Professional Documents

Culture Documents

Project Charter Example New Product

Project Charter Example New Product

Uploaded by

Khushbu IndreshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Charter Example New Product

Project Charter Example New Product

Uploaded by

Khushbu IndreshCopyright:

Available Formats

PROJECT DESCRIPTION

Add a heavy duty line of aftermarket suspension airbags, to supplement the standard product line. The heavy duty option will include a 20 percent

increase in wall thickness and a threaded valve connection, compared to the current slip-fit connection.

BUSINESS NEED

Market tests showed that 14% of consumers would step up to the premium bags, when offered at a $20 markup. Total product cost will increase

$2.20, creating a $17.80 gross margin increase per heavy-duty unit.

OWNERSHIP & APPROVAL

Project Manager Mike Cote Project Champion Brian Frizzel Approval Date Pending

Project Number AB-08

FINANCIALS & MILESTONES

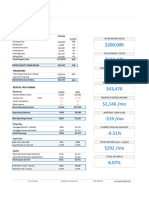

Financials Capital/Expense Milestones (Schedule)

Goal Actual Goal Actual Goal Actual

Initial Investment $ 214,500 Capital approved 15-Feb

$ 180,000

Net Present Value (5 yr) $ 276,519 Tooling for new bags (capital) Tooling complete 1-May

ROI 98% Engineering materials for trials $ 20,000 Testing complete 1-Jul

IRR 50% Marketing promotions $ 14,500 SKU launch 15-Sep

RESOURCES & RISKS

Internal Resouces External Services Project Risks

Total Hours Peak Hrs/Wk Budget Actual Medium High

John Smith (Design) 90 40 Pro Tooling of San Diego $ 180,000 Installation difficulty ü

Mike Gorman (Design) 10 2 Marketing Services $ 14,500

David Stone (Mkt Comm.) 15 2

Louis Clemens (A.M.E.) 5 2

Alan Carr (Sourcing) 20 8

Financial Benefits and Costs

Note - review with your finance team to ensure accurate assumptions and calculations

Cost of Capital 8% (see finance team for updated value)

Initial Cost of Project $ 214,500

Cash Inflows Year 0 1 2

Incremental Margin $ $ 134,568 $ 139,552

Material Cost Savings

Labor Savings

Other Savings - Warranty $ 2,400 $ 2,400

Other

Cash Inflow $ 136,968 $ 141,952

Present Value of Cash Inflow $ 126,822 $ 121,701

Cumulative Cash Inflow $ 126,822 $ 248,523

Costs

Initial Investment $ 214,500

Incremental Material Cost $ 16,632 $ 16,632

Incremental Data Storage

Equipment Lease

Other

Cash Outflow $ 214,500 $ 16,632 $ 16,632

PV of Cash Outflow $ 214,500 $ 15,400 $ 14,259

Cumulative Cash Outflow $ 214,500 $ 229,900 $ 244,159

NPV of Project $ 276,519

Cash Flow by Year

IRR 50%

ROI 98% $150,000

$100,000

Year 0 1 2

Cash Flow $50,000$

$ (214,500) 120,336 $ 125,320

$0

0 1 2 3

-$50,000

-$100,000

-$150,000

-$200,000

-$250,000

-$150,000

-$200,000

-$250,000

3 4 5

$ 144,536 $ 134,568 $ 134,568

$ 2,400 $ 2,400

$ 146,936 $ 136,968 $ 134,568

$ 116,643 $ 100,676 $ 91,585

$ 365,166 $ 465,841 $ 557,426

$ 16,632 $ 16,632 $ 16,632

$ 16,632 $ 16,632 $ 16,632

$ 13,203 $ 12,225 $ 11,319

$ 257,362 $ 269,587 $ 280,907

Cash Flow by Year

3 4 5

$ 130,304 $ 120,336 $ 117,936

1 2 3 4 5

You might also like

- CFI - FMVA Practice Exam Case Study ADocument18 pagesCFI - FMVA Practice Exam Case Study AWerfelli MaramNo ratings yet

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Click File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPADocument9 pagesClick File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPAMessias MorettoNo ratings yet

- Water Purification Business PlanDocument39 pagesWater Purification Business PlanDante Sallicop0% (1)

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (22)

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocument9 pagesSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (27)

- Transfer and Business Taxes Solutions Manual Tabag Garcia 3rd Edition PDF FreeDocument39 pagesTransfer and Business Taxes Solutions Manual Tabag Garcia 3rd Edition PDF FreePHILLIT CLASS100% (1)

- Ejercicio 7.5Document6 pagesEjercicio 7.5Enrique M.No ratings yet

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Market StructureDocument12 pagesMarket StructureHODAALE MEDIANo ratings yet

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- Executive SummaryDocument49 pagesExecutive SummaryFikru TesefayeNo ratings yet

