Professional Documents

Culture Documents

Subway2 24

Subway2 24

Uploaded by

sll994Copyright:

Available Formats

You might also like

- Sharpe Ratio Optimal PortfolioDocument2 pagesSharpe Ratio Optimal PortfolioIam LeongNo ratings yet

- Spreadsheet 8 1 SAMPLEDocument48 pagesSpreadsheet 8 1 SAMPLEAnsab ArfanNo ratings yet

- Financial Ratio Analysis: (AIA Engineering LTD.)Document14 pagesFinancial Ratio Analysis: (AIA Engineering LTD.)kalathiadhavalNo ratings yet

- Load CombinationDocument1 pageLoad CombinationCyril SoldevillaNo ratings yet

- The Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramDocument2 pagesThe Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramhenriquegonferNo ratings yet

- Evaco 2 FDocument5 pagesEvaco 2 Fsahil gohadNo ratings yet

- Component Weight InformationDocument2 pagesComponent Weight InformationFarbod Jz.No ratings yet

- Ratio Analysis of Consumer DurablesDocument22 pagesRatio Analysis of Consumer DurablesNishant PahujaNo ratings yet

- Greasing Electric Motors Part 1Document4 pagesGreasing Electric Motors Part 1kidlatzNo ratings yet

- Dimensional Drawing: Features Features Absolute Maximum RatingsDocument2 pagesDimensional Drawing: Features Features Absolute Maximum RatingscizetawwwNo ratings yet

- Endogeneity AnalysisDocument3 pagesEndogeneity AnalysisdebwanismailNo ratings yet

- Two Stage Evaporator: InputsDocument5 pagesTwo Stage Evaporator: InputsHina JagnikNo ratings yet

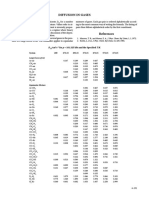

- Diffusion in Gases: /CM S For P 101.325 Kpa and The Specified T/KDocument2 pagesDiffusion in Gases: /CM S For P 101.325 Kpa and The Specified T/KRenan Rosa FerreiraNo ratings yet

- Che 541 Exam QuestionDocument8 pagesChe 541 Exam QuestionAnavheoba AbrahamNo ratings yet

- Corporate Climate Risk and Bond Credit Spreads - 2024 - Finance Research Letters 4Document1 pageCorporate Climate Risk and Bond Credit Spreads - 2024 - Finance Research Letters 4JohnNo ratings yet

- Bank Performance AnalysisDocument10 pagesBank Performance AnalysisSurbhî GuptaNo ratings yet

- Panel 1: Risk Parameters of The Investable Universe (Annualized)Document1 pagePanel 1: Risk Parameters of The Investable Universe (Annualized)JosuaNo ratings yet

- To 92 PackageDocument2 pagesTo 92 PackageBaco_AvaiNo ratings yet

- F&D Heads 2.02 - 10ksiDocument4 pagesF&D Heads 2.02 - 10ksitiepnh.ameccNo ratings yet

- Vehicle Fuel Report 10Document3 pagesVehicle Fuel Report 10muradNo ratings yet

- The Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramDocument1 pageThe Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramInkanata SacNo ratings yet

- Footing BBS - Moshi - 27.03.2024Document17 pagesFooting BBS - Moshi - 27.03.2024Mayuri AmgaonkarNo ratings yet

- Bulletin #D15EDocument4 pagesBulletin #D15EPanos PanosNo ratings yet

- AccountDocument1 pageAccountjigopen219No ratings yet

- F&D Heads 2.02 - 12ksiDocument4 pagesF&D Heads 2.02 - 12ksitiepnh.ameccNo ratings yet

- Tpddl-Operation & Ui Daily Dashboard Adms 04-11-2021Document88 pagesTpddl-Operation & Ui Daily Dashboard Adms 04-11-2021sahilNo ratings yet

- A Comparitive Analysis of Working Capital ofDocument19 pagesA Comparitive Analysis of Working Capital ofManasvi MehtaNo ratings yet

