Professional Documents

Culture Documents

Fsa 3000

Fsa 3000

Uploaded by

Ngọc NguyễnCopyright:

Available Formats

You might also like

- CFI Investment Banking Pitch Book 1Document27 pagesCFI Investment Banking Pitch Book 1Michael Fisher100% (1)

- CFI Investment Banking PitchBookDocument28 pagesCFI Investment Banking PitchBookee sNo ratings yet

- Probe42.in: Usha International LimitedDocument66 pagesProbe42.in: Usha International LimitedrajvvkNo ratings yet

- Equity Research Methodology 031604Document1 pageEquity Research Methodology 031604vardashahid100% (1)

- Volkswagen Strategic ManagementDocument15 pagesVolkswagen Strategic ManagementSaloni Maheshwari100% (1)

- U45200HR2010PTC040589Document37 pagesU45200HR2010PTC040589Bithal PrasadNo ratings yet

- Presentation ElcoDocument24 pagesPresentation ElcoemaNo ratings yet

- Abra CottonDocument28 pagesAbra CottondhruvrealtyNo ratings yet

- Probe42.in: Ms Biotech Private LimitedDocument33 pagesProbe42.in: Ms Biotech Private LimitedSriram ReddyNo ratings yet

- U72900DL1991PLC044831Document66 pagesU72900DL1991PLC044831mhgr58tj9qNo ratings yet

- Corning Technology PVT LTDDocument37 pagesCorning Technology PVT LTDUTSAV DUBEYNo ratings yet

- Aan 4560Document22 pagesAan 4560ompatelNo ratings yet

- U27109WB2006PTC111146Document45 pagesU27109WB2006PTC111146Vitul GuptaNo ratings yet

- Infografía-PMI Guide To BADocument1 pageInfografía-PMI Guide To BACarlos GNo ratings yet

- Environmental Scanning The Basic Model: - 30/11/2011 - Prepared by Carl Olav Staff / Rune Fjellvang Page 1 of 1Document1 pageEnvironmental Scanning The Basic Model: - 30/11/2011 - Prepared by Carl Olav Staff / Rune Fjellvang Page 1 of 1Baher WilliamNo ratings yet

- Level-1-Fixed - Income CFADocument1 pageLevel-1-Fixed - Income CFAk60.2113340016No ratings yet

- Nilons PVT LTDDocument60 pagesNilons PVT LTDUTSAV DUBEYNo ratings yet

- Garp MarchDocument5 pagesGarp MarchZerohedgeNo ratings yet

- Gajanan Agro PVT LTDDocument31 pagesGajanan Agro PVT LTDUTSAV DUBEYNo ratings yet

- Topic 2 - STDocument36 pagesTopic 2 - STdhyukm7No ratings yet

- Office of The Economic AdviserDocument1 pageOffice of The Economic AdviserVISHWAJITNo ratings yet

- Inf JPNDocument67 pagesInf JPNFlor Terrera HamadaNo ratings yet

- Improving Banking EfficiencyDocument26 pagesImproving Banking EfficiencyiitbhuNo ratings yet

- Fauji Cement Co LTD Swot Analysis BacDocument13 pagesFauji Cement Co LTD Swot Analysis BacSyed Ali HamzaNo ratings yet

- Internship Schedule - Mr. DineshDocument2 pagesInternship Schedule - Mr. DineshDinesh MNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- Industry & Distribution Business Strategy: Hiroyuki UgawaDocument22 pagesIndustry & Distribution Business Strategy: Hiroyuki UgawacarlammartinsNo ratings yet

- BDOLeasingandFinanceIncPSEBLFI PublicCompanyDocument1 pageBDOLeasingandFinanceIncPSEBLFI PublicCompanyLester FarewellNo ratings yet

- Itc LTD ItcDocument4 pagesItc LTD ItcSaravanan BalakrishnanNo ratings yet

- WFP Meds 37kDocument38 pagesWFP Meds 37kFallucky SantiagoNo ratings yet

- BSC Fuzzy-Delphi-Analysis - 26 Sep23Document19 pagesBSC Fuzzy-Delphi-Analysis - 26 Sep23Muhammad HurraraNo ratings yet