- FinACt 5 Foreign Currency TransactionsDocument2 pagesFinACt 5 Foreign Currency TransactionsBedynz Mark Pimentel100% (2)

- Answers LotteryDocument2 pagesAnswers LotteryJohn Alba Marcelo100% (1)

- Cashflow Analysis - Beta - GammaDocument14 pagesCashflow Analysis - Beta - Gammashahin selkarNo ratings yet

- Project CharterDocument11 pagesProject CharterasdasNo ratings yet

- Business Plan - PresentationDocument35 pagesBusiness Plan - Presentationmhdalamoudi5184No ratings yet

- Energold Drilling - Investor PresentationDocument23 pagesEnergold Drilling - Investor PresentationkaiselkNo ratings yet

- Seedly Financials 2017 To 2020Document4 pagesSeedly Financials 2017 To 2020AzliGhaniNo ratings yet

- Chapter07 XlssolDocument49 pagesChapter07 XlssolEkhlas AmmariNo ratings yet

- CAG Financials 2019Document4 pagesCAG Financials 2019AzliGhaniNo ratings yet

- M - 30 S 2020 o ($'000) ($'000) ADocument10 pagesM - 30 S 2020 o ($'000) ($'000) AAmmar TahirNo ratings yet

- Ativision Blizzard Inc Valuation - Final WorkDocument24 pagesAtivision Blizzard Inc Valuation - Final WorkMichael Andres Gamarra TorresNo ratings yet

- Rental Investment ReportDocument5 pagesRental Investment ReportTuba TunaNo ratings yet

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDocument7 pagesMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNo ratings yet

- Module 5Document3 pagesModule 5Vikki ElNo ratings yet

- Project Financing & EvaluationDocument103 pagesProject Financing & EvaluationIswahyudi yudi100% (1)

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDocument7 pagesMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNo ratings yet

- Additional Funds Needed in Capital ManagementDocument37 pagesAdditional Funds Needed in Capital Managementaneel.bsafs21No ratings yet

- MBF5207201004 Strategic Financial ManagementDocument5 pagesMBF5207201004 Strategic Financial ManagementtawandaNo ratings yet

- Aristro 73.74Document8 pagesAristro 73.74Bikash SedhainNo ratings yet

- Investment CaseDocument7 pagesInvestment Caseafif12No ratings yet

- Feasibility Study Excel TemplateDocument9 pagesFeasibility Study Excel TemplateBeede AshebirNo ratings yet

- Assignment Ch2Document7 pagesAssignment Ch2Ashraf Seif El-NasrNo ratings yet

- ENGR 3322 Written Report 3Document3 pagesENGR 3322 Written Report 3Darwin LomibaoNo ratings yet

- Financial Projections SampleDocument21 pagesFinancial Projections SampleAbubakarNo ratings yet

- 2022 Dow Inc Annual ReportDocument168 pages2022 Dow Inc Annual ReportAliceadriana SoimuNo ratings yet

- Executive SummaryDocument39 pagesExecutive SummaryvehiclesalesbeaekaNo ratings yet

- Cost Benefit Analysis Dashboard Template: Employee SalariesDocument10 pagesCost Benefit Analysis Dashboard Template: Employee SalariesKarthik HegdeNo ratings yet

- A-09.21.051 D .NAKUL Holmes BFDocument14 pagesA-09.21.051 D .NAKUL Holmes BFAustin GomesNo ratings yet

- Bohol Crayfish Farm Presentation by Fel Vincent VargasDocument14 pagesBohol Crayfish Farm Presentation by Fel Vincent VargasJade Lykarose Ochavillo GalendoNo ratings yet

- Case The Investment DetectiveDocument9 pagesCase The Investment Detectivesakshi agarwalNo ratings yet

- Evaluating Operating and Financial PerformanceDocument33 pagesEvaluating Operating and Financial PerformanceAbhi PatelNo ratings yet

- Accounting Project - EMBA Cohort 43 Group33 - FinalSubmissionDocument4 pagesAccounting Project - EMBA Cohort 43 Group33 - FinalSubmissionodlivingstonNo ratings yet

- XYZ Energy ROIDocument27 pagesXYZ Energy ROIWei ZhangNo ratings yet

- Case Study - Discounted Cash FlowDocument14 pagesCase Study - Discounted Cash FlowSalman AhmadNo ratings yet

- EKOS Financials 2020Document4 pagesEKOS Financials 2020AzliGhaniNo ratings yet

- Project Management: Spring 2007 Project Financing & EvaluationDocument116 pagesProject Management: Spring 2007 Project Financing & EvaluationFrialynNo ratings yet

- Balance Sheet: Assets Value Liabilities ValueDocument32 pagesBalance Sheet: Assets Value Liabilities ValueomernoumanNo ratings yet

- You Exec - Budget Template FreeDocument12 pagesYou Exec - Budget Template FreeHumberto MartinezNo ratings yet

