Professional Documents

Culture Documents

Form 1040 2019-3

Form 1040 2019-3

Uploaded by

Mediaite0 ratings0% found this document useful (0 votes)

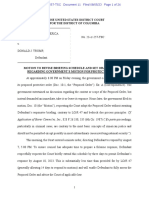

5K views70 pagesTRUMP TAX RETURN 2019 (3)

Copyright

© Public Domain

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentYou are on page 1of 70

Depreciation and Amortization sete, cette

rom4 562 a

(Including Information on Listed Property) 2019

Dept aay

Inter Revenie Service pasate yauriae return. attachment

i) > cote muvw.irs.cov/Form4s62 for instructions and the latest information. Sequence No. 479

Name(s) shawn on return f= oF Baro wen i Torn Feats [denying number

DONALD J & MELANIASTRUM RUMP INTERNATIONAL GOLF CLUB

‘SCOTLAND 1

Part Election To Expense Certain Property Under Section 179

Nota: you have ay sted property, complete Part V before you complete Pat

1 Waximum amount (eee instruciona) = z

2. Total com of section 179 propery placed inser see nsrudions) = sv tL

13. Threshold cost of section 179 property before reduction in imitation (see Instructions) + + 3

44 Reduction in imitation. Subtract ne 3 trom line 2. If zero or less, enter -O-« + + + Bere a

‘5 olla liitaton for tax year. Subtract Ine 4 from tne 1. I zere oles, enter If mare fi ing septa,

6 (a) Description of property © a Rar use | (¢) Elected cost

7 Usted property. Enter the amount Fomine 29... =... he

18 Total elected cost of section 179 property. Ads amourts In eon (cine 6 and 7 Ls

8 Tertatve deduction, Enter the smaller of ineSorling 8s + 2 es ee Sere

20 Carryover of disallowed deduction from line 13 of your 2018 Form 4562.- + + + Bee lao!

414 Business income limitation, Enter the smaller ef business income (not less than zera) orline 5. See

Instructions, : Sree glee ese uae ae [ae

42 Section 179 expense deduction. Add lines 9 and 10, but dont enter more than tine 11+ + + + + + paz

13._Corryover of disallowed deduction to 2020, Add Enes 9 and 10, lessline 12 [ a3]

‘Note: Don't use Part If or Part III below for isted property, Instead, use Part V.

Parti Special Depreciation Allowance and Other Depreciation (Don’t include lated property, See instructions)

14 Spel deprecation nlowance fr gn repay (aer thn ted rope) Haren seve Gg the

sax year. See inetictons, = + Pace eee ee aes eis [ae

35 Property sublect tm section 16001) lesion Ss eee ee eee [ae

46 _Ctner deprecation Ickdng ACRS) + + + ss wes Ges s faa

aii MAGRS Depreciation (Don'€indude [sted provety. See istuctions.)

‘Section A

7 WACRS deductans for eels phced h sevice nfax yeas beginning belore 2017

+18. Ifyou are electing to group any ase placa nsevice dung te tax year into one or more general asset,

Moun CNN ee Ed

Section BAsaets Pnesd in Series Duving 2019 Tax Your Using Wha General Depreciation SSM

(e) Be for

by Month and | erection

(3) clases of head Coninerfreimene | (Ofer | ay convertion] ct Heted | ‘epson

nyse isvtons)

oa Tyer nae

5-Yeor property

€ Fear property

a iO-yenr eeperty

e 15 yer property

20-year property

yer orpery ye a

T Reser eral sve om si

oper TSyis i Sh

Tonsil ea 3 7 Si

oper) wn Si

Secon C~Assets Placed in Service During 2019 Tax Vans Using the alternative Depreciation System

Boa Gass ie

b B2-year

fe 30-yenr

a 40-yeor

Part iv Summary (See instructions)

7H Usted propery. Enter amount fromiine 28 © > 7 + E Te Pe

22 Tota. a amount rom ine 12, nes 34 though 17, ne 19 and 20 clu (), ae ne 21 re

and on the appropriate lines of your return, Partnerships and S corporations—see instructions = - + + + | 22

Sit

s/t

Sit,

Si

7s

30 yes.

a0 yrs

123 For assets shown above and placed inservice during the current year, enter the

Portion ofthe basis acviourabe fo Section 253A costs es

23

For Paperwork Reduction Act Notice, see separate Instructions.