- Ffice of The Conomic Dviser: HindiDocument1 pageFfice of The Conomic Dviser: HindiMuralidhar PVNo ratings yet

- CH 02Document36 pagesCH 02api-3804982100% (1)

- Revised Proposal For Final Project FIn619Document7 pagesRevised Proposal For Final Project FIn619Khalid Mahmood SialNo ratings yet

- Revised Proposal For Final Project FIn619Document7 pagesRevised Proposal For Final Project FIn619Mirza Abu Sufiyan BaigNo ratings yet

- Nyse FFG 2004Document129 pagesNyse FFG 2004Bijoy AhmedNo ratings yet

- Tata Pow FY20Document433 pagesTata Pow FY20Partha SahaNo ratings yet

- Tailored Enterprise Governance System For Information and Technology Cobit CoreDocument6 pagesTailored Enterprise Governance System For Information and Technology Cobit CorefauziahezzyNo ratings yet

- 2017 Yamaha AR All enDocument38 pages2017 Yamaha AR All enHarshitNo ratings yet

- l4dlB5oHO81V8XME 812 PDFDocument149 pagesl4dlB5oHO81V8XME 812 PDFsha ve3No ratings yet

- Affle Ar Fy22Document193 pagesAffle Ar Fy22chiragchhillar9711No ratings yet

- 2020-03-06-February 2020 PMI Investor Information (FINAL)Document79 pages2020-03-06-February 2020 PMI Investor Information (FINAL)Alex espargoNo ratings yet

- Krishna G. Palepu, Paul M. Healy, Erik Peek - Business Analysis and Valuation - IFRS Edition-Cengage Learning (2013) - Chapter 5 PDFDocument58 pagesKrishna G. Palepu, Paul M. Healy, Erik Peek - Business Analysis and Valuation - IFRS Edition-Cengage Learning (2013) - Chapter 5 PDFTrần BetaNo ratings yet

- Uacs SummaryDocument7 pagesUacs SummaryDawn Rei DangkiwNo ratings yet

- Book For DR FudDocument18 pagesBook For DR FudSiddharthNo ratings yet

- PosterDocument1 pagePosterbhoomikahv31No ratings yet

- 2021 Business PerformanceDocument22 pages2021 Business PerformanceSebastian SinclairNo ratings yet

- The Business and Financial Performance of Panasonic and SonyDocument24 pagesThe Business and Financial Performance of Panasonic and SonyMuhammad AkhtarNo ratings yet

- K Kiran Kumar: Any Questions? Behavioral Finance, Netscape IPO, ReviewDocument33 pagesK Kiran Kumar: Any Questions? Behavioral Finance, Netscape IPO, ReviewJohn DoeNo ratings yet

- sdb23 enDocument128 pagessdb23 enazizNo ratings yet

- U 28993 MH 1932 PLC 001828Document208 pagesU 28993 MH 1932 PLC 001828dhapola552No ratings yet

- ECOFUND Factsheet ENGDocument1 pageECOFUND Factsheet ENGdave.importacionesNo ratings yet

- Work Program - Indirect TaxesDocument5 pagesWork Program - Indirect TaxesHarold Dan AcebedoNo ratings yet

- Poonawal Fincorp Anandrathi 310323 EbrDocument21 pagesPoonawal Fincorp Anandrathi 310323 EbrSaddam AnsariNo ratings yet

- Termpapermgt517Document3 pagesTermpapermgt517Addydutt SharmaNo ratings yet

- The World's Largest 500 Asset Managers - Joint Study With Pensions & Investments - October 2020Document56 pagesThe World's Largest 500 Asset Managers - Joint Study With Pensions & Investments - October 2020alexNo ratings yet

- 11.10.21.BAC Conference DS PresentationDocument8 pages11.10.21.BAC Conference DS Presentationhanz.commerceNo ratings yet