- A Comparitive Analysis of Working Capital ofDocument19 pagesA Comparitive Analysis of Working Capital ofManasvi MehtaNo ratings yet

- Manac ProjectDocument5 pagesManac Projectpgp39363No ratings yet

- Handrail Pipe: Beam End Force SummaryDocument1 pageHandrail Pipe: Beam End Force SummaryAbdul basithNo ratings yet

- Panel 1: Risk Parameters of The Investable Universe (Annualized)Document27 pagesPanel 1: Risk Parameters of The Investable Universe (Annualized)Ansab ArfanNo ratings yet

- E13003 PDFDocument2 pagesE13003 PDFLuis VivasNo ratings yet

- Datasheet PDFDocument2 pagesDatasheet PDFCalixto Milla EsauNo ratings yet

- OR Non Linear Programming PracticalsDocument50 pagesOR Non Linear Programming PracticalsPRATIKSHA 20MTS5721No ratings yet

- 28 - Swati Aggarwal - VedantaDocument11 pages28 - Swati Aggarwal - Vedantarajat_singlaNo ratings yet

- Average Viscosities LiquidsDocument1 pageAverage Viscosities LiquidsAlix Doughnuts FraiserNo ratings yet

- Average Viscosities LiquidsDocument1 pageAverage Viscosities LiquidsshubhamNo ratings yet

- Average Viscosities LiquidsDocument1 pageAverage Viscosities LiquidsGiang NguyenNo ratings yet

- Sec B - Group 1Document13 pagesSec B - Group 1swapnil anandNo ratings yet

- Assignment On Ratio AnalysisDocument6 pagesAssignment On Ratio AnalysisSurbhî GuptaNo ratings yet

- A Case Study On COkeDocument6 pagesA Case Study On COkeDulon DuttaNo ratings yet

- Market Update 25th Sept 2018Document1 pageMarket Update 25th Sept 2018Anonymous FnM14a0No ratings yet

- Asp 134486 01Document4 pagesAsp 134486 01Hassan MahdaviNo ratings yet

- Developing The "Right" Modularization Decisions For Mining Modules in ChinaDocument28 pagesDeveloping The "Right" Modularization Decisions For Mining Modules in ChinaKhaled GameaNo ratings yet

- IDFC First Bank LTD Performance Analysis: Total AssetsDocument9 pagesIDFC First Bank LTD Performance Analysis: Total AssetsSurbhî GuptaNo ratings yet

- Reservoir Engineering I (Pdb2023) Assignment: Vle Due Date: Total: 10 MarksDocument1 pageReservoir Engineering I (Pdb2023) Assignment: Vle Due Date: Total: 10 MarksZain NNo ratings yet

- Kem Se0202 OhdDocument6 pagesKem Se0202 OhdabalqassemNo ratings yet

- Vehicle Fuel Report 8Document2 pagesVehicle Fuel Report 8muradNo ratings yet

- Worklist ReportDocument3 pagesWorklist ReporttamacahyaNo ratings yet

- Kapasitas OilDocument1 pageKapasitas OilBudi ManNo ratings yet

- Grafik OTK Ke 2Document15 pagesGrafik OTK Ke 2seno tadiNo ratings yet

- Equities and Liabilities Shareholder'S Funds Mar-20 Mar-19 Total Share Capital 3,277.66 2,760.03Document11 pagesEquities and Liabilities Shareholder'S Funds Mar-20 Mar-19 Total Share Capital 3,277.66 2,760.03Surbhî GuptaNo ratings yet

- Trading Comps 03 March 2013 Explain EachDocument9 pagesTrading Comps 03 March 2013 Explain Eachyash1990No ratings yet

- Santu 2 PDFDocument5 pagesSantu 2 PDFAjaratanNo ratings yet

- LKUV 2 Air Relief Valve PDDocument3 pagesLKUV 2 Air Relief Valve PDtestNo ratings yet

- John Deere 6145RDocument5 pagesJohn Deere 6145RGABRIELE GUALDINo ratings yet

- Service Bulletin - (OI00-0000-13) - Low Sulphur Fuel OilDocument4 pagesService Bulletin - (OI00-0000-13) - Low Sulphur Fuel Oilps_visjehotmailcomNo ratings yet

