Professional Documents

Culture Documents

Tax Calculator

Tax Calculator

Uploaded by

Lovish Vatwani0 ratings0% found this document useful (0 votes)

18 views1 pageThis document is a tax calculator for an employee that compares taxes owed under the old tax regime versus the new tax regime based on an annual gross salary of 1,493,934. Under the old regime, the employee's net taxable salary is 684,008 with a total tax payable of 51,273. Under the new regime without exemptions and deductions, the employee's total tax payable is higher at 193,422. The document disclaimer notes that the calculator is illustrative and the actual tax calculation may differ based on additional variables in the employee's payroll.

Original Description:

Original Title

TaxCalculator

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a tax calculator for an employee that compares taxes owed under the old tax regime versus the new tax regime based on an annual gross salary of 1,493,934. Under the old regime, the employee's net taxable salary is 684,008 with a total tax payable of 51,273. Under the new regime without exemptions and deductions, the employee's total tax payable is higher at 193,422. The document disclaimer notes that the calculator is illustrative and the actual tax calculation may differ based on additional variables in the employee's payroll.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageTax Calculator

Tax Calculator

Uploaded by

Lovish VatwaniThis document is a tax calculator for an employee that compares taxes owed under the old tax regime versus the new tax regime based on an annual gross salary of 1,493,934. Under the old regime, the employee's net taxable salary is 684,008 with a total tax payable of 51,273. Under the new regime without exemptions and deductions, the employee's total tax payable is higher at 193,422. The document disclaimer notes that the calculator is illustrative and the actual tax calculation may differ based on additional variables in the employee's payroll.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Tax Calculator

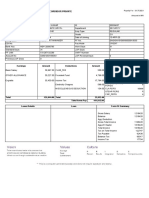

Employee Code : 63867

Section Name According To Old Regime According To New Regime(u/s 115BAC)

Gross Salary 1493934 1493934

Less: Exemption and Deduction 0 0

Less: Housing Rent Exemption 179926 0

Less: Standard Deduction 50000 0

Less: Professional Tax Exemption 0 0

Less: Total Deduction Under Chp VIA 380000 0

Total Other Income 0 0

Housing Loan Exemption -200000 0

Net Taxable Salary 684008 1493934

Tax Payable on total Income 49301 185983

Less: U/S 87(A)Rebate 0 0

Surcharge 0 0

Education Cess 1972 7439

Total Tax Payable 51273 193422

Disclaimer: The above calculator is illustrative and designed to enable Employee to get a quick view toward Old vs New Regime tax calculation.

Please follow your discretion in deciding which plan suits you the best. The data shown above does not get saved anywhere. The Actual Tax

Calculation could be different based on actual & additional variable payment and paydays, if applicable, which will be part of your final respective

month Payroll cycle.

Page 1 of 1

You might also like

- Group 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplDocument13 pagesGroup 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplSarah WuNo ratings yet

- Ganpact CompanyDocument1 pageGanpact CompanyAsmin Sultana Ahmed100% (1)

- US Patent - DiwakarDocument65 pagesUS Patent - DiwakarDiwakar RoyNo ratings yet

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- EMP23 Tax Sheet Report202311152219Document2 pagesEMP23 Tax Sheet Report202311152219SoumyaranjanNo ratings yet

- PayslipDocument3 pagesPayslipbibhutisahu23No ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- 4 MergedDocument12 pages4 MergedPonugoti Pavan kumarNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Shivansh WarehouseDocument1 pageShivansh WarehouseAccounts DepartmentNo ratings yet

- ComputationDocument1 pageComputationLakshay RajoraNo ratings yet

- Revised Estimation - FY 2023-24Document1 pageRevised Estimation - FY 2023-24Debojyoti MukherjeeNo ratings yet

- PayslipDocument1 pagePayslipSiyaram MeenaNo ratings yet

- Pay Slip ExampleDocument1 pagePay Slip ExampleMahmud Morshed100% (1)

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- MediaAgility 2019 Form16Document1 pageMediaAgility 2019 Form16SiddharthNo ratings yet

