics BrochurePAVAN kumarNo ratings yet

- Idt EXvb 5 XOl FJJ RDocument2 pagesIdt EXvb 5 XOl FJJ RPAVAN kumarNo ratings yet

- PE 1ph VSI 5.sqprojDocument3 pagesPE 1ph VSI 5.sqprojPAVAN kumarNo ratings yet

- Sunshine CatalogueDocument36 pagesSunshine CataloguePAVAN kumarNo ratings yet

- 01 Rivera vs. ChuaDocument1 page01 Rivera vs. ChuaStefanRodriguez100% (1)

- Module 2Document4 pagesModule 2Its Nico & SandyNo ratings yet

- INTERNSHIP REPOET ON SUNRISE BANK LTD Final DraftDocument41 pagesINTERNSHIP REPOET ON SUNRISE BANK LTD Final DraftSumitNo ratings yet

- Internship Report On BALDocument96 pagesInternship Report On BALM I HASSANNo ratings yet

- Axis Bank - Magnus PPT - Customer Facing 4th DecDocument28 pagesAxis Bank - Magnus PPT - Customer Facing 4th DecJagdish MakwanaNo ratings yet

- URr VG EZsy Y0 VHHJ YDocument3 pagesURr VG EZsy Y0 VHHJ YNitin DawarNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceHARIKIRAN PRNo ratings yet

- Banking SystemDocument2 pagesBanking Systemagus pratamaNo ratings yet

- A Study On Perception of Consumer Towards Digital Payment DoneDocument71 pagesA Study On Perception of Consumer Towards Digital Payment DoneMayur MoreNo ratings yet

- SkitDocument3 pagesSkitopraghav333No ratings yet

- 1.2.problems With Integer NumbersDocument7 pages1.2.problems With Integer NumbersKatherine Roxana Calderon BrionesNo ratings yet

- Finon - Week6 - Banking SystemDocument30 pagesFinon - Week6 - Banking SystemivanNo ratings yet

- Bhim Upi-Singapore Fintech FestivalDocument2 pagesBhim Upi-Singapore Fintech FestivalKunwarbir Singh lohatNo ratings yet

- 6.9 NotesDocument10 pages6.9 NoteszufaroaaNo ratings yet

- Final Project Thanuja Vehicle LoanDocument88 pagesFinal Project Thanuja Vehicle LoanRakeshNo ratings yet

- Recharge Amount: Discount 0Document2 pagesRecharge Amount: Discount 0Susil Kumar SahooNo ratings yet

- Ednovate CAF Accounts UT 1 QDocument3 pagesEdnovate CAF Accounts UT 1 QROCKYNo ratings yet

- Wells Fargo Opportunity CheckingDocument4 pagesWells Fargo Opportunity Checkingson tungNo ratings yet

- CreditCardStatement2801868 - 2085 - 27-Oct-20Document1 pageCreditCardStatement2801868 - 2085 - 27-Oct-20Abdul AleemNo ratings yet

- Yes Bank Rtgs FormDocument1 pageYes Bank Rtgs Formsaurabh100% (2)

- Fees and Commission of SoDocument2 pagesFees and Commission of SoZahid AkhtarNo ratings yet

- Transactions 600 051949600 20220324 160153Document2 pagesTransactions 600 051949600 20220324 160153Hemanth Kumar NNo ratings yet

- Team Singapore HDFC BankDocument14 pagesTeam Singapore HDFC BankRajeev KumarNo ratings yet

- Receipt & Disbursment Cycles: Audit of Cash Balance: Auditing ProblemsDocument6 pagesReceipt & Disbursment Cycles: Audit of Cash Balance: Auditing ProblemsJohn Lester DocaNo ratings yet

- e-StatementBRImo 099701050646532 Dec2023 20231220 202008Document1 pagee-StatementBRImo 099701050646532 Dec2023 20231220 202008frysel27No ratings yet

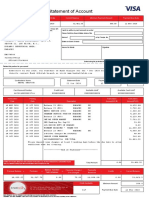

- STLMNT - Letter - 4748XXXXXXXX5001 - SAVAN PATELDocument3 pagesSTLMNT - Letter - 4748XXXXXXXX5001 - SAVAN PATELshivagencies2021No ratings yet

- Bank Statement Template 3 - TemplateLabDocument1 pageBank Statement Template 3 - TemplateLabAlex AxfordNo ratings yet

- TandC PDFDocument2 pagesTandC PDFAshish MalhotraNo ratings yet