Professional Documents

Culture Documents

Allocation and Apportionment and Job and Batch Costing Worked Example Question 10

Allocation and Apportionment and Job and Batch Costing Worked Example Question 10

Uploaded by

Roshan RamkhalawonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allocation and Apportionment and Job and Batch Costing Worked Example Question 10

Allocation and Apportionment and Job and Batch Costing Worked Example Question 10

Uploaded by

Roshan RamkhalawonCopyright:

Available Formats

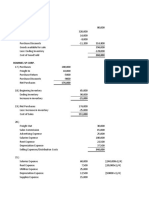

Allocation and Apportionment and Job and Batch Costing Solution

Question 10

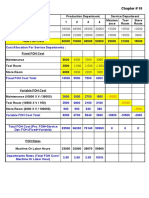

(a) Overhead Analysis Sheet

Overheads Basis Machining Assembly Maintenance Canteen

2120000 2120000 2120000 2120000

( 200 X70) ( 200 X104) ( 200 X16) ( 200 X10)

Indirect wages Number of employees 742000 1102400 169600 106000

410000 410000

(225000X202500) (225000X22500)

Repairs and maintenance of machinery Machine hours 369000 41000 - -

53000 53000 53000 53000

(20000X9000) (20000X8000) (20000X2000) (20000X1000)

Rent and Rates Floor area 23850 21200 5300 2650

24000 24000

(950000X617500) (950000X332500) - -

Machinery Insurance Machine Cost 15600 8400

28000 28000 28000 28000

(20000X9000) (20000X8000) (20000X2000) (20000X1000)

Premises Insurance Floor area 12600 11200 2800 1400

55 35 5 5

(100X48000) (100X48000) (100X48000) (100X48000)

Electricity – Power Power usage 26400 16800 2400 2400

14000 14000

( X617500) ( X332500)

950000 950000

Depreciation of machinery Machine cost 9100 4900 - -

Consumables Allocated 9550 9800 550 1250

Total allocated and apportioned 1208100 1215700 180650 113700

First reapportionment

35 60 5

(100X113700) (100X113700) (100X113700)

Canteen Given % 39795 68220 5685 (113700)

Second reapportionment

80 20

(100X186335) (100X186335) (180650+5685)

Maintenance Given % 149068 37267 (186335)

Total overheads 1396963 1321187 - -

(b) Overhead absorption rate (OAR)

OAR Machining = Budgeted Overheads /Budgeted Machine hours

= 1 396 963/ 202 500

= $6.90 per machine hour

OAR Assembly = Budgeted Overheads / Budgeted Labour hours

= 1 321 187 / 314 500

= $4.20 per labour hour

(c) Over/Under absorption of overheads

Machining Assembly

(6.90 X 195 000) (4.20 X 318 000)

Overhead Absorbed 1 345 500 1 335 600

Less Actual Overheads (1 410 000) (1 312 000)

Over / (Under) Absorption (64 500) 23 600

Under absorption Over absorption

(d) The under absorption of $64500 in machining department occurred due to the following:

1. Overhead absorbed of $1 345 500 is less than actual overheads of $1 410 000.

2. Budgeted overheads of $1 396 963 is less than actual overheads of $1 410 000

3. Budgeted machine hours of 202500 is more than actual machine hours of 195 000. The machining

department has actually worked 7 500 less machine hours than planned.

The over absorption of $23 600 in assembly department occurred due to the following:

1. Overhead absorbed of $1 335 600 is more than actual overheads of $1 312 000.

2. Budgeted overheads of $1 321 187 is more than actual overheads of $1 312 000.

3. Budgeted labour hours of 314 500 is less than actual labour hours of 318 000. The assembly department

has actually worked 3 500 more labour hours than planned.

(e) The use of pre-determined OAR which is not accurate will result in an over or under absorption of

overheads.

When there is under absorption, the business has charged insufficient overheads when plan was made

resulting in the following:

• Overheads understated, understating cost.

• Selling price will be too low.

• The low selling price will not be sufficient to cover cost.

• Profit will fall.

When there is over absorption, the business has charged too much overheads when plan was made resulting

in the following:

• Overheads overstated, overstating cost

• Selling price will be too high, making the product uncompetitive.

• Demand will fall

• Revenue will fall

• Profit will fall.

