Professional Documents

Culture Documents

Acuvon Compensation - Junior Associate

Acuvon Compensation - Junior Associate

Uploaded by

John DoeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acuvon Compensation - Junior Associate

Acuvon Compensation - Junior Associate

Uploaded by

John DoeCopyright:

Available Formats

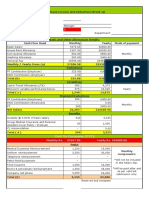

Salary details – Junior Associate (Associate Level 1)

Component description Monthly Annual

Fixed

Basic (includes employer share of PF) 38,500 4,62,000

HRA (50% of basic) 19,250 2,31,000

Special allowance 52,250 6,27,000

A. Total fixed salary 1,10,000 13,20,000

Variable

Bonus (maximum) - 2,77,200

B. Total variable salary - 2,77,200

Retirals

Gratuity (4.81% of basic) - 22,222

C. Total retirals - 22,222

D. Joining bonus 1,00,000

E. Deferred bonus 2,00,000

Total cash salary (A+B+C+D+E) - 19,19,422

Other benefits (non-cash)

Group medical insurance premium - 7,500

International travel insurance premium - 2,500

Team outings & offsite - 50,000

Food reimbursement - 39,600

Training & development - 75,000

F. Total other benefits (non-cash) - 1,74,600

Please note:

PF is contributed at 12% of basic (included in basic)

Bonus is subject to performance (company and individual employee) and can range between 0-40% of last

Basic + HRA. 40% is used for calculation

Gratuity is contributed @4.81% of Basic, on separation after 5 years of continuous service, payable as per

Payment of Gratuity Act

Joining bonus will be payable on satisfactory completion of working 1 month excluding notice period. The

person has to stay with the company for a period of 6 months excluding notice period, failing to which the

person has to payback the entire amount to the company

Deferred bonus will be payable on satisfactory completion of working 2 years excluding notice period

Other benefits are non-cash components based on average spend. This amount can vary for each year and

cannot be converted into cash pay-out for employee

Medical insurance coverage of INR 300,000 per annum for employee, spouse and maximum of 2

dependent children

International travel insurance coverage of USD 100,000 per annum for employee

Covers team outings and partial cost of offsite for employee, spouse and 2 dependent children

Food reimbursement of INR 150 per day for the number of days employee is present in India office

Average spend on employee learning & development and training program including internal trainings,

external trainings, development program, reimbursements for professional certifications

Additional per diem for onsite travel. Onsite expenses will be borne by company

Acuvon Consulting Pvt. Ltd.

Corporate Office: Berger Delhi One, 18th Floor, Sector 16B, Noida, (UP) – 201301, India

Registered Office: E 19, Lajpat Nagar III, New Delhi – 110024, India

e: info@acuvon.com w: www.acuvon.com CIN No. U74999DL2018PTC340046

You might also like

- Sample UK Sublet AgreementDocument4 pagesSample UK Sublet Agreementjohn975367% (3)

- Annexure 1 - Sayali TawadeDocument1 pageAnnexure 1 - Sayali TawadesayaliNo ratings yet

- Scenario ADocument10 pagesScenario ADandyNo ratings yet

- A91 Partners JDDocument2 pagesA91 Partners JDJohn DoeNo ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFAdarsh RaoNo ratings yet

- Guide To Inpatient Care at McLeanDocument28 pagesGuide To Inpatient Care at McLeanmcleanhospitalNo ratings yet

- January 2012Document64 pagesJanuary 2012Eric SantiagoNo ratings yet

- PPPPPPPDocument1 pagePPPPPPPsahildargan09No ratings yet

- Acuvon Compensation - AssociateDocument1 pageAcuvon Compensation - AssociateJohn DoeNo ratings yet

- ADOBE - Compensation Breakup - Member of Technical StaffDocument2 pagesADOBE - Compensation Breakup - Member of Technical Staffdehejar970No ratings yet

- 12290.0 - Gurrapu Bhargav StructureDocument1 page12290.0 - Gurrapu Bhargav StructureBhargav GurrapuNo ratings yet

