Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

28 viewsSingle Entry System

Single Entry System

Uploaded by

Rhea Royce CabuhatThis document provides an overview of single entry accounting systems and compares them to cash and accrual-based accounting systems. Key points include:

- Single entry systems record transactions in cash books rather than using double entry accounting with debits and credits. Net income is calculated by comparing beginning and ending capital or retained earnings.

- Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid. Accrual basis recognizes revenue when earned and expenses when incurred.

- T-accounts can be used to track balances and transactions for accounts like receivables, payables, inventory, fixed assets, and more under both cash and accrual-based systems.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- MPM TroubleshootingDocument34 pagesMPM TroubleshootingMustafaNo ratings yet

- To Make Flip Flop Led Flasher Circuit Using Transistor Bc547Document17 pagesTo Make Flip Flop Led Flasher Circuit Using Transistor Bc547ananyabedekar83No ratings yet

- Least Mastered Competencies (Grade 6)Document14 pagesLeast Mastered Competencies (Grade 6)Renge Taña91% (33)

- Professional Practice Session 1Document23 pagesProfessional Practice Session 1Dina HawashNo ratings yet

- Chapter 6 StressDocument9 pagesChapter 6 StressSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Feedback Control Systems by S C Goyal U A Bakshi PDFDocument2 pagesFeedback Control Systems by S C Goyal U A Bakshi PDFHeather29% (7)

- Accounting ReviewerDocument2 pagesAccounting ReviewerPatricia May CayagoNo ratings yet

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocument15 pagesCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaSano ManjiroNo ratings yet

- FAR QTR1 Part2.notesDocument22 pagesFAR QTR1 Part2.notestygurNo ratings yet

- Cash and Accrual Basis & Single Entry - OUTLINEDocument3 pagesCash and Accrual Basis & Single Entry - OUTLINESophia Marie VerdeflorNo ratings yet

- AUD02 - 03 Cash and Accrual BasisDocument16 pagesAUD02 - 03 Cash and Accrual BasisMark BajacanNo ratings yet

- 5 Accounts From Incomplete Records 1682142260Document6 pages5 Accounts From Incomplete Records 1682142260sunil.h68 SunilNo ratings yet

- Basic Accounting Questionnaire Reviewer 35Document2 pagesBasic Accounting Questionnaire Reviewer 35marjoriedeguzman80No ratings yet

- Cash To Accural BasisDocument3 pagesCash To Accural BasisfrondagericaNo ratings yet

- Lesson 1 and 2 - Single Entry System, Correction of ErrorsDocument8 pagesLesson 1 and 2 - Single Entry System, Correction of ErrorsThe Brain Dump PHNo ratings yet

- Financial Accounting and ReportingDocument6 pagesFinancial Accounting and Reportingsinatoyakoto051No ratings yet

- ACCOUNTING PROCESS and CLASSIFICATIONDocument26 pagesACCOUNTING PROCESS and CLASSIFICATIONvdhanyamrajuNo ratings yet

- Accounting Clinic II ModiDocument27 pagesAccounting Clinic II ModiFashion ThriftNo ratings yet

- Cash Vs Accrual Basis of AccountingDocument8 pagesCash Vs Accrual Basis of AccountingThanupa KopparapuNo ratings yet

- RECEIVABLESDocument7 pagesRECEIVABLESbona jirahNo ratings yet

- Ch.3 - Accrual Accounting and The Financial Statements (Pearson 6th Edition) - MHDocument85 pagesCh.3 - Accrual Accounting and The Financial Statements (Pearson 6th Edition) - MHSamZhao100% (1)

- Discussion Questions: That Debits ListingDocument3 pagesDiscussion Questions: That Debits ListingKim Willard GarlanNo ratings yet

- Accounting vs. BookkeepingDocument5 pagesAccounting vs. BookkeepingRolly BaroyNo ratings yet

- Saq-Aq - VPTDocument7 pagesSaq-Aq - VPTVũ VũNo ratings yet

- Certs - Cash Basis VS Accrual BasisDocument3 pagesCerts - Cash Basis VS Accrual BasisCJ ManaloNo ratings yet

- Mock BoardsDocument11 pagesMock BoardsRaenessa FranciscoNo ratings yet

- Accounting Brief NotesDocument12 pagesAccounting Brief NotesEshita SuvarnaNo ratings yet

- Updates in Financial Reporting Standards: Northeastern CollegeDocument3 pagesUpdates in Financial Reporting Standards: Northeastern CollegeJobelle Grace SorianoNo ratings yet

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- ACCT 301B - Exam 1 ReviewDocument9 pagesACCT 301B - Exam 1 ReviewJudith GarciaNo ratings yet

- Financial Accounting and Reporting (FAR) - Part 4Document3 pagesFinancial Accounting and Reporting (FAR) - Part 4Malcolm HolmesNo ratings yet

