Professional Documents

Culture Documents

Consolidated Receipt

Consolidated Receipt

Uploaded by

Saket TiwariCopyright:

Available Formats

You might also like

- Athletic Coping Skills Inventory Athletic Management PDFDocument3 pagesAthletic Coping Skills Inventory Athletic Management PDFLuciana Alessandrini100% (1)

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- Renewal ReceiptDocument1 pageRenewal ReceiptAnkit SinghNo ratings yet

- Geriatric Consideration in NursingDocument31 pagesGeriatric Consideration in NursingBabita Dhruw100% (5)

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- SBI Insurance 2021Document1 pageSBI Insurance 2021personal listNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateSenthil balasubramanianNo ratings yet

- Religare PDFDocument5 pagesReligare PDFsomnathNo ratings yet

- Product Name: Heartbeat - Product UIN: MAXHLIP20065V051920Document61 pagesProduct Name: Heartbeat - Product UIN: MAXHLIP20065V051920RekhaNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFsanto02No ratings yet

- Bajaj Cash Assure Renewal Receipt PDFDocument1 pageBajaj Cash Assure Renewal Receipt PDFPawan KumarNo ratings yet

- Wisdom From TD Jakes FREEDocument224 pagesWisdom From TD Jakes FREEayodeji78100% (3)

- Afar 2 - Summative Test (Consolidated) Theories: Realized in The Second Year From Upstream Sales Made in Both YearsDocument23 pagesAfar 2 - Summative Test (Consolidated) Theories: Realized in The Second Year From Upstream Sales Made in Both YearsVon Andrei Medina100% (1)

- Premium ReceiptsDocument1 pagePremium Receiptsani dNo ratings yet

- Ashwani KumarDocument1 pageAshwani KumarTarunNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailschanam bedantaNo ratings yet

- PolicyDocument55 pagesPolicyBaneNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- C320284551-Renewal Premium ReceiptDocument1 pageC320284551-Renewal Premium ReceiptThelu RajuNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- Pawan S PDF CompletedDocument1 pagePawan S PDF CompletedAsifshaikh7566No ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- Gym FeesDocument1 pageGym FeesMrityunjay AryanNo ratings yet

- Prashant (1) CompletedDocument1 pagePrashant (1) CompletedAsifshaikh7566No ratings yet

- HDFC ERGO General Insurance Company LimitedDocument3 pagesHDFC ERGO General Insurance Company LimitedAnish ShahNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Kavita 2Document2 pagesKavita 2api-3721187No ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Bill 12sep2023Document1 pageBill 12sep2023UR12ME148 PrafullaNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVishal DNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- PremiumReceipt PR0941870700012324Document2 pagesPremiumReceipt PR0941870700012324gjsivakumarNo ratings yet

- HDFC ERGO General Insurance Company Limited: Date: 04/02/2019Document4 pagesHDFC ERGO General Insurance Company Limited: Date: 04/02/2019rohit choudharyNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- FeesPaymentReceipt 1358Document1 pageFeesPaymentReceipt 1358Subrata DasNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- 02122020Document5 pages02122020Kumar FanishwarNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- 10007104150chan PDFDocument4 pages10007104150chan PDFChandrasekhara kNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Preventive Health Check Up Receipt PDFDocument41 pagesPreventive Health Check Up Receipt PDFsan mohNo ratings yet

- This Is An Electronically Generated Duplicate Premium Receipt and Does Not Require Any SignatureDocument2 pagesThis Is An Electronically Generated Duplicate Premium Receipt and Does Not Require Any SignaturefyjghnmghNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- PolicySoftCopy 473620702Document50 pagesPolicySoftCopy 473620702Amit MalikNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- LIC Premium Jan 2023Document4 pagesLIC Premium Jan 2023Akriti SinghNo ratings yet

- Sailaja Jaliparthi Icici PrudentialDocument1 pageSailaja Jaliparthi Icici PrudentialSobhan JaliparthiNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- Renewal of Your Easy Health Floater Standard Insurance PolicyDocument4 pagesRenewal of Your Easy Health Floater Standard Insurance PolicyAhesan Ali MominNo ratings yet

- Lic PreimumDocument1 pageLic PreimumAamir ShahNo ratings yet

- HDFC Tli Converted by AbcdpdfDocument1 pageHDFC Tli Converted by Abcdpdfharshim guptaNo ratings yet

- Premium Receipt PDFDocument1 pagePremium Receipt PDFAjit Kumar TiwariNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Consolidated ReceiptDocument2 pagesConsolidated Receiptdigital.arun999No ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Questionnaire For Technical AssistantDocument4 pagesQuestionnaire For Technical AssistantHabtamu Ye Asnaku LijNo ratings yet

