Professional Documents

Culture Documents

CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not Apply

CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not Apply

Uploaded by

SRIKANTA ROUTCopyright:

Available Formats

You might also like

- Notification 34 2024Document1 pageNotification 34 2024Kirtan Ramesh JethvaNo ratings yet

- 20 Lakh After 29 March 2018Document1 page20 Lakh After 29 March 2018MCB ACCOUNT BRANCHNo ratings yet

- csnt23 2022Document1 pagecsnt23 2022nitin DRINo ratings yet

- st17 2014Document1 pagest17 2014hqpoolkolsouthNo ratings yet

- Notification 1Document1 pageNotification 1Parmeet NainNo ratings yet

- Notification26 2018Document1 pageNotification26 2018PrashantSinghNo ratings yet

- Notification 35and39Document3 pagesNotification 35and39varunnamin1992No ratings yet

- CST 17 2024Document1 pageCST 17 2024ndshiva22No ratings yet

- Ministry of Finance (Department of Revenue) NotificationDocument1 pageMinistry of Finance (Department of Revenue) NotificationKittuNo ratings yet

- Customs Notification 2 - 2023Document1 pageCustoms Notification 2 - 2023Raja SinghNo ratings yet

- GST CT 31 2023 3Document1 pageGST CT 31 2023 3cadeepaksingh4No ratings yet

- 40-2022-Custom-Increase in GST Import Rate From 5% To 12%Document2 pages40-2022-Custom-Increase in GST Import Rate From 5% To 12%legendry007No ratings yet

- Ministry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Document1 pageMinistry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Vishal KanadeNo ratings yet

- Notification42 2017Document1 pageNotification42 2017NDTV100% (1)

- 05 2024 CT EngDocument1 page05 2024 CT EngArun_ecNo ratings yet

- Notification 98 2023Document1 pageNotification 98 2023tax.contactNo ratings yet

- Customs Non Tariff Notifications No.51/2014 Dated 11th July, 2014Document1 pageCustoms Non Tariff Notifications No.51/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- ST STDocument1 pageST STsrinivasan subbaiyanNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- Customs Notification 44 - 2023Document1 pageCustoms Notification 44 - 2023Raja SinghNo ratings yet

- Notfctn 10 Central Tax English 2021Document2 pagesNotfctn 10 Central Tax English 2021cadeepaksingh4No ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- GST CT 13 2023Document1 pageGST CT 13 2023Naga Obul ReddyNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- Notfctn 14 Central TaxDocument1 pageNotfctn 14 Central TaxVikas AgrawalNo ratings yet

- Notification 89 2023Document1 pageNotification 89 2023sarvagya.mishra448No ratings yet

- Prescribing Modes of PaymentDocument1 pagePrescribing Modes of PaymentJalaj JainNo ratings yet

- Notification 97 2023Document1 pageNotification 97 2023tax.contactNo ratings yet

- Ce18 2023Document1 pageCe18 2023Aravind GovindarajaluNo ratings yet

- Explanation III. For The Purposes of This Notification, "Non-Assesse Online Recipient" HasDocument1 pageExplanation III. For The Purposes of This Notification, "Non-Assesse Online Recipient" HasSushant SaxenaNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- cs33 2013Document1 pagecs33 2013stephin k jNo ratings yet

- 05 - 2022-Amendment To Notification 13Document2 pages05 - 2022-Amendment To Notification 13deepak.sharmaNo ratings yet

- 05 - 2022 CTR EngDocument2 pages05 - 2022 CTR EngJeremy RemlalfakaNo ratings yet

- CST 45 2023Document1 pageCST 45 2023Raja SinghNo ratings yet

- Circular 2 2023Document1 pageCircular 2 2023NESL WebsiteNo ratings yet

- 11 2022 Itr Eng PDFDocument1 page11 2022 Itr Eng PDFSuresh KumarNo ratings yet

- (To Be Published in The Gazette of India, Extraordinary, Part-Ii, Section-3, Sub-Section (Ii) )Document1 page(To Be Published in The Gazette of India, Extraordinary, Part-Ii, Section-3, Sub-Section (Ii) )Mahaveer DhelariyaNo ratings yet

