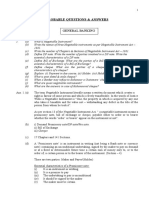

Professional Documents

Culture Documents

Credit Boss

Credit Boss

Uploaded by

uttamdas790 ratings0% found this document useful (0 votes)

38 views8 pagesThe document contains questions about various topics related to banking and finance including credit, types of security, intangible assets, provisions for loans, ratios, risk management, and credit approval processes. It asks multiple choice questions to test understanding of key concepts such as the limitation period for registered mortgages, definitions of pledge, hypothecation and floating charges, principles of sound lending, provisioning requirements, and risk management standards like Basel accords.

Original Description:

Original Title

credit boss

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains questions about various topics related to banking and finance including credit, types of security, intangible assets, provisions for loans, ratios, risk management, and credit approval processes. It asks multiple choice questions to test understanding of key concepts such as the limitation period for registered mortgages, definitions of pledge, hypothecation and floating charges, principles of sound lending, provisioning requirements, and risk management standards like Basel accords.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

38 views8 pagesCredit Boss

Credit Boss

Uploaded by

uttamdas79The document contains questions about various topics related to banking and finance including credit, types of security, intangible assets, provisions for loans, ratios, risk management, and credit approval processes. It asks multiple choice questions to test understanding of key concepts such as the limitation period for registered mortgages, definitions of pledge, hypothecation and floating charges, principles of sound lending, provisioning requirements, and risk management standards like Basel accords.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 8

Credit:

1. The limitation period of loan covered by a registered mortgage deed is -

A. Three years

B. Twelve years

C. Fifteen years

D. Twenty years

2. Which of the following is the weakest method of charging security?

A. A Pledge

B. Mortgage

C. Hypothecation

D. Assignment

3. Transfer of possession of physical security is essential in the case of -

A. Lien

B. Mortgage

C. Pledge

D. Both (a) and (C)

4. Which of the following is not an intangible asset?

A. Goodwill

B. Copyright

C. Land

D. Trademark

5. In case of hypothecation, the banker has -

A. The possession of goods

B. Right to sell the goods

C. A specific interest in the goods

D. None of the above rights

6. Pledge can be created by -

A. Actual delivery

B. Constructive delivery

C. Symbolic delivery

D. Any of the above methods.

7. The Letter of Continuity should be taken in the case of -

A. Advances to companies

B. Overdraft or Cash Credit Account

C. Time barred advances

D. Accounts of the deceased borrowers

8. A floating charge means –

A. a charge of the assets of a company which is being floated

B. a charge on the shares of a company

C. a charge on the current assets of the company which are constantly changing

D. None of the above

9. Principles of sound lending mean:

A. Safety, Security, Liquidity & Profitability of the fund

B. Security, Safety, Purchase, Spread & National Interest

C. Security, Safety, Purchase, Person & Capital

D. None of the above.

10. Bank Conduct Classification of Loan Activities as per BRPD circular

A. Monthly

B. Quarterly

C. Half yearly

D. Yearly

11. What is the percentage of provision kept for Doubtful Loans and Advances?

A. 5% of base for provision

B. 20% of base for provision

C. 50% of base for provision

D. 100% of base for provision

12. Calculate the eligible security of the Land and Building Mortgaged with the Bank.

A. 100% of market value

B. 75% of market value

C. Maximum 50% of market value

D. Maximum 50% of market forced sell value

13. Under what section of Negotiable Instrument Act we file criminal case?

A. Section 12

B. Section 112

C. Section 138

D. Section 133

14. Which one is not the irregularities in case of approving Loans and Advances

A. Over or Under Invoicing

B. Inadequate Security Stipulation

C. Undue Influence

D. Estimation of the cost of the project and means of finance

15. Which of the following is termed as earning asset

A. Deposit/Borrowing

B. Cash and Liquid Reserve

C. Investment

D. Capital

16. The pattern of the operating cycle follows __________.

A. Cash, procurement of RM, Work in process, Stock of FGs, Receivables, Cash

B. Procurement of RM, Work in process, Stock of FGs, Receivables, Cash

C. Cash, Work in process, procurement of RM, Receivables, Stock of FGs,

D. Cash, procurement of RM, Stock of FGs, Work in process, Receivables

17. At least how many years financial is required to prepare CRG?

A. 1 year

B. 2 years

C. 3 years

D. 5 years

18. The Primary Security of Overdraft (work order) is

A. Mortgage of Land & Building

B. Hypothecation of Stock

C. Personal Guarantee of the Proprietors/Directors

D. Assignment of Bill.

19. For collateral located outside Pourashava, the coverage should be:

A. 1.25 times of the proposed limit

B. 1.80 times of the proposed limit

C. 1.40 times of the proposed limit

D. 1.75 times of the proposed limit

20. What does ‘SPC’ stand for:

A. Sustainable Property Certificate

B. Security Perfection Certificate

C. Both (a) & (b)

D. None of the above.

21. What is the basic difference between OD (Gen) and CC (Hypo)?

A. Stock

B. Security

C. Capacity

D. None of the above

22. Current Ratio is

A. Quick assets / total liability

B. Current assets /current liability

C. External Equities / Internal equities

D. All of the above

23. The right of set – off is nothing but a ______.

A. right to sell.

B. right to retain.

C. right to combine

D. right to appropriate

24. Which type of Advance can be repayment without any specific date?

A. LTR.

B. LIM.

C. CC(Hypo).

D. OAP

25. CC (H) Drawing determined by?

A. Limit

B. Drawing Power

C. Limit or Drawing Power whichever is lower

D. Limit or Drawing Power whichever is higher

26. What is the rate of provision on Off-Balance Sheet exposures?

A. 0.25% on total exposure

B. 1.00% after deducting cash margin/eligible collateral

C. 1.00% on total exposure

D. 2.00% on total exposure

27. Liquidity Ratio indicates to meet future-

A. Short term financial obligation;

B. Long term financial obligation;

C. Both Short and Long term financial obligation;

D. None of the above.

28. Asset Utilization (Activity) Ratio indicates to meet-

A. Short term financial obligation;

B. Long term financial obligation;

C. Working Capital obligation;

D. None of the above.

29. Debt Service Coverage Ratio indicates to meet-

A. Interest Servicing obligation;

B. Principal Servicing obligation;

C. Both Interest & Principal Servicing obligation;

D. None of the above.

30. Interest Coverage Ratio indicates to meet-

A. Interest Servicing obligation;

B. Principal Servicing obligation;

C. Both Interest & Principal Servicing obligation;

D. None of the above.

31. Which one of the following is true about loan write-off?

A. 100 percent provision is required before write-off

B. It is done for cleaning balance sheet

C. Loan amounting taka upto 50,000 can be written-off without filing suit

D. All of these

32. Which of the following is true for base for provision calculation?

A. Outstanding loan - balance of interest suspense

B. Outstanding loan - balance of interest suspense - value of eligible securities

C. Outstanding loan - value of eligible securities

D. None of these

33. Economic aspect of a project deals with-

A. Private cost and benefit

B. Central bank's cost and benefit

C. Social cost and benefit

D. Direct foreign investors' cost and benefit

34. Which of the following is known as horizontal analysis?

A. Common size analysis

B. Scenario Analysis

C. Ratio analysis

D. Trend Analysis

35. Line of credit is term frequently used in business terminology .it refers to-

A. The use of credit facility in the operational activities

B. The maximum amount of loan an organization can avail

C. The basis on which credit can be utilized

D. The limits set for acquiring credit

36. Ratios are mathematical indicators which are calculated by comparing two values, financial

ratios help in-

A. Estimating the company’s gross profit

B. Understanding the financial workings of the company

C. Analysing the financial statements

D. Understanding the internal working structure in the company.

37. Which of the following is the probability that market interest rates will change and cause it to

have lower profits or a decrease in the value of its equity?

