Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

13 viewsEconomic Profit

Economic Profit

Uploaded by

saiEconomic profit considers total costs including opportunity costs, while accounting profit only considers explicit costs. Economic profit belongs to business owners and increases their wealth. Accounting profit is reported on financial statements. Three examples are given comparing the calculation of economic profit versus accounting profit in different business scenarios involving production costs, opportunity costs, and startup costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Integrative Case 1.1. WalmartDocument29 pagesIntegrative Case 1.1. WalmartMike rossNo ratings yet

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionLoleeta H. Khaleel67% (9)

- Intercompany Sale of Depreciable AssetsDocument2 pagesIntercompany Sale of Depreciable AssetsTriechia LaudNo ratings yet

- Revise Mid TermDocument43 pagesRevise Mid TermThe FacesNo ratings yet

- Leverage and Capital StructureDocument22 pagesLeverage and Capital Structureephraim100% (1)

- Case ChemaliteDocument1 pageCase ChemaliteRosario PhillipsNo ratings yet

- Chapter 1 Review of The Accounting Cycle of A Service and Merchandising BusinessDocument17 pagesChapter 1 Review of The Accounting Cycle of A Service and Merchandising Businesstim c0% (1)

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Accounting Vs Economic Profit-LectureDocument3 pagesAccounting Vs Economic Profit-LecturejaimepatriciomNo ratings yet

- Chapter 13 - The Costs of Production: Profit MaximizationDocument28 pagesChapter 13 - The Costs of Production: Profit MaximizationTường HuyNo ratings yet

- Bepmc 311: Managerial Economics: Module 4: Analysis of The Theory of Production, Cost, Revenue and ProfitDocument21 pagesBepmc 311: Managerial Economics: Module 4: Analysis of The Theory of Production, Cost, Revenue and ProfitAliezaNo ratings yet

- Quiz 2 Solutions...Document34 pagesQuiz 2 Solutions...Esmer AliyevaNo ratings yet

- Module 4-AFDocument10 pagesModule 4-AFShayan KhanNo ratings yet

- EconDocument3 pagesEconAngeline nchtNo ratings yet

- Pte 5Document3 pagesPte 5selse060No ratings yet

- Capital Budgeting Ch 2(1) (1) (1)Document50 pagesCapital Budgeting Ch 2(1) (1) (1)tariqNo ratings yet

- Chapter 1: Answers To Questions and Problems: Managerial Economics and Business Strategy, 6e PageDocument6 pagesChapter 1: Answers To Questions and Problems: Managerial Economics and Business Strategy, 6e PageVotues PSNo ratings yet

- Chap 001Document6 pagesChap 001Sana MahmoodNo ratings yet

- 1 Business Vs Economic Profit: Table of ContentsDocument8 pages1 Business Vs Economic Profit: Table of ContentsKashaf AmjadNo ratings yet

- Capital Budeting ProjectDocument19 pagesCapital Budeting ProjectPrathmesh BagweNo ratings yet

- Chapter 03Document12 pagesChapter 03Asim NazirNo ratings yet

- Cost of Production: Producer Behavior and SocietyDocument21 pagesCost of Production: Producer Behavior and SocietyDyisi DyisiNo ratings yet

- Economics 100 New Class 7 and 8Document9 pagesEconomics 100 New Class 7 and 8airtonfelixNo ratings yet

- Mfin202 Ch3 SolutionsDocument14 pagesMfin202 Ch3 SolutionsNayyar Abbas0% (1)

- How Do You Find The Optimal Output AlgebraicallyDocument7 pagesHow Do You Find The Optimal Output AlgebraicallyasfawmNo ratings yet

- Producer Decision MakingDocument17 pagesProducer Decision MakingsarasNo ratings yet

- The Determination of National IncomeDocument3 pagesThe Determination of National IncomeKyeame_Ghansah_6556No ratings yet

- Lilongwe University of Agriculture and Natural Resources Faculty of Development Studies Department of Agricultural and Applied EconomicsDocument43 pagesLilongwe University of Agriculture and Natural Resources Faculty of Development Studies Department of Agricultural and Applied EconomicsRil KelzNo ratings yet

- Google Form Model A.A University 1Document96 pagesGoogle Form Model A.A University 1Tesfu HettoNo ratings yet