- Cus 2212Document1 pageCus 2212patelpratik1972No ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- 2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-BDocument2 pages2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-BRaj A KapadiaNo ratings yet

- cs10 2013Document1 pagecs10 2013stephin k jNo ratings yet

- 2017-07-04 - The Income-Tax (19th Amendment) Rules, 2017 - Amendment of Rule 29-B and Form No 15-CDocument1 page2017-07-04 - The Income-Tax (19th Amendment) Rules, 2017 - Amendment of Rule 29-B and Form No 15-CRaj A KapadiaNo ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- TH THDocument2 pagesTH THKrishna GoyalNo ratings yet

- st01 2017Document1 pagest01 2017Rajula Gurva ReddyNo ratings yet

- Notfctn 02 2021 2020 CGST RateDocument2 pagesNotfctn 02 2021 2020 CGST RateJatinMittalNo ratings yet

- Notfctn 22 2021 CGST Rate 1Document1 pageNotfctn 22 2021 CGST Rate 1GST ACADEMY OF EXCELLENCE ERODE 73737 16648No ratings yet

- Vide Number G.S.R. 483 (E), Dated The 11: TH THDocument1 pageVide Number G.S.R. 483 (E), Dated The 11: TH THSushant SaxenaNo ratings yet

- GST CT 37 2023 1Document1 pageGST CT 37 2023 1cadeepaksingh4No ratings yet

- 12 2022 CT Eng-3Document1 page12 2022 CT Eng-3cadeepaksingh4No ratings yet

- Notification No.09/2013 - Service TaxDocument2 pagesNotification No.09/2013 - Service Taxmaahi7No ratings yet

- Clean Energy Cess Notn.Document11 pagesClean Energy Cess Notn.Aditya SairamNo ratings yet

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- cs26 2013Document1 pagecs26 2013stephin k jNo ratings yet

- Compensation Cess02 2021 Rate EngDocument1 pageCompensation Cess02 2021 Rate EngHemant SinhmarNo ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- Click Here: Covid Guidelines: Hotel DetailsDocument4 pagesClick Here: Covid Guidelines: Hotel DetailsSRIKANTA ROUTNo ratings yet

- Delivery Service TNCDocument1 pageDelivery Service TNCSRIKANTA ROUTNo ratings yet

- Soro PuriDocument1 pageSoro PuriSRIKANTA ROUTNo ratings yet

- CDF SPC All LOB Except HL LevelDocument2 pagesCDF SPC All LOB Except HL LevelSRIKANTA ROUTNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)SRIKANTA ROUTNo ratings yet

- 2023 New Resume - PubaliDocument6 pages2023 New Resume - PubaliSRIKANTA ROUTNo ratings yet

- Pau Pnbe Exp Sleeper Class (SL)Document2 pagesPau Pnbe Exp Sleeper Class (SL)amit patel funny videosNo ratings yet

- Consolidated Formcpdf 1288755 075734 SignedDocument4 pagesConsolidated Formcpdf 1288755 075734 SignedSRIKANTA ROUTNo ratings yet

- Vacancies As OnDocument28 pagesVacancies As OnSRIKANTA ROUTNo ratings yet

- Supreme Court Directs GSTN To Open Portal For Filing TRAN-1Document2 pagesSupreme Court Directs GSTN To Open Portal For Filing TRAN-1SRIKANTA ROUTNo ratings yet

- Tax Audit Under Section 44AB For AY 2022-23Document31 pagesTax Audit Under Section 44AB For AY 2022-23SRIKANTA ROUTNo ratings yet

CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not Apply

CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not Apply

Uploaded by

SRIKANTA ROUTOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not Apply

CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not Apply

Uploaded by

SRIKANTA ROUTCopyright:

Available Formats

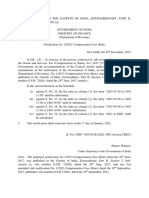

2 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC.

3(ii)]

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 17th August, 2022

INCOME-TAX

S.O. 3878(E).—In exercise of the powers conferred by clause (ii) to fifth proviso to sub-section

(1G) of section 206C of the Income-tax Act, 1961 (43 of 1961) (hereinafter referred to as “Act”) and in

suppression of the notification of the Government of India, Central Board of Direct Taxes published in the

Gazette of India, Extraordinary, Part II, Section 3, Sub-section (ii) vide number S.O. 1494(E), dated the

30th March 2022, except as respects things done or omitted to be done before such suppression, the Central

Government hereby notifies that the provisions of sub-section (1G) of section 206C of the Act shall not

apply to a person (being a buyer) who is a non-resident in terms of section 6 of the Act and who does not

have a permanent establishment in India.

