Professional Documents

Culture Documents

Invest Small Cap MF

Invest Small Cap MF

Uploaded by

chintan mehta0 ratings0% found this document useful (0 votes)

27 views3 pagesInvest small cap Mutual fund

Original Title

InvestSmallCapMF

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInvest small cap Mutual fund

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

27 views3 pagesInvest Small Cap MF

Invest Small Cap MF

Uploaded by

chintan mehtaInvest small cap Mutual fund

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

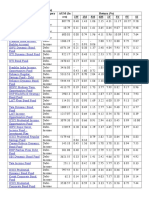

Best Small Cap Funds (December 2022):

Top-performing schemes since inception

Story by PF Desk • 2h ago

S mall Cap mutual funds attract investors because of their potential to give

better returns compared to large and mid-cap funds. In November 2022,

small-cap equity/growth-oriented funds witnessed a total inflow of Rs 1378

crore even as several other funds witnessed big outflows. There are several

small-cap funds that have given returns of over 20% since their respective

launch dates. Let’s have a look at such top-performing small-cap funds:

Here are top 10 best performing small cap funds since launch till December 16, 2022. Representational

image© Provided by The Financial Express

Top 10 best-performing small-cap mutual funds since inception (till

December 16, 2022)

IDFC Emerging Businesses Fund

The direct plan of IDFC Emerging Businesses Fund has given 33.85%

annualised returns since inception while the regular plan has given a return of

31.45%. The scheme tracks S&P BSE 250 SmallCap Total Return Index.

Bank of India Small Cap Fund

The direct plan of Bank of India Small Cap Fund has given 30.92% annualised

returns since inception while the regular plan has given a return of 28.6%. The

scheme tracks NIFTY Smallcap 250 Total Return Index.

Edelweiss Small Cap Fund

The direct plan of Edelweiss Small Cap Fund has given 29.87% annualised

returns since inception while the regular plan has given a return of 27.81%.

The scheme tracks NIFTY Smallcap 250 Total Return Index.

Also Read: Best Small Cap Funds Till November 2022

Canara Robeco Small Cap Fund

Related video: Value Funds Make A Spirited Comeback l Check Out Their

Top Mid-Cap & Small-cap Picks (Moneycontrol)

The direct plan of Canara Robeco Small Cap Fund has given 29.32%

annualised returns since inception while the regular plan has given a return of

27.09%. The scheme tracks NIFTY Smallcap 250 Total Return Index.

UTI Small Cap Fund

The direct plan of UTI Small Cap Fund has given 28.52% annualised returns

since inception while the regular plan has given a return of 26.08%. The

scheme tracks NIFTY Smallcap 250 Total Return Index.

Tata Small Cap Fund

The direct plan of Tata Small Cap Fund has given 26.54% annualised returns

since inception while the regular plan has given a return of 24.16%. The

scheme tracks NIFTY Smallcap 250 Total Return Index.

SBI Small Cap Fund

The direct plan of SBI Small Cap Fund has given 26.13% annualised returns

since inception while the regular plan has given a return of 20.3%. The

scheme tracks S&P BSE 250 SmallCap Total Return Index.

Nippon India Small Cap

The direct plan of Nippon India Small Cap fund has given 25.28% annualised

returns since inception while the regular plan has given a return of 20.13%.

The scheme tracks NIFTY Smallcap 250 Total Return Index.

Also Read: How much SIP is required for Rs 10 crore from Mutual Funds

Axis Small Cap Fund

The direct plan of Axis Small Cap Fund has given 24.47% annualised returns

since inception while the regular plan has given a return of 22.88%. The

scheme tracks NIFTY Smallcap 250 Total Return Index.

Invesco India Smallcap Fund

The direct plan of Invesco India Smallcap Fund has given 23.02% annualised

returns since inception while the regular plan has given a return of 21.05%.

The scheme tracks S&P BSE 250 SmallCap Total Return Index.