- Ch.8 Preparation of Accounts From Incomplete RecordsDocument22 pagesCh.8 Preparation of Accounts From Incomplete RecordsMalayaranjan PanigrahiNo ratings yet

- Financial Accounting and ReportingDocument13 pagesFinancial Accounting and ReportingKimberly RamosNo ratings yet

- Two-Date Bank Reconciliation Receivables: Example Format OnlyDocument2 pagesTwo-Date Bank Reconciliation Receivables: Example Format Onlymagic costaNo ratings yet

- Balance SheetDocument28 pagesBalance SheetrimaNo ratings yet

- Financial Accounting and Reporting - Chapter 04 PDFDocument11 pagesFinancial Accounting and Reporting - Chapter 04 PDFKenjo NevalgaNo ratings yet

- Cash and Accrual Single Entry PDFDocument8 pagesCash and Accrual Single Entry PDFJoyce Anne GarduqueNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts Receivablelea atienza100% (1)

- Pointers To Review: FABM 2: Recording Phase: Answer KeyDocument9 pagesPointers To Review: FABM 2: Recording Phase: Answer KeyMaria Janelle BlanzaNo ratings yet

- Adjusting Entries Worksheet and Financial StatementDocument11 pagesAdjusting Entries Worksheet and Financial StatementGaming AlliNo ratings yet

- Chapter 14: Cash and Accrual BasisDocument60 pagesChapter 14: Cash and Accrual BasissofiaNo ratings yet

- Local Media3478943310777218263Document13 pagesLocal Media3478943310777218263Maria Nena LoretoNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- Fabm Key Points - Nella. Thanks SramDocument4 pagesFabm Key Points - Nella. Thanks SramSaimon SarmientoNo ratings yet

- MODADV1 Corporate Liquidation - Statement of AffairsDocument2 pagesMODADV1 Corporate Liquidation - Statement of AffairsRedNo ratings yet

- Chapters 8 9Document2 pagesChapters 8 9Rena Jocelle NalzaroNo ratings yet

- FAR Module 4,5,6 - Assignment ActivityDocument5 pagesFAR Module 4,5,6 - Assignment ActivityairamaecsibbalucaNo ratings yet

- FAR 8.5MC Cash Basis To Accrual Basis FDocument3 pagesFAR 8.5MC Cash Basis To Accrual Basis FKim Flores100% (2)

- Accrual vs. Cash AccountingDocument33 pagesAccrual vs. Cash AccountingAbhishek ShetyeNo ratings yet

- Accrual Versus Cash Basis AccountingDocument4 pagesAccrual Versus Cash Basis AccountingDariya DobrevaNo ratings yet

- Accounting For Receivables 1Document48 pagesAccounting For Receivables 1ramadhan wiprayogaNo ratings yet

- Accounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụDocument45 pagesAccounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụHiep Nguyen TuanNo ratings yet

- ToA.1828 - Accounting Process - Online ReviewDocument3 pagesToA.1828 - Accounting Process - Online ReviewJay-L TanNo ratings yet

- Caie Igcse Accounting 0452 Theory v3Document23 pagesCaie Igcse Accounting 0452 Theory v3tarzan.shakilNo ratings yet

- Basic Accounting For PracticeDocument55 pagesBasic Accounting For PracticeSunil CoelhoNo ratings yet

- Key Terms and Chapter Summary-20Document1 pageKey Terms and Chapter Summary-20Rudravisek SahuNo ratings yet

- Accounting NotesDocument6 pagesAccounting NotesD AngelaNo ratings yet

- Review 105 - Day 5 Theory of AccountsDocument12 pagesReview 105 - Day 5 Theory of AccountsAndre PulancoNo ratings yet

- Review 105 - Day 5 Theory of AccountsDocument12 pagesReview 105 - Day 5 Theory of Accountsneo14No ratings yet

- Cash Basis To Accrual Basis of AccountingDocument15 pagesCash Basis To Accrual Basis of Accountingmary grace abrisNo ratings yet

- SodaPDF Converted Cash To AccrualDocument7 pagesSodaPDF Converted Cash To AccrualestesgadzNo ratings yet

- Dcom205 Accounting For Companies Ii PDFDocument312 pagesDcom205 Accounting For Companies Ii PDFKhawaish MittalNo ratings yet

- Chapter 4 - Adjusting AccountsDocument4 pagesChapter 4 - Adjusting AccountsIESHA JAESAMIN TWAYE BASTIANNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- RFBT.04 Law On Credit TransactionDocument2 pagesRFBT.04 Law On Credit TransactionRhea Royce CabuhatNo ratings yet

- Tax.02 Taxes, Tax Laws and Tax AdministrationDocument6 pagesTax.02 Taxes, Tax Laws and Tax AdministrationRhea Royce CabuhatNo ratings yet