- Act FinalDocument6 pagesAct Finalabu.sakibNo ratings yet

- Finance Final222Document7 pagesFinance Final222Mohamed SalamaNo ratings yet

- Profit Analysis: Concept of Profit Analysis Gross Profit Net ProfitDocument36 pagesProfit Analysis: Concept of Profit Analysis Gross Profit Net ProfitGiselleNo ratings yet

- AccDocument15 pagesAccMartin TrịnhNo ratings yet

- 2 National Accounting - Lecture 2.Ppt (Autosaved)Document32 pages2 National Accounting - Lecture 2.Ppt (Autosaved)Darren MgayaNo ratings yet

- Earn Profits: "Goodwill Is Nothing More Than The Probability That The Old Customer Will Resort To The Old Place."Document4 pagesEarn Profits: "Goodwill Is Nothing More Than The Probability That The Old Customer Will Resort To The Old Place."MayurRawoolNo ratings yet

- Exam 1 - VI SolutionsDocument9 pagesExam 1 - VI SolutionsZyraNo ratings yet

- Case6 AnswersDocument7 pagesCase6 AnswersNitesh Agrawal100% (1)

- 3rd Examination Test in AccountingDocument23 pages3rd Examination Test in AccountingNanya BisnestNo ratings yet

- Differential Cost and Differential RevenueDocument4 pagesDifferential Cost and Differential RevenueasadshakirNo ratings yet

- NCERT Solutions For Class 12 Economics Introductory Macroeconomics Chapter 2Document11 pagesNCERT Solutions For Class 12 Economics Introductory Macroeconomics Chapter 2Dimple BrahmaNo ratings yet

- DraftDocument2 pagesDraftthuhadt.yes20No ratings yet

- Econ NotesDocument8 pagesEcon NotesRonita ChatterjeeNo ratings yet

- Accounting Assesment SolutionDocument4 pagesAccounting Assesment Solutionasif tajNo ratings yet

- Accounting Cost Does Not Include Opportunity CostDocument3 pagesAccounting Cost Does Not Include Opportunity CostokaysigesigeNo ratings yet

- Cash Flow AnalysisDocument5 pagesCash Flow AnalysisHassanNo ratings yet

- Assignment 44Document14 pagesAssignment 44Khadar MaxamedNo ratings yet

- Principal of Accounting-1Document34 pagesPrincipal of Accounting-1thefleetstrikerNo ratings yet

- f3 Financial AccountingDocument11 pagesf3 Financial AccountingSam KhanNo ratings yet

- Unit 3 GoodwillitsvaluationDocument21 pagesUnit 3 GoodwillitsvaluationMir AqibNo ratings yet

- Pay Back Period, NPV, ROIDocument7 pagesPay Back Period, NPV, ROIAshwini shenolkarNo ratings yet

- W9. After-Tax Analysis PDFDocument31 pagesW9. After-Tax Analysis PDFCHRISTOPHER ABIMANYUNo ratings yet

- Be Stu - Tutorial 4Document18 pagesBe Stu - Tutorial 4Gia LinhNo ratings yet

- E Thomson CyDocument1 pageE Thomson CythuyhazinaNo ratings yet

- Numerical Illustrations On Determining Cash Flows For Investment AnalysisDocument2 pagesNumerical Illustrations On Determining Cash Flows For Investment AnalysisRajendran KajananthanNo ratings yet

- Test 3 Corprate FinanceDocument10 pagesTest 3 Corprate FinancekeelyNo ratings yet

- Answers To Text Questions and Problems in Chapter 8Document12 pagesAnswers To Text Questions and Problems in Chapter 8carynesssNo ratings yet

- CH01 Introduction To Accounting PDFDocument40 pagesCH01 Introduction To Accounting PDFindra6rusadie100% (1)

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- q1 Business Math Module 5Document17 pagesq1 Business Math Module 5Reigi May100% (2)

- Business Math 11 Q1M5Document16 pagesBusiness Math 11 Q1M5Lalie ESCNo ratings yet

- Control No 3 V MF XXVIII Tema B SolucionarioDocument7 pagesControl No 3 V MF XXVIII Tema B SolucionarioJohnny TrujilloNo ratings yet