You might also like

- Cracking The Code UccDocument592 pagesCracking The Code Uccalanbwilliams98% (168)

- Unemployment Class Action LawsuitDocument36 pagesUnemployment Class Action LawsuitMallory Sofastaii100% (2)

- Capital Budgeting of ITC Company LimitedDocument12 pagesCapital Budgeting of ITC Company LimitedRama Sardesai50% (2)

- 07 - Remedial LawDocument388 pages07 - Remedial Lawfreegalado100% (2)

- Mutual FundsDocument3 pagesMutual FundsGENITH GEORGENo ratings yet

- MF ChikkiDocument12 pagesMF ChikkipenchalaamaravathiNo ratings yet

- HDFC Asset Management Company LimitedDocument12 pagesHDFC Asset Management Company LimitedAnuraag SharmaNo ratings yet

- HhaheDocument4 pagesHhahemagicheatgamingytNo ratings yet

- AIF NewsDocument3 pagesAIF NewsDiksha DuttaNo ratings yet

- A Scheme That Returned 20 Per Cent or More: Stress Test: Star PowerDocument9 pagesA Scheme That Returned 20 Per Cent or More: Stress Test: Star PowerPiyush ChauhanNo ratings yet

- InterpretationsDocument2 pagesInterpretationsLaghimaNo ratings yet

- Future DRDocument34 pagesFuture DRarpitimsrNo ratings yet

- Sbi Mutual Fund: by Anand A.KDocument10 pagesSbi Mutual Fund: by Anand A.KAnand Kudavakkaligi KNo ratings yet

- Empower September 2016Document110 pagesEmpower September 2016mannddarrNo ratings yet

- SBI Mutual FundsDocument37 pagesSBI Mutual FundsWahab KukaswadiaNo ratings yet

- Mirae Asset Emerging Bluechip FundDocument4 pagesMirae Asset Emerging Bluechip Fundsachin_sac100% (1)

- Suzuki Motors, PK.: Financial Analysis To Approach Their FutureDocument10 pagesSuzuki Motors, PK.: Financial Analysis To Approach Their FutureAsma ZameerNo ratings yet

- Systematic Investment PlanDocument28 pagesSystematic Investment PlansangnaguNo ratings yet

- Small Industries Development Bank of India (Sidbi) : Growth, Development and Role in The Promotion of Entrepreneurship in Uttar Pradesh (U.P.)Document46 pagesSmall Industries Development Bank of India (Sidbi) : Growth, Development and Role in The Promotion of Entrepreneurship in Uttar Pradesh (U.P.)Suhani jainNo ratings yet

- Systematic Investment Plan: DSP Blackrock Mutual FundDocument28 pagesSystematic Investment Plan: DSP Blackrock Mutual FundmynksharmaNo ratings yet

- Birla Sun Life Tax Relief 96Document5 pagesBirla Sun Life Tax Relief 96MANAV YADAVNo ratings yet

- SBI Magnum Tax Gain SchemeDocument14 pagesSBI Magnum Tax Gain SchemeabhiranjanNo ratings yet

- Cash Management of Icici BankDocument19 pagesCash Management of Icici BankBassam QureshiNo ratings yet

- The Financial Plan: Arya Kumar Chief ED & IPR Unit BITS, PilaniDocument20 pagesThe Financial Plan: Arya Kumar Chief ED & IPR Unit BITS, Pilanirock_worldNo ratings yet

- Summer Training Report Summer Training Report ON ON Analysis of Mutual Fund Analysis of Mutual Fund IN IN State Bank of India State Bank of IndiaDocument44 pagesSummer Training Report Summer Training Report ON ON Analysis of Mutual Fund Analysis of Mutual Fund IN IN State Bank of India State Bank of IndiaSonia PuriNo ratings yet

- Sbi ProjectDocument16 pagesSbi Projectsanjanagoud01No ratings yet

- Franklin India Bluechip FundDocument5 pagesFranklin India Bluechip Fundbanerjee_rocksNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksLaharii MerugumallaNo ratings yet

- How Much Commission Mutual Fund Agent GetsDocument19 pagesHow Much Commission Mutual Fund Agent GetsjvmuruganNo ratings yet

- Pgim India Fullar23Document276 pagesPgim India Fullar23Sourav ChutaniNo ratings yet

- Final SidbiDocument19 pagesFinal SidbiSahil TrehanNo ratings yet

- Systematic Investment Plan (SIP) : ImpleDocument24 pagesSystematic Investment Plan (SIP) : ImpleHarsha PursnaniNo ratings yet

- Presented By:-Hirapara Kaushal, Sojitra ParagDocument20 pagesPresented By:-Hirapara Kaushal, Sojitra ParagKaushal HiraparaNo ratings yet

- State Bank of IndiaDocument30 pagesState Bank of IndiaSahil ChhibberNo ratings yet

- Financial Management - CIADocument14 pagesFinancial Management - CIAKhushiNo ratings yet

