Professional Documents

Culture Documents

Solution Accounting Problem 1

Solution Accounting Problem 1

Uploaded by

Luna ShiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution Accounting Problem 1

Solution Accounting Problem 1

Uploaded by

Luna ShiCopyright:

Available Formats

SOLUTION - AUDITING PROBLEMS TEST BANK 1

PROBLEM 1 – TANYING CORP.

1. B Sales (P1,353,000 + P10,500 Freight) P1,363,500

Sales returns and allowances (11,700)

Sales discounts (2,60)

!et sales P1,3",160

2. C #n$entor%, &an. 1 P26",100

Purchases P2,'00

Purchase returns and allowances (P2,'00 6) (25,'')

Freight in (P16,575 + P1,710) 1',2'5 17,5"7

*ost o goods a$ailale or sale P6'6,6"7

3. D #n$entor%, -ec. 31, 2017

Per oos P 61,650

/oods out on consignent 55,'00

Per audit P117,50

. C -istriution costs

Sales salaries and coissions (P75,000 + P",1'0 3) P75,275

4d$ertising eense (P',270 + P5,5 26) 50,0''

-ereciation eense Salesdeli$er% e8uient

e8uient (P1',300 + P23,00 10 1012) 20,250

Freight eense 10,500

9ra$el eense sales reresentati$es 13,6'0

:iscellaneous selling eenses ',220

9otal P17',013

5. B 4dinistrati$e eenses

;egal ser$ices P 6,675

#nsurance and licenses 23,00

-ereciation eense oice e8uient 12,600

<tilities 1",200

9elehone and ostage ,25

=ice sulies eense (P6,50 P3,675) 2,'65

=icers> salaries 10",'00

-outul accounts eense (P7'3,000 2 ? P15,660 P'0) 15,1'0

9otal P1"3,7'5

6. A 4llowance or doutul accounts (P7'3,000 2) P15,660

7. D !et sales P1,3",160

*ost o goods sold (P6'6,6"7 P117,50) (56",27)

/ross incoe 77","13

#nterest re$enue (P1,650 + P1,6'0) 3,330

-i$idend re$enue 15,50

/ain on sale o assets 23,60

9otal incoe P'22,153

'. C 9otal incoe P'22,153

-istriution costs (17',013)

4dinistrati$e eenses (1"3,7'5)

#nterest eense

(13,560)

;oss on sale o e8uient (217,'00)

#ncoe ro continuing oerations eore ta P21',""5

". B =ice sulies in$entor% P3,675

10. A #ncoe eore ta P21',""5

#ncoe ta (P21',""5 30) (65,66")

#ncoe ro continuing oerations 153,2"6

#ncoe ro discontinued oerations, net o ta (P120,000 70) ',000

!et incoe P237,2"6

Page 2

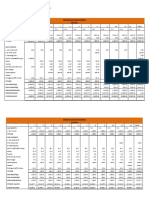

PROBLEM 2 – BUNCHING COMPANY

4ccounts 4ccounts

*ash @ecei$ale #n$entor% Pa%ale

Per oos P"63,200 P2,25,000 P6,050,000 P,201,000

4&A 1 (65,600) 310,000 BBB BBB

2 360,000 BBB BB B 372,00

3 a BBB BBB BBB (175,000)

BBB BBB 130,000 BBB

c BBB BBB (637,500) BBB

d BBB BBB 217,500 217,500

e BBB BBB 275,000 BBB

Per audit P66',600 P2,56,000 P6,035,000 P,615,"00

(11 C) (12 B) (13 A)

A) (1 B)

B)

AJES

1. Sales 360,100

4ccounts recei$ale (P2",500 "5) 310,000

Sales discounts (P310,000 5) 15,500

*ash 65,600

2. *ash (P372,00 P12,00) 360,000

Purchase discounts 12,00

4ccounts a%ale 372,00

3. a 4ccounts a%ale 175,000

Purchases 175,000

#n$entor% 130,000

*ost o sales 130,000

c *ost o sales 637,500

#n$entor% 637,500

d Purchases 217,500

4ccounts a%ale 217,500

#n$entor% 217,500

*ost o sales 217,500

e #n$entor% 275,000

*ost o sales 275,000

!o adCu

adCust

stin

ing

g ent

entr%

r%

15. C *urrent ratio

*urrent assets

*ash P 66',600

4ccounts recei$ale 2,56,000

#n$entor% 6,035,000 P",267,600

*urrent liailities

4ccounts a%ale P,615,"00

4ccrued eenses 31,000 5,06,"00

1.'