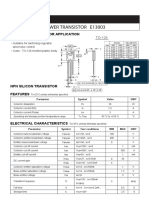

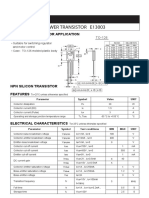

- Power Transistor E13003: Switching Regulator ApplicationDocument2 pagesPower Transistor E13003: Switching Regulator Applicationblancodaniel00000No ratings yet

- CI20T120P: Features OutlineDocument4 pagesCI20T120P: Features OutlineAsad AhmedNo ratings yet

- Subway2 47Document1 pageSubway2 47sll994No ratings yet

- Subway2 36Document1 pageSubway2 36sll994No ratings yet

- Subway2 37Document1 pageSubway2 37sll994No ratings yet

- Subway2 35Document1 pageSubway2 35sll994No ratings yet

- Subway2 19Document1 pageSubway2 19sll994No ratings yet

- Subway2 20Document1 pageSubway2 20sll994No ratings yet

- Subway2 21Document1 pageSubway2 21sll994No ratings yet

- Subway2 22Document1 pageSubway2 22sll994No ratings yet

- Subway2 12Document1 pageSubway2 12sll994No ratings yet

- Subway2 18Document1 pageSubway2 18sll994No ratings yet

- Subway2 11Document1 pageSubway2 11sll994No ratings yet

- Subway2 23Document1 pageSubway2 23sll994No ratings yet

- Subway2 10Document1 pageSubway2 10sll994No ratings yet

Subway2 24

Subway2 24

Uploaded by

sll994Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Subway2 24

Subway2 24

Uploaded by

sll994Copyright:

Available Formats

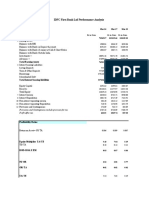

• The company has increased common stock dividends and treasury stock

purchases as part of its $5 billion dollar buy back that started in 2000.

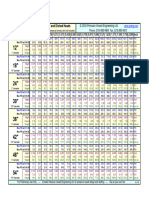

XII. Correlation with Current Portfolio

CORRELATION

Stock COEFFICIENT (R)

MCD

C 0.298

COH 0.143

DELL 0.215

EBAY 0.145

ERTS 0.181

FRX 0.155

GD 0.203

GE 0.373

HDI 0.256

KSS 0.223

PEP 0.226

WMT 0.309

XOM 0.265

The correlation coefficient was calculated by obtaining the stock price returns of

MacDonald’s and the other stocks in the portfolio from June 14, 2002-June 14, 2005, a

three-year period. Based on the above table, the security with the highest correlation to

MacDonald’s is General Electric with a value of just 0.373.

24

You might also like

- Sharpe Ratio Optimal PortfolioDocument2 pagesSharpe Ratio Optimal PortfolioIam LeongNo ratings yet

- Spreadsheet 8 1 SAMPLEDocument48 pagesSpreadsheet 8 1 SAMPLEAnsab ArfanNo ratings yet

- Financial Ratio Analysis: (AIA Engineering LTD.)Document14 pagesFinancial Ratio Analysis: (AIA Engineering LTD.)kalathiadhavalNo ratings yet

- Load CombinationDocument1 pageLoad CombinationCyril SoldevillaNo ratings yet

- The Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramDocument2 pagesThe Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramhenriquegonferNo ratings yet

- Evaco 2 FDocument5 pagesEvaco 2 Fsahil gohadNo ratings yet

- Component Weight InformationDocument2 pagesComponent Weight InformationFarbod Jz.No ratings yet

- Ratio Analysis of Consumer DurablesDocument22 pagesRatio Analysis of Consumer DurablesNishant PahujaNo ratings yet

- Greasing Electric Motors Part 1Document4 pagesGreasing Electric Motors Part 1kidlatzNo ratings yet