- PRESENTATION ON FINANCIAL MANAGEMENT - Copy124524Document34 pagesPRESENTATION ON FINANCIAL MANAGEMENT - Copy1245249824534642No ratings yet

- Axis Factsheet February 2015Document20 pagesAxis Factsheet February 2015Sumit GuptaNo ratings yet

- Portfolio Management: Different Types of Secured Investments Plan, and Types of AnalysisDocument22 pagesPortfolio Management: Different Types of Secured Investments Plan, and Types of AnalysisAnkita ModiNo ratings yet

- 103 Sbi Blue Chip FundDocument21 pages103 Sbi Blue Chip FundsagarNo ratings yet

- Kotak Mahindra Bank Q2 FY18 Earnings Conference Call: October 25, 2017Document18 pagesKotak Mahindra Bank Q2 FY18 Earnings Conference Call: October 25, 2017divya mNo ratings yet

- All Funds - Period (Last 5 Years)Document3 pagesAll Funds - Period (Last 5 Years)vivekNo ratings yet

- Types of Mutual Fund Schemes Offered by Baroda Pioneer Mutual FundDocument15 pagesTypes of Mutual Fund Schemes Offered by Baroda Pioneer Mutual FundNeha KumariNo ratings yet

- SBI Focused Equity Fund: Outstanding Track Record of Wealth CreationDocument5 pagesSBI Focused Equity Fund: Outstanding Track Record of Wealth CreationHariprasad ManchiNo ratings yet

- S No. Return: Name of The Mutual Fund SchemeDocument4 pagesS No. Return: Name of The Mutual Fund SchemeHarsh KandeleNo ratings yet

- Sbi Saving SchemeDocument5 pagesSbi Saving SchemeHitesh HasijaNo ratings yet

- Top Small Mid and Large CapDocument2 pagesTop Small Mid and Large Caprajandubey660No ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Document39 pagesBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYNo ratings yet

- Financial PlanDocument22 pagesFinancial PlanVenkatesh EpNo ratings yet

- Banking and Financial Awareness Digest June 2021Document9 pagesBanking and Financial Awareness Digest June 2021Sakshi GuptaNo ratings yet

- Systematic Investment Plan: What Is An SIP?Document3 pagesSystematic Investment Plan: What Is An SIP?Ankita RanaNo ratings yet

- Besel Disclosures Mar11Document14 pagesBesel Disclosures Mar11adityanukalaNo ratings yet

- 6622 DocumentDocument4 pages6622 DocumentKhursheed AhmadNo ratings yet

- Equity Mutual Fund 19 Equity Mutual Funds OffereDocument1 pageEquity Mutual Fund 19 Equity Mutual Funds OfferedrhimanshuagniNo ratings yet

- Sidbi, Idbi and Ex-Im BankDocument33 pagesSidbi, Idbi and Ex-Im BankIshita GuptaNo ratings yet

- Aia Annual Funds Report 2021Document182 pagesAia Annual Funds Report 2021Navin IndranNo ratings yet

- Historical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument12 pagesHistorical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolSHARIQUE TANVEERNo ratings yet

- Comparative Analysis of Mutual FundDocument20 pagesComparative Analysis of Mutual FundSaurabh VermaNo ratings yet

- Dissertation On Mutual FundsDocument5 pagesDissertation On Mutual FundsHowToWriteMyPaperSingapore100% (1)

- Abstract:: Qualified Institutional PlacementsDocument5 pagesAbstract:: Qualified Institutional Placements281694No ratings yet

- Company Name:Itc: Business Finance Assignment Sectio NCDocument13 pagesCompany Name:Itc: Business Finance Assignment Sectio NCDIVYANG AGARWAL 2023291No ratings yet

- DSPBRIM-Mutual Fund Basics and SIP Presentation NewDocument45 pagesDSPBRIM-Mutual Fund Basics and SIP Presentation NewavinashmunnuNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Movies 10 Outof 10Document5 pagesMovies 10 Outof 10chintan mehtaNo ratings yet

- Best & Easy Brownie ReciepeDocument3 pagesBest & Easy Brownie Reciepechintan mehtaNo ratings yet

- Tell Me About Yourself: What Do You Do?Document3 pagesTell Me About Yourself: What Do You Do?chintan mehtaNo ratings yet

- SAP BPC - Overview: What Is EPM?Document105 pagesSAP BPC - Overview: What Is EPM?chintan mehtaNo ratings yet