- Far.02 Conceptual Framework For Financial ReportingDocument9 pagesFar.02 Conceptual Framework For Financial ReportingRhea Royce CabuhatNo ratings yet

- Tax.01 Constitutional LimitationsDocument2 pagesTax.01 Constitutional LimitationsRhea Royce CabuhatNo ratings yet

- Mas.02 Variable and Absorption CostingDocument6 pagesMas.02 Variable and Absorption CostingRhea Royce CabuhatNo ratings yet

- Far 01. Introduction To Accountancy Profession & Preface To PfrsDocument5 pagesFar 01. Introduction To Accountancy Profession & Preface To PfrsRhea Royce CabuhatNo ratings yet

- Far.06 Biological AssetsDocument3 pagesFar.06 Biological AssetsRhea Royce CabuhatNo ratings yet

- Far.03 Cash and Cash EquivalentsDocument8 pagesFar.03 Cash and Cash EquivalentsRhea Royce CabuhatNo ratings yet

- At.03 Fundamentals of Assurance ServicesDocument1 pageAt.03 Fundamentals of Assurance ServicesRhea Royce CabuhatNo ratings yet

- At.02 Code of EthicsDocument10 pagesAt.02 Code of EthicsRhea Royce CabuhatNo ratings yet

- Ap.03 Shareholders EquityDocument9 pagesAp.03 Shareholders EquityRhea Royce CabuhatNo ratings yet

- Afar.04 Decentralized OperationDocument2 pagesAfar.04 Decentralized OperationRhea Royce Cabuhat0% (1)

- Afar.03 Revenue From Contracts With CustomersDocument21 pagesAfar.03 Revenue From Contracts With CustomersRhea Royce CabuhatNo ratings yet

- Afar.02 Corporate LiquidationDocument3 pagesAfar.02 Corporate LiquidationRhea Royce CabuhatNo ratings yet

- Present Continuous - Present Simple Vs Present ContinuousDocument2 pagesPresent Continuous - Present Simple Vs Present ContinuouseewuanNo ratings yet

- Whyte Human Rights and The Collateral Damage oDocument16 pagesWhyte Human Rights and The Collateral Damage ojswhy1No ratings yet

- Schedule CDocument273 pagesSchedule CAzi PaybarahNo ratings yet

- Academic Calendar Fall 19-Spring 20 & Summer 20-Final-1 PDFDocument3 pagesAcademic Calendar Fall 19-Spring 20 & Summer 20-Final-1 PDFAhmadNo ratings yet

- A320 PedestalDocument14 pagesA320 PedestalAiman ZabadNo ratings yet

- Product Data Sheet Ingenuity Core LRDocument16 pagesProduct Data Sheet Ingenuity Core LRCeoĐứcTrườngNo ratings yet

- Influence of Cooling Rate On The Structure and Formation of Oxide Scale in LowDocument7 pagesInfluence of Cooling Rate On The Structure and Formation of Oxide Scale in LowVarun MangaloreNo ratings yet

- Female Genital Organ AnomaliesDocument83 pagesFemale Genital Organ AnomalieszulinassirNo ratings yet

- Commuter Crossword Puzzles UpdatedDocument3 pagesCommuter Crossword Puzzles UpdatedChidinma UwadiaeNo ratings yet

- Trial in AbsentiaDocument12 pagesTrial in AbsentiaNahid hossainNo ratings yet

- A Bravo Delta Lancaster Model Worth 329: 38 Paralle L Paralle LDocument116 pagesA Bravo Delta Lancaster Model Worth 329: 38 Paralle L Paralle LAnonymous 7Je2SSU100% (2)

- How To Register A Partnership in SECDocument4 pagesHow To Register A Partnership in SECMa Zola EstelaNo ratings yet

- Environmental Protection: "We Never Know The Worth of Water Till The Wellis Dry."Document14 pagesEnvironmental Protection: "We Never Know The Worth of Water Till The Wellis Dry."Mary Jane BuaronNo ratings yet

- Essay by MariemDocument2 pagesEssay by MariemMatthew MaxwellNo ratings yet

- Past Simple Weekend.m4aDocument7 pagesPast Simple Weekend.m4aCarmen Victoria Niño RamosNo ratings yet

- UNIT 3 Part 1-Propositional LogicDocument11 pagesUNIT 3 Part 1-Propositional LogicVanshika ChauhanNo ratings yet

- Dermatology TreatmentsDocument6 pagesDermatology TreatmentsMayar MostafaNo ratings yet

- Loi Bayanihan PCR ReviewerDocument15 pagesLoi Bayanihan PCR Reviewerailexcj20No ratings yet