- Dimensional Drawing: Features Features Absolute Maximum RatingsDocument2 pagesDimensional Drawing: Features Features Absolute Maximum RatingscizetawwwNo ratings yet

- Endogeneity AnalysisDocument3 pagesEndogeneity AnalysisdebwanismailNo ratings yet

- Two Stage Evaporator: InputsDocument5 pagesTwo Stage Evaporator: InputsHina JagnikNo ratings yet

- Diffusion in Gases: /CM S For P 101.325 Kpa and The Specified T/KDocument2 pagesDiffusion in Gases: /CM S For P 101.325 Kpa and The Specified T/KRenan Rosa FerreiraNo ratings yet

- Che 541 Exam QuestionDocument8 pagesChe 541 Exam QuestionAnavheoba AbrahamNo ratings yet

- Corporate Climate Risk and Bond Credit Spreads - 2024 - Finance Research Letters 4Document1 pageCorporate Climate Risk and Bond Credit Spreads - 2024 - Finance Research Letters 4JohnNo ratings yet

- Bank Performance AnalysisDocument10 pagesBank Performance AnalysisSurbhî GuptaNo ratings yet

- Panel 1: Risk Parameters of The Investable Universe (Annualized)Document1 pagePanel 1: Risk Parameters of The Investable Universe (Annualized)JosuaNo ratings yet

- To 92 PackageDocument2 pagesTo 92 PackageBaco_AvaiNo ratings yet

- F&D Heads 2.02 - 10ksiDocument4 pagesF&D Heads 2.02 - 10ksitiepnh.ameccNo ratings yet

- Vehicle Fuel Report 10Document3 pagesVehicle Fuel Report 10muradNo ratings yet

- The Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramDocument1 pageThe Tolerance Unless Classified 0.3mm: Outline Dimension & Block DiagramInkanata SacNo ratings yet

- Footing BBS - Moshi - 27.03.2024Document17 pagesFooting BBS - Moshi - 27.03.2024Mayuri AmgaonkarNo ratings yet

- Bulletin #D15EDocument4 pagesBulletin #D15EPanos PanosNo ratings yet

- AccountDocument1 pageAccountjigopen219No ratings yet

- F&D Heads 2.02 - 12ksiDocument4 pagesF&D Heads 2.02 - 12ksitiepnh.ameccNo ratings yet

- Tpddl-Operation & Ui Daily Dashboard Adms 04-11-2021Document88 pagesTpddl-Operation & Ui Daily Dashboard Adms 04-11-2021sahilNo ratings yet

- A Comparitive Analysis of Working Capital ofDocument19 pagesA Comparitive Analysis of Working Capital ofManasvi MehtaNo ratings yet

- A Comparitive Analysis of Working Capital ofDocument19 pagesA Comparitive Analysis of Working Capital ofManasvi MehtaNo ratings yet

- Manac ProjectDocument5 pagesManac Projectpgp39363No ratings yet

- Handrail Pipe: Beam End Force SummaryDocument1 pageHandrail Pipe: Beam End Force SummaryAbdul basithNo ratings yet

- Panel 1: Risk Parameters of The Investable Universe (Annualized)Document27 pagesPanel 1: Risk Parameters of The Investable Universe (Annualized)Ansab ArfanNo ratings yet

- E13003 PDFDocument2 pagesE13003 PDFLuis VivasNo ratings yet

- Datasheet PDFDocument2 pagesDatasheet PDFCalixto Milla EsauNo ratings yet

- OR Non Linear Programming PracticalsDocument50 pagesOR Non Linear Programming PracticalsPRATIKSHA 20MTS5721No ratings yet

- 28 - Swati Aggarwal - VedantaDocument11 pages28 - Swati Aggarwal - Vedantarajat_singlaNo ratings yet

- Average Viscosities LiquidsDocument1 pageAverage Viscosities LiquidsAlix Doughnuts FraiserNo ratings yet

- Average Viscosities LiquidsDocument1 pageAverage Viscosities LiquidsshubhamNo ratings yet

- Average Viscosities LiquidsDocument1 pageAverage Viscosities LiquidsGiang NguyenNo ratings yet