- Where Intelligence Meets Infrastructure: Investor Presentation August & September, 2022Document37 pagesWhere Intelligence Meets Infrastructure: Investor Presentation August & September, 2022Harbour MediaNo ratings yet

- Business Fundamentals Mind MapDocument1 pageBusiness Fundamentals Mind MapTaelon SteeleNo ratings yet

- Car Aftermarket Components - OES -v- Generic Suppliers World Summary: Market Values & Financials by CountryFrom EverandCar Aftermarket Components - OES -v- Generic Suppliers World Summary: Market Values & Financials by CountryNo ratings yet

- Bihar Stamp Duty and Registration Charges BiharDocument1 pageBihar Stamp Duty and Registration Charges BiharAkshansh NegiNo ratings yet

- Isaacson Emory Marketing ResumeDocument1 pageIsaacson Emory Marketing ResumeemoryleighNo ratings yet

- Sales Letter (Written Report)Document10 pagesSales Letter (Written Report)Mica RaymundoNo ratings yet

- Nonprofit OrganizationDocument13 pagesNonprofit OrganizationJeric TorionNo ratings yet

- CinePro CaseDocument4 pagesCinePro Casemoshe1.bendayanNo ratings yet

- Assignment-7 Assignment-7 MB4706Document4 pagesAssignment-7 Assignment-7 MB4706efraimjeferson1010No ratings yet

- Fundamentals of Accountancy, Business and Management 2 Accounting Books - Journal and LedgerDocument20 pagesFundamentals of Accountancy, Business and Management 2 Accounting Books - Journal and LedgerGeraldine EctanaNo ratings yet

- Faculty - Law - 2011 - Sessi 2 - Law240 - 231PDF - 230105 - 082647Document10 pagesFaculty - Law - 2011 - Sessi 2 - Law240 - 231PDF - 230105 - 0826472021202082No ratings yet

- Times Pass List Jan 2020-1Document1 pageTimes Pass List Jan 2020-1antiqurrNo ratings yet

- HP - Strategic Management Case Study 2007Document18 pagesHP - Strategic Management Case Study 2007Furqan MohyuddinNo ratings yet

- 12-01087 - Mai Nguyen Hoang Nam - ECO 601 - Final AssignmentDocument19 pages12-01087 - Mai Nguyen Hoang Nam - ECO 601 - Final AssignmentnamNo ratings yet

- Adjusting Entries Quiz PDFDocument13 pagesAdjusting Entries Quiz PDFnewonemade100% (1)

- Feasibility Study On Establishing Food Delivery in Tiaong, QuezonDocument4 pagesFeasibility Study On Establishing Food Delivery in Tiaong, QuezonCONCORDIA RAFAEL IVANNo ratings yet

- IGP - Coffee All 10 - 035921Document11 pagesIGP - Coffee All 10 - 035921Mary Rose Pegalan SunotNo ratings yet

- OD Diagnosing Organizational Effectiveness ToolsDocument76 pagesOD Diagnosing Organizational Effectiveness ToolsAnonymous FQTgjfNo ratings yet

- Muthu Resume (3) ..Document2 pagesMuthu Resume (3) ..arun kNo ratings yet

- Ifrs Sustainability Disclosure Standards GuidanceDocument21 pagesIfrs Sustainability Disclosure Standards GuidanceMJ DiazNo ratings yet

- Acc Statement 1020010537121 2023-01-01 2023-01-31 20230131193025Document2 pagesAcc Statement 1020010537121 2023-01-01 2023-01-31 20230131193025TheBlackJenny TBJNo ratings yet

- Accounting Principles (Very Important)Document3 pagesAccounting Principles (Very Important)7a4374 hisNo ratings yet

- Paperwork: Prepared By: Sabina AlomerovicDocument16 pagesPaperwork: Prepared By: Sabina AlomerovicRupangi VatsNo ratings yet

- JOURNALIZINGDocument2 pagesJOURNALIZINGArneld SantiagoNo ratings yet

- Project Management Notes-1Document43 pagesProject Management Notes-1MrugendraNo ratings yet

