Professional Documents

Culture Documents

ULIPRPR XXXXXXX8009 19022021 4680 Unlocked

ULIPRPR XXXXXXX8009 19022021 4680 Unlocked

Uploaded by

manish sharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ULIPRPR XXXXXXX8009 19022021 4680 Unlocked

ULIPRPR XXXXXXX8009 19022021 4680 Unlocked

Uploaded by

manish sharmaCopyright:

Available Formats

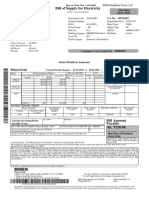

Receipt No.: I00015286918 Receipt Date: 02-Jan-2023 Invoice No.

: HRI022103979930 Invoice Date:02-01-2023

Correspondence address & GSTIN of policyholder: Branch Address & GSTIN of SBI Life:

SH HOSHIAR SINGH Sbi Life Insurance Co Ltd, 2nd Floor, Shop No. 1702, 1703, 1703-A,

S/O Sh Hoshiar Singh, V And P O Saharanwas, Rewari, Haryana, 123401 1704,, Railway Road, Chowk, Rewari,, Rewari Haryana India

Place of supply (State name and code) : HARYANA/6

GSTIN: N.A GSTIN & State Name: 06AAFCS2530P1Z5 and HARYANA/6

HSN Code -997132 HSN Description - Insurance and Pension Services

Life Assured : Mr. Manish Kumar

Assignee: N.A

UIN: 111L095V01 Sum Assured (f): 1000000.00

Policy Number: 1K085788009 Channel: Agency

Plan: SBIL - Smart Wealth Builder - RP and LP Premium Frequency: Annual

Date Of Commencement: 13-Feb-2017 Channel Code: 990636094

Distributor Name: Mr. Suresh Sharma Previous Shortage/Excess (f):

Policy Term: 10 Current Shortage/Excess (f):

Premium Payment Term: 5 Other Charges (f): 0.00

Mode Of Payment Instrument No. Instrument Date Instrument Amount (`) Renewal Adjustment (`)

CSS Online Payment VICI9708635395 02-Jan-2023 100000 100000.00

Received with thanks Rs.100000/- (100000) by way of CSS Online Payment

Total Premium Allocated (f) 100000.00 CGST (f) 0.00

Less: Allocation Charges (f) 6000.00 SGST (f) 0.00

Taxable value of Allocation charge (f) 6000.00 IGST (f) 0.00

Total Allocation Charge with GST (f) 7080.00 KFCT (f) 0.00

Less:- GST on Charges (Whether the tax is payable on reverse charge basis or not - No.) ( ) f 0.00

Net Invested Amount (f) 92920.00

NEXT PREMIUM DUE DATE : -- 02/01/2024

UNIT ALLOCATION STATEMENT

For updated Investment details, please download fund statement from SBI Life website - Customer Service Portal OR SMS FV <<space>>

(Policy Number) to 56161 OR 9250001848 for latest fund details.

Authorized Signatory

Notes:

The validity of this receipt is subject to realization of cheque.

In case of outstation cheques, allocation amount will be done on the date of adjustment of premiums or the realizatin of cheque whichver is later.

In case of revival of the policy, the risk cover under the base policy and the rider covers if any, will recommence from the date of revival. Any

contingencies which may have happened while the policy was lapzed will NOT be covered even if the claim is made or intimated after the policy has

been revived

As per GOI registration,GST has been levied on your insurance policy @18% on premium or charges, (or as applicable) w.e.f. 01.07.2017. In the case of

endowment policy, the taxable value is 25% of the premium for first year and 12.5% for second and subsequent year. For single premium annuity

policy, the taxable value is 10% of the premium, pleae refer SBI Life website for details.

Goods and Service Tax (GST) Cess and/or any other statutory levy/duty/surcharge at the rate notified by the Central Government/State Government/

Union Territories of India from time to time, shall be levied on premium/charges (as applicable) as per rhe provisions of the prevalent tax laws.

Premium paid under this policy is eligible for tax rebates under 80C of the Income Tax Act, 1961 as applicable.