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Letter PDFDocument2 pagesLetter PDFAnilkumar DaaraaNo ratings yet

- SE FY14 - Compensation Plan Group IIIDocument2 pagesSE FY14 - Compensation Plan Group IIISabyasachi DeNo ratings yet

- Promotion Letter ShwetaDocument2 pagesPromotion Letter ShwetayogeshNo ratings yet

- 10029-Test 5Document3 pages10029-Test 5pratap.reddyNo ratings yet

- Accenture - OfferletterDocument1 pageAccenture - OfferletternittingulatiNo ratings yet

- Offer Letter - Naga Mythili JuturDocument3 pagesOffer Letter - Naga Mythili JuturAnu RadhaNo ratings yet

- VijayDocument2 pagesVijayFiroj AlamNo ratings yet

- Examples PayrollDocument10 pagesExamples PayrollAlliana Nicole Masalta TorrefrancaNo ratings yet

- MediamintDocument1 pageMediamintKaparthi GujjarNo ratings yet

- Offer Letter - Mohan KumarDocument3 pagesOffer Letter - Mohan KumarMohan MoniNo ratings yet

- Mohammed - Moinuddin Sutherland SalaryDocument2 pagesMohammed - Moinuddin Sutherland SalaryShoaib Khan -Vlog'sNo ratings yet

- AlfredDocument4 pagesAlfredAbhijeet SinghNo ratings yet

- Offer Letter: Mr. Lalit SharmaDocument3 pagesOffer Letter: Mr. Lalit SharmaDr. Bhasker Pratap ChoudharyNo ratings yet

- Alphonse Irudayaraj Offer LetterDocument4 pagesAlphonse Irudayaraj Offer Letteralphonse INo ratings yet

- CTC Structure FEB20Document2 pagesCTC Structure FEB20Wall Street Forex (WSFx)No ratings yet

- Abhishek Gowda - 106 - KIC PDFDocument2 pagesAbhishek Gowda - 106 - KIC PDFAbhishek GowdaNo ratings yet

- 03 Compensation Income Seatwork 1Document1 page03 Compensation Income Seatwork 1Gaño, Alexander James R.No ratings yet

- India Offer Letter 2024-02-07Document9 pagesIndia Offer Letter 2024-02-07jagdishkumawat22576No ratings yet

- Trainee Letter Tech MahindraDocument4 pagesTrainee Letter Tech MahindraPreeti SureshNo ratings yet

- Offer LetterDocument3 pagesOffer LetterrudraNo ratings yet

- Remuneration StructureDocument1 pageRemuneration StructureKiran Kumar JNo ratings yet

- Siva - Offer LetterDocument2 pagesSiva - Offer Letterpruthvirajaws1807No ratings yet

- OfferLetter Riya GuptaDocument2 pagesOfferLetter Riya Guptavermatanishq1610No ratings yet

- FICO Compensation Details - FTE ConversionDocument1 pageFICO Compensation Details - FTE ConversionNiteshNo ratings yet

- Airbus India - SAMPLE - Offer - LetterDocument2 pagesAirbus India - SAMPLE - Offer - LetterKshitij SinghNo ratings yet

- Chapter 19 in Class ExercisesDocument14 pagesChapter 19 in Class ExercisesByul ProductionsNo ratings yet

- 4.5.1 Case Study AbellaCaparrosPadaoilParagasSinakayDocument4 pages4.5.1 Case Study AbellaCaparrosPadaoilParagasSinakayDannah Celiste ParagasNo ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFPurushothaman ANo ratings yet

- Pre Salary Revision:: For Current FY Apr '05 To Mar '06Document4 pagesPre Salary Revision:: For Current FY Apr '05 To Mar '06Vij Vaibhav VermaNo ratings yet

- GeneralPrinciples Incometax Tabag 51 224Document28 pagesGeneralPrinciples Incometax Tabag 51 224John Carlo Dela CruzNo ratings yet