- Big Hoss Barbershop Financial PlanDocument8 pagesBig Hoss Barbershop Financial Plancucku4u0% (1)

- 5 E. Monin Inc. - Board Packet 4Document25 pages5 E. Monin Inc. - Board Packet 4Lolahandasa888gmail.com LovecappoNo ratings yet

- 5G Infosys IngeniousDocument14 pages5G Infosys IngeniousVijay YadavNo ratings yet

- WA12Document2 pagesWA12IzzahIkramIllahiNo ratings yet

- Budget PlanDocument4 pagesBudget PlanTrinh NhaNo ratings yet

- Accts Imp QnsDocument4 pagesAccts Imp QnsnishabilochiNo ratings yet

- Accounting Principles 10th Edition Weygandt & Kimmel Chapter 1Document40 pagesAccounting Principles 10th Edition Weygandt & Kimmel Chapter 1ZisanNo ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- Costing ProfitssDocument9 pagesCosting Profitssapi-542433757No ratings yet

- W2 - Disney Theme Park - With NPVDocument15 pagesW2 - Disney Theme Park - With NPVChip choiNo ratings yet

- CAG Financials 2020Document4 pagesCAG Financials 2020AzliGhaniNo ratings yet

- Glenn Barnes: Better Buildings WorkshopDocument37 pagesGlenn Barnes: Better Buildings WorkshopEndashu TekalignNo ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Materi Lab 5 - Consolidated Techniques and ProceduresDocument7 pagesMateri Lab 5 - Consolidated Techniques and ProceduresrahayuNo ratings yet

- More Thought Square Foot: Enlivening WorkspacesDocument173 pagesMore Thought Square Foot: Enlivening WorkspacesRaviraj Tiruke100% (1)

- Ambo University College of Social Science Course Title: EnterprenureshipDocument24 pagesAmbo University College of Social Science Course Title: EnterprenureshipAboma Mekonnen100% (4)

- Wistron (3231.TW) - Debates On Position in Next Generation AI Servers - Reiterate BuyDocument7 pagesWistron (3231.TW) - Debates On Position in Next Generation AI Servers - Reiterate Buy張清發No ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- CV Sujal KashyapDocument1 pageCV Sujal Kashyapritesh9452No ratings yet

- Polands A2Document8 pagesPolands A2aanya17No ratings yet

- SFM CA Final (New) Block Test Series: Total Marks: 30 Time: 1 HourDocument2 pagesSFM CA Final (New) Block Test Series: Total Marks: 30 Time: 1 Hourshivam wadhwaNo ratings yet

- Auto Loan AgreementDocument3 pagesAuto Loan Agreementkristin.luceroNo ratings yet

- Murphy PDF OptionsDocument368 pagesMurphy PDF Optionsassas100% (3)

- Modules and TasksDocument2 pagesModules and TasksRITESH NANDANNo ratings yet

- FRRB 2Document220 pagesFRRB 2gauravmandu100% (2)

- Project Report-Corporate RestructuringDocument26 pagesProject Report-Corporate Restructuringchahvi bansal100% (1)

- Lendo Business Plan FinalDocument15 pagesLendo Business Plan FinalMelat MakonnenNo ratings yet

- Budgeting, Budgetary Accounting, and Budgetary ReportingDocument55 pagesBudgeting, Budgetary Accounting, and Budgetary Reportingnoof alkhulifiNo ratings yet

- Generic Apartment Rental Application FormDocument4 pagesGeneric Apartment Rental Application FormWalex BerryNo ratings yet

- Cost Flow in Production - Chap-6Document4 pagesCost Flow in Production - Chap-6Shahaer MumtazNo ratings yet

- Asset Management Manual - ENGDocument101 pagesAsset Management Manual - ENGJoann Saballero HamiliNo ratings yet

- DCF AAPL Course Manual PDFDocument175 pagesDCF AAPL Course Manual PDFShivam Kapoor100% (1)

- Del MonteDocument7 pagesDel MonteGlyssa AlcantaraNo ratings yet

- Affidavit of BorrowerDocument3 pagesAffidavit of Borrowerwarrenjohn100% (1)

- Soal Asistensi Pertemuan 12Document2 pagesSoal Asistensi Pertemuan 12Cut Farisa MachmudNo ratings yet

- Federal Funds RateDocument2 pagesFederal Funds RateNicolas JaramilloNo ratings yet

- Dissertation Report MicrofinanceDocument7 pagesDissertation Report MicrofinanceCollegePaperWriterLittleRock100% (1)

- ALMI - Annual Report - 2016 (Rugi) PDFDocument115 pagesALMI - Annual Report - 2016 (Rugi) PDFbuwat donlotNo ratings yet

- Snowflake Sec Form s1Document848 pagesSnowflake Sec Form s1anoopiit2012No ratings yet