- Sap BPC PDFDocument105 pagesSap BPC PDFchintan mehtaNo ratings yet

- Sap BPCDocument105 pagesSap BPCchintan mehta100% (2)

- Business Benefits of BCS in Compare To Former BudgetingDocument2 pagesBusiness Benefits of BCS in Compare To Former Budgetingchintan mehtaNo ratings yet

- Sucess Factor GuideDocument60 pagesSucess Factor Guidechintan mehta100% (1)

- Written Assignment 6 Employment LawsDocument6 pagesWritten Assignment 6 Employment LawsXavierNo ratings yet

- Psychological Society Constitution and By-LawsDocument3 pagesPsychological Society Constitution and By-LawsMary Grace A. NonayNo ratings yet

- AltechCorp - DIN Rail and Panel Mount Terminal BlocksDocument119 pagesAltechCorp - DIN Rail and Panel Mount Terminal BlocksQuantumAutomationNo ratings yet

- Module 4 To Module 6 POMDocument105 pagesModule 4 To Module 6 POMARYA JAIN 21111511No ratings yet

- PSCAD Essential Tutorials - Getting Started and Basic FeaturesDocument5 pagesPSCAD Essential Tutorials - Getting Started and Basic FeaturesGabriel Vinicios Moreira FernandesNo ratings yet

- Belgrade To Rome Google FlightsDocument1 pageBelgrade To Rome Google FlightsjasminaNo ratings yet

- Ra 8551 Chapter 1Document11 pagesRa 8551 Chapter 1Jayson ampatuanNo ratings yet

- Muhamma D Asim: ObjectiveDocument2 pagesMuhamma D Asim: ObjectiveMuzaffar HussainNo ratings yet

- Mas QuizzerDocument11 pagesMas QuizzerNica Jane MacapinigNo ratings yet

- Eyesi Indirect BrochureDocument12 pagesEyesi Indirect BrochureHaag-Streit UK (HS-UK)No ratings yet

- Sugeng,+4a +Niru+AnitaDocument22 pagesSugeng,+4a +Niru+Anitabyunsona 07No ratings yet

- 5.1PUNNF Brochure 2Document10 pages5.1PUNNF Brochure 2Darlington EzeNo ratings yet

- YMCA Annual Report 2013Document8 pagesYMCA Annual Report 2013cn_cadillacmiNo ratings yet

- Indicator 11.7.1 Training Module Public SpaceDocument39 pagesIndicator 11.7.1 Training Module Public SpaceCarlos MartinsNo ratings yet

- Branch Trigram Product Name: Export Control Classification Number (US EAR)Document37 pagesBranch Trigram Product Name: Export Control Classification Number (US EAR)marufuddin0No ratings yet

- Use of Bamboo As Housing Material and in Making Various ProductsDocument69 pagesUse of Bamboo As Housing Material and in Making Various ProductsRAHUL100% (2)

- Investment PDFDocument10 pagesInvestment PDFMahima MehtaNo ratings yet

- HDFC Bank Statement 09-08-2022Document5 pagesHDFC Bank Statement 09-08-2022mahakaal digital point bhopalNo ratings yet

- Supply Chain Management of Wal-MartDocument17 pagesSupply Chain Management of Wal-Martuma6677No ratings yet

- Job ClassificationDocument2 pagesJob Classificationpeter mulilaNo ratings yet

- Introducing... : ... A New Paradigm in Personal, Real-Time, Biologically Protected AirDocument8 pagesIntroducing... : ... A New Paradigm in Personal, Real-Time, Biologically Protected AirslowmosquitoNo ratings yet

- GBP Statement: TransactionsDocument2 pagesGBP Statement: Transactions13KARATNo ratings yet

- MC2008-102 LTIA GuidelinesDocument17 pagesMC2008-102 LTIA GuidelinesBegie Lucenecio100% (1)

- Chocho Language - WikipediaDocument2 pagesChocho Language - Wikipediajjlajom0% (1)

- Chandigarh MediaDocument9 pagesChandigarh MediaBhavyaNo ratings yet

- HT9610P0100 Room Unit of Communicating Fan Coil Thermostat HoneywellDocument3 pagesHT9610P0100 Room Unit of Communicating Fan Coil Thermostat HoneywellJahir Ortega RuizNo ratings yet

- OECD Comparison of Technology TransferDocument32 pagesOECD Comparison of Technology Transfercdh1001No ratings yet