- Job Application Letter in MarathiDocument5 pagesJob Application Letter in Marathicprdxeajd100% (2)

- Netflix ProjectDocument2 pagesNetflix Projectapi-629533605No ratings yet

- Merchant Rates 2019 2020 Oct 2019Document11 pagesMerchant Rates 2019 2020 Oct 2019rh007No ratings yet

- Document TypeDocument1 pageDocument TypeAdam JurekNo ratings yet

- Unibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxDocument17 pagesUnibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxMiguel RamosNo ratings yet

- A1 - DBCB3033 (202301)Document2 pagesA1 - DBCB3033 (202301)Darshene ChandrasegaranNo ratings yet

- Customer Relationship On Business Model DesignDocument31 pagesCustomer Relationship On Business Model DesignInacio LourdesNo ratings yet

Fsa 3000

Fsa 3000

Uploaded by

Ngọc NguyễnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fsa 3000

Fsa 3000

Uploaded by

Ngọc NguyễnCopyright:

Available Formats

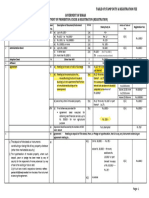

Overall information Current

Price 52 week high

Tear sheet provides a 52 week low

one-page summary of

1. Analyst's tearsheet

the company with the

Beta 5 years (S&P500)

following information

Dividend yield

General information of

Shares outstanding

stock

Float Shares

2. Company profile, including a segmental analysis

Float % of O/S

Market capitalization

Political factors Enterprise value

Economic factors

3. Industry analysis (including PEST analysis)

Socio-cultural factors

Technological factors

4. Competitor's analysis, using Porter's Five Forces model

Business models

5. Discussion of the company's business model and

corporate strategy

Company Company strategy

Produce a company Merger and acquisition

analysis report

6. Analysis of key corporate events and activities (only Key corporate events

Expansionary

if these events are significant) and activities

Open new factory

7. A summary analysis of the company's financial statements

Trend analysis

1. Presentation and

Comparison with

quality of the final

8. A full financial ratio analysis, including trend analysis, industry ratios

report

comparison with industry ratios, the identification and

computation of customized industry ratios

Profitability

2. Depth of analysis of

the macroeconomic and

industry environment Other financial ratios

Efficiency

analysis

3. Quality of analysis of Liquidity

the company, its

business model, and its

strategy Financial Statement Dividend models

Criteria Requirements

Analysis

4. Competency of Multiples models

financlal statement

analysis 9. Company valuations, employing dividend models

(where appropriate), multiples models, and free cash Free cashflow model

flow model with all assumptions justified

5. Quality of equity

valuations Assume that the

company continues

Assumptions and paying dividend

6. Creditability of justifications

outlook and investment

recommendation Going concern

10. All the models assumptions should be placed in

the appendix, along with the justifications

Multistage dividend

Tab 1 model (where

appropriate)

Tab 2 Multiples models

Discount to present

Projected statements in

Free cashflow value to get the

the next 5 year

EXCEL WORKING FILES enterprise value

Profit after tax

+ Depreciation

+ Net after tax interest payments (Net after tax finance cost)

- Increase in current assets

+ Increase in current liabilities

- Increase in non-current assets at cost

Free cashflow model

Tab 3

with all assumptions

Sales bao nhiêu %

Tính ra các chỉ tiêu báo

Receivables / Sales = ? %

cáo tài chính khác nhau

COGS/ Sales = ? %

Assumptions

You might also like

- CFI Investment Banking Pitch Book 1Document27 pagesCFI Investment Banking Pitch Book 1Michael Fisher100% (1)

- CFI Investment Banking PitchBookDocument28 pagesCFI Investment Banking PitchBookee sNo ratings yet

- Probe42.in: Usha International LimitedDocument66 pagesProbe42.in: Usha International LimitedrajvvkNo ratings yet

- Equity Research Methodology 031604Document1 pageEquity Research Methodology 031604vardashahid100% (1)

- Volkswagen Strategic ManagementDocument15 pagesVolkswagen Strategic ManagementSaloni Maheshwari100% (1)