You might also like

- Bedspace ContractDocument3 pagesBedspace ContractMervin Fernando77% (43)

- Accounting As-Level Paper 2 Topical andDocument19 pagesAccounting As-Level Paper 2 Topical andRoshan Ramkhalawon50% (4)

- Assignment - Service Cost AllocationDocument4 pagesAssignment - Service Cost AllocationRoselyn LumbaoNo ratings yet

- Manufacturing Accounts Notes and QuestionsDocument31 pagesManufacturing Accounts Notes and QuestionsRoshan Ramkhalawon100% (1)

- Manufacturing Account Worked Example Question 13Document6 pagesManufacturing Account Worked Example Question 13Roshan Ramkhalawon100% (1)

- HBL Business Model: HBL - Strategic Management Assignment - by Sohail (11837)Document7 pagesHBL Business Model: HBL - Strategic Management Assignment - by Sohail (11837)Firdous SaeedNo ratings yet

- A Levels Accounting Notes PDFDocument207 pagesA Levels Accounting Notes PDFLeanne Teh100% (4)

- Mechanical Drying Equipment FinalDocument8 pagesMechanical Drying Equipment Finalvijaypal2000100% (1)

- PAPER-3 Worked SolutionsDocument401 pagesPAPER-3 Worked SolutionsRoshan Ramkhalawon100% (2)

- Credo Auto SupplyDocument4 pagesCredo Auto SupplyShinji0% (1)

- Zeta MiningDocument2 pagesZeta MiningChandra Prakash SNo ratings yet

- 9609 s18 QP 12Document4 pages9609 s18 QP 12Vishaal KumarNo ratings yet

- Manhattan DA Motion in Jogger CaseDocument58 pagesManhattan DA Motion in Jogger CaseJustin Rohrlich100% (1)

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 2Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 2Roshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 21Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 21Roshan RamkhalawonNo ratings yet

- 21st - OCTOBER - 2022-TODAY CLASS - DotDocument23 pages21st - OCTOBER - 2022-TODAY CLASS - DotPalesaNo ratings yet

- (MCOF19M018) CF ProjectDocument8 pages(MCOF19M018) CF ProjectFaaiz YousafNo ratings yet

- Acc116 Assignment Ahmad Irfan Bin Zakaria 2020836308Document7 pagesAcc116 Assignment Ahmad Irfan Bin Zakaria 2020836308Siti RuzanaNo ratings yet

- (Mcof19m014) M Abdullah ZafarDocument9 pages(Mcof19m014) M Abdullah ZafarFaaiz YousafNo ratings yet

- CAF 3 Spring 2024Document8 pagesCAF 3 Spring 2024ar7461764No ratings yet

- Rent 1,000,000: S/N Particular UOM Rate Loading Value EMI CostDocument7 pagesRent 1,000,000: S/N Particular UOM Rate Loading Value EMI CostAbhimanyu ArjunNo ratings yet

- TYBCOM - Cost - OverheadsDocument8 pagesTYBCOM - Cost - Overheadsmkbooks4uNo ratings yet

- Cost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaDocument7 pagesCost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaShambhawi SinhaNo ratings yet

- Tutorial OverheadDocument6 pagesTutorial OverheadImran FarhanNo ratings yet

- Assignment - OHD ACC116Document3 pagesAssignment - OHD ACC116Nurul NajihaNo ratings yet

- Particulars P1 P2Document4 pagesParticulars P1 P2sanket pareekNo ratings yet

- COMA211 Textbook Ch13Document17 pagesCOMA211 Textbook Ch13Palesa SemakaleNo ratings yet

- Module 2 Capital Budgeting Handout For LMS 2020Document11 pagesModule 2 Capital Budgeting Handout For LMS 2020sandeshNo ratings yet

- Q-6 Spr-08 (Yahya Limited) Q ADocument2 pagesQ-6 Spr-08 (Yahya Limited) Q AiamneonkingNo ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- Gesco Kabab: Worksheet For The Month Ended in December 31, 2021Document20 pagesGesco Kabab: Worksheet For The Month Ended in December 31, 2021TanjinNo ratings yet

- These Overhead Are To Be Allocated and Apportioned To The Four Departements Using The Information BelowDocument13 pagesThese Overhead Are To Be Allocated and Apportioned To The Four Departements Using The Information BelowKos PaviliunNo ratings yet

- Accounts Assignment 104Document6 pagesAccounts Assignment 104busybeefreedomNo ratings yet

- Chapter # 10Document2 pagesChapter # 10kqandeelNo ratings yet

- Cup Pa Mania ProjectDocument4 pagesCup Pa Mania ProjectDurgaprasad VelamalaNo ratings yet

- Management and Financial Accounting Assessment-2Document6 pagesManagement and Financial Accounting Assessment-2saranyaNo ratings yet

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisShambhawi SinhaNo ratings yet

- Quarter 1: Net ProfitDocument20 pagesQuarter 1: Net ProfitAzmain MugdhoNo ratings yet

- Chapter 27Document7 pagesChapter 27Shane Ivory ClaudioNo ratings yet

- Particulars Units Unit Cost (RS) Total Cost (RS)Document3 pagesParticulars Units Unit Cost (RS) Total Cost (RS)ginish12No ratings yet