* -KFCT (Kerala Flood Cess Tax) If applicable effective 1st August 2019 for policies were customer and branch address is same for Kerala state

Consolidated Stamp duty paid vide Mudrank receipt no. CSD/147/2020/2417 dated 29 Oct 2020

SBI Life Insurance Company Limited

IRDAI Regn. No. 111 CIN: L99999MH2000PLC1291113

Central Processing Centre, 7th Level(D Wing) & 8th Level, Seawoods Grand Central, Tower2 Plot No R-1, Sector 40, Seawoods, Nerul Node, Navi Mumbai 400706

Dist:Thane, Maharashtra

0/16368

You might also like

- RPR Whatsapp PDFDocument1 pageRPR Whatsapp PDFHarpinder ਮਾਨNo ratings yet

- ULIPRPR XXXXXXX8009 19022021 4680 UnlockedDocument1 pageULIPRPR XXXXXXX8009 19022021 4680 Unlockedmanish sharmaNo ratings yet

- RPR WhatsappDocument1 pageRPR WhatsappLalit Kumar SunariNo ratings yet

- Account Certificate 20240214053224 20078018Document2 pagesAccount Certificate 20240214053224 20078018ArunNo ratings yet

- RPR WhatsappDocument1 pageRPR WhatsappprabhuNo ratings yet

- Sbil RPRDocument1 pageSbil RPRMS Nayak Ms NayakNo ratings yet

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. PAWAN KUMAR Assignee: N.A. Policy DetailsDocument1 pageRenewal Premium Receipt - NON ULIP: Life Assured: Mr. PAWAN KUMAR Assignee: N.A. Policy DetailsPawan KumarNo ratings yet

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsDocument1 pageRenewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsVinodkumar ShethNo ratings yet

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- Sbil RPRDocument1 pageSbil RPRjothikumar1405No ratings yet

- OS15830487 PremiumPaymentCertificateDocument1 pageOS15830487 PremiumPaymentCertificateRohit ChogleNo ratings yet

- ETRXN Acctstmt MMDocument4 pagesETRXN Acctstmt MMarvajaniNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document4 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377BHAWANATH JHANo ratings yet

- Pol # 744Document3 pagesPol # 744kassociates687No ratings yet

- Collection - C - SalesforceDocument2 pagesCollection - C - SalesforceDay by day fit fitnessNo ratings yet

- Account Certificate 20240214053224 20078018Document2 pagesAccount Certificate 20240214053224 20078018ArunNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document6 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377meedinesh123No ratings yet

- Appolo Munich PolicyDocument3 pagesAppolo Munich PolicyEswar VakkalagaddaNo ratings yet

- Renewal Premium Receipt: Invoice Number: A150048237100041Document1 pageRenewal Premium Receipt: Invoice Number: A150048237100041Aasiya shadab KhanNo ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- Receipt OT037733302Document2 pagesReceipt OT037733302Gaurang MandalNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document6 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377mohinuddinNo ratings yet

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinod S Assignee: N.A. Policy DetailsDocument1 pageRenewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinod S Assignee: N.A. Policy Detailsvinod sNo ratings yet

- Adobe Scan Nov 27, 2023-CompressedDocument7 pagesAdobe Scan Nov 27, 2023-Compressedswainsachidananda1950No ratings yet

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- 9704316Document105 pages9704316abhinav pachauriNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document4 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377far03No ratings yet

- Premium ReceiptDocument1 pagePremium Receiptgaurav sharmaNo ratings yet

- Zprmrnot 22847670 15676911Document1 pageZprmrnot 22847670 15676911Gulshan GavelNo ratings yet

- Aa00486044 01Document3 pagesAa00486044 01Sachin ShindeNo ratings yet

- Dear Prakash Chandra Sharma,: Policy DetailsDocument5 pagesDear Prakash Chandra Sharma,: Policy DetailsShivam SharmaNo ratings yet

- Bill of Supply For Electricity: Due Date: 24-03-2018Document2 pagesBill of Supply For Electricity: Due Date: 24-03-2018gurdeeNo ratings yet