A. Credit risk

B. Market risk

C. Strategic risk

D. Interest rate risk

38 Which of the following is used as the highest layers in credit approval process?

A. Source of cash flows

B. Type of borrower

C. Value and type of collateral

D. Amount and type of claim

39. Which of the following is an important tool in monitoring and controlling credit risk?

A. Holistic rating

B. Interval rating

C. Internal risk rating

D. Analytical rating

40. Which of the following are to be followed by commercial banks to risk management?

A. Basel I norms

B. Basel II norms

C. Basel III norms

D. Solvency II norms

41. What is factoring?

A. An easy way of rising capital from a factoring company by small business

B. Selling of account receivables on a contract basis for cash payment to factor before it is

due.

C. An arrangement for raising short term money against prepaid expenses

D. A method of discounting a loan term bills.

42. Which one of the following is the ratio of the loan principal to the appraised value?

A. Combined loan to value (CL IV) ratio

B. Loan to value ratio

C. Mortgage loan

D. Statutory liquidity ratio

43. ALM approach emphasize more on –

A. Asset management

B. Liquidity management

C. Liability management

D. Coordinated approach to assets and liabilities

44. As regard ratings and aggregate quantitative score in ICRR, which of the following is not true?

A. Aggregate score of 80 or greater is excellent.

B. Aggregate score of 70 or greater but less than 80 is good.

C. Aggregate score of 60 or greater but less than 75 is marginal.

D. Aggregate score less than 60 is unacceptable.

45. IRR is the discount rate is which –

A. NPV = 0

B. NPV ≠ 0

C. NPV ≤ 0

D. NPV ≥ 0

46. Restrictions on the respite of loans have been imposed under which section of the Bank

Company Act, 1991 (as amended in 2013)

A. Section 14A

B. Section 27

C. Section 26A

D. Section 28

47. Quantitative Credit controls do not include-

A. Bank Rate

B. CRR

C. BB Directives

D. Open market operations

48. The primary objectives of Nationalizations of banks was-

A. Improving credit facilities

B. Improving security of deposits

C. Financing in Industries

D. Consolidating the economy

49. Pricing of the Loan is set by?

A. CRMD

B. Corporate Banking Division

C. ALCO

D. General Banking Division

50. Maximum what % of current remaining time to maturity of a term loan may be extended?

A. 35 %

B. 25 %

C. 10 %

D. None

1 2 3 4 5 6 7 8 9 10

B C D C C B B C A B

11 12 13 14 15 16 17 18 19 20

C C C D C A C D D B

21 22 23 24 25 26 27 28 29 30

A B C C C C A C C A

31 32 33 34 35 36 37 38 39 40

D B C D B C D B C B

41 42 43 44 45 46 47 48 49 50

B B D C A D C A C B

You might also like

- Diagnostic Test Business Finance - CorrectedDocument5 pagesDiagnostic Test Business Finance - CorrectedWilson MoralesNo ratings yet

- Methodology For Rating General Trading and Investment CompaniesDocument23 pagesMethodology For Rating General Trading and Investment CompaniesAhmad So MadNo ratings yet

- Strategic Financial Management Formula KitDocument85 pagesStrategic Financial Management Formula KitSangeetha HariNo ratings yet

- FM Theory PDFDocument55 pagesFM Theory PDFJeevan JazzNo ratings yet

- Kim Financial ManagementDocument272 pagesKim Financial ManagementRonnie KinyanjuiNo ratings yet

- Q1 Module 1 To 5Document16 pagesQ1 Module 1 To 5Rajiv WarrierNo ratings yet

- Factoring in VietnamDocument11 pagesFactoring in VietnamHồ LyNo ratings yet

- Syllabus For Banking and Insurance: Sem 1 1. Environment and Management of Financial ServicesDocument44 pagesSyllabus For Banking and Insurance: Sem 1 1. Environment and Management of Financial ServicesVinod TiwariNo ratings yet

- FXTM - Model Question PaperDocument36 pagesFXTM - Model Question PaperRajiv Warrier0% (1)

- 11e Ch3 Mini Case Client ContDocument10 pages11e Ch3 Mini Case Client ContHao Cui100% (1)