- WACC Capital StructureDocument68 pagesWACC Capital StructuremileticmarkoNo ratings yet

- The Effect of Profits or Losses On CapitalDocument2 pagesThe Effect of Profits or Losses On CapitalCynNo ratings yet

- Intriioiiducintrotioniiiiiiiiiiiiiiiiiiiiiiiiiiiiii To Income StatementDocument3 pagesIntriioiiducintrotioniiiiiiiiiiiiiiiiiiiiiiiiiiiiii To Income StatementYashika RanaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Economic For Decision Making Assignment - 2Document5 pagesEconomic For Decision Making Assignment - 2saiNo ratings yet

- 10Document6 pages10saiNo ratings yet

- DemandDocument4 pagesDemandsaiNo ratings yet

- Unit 1-Demand and Supply - Consumer Behaviour: Micro Economics Macro EconomicsDocument3 pagesUnit 1-Demand and Supply - Consumer Behaviour: Micro Economics Macro EconomicssaiNo ratings yet

- Howtonote 1804Document14 pagesHowtonote 1804saiNo ratings yet

- Ques Bank Anna EDM 2022Document3 pagesQues Bank Anna EDM 2022saiNo ratings yet

- What Is Fiscal Policy?Document2 pagesWhat Is Fiscal Policy?saiNo ratings yet

- Orbis Export DATADocument22 pagesOrbis Export DATAAnthony Arcilla PulhinNo ratings yet

- Chapter 03 Valuing BondsDocument37 pagesChapter 03 Valuing BondsUmme SumaiyaNo ratings yet

- Trial BalanceDocument5 pagesTrial BalanceHanna Ysabelle AldeaNo ratings yet

- Intermediate Accounting: Shareholders' EquityDocument49 pagesIntermediate Accounting: Shareholders' EquityShuo Lu100% (1)

- McDonalds Financial AnalysisDocument11 pagesMcDonalds Financial AnalysisHooksA01No ratings yet

- Book AnalysisofFinancialStatementsDocument208 pagesBook AnalysisofFinancialStatementsusamamalik0915No ratings yet

- Bright Co. Dull Co. AssetsDocument5 pagesBright Co. Dull Co. AssetsJJ JaumNo ratings yet

- Indian Accounting StandardsDocument7 pagesIndian Accounting StandardsVishal JoshiNo ratings yet

- Gaurav Jain JN23PGC0Document14 pagesGaurav Jain JN23PGC0gaurav.jain.25nNo ratings yet

- Cash Flow Problems - Group 1Document7 pagesCash Flow Problems - Group 1TrixieNo ratings yet

- Practice-Exam - Principles of AccountingDocument7 pagesPractice-Exam - Principles of AccountingNg. Minh ThảoNo ratings yet

- AccauntingDocument37 pagesAccauntingSamurai JackNo ratings yet

- Change in Estimate and Error Correction Holtzman Company Is in PDFDocument1 pageChange in Estimate and Error Correction Holtzman Company Is in PDFAnbu jaromiaNo ratings yet

- Analysis of Financial Statements Solved MCQs (Set-2)Document6 pagesAnalysis of Financial Statements Solved MCQs (Set-2)VenkataRamana IkkurthiNo ratings yet

- Starbucks Corporation (SBUX) Balance SheetDocument2 pagesStarbucks Corporation (SBUX) Balance Sheetstevan joeNo ratings yet

- Longenecker-Materi KomplemenDocument13 pagesLongenecker-Materi KomplemenAtyaFitriaRiefantsyahNo ratings yet

- TUTORIAL CHAPTER 5 - Bad and Doubtful DebtsDocument3 pagesTUTORIAL CHAPTER 5 - Bad and Doubtful DebtsShowenah ThiruNo ratings yet

- MBS Corporate Finance 2023 Slide Set 4Document112 pagesMBS Corporate Finance 2023 Slide Set 4PGNo ratings yet

- Exercises 4Document19 pagesExercises 4Mrcool AtifNo ratings yet

- L-5 Recording Merchandising OperationsDocument55 pagesL-5 Recording Merchandising OperationsSabrina RahmanNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- CS FSM Excecutive Revision Series by CA CMA Suraj TatiyaDocument38 pagesCS FSM Excecutive Revision Series by CA CMA Suraj TatiyaAbhay WritesNo ratings yet

