Professional Documents

Culture Documents

Img 20220411 0006

Img 20220411 0006

Uploaded by

herb flatherOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Img 20220411 0006

Img 20220411 0006

Uploaded by

herb flatherCopyright:

Available Formats

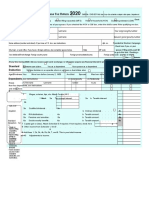

NH001931 04/1'l/2022 3:23 PM

,.,,8879

2021)

(Rev. January

I

IRS e-file Signature Authorization

OMB No. '154t0074

|

) ERO must obtain and retain completed Form 8879.

Depadment of lhe Treasury

lntemal Revenue Seryi@

|

I

) Go to www.lrs.gav/Form8879 tot the latest lnformatlon.

Submission ldentification Number (SlD)

Taxpaye/s name Social security number

Spouse's gocial security number

Spouse's name

Tax Tax Year December 31 2021

Enter whole dollars only on lines 1 through 5.

-

Note: Form 1040-SS filers use line4 only. Leave lines 1,2,3, and 5 blank.

Adjusted gross income. .. .. .

1 427

Total tax 2

Federal income tax withheld from Form(s) W-2 and Form(s) 1099 3

Amount you want refunded to you .. 4

5 Amount owe 5 6

sure

Under penalties of perjury, I declare that I have examined a copy of the income tax return (original or amended) I am now authorizing, and to the best of

my knowledge and belief, it is true, correct, and complete. I further declare that the amounts in Part I above are the amounts trom the income tax

return (original or amended) I am now authorizing. I consent to allow my intermediate service provider, transmitter, or electronic retum originator (ERO)

to send my retum to the IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason

for any delay in processing the retum or refund, and (c) the date of any refund. lf applicable, I authorize the U.S. Treasury and its designated Financial

Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for

payment of my federal taxes owed on this retum andlot a payment of estimated trax, and the financial insiitution to debit the entry to this account. This

authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke (cancel) a

payment, I must contact the U.S. Treasury Financial Agent at 1{88-353-4537, Payment cancellation requests must be received no later than 2

business days prior to the payment (settlement) date. I also authorize the financial institutions involved in the processing of the electronic payment of

taxes to receive confidential information necessary to answer inquiries and resolve issues related to the payment. I further acknowledge lhat the

personal identification number (PlN) below is my signature for the income tax return (original or amended) I am now authorizing and, if applicable, my

Electronic Funds Withdrawal Consent.

Taxpayer's PIN: check one box only

lE I authortze HODGDON, WILSON & GRTEFIN, CPAS to enter or generate my PIN )1931 as my

fim name

ERO Enter fiye digits, h;1

signature on the income tax retum (original or amended) I am now authorilng. donr en6r a1 aG

n I will enter my PIN as my signature on the income tax retum (original or amended) I am now authorizing. Check this box only

if you are entering your own PIN and your retum is filed using the Practitioner PIN method. The ERO must complete Part III

below.

Your slgnature > ?a ,1

Spouse's PIN: check one box only

I I authorize

name

to enter or generate my PIN as my

Enter five digits, but

signature on the income tax retum (original or amended) I am now authorizing.

n I will enter my PIN as my signafure on the income tiax retum (original or amended) I am now authorizing. Check this box only

if you are entering your own PIN and your retum is filed using the Practitioner PIN method. The ERO must complete Part lll

below.

ERO's EFIN/PIN. Enter your six-digit EFIN followed by your fivedigit self-selected PlN.

Don't 6ntsr all zercs

I certify that the above numeric entry is my PlN, which is my signature for the electronic individual income tax retum (odginal or amended) I am now

authorized to file for tax year indicated above for the taxpaye(s) indicated above. I confirm that I am submitting this retum in accordance with the

requirements of the Practitioner PIN method and Pub, 1345, Handbook for Authorized IRS e-17le Providers of lndMdual lncome Tax Retums.

ERO's siqnature ) Date ) O4/LL/22

ERO Must Retain This Form See lnstructions

-

Don't Submit This Form to the IRS Unless Requested To Do So

For Paperwork Reduction Act Notice, see your tax retum instructions. ro* 8879 (Rev. 01-2021)

DAA

You might also like

- Lawsuit Filed Against Robert Shinn, Shekinah Church, 7m FilmsDocument78 pagesLawsuit Filed Against Robert Shinn, Shekinah Church, 7m FilmsKatie Joy100% (1)

- CPR 2022 Tax ReturnDocument1 pageCPR 2022 Tax ReturnUmair MughalNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Legal MemorandumDocument2 pagesLegal MemorandumPam Ramos100% (2)