Page 3

PROBLEM 3 – PAKO COMPANY

16. D Dalance, &an. 1 P1,'00,000

&une 30 ac8uisition (P1,0'0,000 + P',000) 1,12',000

Set. 30 sale (150,000)

-ec. 1 trade in old achine ("0,000)

new achine 270,000

Dalance, -ec. 31 P2,"5',000

17. A @eainder o eginning alance (P1,'00,000 P150,000 P"0 ,000 ?

P1,560,000 10) P156,000

&une 30 ac8uisition (P1,12',000 10 612) 56,00

Set. 30 sale (P150,000 10 "12) 11,250

-ec. 1 trade in old achine (P"0,000 10 1112) ',250

new achine (P270,000 10 112) 2,250

-ereciation eense or 2015 P23,150

GENLUNA COPPERMINES, INC.

1'. C -eletion rate er ton (P1,5'0,000 1,620,000) P"

*oer ore ined in 2017 (15,000 6 onths) "0,000

-eletion or 2017 P '10,000

-eletion er oos 1,215,000

=$erstateent o deletion eense P05,000

1". D -ereciale cost o achiner% (P1,'00,000 "0) P1,620,000

Astiated coer ore reser$e 1,620,000

-ereciation rate er ton P1

*oer ore ined in 2017 "0,000

-ereciation eense or 2017 P "0,000

-ereciation er oos 120,000

=$erstateent o dereciation eense P 30,000

20. D &anuar% 1, 201

9otal cost o achine (P300,000 + P3,000 + P12,000) P315,000

@esidual $alue (12,000)

-ereciale cost P303,000

Astiated useul lie 10 %ears

4nnual dereciation P30,300

-ereciale cost P303,000

-ereciation, 2016 201 (P30,300 3 %ears) ("0,000)

@eaining dereciale cost, &an. 1, 2017 P212,100

*ost o new arts 37,'00

9otal P2","00

@eaining useul lie (10 %ears 3 %ears) 7 %ears

@e$ised annual dereciation P35,700

PROBLEM 4 – HARLINGTON COMPANY

21. A !et incoe eore trading securit% adCustent P2,700,000

<nrealiEed loss (P3,65,000 cost P3,1"5,000 aret $alue) (270,000)

!et incoe, as adCusted P2,30,000

22. B !et incoe eore trading securit% adCustent P2,700,000

<nrealiEed gain (P3,65,000 cost P3,56,000 aret $alue) "",000

!et incoe, as adCusted P2,7"",000

LABADA CO.

23. D *arr%ing alue :aret alue

/anda *o. P1,710,000 P1,75",500

Gaston, #nc. (P135 1,'00) 23,000 22",500

P1,"53,000 P1,"'",000

<nrealiEed gain (P1,"'",000 P1,"53,000) P36,000

2. C !et roceeds (P"3 15,000 ? P1,3"5,000 P13,500) P1,3'1,500

*arr%ing $alue (1,251,000)

/ain on sale P 130,500

25. B 9rading securities at air $alue P1,"'",000

Page

PROBLEM 5 – SAMSON MFG. CO.