- Interm Acctng ReviewerDocument34 pagesInterm Acctng Reviewershaylieee67% (9)

- A Report Submitted in Partial Fulfilment of The Requirements of Master of Business Administration DegreeDocument44 pagesA Report Submitted in Partial Fulfilment of The Requirements of Master of Business Administration DegreeKunTal MoNdalNo ratings yet

Economic Profit

Economic Profit

Uploaded by

sai0 ratings0% found this document useful (0 votes)

13 views3 pagesEconomic profit considers total costs including opportunity costs, while accounting profit only considers explicit costs. Economic profit belongs to business owners and increases their wealth. Accounting profit is reported on financial statements. Three examples are given comparing the calculation of economic profit versus accounting profit in different business scenarios involving production costs, opportunity costs, and startup costs.

Original Description:

Original Title

2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEconomic profit considers total costs including opportunity costs, while accounting profit only considers explicit costs. Economic profit belongs to business owners and increases their wealth. Accounting profit is reported on financial statements. Three examples are given comparing the calculation of economic profit versus accounting profit in different business scenarios involving production costs, opportunity costs, and startup costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views3 pagesEconomic Profit

Economic Profit

Uploaded by

saiEconomic profit considers total costs including opportunity costs, while accounting profit only considers explicit costs. Economic profit belongs to business owners and increases their wealth. Accounting profit is reported on financial statements. Three examples are given comparing the calculation of economic profit versus accounting profit in different business scenarios involving production costs, opportunity costs, and startup costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

ADWAITH PRAMOD

22AA02

2. Differentiate Economic Profit versus Accounting Profit with

three applied mathematical examples.

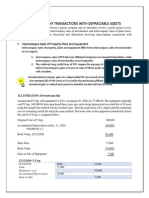

Economic Profit:

Economic profit is the difference between total revenue and total

economic

Total economic cost measures the opportunity costs of all the

resources used by the business (refer below image)

Which includes both market-supplied and owner-supplied resources,

and thus:

Economic profit = Total Revenues – Total Economic cost

Economic profit = Total Revenues - Explicit costs - Opportunity costs

Economic profit, when it arises, belongs to the owners of the firm,

and will increase the wealth of the owners

Examples of Economic Profit

1) Explicit costs amount to $5,000 and implicit costs to produce them

total $2,000. Using the formula above, we can determine that the

economic profit of producing these toys is

Economic Profit = $10,000 - $5,000 - $2,000 = $3,000

2) An individual starts a business and incurs start-up costs of $100,000.

During the first year of operation, the business earns revenue of

$120,000. This results in an accounting profit of $20,000. However, if

the individual had stayed at her previous job, she would have made

$45,000. In this example, the individual’s economic profit is equal to:

Economic Profit = $120,000 - $100,000 - $45,000 = -$25,000

3) If a company generates $10 per unit from selling t-shirts with a $5

cost per unit, then its gross profit per unit for t-shirts is $5. However,

if they could have potentially produced shorts with revenue of $10

and costs of $2 then there could be an opportunity cost of $8 as well:

Economic Profit = $10 - $5 - $8 = -$3

Accounting Profit:

Accounting profit is the difference between total revenue and explicit

costs

Accounting profit does not subtract from total revenue the implicit

costs of using resources

Depending on the type of financial statement and where it appears in

a statement, accounting profit goes by a variety of names such as

net income, operating income, net profit, or net earnings

Accounting Profit = Total Revenue – Explicit Costs

Examples of Accounting Profit

1) For example, if a person invested $100,000 to start a business and

earned $120,000 in profit, their accounting profit would be $20,000.

