Professional Documents

Culture Documents

Share MO Chapter 3 Excercises and Solutions

Share MO Chapter 3 Excercises and Solutions

Uploaded by

Hesham Ahmed0 ratings0% found this document useful (0 votes)

19 views6 pages1. Menefee City levied $12 million in property taxes for 20X6 and recorded various journal entries to record the tax levy, collections within the discount period, collections after the discount period, and delinquent taxes.

2. The City of Asher estimated $210,000 in revenues for 20X7 from various sources like property taxes, parking meters, etc. and recorded journal entries for the estimated revenues, property tax levy, budget revisions, and actual revenue collections.

3. At year-end, Asher prepared a trial balance for the Revenues Subsidiary Ledger to show agreement with the control accounts, with various revenue accounts having debit or credit balances.

Original Description:

Test bank chapter 3 CVP

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Menefee City levied $12 million in property taxes for 20X6 and recorded various journal entries to record the tax levy, collections within the discount period, collections after the discount period, and delinquent taxes.

2. The City of Asher estimated $210,000 in revenues for 20X7 from various sources like property taxes, parking meters, etc. and recorded journal entries for the estimated revenues, property tax levy, budget revisions, and actual revenue collections.

3. At year-end, Asher prepared a trial balance for the Revenues Subsidiary Ledger to show agreement with the control accounts, with various revenue accounts having debit or credit balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

19 views6 pagesShare MO Chapter 3 Excercises and Solutions

Share MO Chapter 3 Excercises and Solutions

Uploaded by

Hesham Ahmed1. Menefee City levied $12 million in property taxes for 20X6 and recorded various journal entries to record the tax levy, collections within the discount period, collections after the discount period, and delinquent taxes.

2. The City of Asher estimated $210,000 in revenues for 20X7 from various sources like property taxes, parking meters, etc. and recorded journal entries for the estimated revenues, property tax levy, budget revisions, and actual revenue collections.

3. At year-end, Asher prepared a trial balance for the Revenues Subsidiary Ledger to show agreement with the control accounts, with various revenue accounts having debit or credit balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

E1

Prepare general journal entries to record the following transactions in Menfee

City’s General Ledger and make adjusting entries, if needed:

1. Menefee City levied property tax of $12,000,000 FOR 20X6. The taxes were

levied on January 1, 20x6. Menefee expects $80,000 to be uncollectible.

Three-fourths of the taxes receivable are expected to be collected within

the 2% discount period. Another $1,000,000 of taxes receivable should be

collected before year-end but after the discount period. The balance of

collectible taxes is expected to be collected at a uniform rate over the first

10 month of 20x7.

2. Menefee collected $9,100,000 (before discounts) of its taxes receivable

prior to the end of the discount period. The balance of the taxes receivables

are past due.

3. Menefee wrote off taxes receivables of $30,000 as uncollectible.

4. Menefee collected another $900,000 of its taxes receivables after the

discount period but before the year end.

Solution

Taxes Receivable—Current 12,000,000

Allowance for Uncollectible Current Taxes 80,000

Allowance for Discounts on Taxes 180,000

Revenues

10,204,000

Deferred Revenues

1,536,000

To record tax levy.

Computations:

Discounts—$12,000,000 x .75 x.98 = $180,000

Revenues:

Expected collections in discount period ($12,000,000 x .75 x.98) $8

Expected collections after discount period and before year end 1,0

Collections in first 60 days of 20X7:

($12,000,000 - 9,000,000- $1,000,000 -$80,000) x 2/10

384,000

Total property tax revenues

$10,204,000

2a. Cash ($9,100,000 x .98) 8,918,000

Allowance for Discounts on Taxes 180,000

Revenues 2,000

Taxes Receivable—Current 9,100,000

To record tax collections in the discount period.

Note that when actual discounts are more (or less) than the estimated amount this

difference results in decreasing (or increasing) revenues. This adjustment makes

revenues equal to the amount that would have been recorded initially had the

estimate proved correct.

2b. Taxes Receivable—Delinquent 2,900,000

Allowance for Uncollectible Current Taxes 80,000

Taxes Receivable—Current 2,900,000

Allowance for Uncollectible

Delinquent Taxes 80,000

To reclassify past due taxes as delinquent.