Tat Ne, 72506N1

Form 4562 (2010)

Form 4562 (2019) Page 2

PartV Listed Property (Include autowobles, certain other vehices, certain aircraft, and property used Tor entertainment,

recreation, or amusement.)

Note:For any vehicle for vihich you are using the standard mileage rate or deducting lease expense, complete only

24a, 24b, columns (a) through (c) of Section A, all of Section 8, and Section C if applicable,

Section A—Depreciation and Other Information (Caution: See the instructions for mits for passenger automobiles.)

£249 09 you have evidence to support the busneteinvestment use camed? [Iyer LIne _|24b ites," isthe evidence writen? Clee CINo

©, 7

@ el @ Bast tor Seeecston | ped 9, cates

“ype or nopery (it invesenont | cost rather = resarery | tatagy | Depron’ o

‘le fe) ‘ee ‘a (utrem/eveciment | SEIT | ctrwerton | 'deducton’ | section 179

centage ‘sean on

25" Spcal doractonalovace fox auf sd property Pac sees ding thet veer

and used more than 50% in a qualified business use, See structions, Hee

Ze Property used more than 50% in qualfied business use:

2 Propariy used SOs or ise p 9 qualified business we

se Is

we Ef

‘28 Add amounts calum (hj, nes 25 Gough 27. Enter here and on lve 2, pose P

£29 Add amounts in column (0) tne 26. Enter here and online 7, page 1+ vs ss es 23

‘Section B—Information on Use of Vehicles

Complete this section for vehicles uses by a sole proprctar, partner or other "more then SY owner,” or related person If you provided veces to

Your employees, first answer tne questlons In Sesion Cta see you meet an exception to comet tis section for chase vetiles

(a oy te) @ | o

vehicles | veticle2 | vente | vente | vehicles | venice 6

2s

30 Total businassinvestment miles crven during the year

(on Incuge commucng miles) = ss +

‘34 Total commuting miles criven during the years

‘32 Total szher personal(noncommuting) mies driven.

35 Toa mis dendrite year. Aas Ines 30

trough 3200 beats

34 os ee efor pr we yes [No [ves [No | ves [No [Ves [No [Yes [No |¥es [No

uring of duty ROUTS? ee

‘35 Was the vehicle use primarily by 2 more than 5%

boner errlatee person? .

[36 Is another vehicle available for personal use?"

‘Section C= Quastions for Eraployers Who Pravide Vehicles Yor Use by Thalt Employees

‘Answer these questions to determine if you meet an exception to completing Section for Vehicles used By employees who aren't mare than S%

‘Swers or related persons, See Instructons

37 bo you attain writen pole satemert that rosa peter u of eles, nung crs, by your Yes | No,

employes? se se tite ttt te

‘38 be you attain a wren goley statement tht probs pesoal se of vi ecg cammuting, by yor eplyees?

See the instructions far vehicies used by coxporate officer, clracto's, a 194 a more oaers

39 Do you treat all use of vehicles by employees as personal use? eesti etetuete

“40bp you rovde more tan ve velo your employees, cain nrormatien fom your employes abot thes of

vehleles, and retain the infermaton recelves? ‘

41 Do you mest the requirements concerning sualfied automobile demorstration use? See Instuctons. «

Note: if your answer to 37, 38,38, 4, oF 41s "Yes," don® complete Secon 8 forte covered ves.

Fart Vi Amortization

o ore ey ) oan ,

Descrpttonorensts | amarson | Amortzle oe riod or en

vt . mount section . this year

cans percentage

‘42. Amortizaton of casts that begins during your 2019 tax year (Gee instructions)

“43 Amortization of costs that bepan betore your 2019 tax year». eTecreeeeS eat [ea

44 Total Add amounts in column (1. See the instructions for where toreport_» . ss ss + | 44

Form 4562 (2015)

SSN:

‘Spouse SSN:

Name: DONALD J & MELANIACTRUMP

(afile GRAPAIC

TY 2019 Ite

‘DO NOT PROCESS [LATEST DATA

ed Other Categories Statement

roduction

Name: DONALD J & MELANIA

2. Maximum Value ofA Depost Accounts =. = e =

‘3. Number of Custodial Accounts (eperted Pat V) >

“4. Maxim Value of Al Custodial Accounts 3

5, Were any foreign depos or custodial accounts closed cng the taxyeer? ~ ves wo

Parti Other Foreign Assets Summary

7. Number of Foreign Assets (eported in Pat). >

2. Maximum Value of A Asses (eporiedin Part V) : =

3 Wore ary foreign assateacmured or sold cutrg tha axyear?. ss ~. +. Gye One

Patil Summary of Tax ome Attributable to Specified Foreign Financial Assoto (se instucions)

7 {@) Amount reper Where reporied

(2) Asset Catego i taxtom | sniormor schedule @ramandine io) Sched and na

7 Foreign Depost and [fainirest

Custodial Accounts rib Dvidends

“¢ Royals 5 | |

‘a other income (6 1 |

“fe Gains (osses) —_[S [ I

fDeductons 8 { it

1g Credits is I I

2 Other Foreign Assets [2a Interest is [ I

[2b Dividends. \s | |

[2c Royattes |s | I

[2a.other income [5 | L

[2e Gains (losses) |S | I

[ztDeductins —_S L I

[2a creas is L L

Part IV Excepted Specified Foreign Financial Assets (see instructions)

If you reported specified foreign financial ascets on ore of more of ha folowing for, enter the huribar of such forme fled. Vou do not need to

Include these assets on Form 8838 forthe tax year.

4. Number of Forms 9820 2. Number of Forms 3620-4 3. Number of Forms 5471 1

4. Number of Forms 8621 5. Number of Forms 8885 4

PartV Detailed Information for Each Foreign Deposit and Custodial Account Included in the Part |

jummary (s2¢ instructions)

‘you have more than one account fo report in Pa V,alach& continuation statement for each eddlional account (eee ierucions)

ata CF topest EY a Fea aber ot ean

3 Check all that apply a C] Account opened during tax year b (1 Account closed during tax year

¢ C1 Account jointly owned with spouse d CI Notax item reported in Part iit with respect to this asset

1 areca eee eae ats ¥

5 Did you use a foreign currency exchange rate to convert the value of the account into U.S. dollars? O Yes C1 No

6 Tyou annette corm al hao

Se cane | Matias ses ale Tal Pa Tae ITE

te Fowgncurensynvnin | Eon ous dere (Ge eta Departs Buca ote Peal

fies

sare a a aa Cat Ne SER Fa BOT

Form 8838 2918) Page 2

Part Detailed Information for Each Foreign Deposit and Custodial Account Included in the Part |

‘Summary (see instructions) (continued)

7a _ Name of nancial nattution in whieh account is mainiained _b Global intermediary dentfcation Number (GIN) Opto)

‘8 Maling aderese of financial inattion in whieh aeoount& malntabed. Number, sree, and room or sullen.

Oli or Town, Sate or province, and county (ncuaing postal cade}

Part Vi__Detailed Information for Each “Other Foreign Asset” Included in the Part ll Summary (see instructions)

Tryeu have moe Tan one asset fo report Parl Vi. allach a continuation statement Tor each addiional asset (ese instiucTons)

"1 Description af asset 7 Waning number or other designation

3 Compete al that apply. See insuctons for reparting of muliple scquston or deposition dates

‘4 Date asset acquired during tax year, if applicable

3 Dae ase dose o dng iax year, apleble fee taaee

© C1 Check asset jointly owned with spouse U1 check if no tax item reported in Part Ill with respect to this asset

4 Maximum value of asset during tax year (check box that applies)

= 11 $0- $50,000 b C1 $50,001 - $100,000 ¢ C1 $100,001 - $150,000 a (2 $150,001 - $200,000

ita dP BS oc, e auee area nasty

5 Did you use a foreign currency exchange rate to convert the value of the asset into U.S. dollars?. O yes C1 No

€_Myeuanewered "ax tw compe a htop

Forage emrany ann] FOG TE] SEARS wd Sarena ae no OTTO

(2) Foreign cxvncyinwicn | OE ret iw US cers eS Froauy Gepertrente Buea tte Fecal

Sevdoe

"7 Wasset reported on Ine 1 Sock ofa Toregn anily or an lareat na fovaign any, enter th folowing wformalion fo ie aSSaL