- Universa Letter April 2020Document8 pagesUniversa Letter April 2020Zerohedge88% (25)

- Answer KeyDocument24 pagesAnswer KeyUdita YadavNo ratings yet

- Different Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountDocument4 pagesDifferent Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountSunaina Kodkani100% (1)

- Factoring and ForfaitingDocument4 pagesFactoring and ForfaitingAmruta TurméNo ratings yet

- Risk Management 6Document36 pagesRisk Management 6ZainNo ratings yet

- CMPCir1656 12Document95 pagesCMPCir1656 12sunilNo ratings yet

- 3-6int 2004 Dec ADocument12 pages3-6int 2004 Dec AsyedtahaaliNo ratings yet

- CT-2 Notes. Part IDocument30 pagesCT-2 Notes. Part I1982ajayNo ratings yet

- General BankingDocument43 pagesGeneral BankingGolpo MahmudNo ratings yet

- 1 SEM BCOM - Indian Financial SystemDocument35 pages1 SEM BCOM - Indian Financial SystemShambhavi JNo ratings yet

- Credit Questions Summarized (Final Dose)Document40 pagesCredit Questions Summarized (Final Dose)uttamdas79No ratings yet

- Bbe Minutes Sem III, 2012Document8 pagesBbe Minutes Sem III, 2012Sdrt YdvNo ratings yet

- MCom CBCS Syllabus and Course Structure 2015 16 1Document50 pagesMCom CBCS Syllabus and Course Structure 2015 16 1Ganesh KotteNo ratings yet

- Financing Working Capital - Naveen SavitaDocument7 pagesFinancing Working Capital - Naveen SavitaMurli SavitaNo ratings yet

- FXTM - Model Question Paper 2Document37 pagesFXTM - Model Question Paper 2Rajiv WarrierNo ratings yet

- CA Final G2 SFM Paper 2 SolutionDocument13 pagesCA Final G2 SFM Paper 2 SolutionDEVANSHNo ratings yet

- Final Project of Reliance InfraDocument57 pagesFinal Project of Reliance InfraChaitali SarmalkarNo ratings yet

- PGDBF SyllabusDocument18 pagesPGDBF SyllabusAtul MadNo ratings yet

- DAIBB Lending - 1Document40 pagesDAIBB Lending - 1Md Alim100% (1)

- Lawrence Sports Problem 1Document18 pagesLawrence Sports Problem 1Joe BandaNo ratings yet

- MB0053 - International Business Management - Set 2Document15 pagesMB0053 - International Business Management - Set 2Abhishek Jain100% (1)

- Accounts Receivable Management Practices and Growth of SMEDocument165 pagesAccounts Receivable Management Practices and Growth of SMELuke Robert HemmingsNo ratings yet

- Icfai Model PapersDocument23 pagesIcfai Model Papersshubhamjain45No ratings yet

- 11 Chapter 3 (Working Capital Aspects)Document30 pages11 Chapter 3 (Working Capital Aspects)Abin VargheseNo ratings yet

- CAIIB BFM Sample Questions by Murugan For Dec 2015Document290 pagesCAIIB BFM Sample Questions by Murugan For Dec 2015Varun Shastry100% (3)

- Summer Training in Intex TechnologyDocument37 pagesSummer Training in Intex TechnologyMj PayalNo ratings yet

- Payyyyyying Banker and Collllllecting Banker by Chu PersonDocument59 pagesPayyyyyying Banker and Collllllecting Banker by Chu PersonSahirAaryaNo ratings yet

- A Presentation On The Credit Insurance ProductsDocument24 pagesA Presentation On The Credit Insurance ProductsAmresh SinhaNo ratings yet

- Ok. Questions of GB & Negotiable InstrumentDocument10 pagesOk. Questions of GB & Negotiable InstrumentJubaida Alam JuthyNo ratings yet

- Ok-Negotiable InstrumentDocument7 pagesOk-Negotiable InstrumentJubaida Alam JuthyNo ratings yet