26. C 4ctual orrowing cost

Seciic orrowing (P5 illion 10) P500,000

/eneral orrowings

P25 illion ' P2,000,000

P15 illion 6 "00,000 2,"00,000

9otal P3,00,000

*aitaliEation rate (P2,"00,000P0 illion) 7.25

4$erage eenditures 2016 P7,250,000

*aitaliEale interest 2016

Seciic orrowing (P5 illion 10) P500,000

/ene

/enerral orr

orrowi

owings

ngs (P7,

(P7,25

250,

0,00

0000 P5,00

5,000,

0,00

000

0 ? P2,25

2,250,

0,00

000

0 7.25

7.25)

) 163,

163,12

125

5

9otal P663,125

27. B 4$erage eenditures 2017 P16,163,125

*aitaliEale interest 2017

Seciic orrowing (P5 illion 10 612) P250,000

/eneral orrowings

orrowings (P16,163,125 P5,000,000 ? P11,163,125 7.25 612) 0,663

9otal P65,663

2'. A 201 interest eense (P3,00,000 P663,125) P2,736,'75

2". D 2015 interest eense (P3,00,000 P65,663) P2,75,337

30. B 4ccuulated eenditures eore

eore interest P1",500,000

#nterest caitaliEed in 2016 and 2017 (P663,125 + P65,663) 1,317,7''

9otal cost o uilding P20,'17,7''

PROBLEM 6

C!"#$%&'($ C)!)*&'(+#

E"#$%# C!"#$%&'($

Y#&- C&*)*&'($ /- P#-(0

P#-(0 E"#$%#

1 30,000 otions P5 air $alue P 50,000 P 50,000

2 30,000 otions P5 air $alue 50,000 100,000

3 30,000 otions P5 air $alue 50,000 150,000

31. C 32. C 33. D 3. D 35. D

PROBLEM – BRANDY CO.

36. C =rdinar% shares issued and outstanding 72,000

=rdinar% shares suscried 72,000

9otal 1,000

=rdinar% shares issued to ac8uire land (2,000)

=rdinar% shares originall% suscried 120,000

Par $alueshare P10

9otal ar $alue P1,200,000

Share reiu (P2,'50,000 P50,000) 2,00,000

9otal suscrition rice P3,600,000

H P6"0,000 F o land P20,000 P

37. D Suscrition o 12,000 reerence shares I P120share P1,0,000

Suscrition o 60,000 reerence shares I P100share 6,000,000

9otal 7,0,000

JearBend alance o suscritions

suscritions recei$ale reerence (360,000)

4ount collected ro suscriers P7,0'0,000

3'. B Preerence =rdinar%

#ssued P6,600,000 P 720,000

Suscried 600,000 720,000

Share reiu 20,000 2,'50,000

Suscritions recei$ale (360,000) (1,0'0,000)

*ontriuted caital P7,0'0,000 P3,210,000

Page 5

CONDESSA CO.

1. -i$idends a%ale reerence (P' 60,000) '0,000

-i$idends a%ale ordinar% (P2 600,000) 1,200,000

*ash 1,6'0,000

2. 9reasur% shares 3,20,000

*ash (P0 '1,000) 3,20,000

3. ;and "00,000

9reasur% shares (P0 21,000) '0,000

Share reiu treasur% 60,000

. *ash (P105 15,000) 1,575,000

Preerence share caital (P100 15,000) 1,500,000

Share reiu reerence 75,000

5. @etained earnings (P5 5,000H) 2,30,000

Stoc di$idends a%ale (P5 5,000) 270,000

Share reiu ordinar% 2,160,000

H 600,000 60,000 treasur% shares ? 50,000 10

6. Stoc di$idends a%ale 270,000

=rdinar% share caital 270,000

7. @e

@etained earnings 1,7'',000

-i$idends a%ale reerence (P' 75,000) 600,000

-i$idends a%ale ordinar% (P2 5",000H) 1,1'',000

H 50,000 + 5,000

'. #ncoe suar% ","00,000

@etained earnings ","00,000

Preerence share caital (P6,000,000 + P1,500,000) P7,500,000

=rdinar% share caital (P3,000,000 + P270,000) 3,270,000

Share reiu (P3,750,000 + P60,000 + P75,000 + P2,160,000) 6,05,000

A))

@etained earnings (P3,500,000 P2,30,000 P1,7'',000 + P","00,000) (3" A ",1'2,000

9reasur% shares (P3,20,000 P'0,000) (2,00,000)

9otal (0 B) P23,5"7,000

PROBLEM – CABOOM LABORATORIES

1. D *ost to otain atent (&anuar% 2010) P1'6,150

2010 aortiEation (P1'6,15017) (10,"50)