- View AnswerDocument112 pagesView Answershiv anantaNo ratings yet

- Company Feasibility StudyDocument21 pagesCompany Feasibility StudyDesiree Raot RaotNo ratings yet

- SPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLADocument2 pagesSPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLAAlia Arnz-Dragon100% (1)

- Project Summary, WOFDocument2 pagesProject Summary, WOFEsha GargNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificatesahityaasthaNo ratings yet

- GIDC Rajju Shroff ROFEL Institute of Management Studies: Subject:-CRVDocument7 pagesGIDC Rajju Shroff ROFEL Institute of Management Studies: Subject:-CRVIranshah MakerNo ratings yet

Single Entry System

Single Entry System

Uploaded by

Rhea Royce Cabuhat0 ratings0% found this document useful (0 votes)

28 views4 pagesThis document provides an overview of single entry accounting systems and compares them to cash and accrual-based accounting systems. Key points include:

- Single entry systems record transactions in cash books rather than using double entry accounting with debits and credits. Net income is calculated by comparing beginning and ending capital or retained earnings.

- Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid. Accrual basis recognizes revenue when earned and expenses when incurred.

- T-accounts can be used to track balances and transactions for accounts like receivables, payables, inventory, fixed assets, and more under both cash and accrual-based systems.

Original Description:

Original Title

SINGLE ENTRY SYSTEM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of single entry accounting systems and compares them to cash and accrual-based accounting systems. Key points include:

- Single entry systems record transactions in cash books rather than using double entry accounting with debits and credits. Net income is calculated by comparing beginning and ending capital or retained earnings.

- Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid. Accrual basis recognizes revenue when earned and expenses when incurred.

- T-accounts can be used to track balances and transactions for accounts like receivables, payables, inventory, fixed assets, and more under both cash and accrual-based systems.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

28 views4 pagesSingle Entry System

Single Entry System

Uploaded by

Rhea Royce CabuhatThis document provides an overview of single entry accounting systems and compares them to cash and accrual-based accounting systems. Key points include:

- Single entry systems record transactions in cash books rather than using double entry accounting with debits and credits. Net income is calculated by comparing beginning and ending capital or retained earnings.

- Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid. Accrual basis recognizes revenue when earned and expenses when incurred.

- T-accounts can be used to track balances and transactions for accounts like receivables, payables, inventory, fixed assets, and more under both cash and accrual-based systems.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

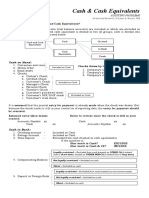

AP.

01 SINGLE ENTRY SYSTEM

SINGLE ENTRY SYSTEM - Generally Accepted Accounting

Principle.

- A system of record keeping which the

- Accrued Income – item of income that is

transactions are not analyzed and

already earned but not yet collected.

recorded in the double entry framework.

- Accrued Expense – item of expense that

- Not a double entry system – duality of

is already Incurred but not yet paid.

transaction of events in Assets,

Liabilities and Capital.

- Common Records Used:

COMPARISON OF CASH BASIS OF

o Cash Books

ACCOUNTING AND ACCRUAL BASIS OF

Cash Outflow

ACCOUNTING

Cash Inflow

o Accounts Payable

o Accounts Receivable

1. SALES

o Property, Plant and Equipment

a. Cash Basis

SINGLE ENTRY METHOD i. Cash Sales

ii. Collection of Trade

- Computation in determining net income Accounts Receivable

or loss is simply to compare the capital iii. Collection of Trade

or retained earnings at the beginning of Notes Receivable

the year and capital or retained earnings b. Accrual Basis

at the end of the same year after taking i. Cash Sales

into consideration drawings or dividends ii. Credit Sales (Sales on

and additional investments. Account)

- Retained earnings increased during the 2. INCOME OTHER THAN SALES

period a. Cash Basis

o No dividends or drawings i. Includes only those

o No additional investments collected during the

period.

Increase in Retained Earnings –

b. Accrual Basis

Net income during the period

i. Includes those items

earned during the

period.

CASH BASIS OF ACCOUNTING

- System that recognizes revenue when 3. PURCHASES

cash is received and expenses when cash a. Cash Basis

is paid. i. Cash Purchase

- Not GAAP (Generally Accepted ii. Payment of Trade

Accounts Payable

Accounting Principle)

iii. Payment of Trade Notes

ACCRUAL BASIS OF ACCOUNTING Payable

iv. Payment in Advances to

- System that recognizes revenue when Suppliers

earned rather than when cash is received b. Accrual Basis

and recognizes expenses as it is incurred i. Cash Purchase

rather than when cash is paid. ii. Purchases on Accounts

4. EXPENSES

AP.01 SINGLE ENTRY SYSTEM

a. Cash Basis 6. Accumulated Depreciation

i. Includes only those 7. Rent Receivable/ Unearned Rent Income

expenses that are paid. 8. Prepaid Rent/Rent Payable

b. Accrual Basis 9. Capital

i. Includes those items 10. Retained Earnings

that are incurred 11. Net Assets

regardless of when paid.