- Vernacular Terms 2 PDFDocument3 pagesVernacular Terms 2 PDFsmmNo ratings yet

- Adamco BIFDocument2 pagesAdamco BIFMhie DazaNo ratings yet

- Dance As A CompetitionDocument3 pagesDance As A CompetitionJaymie NeriNo ratings yet

- Eastron Electronic Co., LTDDocument2 pagesEastron Electronic Co., LTDasd qweNo ratings yet

- Bayley ReviewDocument12 pagesBayley ReviewagNo ratings yet

- Unit IG2: Risk Assessment: L L P 1 o 2Document24 pagesUnit IG2: Risk Assessment: L L P 1 o 2white heart green mindNo ratings yet

- ResearchDocument38 pagesResearchHelen McClintockNo ratings yet

- The Price of SilenceDocument9 pagesThe Price of Silencewamu885100% (1)

- Rock Mass Characterization by High-Resolution SoniDocument17 pagesRock Mass Characterization by High-Resolution SoniJose AleNo ratings yet

- sn74hct138 PDFDocument21 pagessn74hct138 PDFpabloNo ratings yet

- Geography P1 May-June 2023 EngDocument20 pagesGeography P1 May-June 2023 Engtanielliagreen0No ratings yet

- Lesson Plan 8 (September) (AutoRecovered) 1Document3 pagesLesson Plan 8 (September) (AutoRecovered) 1Rutchie AbantoNo ratings yet

- Azosprilum 2Document24 pagesAzosprilum 2Dipti PriyaNo ratings yet

- A Short Version of The Big Five Inventory (BFI-20) : Evidence On Construct ValidityDocument22 pagesA Short Version of The Big Five Inventory (BFI-20) : Evidence On Construct ValidityBagas IndiantoNo ratings yet

- Jobdesc Project Officer Intern TRACK SDGsDocument2 pagesJobdesc Project Officer Intern TRACK SDGssocmed gistiNo ratings yet

- Infosys-Broadcom E2E Continuous Testing Platform Business Process Automation SolutionDocument16 pagesInfosys-Broadcom E2E Continuous Testing Platform Business Process Automation Solutioncharu.hitechrobot2889No ratings yet

- Lesson Plan: I've Got Two SistersDocument5 pagesLesson Plan: I've Got Two SistersBianca BybyNo ratings yet

- JTB Unitization Gas Project: Electrical Equipment/ Tools Inspection ChecklistDocument1 pageJTB Unitization Gas Project: Electrical Equipment/ Tools Inspection ChecklistAK MizanNo ratings yet

- ESSAYDocument7 pagesESSAYKaren OliveraNo ratings yet

- Factory Physics PrinciplesDocument20 pagesFactory Physics Principlespramit04100% (1)

- Sony Kdl-40xbr9 Kdl-46xbr9 Kdl-52xbr9 Ex2m ChassisDocument118 pagesSony Kdl-40xbr9 Kdl-46xbr9 Kdl-52xbr9 Ex2m ChassisAndy WilsonNo ratings yet

- Informe Sobre El Manejo de CostasDocument88 pagesInforme Sobre El Manejo de CostasMetro Puerto RicoNo ratings yet

- ACCA P5 Question 2 June 2013 QaDocument4 pagesACCA P5 Question 2 June 2013 QaFarhan AlchiNo ratings yet

- Exploring Music in ContextDocument3 pagesExploring Music in ContextpkutinNo ratings yet

- DSF Course Curriculum 1305231045Document8 pagesDSF Course Curriculum 1305231045Gaurav BhadaneNo ratings yet

Consolidated Receipt

Consolidated Receipt

Uploaded by

Saket TiwariOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Receipt

Consolidated Receipt

Uploaded by

Saket TiwariCopyright:

Available Formats

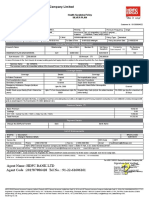

Date: 31-MAR-2023

Premium Paid Certificate

Duration For Which the Premium is Received: 27/08/2022 to 31/03/2023

Personal Details

Policy Number: 114925787 Current residential state: Karnataka

Policyholder Name: Mr. Saket Tiwari Mobile No. 9620413170

Commuinication Address: 003 AKSHARA ASPIRE Landline no. Please inform us for regular updates

APARTMENT NAGARAJ Life Insured Name: Mr. Saket Tiwari

LAYOUT VIJAYNAGAR PAN Number: AMMPT5010B

ROAD

WHITEFIELD

NEAR MURGUN TEMPLE

Bengaluru - 560066

Email ID: sakettiwari1988@gmail.com

Policy Details

Plan Name: Max Life Smart Secure Plus Plan - 104N118V04

Policy Term 32 Years Premium Payment Frequency Semi-Annual

Date of Commencement 27-AUG-2022 Date of Maturity 27-AUG-2054

Last Premium Due Date 27-AUG-2022 Next Due Date 27-FEB-2023

Reinstatement Interest (incl. ` 0.00 Model Premium (incl. GST) ` 7,722.25

GST/S.Tax)

Total Premium Received (incl. ` 7,722.17 Total Sum Assured of base plan and term ` 1,00,00,000.00

GST/S.Tax)* rider (if any)

Agent's Name Internet Sales Agent's Contact No.