- Sample Structure 15lpa IX XDocument1 pageSample Structure 15lpa IX XKiran IconNo ratings yet

- Finals Quiz No. 1 W AnswerDocument4 pagesFinals Quiz No. 1 W AnswerLouris DanielNo ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFPurushothaman ANo ratings yet

- OfferLetter 225107Document2 pagesOfferLetter 225107NIKHIL RANANo ratings yet

- Salary Slip Emp # 24650 - June 2020Document1 pageSalary Slip Emp # 24650 - June 2020Malik of ChakwalNo ratings yet

- Trainee Letter-Abhishek Rao-2240575Document4 pagesTrainee Letter-Abhishek Rao-2240575Surya SrivastavaNo ratings yet

- CTC BreakupDocument2 pagesCTC BreakupbaluNo ratings yet

- Siva - Offer LetterDocument3 pagesSiva - Offer Letterpruthvirajaws1807No ratings yet

- Offer Letter TaskusDocument9 pagesOffer Letter TaskusAkshay SharmaNo ratings yet

- Print Layout - India Compensation - Statement - 2022-06-01 00 - 31 PDTDocument1 pagePrint Layout - India Compensation - Statement - 2022-06-01 00 - 31 PDTAashutosh MahajanNo ratings yet

- 1 BSG Compensation&TrainingDocument1 page1 BSG Compensation&TrainingBust everyNo ratings yet

- Cia 2 EcbmDocument9 pagesCia 2 Ecbmchakradhar pmNo ratings yet

- Anusha Yenishetty PDFDocument2 pagesAnusha Yenishetty PDFSrinivasa Rao JagarapuNo ratings yet

- Appraisal, Letter PDFDocument2 pagesAppraisal, Letter PDFSanket JadhavNo ratings yet

- Letter-2 Appraisal 19-27 Sep 2019Document2 pagesLetter-2 Appraisal 19-27 Sep 2019Kiran DandileNo ratings yet

- Counter OfferDocument1 pageCounter Offermac martinNo ratings yet

- Ashwinisudhakarrao EmekarDocument2 pagesAshwinisudhakarrao EmekarswatiNo ratings yet

- Computation of Income Under The Head "Profits and Gains of Business or Profession"Document14 pagesComputation of Income Under The Head "Profits and Gains of Business or Profession"Shubham KumarNo ratings yet

- EntriesDocument4 pagesEntriesTAX PAYERNo ratings yet

- LM-24 Intermediate AccountingDocument7 pagesLM-24 Intermediate AccountingMary Jane TalanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- ADL Job Description FormDocument1 pageADL Job Description FormJohn DoeNo ratings yet

- Amex Campus (JD) AM II - Analytics - Full Time - 2Document1 pageAmex Campus (JD) AM II - Analytics - Full Time - 2John DoeNo ratings yet

- Acuvon Compensation - AssociateDocument1 pageAcuvon Compensation - AssociateJohn DoeNo ratings yet

- Afbp - JD FteDocument3 pagesAfbp - JD FteJohn DoeNo ratings yet

- McKinsey Implementation FlyerDocument1 pageMcKinsey Implementation FlyerJohn DoeNo ratings yet

- Job Description - Product ManagementDocument2 pagesJob Description - Product ManagementJohn DoeNo ratings yet

- Infra Finance Role Campus JDDocument3 pagesInfra Finance Role Campus JDJohn DoeNo ratings yet

- General MI JDDocument2 pagesGeneral MI JDJohn DoeNo ratings yet

- Dy. Manager - Manager Infra InvestmentsDocument1 pageDy. Manager - Manager Infra InvestmentsJohn DoeNo ratings yet

- Essay 4 Draft 2Document4 pagesEssay 4 Draft 2api-241967597No ratings yet

- Affiliated Service Providers As of January 24 2019Document13 pagesAffiliated Service Providers As of January 24 2019Marjorie Pagaduan JacintoNo ratings yet

- 20 Years of ICRC in LiberiaDocument8 pages20 Years of ICRC in LiberiaInternational Committee of the Red Cross100% (1)