3. Allowance for Uncollectible Delinquent Taxes 30,000

Taxes Receivable—Delinquent 30,000

To record write-off of taxes as uncollectible.

4. Cash 900,000

Taxes Receivable—Delinquent 900,000

To record tax collections.

E2 The City of Asher had the following transactions, among others in 20x7:

1. The council estimated that revenues of £210,000 would be generated for

the General Fund in 20x7. The sources and amounts of expected revenues

are as follows:

Property taxes £150,000

Parking meters 5,000

Business Licenses 30,000

Amusement Licenses 10,000

Charges for services 8,000

Other Revenues 7,000

£210,000

2. Property taxes of £152,000 were levied by the council ; £2,000 of these

taxes are expected to be uncollectible.

3. The council adopted a budget revision increasing the estimate of

amusement licenses revenues by £2,000 and decreasing the estimate for

business licenses revenues by £2,000.

4. The following collections were made by the city:

Property taxes £140,000

Parking meters 5,500

Business licenses 28,000

Amusement licenses 9,500

Charges for services (not 9,000

previously accrued)

Other revenues 10,000

£202,000

5. The resources of a discontinued Capital Projects fund were transferred to

the General Fund, £4,800.

6. Enterprise Fund cash of £5,000 was paid to the General fund to subsidise

its operations.

Required

a. Prepare general journal entries and budgetary entries to record the

transactions in the General Ledger and Revenues Subsidiary Ledger

accounts.

b. Prepare a trial balance for the Revenues Ledger after posting the general

journal entries prepared in item (a) show agreement with the control

accounts.

c. Prepare the general journal entries to close the revenue accounts in the

general ledger and Revenues ledger.

Solution

E2 (a)

City of Asher

General Fund

General Journal

General Ledger

# Accounts Dr. Cr.

1. Budgetary Entry

Estimated Revenues 210,000

Fund Balance 210,000

To record estimated revenues.

Revenues Ledger (Estimated Revenues):

Property Taxes 150,000

Parking Meters 5,000

Business Licenses 30,000

Amusement Licenses 10,000

Charges for Services 8,000

Other Revenues 7,000

210,000

2. Taxes Receivable—Current 152,000

Allowance for Uncollectible Current Taxes 2,000

Revenues 150,000

To record property tax levy.

Revenues Ledger (Revenues):

Property Taxes 150,000

3. Budgetary Entry

Estimated Revenues 2,000

Estimated Revenues. 2,000

To record budget revisions.

Revenues Ledger (Estimated Revenues):

Amusement Licenses 2,000

Business Licenses 2,000

E2 (a) (continued)

4. Cash 202,000

Taxes Receivable—Current 140,000

Revenues 62,000

To record taxes and other revenues collected.

Revenues Ledger (Revenues):

Parking Meters 5,500

Business Licenses 28,000

Amusement Licenses 9,500

Charges for Services 9,000

Other Revenues 10,000

62,000

5. Cash 4,800

Transfer from Capital Projects Fund 4,800

To record transfer from Capital Projects Fund.

6. Cash 5,000

Transfer from Enterprise Fund 5,000

To record transfer from Enterprise Fund.

E2 (b)

Revenues Subsidiary Ledger (Not Required)

Balance

Accounts Dr. Cr. Dr. (Cr.)

Property Taxes 150,000 (1) 150,000(2) –

Parking Meters. 5,000 (1) 5,500(4) (500)

Business Licenses 30,000 (1)

(2,000)(3) 28,000(4) –

Amusement Licenses 10,000 (1) 9,500(4) 2,500

2,000 (3)

Charges for Services 8,000 (1) 9,000(4) (1,000)

Other Revenues 7,000 (1) 10,000(4) (3,000)

(2,000)

E2 (b) (continued)

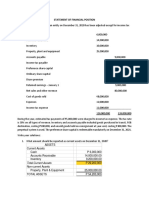

City of Asher

General Fund

Trial Balance—Revenues Subsidiary Ledger

At 20X7 Year End

Dr. Cr.