5. DEPRECIATION

a. Cash Basis

i. Typically provided

except when the cost of

equipment was treated

as expense.

b. Accrual Basis

i. Depreciation is typically

provided.

6. BAD DEBTS ACCOUNTS RECEIVABLES/NOTES

a. Cash Basis RECEIVABLES/ADVANCES FROM

i. No Bad Debts Expense CUSTOMERS

is recognized since cash

basis does not recognize Beg. Balance – AR Bal. End – AR

receivables. Although Beg. Balance – NR Bal. End – NR

some problems may Bal. End – Advances Beg. Balance – Advances

give an indication that Sales on Account Sales Returns and Allowance*

the accounts written off Recoveries Sales Discounts

were charged to bad Collections incldg. Recoveries

Write-off

debts.

b. Accrual Basis

i. Doubtful accounts are

*Included only those Sales Returns and Allowance that

treated as bad debts.

are deducted from the Accounts Receivable. If the Sales

Return and Allowances arise from cash refund to

customer, it should not be included in the T-account of

T-ACCOUNTS APPROACH the receivables.

In order to compute for the cash payments or

collections for certain account, it is suggested ALLOWANCE FOR DOUBTFUL

that the T-account approach will be used on the ACCOUNTS

following:

Balance End Beginning Balance

1. Accounts Receivable/Notes Accounts written off Doubtful Accounts Exp.

Receivable/Advances from Customers Recoveries

2. Allowance for Doubtful Accounts

3. Accounts Payable/Notes

Payable/Advances to Suppliers ACCOUNTS PAYABLE/NOTES

4. Merchandise Inventory PAYABLE/ADVANCES TO SUPPLIERS

5. Property, Plant and Equipment

AP.01 SINGLE ENTRY SYSTEM

Bal. End – AP Beg. Balance – AP

Bal. End – NP Beg. Balance – NP

Beg. Balance – Advances Bal. End – Advances

Purch. Ret and Allowance Purchases

Purch. Discount

Payments

MERCHANDISE INVENTORY

Beg. Balance Bal. End RENT RECEIVABLE/UNEARNED RENT

Net Purchase Cost of Sales INCOME

Beg. Balance - RR Balance End - RR

Balance End - URI Beg. Balance - URI

Rent Income Collection of Rent

NOTES:

Using T-account, aside from the journal This T-account is also applicable to interest

entries, it follows the following formula receivable/unearned interest income, royalty

in the computation of the Cost of Sales: receivable/unearned royalty income and other

deferred assets.

Merchandise Inventory, Beg xx

Add: Net Purchases xx PREPAID RENT/RENT PAYABLE

Total Goods Available for Sale xx

Beg. Balance - PR Balance End - PR

Less: Merch. Inventory, End xx

Balance End - RP Beg. Balance - RP

COST OF SALES XX

Payment of Rent Rent Expense

Net purchases is computed as follows:

Purchases on Account xx This T-account is also applicable to prepaid

Add: Cash Purchases xx salaries/salaries payable.

Gross Purchases xx

Add: Freight-in xx PROPERTY, PLANT AND EQUIPMENT

Less: Beg. Balance Balance End

Purch. Discount xx Cost of the Asset Acquired Cost of asset Derecog.

Purch. Allowance xx

Purch. Returns xx ACCUMULATED DEPRECIATION

NET PURCHASES XX

Balance End Beg. Balance

The T-account presented is applicable to AD of the Asset Derecognized Dep. Expense

finished goods inventory of merchandising

company. CAPITAL

Balance End Beg. Balance

Net Sales is computed as follows: Withdrawal Additional Investment

Sales on Account xx Net Loss Net Income

Add: Cash Sales xx

Gross Sales xx When the owner withdrew merchandise

Less: inventories or other non-cash assets, the

Sales Returns and Allowances xx drawings account should be debited to an

Sales Discount xx amount equal to the cost, not the selling price or

NET SALES XX

AP.01 SINGLE ENTRY SYSTEM

fair value of the merchandise or non-cash asset

withdrawn.

RETAINED EARNINGS

Balance End Beg. Balance

PP Error PP Error

Net Loss Net Income

Div. Declared

NET ASSETS

Increase in Asset Decrease in Asset

Decrease in Liab Increase in Liab

Net Loss Increase in SC

Div. Declared Increase in SP

Net Income

This T-account follows the basic rule in making

journal entry that an account is increased

through its normal balance while it is decreased

at the other side of the normal balance, for

example increase in asset is debited which is

the normal balance of an asset while decrease

is credited which is at other side of the normal

balance.