- Final Exams PoliticsDocument11 pagesFinal Exams Politicsbaby rafaNo ratings yet

- Badac Functionality Audit IndicatorsDocument39 pagesBadac Functionality Audit IndicatorsBlambitchNo ratings yet

- Vickie L. Frederick v. Jack Nobel, M.D., 951 F.2d 1259, 10th Cir. (1991)Document5 pagesVickie L. Frederick v. Jack Nobel, M.D., 951 F.2d 1259, 10th Cir. (1991)Scribd Government DocsNo ratings yet

- BASONDocument8 pagesBASONJuan BakawanNo ratings yet

- Health Insurance Compliance Counsel in Buffalo NY Resume Lindsay HecklerDocument1 pageHealth Insurance Compliance Counsel in Buffalo NY Resume Lindsay HecklerLindsay HecklerNo ratings yet

- Frequently Asked Questions: Medi Assist Confidential InformationDocument7 pagesFrequently Asked Questions: Medi Assist Confidential InformationArunBelwarNo ratings yet

- Glossary of Common Industry AbbreviationsDocument7 pagesGlossary of Common Industry AbbreviationsVarun KhannaNo ratings yet

- Planning, Design, and Construction of Health Care Facilities, Second EditionDocument10 pagesPlanning, Design, and Construction of Health Care Facilities, Second EditionKenneth Awoonor-RennerNo ratings yet

- FOURTH FIVEDocument12 pagesFOURTH FIVEJayesh ShirkeNo ratings yet

- RADTECH0718 Iloilo JG18 PDFDocument20 pagesRADTECH0718 Iloilo JG18 PDFPhilBoardResultsNo ratings yet

- United States Complaint in Intervention in False Claims Act Lawsuits Accusing Insys Therapeutics of Paying Kickbacks and Engaging in Other Unlawful Practices to Promote Subsys, A Powerful Opioid PainkillerDocument37 pagesUnited States Complaint in Intervention in False Claims Act Lawsuits Accusing Insys Therapeutics of Paying Kickbacks and Engaging in Other Unlawful Practices to Promote Subsys, A Powerful Opioid PainkillerBeverly Tran100% (1)

- CDC Security Certification and Accreditation Plan (Intranet)Document2 pagesCDC Security Certification and Accreditation Plan (Intranet)JaredNo ratings yet

- Event Invitation For CPhI, P-MEC, InnoPack South East Asia 2015Document8 pagesEvent Invitation For CPhI, P-MEC, InnoPack South East Asia 2015HrisVAsilevaNo ratings yet

- Senior Paper Final 1-10-17Document21 pagesSenior Paper Final 1-10-17api-350354335No ratings yet

- Ripe For InvestmentDocument76 pagesRipe For InvestmentFaris ImanNo ratings yet

- Indg232 PDFDocument6 pagesIndg232 PDFmuhammadsuhaibNo ratings yet

- Thyroid Papillary Carcinoma CaseDocument6 pagesThyroid Papillary Carcinoma CaseRandy F BabaoNo ratings yet

- Kant and Therapeutic PrivilegeDocument16 pagesKant and Therapeutic PrivilegeMAVillarNo ratings yet

- United Healthcare CA Select Plus Silver 30 2000 30 Aksa W 405Document8 pagesUnited Healthcare CA Select Plus Silver 30 2000 30 Aksa W 405zxcvNo ratings yet

- What Is Meant by GenderDocument4 pagesWhat Is Meant by GenderLance Aldrin AdionNo ratings yet

- RA PHYSICIAN DAVAO Sep2018 PDFDocument10 pagesRA PHYSICIAN DAVAO Sep2018 PDFPhilBoardResultsNo ratings yet

- Q # 6 BE CHP 7 WK 8Document35 pagesQ # 6 BE CHP 7 WK 8saminaJanNo ratings yet

- Ra 6969Document5 pagesRa 6969CharnemNo ratings yet

- 5 BCPC PlanDocument9 pages5 BCPC PlanAlnair CruzNo ratings yet