*arr%ing $alue, -ec. 31, 2010 P175,200

2. C *arr%ing $alue, &an. 1, 2011 P175,200

4ortiEation, 2011B201 (P10,"50 %ears) (3,'00)

*arr%ing $alue, -ec. 31, 201 P131,00

3. C *arr%ing $alue, &an. 1, 2015 P131,00

4ortiEation, 2015B2017 (P131,00 35) (7','0)

*arr%ing $alue, -ec. 31, 2017 P 52,560

BARTOLO COMPANY

. A *ost o atent urchased on &an. 1, 2016 P,000,000

2016 aortiEation (P,000,00010) (00,000)

*arr%ing $alue, -ec. 31, 2016 3,600,000

2017 aortiEation (P3,600,0005) (720,000) P2,''0,000

*ost o ranchise P"60,000

2017 aortiEation (P"60,00010) ("6,000) '6,000

9otal carr%ing $alue o intangiles P3,7,000

5. B 4ortiEation o atent 2017 P720,000

4ortiEation o ranchise 2017 "6,000

Pa%ent to -elco (P5,000,000 5) 250,000

@esearch and de$eloent costs '66,000

9otal charges against 2017 incoe P1,"32,000

Page 6

PROBLEM NO. – SAMOA COMPANYCHILE CO.

6. A =$erB (<nderB)stateent

<nderstateent o 2016 ending in$entor% P ',000

=$erstateent o 2017 ending in$entor% 0,500

Preaid insurance charged to eense in 2016 (P330,000 K 3) 110,000

<nrecorded sale o ull% dereciated achiner% in 2017 (75,000)

9otal eect o errors on net incoe P123,500

7. D =$erB (<nderB)stateent

=$erstateent o 2017 ending in$entor% P 0,500

Preaid insurance charged to eense in 2016 (110,000)

<nrecorded sale o ull% dereciated achiner% in 2017 (75,000)

9otal eect on woring caital (P1,500)

'. C =$erB (<nderB)stateent

=$erstateent o 2017 ending in$entor% P 0,500

<nderstateent o dereciation eense in 2016 11,500

Preaid insurance charged to eense in 2016 (110,000)

<nrecorded sale o ull% dereciated achiner% in 2017 (75,000)

9otal eect on retained earnings (P133,000)

2016 2017

Preta incoe P505,000 P3'7,000

Sales re$enue erroneousl% recogniEed in 2016 (1"1,000) 1"1,000

<nderstateent o 2016 ending in$entor% 3,200 (3,200)

<nderstateent o ond interest eense (1) (7,250) (7,75')

=rdi

=rdina

nar%

r% re

reair

airs erron

rroneo

eous

usll% ca

caita

italiE

liEed (2,

(2,50

500)

0) (7,

(7,00

000)

0)

(2)

=$erstateent o dereciation ,250 ',"50

*orrected reta incoe P311,700 P'',""2

(1)

Doo alue !oinal Aecti$e -iscount

Jear o Donds #nterest #nterest 4ortiEation

2016 P1,175,000 P75,000 P'2,250 P7,250

2017 1,1'2,250 75,000 '2,75' 7,75'

(2)

2016 (P2,500 K 10) P,250

2017 (P2,500 K 10) P,250

(P7,000 K 10) ,700 P',"50

". C 50. D

PROBLEM NO. 1 – OMEGA COMPANYDP,

COMPANYDP, INC.

51. C *ontainers he

held %

% cu

custoers at

at -e

-ec. 31

31, 20

2016 r

ro de

deli$eries in

in 20

2015 P'5,000

*ontainers returned in 2017 ro deli$eries in 2015 (57,500)

@e$enue ro container sales P27,500

52. A ;iailit% or returnale containers, -ec. 31, 2016 P325,000

-eli$eries in 2017 30,000

9otal 755,000

2017 container returns P35,500

2017 container sales 27,500 (3'2,000)