- Absorption (Total) Costing AnswersDocument7 pagesAbsorption (Total) Costing AnswersNalan TafanaNo ratings yet

- Cost SheetDocument5 pagesCost Sheetrajan mishraNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 5Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 5Roshan RamkhalawonNo ratings yet

- Bacc232 .309 Management Accounting Assignment 1Document13 pagesBacc232 .309 Management Accounting Assignment 1TarusengaNo ratings yet

- Pg-11-7 Book Valuve: Assignment Capital BudgetingDocument9 pagesPg-11-7 Book Valuve: Assignment Capital BudgetingIffi RaniNo ratings yet

- Cost Estimation & CVP Suggested SolutionDocument15 pagesCost Estimation & CVP Suggested SolutionNguyên Văn NhậtNo ratings yet

- Buget ExcelDocument9 pagesBuget ExcelKhushbu PandeyNo ratings yet

- SOLUTIONS-WPS Office PDFDocument3 pagesSOLUTIONS-WPS Office PDFJoventino NebresNo ratings yet

- Maf251 Q5 Sept2015 DianaDocument1 pageMaf251 Q5 Sept2015 DianaSITI NUR DIANA SELAMATNo ratings yet

- Lecture 14 POADocument7 pagesLecture 14 POALau Chun GuiNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Submitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoDocument8 pagesSubmitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoFaaiz YousafNo ratings yet

- Tuto 1Document9 pagesTuto 1Rara MignonneNo ratings yet

- Chapter 5 ExercisesDocument12 pagesChapter 5 ExercisesIsaiah BatucanNo ratings yet

- ABC Company Is Considering The Replacement of Old Machine That Is 3 Three Years Old With A NewDocument9 pagesABC Company Is Considering The Replacement of Old Machine That Is 3 Three Years Old With A Newrajaroma45No ratings yet

- Activity 1 PDFDocument2 pagesActivity 1 PDFnimeshaNo ratings yet

- Homework No.12Document6 pagesHomework No.12Danna ClaireNo ratings yet

- Income Taxes - Moments LTD Rupert LTD MemoDocument5 pagesIncome Taxes - Moments LTD Rupert LTD Memoandiswa zuluNo ratings yet

- ACB 10203 Tutorial Cost Allocation With SolutionDocument5 pagesACB 10203 Tutorial Cost Allocation With SolutionainfarhanaNo ratings yet

- Arcadia and Enterprise Co. Worked ExamplesDocument22 pagesArcadia and Enterprise Co. Worked ExamplesIvy TulesiNo ratings yet

- Budet ExerciseDocument5 pagesBudet ExerciseVarun yashuNo ratings yet

- Chapter 29 Machinery Capital Expenditures and Revenue Expenditures PDF FreeDocument9 pagesChapter 29 Machinery Capital Expenditures and Revenue Expenditures PDF FreeSherri BonquinNo ratings yet

- Job Costing ADMDocument18 pagesJob Costing ADMSiddhanta MishraNo ratings yet

- F5 CRQ PracticeDocument11 pagesF5 CRQ Practiceprabhakaran arumugamNo ratings yet

- Overhead ApportionmentDocument3 pagesOverhead ApportionmentHassanAbsarQaimkhaniNo ratings yet

- Activity and TransportationDocument7 pagesActivity and TransportationBIJIT GOSWAMINo ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 15Document22 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 15Mr. JalilNo ratings yet

- Mechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesFrom EverandMechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesDileep SinghNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 18Document5 pagesManufacturing Account Worked Example Question 18Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 8Document7 pagesManufacturing Account Worked Example Question 8Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 16Document5 pagesManufacturing Account Worked Example Question 16Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 17Document6 pagesManufacturing Account Worked Example Question 17Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 4Document5 pagesManufacturing Account Worked Example Question 4Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 7Document4 pagesManufacturing Account Worked Example Question 7Roshan Ramkhalawon100% (1)

- Manufacturing Account Worked Example Question 2Document4 pagesManufacturing Account Worked Example Question 2Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 9Document5 pagesManufacturing Account Worked Example Question 9Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Examples Question 6 - No Separate Books of AccountsDocument3 pagesJoint Venture Worked Examples Question 6 - No Separate Books of AccountsRoshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 8 - No Seperate Books of AccountsDocument4 pagesJoint Venture Worked Example Question 8 - No Seperate Books of AccountsRoshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 3Document3 pagesManufacturing Account Worked Example Question 3Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 4 - Separate Books of AccountsDocument4 pagesJoint Venture Worked Example Question 4 - Separate Books of AccountsRoshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 1 - Separate Books of AccountDocument2 pagesJoint Venture Worked Example Question 1 - Separate Books of AccountRoshan RamkhalawonNo ratings yet