- Payslip-Apr AvinashDocument1 pagePayslip-Apr AvinashCash monkeyNo ratings yet

- Computation 2022Document2 pagesComputation 2022kshu6104No ratings yet

- SalarySlip MarchDocument2 pagesSalarySlip Marchseenasrinivas113No ratings yet

- Sunil PayslipDocument1 pageSunil PayslipSiyaram MeenaNo ratings yet

- Computation of Total Income (As Per 115BAC)Document2 pagesComputation of Total Income (As Per 115BAC)N PrabhurajanNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAmitraja DasNo ratings yet

- Zaib - Altaf - Naik - Payslip - July - 2022 (1) NewDocument2 pagesZaib - Altaf - Naik - Payslip - July - 2022 (1) Newzuber shaikhNo ratings yet

- Viridian Development Managers Pvt. Limited: Pay Slip For The Month of August 2018Document1 pageViridian Development Managers Pvt. Limited: Pay Slip For The Month of August 2018userabazNo ratings yet

- Document 0Document16 pagesDocument 0Ruby QienNo ratings yet

- Computation Abhishek 2021-22Document2 pagesComputation Abhishek 2021-22vm4416122No ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- Ivt BS 2021Document53 pagesIvt BS 2021Sujan TripathiNo ratings yet

- Sudha 2022 PDFDocument1 pageSudha 2022 PDFBikash KumarNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- FF PayslipDocument1 pageFF PayslipYviie VANo ratings yet

- ITR Computation ABOPD4303LDocument2 pagesITR Computation ABOPD4303LJIGNA NAKARNo ratings yet

- UntitledDocument1 pageUntitledAnkush SinghNo ratings yet

- Venkatesh 2023Document1 pageVenkatesh 2023pulapa umamaheswara raoNo ratings yet

- Nirmal Todi 2021Document24 pagesNirmal Todi 2021Sujan TripathiNo ratings yet

- Adecco India Private Limited: Payslip For The Month of October 2022Document1 pageAdecco India Private Limited: Payslip For The Month of October 2022VeereshPammarNo ratings yet

- N01887estax2007 09Document2 pagesN01887estax2007 09api-3747051100% (1)

- NewOldRegime - 2024-2025 - SALUNKEDocument1 pageNewOldRegime - 2024-2025 - SALUNKEYogesh KaleNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Coi Ay 2021-22 Naveen KumarDocument3 pagesCoi Ay 2021-22 Naveen Kumarprateek gangwaniNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Apr 2023Document1 pageApr 2023saurabhjaNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorPapun Kumar SwainNo ratings yet

- 01.dcreative 1601c Jan2019 FinalDocument2 pages01.dcreative 1601c Jan2019 FinalChristopher John CarmenNo ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6Document1 pageM/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6fergusonaf555No ratings yet

- Naveen 22-23 ComputationDocument2 pagesNaveen 22-23 Computationdeepkaler219No ratings yet

- Tax Sheet Report Febuary 2024Document3 pagesTax Sheet Report Febuary 2024Suprasanna KallakuntlaNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- N2K Info Systems Private Limited: Payslip For The Month of April - 2019Document1 pageN2K Info Systems Private Limited: Payslip For The Month of April - 2019Munna ShaikNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesPersonal Note: This Is A System Generated Payslip, Does Not Require Any Signatureypfjcd8qq9No ratings yet

- 1663274292-Tax Cals-1Document1 page1663274292-Tax Cals-1Kriti GandhiNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- Draft Comp 23-24-1Document2 pagesDraft Comp 23-24-1Vishal SinghNo ratings yet

- Comp 2022-23Document1 pageComp 2022-23yogiprathmeshNo ratings yet

- Coi - A.Y. 2017-2018 - Bharti GohilDocument2 pagesCoi - A.Y. 2017-2018 - Bharti GohilSuman jhaNo ratings yet

- POB - Lesson 4 - Factors of ProductionDocument3 pagesPOB - Lesson 4 - Factors of ProductionAudrey RolandNo ratings yet

- What Is The Importance of Global Demography in Contemporary World?Document2 pagesWhat Is The Importance of Global Demography in Contemporary World?Lala Monica TiraoNo ratings yet