GST Details

Coverage Type SAC Code IGST/S.Tax GSTIN 06AACCM3201E1Z7

(INR) GST Regd. State Haryana

Base 997132 ` 1,131.28

Rider 997132 ` 46.61

Reinstatement Interest ` 0.00

Total ` 1,177.89

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premiums may be

eligible for tax benefits under section 80C/80CCC/80D/37(1) of the Income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due

to changes in legislation or government notification. GST shall comprise of CGST, SGST/UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable

taxes, cesses and levies, as per prevailing laws, shall be borne by you. *For GST purposes ,this premium receipt is Tax Invoice. Assessable Value in GST for Endowment First Year

is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%.

Authorised signatory

PRM23 V2.9 01082019

You might also like

- Athletic Coping Skills Inventory Athletic Management PDFDocument3 pagesAthletic Coping Skills Inventory Athletic Management PDFLuciana Alessandrini100% (1)

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- Renewal ReceiptDocument1 pageRenewal ReceiptAnkit SinghNo ratings yet

- Geriatric Consideration in NursingDocument31 pagesGeriatric Consideration in NursingBabita Dhruw100% (5)

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- SBI Insurance 2021Document1 pageSBI Insurance 2021personal listNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateSenthil balasubramanianNo ratings yet

- Religare PDFDocument5 pagesReligare PDFsomnathNo ratings yet

- Product Name: Heartbeat - Product UIN: MAXHLIP20065V051920Document61 pagesProduct Name: Heartbeat - Product UIN: MAXHLIP20065V051920RekhaNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFsanto02No ratings yet

- Bajaj Cash Assure Renewal Receipt PDFDocument1 pageBajaj Cash Assure Renewal Receipt PDFPawan KumarNo ratings yet

- Wisdom From TD Jakes FREEDocument224 pagesWisdom From TD Jakes FREEayodeji78100% (3)

- Afar 2 - Summative Test (Consolidated) Theories: Realized in The Second Year From Upstream Sales Made in Both YearsDocument23 pagesAfar 2 - Summative Test (Consolidated) Theories: Realized in The Second Year From Upstream Sales Made in Both YearsVon Andrei Medina100% (1)

- Premium ReceiptsDocument1 pagePremium Receiptsani dNo ratings yet

- Ashwani KumarDocument1 pageAshwani KumarTarunNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailschanam bedantaNo ratings yet

- PolicyDocument55 pagesPolicyBaneNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- C320284551-Renewal Premium ReceiptDocument1 pageC320284551-Renewal Premium ReceiptThelu RajuNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- Pawan S PDF CompletedDocument1 pagePawan S PDF CompletedAsifshaikh7566No ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- Gym FeesDocument1 pageGym FeesMrityunjay AryanNo ratings yet

- Prashant (1) CompletedDocument1 pagePrashant (1) CompletedAsifshaikh7566No ratings yet

- HDFC ERGO General Insurance Company LimitedDocument3 pagesHDFC ERGO General Insurance Company LimitedAnish ShahNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Kavita 2Document2 pagesKavita 2api-3721187No ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Bill 12sep2023Document1 pageBill 12sep2023UR12ME148 PrafullaNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVishal DNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- PremiumReceipt PR0941870700012324Document2 pagesPremiumReceipt PR0941870700012324gjsivakumarNo ratings yet

- HDFC ERGO General Insurance Company Limited: Date: 04/02/2019Document4 pagesHDFC ERGO General Insurance Company Limited: Date: 04/02/2019rohit choudharyNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- FeesPaymentReceipt 1358Document1 pageFeesPaymentReceipt 1358Subrata DasNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- 02122020Document5 pages02122020Kumar FanishwarNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- 10007104150chan PDFDocument4 pages10007104150chan PDFChandrasekhara kNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Preventive Health Check Up Receipt PDFDocument41 pagesPreventive Health Check Up Receipt PDFsan mohNo ratings yet

- This Is An Electronically Generated Duplicate Premium Receipt and Does Not Require Any SignatureDocument2 pagesThis Is An Electronically Generated Duplicate Premium Receipt and Does Not Require Any SignaturefyjghnmghNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- PolicySoftCopy 473620702Document50 pagesPolicySoftCopy 473620702Amit MalikNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- LIC Premium Jan 2023Document4 pagesLIC Premium Jan 2023Akriti SinghNo ratings yet