- Sec B - Group 1Document13 pagesSec B - Group 1swapnil anandNo ratings yet

- Assignment On Ratio AnalysisDocument6 pagesAssignment On Ratio AnalysisSurbhî GuptaNo ratings yet

- A Case Study On COkeDocument6 pagesA Case Study On COkeDulon DuttaNo ratings yet

- Market Update 25th Sept 2018Document1 pageMarket Update 25th Sept 2018Anonymous FnM14a0No ratings yet

- Asp 134486 01Document4 pagesAsp 134486 01Hassan MahdaviNo ratings yet

- Developing The "Right" Modularization Decisions For Mining Modules in ChinaDocument28 pagesDeveloping The "Right" Modularization Decisions For Mining Modules in ChinaKhaled GameaNo ratings yet

- IDFC First Bank LTD Performance Analysis: Total AssetsDocument9 pagesIDFC First Bank LTD Performance Analysis: Total AssetsSurbhî GuptaNo ratings yet

- Reservoir Engineering I (Pdb2023) Assignment: Vle Due Date: Total: 10 MarksDocument1 pageReservoir Engineering I (Pdb2023) Assignment: Vle Due Date: Total: 10 MarksZain NNo ratings yet

- Kem Se0202 OhdDocument6 pagesKem Se0202 OhdabalqassemNo ratings yet

- Vehicle Fuel Report 8Document2 pagesVehicle Fuel Report 8muradNo ratings yet

- Worklist ReportDocument3 pagesWorklist ReporttamacahyaNo ratings yet

- Kapasitas OilDocument1 pageKapasitas OilBudi ManNo ratings yet

- Grafik OTK Ke 2Document15 pagesGrafik OTK Ke 2seno tadiNo ratings yet

- Equities and Liabilities Shareholder'S Funds Mar-20 Mar-19 Total Share Capital 3,277.66 2,760.03Document11 pagesEquities and Liabilities Shareholder'S Funds Mar-20 Mar-19 Total Share Capital 3,277.66 2,760.03Surbhî GuptaNo ratings yet

- Trading Comps 03 March 2013 Explain EachDocument9 pagesTrading Comps 03 March 2013 Explain Eachyash1990No ratings yet

- Santu 2 PDFDocument5 pagesSantu 2 PDFAjaratanNo ratings yet

- LKUV 2 Air Relief Valve PDDocument3 pagesLKUV 2 Air Relief Valve PDtestNo ratings yet

- John Deere 6145RDocument5 pagesJohn Deere 6145RGABRIELE GUALDINo ratings yet

- Service Bulletin - (OI00-0000-13) - Low Sulphur Fuel OilDocument4 pagesService Bulletin - (OI00-0000-13) - Low Sulphur Fuel Oilps_visjehotmailcomNo ratings yet

- Power Transistor E13003: Switching Regulator ApplicationDocument2 pagesPower Transistor E13003: Switching Regulator Applicationblancodaniel00000No ratings yet

- CI20T120P: Features OutlineDocument4 pagesCI20T120P: Features OutlineAsad AhmedNo ratings yet

- Subway2 47Document1 pageSubway2 47sll994No ratings yet

- Subway2 36Document1 pageSubway2 36sll994No ratings yet

- Subway2 37Document1 pageSubway2 37sll994No ratings yet

- Subway2 35Document1 pageSubway2 35sll994No ratings yet

- Subway2 19Document1 pageSubway2 19sll994No ratings yet

- Subway2 20Document1 pageSubway2 20sll994No ratings yet

- Subway2 21Document1 pageSubway2 21sll994No ratings yet

- Subway2 22Document1 pageSubway2 22sll994No ratings yet

- Subway2 12Document1 pageSubway2 12sll994No ratings yet

- Subway2 18Document1 pageSubway2 18sll994No ratings yet

- Subway2 11Document1 pageSubway2 11sll994No ratings yet

- Subway2 23Document1 pageSubway2 23sll994No ratings yet

- Subway2 10Document1 pageSubway2 10sll994No ratings yet