You might also like

- MPM TroubleshootingDocument34 pagesMPM TroubleshootingMustafaNo ratings yet

- To Make Flip Flop Led Flasher Circuit Using Transistor Bc547Document17 pagesTo Make Flip Flop Led Flasher Circuit Using Transistor Bc547ananyabedekar83No ratings yet

- Least Mastered Competencies (Grade 6)Document14 pagesLeast Mastered Competencies (Grade 6)Renge Taña91% (33)

- Professional Practice Session 1Document23 pagesProfessional Practice Session 1Dina HawashNo ratings yet

- Chapter 6 StressDocument9 pagesChapter 6 StressSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Feedback Control Systems by S C Goyal U A Bakshi PDFDocument2 pagesFeedback Control Systems by S C Goyal U A Bakshi PDFHeather29% (7)

- Accounting ReviewerDocument2 pagesAccounting ReviewerPatricia May CayagoNo ratings yet

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocument15 pagesCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaSano ManjiroNo ratings yet

- FAR QTR1 Part2.notesDocument22 pagesFAR QTR1 Part2.notestygurNo ratings yet

- Cash and Accrual Basis & Single Entry - OUTLINEDocument3 pagesCash and Accrual Basis & Single Entry - OUTLINESophia Marie VerdeflorNo ratings yet

- AUD02 - 03 Cash and Accrual BasisDocument16 pagesAUD02 - 03 Cash and Accrual BasisMark BajacanNo ratings yet

- 5 Accounts From Incomplete Records 1682142260Document6 pages5 Accounts From Incomplete Records 1682142260sunil.h68 SunilNo ratings yet

- Basic Accounting Questionnaire Reviewer 35Document2 pagesBasic Accounting Questionnaire Reviewer 35marjoriedeguzman80No ratings yet

- Cash To Accural BasisDocument3 pagesCash To Accural BasisfrondagericaNo ratings yet

- Lesson 1 and 2 - Single Entry System, Correction of ErrorsDocument8 pagesLesson 1 and 2 - Single Entry System, Correction of ErrorsThe Brain Dump PHNo ratings yet

- Financial Accounting and ReportingDocument6 pagesFinancial Accounting and Reportingsinatoyakoto051No ratings yet

- ACCOUNTING PROCESS and CLASSIFICATIONDocument26 pagesACCOUNTING PROCESS and CLASSIFICATIONvdhanyamrajuNo ratings yet

- Accounting Clinic II ModiDocument27 pagesAccounting Clinic II ModiFashion ThriftNo ratings yet

- Cash Vs Accrual Basis of AccountingDocument8 pagesCash Vs Accrual Basis of AccountingThanupa KopparapuNo ratings yet

- RECEIVABLESDocument7 pagesRECEIVABLESbona jirahNo ratings yet

- Ch.3 - Accrual Accounting and The Financial Statements (Pearson 6th Edition) - MHDocument85 pagesCh.3 - Accrual Accounting and The Financial Statements (Pearson 6th Edition) - MHSamZhao100% (1)

- Discussion Questions: That Debits ListingDocument3 pagesDiscussion Questions: That Debits ListingKim Willard GarlanNo ratings yet

- Accounting vs. BookkeepingDocument5 pagesAccounting vs. BookkeepingRolly BaroyNo ratings yet

- Saq-Aq - VPTDocument7 pagesSaq-Aq - VPTVũ VũNo ratings yet

- Certs - Cash Basis VS Accrual BasisDocument3 pagesCerts - Cash Basis VS Accrual BasisCJ ManaloNo ratings yet

- Mock BoardsDocument11 pagesMock BoardsRaenessa FranciscoNo ratings yet

- Accounting Brief NotesDocument12 pagesAccounting Brief NotesEshita SuvarnaNo ratings yet

- Updates in Financial Reporting Standards: Northeastern CollegeDocument3 pagesUpdates in Financial Reporting Standards: Northeastern CollegeJobelle Grace SorianoNo ratings yet

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- ACCT 301B - Exam 1 ReviewDocument9 pagesACCT 301B - Exam 1 ReviewJudith GarciaNo ratings yet

- Financial Accounting and Reporting (FAR) - Part 4Document3 pagesFinancial Accounting and Reporting (FAR) - Part 4Malcolm HolmesNo ratings yet

- Ch.8 Preparation of Accounts From Incomplete RecordsDocument22 pagesCh.8 Preparation of Accounts From Incomplete RecordsMalayaranjan PanigrahiNo ratings yet

- Financial Accounting and ReportingDocument13 pagesFinancial Accounting and ReportingKimberly RamosNo ratings yet

- Two-Date Bank Reconciliation Receivables: Example Format OnlyDocument2 pagesTwo-Date Bank Reconciliation Receivables: Example Format Onlymagic costaNo ratings yet

