Professional Documents

Culture Documents

Markup Vs Margin

Markup Vs Margin

Uploaded by

Alexis VictorioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Markup Vs Margin

Markup Vs Margin

Uploaded by

Alexis VictorioCopyright:

Available Formats

Markup vs Margin

When you’re developing your pricing strategy, projected financial

statements or even calculating financial ratios on your past year’s performance,

you’re going to hear the terms markup and margin. Two important terms, with very different meanings.

These are two terms you do not want to mix up!

Markup refers to the profit made from a good/service, related to it’s cost.

As a percentage, markup is calculated as: Selling Price ‐ Cost

Cost

Here’s an example:

Product Cost = ₱700 Selling Price = ₱1000

Markup = ₱1000 ‐ ₱700 = 42.9%

₱700

Margin refers to the profit made from a good/service, related to its selling price.

As a percentage, margin is calculated as: Selling Price ‐ Cost

Selling Price

Let’s apply this calculation to the last example:

Margin = ₱1000 ‐ ₱700 = 30%

₱1000

So we can see that Markup and Margin are very different, and can’t be used interchangeably in calculations!

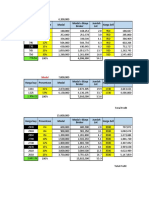

Here’s a quick‐reference markup vs margin chart:

Markup % Margin % Markup % Margin %

10 9.0 60 37.5

20 16.6 65 39

25 20 70 41.1

30 23 75 42

35 25 80 44.4

40 28.5 85 45

45 31 90 47

50 33.3 95 48.7

55 35 100 50

You might also like

- Project Finance - Test - QuestionDocument18 pagesProject Finance - Test - QuestionDeepika67% (3)

- Markup Vs Margin: Markup Refers To The Profit Made From A Good/service, Related To It's CostDocument1 pageMarkup Vs Margin: Markup Refers To The Profit Made From A Good/service, Related To It's CostZzzdddNo ratings yet

- Chapters ExcelsDocument50 pagesChapters ExcelsDimple PandeyNo ratings yet

- Central Dep. SerDocument18 pagesCentral Dep. ServishalNo ratings yet

- 2LM4 Hidalgo Activity1Document4 pages2LM4 Hidalgo Activity1alyannahhidagoNo ratings yet

- 2LM1 Milan Ma YsabellaDocument4 pages2LM1 Milan Ma YsabellaBella AdrianaNo ratings yet

- Rubric Points CalculatorDocument6 pagesRubric Points CalculatormassagekevinNo ratings yet

- PracticeDocument2 pagesPracticeAbel CarrNo ratings yet

- Pricing Strategy: I I O M, BDocument5 pagesPricing Strategy: I I O M, BPraveen RevankarNo ratings yet

- Indika Energy Company Update 13 September 2012-1Document116 pagesIndika Energy Company Update 13 September 2012-1AJoshuaNo ratings yet

- Advanced Capital Budgeting 3 HW - q7Document3 pagesAdvanced Capital Budgeting 3 HW - q7sairad1999No ratings yet

- Icici Pru LifeDocument18 pagesIcici Pru LifevishalNo ratings yet

- Planning Construction MaterialsDocument37 pagesPlanning Construction MaterialsIshwor PrajapatiNo ratings yet

- Higher Check in - 2.03 Percentages: ExtensionDocument4 pagesHigher Check in - 2.03 Percentages: ExtensionKyleNo ratings yet

- Grafica de Granulometria: % Retenido ( ) / ( )Document3 pagesGrafica de Granulometria: % Retenido ( ) / ( )anyNo ratings yet

- Bharat DynamicsDocument18 pagesBharat DynamicsvishalNo ratings yet

- You Exec - Budget Proposal FreeDocument8 pagesYou Exec - Budget Proposal FreeRavi MishraNo ratings yet

- Computing The Value of A Growing Finite AnnuityDocument10 pagesComputing The Value of A Growing Finite AnnuityMahmood AhmadNo ratings yet

- Jasika RM LabDocument92 pagesJasika RM LabJessica NigamNo ratings yet

- Exercise 5 Activity 5Document2 pagesExercise 5 Activity 5Omar KatogNo ratings yet

- Tabel MM MNCNDocument5 pagesTabel MM MNCNKhairu SyuhadaNo ratings yet

- Year 0 - 8000 - 8800 1 7600 6800 2 7800 7600 3 8400 7800 4 9600 7950 5 9800 8300 6 8450 7 8900 8 9300 Project Rose Project LilyDocument2 pagesYear 0 - 8000 - 8800 1 7600 6800 2 7800 7600 3 8400 7800 4 9600 7950 5 9800 8300 6 8450 7 8900 8 9300 Project Rose Project LilySourav SinghNo ratings yet