- U45200HR2010PTC040589Document37 pagesU45200HR2010PTC040589Bithal PrasadNo ratings yet

- Presentation ElcoDocument24 pagesPresentation ElcoemaNo ratings yet

- Abra CottonDocument28 pagesAbra CottondhruvrealtyNo ratings yet

- Probe42.in: Ms Biotech Private LimitedDocument33 pagesProbe42.in: Ms Biotech Private LimitedSriram ReddyNo ratings yet

- U72900DL1991PLC044831Document66 pagesU72900DL1991PLC044831mhgr58tj9qNo ratings yet

- Corning Technology PVT LTDDocument37 pagesCorning Technology PVT LTDUTSAV DUBEYNo ratings yet

- Aan 4560Document22 pagesAan 4560ompatelNo ratings yet

- U27109WB2006PTC111146Document45 pagesU27109WB2006PTC111146Vitul GuptaNo ratings yet

- Infografía-PMI Guide To BADocument1 pageInfografía-PMI Guide To BACarlos GNo ratings yet

- Environmental Scanning The Basic Model: - 30/11/2011 - Prepared by Carl Olav Staff / Rune Fjellvang Page 1 of 1Document1 pageEnvironmental Scanning The Basic Model: - 30/11/2011 - Prepared by Carl Olav Staff / Rune Fjellvang Page 1 of 1Baher WilliamNo ratings yet

- Level-1-Fixed - Income CFADocument1 pageLevel-1-Fixed - Income CFAk60.2113340016No ratings yet

- Nilons PVT LTDDocument60 pagesNilons PVT LTDUTSAV DUBEYNo ratings yet

- Garp MarchDocument5 pagesGarp MarchZerohedgeNo ratings yet

- Gajanan Agro PVT LTDDocument31 pagesGajanan Agro PVT LTDUTSAV DUBEYNo ratings yet

- Topic 2 - STDocument36 pagesTopic 2 - STdhyukm7No ratings yet

- Office of The Economic AdviserDocument1 pageOffice of The Economic AdviserVISHWAJITNo ratings yet

- Inf JPNDocument67 pagesInf JPNFlor Terrera HamadaNo ratings yet

- Improving Banking EfficiencyDocument26 pagesImproving Banking EfficiencyiitbhuNo ratings yet

- Fauji Cement Co LTD Swot Analysis BacDocument13 pagesFauji Cement Co LTD Swot Analysis BacSyed Ali HamzaNo ratings yet

- Internship Schedule - Mr. DineshDocument2 pagesInternship Schedule - Mr. DineshDinesh MNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- Industry & Distribution Business Strategy: Hiroyuki UgawaDocument22 pagesIndustry & Distribution Business Strategy: Hiroyuki UgawacarlammartinsNo ratings yet

- BDOLeasingandFinanceIncPSEBLFI PublicCompanyDocument1 pageBDOLeasingandFinanceIncPSEBLFI PublicCompanyLester FarewellNo ratings yet

- Itc LTD ItcDocument4 pagesItc LTD ItcSaravanan BalakrishnanNo ratings yet

- WFP Meds 37kDocument38 pagesWFP Meds 37kFallucky SantiagoNo ratings yet

- BSC Fuzzy-Delphi-Analysis - 26 Sep23Document19 pagesBSC Fuzzy-Delphi-Analysis - 26 Sep23Muhammad HurraraNo ratings yet

- Ffice of The Conomic Dviser: HindiDocument1 pageFfice of The Conomic Dviser: HindiMuralidhar PVNo ratings yet

- CH 02Document36 pagesCH 02api-3804982100% (1)

- Revised Proposal For Final Project FIn619Document7 pagesRevised Proposal For Final Project FIn619Khalid Mahmood SialNo ratings yet

- Revised Proposal For Final Project FIn619Document7 pagesRevised Proposal For Final Project FIn619Mirza Abu Sufiyan BaigNo ratings yet