- Balance SheetDocument28 pagesBalance SheetrimaNo ratings yet

- Financial Accounting and Reporting - Chapter 04 PDFDocument11 pagesFinancial Accounting and Reporting - Chapter 04 PDFKenjo NevalgaNo ratings yet

- Cash and Accrual Single Entry PDFDocument8 pagesCash and Accrual Single Entry PDFJoyce Anne GarduqueNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts Receivablelea atienza100% (1)

- Pointers To Review: FABM 2: Recording Phase: Answer KeyDocument9 pagesPointers To Review: FABM 2: Recording Phase: Answer KeyMaria Janelle BlanzaNo ratings yet

- Adjusting Entries Worksheet and Financial StatementDocument11 pagesAdjusting Entries Worksheet and Financial StatementGaming AlliNo ratings yet

- Chapter 14: Cash and Accrual BasisDocument60 pagesChapter 14: Cash and Accrual BasissofiaNo ratings yet

- Local Media3478943310777218263Document13 pagesLocal Media3478943310777218263Maria Nena LoretoNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- Fabm Key Points - Nella. Thanks SramDocument4 pagesFabm Key Points - Nella. Thanks SramSaimon SarmientoNo ratings yet

- MODADV1 Corporate Liquidation - Statement of AffairsDocument2 pagesMODADV1 Corporate Liquidation - Statement of AffairsRedNo ratings yet

- Chapters 8 9Document2 pagesChapters 8 9Rena Jocelle NalzaroNo ratings yet

- FAR Module 4,5,6 - Assignment ActivityDocument5 pagesFAR Module 4,5,6 - Assignment ActivityairamaecsibbalucaNo ratings yet

- FAR 8.5MC Cash Basis To Accrual Basis FDocument3 pagesFAR 8.5MC Cash Basis To Accrual Basis FKim Flores100% (2)

- Accrual vs. Cash AccountingDocument33 pagesAccrual vs. Cash AccountingAbhishek ShetyeNo ratings yet

- Accrual Versus Cash Basis AccountingDocument4 pagesAccrual Versus Cash Basis AccountingDariya DobrevaNo ratings yet

- Accounting For Receivables 1Document48 pagesAccounting For Receivables 1ramadhan wiprayogaNo ratings yet

- Accounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụDocument45 pagesAccounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụHiep Nguyen TuanNo ratings yet

- ToA.1828 - Accounting Process - Online ReviewDocument3 pagesToA.1828 - Accounting Process - Online ReviewJay-L TanNo ratings yet

- Caie Igcse Accounting 0452 Theory v3Document23 pagesCaie Igcse Accounting 0452 Theory v3tarzan.shakilNo ratings yet

- Basic Accounting For PracticeDocument55 pagesBasic Accounting For PracticeSunil CoelhoNo ratings yet

- Key Terms and Chapter Summary-20Document1 pageKey Terms and Chapter Summary-20Rudravisek SahuNo ratings yet

- Accounting NotesDocument6 pagesAccounting NotesD AngelaNo ratings yet

- Review 105 - Day 5 Theory of AccountsDocument12 pagesReview 105 - Day 5 Theory of AccountsAndre PulancoNo ratings yet

- Review 105 - Day 5 Theory of AccountsDocument12 pagesReview 105 - Day 5 Theory of Accountsneo14No ratings yet

- Cash Basis To Accrual Basis of AccountingDocument15 pagesCash Basis To Accrual Basis of Accountingmary grace abrisNo ratings yet

- SodaPDF Converted Cash To AccrualDocument7 pagesSodaPDF Converted Cash To AccrualestesgadzNo ratings yet

- Dcom205 Accounting For Companies Ii PDFDocument312 pagesDcom205 Accounting For Companies Ii PDFKhawaish MittalNo ratings yet

- Chapter 4 - Adjusting AccountsDocument4 pagesChapter 4 - Adjusting AccountsIESHA JAESAMIN TWAYE BASTIANNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- RFBT.04 Law On Credit TransactionDocument2 pagesRFBT.04 Law On Credit TransactionRhea Royce CabuhatNo ratings yet

- Tax.02 Taxes, Tax Laws and Tax AdministrationDocument6 pagesTax.02 Taxes, Tax Laws and Tax AdministrationRhea Royce CabuhatNo ratings yet

- Far.02 Conceptual Framework For Financial ReportingDocument9 pagesFar.02 Conceptual Framework For Financial ReportingRhea Royce CabuhatNo ratings yet

- Tax.01 Constitutional LimitationsDocument2 pagesTax.01 Constitutional LimitationsRhea Royce CabuhatNo ratings yet

- Mas.02 Variable and Absorption CostingDocument6 pagesMas.02 Variable and Absorption CostingRhea Royce CabuhatNo ratings yet