2. This notification shall come into force with effect from the date of publication of this notification in the

Official Gazette.

[Notification No. 99/2022/F. No. 370142/9/2022-TPL Part (2)]

MRINALINI KAUR SAPRA, Director

Uploaded by Dte. of Printing at Government of India Press, Ring Road, Mayapuri, New Delhi-110064

and Published by the Controller of Publications, Delhi-110054.

You might also like

- Notification 34 2024Document1 pageNotification 34 2024Kirtan Ramesh JethvaNo ratings yet

- 20 Lakh After 29 March 2018Document1 page20 Lakh After 29 March 2018MCB ACCOUNT BRANCHNo ratings yet

- csnt23 2022Document1 pagecsnt23 2022nitin DRINo ratings yet

- st17 2014Document1 pagest17 2014hqpoolkolsouthNo ratings yet

- Notification 1Document1 pageNotification 1Parmeet NainNo ratings yet

- Notification26 2018Document1 pageNotification26 2018PrashantSinghNo ratings yet

- Notification 35and39Document3 pagesNotification 35and39varunnamin1992No ratings yet

- CST 17 2024Document1 pageCST 17 2024ndshiva22No ratings yet

- Ministry of Finance (Department of Revenue) NotificationDocument1 pageMinistry of Finance (Department of Revenue) NotificationKittuNo ratings yet

- Customs Notification 2 - 2023Document1 pageCustoms Notification 2 - 2023Raja SinghNo ratings yet

- GST CT 31 2023 3Document1 pageGST CT 31 2023 3cadeepaksingh4No ratings yet

- 40-2022-Custom-Increase in GST Import Rate From 5% To 12%Document2 pages40-2022-Custom-Increase in GST Import Rate From 5% To 12%legendry007No ratings yet

- Ministry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Document1 pageMinistry of Finance (Department of Revenue) : The Gazette of India: Extraordinary (P Ii-S - 3 (Ii) )Vishal KanadeNo ratings yet

- Notification42 2017Document1 pageNotification42 2017NDTV100% (1)

- 05 2024 CT EngDocument1 page05 2024 CT EngArun_ecNo ratings yet

- Notification 98 2023Document1 pageNotification 98 2023tax.contactNo ratings yet

- Customs Non Tariff Notifications No.51/2014 Dated 11th July, 2014Document1 pageCustoms Non Tariff Notifications No.51/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- ST STDocument1 pageST STsrinivasan subbaiyanNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- Customs Notification 44 - 2023Document1 pageCustoms Notification 44 - 2023Raja SinghNo ratings yet

- Notfctn 10 Central Tax English 2021Document2 pagesNotfctn 10 Central Tax English 2021cadeepaksingh4No ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- GST CT 13 2023Document1 pageGST CT 13 2023Naga Obul ReddyNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- Notfctn 14 Central TaxDocument1 pageNotfctn 14 Central TaxVikas AgrawalNo ratings yet

- Notification 89 2023Document1 pageNotification 89 2023sarvagya.mishra448No ratings yet

- Prescribing Modes of PaymentDocument1 pagePrescribing Modes of PaymentJalaj JainNo ratings yet

- Notification 97 2023Document1 pageNotification 97 2023tax.contactNo ratings yet

- Ce18 2023Document1 pageCe18 2023Aravind GovindarajaluNo ratings yet

- Explanation III. For The Purposes of This Notification, "Non-Assesse Online Recipient" HasDocument1 pageExplanation III. For The Purposes of This Notification, "Non-Assesse Online Recipient" HasSushant SaxenaNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- cs33 2013Document1 pagecs33 2013stephin k jNo ratings yet

- 05 - 2022-Amendment To Notification 13Document2 pages05 - 2022-Amendment To Notification 13deepak.sharmaNo ratings yet

- 05 - 2022 CTR EngDocument2 pages05 - 2022 CTR EngJeremy RemlalfakaNo ratings yet