;iailit% or returnale containers P373,000

53. C <nearned warrant% re$enue

*urrent (P'10 270 13) P72,"00

!onBcurrent (P'10 270 23) P15,'00

5. D Parts P1',000

;aor 36,000

9otal warrant% eense P5,000

55. B <nearned warrant% re$enue

*urrent (P'10 270 13) P72,"00

!onBcurrent (P'10 270 13) P72,"00

Page 7

PROBLEM 11 – TGR C!"&$

56. D 9radeBin &une 30, 2015

*ost P157,200

4ccu. dereciation, 1113 63015 (P157,200 20 2.5 %rs.) 7',600

*arr%ing $alue 7',600

9radeBin $alue 12",000 P50,00

Sale &an. 1, 2016

*ost P132,000

4ccu. dereciation, 1113 1116 (P132,000 20 3 %rs.) 7",200

*arr%ing $alue 52,'00

!et roceeds 71,250 1',50

Sale =ctoer 1, 2017

*ost P120,000

4ccu. dereciation, 1113 10117 (P120,000 20 "12) 11,000

*arr%ing $alue 6,000

Proceeds 2,000 1',000

9otal gain P'6,'50

57. C :achine ac8uired on Set. 30, 2013 (P1'0,000 + P6,000) P1'6,000

:achine ac8uired on &une 30, 201 (P20,000 "') 235,200

:achine ac8uired on &une 30, 2016 (list rice) 27",000

9otal P700,200

5'. C :achine ac8uired on

Set. 30, 2013 (P1'6,000 20 312) P15',100

&une 30, 201 (P235,200 20 3 612) 16,60

&une 30, 2015 (P27",000 20 2 612) 13",500

4ccuulated dereciation, -eceer 31, 2017 P62,20

5". B

-ate o

4c8uisition *ost 2013 201 2015 2016 2017 9otal

112013 P157,200 P31,0 P31,0 P15,720 P0 P0 P 7',600

120,000 2,000 2,000 2,000 2,000 1',000 11,000

132,000 26,00 26,00 26,00 0 0 7",200

"302013 1'6,000 ",300 37,200 37,200 37,200 37,200 15',100

630201 235,200 0 23,520 7,00 7,00 7,00 16,60

6302015 27",000 0 0 27,"00 55,'00 55,'00 13",500

*orrect dereciation P"1,10 P12,560 P17',260 P16,00 P15',00 P73,00

-ereciation er client "7,0 15,752 153,'02 10',7"1 '2,233 5"7,01'

=$er (u

(under)stateent P 6,

6,300 P 12

12,1"2 (P 2

2,5') (P 55

55,2") (P 75

75,'07) (P 13

137,022)

60. A -ereciation eense (2017) 75,'07

@etained earnings (2013 2016) 61,215

4ccuulated dereciation 137,022

---END---

You might also like

- ACCCOB1 Chapter 5 Worktext Solution Exercise 5-1 and 5-2 Theory 5-3 To 5-5 PDFDocument4 pagesACCCOB1 Chapter 5 Worktext Solution Exercise 5-1 and 5-2 Theory 5-3 To 5-5 PDFJose GuerreroNo ratings yet

- Rosalina Besario Surveyors - Worksheet - CASIGNIADocument8 pagesRosalina Besario Surveyors - Worksheet - CASIGNIAJowe Ringor CasigniaNo ratings yet

- Exercise 6 22 Acctba1Document11 pagesExercise 6 22 Acctba1Sophia Santos50% (2)

- Trial BalanceDocument1 pageTrial BalanceDian Novia PurwandariNo ratings yet

- Appendices To The Business Plan-1Document5 pagesAppendices To The Business Plan-1smile ChristianNo ratings yet

- Chapter 5 Partnership Liquidation by InstallmentDocument25 pagesChapter 5 Partnership Liquidation by InstallmentManamiNo ratings yet

- Acctng Midterms GWDocument12 pagesAcctng Midterms GWGianna ReyesNo ratings yet

- Kunci Quiz 3 Bond BaruDocument1 pageKunci Quiz 3 Bond BaruKoko D'DemonsongNo ratings yet