- Sailaja Jaliparthi Icici PrudentialDocument1 pageSailaja Jaliparthi Icici PrudentialSobhan JaliparthiNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- Renewal of Your Easy Health Floater Standard Insurance PolicyDocument4 pagesRenewal of Your Easy Health Floater Standard Insurance PolicyAhesan Ali MominNo ratings yet

- Lic PreimumDocument1 pageLic PreimumAamir ShahNo ratings yet

- HDFC Tli Converted by AbcdpdfDocument1 pageHDFC Tli Converted by Abcdpdfharshim guptaNo ratings yet

- Premium Receipt PDFDocument1 pagePremium Receipt PDFAjit Kumar TiwariNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Consolidated ReceiptDocument2 pagesConsolidated Receiptdigital.arun999No ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Questionnaire For Technical AssistantDocument4 pagesQuestionnaire For Technical AssistantHabtamu Ye Asnaku LijNo ratings yet

- Vernacular Terms 2 PDFDocument3 pagesVernacular Terms 2 PDFsmmNo ratings yet

- Adamco BIFDocument2 pagesAdamco BIFMhie DazaNo ratings yet

- Dance As A CompetitionDocument3 pagesDance As A CompetitionJaymie NeriNo ratings yet

- Eastron Electronic Co., LTDDocument2 pagesEastron Electronic Co., LTDasd qweNo ratings yet

- Bayley ReviewDocument12 pagesBayley ReviewagNo ratings yet

- Unit IG2: Risk Assessment: L L P 1 o 2Document24 pagesUnit IG2: Risk Assessment: L L P 1 o 2white heart green mindNo ratings yet

- ResearchDocument38 pagesResearchHelen McClintockNo ratings yet

- The Price of SilenceDocument9 pagesThe Price of Silencewamu885100% (1)

- Rock Mass Characterization by High-Resolution SoniDocument17 pagesRock Mass Characterization by High-Resolution SoniJose AleNo ratings yet

- sn74hct138 PDFDocument21 pagessn74hct138 PDFpabloNo ratings yet

- Geography P1 May-June 2023 EngDocument20 pagesGeography P1 May-June 2023 Engtanielliagreen0No ratings yet

- Lesson Plan 8 (September) (AutoRecovered) 1Document3 pagesLesson Plan 8 (September) (AutoRecovered) 1Rutchie AbantoNo ratings yet

- Azosprilum 2Document24 pagesAzosprilum 2Dipti PriyaNo ratings yet

- A Short Version of The Big Five Inventory (BFI-20) : Evidence On Construct ValidityDocument22 pagesA Short Version of The Big Five Inventory (BFI-20) : Evidence On Construct ValidityBagas IndiantoNo ratings yet

- Jobdesc Project Officer Intern TRACK SDGsDocument2 pagesJobdesc Project Officer Intern TRACK SDGssocmed gistiNo ratings yet

- Infosys-Broadcom E2E Continuous Testing Platform Business Process Automation SolutionDocument16 pagesInfosys-Broadcom E2E Continuous Testing Platform Business Process Automation Solutioncharu.hitechrobot2889No ratings yet

- Lesson Plan: I've Got Two SistersDocument5 pagesLesson Plan: I've Got Two SistersBianca BybyNo ratings yet

- JTB Unitization Gas Project: Electrical Equipment/ Tools Inspection ChecklistDocument1 pageJTB Unitization Gas Project: Electrical Equipment/ Tools Inspection ChecklistAK MizanNo ratings yet

- ESSAYDocument7 pagesESSAYKaren OliveraNo ratings yet

- Factory Physics PrinciplesDocument20 pagesFactory Physics Principlespramit04100% (1)

- Sony Kdl-40xbr9 Kdl-46xbr9 Kdl-52xbr9 Ex2m ChassisDocument118 pagesSony Kdl-40xbr9 Kdl-46xbr9 Kdl-52xbr9 Ex2m ChassisAndy WilsonNo ratings yet

- Informe Sobre El Manejo de CostasDocument88 pagesInforme Sobre El Manejo de CostasMetro Puerto RicoNo ratings yet

- ACCA P5 Question 2 June 2013 QaDocument4 pagesACCA P5 Question 2 June 2013 QaFarhan AlchiNo ratings yet

- Exploring Music in ContextDocument3 pagesExploring Music in ContextpkutinNo ratings yet

- DSF Course Curriculum 1305231045Document8 pagesDSF Course Curriculum 1305231045Gaurav BhadaneNo ratings yet