2) Let’s assume you own a T-shirt business. You made a revenue of

$150,000 from sales. And your explicit costs include:

$70,000 for raw material costs

$10,000 in payroll

$8,000 for factory rent per year

Accounting Profit = $150,000 – ($70,000 + $10,000 + $8,000) = $62,000

3) Company A produces iron used in construction. Over the course of

the year, they were able to generate revenue of $1.5 million by

spending $1 million on all the costs associated with the generation of

their product. As you can see from this example, Company A

managed to generate an accounting profit of $500,000, which is

worked out below:

Accounting Profit = $1,500,000 - $1,000,000 = $500,000

You might also like

- Integrative Case 1.1. WalmartDocument29 pagesIntegrative Case 1.1. WalmartMike rossNo ratings yet

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionLoleeta H. Khaleel67% (9)

- Intercompany Sale of Depreciable AssetsDocument2 pagesIntercompany Sale of Depreciable AssetsTriechia LaudNo ratings yet

- Revise Mid TermDocument43 pagesRevise Mid TermThe FacesNo ratings yet

- Leverage and Capital StructureDocument22 pagesLeverage and Capital Structureephraim100% (1)

- Case ChemaliteDocument1 pageCase ChemaliteRosario PhillipsNo ratings yet

- Chapter 1 Review of The Accounting Cycle of A Service and Merchandising BusinessDocument17 pagesChapter 1 Review of The Accounting Cycle of A Service and Merchandising Businesstim c0% (1)

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Accounting Vs Economic Profit-LectureDocument3 pagesAccounting Vs Economic Profit-LecturejaimepatriciomNo ratings yet

- Chapter 13 - The Costs of Production: Profit MaximizationDocument28 pagesChapter 13 - The Costs of Production: Profit MaximizationTường HuyNo ratings yet

- Bepmc 311: Managerial Economics: Module 4: Analysis of The Theory of Production, Cost, Revenue and ProfitDocument21 pagesBepmc 311: Managerial Economics: Module 4: Analysis of The Theory of Production, Cost, Revenue and ProfitAliezaNo ratings yet

- Quiz 2 Solutions...Document34 pagesQuiz 2 Solutions...Esmer AliyevaNo ratings yet

- Module 4-AFDocument10 pagesModule 4-AFShayan KhanNo ratings yet

- EconDocument3 pagesEconAngeline nchtNo ratings yet

- Pte 5Document3 pagesPte 5selse060No ratings yet

- Capital Budgeting Ch 2(1) (1) (1)Document50 pagesCapital Budgeting Ch 2(1) (1) (1)tariqNo ratings yet

- Chapter 1: Answers To Questions and Problems: Managerial Economics and Business Strategy, 6e PageDocument6 pagesChapter 1: Answers To Questions and Problems: Managerial Economics and Business Strategy, 6e PageVotues PSNo ratings yet

- Chap 001Document6 pagesChap 001Sana MahmoodNo ratings yet

- 1 Business Vs Economic Profit: Table of ContentsDocument8 pages1 Business Vs Economic Profit: Table of ContentsKashaf AmjadNo ratings yet

- Capital Budeting ProjectDocument19 pagesCapital Budeting ProjectPrathmesh BagweNo ratings yet

- Chapter 03Document12 pagesChapter 03Asim NazirNo ratings yet

- Cost of Production: Producer Behavior and SocietyDocument21 pagesCost of Production: Producer Behavior and SocietyDyisi DyisiNo ratings yet

- Economics 100 New Class 7 and 8Document9 pagesEconomics 100 New Class 7 and 8airtonfelixNo ratings yet

- Mfin202 Ch3 SolutionsDocument14 pagesMfin202 Ch3 SolutionsNayyar Abbas0% (1)

- How Do You Find The Optimal Output AlgebraicallyDocument7 pagesHow Do You Find The Optimal Output AlgebraicallyasfawmNo ratings yet

- Producer Decision MakingDocument17 pagesProducer Decision MakingsarasNo ratings yet

- The Determination of National IncomeDocument3 pagesThe Determination of National IncomeKyeame_Ghansah_6556No ratings yet

- Lilongwe University of Agriculture and Natural Resources Faculty of Development Studies Department of Agricultural and Applied EconomicsDocument43 pagesLilongwe University of Agriculture and Natural Resources Faculty of Development Studies Department of Agricultural and Applied EconomicsRil KelzNo ratings yet

- Google Form Model A.A University 1Document96 pagesGoogle Form Model A.A University 1Tesfu HettoNo ratings yet

- Act FinalDocument6 pagesAct Finalabu.sakibNo ratings yet

- Finance Final222Document7 pagesFinance Final222Mohamed SalamaNo ratings yet

- Profit Analysis: Concept of Profit Analysis Gross Profit Net ProfitDocument36 pagesProfit Analysis: Concept of Profit Analysis Gross Profit Net ProfitGiselleNo ratings yet