- OrderInvoice - 53821082004769033Document1 pageOrderInvoice - 53821082004769033Yoyo Toyo100% (1)

- The Image of The Child in Charles Dickens NovelsDocument2 pagesThe Image of The Child in Charles Dickens NovelsMarioara CiobanuNo ratings yet

- Offshore CurrencyDocument16 pagesOffshore Currencypriya_1234563236980% (5)

- Financial Times Europe - 26.05.23Document18 pagesFinancial Times Europe - 26.05.23Paulo4255No ratings yet

- EN14904 - Pavimentazioni SportiveDocument2 pagesEN14904 - Pavimentazioni SportiveasaNo ratings yet

- Tittle: Project Meeting Regarding Temporary Facilities Subject: Minutes of Meeting Venue: Project Engineering Office Date: November 6, 2017Document2 pagesTittle: Project Meeting Regarding Temporary Facilities Subject: Minutes of Meeting Venue: Project Engineering Office Date: November 6, 2017Ralph CastilloNo ratings yet

- Proofofcashbylailanepptxpdf PDF FreeDocument19 pagesProofofcashbylailanepptxpdf PDF Freedanica gomezNo ratings yet

- College of Education: Northwestern Visayan CollegesDocument8 pagesCollege of Education: Northwestern Visayan CollegesMarissa Altarejos BrionesNo ratings yet

- Company Valuation MethodsDocument20 pagesCompany Valuation MethodsKlaus LaurNo ratings yet

- Implementation of Mgnrega Inkarnataka Issues and ChallengesDocument19 pagesImplementation of Mgnrega Inkarnataka Issues and ChallengesVENKY KRISHNANo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument57 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepra09031888No ratings yet

- Master Circular For Stock BrokersDocument209 pagesMaster Circular For Stock BrokersNilesh NayeeNo ratings yet

- Lic Nach MandateDocument1 pageLic Nach Mandatefibiro9231No ratings yet

- Microfoundations of MacroeconomicsDocument1 pageMicrofoundations of MacroeconomicssaghNo ratings yet

- New Rekening Koran Online 216801010479506 2023-02-01 2023-02-28 00313019Document9 pagesNew Rekening Koran Online 216801010479506 2023-02-01 2023-02-28 00313019dodimaryono22No ratings yet

- FRM - Syllabus PDFDocument64 pagesFRM - Syllabus PDFAnonymous x5odvnNVNo ratings yet

- International Business: by Charles W.L. HillDocument36 pagesInternational Business: by Charles W.L. Hilllovelyday9876No ratings yet

- List of Residential Properties (P, GP and SP) of Rohtak Zone For Auction Dated 20.07.2022Document1 pageList of Residential Properties (P, GP and SP) of Rohtak Zone For Auction Dated 20.07.2022Yogesh MittalNo ratings yet

- Nueva Vizcaya State University Instructional ModuleDocument14 pagesNueva Vizcaya State University Instructional ModuleInfinity KingNo ratings yet

- Net Economic Value Added From Year To Year: Group 7Document17 pagesNet Economic Value Added From Year To Year: Group 7James Ryan AlzonaNo ratings yet

- The COVIDDocument2 pagesThe COVIDVYXNo ratings yet

- Cashflow Project Hotel PodomoroDocument44 pagesCashflow Project Hotel PodomoroBrandy HarperNo ratings yet

- ED CycleDocument5 pagesED CycleNayan BhalotiaNo ratings yet

- Literature Review On Basel IIDocument6 pagesLiterature Review On Basel IIaflslcqrg100% (1)

- AS1418.8-2008 Rated Capacity For Earthmoving Machines: Plant AssessorDocument3 pagesAS1418.8-2008 Rated Capacity For Earthmoving Machines: Plant AssessorTAIYONG GUONo ratings yet

- CreditAccess Grameen - Company Update - 07102021 - 07!10!2021 - 10Document7 pagesCreditAccess Grameen - Company Update - 07102021 - 07!10!2021 - 10pr SinggNo ratings yet