- Audit of Receivables and Sales SolutionsDocument16 pagesAudit of Receivables and Sales SolutionsNICELLE TAGLENo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- Advanced Accounting Chapter 5Document19 pagesAdvanced Accounting Chapter 5belindaNo ratings yet

- EVA Vs NPV and Payback PeriodDocument4 pagesEVA Vs NPV and Payback PeriodAyesha SohailNo ratings yet

- LiquidationDocument4 pagesLiquidationWenjunNo ratings yet

- RM Music Worksheet For The Ended Period July, 31 2016Document25 pagesRM Music Worksheet For The Ended Period July, 31 2016AmandaNo ratings yet

- Mads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEDocument3 pagesMads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEJowe Ringor Casignia100% (1)

- 20201216report Executive Summary December 2020 TheresidencesatbrentDocument2 pages20201216report Executive Summary December 2020 TheresidencesatbrentChaNo ratings yet

- Philippine Politics and Governance DLPDocument6 pagesPhilippine Politics and Governance DLPDMarrie Abao Boniao-LabadanNo ratings yet

- Tully Year 2 Expenses and Cashflow ForecastDocument1 pageTully Year 2 Expenses and Cashflow ForecastTully HamutenyaNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- 8-10 Trading Worksheet For The Year Ended December 31, 2018 Trial Balance Debit CreditDocument18 pages8-10 Trading Worksheet For The Year Ended December 31, 2018 Trial Balance Debit CreditLianna RodriguezNo ratings yet

- Assignment 3.1Document8 pagesAssignment 3.1Jules AguilarNo ratings yet

- In The Books of Ajit Trading A/C & P/L Account For The Year Ended 31.3.16 Particulars Amount AmountDocument43 pagesIn The Books of Ajit Trading A/C & P/L Account For The Year Ended 31.3.16 Particulars Amount AmountflamerydersNo ratings yet

- PNL Chilitos (Versión Mayo 2015)Document38 pagesPNL Chilitos (Versión Mayo 2015)alejandrosantizoNo ratings yet

- EVA, VPL e CVA 2003Document4 pagesEVA, VPL e CVA 2003Pedro CoutinhoNo ratings yet

- CHAPTER 9 For Cost Con de LeonDocument5 pagesCHAPTER 9 For Cost Con de LeonRose Ann GarciaNo ratings yet

- Tully Year 3 Expenses and Cashflow ForecastDocument1 pageTully Year 3 Expenses and Cashflow ForecastTully HamutenyaNo ratings yet

- Sample Muscovado CTMDDocument29 pagesSample Muscovado CTMDJan ryanNo ratings yet

- Report Executive Summary January 2021 TheresidencesatbrentDocument2 pagesReport Executive Summary January 2021 TheresidencesatbrentChaNo ratings yet

- Solution To The 1st Deptal (Trade Receivables and Sales)Document14 pagesSolution To The 1st Deptal (Trade Receivables and Sales)yen claveNo ratings yet

- BA 118.3 Module 2 Post and Sage AnswersDocument18 pagesBA 118.3 Module 2 Post and Sage AnswersRed Ashley De LeonNo ratings yet

- Cost Benefit Analysis Dashboard Template: Employee SalariesDocument10 pagesCost Benefit Analysis Dashboard Template: Employee SalariesKarthik HegdeNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- CHAPTER 4: DO IT! 1 Worksheet: Blessie, Capital Jan. 1, 2019 961,900Document3 pagesCHAPTER 4: DO IT! 1 Worksheet: Blessie, Capital Jan. 1, 2019 961,900CacjungoyNo ratings yet

- Completing The Accounting CycleDocument11 pagesCompleting The Accounting CycleRaymond RocoNo ratings yet

- WorkshitDocument12 pagesWorkshitLukman ArimartaNo ratings yet

- PDF Financial Management DDDocument40 pagesPDF Financial Management DDFernanda YogaNo ratings yet

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRNo ratings yet

- BalanceDocument2 pagesBalanceAnonymous 9xKDY2G27QNo ratings yet

- Activity 3 ColleaguesDocument5 pagesActivity 3 ColleaguesKeahlyn BoticarioNo ratings yet

