Professional Documents

Culture Documents

Flow Chart (L-3)

Flow Chart (L-3)

Uploaded by

Simer preet kaur0 ratings0% found this document useful (0 votes)

25 views1 pageThis document outlines three methods for valuing goodwill: the average profit method, super profit method, and capitalization method. The average profit method calculates goodwill as the average normal profit multiplied by the number of years' purchase. The super profit method determines goodwill as the super profit - the adjusted average profit minus the normal profit - multiplied by the number of years' purchase. The capitalization method values goodwill as either the capitalized value of the average normal profit or the capitalized value of the super profit.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines three methods for valuing goodwill: the average profit method, super profit method, and capitalization method. The average profit method calculates goodwill as the average normal profit multiplied by the number of years' purchase. The super profit method determines goodwill as the super profit - the adjusted average profit minus the normal profit - multiplied by the number of years' purchase. The capitalization method values goodwill as either the capitalized value of the average normal profit or the capitalized value of the super profit.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

25 views1 pageFlow Chart (L-3)

Flow Chart (L-3)

Uploaded by

Simer preet kaurThis document outlines three methods for valuing goodwill: the average profit method, super profit method, and capitalization method. The average profit method calculates goodwill as the average normal profit multiplied by the number of years' purchase. The super profit method determines goodwill as the super profit - the adjusted average profit minus the normal profit - multiplied by the number of years' purchase. The capitalization method values goodwill as either the capitalized value of the average normal profit or the capitalized value of the super profit.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

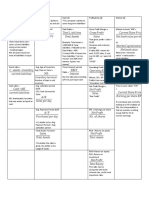

METHODS OF VALUATION OF GOODWILL

Average Profit Method Super Profit Method Capitalisation Method

Adjusted Average Profit = Average Profit

Adjusted by Deducting Abnormal Gains

and by adding Abnormal Losses

Simple Average Weighted Average

Profit Method Profit Method Capitalisation of Average Capitalisation of

Normal Profit Super Profit

Determine Capital Employed,

if not given

Determine Normal Profit*

Determine Normal Profit* Calculate Capital

Determine Normal Profit and Capitalised Value Employed

Normal Rate of Return (NRR), 100

Assign weight to each year if not given = Average Normal Profit ×

NRR

Average Profit =

Calculate Normal Profit

Total Normal Profit Normal Profit = Average on Capital Employed

Determine Weighted Profit:

Number of Years Normal Profit × Weight Assigned NRR Net Assets

Capital Employed ×

100 = All Assets (Other Than Goodwill,

Non-trade Investments and Calculate Average

Total the Weights and Fictitious Assets) at their Current

Total of Weighted Profit (Product) Super Profit = Adjusted Profit of Past Years

Number of Years’ Purchase Values minus Outsiders’ Liabilities

Average Profit – Normal Profit

Weighted Average Profit = Calculate Super Profit,

Numbers of Years’ Purchase i.e., Actual Average

Total of Weighted Profit (Product) Goodwill = Capitalised Value – Net Assets

Goodwill = Average Profit × Profit – Normal Profit

Number of Years’ Purchase Total of Weights

Goodwill = Super Profit ×

Number of Years’ Purchase

Number of Years’ Purchase Goodwill =

100

Super Profit ×

NRR

Goodwill = Weighted Average

Profit × Number of Years’

Purchase

*Normal Profit = Net Profit is adjusted by adding abnormal losses and by deducting abnormal gains of past years to determine Normal Profit.

You might also like

- Basic Journal Entries ExerciseDocument3 pagesBasic Journal Entries ExerciseCharlito Macalos PaglinawanNo ratings yet

- FL CFA Formula Sheet FRA 2020Document1 pageFL CFA Formula Sheet FRA 2020Opal Chais100% (1)

- Flow Chart-2Document1 pageFlow Chart-2mirannawazkhan00022No ratings yet

- Stracos Notes 1Document1 pageStracos Notes 1bangtan sonyeondanNo ratings yet

- Ratio FormulasDocument3 pagesRatio Formulasakk59No ratings yet

- Ratio Analysis ch-6Document11 pagesRatio Analysis ch-6IP MAXNo ratings yet

- BCM 2303 FM Unit 2 Chapter 1Document23 pagesBCM 2303 FM Unit 2 Chapter 1Priynah ValechhaNo ratings yet

- BusFin FormulasRatioDocument3 pagesBusFin FormulasRatiojpNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- RatiosDocument2 pagesRatiosMina EskandarNo ratings yet

- Chapter at A Glance-3Document2 pagesChapter at A Glance-3hk6206131516No ratings yet

- 4 Summary of Commonly Used Ratios (AS & A Level)Document3 pages4 Summary of Commonly Used Ratios (AS & A Level)Musthari KhanNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisSHENo ratings yet

- MAS Financial-RatiosDocument4 pagesMAS Financial-RatiosJulius Lester AbieraNo ratings yet

- Liquidity: Financial Statements (FS) Analysis Tools and TechniqueDocument6 pagesLiquidity: Financial Statements (FS) Analysis Tools and TechniqueDondie ArchetaNo ratings yet