- Nyse FFG 2004Document129 pagesNyse FFG 2004Bijoy AhmedNo ratings yet

- Tata Pow FY20Document433 pagesTata Pow FY20Partha SahaNo ratings yet

- Tailored Enterprise Governance System For Information and Technology Cobit CoreDocument6 pagesTailored Enterprise Governance System For Information and Technology Cobit CorefauziahezzyNo ratings yet

- 2017 Yamaha AR All enDocument38 pages2017 Yamaha AR All enHarshitNo ratings yet

- l4dlB5oHO81V8XME 812 PDFDocument149 pagesl4dlB5oHO81V8XME 812 PDFsha ve3No ratings yet

- Affle Ar Fy22Document193 pagesAffle Ar Fy22chiragchhillar9711No ratings yet

- 2020-03-06-February 2020 PMI Investor Information (FINAL)Document79 pages2020-03-06-February 2020 PMI Investor Information (FINAL)Alex espargoNo ratings yet

- Krishna G. Palepu, Paul M. Healy, Erik Peek - Business Analysis and Valuation - IFRS Edition-Cengage Learning (2013) - Chapter 5 PDFDocument58 pagesKrishna G. Palepu, Paul M. Healy, Erik Peek - Business Analysis and Valuation - IFRS Edition-Cengage Learning (2013) - Chapter 5 PDFTrần BetaNo ratings yet

- Uacs SummaryDocument7 pagesUacs SummaryDawn Rei DangkiwNo ratings yet

- Book For DR FudDocument18 pagesBook For DR FudSiddharthNo ratings yet

- PosterDocument1 pagePosterbhoomikahv31No ratings yet

- 2021 Business PerformanceDocument22 pages2021 Business PerformanceSebastian SinclairNo ratings yet

- The Business and Financial Performance of Panasonic and SonyDocument24 pagesThe Business and Financial Performance of Panasonic and SonyMuhammad AkhtarNo ratings yet

- K Kiran Kumar: Any Questions? Behavioral Finance, Netscape IPO, ReviewDocument33 pagesK Kiran Kumar: Any Questions? Behavioral Finance, Netscape IPO, ReviewJohn DoeNo ratings yet

- sdb23 enDocument128 pagessdb23 enazizNo ratings yet

- U 28993 MH 1932 PLC 001828Document208 pagesU 28993 MH 1932 PLC 001828dhapola552No ratings yet

- ECOFUND Factsheet ENGDocument1 pageECOFUND Factsheet ENGdave.importacionesNo ratings yet

- Work Program - Indirect TaxesDocument5 pagesWork Program - Indirect TaxesHarold Dan AcebedoNo ratings yet

- Poonawal Fincorp Anandrathi 310323 EbrDocument21 pagesPoonawal Fincorp Anandrathi 310323 EbrSaddam AnsariNo ratings yet

- Termpapermgt517Document3 pagesTermpapermgt517Addydutt SharmaNo ratings yet

- The World's Largest 500 Asset Managers - Joint Study With Pensions & Investments - October 2020Document56 pagesThe World's Largest 500 Asset Managers - Joint Study With Pensions & Investments - October 2020alexNo ratings yet

- 11.10.21.BAC Conference DS PresentationDocument8 pages11.10.21.BAC Conference DS Presentationhanz.commerceNo ratings yet

- Where Intelligence Meets Infrastructure: Investor Presentation August & September, 2022Document37 pagesWhere Intelligence Meets Infrastructure: Investor Presentation August & September, 2022Harbour MediaNo ratings yet

- Business Fundamentals Mind MapDocument1 pageBusiness Fundamentals Mind MapTaelon SteeleNo ratings yet

- Car Aftermarket Components - OES -v- Generic Suppliers World Summary: Market Values & Financials by CountryFrom EverandCar Aftermarket Components - OES -v- Generic Suppliers World Summary: Market Values & Financials by CountryNo ratings yet

- Bihar Stamp Duty and Registration Charges BiharDocument1 pageBihar Stamp Duty and Registration Charges BiharAkshansh NegiNo ratings yet

- Isaacson Emory Marketing ResumeDocument1 pageIsaacson Emory Marketing ResumeemoryleighNo ratings yet