- Chapter07 XlssolDocument49 pagesChapter07 XlssolEkhlas AmmariNo ratings yet

- Jawaban Soal Latihan LKK1-BondsDocument22 pagesJawaban Soal Latihan LKK1-Bondszahra calista armansyahNo ratings yet

- Balance General de 8 ColumnasDocument4 pagesBalance General de 8 ColumnasJavier Ignacio ValdiviaNo ratings yet

- Prelim Quiz 2 CMPC 313Document10 pagesPrelim Quiz 2 CMPC 313Nicole ViernesNo ratings yet

- Financial MonitoringDocument6 pagesFinancial Monitoringarchie_728No ratings yet

- Centre Overheads FY21 SummaryDocument13 pagesCentre Overheads FY21 Summarysingh.omar.mrNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- Alifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcDocument9 pagesAlifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcFaldo DaffaNo ratings yet

- Mandal& C-1, & Mill Vll. & Profit & Loss For The 3lstmarch By, ToDocument4 pagesMandal& C-1, & Mill Vll. & Profit & Loss For The 3lstmarch By, ToSatish GoenkaNo ratings yet

- Hoba Icare Answer KeysDocument15 pagesHoba Icare Answer KeysMark Gelo WinchesterNo ratings yet

- Note Chapter 14 + 15 + CH A Mid-Term TestDocument4 pagesNote Chapter 14 + 15 + CH A Mid-Term TestGenoso OtakuNo ratings yet

- AccountDocument3 pagesAccountkarangasharon9No ratings yet

- Problem I - SolutionsDocument10 pagesProblem I - SolutionsDing CostaNo ratings yet

- 8 4Document3 pages8 4FakerPlaymakerNo ratings yet

- Marketing and Financial PlanDocument13 pagesMarketing and Financial PlanBSCE 1-3 Baguio, KeanuNo ratings yet

- Jawaban Soal Latihan LKK1-BondsDocument21 pagesJawaban Soal Latihan LKK1-Bondszahra calista armansyahNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Acps 3 Complete Solutions 2Document3 pagesAcps 3 Complete Solutions 2Luna ShiNo ratings yet

- Acps 2 4Document1 pageAcps 2 4Luna ShiNo ratings yet

- Acps 2 Complete Solutions 1Document3 pagesAcps 2 Complete Solutions 1Luna ShiNo ratings yet

- Acps 2 3Document1 pageAcps 2 3Luna ShiNo ratings yet

- Acps 2Document3 pagesAcps 2Luna ShiNo ratings yet

- ACPS 7 Complete Solutions 2 2Document2 pagesACPS 7 Complete Solutions 2 2Luna ShiNo ratings yet

- Acps 1 1Document3 pagesAcps 1 1Luna ShiNo ratings yet

- Acps 2 2Document2 pagesAcps 2 2Luna ShiNo ratings yet

- Acps 1 Complete SolutionsDocument2 pagesAcps 1 Complete SolutionsLuna ShiNo ratings yet

- Acps 4 Complete SolutionsDocument2 pagesAcps 4 Complete SolutionsLuna ShiNo ratings yet

- Accounting Made EasyDocument14 pagesAccounting Made EasyLuna ShiNo ratings yet

- Basic Accounting Chapter 1-5 QuizzesDocument6 pagesBasic Accounting Chapter 1-5 QuizzesLuna Shi100% (1)

- Reviewer Midterm Math in Modern WorldDocument10 pagesReviewer Midterm Math in Modern WorldLuna ShiNo ratings yet

- Lesson 1 - Philosophical Perspectives On The SelfDocument4 pagesLesson 1 - Philosophical Perspectives On The SelfLuna ShiNo ratings yet

- Mathematics in Modern World Notes PrintableDocument5 pagesMathematics in Modern World Notes PrintableLuna ShiNo ratings yet

- Community Profile Assignment RevisedDocument4 pagesCommunity Profile Assignment RevisedKing EbenGhNo ratings yet

- Consumer AnalysisDocument2 pagesConsumer AnalysisammarNo ratings yet

- Pricing StrategyDocument17 pagesPricing Strategylifemyth100% (1)