Property Taxes – –

Parking Meters 500

Business Licenses – –

Amusement Licenses 2,500

Charges for Services 1,000

Other Revenues 3,000

2,500 4,500

(2,500)

2,000

Proof from General Ledger:

Revenues $212,000

Estimated Revenues 210,000

$ 2,000

E2 (c)

General Ledger

# Accounts Dr. Cr.

C1. General Ledger

Revenues 212,000

Fund Balance 2,000

Estimated Revenues 210,000

To close revenue-related accounts.

Revenues Ledger (Estimated Revenues):

Parking Meters 500

Amusement Licenses 2,500

Charges for Services 1,000

Other Revenues 3,000

4,500 2,500

You might also like

- SAP SD, FI, MM and PP Business Blueprint DocumentDocument252 pagesSAP SD, FI, MM and PP Business Blueprint Documentdilmeetd91% (129)

- Osborne Books Answer Document AS AccountingDocument37 pagesOsborne Books Answer Document AS AccountingAaron33% (3)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- CH Proble 3 8 PDFDocument29 pagesCH Proble 3 8 PDFYogun Bayona100% (1)

- Mock Test (Final Exam) KeyDocument4 pagesMock Test (Final Exam) KeyKhoa TrầnNo ratings yet

- Solution of Governmentl CH 5Document18 pagesSolution of Governmentl CH 5Ahmad KamalNo ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Accounting Process HandoutsDocument6 pagesAccounting Process HandoutsMichael BongalontaNo ratings yet

- Chapter 5 Solutions To Assigned HomeworkDocument9 pagesChapter 5 Solutions To Assigned HomeworkLiyue QiNo ratings yet

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- Assignment - J&RDocument6 pagesAssignment - J&RJie SapornaNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- Ias 07Document72 pagesIas 07Hannan Fatima EllahiNo ratings yet

- Acc Concepts PP QnsDocument9 pagesAcc Concepts PP Qnsmoots altNo ratings yet

- Cases Chapter 5Document2 pagesCases Chapter 5Rifqi FarhanNo ratings yet

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Corporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMDocument3 pagesCorporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMChirag JainNo ratings yet

- SdsasacsacsacsacsacDocument4 pagesSdsasacsacsacsacsacIden PratamaNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Ilustrasi Cash Flow Pertemuan Ke 5 11-10-2022Document6 pagesIlustrasi Cash Flow Pertemuan Ke 5 11-10-2022nur sayNo ratings yet

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- Net Income 17,000: Account Receivable - 45,000Document3 pagesNet Income 17,000: Account Receivable - 45,000Rock RoseNo ratings yet

- Chapter 23 - Ringkasan Cash FlowDocument7 pagesChapter 23 - Ringkasan Cash FlowMunisa LailaNo ratings yet

- Tidak Boleh Diakui Sama Sekali: Dicatat Sebagai Deferred TaxDocument7 pagesTidak Boleh Diakui Sama Sekali: Dicatat Sebagai Deferred TaxAlfatih 1453No ratings yet

- Northern Cpa Review: First Pre-Board ExaminationDocument13 pagesNorthern Cpa Review: First Pre-Board ExaminationKim Cristian MaañoNo ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- Answers Governmental Accounting ExercisesDocument10 pagesAnswers Governmental Accounting Exerciseswerewolf2010No ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Bba F&a Notes & ProbDocument5 pagesBba F&a Notes & ProbMouly ChopraNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- O CPA Review: Taxation PreweekDocument19 pagesO CPA Review: Taxation PreweekVanessa Anne Acuña DavisNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Tugas CH 1, 2 Dan 4 Inter I Sepr 17Document2 pagesTugas CH 1, 2 Dan 4 Inter I Sepr 17dheyaNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- Exercise 13 Statement of Cash Flows - 054924Document2 pagesExercise 13 Statement of Cash Flows - 054924Hoyo VerseNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- ACW2491 Lecture 4 Handout SolutionS22016Document4 pagesACW2491 Lecture 4 Handout SolutionS22016林志成No ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocument4 pagesExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- CostDocument3 pagesCostMary CharlesNo ratings yet

- 2542 - Tut1Document14 pages2542 - Tut1(Alumna 2018-6A07) CHUCK LONG YAU 卓朗悠No ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- Local Media6884512623317631833Document29 pagesLocal Media6884512623317631833Yogun BayonaNo ratings yet