- AccDocument15 pagesAccMartin TrịnhNo ratings yet

- 2 National Accounting - Lecture 2.Ppt (Autosaved)Document32 pages2 National Accounting - Lecture 2.Ppt (Autosaved)Darren MgayaNo ratings yet

- Earn Profits: "Goodwill Is Nothing More Than The Probability That The Old Customer Will Resort To The Old Place."Document4 pagesEarn Profits: "Goodwill Is Nothing More Than The Probability That The Old Customer Will Resort To The Old Place."MayurRawoolNo ratings yet

- Exam 1 - VI SolutionsDocument9 pagesExam 1 - VI SolutionsZyraNo ratings yet

- Case6 AnswersDocument7 pagesCase6 AnswersNitesh Agrawal100% (1)

- 3rd Examination Test in AccountingDocument23 pages3rd Examination Test in AccountingNanya BisnestNo ratings yet

- Differential Cost and Differential RevenueDocument4 pagesDifferential Cost and Differential RevenueasadshakirNo ratings yet

- NCERT Solutions For Class 12 Economics Introductory Macroeconomics Chapter 2Document11 pagesNCERT Solutions For Class 12 Economics Introductory Macroeconomics Chapter 2Dimple BrahmaNo ratings yet

- DraftDocument2 pagesDraftthuhadt.yes20No ratings yet

- Econ NotesDocument8 pagesEcon NotesRonita ChatterjeeNo ratings yet

- Accounting Assesment SolutionDocument4 pagesAccounting Assesment Solutionasif tajNo ratings yet

- Accounting Cost Does Not Include Opportunity CostDocument3 pagesAccounting Cost Does Not Include Opportunity CostokaysigesigeNo ratings yet

- Cash Flow AnalysisDocument5 pagesCash Flow AnalysisHassanNo ratings yet

- Assignment 44Document14 pagesAssignment 44Khadar MaxamedNo ratings yet

- Principal of Accounting-1Document34 pagesPrincipal of Accounting-1thefleetstrikerNo ratings yet

- f3 Financial AccountingDocument11 pagesf3 Financial AccountingSam KhanNo ratings yet

- Unit 3 GoodwillitsvaluationDocument21 pagesUnit 3 GoodwillitsvaluationMir AqibNo ratings yet

- Pay Back Period, NPV, ROIDocument7 pagesPay Back Period, NPV, ROIAshwini shenolkarNo ratings yet

- W9. After-Tax Analysis PDFDocument31 pagesW9. After-Tax Analysis PDFCHRISTOPHER ABIMANYUNo ratings yet

- Be Stu - Tutorial 4Document18 pagesBe Stu - Tutorial 4Gia LinhNo ratings yet

- E Thomson CyDocument1 pageE Thomson CythuyhazinaNo ratings yet

- Numerical Illustrations On Determining Cash Flows For Investment AnalysisDocument2 pagesNumerical Illustrations On Determining Cash Flows For Investment AnalysisRajendran KajananthanNo ratings yet

- Test 3 Corprate FinanceDocument10 pagesTest 3 Corprate FinancekeelyNo ratings yet

- Answers To Text Questions and Problems in Chapter 8Document12 pagesAnswers To Text Questions and Problems in Chapter 8carynesssNo ratings yet

- CH01 Introduction To Accounting PDFDocument40 pagesCH01 Introduction To Accounting PDFindra6rusadie100% (1)

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- q1 Business Math Module 5Document17 pagesq1 Business Math Module 5Reigi May100% (2)

- Business Math 11 Q1M5Document16 pagesBusiness Math 11 Q1M5Lalie ESCNo ratings yet

- Control No 3 V MF XXVIII Tema B SolucionarioDocument7 pagesControl No 3 V MF XXVIII Tema B SolucionarioJohnny TrujilloNo ratings yet

- WACC Capital StructureDocument68 pagesWACC Capital StructuremileticmarkoNo ratings yet

- The Effect of Profits or Losses On CapitalDocument2 pagesThe Effect of Profits or Losses On CapitalCynNo ratings yet