- Far 01. Introduction To Accountancy Profession & Preface To PfrsDocument5 pagesFar 01. Introduction To Accountancy Profession & Preface To PfrsRhea Royce CabuhatNo ratings yet

- Far.06 Biological AssetsDocument3 pagesFar.06 Biological AssetsRhea Royce CabuhatNo ratings yet

- Far.03 Cash and Cash EquivalentsDocument8 pagesFar.03 Cash and Cash EquivalentsRhea Royce CabuhatNo ratings yet

- At.03 Fundamentals of Assurance ServicesDocument1 pageAt.03 Fundamentals of Assurance ServicesRhea Royce CabuhatNo ratings yet

- At.02 Code of EthicsDocument10 pagesAt.02 Code of EthicsRhea Royce CabuhatNo ratings yet

- Ap.03 Shareholders EquityDocument9 pagesAp.03 Shareholders EquityRhea Royce CabuhatNo ratings yet

- Afar.04 Decentralized OperationDocument2 pagesAfar.04 Decentralized OperationRhea Royce Cabuhat0% (1)

- Afar.03 Revenue From Contracts With CustomersDocument21 pagesAfar.03 Revenue From Contracts With CustomersRhea Royce CabuhatNo ratings yet

- Afar.02 Corporate LiquidationDocument3 pagesAfar.02 Corporate LiquidationRhea Royce CabuhatNo ratings yet

- Present Continuous - Present Simple Vs Present ContinuousDocument2 pagesPresent Continuous - Present Simple Vs Present ContinuouseewuanNo ratings yet

- Whyte Human Rights and The Collateral Damage oDocument16 pagesWhyte Human Rights and The Collateral Damage ojswhy1No ratings yet

- Schedule CDocument273 pagesSchedule CAzi PaybarahNo ratings yet

- Academic Calendar Fall 19-Spring 20 & Summer 20-Final-1 PDFDocument3 pagesAcademic Calendar Fall 19-Spring 20 & Summer 20-Final-1 PDFAhmadNo ratings yet

- A320 PedestalDocument14 pagesA320 PedestalAiman ZabadNo ratings yet

- Product Data Sheet Ingenuity Core LRDocument16 pagesProduct Data Sheet Ingenuity Core LRCeoĐứcTrườngNo ratings yet

- Influence of Cooling Rate On The Structure and Formation of Oxide Scale in LowDocument7 pagesInfluence of Cooling Rate On The Structure and Formation of Oxide Scale in LowVarun MangaloreNo ratings yet

- Female Genital Organ AnomaliesDocument83 pagesFemale Genital Organ AnomalieszulinassirNo ratings yet

- Commuter Crossword Puzzles UpdatedDocument3 pagesCommuter Crossword Puzzles UpdatedChidinma UwadiaeNo ratings yet

- Trial in AbsentiaDocument12 pagesTrial in AbsentiaNahid hossainNo ratings yet

- A Bravo Delta Lancaster Model Worth 329: 38 Paralle L Paralle LDocument116 pagesA Bravo Delta Lancaster Model Worth 329: 38 Paralle L Paralle LAnonymous 7Je2SSU100% (2)

- How To Register A Partnership in SECDocument4 pagesHow To Register A Partnership in SECMa Zola EstelaNo ratings yet

- Environmental Protection: "We Never Know The Worth of Water Till The Wellis Dry."Document14 pagesEnvironmental Protection: "We Never Know The Worth of Water Till The Wellis Dry."Mary Jane BuaronNo ratings yet

- Essay by MariemDocument2 pagesEssay by MariemMatthew MaxwellNo ratings yet

- Past Simple Weekend.m4aDocument7 pagesPast Simple Weekend.m4aCarmen Victoria Niño RamosNo ratings yet

- UNIT 3 Part 1-Propositional LogicDocument11 pagesUNIT 3 Part 1-Propositional LogicVanshika ChauhanNo ratings yet

- Dermatology TreatmentsDocument6 pagesDermatology TreatmentsMayar MostafaNo ratings yet

- Loi Bayanihan PCR ReviewerDocument15 pagesLoi Bayanihan PCR Reviewerailexcj20No ratings yet

- View AnswerDocument112 pagesView Answershiv anantaNo ratings yet

- Company Feasibility StudyDocument21 pagesCompany Feasibility StudyDesiree Raot RaotNo ratings yet

- SPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLADocument2 pagesSPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLAAlia Arnz-Dragon100% (1)

- Project Summary, WOFDocument2 pagesProject Summary, WOFEsha GargNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificatesahityaasthaNo ratings yet

- GIDC Rajju Shroff ROFEL Institute of Management Studies: Subject:-CRVDocument7 pagesGIDC Rajju Shroff ROFEL Institute of Management Studies: Subject:-CRVIranshah MakerNo ratings yet