- Question 1: Multiple Choice: Leave BlankDocument12 pagesQuestion 1: Multiple Choice: Leave BlankJubaida Alam JuthyNo ratings yet

- Banks, Banking & Retail Banking Services: Prepared By:: Mithun ShankarDocument56 pagesBanks, Banking & Retail Banking Services: Prepared By:: Mithun Shankardevendrachoudhary_upscNo ratings yet

- Business Correspondents PolicyDocument66 pagesBusiness Correspondents Policyprathipunam0051522No ratings yet

- 4 Unit Asset & Fund Based Financial ServicesDocument188 pages4 Unit Asset & Fund Based Financial ServicesVijay KumarNo ratings yet

- Trade Finance PresentationDocument8 pagesTrade Finance PresentationDiana SumailiNo ratings yet

- Credit Risk Management of United Commercial BDocument45 pagesCredit Risk Management of United Commercial Bএকজন নিশাচরNo ratings yet

- Impacts of IT On The Banking Sector of Bangladesh PDFDocument8 pagesImpacts of IT On The Banking Sector of Bangladesh PDFBipul RahulNo ratings yet

- Factoring Vs ForfeitingDocument27 pagesFactoring Vs ForfeitingShruti AshokNo ratings yet

- Ebl HRDocument37 pagesEbl HRsam heisenbergNo ratings yet

- Application Form PNB 1166 Upto 1 Crore MsmeDocument7 pagesApplication Form PNB 1166 Upto 1 Crore MsmeChristopher GarrettNo ratings yet

- RBS Guide To International Trade PDFDocument60 pagesRBS Guide To International Trade PDFJayakumar Sankaran100% (1)

- Factoring ServicesDocument22 pagesFactoring ServicesamygurlNo ratings yet

- January 03, 2017: Subject: Request For Return The Security Money Amount of TK. 5,000.00/-Because of Cadre ChangeDocument3 pagesJanuary 03, 2017: Subject: Request For Return The Security Money Amount of TK. 5,000.00/-Because of Cadre ChangeJubaida Alam JuthyNo ratings yet

- Management of Financial Services AssignmentDocument12 pagesManagement of Financial Services AssignmentDivya ShettyNo ratings yet

- SanctionDocument4 pagesSanctionuttamdas79No ratings yet

- AdvancesDocument174 pagesAdvancests pavanNo ratings yet

- Chapter 17Document7 pagesChapter 17Linh ChiNo ratings yet

- Chapter 10 Credit Risk I Individual Loan RiskDocument8 pagesChapter 10 Credit Risk I Individual Loan RiskTu NgNo ratings yet

- SME Business Division: Question BankDocument26 pagesSME Business Division: Question BankKawoser AhammadNo ratings yet

- Project Management MCQ 2Document6 pagesProject Management MCQ 2Muskan SaiyedNo ratings yet

- Unit 5Document9 pagesUnit 5SowmiyaNo ratings yet

- John Bo HandoutDocument9 pagesJohn Bo HandoutPachiNo ratings yet

- Questions - Incoterms 2010 - WA - PDFDocument5 pagesQuestions - Incoterms 2010 - WA - PDFuttamdas79No ratings yet

- New Report FinalDocument2 pagesNew Report Finaluttamdas79No ratings yet

- SanctionDocument4 pagesSanctionuttamdas79No ratings yet

- ValuationDocument2 pagesValuationuttamdas79No ratings yet

- Credit Questions Summarized (Final Dose)Document40 pagesCredit Questions Summarized (Final Dose)uttamdas79No ratings yet

- Next Gen BankingDocument5 pagesNext Gen Bankinguttamdas79No ratings yet

- General Banking Part-01Document20 pagesGeneral Banking Part-01uttamdas79No ratings yet

- Credit MaretialsDocument21 pagesCredit Maretialsuttamdas79No ratings yet

- Foreign Trade (FEX)Document11 pagesForeign Trade (FEX)uttamdas79No ratings yet

- Trade Finance Question BankDocument10 pagesTrade Finance Question Bankuttamdas79No ratings yet