8 Name of foreign entity GIN (Options

© Typeofforeignentty (4) C] parnership 2) C1 Corporation (a) Trust (@ 01 estate

1d Maling address of foreign ently. Number, street, and room or sue no,

(@Gilyortown, state or provines, and country (neuding postal code)

8 _Tasset reported on Ine Tle rl lock of &Toelgn any or an ifarestin a reign eri, enter Te Yolowing Formation for The asso

Note. ithis asset has more than ane issuer ar counterparty, attach a continuation statement withthe same information for each

‘ckitonal issuer or counterpart (see instructions).

a Name of sever or counterparty

Check information is for OD twaer canigany

b Type of issuer or counterparty

() Individual (2 C1 Partnership (3) C1 Corporation (4) CI) Trust (5) CI Estate

© Checkifissuer or counterparysa TE] ys, person El Fosin ponon

Mating address of issuer or counterparty, Number, steet, and 1oom or sult no

‘© Gaver town, state or province, and country (wcluding postal code)

Form 8838 (2015)

DONALD J & MELANIACTRUMP

Farm 8006-4 2010)

Patil’ Phase@in Reduction

Page

onset Pat ont your taxable nome mare an $76 70 bl na $270 T0 (5760725 a $270 72S maa tg SaparaTey HAH 40 ad SAE AOOT

‘maroc hing jonty)andina fOr less han ine’ Ofer, se Pa I,

a 8 ©

47 Enter amouns emtnes eee amr

18 Emertne amounts om ie 10 seeeereiee

19 Subvactine 18 vomine 17 : eee

20 Ta1abeincome bor qalficg

Baineincome deduclon =. | 20 2ersams

21 Theshol. Ener 8180700 (6190725:

mated ng separate 8221400

mae ng ney)

Ue eee at

22 Subractine 2 fom ine 20 B

23. Phasoinango. Erte $80,000

(6100000 merraa ing joy) — | as

24 Phasoin pecantago Divide ne 22y|

fine 29 nee 4 +

25 Toalphasein resueton Mlb ine 1b me 24 Series

26 uated nusnessncone ser phan duction. Swat

‘ino 25 tfom in 1. Erte mount Neeson Ine 12 forthe

‘corcrpendng vada obucnese| ei .. [a

Fart Determine Your Qualified Business Income Deduction,

"27_Totl qualified bsnoaansame camparet rom al ques Wades, bosnesen, oF

‘oafagalona. Ena the smeunt Fomine paeee eal dar

28 Quatied REIT aidars and publiyvaded parnership (TP income or fos). Se=

Ineeuctons ra a

29° Qualied REIT dvidends and PTP os) canyfonwars tom por years . De

30 Teal quale REIT dvdends and PTP incore. Canine nes 28 and 29 lees han zero,

eee be 7 »

31 RET and PIP component. Mutiny tne 90 by 20% (20) .. De

32 Quali business income deduction before the nea nian, Add nes 27 ane 31 F 7 Le

33 Tasabisicame before quafed brass income seduclon aii Le 2976.73

134 Net captl gin. See instructions piesa 5 3a 227637

38. Subtracting 34 fm ne 3. Ize ora, nt -0- 3s °

38 Incomaliton. tp ne 35 by 20% (0.20) ED

137 Qualted business income deducton before he coms production aetvles deduct (OPAD) under

‘Seetion T95A()- Ener he smal of Ine 32 ore 38 pee oe oar

‘38 PAD uncer secon T88A() located tom an aprcutra or hricuuralesoperave, Do eter more than ne 38 minus he

a

39 Tal qafed turns income deduction. A nes 37 and 38 ea se 2. Dae

440, Total quafed RET ditends and FTP (oss caryfomard. Combine Ines 28 and 2,20 or eee,

enter. moe ne «0

Fam BEACH,

[ele GRAPHIC print DONOT PROCESS ETT)

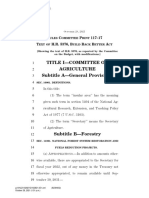

rom 8995-A Qualified Business Income Deduction OB ie ee

sal sagonaecgin 2019

Go to wines. govFormB90SA for Instructions andthe atest information,

" ‘tachment

Intl Rove Sere

Sequence No. S5A

Tana aan Tea

Part! Trade, Business, or Aggregation Information’