- Balancing of Accounts SolutionDocument3 pagesBalancing of Accounts SolutionRoshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 2Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 2Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 3 - Separte Books of AccountsDocument3 pagesJoint Venture Worked Example Question 3 - Separte Books of AccountsRoshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 5 - Separate Books of AccountsDocument3 pagesJoint Venture Worked Example Question 5 - Separate Books of AccountsRoshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 21Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 21Roshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 5Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 5Roshan RamkhalawonNo ratings yet

- Grade Thresholds - June 2021: Cambridge International AS & A Level Accounting (9706)Document2 pagesGrade Thresholds - June 2021: Cambridge International AS & A Level Accounting (9706)Roshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 20Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 20Roshan RamkhalawonNo ratings yet

- Joint Venture AsdDocument15 pagesJoint Venture AsdRoshan RamkhalawonNo ratings yet

- Accounting Concept or Principles PDFDocument3 pagesAccounting Concept or Principles PDFRoshan RamkhalawonNo ratings yet

- O Level IGCSE Accounting Notes Final NauDocument14 pagesO Level IGCSE Accounting Notes Final NauRoshan RamkhalawonNo ratings yet

- Account ListDocument208 pagesAccount ListChaitali DegavkarNo ratings yet

- MPL Product Hunting CriteriaDocument1 pageMPL Product Hunting CriteriaSoccer ScenarioNo ratings yet

- Art 147 and 148 DistinguishedDocument4 pagesArt 147 and 148 DistinguishedAnonymous qVBPAB3QwYNo ratings yet

- Billing Statement 1Document1 pageBilling Statement 1Dwi RetnoNo ratings yet

- Victoria Hewlett V USU Settlement Agreement and Release 062718Document8 pagesVictoria Hewlett V USU Settlement Agreement and Release 062718Utah StatesmanNo ratings yet

- Trichy RTI CtsDocument5 pagesTrichy RTI CtsDawood KSNo ratings yet

- Criminal Copyright Infringement: Improper Punishments From An Improper Analogy To TheftDocument19 pagesCriminal Copyright Infringement: Improper Punishments From An Improper Analogy To TheftNEJCCCNo ratings yet

- IAS 40 - Investment PropertyDocument11 pagesIAS 40 - Investment PropertyjfkdfkNo ratings yet

- 17 - SANSON vs. CADocument3 pages17 - SANSON vs. CAAkagamiNo ratings yet

- Travel Insurance Certificate of Coverage No: EM-VBOQ-C-192393Document1 pageTravel Insurance Certificate of Coverage No: EM-VBOQ-C-192393nithinNo ratings yet

- Contract - I March/April 2021: ST ND RD RD THDocument2 pagesContract - I March/April 2021: ST ND RD RD THBalachandra P RNo ratings yet

- Business Analyst AdroitDocument3 pagesBusiness Analyst AdroitRizwan Jaffer SultanNo ratings yet

- Legal Responses To Cyber Bullying and Sexting in South AfricaDocument20 pagesLegal Responses To Cyber Bullying and Sexting in South AfricaJacques HammanNo ratings yet

- Speech RobespierreDocument1 pageSpeech Robespierreapi-279399786No ratings yet

- Financial Accounting and Reporting - Week 1 Topic 1 - Overview of AccountingDocument9 pagesFinancial Accounting and Reporting - Week 1 Topic 1 - Overview of AccountingLuisitoNo ratings yet

- Chapter 5 (5.3) - Technical Documents - Drawings 2014Document3 pagesChapter 5 (5.3) - Technical Documents - Drawings 2014eugenio lorenzoNo ratings yet

- Anti Dumping DutyDocument5 pagesAnti Dumping DutyyeshanewNo ratings yet

- Cir Vs Victorias Milling CoDocument2 pagesCir Vs Victorias Milling ConazhNo ratings yet

- Word Families: Promoting Success For You & Your Students!Document8 pagesWord Families: Promoting Success For You & Your Students!Marie CrystallineNo ratings yet

- UN (1) United NationsDocument62 pagesUN (1) United NationsNoor ZamanNo ratings yet

- How Do I Delete My Quora Account - QuoraDocument6 pagesHow Do I Delete My Quora Account - Quoravvk.mit4766No ratings yet

- PCMM/SRLY Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 97195623Document3 pagesPCMM/SRLY Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No 97195623Mayank UkaniNo ratings yet

- Lopez VS CaDocument2 pagesLopez VS CaKeisha Mariah Catabay Lauigan100% (1)

- E3-Assignment 2Document2 pagesE3-Assignment 2Munawar AliNo ratings yet

- Fine Foods Limited: FU Wang Food LimitedDocument8 pagesFine Foods Limited: FU Wang Food LimitedS. M. Zamirul IslamNo ratings yet

- Astm f2126Document3 pagesAstm f2126Darío SadlerNo ratings yet