- GB MaterialsDocument21 pagesGB Materialsuttamdas79No ratings yet

- Country Name, CurencyDocument1 pageCountry Name, Curencyuttamdas79No ratings yet

- Analitical Moinul ViDocument4 pagesAnalitical Moinul Viuttamdas79No ratings yet

- FOREXDocument3 pagesFOREXuttamdas79No ratings yet

- Credit RiskDocument1 pageCredit Riskuttamdas79No ratings yet

- RMG DivisionDocument5 pagesRMG Divisionuttamdas79No ratings yet

- Short QuestionDocument25 pagesShort Questionuttamdas79No ratings yet

- General Banking (Summarized)Document15 pagesGeneral Banking (Summarized)uttamdas79100% (1)

- DailystockmktDocument1 pageDailystockmktAbdul SamadNo ratings yet

- Topic - Week 2 Valuation of Bonds MCQDocument6 pagesTopic - Week 2 Valuation of Bonds MCQmail2manshaaNo ratings yet

- Auditing Assurance - Specialized IndustriesDocument10 pagesAuditing Assurance - Specialized IndustriesTOLENTINO, Joferose AluyenNo ratings yet

- Your Personality and Successful TradingDocument17 pagesYour Personality and Successful TradingIan Moncrieffe100% (5)

- Form GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDocument5 pagesForm GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDSPNo ratings yet

- Akshay JangraDocument4 pagesAkshay JangraVipinNo ratings yet

- SAP BPC QuestionsDocument5 pagesSAP BPC Questionskusumastuti_wiratnaningtyasNo ratings yet

- Gas Station QuestionnaireDocument4 pagesGas Station QuestionnairepeeteoNo ratings yet

- Acctg 10 - Final LessonDocument32 pagesAcctg 10 - Final LessonNANNo ratings yet

- Kebs 102Document31 pagesKebs 102Dev Krishna GoyalNo ratings yet

- Accounting Standards 5Document13 pagesAccounting Standards 5prash1820No ratings yet

- Finance and AccountingDocument143 pagesFinance and Accountingrt222250% (2)

- Study Now. Pay Later Scheme in The Philippines Student LoanDocument11 pagesStudy Now. Pay Later Scheme in The Philippines Student Loanjulia sabasNo ratings yet

- Arthur Andersen CollapseDocument21 pagesArthur Andersen CollapsePurnima MeenaNo ratings yet

- SCABAADocument3 pagesSCABAAHelen Joy Grijaldo JueleNo ratings yet

- Group 7 - Neelabh Barua - PGFB2027Document49 pagesGroup 7 - Neelabh Barua - PGFB2027NeelabhNo ratings yet

- ACCA F3 China Slidesv2Document129 pagesACCA F3 China Slidesv2JoeFSabater50% (2)

- Cash Book RevisionDocument2 pagesCash Book RevisionSwati ChamariaNo ratings yet

- Pinkerton (B)Document3 pagesPinkerton (B)Anupam Chaplot100% (1)

- Resignation Process: Frequently Asked Questions: Pre Resignation Phase - For EmployeesDocument3 pagesResignation Process: Frequently Asked Questions: Pre Resignation Phase - For EmployeesLeo John Bosco JNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- Os2 PDFDocument1 pageOs2 PDFBarry Ysrnr100% (1)

- Les Politiques de Financement de Linnovation Au Maroc - Etat Des Lieux Et PerspectivesDocument19 pagesLes Politiques de Financement de Linnovation Au Maroc - Etat Des Lieux Et PerspectivesIJAR JOURNALNo ratings yet

- BCG - India Banking - 2023Document47 pagesBCG - India Banking - 2023Олег КарбышевNo ratings yet

- ICDMDocument18 pagesICDMRayNo ratings yet

- Total Cost of OwnershipDocument56 pagesTotal Cost of Ownershipasawinraja100% (3)

- Agregrate Supply and DemandDocument25 pagesAgregrate Supply and DemandReza AfrisalNo ratings yet

- Personal Loan ContractDocument2 pagesPersonal Loan ContractJohnNo ratings yet