- Sales Letter (Written Report)Document10 pagesSales Letter (Written Report)Mica RaymundoNo ratings yet

- Nonprofit OrganizationDocument13 pagesNonprofit OrganizationJeric TorionNo ratings yet

- CinePro CaseDocument4 pagesCinePro Casemoshe1.bendayanNo ratings yet

- Assignment-7 Assignment-7 MB4706Document4 pagesAssignment-7 Assignment-7 MB4706efraimjeferson1010No ratings yet

- Fundamentals of Accountancy, Business and Management 2 Accounting Books - Journal and LedgerDocument20 pagesFundamentals of Accountancy, Business and Management 2 Accounting Books - Journal and LedgerGeraldine EctanaNo ratings yet

- Faculty - Law - 2011 - Sessi 2 - Law240 - 231PDF - 230105 - 082647Document10 pagesFaculty - Law - 2011 - Sessi 2 - Law240 - 231PDF - 230105 - 0826472021202082No ratings yet

- Times Pass List Jan 2020-1Document1 pageTimes Pass List Jan 2020-1antiqurrNo ratings yet

- HP - Strategic Management Case Study 2007Document18 pagesHP - Strategic Management Case Study 2007Furqan MohyuddinNo ratings yet

- 12-01087 - Mai Nguyen Hoang Nam - ECO 601 - Final AssignmentDocument19 pages12-01087 - Mai Nguyen Hoang Nam - ECO 601 - Final AssignmentnamNo ratings yet

- Adjusting Entries Quiz PDFDocument13 pagesAdjusting Entries Quiz PDFnewonemade100% (1)

- Feasibility Study On Establishing Food Delivery in Tiaong, QuezonDocument4 pagesFeasibility Study On Establishing Food Delivery in Tiaong, QuezonCONCORDIA RAFAEL IVANNo ratings yet

- IGP - Coffee All 10 - 035921Document11 pagesIGP - Coffee All 10 - 035921Mary Rose Pegalan SunotNo ratings yet

- OD Diagnosing Organizational Effectiveness ToolsDocument76 pagesOD Diagnosing Organizational Effectiveness ToolsAnonymous FQTgjfNo ratings yet

- Muthu Resume (3) ..Document2 pagesMuthu Resume (3) ..arun kNo ratings yet

- Ifrs Sustainability Disclosure Standards GuidanceDocument21 pagesIfrs Sustainability Disclosure Standards GuidanceMJ DiazNo ratings yet

- Acc Statement 1020010537121 2023-01-01 2023-01-31 20230131193025Document2 pagesAcc Statement 1020010537121 2023-01-01 2023-01-31 20230131193025TheBlackJenny TBJNo ratings yet

- Accounting Principles (Very Important)Document3 pagesAccounting Principles (Very Important)7a4374 hisNo ratings yet

- Paperwork: Prepared By: Sabina AlomerovicDocument16 pagesPaperwork: Prepared By: Sabina AlomerovicRupangi VatsNo ratings yet

- JOURNALIZINGDocument2 pagesJOURNALIZINGArneld SantiagoNo ratings yet

- Project Management Notes-1Document43 pagesProject Management Notes-1MrugendraNo ratings yet

- Job Application Letter in MarathiDocument5 pagesJob Application Letter in Marathicprdxeajd100% (2)

- Netflix ProjectDocument2 pagesNetflix Projectapi-629533605No ratings yet

- Merchant Rates 2019 2020 Oct 2019Document11 pagesMerchant Rates 2019 2020 Oct 2019rh007No ratings yet

- Document TypeDocument1 pageDocument TypeAdam JurekNo ratings yet

- Unibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxDocument17 pagesUnibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxMiguel RamosNo ratings yet

- A1 - DBCB3033 (202301)Document2 pagesA1 - DBCB3033 (202301)Darshene ChandrasegaranNo ratings yet

- Customer Relationship On Business Model DesignDocument31 pagesCustomer Relationship On Business Model DesignInacio LourdesNo ratings yet