‘ome te schedules for Form 996A, (A B,C, andr, a5 appt, befor sara PartT Aaah edeona schedules whan needed, Soe hetetons

: (a) Ted, business, cr agarensten name ‘wcrecc# | (ercneacr | (a) Texpayer ]fe) check paton|

ptchiadserece | agoreseion | Wenieton

Determine Vour Adjusted Gualified Business Income o

A 8 c

2 Qusffed business come fem the rad, business or aggregation. See

Irerstene 2

3 Mati tne 2 by 20% (020). tyour taxable income ie $180,700 or

($160,725 fared fing separtoy $321,400 maria tins Ja),

hip nes 4 trough 12 end ene the aunt from ine' anne 13

4 Alocabe share of 2 wage rom he wade, ousnees er agaregaton|

5 Muli ne 4 by 0% (2.50) 7 @

8 ttpy Ine by 25% (225) @

7 Alcan nectine rag bask naa ae ston

(UBtA) ta gaits prose, is 1

18 Mul ino 7 by 2.5% (0.028) 7 : fe

3 Add ines Band Se 3

10 Enertte geaterotineSorines rm

11 Wz uage and uae ropa tan Eriorhe eater one or

Tne 12 "

12 Phacownteduten, Enar amount fom line 26, tony

Seeinsiniors| 2

43. Guanes busess reome deavton bee pston edn, Ene he

Stetar ote 1 rine 2 2

14 Pane. tere aoun tom Seta D orn 65. ne

eteny 1“

45 Qiatiedbusness income compenant sutectine i4tomiine 13. is

18 Tou quate sins income component Aaa aroun repre

FFF RTS PTT PS SOFTEE

[efile GRAPHIC print DO NOT PROCESS [LATEST DATA DEN: 16221688991110)

TY 2019 Foreign Tax Credit Carryback

Computation Statement

Nam

ssi

‘Spouse SSI

Explanation:

2017 FR TX PD 490680 CARRYOVER 490680 2016 FR TX PD 1254108 CARRYOVER 1254108 2015 FR

TX PD 465747 CARRYOVER 465747 2014 FR TX PD 550298 CARRYOVER 550298 2013 FR TX PD

1002346 CARRYOVER 1002346 2012 FR TX PD 363405 CARRYOVER 363405 2011 FR TX PD 346519

CARRYOVER 346519 2010 FR TX PD 2010500 CARRYOVER 2010500 2009 FR TX PD 1401174 FTC

CLMD 302915 CARRYOVER 1098259

DONALD 7 & MELANIA

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Trump IRS Form 1040 2017-1Document284 pagesTrump IRS Form 1040 2017-1Paul Conner75% (4)

- Trump V USA Detailed FilingDocument11 pagesTrump V USA Detailed FilingMediaite100% (1)

- Trump DelayDocument24 pagesTrump DelayTroy Matthews100% (4)

- DOJ Opposition To Trump Motion For ExtensionDocument2 pagesDOJ Opposition To Trump Motion For ExtensionBrett Meiselas100% (4)

- Motion For Order of Protection Trump TrialDocument4 pagesMotion For Order of Protection Trump TrialMediaite100% (1)

- Proposed Text Order of Protection Trump TrialDocument5 pagesProposed Text Order of Protection Trump TrialMediaiteNo ratings yet

- Form 1040 2020-3Document96 pagesForm 1040 2020-3MediaiteNo ratings yet

- Form 1040 2020-2Document104 pagesForm 1040 2020-2MediaiteNo ratings yet

- Form 1040 2019-2Document136 pagesForm 1040 2019-2MediaiteNo ratings yet

- Form 1040 2020-1Document150 pagesForm 1040 2020-1MediaiteNo ratings yet

- Form 1040 2015-1Document128 pagesForm 1040 2015-1MediaiteNo ratings yet

- Form 1040 2018 - 1Document157 pagesForm 1040 2018 - 1MediaiteNo ratings yet

- Form 1040 2017-2Document210 pagesForm 1040 2017-2MediaiteNo ratings yet

- Statement Medical AssociationsDocument3 pagesStatement Medical AssociationsMediaite100% (1)

- Text of H.R. 5376, Build Back Better Act As of 10-28-21Document1,684 pagesText of H.R. 5376, Build Back Better Act As of 10-28-21MediaiteNo ratings yet