- Case For Project FinanceDocument21 pagesCase For Project FinanceKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Corpo FinDocument24 pagesCorpo FinShaikh Saifullah KhalidNo ratings yet

- Bivariate Regression+Case+StudiesDocument15 pagesBivariate Regression+Case+StudiesMANJISTHA MUKHERJEENo ratings yet

- Project Finance Test QuestionDocument18 pagesProject Finance Test QuestionKAVYA GUPTANo ratings yet

- Micro Eportfolio Monopoly Spreadsheet Data - SPG 18 - FinalDocument4 pagesMicro Eportfolio Monopoly Spreadsheet Data - SPG 18 - Finalapi-302890540No ratings yet

- Dynamic Cone Penetrometer Test (D C P)Document5 pagesDynamic Cone Penetrometer Test (D C P)eko bari wNo ratings yet

- Motherson SumiDocument18 pagesMotherson SumivishalNo ratings yet

- Initial CapitalDocument48 pagesInitial CapitalDarshan ThakurNo ratings yet

- ABC Analysis FinalDocument3 pagesABC Analysis FinalJoyal GeorgeNo ratings yet

- 01 Task Performance - Management ReportingDocument2 pages01 Task Performance - Management ReportingMillania ThanaNo ratings yet

- Key Performance Indicators (Kpis) : FormulaeDocument4 pagesKey Performance Indicators (Kpis) : FormulaeAfshan AhmedNo ratings yet

- Stock Price: Dividend YieldDocument21 pagesStock Price: Dividend YieldEmre UzunogluNo ratings yet

- Uts Avakova 2Document23 pagesUts Avakova 2titilailyhajiriahNo ratings yet

- Six SigmaDocument27 pagesSix SigmaTanzeel HassanNo ratings yet

- Introduction To Financial Modeling 2Document25 pagesIntroduction To Financial Modeling 2Habib AhmadNo ratings yet

- Theory of Costs A ReviewerDocument11 pagesTheory of Costs A ReviewerRina SoNo ratings yet

- L30 33 InventoryControlDocument26 pagesL30 33 InventoryControlHarsh KumarNo ratings yet

- Vlookup FunctionDocument3 pagesVlookup FunctionMike CharlieNo ratings yet

- Practice 5 Interim Reporting Progressive Corporate Tax Rate Year 1 200,000Document4 pagesPractice 5 Interim Reporting Progressive Corporate Tax Rate Year 1 200,000GianNo ratings yet

- Example of ABC Pareto Analysis For Inventory ManagementDocument3 pagesExample of ABC Pareto Analysis For Inventory ManagementDIEGO2109No ratings yet

- InventoryDocument68 pagesInventoryashu tkNo ratings yet

- Q3 - Analysis and Discussion (Ratios)Document7 pagesQ3 - Analysis and Discussion (Ratios)hannahudNo ratings yet

- L&T Fin - HoldingsDocument18 pagesL&T Fin - HoldingsvishalNo ratings yet

- Albsl Report NMBLDocument6 pagesAlbsl Report NMBLNayan MallaNo ratings yet

- LBSL Weekly Stock Market Report 11 July 2019Document11 pagesLBSL Weekly Stock Market Report 11 July 2019Mohammad YusufNo ratings yet

- Chapter 5: The Production Process and Costs Answers To Questions and ProblemsDocument7 pagesChapter 5: The Production Process and Costs Answers To Questions and ProblemsGaurav KarkiNo ratings yet

- 02 FCF Vs EcfDocument5 pages02 FCF Vs EcfRoberto Sanchez MarquinaNo ratings yet

- Basic Three-Sided Market ModelDocument6 pagesBasic Three-Sided Market Modelisaiah8195No ratings yet

- Manual Benninga Finacial Modeling PDFDocument82 pagesManual Benninga Finacial Modeling PDFomar100% (1)

- IPC 9511 Energy SavingsDocument5 pagesIPC 9511 Energy SavingsOmar MuqtharNo ratings yet

- Exercise Discussion PDFDocument14 pagesExercise Discussion PDFKuzaimah AbdullahNo ratings yet

- Project Schedule and Cash FlowDocument1 pageProject Schedule and Cash FlowAndrei SenoNo ratings yet

- Output SPSSDocument76 pagesOutput SPSSmuliadin_74426729No ratings yet

- Mergers and AquisationsDocument10 pagesMergers and AquisationsNeeraj KumarNo ratings yet

- Product Annual Consumption (In Units Per Item) Price Per Unit Annual Consumption ValueDocument2 pagesProduct Annual Consumption (In Units Per Item) Price Per Unit Annual Consumption Valueashti gosineNo ratings yet

- General Study On "Implied Volatility"Document24 pagesGeneral Study On "Implied Volatility"Nikhil kapadiyaNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)