- Intriioiiducintrotioniiiiiiiiiiiiiiiiiiiiiiiiiiiiii To Income StatementDocument3 pagesIntriioiiducintrotioniiiiiiiiiiiiiiiiiiiiiiiiiiiiii To Income StatementYashika RanaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Economic For Decision Making Assignment - 2Document5 pagesEconomic For Decision Making Assignment - 2saiNo ratings yet

- 10Document6 pages10saiNo ratings yet

- DemandDocument4 pagesDemandsaiNo ratings yet

- Unit 1-Demand and Supply - Consumer Behaviour: Micro Economics Macro EconomicsDocument3 pagesUnit 1-Demand and Supply - Consumer Behaviour: Micro Economics Macro EconomicssaiNo ratings yet

- Howtonote 1804Document14 pagesHowtonote 1804saiNo ratings yet

- Ques Bank Anna EDM 2022Document3 pagesQues Bank Anna EDM 2022saiNo ratings yet

- What Is Fiscal Policy?Document2 pagesWhat Is Fiscal Policy?saiNo ratings yet

- Orbis Export DATADocument22 pagesOrbis Export DATAAnthony Arcilla PulhinNo ratings yet

- Chapter 03 Valuing BondsDocument37 pagesChapter 03 Valuing BondsUmme SumaiyaNo ratings yet

- Trial BalanceDocument5 pagesTrial BalanceHanna Ysabelle AldeaNo ratings yet

- Intermediate Accounting: Shareholders' EquityDocument49 pagesIntermediate Accounting: Shareholders' EquityShuo Lu100% (1)

- McDonalds Financial AnalysisDocument11 pagesMcDonalds Financial AnalysisHooksA01No ratings yet

- Book AnalysisofFinancialStatementsDocument208 pagesBook AnalysisofFinancialStatementsusamamalik0915No ratings yet

- Bright Co. Dull Co. AssetsDocument5 pagesBright Co. Dull Co. AssetsJJ JaumNo ratings yet

- Indian Accounting StandardsDocument7 pagesIndian Accounting StandardsVishal JoshiNo ratings yet

- Gaurav Jain JN23PGC0Document14 pagesGaurav Jain JN23PGC0gaurav.jain.25nNo ratings yet

- Cash Flow Problems - Group 1Document7 pagesCash Flow Problems - Group 1TrixieNo ratings yet

- Practice-Exam - Principles of AccountingDocument7 pagesPractice-Exam - Principles of AccountingNg. Minh ThảoNo ratings yet

- AccauntingDocument37 pagesAccauntingSamurai JackNo ratings yet

- Change in Estimate and Error Correction Holtzman Company Is in PDFDocument1 pageChange in Estimate and Error Correction Holtzman Company Is in PDFAnbu jaromiaNo ratings yet

- Analysis of Financial Statements Solved MCQs (Set-2)Document6 pagesAnalysis of Financial Statements Solved MCQs (Set-2)VenkataRamana IkkurthiNo ratings yet

- Starbucks Corporation (SBUX) Balance SheetDocument2 pagesStarbucks Corporation (SBUX) Balance Sheetstevan joeNo ratings yet

- Longenecker-Materi KomplemenDocument13 pagesLongenecker-Materi KomplemenAtyaFitriaRiefantsyahNo ratings yet

- TUTORIAL CHAPTER 5 - Bad and Doubtful DebtsDocument3 pagesTUTORIAL CHAPTER 5 - Bad and Doubtful DebtsShowenah ThiruNo ratings yet

- MBS Corporate Finance 2023 Slide Set 4Document112 pagesMBS Corporate Finance 2023 Slide Set 4PGNo ratings yet

- Exercises 4Document19 pagesExercises 4Mrcool AtifNo ratings yet

- L-5 Recording Merchandising OperationsDocument55 pagesL-5 Recording Merchandising OperationsSabrina RahmanNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- CS FSM Excecutive Revision Series by CA CMA Suraj TatiyaDocument38 pagesCS FSM Excecutive Revision Series by CA CMA Suraj TatiyaAbhay WritesNo ratings yet

- Interm Acctng ReviewerDocument34 pagesInterm Acctng Reviewershaylieee67% (9)

- A Report Submitted in Partial Fulfilment of The Requirements of Master of Business Administration DegreeDocument44 pagesA Report Submitted in Partial Fulfilment of The Requirements of Master of Business Administration DegreeKunTal MoNdalNo ratings yet