- Part1 Topic 3 Goodwill Nature and ValuationDocument20 pagesPart1 Topic 3 Goodwill Nature and ValuationShivani ChoudhariNo ratings yet

- Ratio AnalysisDocument35 pagesRatio AnalysisArya MahendruNo ratings yet

- STRACOSMAN - Chapter 6Document6 pagesSTRACOSMAN - Chapter 6Rae WorksNo ratings yet

- Accountancy CbseDocument19 pagesAccountancy CbseAccounting HelpNo ratings yet

- Unit 6 - Financial Ratio AnalysisDocument22 pagesUnit 6 - Financial Ratio AnalysisLe TanNo ratings yet

- FS Analysis FormulasDocument3 pagesFS Analysis FormulasCzarhiena SantiagoNo ratings yet

- Formula Financial Management Horizontal Analysis (Or Trend Analysis)Document4 pagesFormula Financial Management Horizontal Analysis (Or Trend Analysis)Janine IgdalinoNo ratings yet

- Interpretation of Financial Statements: Ratio Analysis and ReportingDocument9 pagesInterpretation of Financial Statements: Ratio Analysis and ReportingSania SaeedNo ratings yet

- Ca Inter FM Formula SheetDocument7 pagesCa Inter FM Formula SheetmewtwovarceusNo ratings yet

- RatiosDocument4 pagesRatiosIbrahim AymanNo ratings yet

- Goodwill and Its ValuationDocument16 pagesGoodwill and Its ValuationayushitamtaNo ratings yet

- Demystifying Employee Stock Opt On Plan AccountingDocument9 pagesDemystifying Employee Stock Opt On Plan Accountingatulchaurasiya1610No ratings yet

- Current RatioDocument2 pagesCurrent RatioHafiz UllahNo ratings yet

- Reconstitution Admission of A PartnerDocument12 pagesReconstitution Admission of A PartneranuhyaextraNo ratings yet

- FSA Part2Document19 pagesFSA Part2trangNo ratings yet

- FM Formulae SheetDocument4 pagesFM Formulae Sheetatishayjjj123No ratings yet

- Financial Statement Analysis: Exhibit 12-10Document1 pageFinancial Statement Analysis: Exhibit 12-10prince100% (1)

- Accounting RatiosDocument9 pagesAccounting RatiosRonnie Vond McRyttsson MudyiwaNo ratings yet

- Financial Ratios at A Glance PDFDocument8 pagesFinancial Ratios at A Glance PDFmohit PathakNo ratings yet

- Financial Statement Analysis and Performance MeasurementDocument6 pagesFinancial Statement Analysis and Performance MeasurementBijaya DhakalNo ratings yet

- Chapter 3Document8 pagesChapter 3NHƯ NGUYỄN LÂM TÂMNo ratings yet

- Ratio Analysis Cheat SheetDocument1 pageRatio Analysis Cheat SheetAtharva Gore100% (1)

- Shared by Ca Blog India: Cash Flow Statement: Indirect MethodDocument4 pagesShared by Ca Blog India: Cash Flow Statement: Indirect MethodpoojaNo ratings yet

- Shared by Ca Blog India: Cash Flow Statement: Indirect MethodDocument4 pagesShared by Ca Blog India: Cash Flow Statement: Indirect MethodRaghav BhatNo ratings yet

- RatioDocument2 pagesRatiosayed Abdullah Al Sanazid onibNo ratings yet

- CH 10 - Working Capital Management (Chart 10.1) : Operating CycleDocument2 pagesCH 10 - Working Capital Management (Chart 10.1) : Operating Cyclek kakkarNo ratings yet

- Ratios Notes and ProblemDocument6 pagesRatios Notes and ProblemAniket WaneNo ratings yet

- Spectrans - Installment Sales - NotesDocument1 pageSpectrans - Installment Sales - NotesJoshua LisingNo ratings yet

- Financial Ratios: I. ProfitabilityDocument2 pagesFinancial Ratios: I. ProfitabilityJose Francisco TorresNo ratings yet

- Formula SheetDocument2 pagesFormula SheetBaususNo ratings yet

- Ratios FormulaDocument2 pagesRatios FormulaMURSYIDAH ABD RASIDNo ratings yet

- Formula Sheet - Finance - VTDocument11 pagesFormula Sheet - Finance - VTmariaajudamariaNo ratings yet

- Financial Ratio FormulasDocument2 pagesFinancial Ratio FormulasSyed Shariq AliNo ratings yet

- Financial Ratios at A GlanceDocument8 pagesFinancial Ratios at A Glance365 Financial AnalystNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 14Document67 pagesUEU Penilaian Asset Bisnis Pertemuan 14Saputra SanjayaNo ratings yet

- Business Finance 1st TermDocument2 pagesBusiness Finance 1st TermBrendon BaguilatNo ratings yet

- 2017 Accounting Examination PaperDocument30 pages2017 Accounting Examination PaperAccount NiceNo ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalMuhammad MussayabNo ratings yet