- What Is Toyota Financial ServicesDocument3 pagesWhat Is Toyota Financial ServicesSaurabh TyagiNo ratings yet

- A Century of Steel MakingDocument1 pageA Century of Steel MakingThe SpectatorNo ratings yet

- Saunders CH08 AccessibleDocument33 pagesSaunders CH08 AccessibleindriawardhaniNo ratings yet

- Notice - Inability To Pay - Demand of Discharge 12usc411Document1 pageNotice - Inability To Pay - Demand of Discharge 12usc411Gee Penn100% (1)

- Porter 5 Forces PDFDocument4 pagesPorter 5 Forces PDFakwadNo ratings yet

- Feasibility Study Poring (Jica) PDFDocument278 pagesFeasibility Study Poring (Jica) PDFtnlesmanaNo ratings yet

- 1200 KGBS Newsletter v7Document16 pages1200 KGBS Newsletter v7Frank'kimi'KimaniNo ratings yet

- Long Term MOA For Midyear 2023Document12 pagesLong Term MOA For Midyear 2023Sikeyyy Dela CruzNo ratings yet

- Health Insurance Marketplace Statement: Recipient InformationDocument2 pagesHealth Insurance Marketplace Statement: Recipient InformationPrekelNo ratings yet

- SS - 009 Biography of Chanda KochharDocument4 pagesSS - 009 Biography of Chanda KochharSingh ViratNo ratings yet

- Geography H.C.G. - Paper - 2: (Two Hours)Document9 pagesGeography H.C.G. - Paper - 2: (Two Hours)Aryan GuptaNo ratings yet

- KPMG International: The Accounting Services Segment of The Professional Business Services IndustryDocument27 pagesKPMG International: The Accounting Services Segment of The Professional Business Services IndustryDaniel VuNo ratings yet

- Economy-State-And-Society ExportDocument15 pagesEconomy-State-And-Society ExportTanya SinghNo ratings yet

- Proposal Ride To Himalaya Gunadi English RevisedDocument13 pagesProposal Ride To Himalaya Gunadi English RevisedarisyiNo ratings yet

- 2011 Ifadc Participants ListDocument31 pages2011 Ifadc Participants ListFazila KhanNo ratings yet

- Defination and MeaningDocument4 pagesDefination and MeaningSherry SherNo ratings yet

- 12 Philippine Peso Per Us Dollar Exchange Rate: Period 2018 2019 2020 2021 2022 Monthly AverageDocument1 page12 Philippine Peso Per Us Dollar Exchange Rate: Period 2018 2019 2020 2021 2022 Monthly AverageHector Andrei NicolasNo ratings yet

- TheEconomist 2020 12 10Document296 pagesTheEconomist 2020 12 10merlindebergNo ratings yet

- 06 ISCLO 2018 Paper Template Prosiding v3Document3 pages06 ISCLO 2018 Paper Template Prosiding v3Rumah SepatuNo ratings yet

- Strategic PlanningDocument12 pagesStrategic PlanningTessie MangrobangNo ratings yet

- Persistent Creativity: Peter CampbellDocument300 pagesPersistent Creativity: Peter CampbellViona ShafiyahNo ratings yet

- Catalog of Sunflower OilsDocument17 pagesCatalog of Sunflower OilsJaemoon LimNo ratings yet

- How To Lobby at Intergovernmental MeetingsDocument194 pagesHow To Lobby at Intergovernmental MeetingsQiwei Huang100% (1)

- Travel Confirmation: Flight DatesDocument1 pageTravel Confirmation: Flight DatesДимитријеПопмихајловNo ratings yet

- Importance of Hiring A Licensed HandymanDocument2 pagesImportance of Hiring A Licensed Handymanhuda fatimaNo ratings yet

- Nirma LafargeHolcim DealDocument4 pagesNirma LafargeHolcim DealSahil MakkarNo ratings yet

- 5 Walayat Shah - Pakistan Textile Industry Facing New ChallengesDocument7 pages5 Walayat Shah - Pakistan Textile Industry Facing New ChallengeshumaomarhussainNo ratings yet