- Zprmrnot 23614257 14778150Document1 pageZprmrnot 23614257 14778150c97rvkkyfrNo ratings yet

- RPR WhatsappDocument1 pageRPR WhatsappDhaneswar SwainNo ratings yet

- Malarvizhi GiriDocument2 pagesMalarvizhi Girisun16darNo ratings yet

- Renewal Premium Receipt - ULIP: Life Assured: Mr. AVINASH PATNAIK Assignee: N.A. Policy DetailsDocument1 pageRenewal Premium Receipt - ULIP: Life Assured: Mr. AVINASH PATNAIK Assignee: N.A. Policy DetailsAvinash PatnaikNo ratings yet

- Og 22 2047 1802 00002442Document5 pagesOg 22 2047 1802 00002442sanjayid1980No ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document6 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377chandra_nadikudiNo ratings yet

- Policy Document BajajAllianz General InsuranceDocument5 pagesPolicy Document BajajAllianz General InsurancealirezadoctorNo ratings yet

- Original For Recipient Tax Invoice: (Deepak Das)Document1 pageOriginal For Recipient Tax Invoice: (Deepak Das)Deepak DasNo ratings yet

- RenewalReceipt 502-7066983 PolicyRenewalDocument2 pagesRenewalReceipt 502-7066983 PolicyRenewalSoumitra GuptaNo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Brains Trust PPT - MR Gautam DoshiDocument31 pagesBrains Trust PPT - MR Gautam DoshiIshanNo ratings yet

- Premium Paid Certificate For The Year 2008/09Document1 pagePremium Paid Certificate For The Year 2008/09chandrabhushanp4No ratings yet

- Zprmrnot 20927762 24235025 231002 181434Document2 pagesZprmrnot 20927762 24235025 231002 181434aanandaman1098No ratings yet

- RD ShriramDocument1 pageRD Shriramgautam bhaleraoNo ratings yet

- RO COPY SHASHI SHANKARDocument1 pageRO COPY SHASHI SHANKARukp11No ratings yet

- Tw2677186 Sanction LetterDocument1 pageTw2677186 Sanction Letterasmotorsghugus01No ratings yet

- Sanction LetterDocument1 pageSanction LettervinilNo ratings yet

- LAI-122470246 - GST InvoiceDocument1 pageLAI-122470246 - GST Invoicegamersingh098123No ratings yet

- (Based On Presumed Data) File No.: 2-14349 Ddo: (000015) Accounts Officer Dte of TransportDocument2 pages(Based On Presumed Data) File No.: 2-14349 Ddo: (000015) Accounts Officer Dte of TransportD S PNo ratings yet

- Policy Document BajajAllianz General InsuranceDocument5 pagesPolicy Document BajajAllianz General InsuranceMohd AdilNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptm00162372No ratings yet

- INS 1673863254 PolicydocDocument6 pagesINS 1673863254 Policydocajayparmar015No ratings yet

- Insurance D.B Essem-IIIDocument2 pagesInsurance D.B Essem-IIIAnonymous i3lI9MNo ratings yet

- TQ1136035 Ack 20220319033835Document1 pageTQ1136035 Ack 20220319033835Mukesh YadavNo ratings yet

- OS21998315 PremiumPaymentCertificateDocument1 pageOS21998315 PremiumPaymentCertificateSoumyaranjan SwainNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailschethanchethanmn8No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Iiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiii: Fixedline and Broadband ServicesDocument1 pageIiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiii: Fixedline and Broadband Servicesmanish sharmaNo ratings yet

- Nagarro - Receipt For Claiming Drivers SalaryDocument1 pageNagarro - Receipt For Claiming Drivers SalaryNitin YadavNo ratings yet

- ULIPRPR XXXXXXX8009 19022021 4680 UnlockedDocument1 pageULIPRPR XXXXXXX8009 19022021 4680 Unlockedmanish sharmaNo ratings yet

- DS Algo Book BillDocument1 pageDS Algo Book Billmanish sharmaNo ratings yet