- CST 45 2023Document1 pageCST 45 2023Raja SinghNo ratings yet

- Circular 2 2023Document1 pageCircular 2 2023NESL WebsiteNo ratings yet

- 11 2022 Itr Eng PDFDocument1 page11 2022 Itr Eng PDFSuresh KumarNo ratings yet

- (To Be Published in The Gazette of India, Extraordinary, Part-Ii, Section-3, Sub-Section (Ii) )Document1 page(To Be Published in The Gazette of India, Extraordinary, Part-Ii, Section-3, Sub-Section (Ii) )Mahaveer DhelariyaNo ratings yet

- Cus 2212Document1 pageCus 2212patelpratik1972No ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- 2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-BDocument2 pages2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-BRaj A KapadiaNo ratings yet

- cs10 2013Document1 pagecs10 2013stephin k jNo ratings yet

- 2017-07-04 - The Income-Tax (19th Amendment) Rules, 2017 - Amendment of Rule 29-B and Form No 15-CDocument1 page2017-07-04 - The Income-Tax (19th Amendment) Rules, 2017 - Amendment of Rule 29-B and Form No 15-CRaj A KapadiaNo ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- TH THDocument2 pagesTH THKrishna GoyalNo ratings yet

- st01 2017Document1 pagest01 2017Rajula Gurva ReddyNo ratings yet

- Notfctn 02 2021 2020 CGST RateDocument2 pagesNotfctn 02 2021 2020 CGST RateJatinMittalNo ratings yet

- Notfctn 22 2021 CGST Rate 1Document1 pageNotfctn 22 2021 CGST Rate 1GST ACADEMY OF EXCELLENCE ERODE 73737 16648No ratings yet

- Vide Number G.S.R. 483 (E), Dated The 11: TH THDocument1 pageVide Number G.S.R. 483 (E), Dated The 11: TH THSushant SaxenaNo ratings yet

- GST CT 37 2023 1Document1 pageGST CT 37 2023 1cadeepaksingh4No ratings yet

- 12 2022 CT Eng-3Document1 page12 2022 CT Eng-3cadeepaksingh4No ratings yet

- Notification No.09/2013 - Service TaxDocument2 pagesNotification No.09/2013 - Service Taxmaahi7No ratings yet

- Clean Energy Cess Notn.Document11 pagesClean Energy Cess Notn.Aditya SairamNo ratings yet

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- cs26 2013Document1 pagecs26 2013stephin k jNo ratings yet

- Compensation Cess02 2021 Rate EngDocument1 pageCompensation Cess02 2021 Rate EngHemant SinhmarNo ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- Click Here: Covid Guidelines: Hotel DetailsDocument4 pagesClick Here: Covid Guidelines: Hotel DetailsSRIKANTA ROUTNo ratings yet

- Delivery Service TNCDocument1 pageDelivery Service TNCSRIKANTA ROUTNo ratings yet

- Soro PuriDocument1 pageSoro PuriSRIKANTA ROUTNo ratings yet

- CDF SPC All LOB Except HL LevelDocument2 pagesCDF SPC All LOB Except HL LevelSRIKANTA ROUTNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)SRIKANTA ROUTNo ratings yet

- 2023 New Resume - PubaliDocument6 pages2023 New Resume - PubaliSRIKANTA ROUTNo ratings yet

- Pau Pnbe Exp Sleeper Class (SL)Document2 pagesPau Pnbe Exp Sleeper Class (SL)amit patel funny videosNo ratings yet

- Consolidated Formcpdf 1288755 075734 SignedDocument4 pagesConsolidated Formcpdf 1288755 075734 SignedSRIKANTA ROUTNo ratings yet

- Vacancies As OnDocument28 pagesVacancies As OnSRIKANTA ROUTNo ratings yet

- Supreme Court Directs GSTN To Open Portal For Filing TRAN-1Document2 pagesSupreme Court Directs GSTN To Open Portal For Filing TRAN-1SRIKANTA ROUTNo ratings yet

- Tax Audit Under Section 44AB For AY 2022-23Document31 pagesTax Audit Under Section 44AB For AY 2022-23SRIKANTA ROUTNo ratings yet