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Document7 pagesDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNo ratings yet

- Quiz - Topic 5Document3 pagesQuiz - Topic 5mariakate LeeNo ratings yet

- Problem 2Document2 pagesProblem 2Rio De LeonNo ratings yet

- BIR Form Quarterly Tax Returns: INSTRUCTION: Refer To Chapter 14 of Your Book in Answering The Requirements BelowDocument6 pagesBIR Form Quarterly Tax Returns: INSTRUCTION: Refer To Chapter 14 of Your Book in Answering The Requirements Belowdianne caballeroNo ratings yet

- Screenshot 2023-03-28 at 9.42.11 AMDocument38 pagesScreenshot 2023-03-28 at 9.42.11 AMKinza NawazNo ratings yet

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Accounting Review QuestionsDocument34 pagesAccounting Review Questionsjoyce KimNo ratings yet

- Annual Report 2013 - Olympic IndustriesDocument26 pagesAnnual Report 2013 - Olympic IndustriesAlif RussellNo ratings yet

- Analysis of Working Capital Management: A Project Report OnDocument39 pagesAnalysis of Working Capital Management: A Project Report OngitarghawaleNo ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- FAR 1st PreboardDocument10 pagesFAR 1st PreboardLui100% (2)

- Budget Assignment VADocument4 pagesBudget Assignment VAAhadNurParag0% (1)

- Revision Questions 1Document13 pagesRevision Questions 1Vivian WongNo ratings yet

- FA With AdjustmentsDocument102 pagesFA With AdjustmentsDubai SheikhNo ratings yet

- SAP LockboxDocument7 pagesSAP Lockboxatlanta00100% (1)

- Chapter 13Document61 pagesChapter 13ginish12No ratings yet

- Sap FundamentalsDocument8 pagesSap FundamentalsrifkicayNo ratings yet

- Final Trial Exam k6 Sbs Final PaDocument32 pagesFinal Trial Exam k6 Sbs Final PaChi PhanNo ratings yet

- Control AccountsDocument8 pagesControl AccountsAejaz MohamedNo ratings yet

- Accounts ReceivableDocument27 pagesAccounts ReceivableJomar TeofiloNo ratings yet

- MF Working CapitalDocument81 pagesMF Working CapitalJansen Alonzo BordeyNo ratings yet

- Class Exercise For Bad DebtsDocument2 pagesClass Exercise For Bad DebtsSumeet KumarNo ratings yet

- Intermediate Accounting Practice Sets 1Document17 pagesIntermediate Accounting Practice Sets 1Mhaydel Garcia67% (3)

- Pfrs 15 Revenue From Contracts With CustomersDocument3 pagesPfrs 15 Revenue From Contracts With CustomersR.A.No ratings yet

- RECEIVABLESDocument23 pagesRECEIVABLESSaghielyn BicomongNo ratings yet

- 15 International Working Capital Management: Chapter ObjectivesDocument16 pages15 International Working Capital Management: Chapter ObjectivesNancy DsouzaNo ratings yet

- Accounting - Certificate Level NotesDocument70 pagesAccounting - Certificate Level Notesdiya pNo ratings yet

- Bills of ExchangeDocument16 pagesBills of ExchangeswayamNo ratings yet

- TB Understanding Financial Statements 11ge Lyn M. FraserDocument85 pagesTB Understanding Financial Statements 11ge Lyn M. Fraseremanmamdouh596No ratings yet

- SAP FICO: What Is, Introduction, Full Form & FICO ModuleDocument3 pagesSAP FICO: What Is, Introduction, Full Form & FICO ModuleRajaNo ratings yet

- Ch2 Financial Statement SDocument101 pagesCh2 Financial Statement SK60 NGUYỄN THỊ HƯƠNG QUỲNHNo ratings yet

- Financial Ratios: Arab British Academy For Higher EducationDocument6 pagesFinancial Ratios: Arab British Academy For Higher EducationhirenpadaliaNo ratings yet

- Cash and Accrual Basis ProblemsDocument1 pageCash and Accrual Basis ProblemsCAINo ratings yet