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- TéléchargementDocument9 pagesTéléchargementHichem BarkatiNo ratings yet

- 2023 Tax Return: Prepared ByDocument14 pages2023 Tax Return: Prepared BypatovoidNo ratings yet

- 2023 Tax Return ZaireDocument14 pages2023 Tax Return ZairepatovoidNo ratings yet

- 2023 Tax Return: Prepared ByDocument11 pages2023 Tax Return: Prepared ByopreciousekugbereNo ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- Mart1552 21i FCDocument23 pagesMart1552 21i FCOlga M.No ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- State District of ColumbiaDocument20 pagesState District of ColumbiaRoger federerNo ratings yet

- 2019 Leon California FilingDocument18 pages2019 Leon California FilingPolo PoloNo ratings yet

- 2022 8879 (Brashier Misty) 2Document12 pages2022 8879 (Brashier Misty) 2Astrid ReiNo ratings yet

- 2020 Donnarumma SH Form 1040 Individual Tax Return - RecordsDocument19 pages2020 Donnarumma SH Form 1040 Individual Tax Return - RecordsandyNo ratings yet

- Think Computer Foundation 2009 Tax ReturnDocument10 pagesThink Computer Foundation 2009 Tax ReturnTaxManNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNo ratings yet

- 2021 TaxReturnDocument183 pages2021 TaxReturnCedric McCoyNo ratings yet

- TaxReturn JoderamerDocument19 pagesTaxReturn JoderamerTujuh AnginNo ratings yet

- FTF - David George 2021 PRRRRRDocument7 pagesFTF - David George 2021 PRRRRRkramergeorgec397No ratings yet

- TurboTax Print Preview 02-14-2013T20.10.08.460Document13 pagesTurboTax Print Preview 02-14-2013T20.10.08.460glenncannon1973No ratings yet

- 2013 Tax Return (Shep-Ty DBA Embrace)Document24 pages2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNo ratings yet

- 2009 Income Tax ReturnDocument5 pages2009 Income Tax Returngrantj820No ratings yet

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- 2022TaxReturn StarnesDocument17 pages2022TaxReturn Starnesjpneeb100% (1)

- Income Tax Return 2023 24 Excluding 82C Businesspartnership3Document18 pagesIncome Tax Return 2023 24 Excluding 82C Businesspartnership3Mehedi HasanNo ratings yet

- TB US TaxRefund 2009 ENG PackDocument8 pagesTB US TaxRefund 2009 ENG Packabsolute_absurdNo ratings yet

- Form990 2021 1661373681961Document58 pagesForm990 2021 1661373681961Jeremy Joseph EhlingerNo ratings yet

- Tax Return Receipt ConfirmationDocument5 pagesTax Return Receipt ConfirmationAntoni Boyd Montejo AlicanteNo ratings yet

- FAFSA Submission Summary 2024-25 FAFSA Form Federal Student AidDocument9 pagesFAFSA Submission Summary 2024-25 FAFSA Form Federal Student Aidmatthewrussell661No ratings yet

- Return 2019 BOY FIRST MAKEDocument6 pagesReturn 2019 BOY FIRST MAKEshahabNo ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- FTF 2024-01-19 1705691319142Document16 pagesFTF 2024-01-19 1705691319142Naty MoralesNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- 2021TaxReturnPDF 221003 100736Document18 pages2021TaxReturnPDF 221003 100736Tracy SmithNo ratings yet

- Main - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDocument4 pagesMain - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDiana JuanNo ratings yet

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- Tax Certificate 2022-2023Document1 pageTax Certificate 2022-2023marco.kozilekgoweNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetLabNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- Tax ReturnsDocument1 pageTax Returnshuss eynNo ratings yet

- Tax Return 2017Document23 pagesTax Return 2017jbanuelosv73No ratings yet

- Tax Return 2021Document3 pagesTax Return 2021Mark ThomasNo ratings yet

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Document42 pages2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- 1098T17Document2 pages1098T17RegrubdiupsNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- Hall Tax Services Hall Tax Professionals Chicago Heights Il 60411Document34 pagesHall Tax Services Hall Tax Professionals Chicago Heights Il 60411Rendy MomoNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- 398 2019 ArchiveTaxReturnDocument10 pages398 2019 ArchiveTaxReturnjimmy naranjoNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNo ratings yet

- Tax File 2106 Ss FileingDocument5 pagesTax File 2106 Ss FileingWALLAUERNo ratings yet

- 2020 Tax Return: Prepared ByDocument5 pages2020 Tax Return: Prepared ByAdam MasonNo ratings yet