- Financial Ratios and Analysis Glossary (CVR) PDFDocument4 pagesFinancial Ratios and Analysis Glossary (CVR) PDFDrashti ChoudharyNo ratings yet

- Summary of Ratios: Liquidity Ratios: Profitabnity RatiosDocument1 pageSummary of Ratios: Liquidity Ratios: Profitabnity RatiosNishtha ChaurasiaNo ratings yet

- Trend AnalysisDocument5 pagesTrend AnalysisShozab AliNo ratings yet

- Final Cheat Sheet FA ML X MM UpdatedDocument8 pagesFinal Cheat Sheet FA ML X MM UpdatedIrina StrizhkovaNo ratings yet

- Sample Financial Ratios PDFDocument3 pagesSample Financial Ratios PDFNam Vo HoaiNo ratings yet

- ACCA110-Financial Statement Analysis and RatioDocument7 pagesACCA110-Financial Statement Analysis and RatioJhovet Christian M. CariÑoNo ratings yet

- Audit of Inventory - SW6Document8 pagesAudit of Inventory - SW6d.pagkatoytoyNo ratings yet

- Executive SummaryDocument24 pagesExecutive SummaryeshwarNo ratings yet

- Commercial Real Estate Interview PrepDocument8 pagesCommercial Real Estate Interview PrepciccioNo ratings yet

- (ASSIGNMENT 3) Eslam Mahmoud MohamedDocument4 pages(ASSIGNMENT 3) Eslam Mahmoud MohamedAmira OkashaNo ratings yet

- Wales MBA ModulesDocument163 pagesWales MBA ModulesNada MorisNo ratings yet

- Ba606 Financial Accounting: Professor Garry Carnegie Lectures 9 & 10Document46 pagesBa606 Financial Accounting: Professor Garry Carnegie Lectures 9 & 10Sunita PatilNo ratings yet

- Answers Part 4Document26 pagesAnswers Part 4Great Empress GalaponNo ratings yet

- Toa Valix Vol 1Document451 pagesToa Valix Vol 1Joseph Andrei BunadoNo ratings yet

- ACCT 2301 PP CH 1Document41 pagesACCT 2301 PP CH 1Ela PelariNo ratings yet

- Week11 CH5 SeminarAssignmentDocument10 pagesWeek11 CH5 SeminarAssignmentbhattfenil29No ratings yet

- RitikaDocument73 pagesRitikahanshikagupta6No ratings yet

- 2021 - 2022 Mergers and AquisitionsDocument29 pages2021 - 2022 Mergers and AquisitionsDafrosa HonorNo ratings yet

- MODULE 6A Home Office and Branch AccountingDocument14 pagesMODULE 6A Home Office and Branch AccountingmcespressoblendNo ratings yet

- Financial Statement AnalysisDocument26 pagesFinancial Statement AnalysisRahul DewakarNo ratings yet

- PE, PB and The Present Value of Future DividendsDocument10 pagesPE, PB and The Present Value of Future Dividendsyassine_bnppNo ratings yet

- Chapter 10 in Class Problems DAY 2 SolutionsDocument2 pagesChapter 10 in Class Problems DAY 2 SolutionsAbdullah alhamaadNo ratings yet

- David J. Abrahams Analysis of Heinz Companys Acquisition of Kraft Foods Group IncDocument20 pagesDavid J. Abrahams Analysis of Heinz Companys Acquisition of Kraft Foods Group IncMohamed elamin MaouedjNo ratings yet

- Digital Lending InnovationDocument60 pagesDigital Lending InnovationMiguel Vega OtinianoNo ratings yet

- Sample Exam QuestionsDocument16 pagesSample Exam QuestionsMadina SuleimenovaNo ratings yet

- Impact of Capital Structure On Firms Financial PerformanceDocument15 pagesImpact of Capital Structure On Firms Financial PerformanceArunallNo ratings yet

- Aivazian, Ge and Qiu - 2005Document15 pagesAivazian, Ge and Qiu - 2005bildyNo ratings yet

- St. Joseph'S College of Commerce: Post Graduate DepartmentDocument22 pagesSt. Joseph'S College of Commerce: Post Graduate DepartmentShruti AshokNo ratings yet

- Institute of Chartered Accountants of PakistanDocument4 pagesInstitute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- BISMARK YEBOAH KsTU 2022 FULL WORKDocument68 pagesBISMARK YEBOAH KsTU 2022 FULL WORKBismark YeboahNo ratings yet

- Sample Acctg C6Document22 pagesSample Acctg C6georgette micoNo ratings yet

- Investment Corporation of BangladeshDocument220 pagesInvestment Corporation of BangladeshzamanasifNo ratings yet

- 905pm - 10.EPRA JOURNALS 13145Document3 pages905pm - 10.EPRA JOURNALS 13145Mohammed YASEENNo ratings yet

- F9 Specimen Sept 2016-12Document2 pagesF9 Specimen Sept 2016-12rbaambaNo ratings yet

- Ridgely Manufacturing Company Production Report Jul-92 Quantity of ProductionDocument3 pagesRidgely Manufacturing Company Production Report Jul-92 Quantity of ProductionJessa BasadreNo ratings yet