- Petition To Vacate Void JudgmentDocument5 pagesPetition To Vacate Void JudgmentTiffany Whyask90% (10)

- Ghislaine Maxwell MotionDocument72 pagesGhislaine Maxwell MotionLaw&Crime100% (1)

- LEGAL ETHICS (Prob Areas) Digest CaseDocument3 pagesLEGAL ETHICS (Prob Areas) Digest Casewainie_deroNo ratings yet

- Malangas v. Zaide (Case Brief)Document2 pagesMalangas v. Zaide (Case Brief)nikkisalsNo ratings yet

- Hudson 1Document9 pagesHudson 1Nawaz KhanNo ratings yet

- Macasaet vs. Co Jr. (Rule 10-14)Document1 pageMacasaet vs. Co Jr. (Rule 10-14)Theodore0176No ratings yet

- Board of Architecture-CEDocument3 pagesBoard of Architecture-CExxxxchrjycNo ratings yet

- Module in Negotiable Instrument LawDocument10 pagesModule in Negotiable Instrument LawKheen AndalNo ratings yet

- Memorandum of Association PTVDocument4 pagesMemorandum of Association PTVfarooq61No ratings yet

- Federal Public Service CommissionDocument2 pagesFederal Public Service Commissionabuzar ranaNo ratings yet

- G.R. No. 217974Document15 pagesG.R. No. 217974Elmer LucreciaNo ratings yet

- Bill of RightsDocument75 pagesBill of Rightsgaelan100% (4)

- Amity Business School: MBA, Semester 2 Legal Aspects of Business Ms. Shinu VigDocument14 pagesAmity Business School: MBA, Semester 2 Legal Aspects of Business Ms. Shinu Vigrohitk225No ratings yet

- Salumbides v. OmbudsmanDocument10 pagesSalumbides v. OmbudsmanArnold BagalanteNo ratings yet

- KNRPaquingan - Final PaperDocument7 pagesKNRPaquingan - Final PaperkeziahNo ratings yet

- Gautier, MS - Jerry Cooksey Lawsuit Against City and Police Chief Dante ElbinDocument11 pagesGautier, MS - Jerry Cooksey Lawsuit Against City and Police Chief Dante ElbinElaine VechorikNo ratings yet

- Lease Deed This LEASE DEED Made at - , Gujarat On This The - Day ofDocument31 pagesLease Deed This LEASE DEED Made at - , Gujarat On This The - Day ofPriyankaNo ratings yet

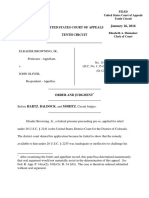

- Browning v. Oliver, 10th Cir. (2016)Document3 pagesBrowning v. Oliver, 10th Cir. (2016)Scribd Government DocsNo ratings yet

- Commissioner of Internal Revenue vs. LA Tondeña Distillers, Inc. (LTDI (Now Ginebra San Miguel) ) - GR No. 175188 - Jul. 15, 2015Document8 pagesCommissioner of Internal Revenue vs. LA Tondeña Distillers, Inc. (LTDI (Now Ginebra San Miguel) ) - GR No. 175188 - Jul. 15, 2015Kristel Anne LiwagNo ratings yet

- Domingo vs. Aquino, 38 SCRA 472 (1971)Document1 pageDomingo vs. Aquino, 38 SCRA 472 (1971)Ridzanna Abdulgafur100% (1)

- Rommel Jacinto Dantes Silverio Vs Republic of The PhilippinesDocument3 pagesRommel Jacinto Dantes Silverio Vs Republic of The PhilippinesJaspherose Peralta MalicdanNo ratings yet

- Evolution of Philippine ConstitutionDocument25 pagesEvolution of Philippine ConstitutionKim Kyun SiNo ratings yet

- Travels in The Great Desert of Sahara, in The Years of 1845 and 1846 by Richardson, James, 1806-1851Document12 pagesTravels in The Great Desert of Sahara, in The Years of 1845 and 1846 by Richardson, James, 1806-1851Gutenberg.orgNo ratings yet

- Public Interest LitigationDocument32 pagesPublic Interest LitigationPratyush GuptaNo ratings yet

- Supreme Court: Republic of The Philippines ManilaDocument5 pagesSupreme Court: Republic of The Philippines ManilaJerik SolasNo ratings yet

- United States Court of Appeals, Third CircuitDocument21 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Dorner v. Los Angeles Police DepartmentDocument14 pagesDorner v. Los Angeles Police DepartmentSGVNewsNo ratings yet

- Legal Victory For The Philippines Against China: A Case StudyDocument3 pagesLegal Victory For The Philippines Against China: A Case StudyANGELO APORTADERANo ratings yet