Professional Documents

Culture Documents

Ann Reyes General Ledgers

Ann Reyes General Ledgers

Uploaded by

DianeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ann Reyes General Ledgers

Ann Reyes General Ledgers

Uploaded by

DianeCopyright:

Available Formats

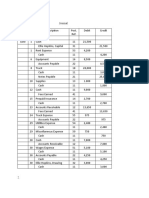

Account Name: CASH Account No.

11

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec. 2 Investment by owner P 60,000 P 60,000

4 Paid insurance for one year P 6,000 54,000

8 Paid office and computer supplies 2,500 51,500

11 60,000 111,500

16 12,500 124,000

18 1,000 123,000

20 10,500 133,500

22 3,600 129,900

25 45,000 84,900

26 7,500 92,400

27 1,500 90,900

28 5,500 85,400

29 12,000 73,400

30 5,000 778,400

Account Name: ACCOUNTS RECEIVABLE Account No. 12

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 24 16,400 16,400

26 7,500 8,900

Account Name: PREPAID INSURANCE Account No. 15

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 4 6000 6000

31 Adjustments 500 5500

Account Name: OFFICE SUPPLIES Account No. 16

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 8 2,500 2,500

31 Adjustments 900 1,600

Account Name: FURNITURE AND EQUIPMENT Account No. 18

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 6 15,000 15,000

14 60,000 75,000

Account Name: ACCOUNTS PAYABLE Account No. 21

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 6 15,000 15,000

14 60,000 75,000

25 45,000 30,000

Account Name: LOANS PAYABLE Account No. 24

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 11 60,000 60,000

Account Name: ANN REYES, CAPITAL Account No. 31

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 2 60,000 60,000

Account Name: ANN REYES, DRAWINGS Account No. 32

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 29 12,000 12,000

Account Name: FEES EARNED Account No. 41

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 16 12,500 12,500

20 10,500 10,500

24 16,400 39,400

30 5,000 44,400

31 Adjustments 5,000 39,400

Account Name: SALARY EXPENSE Account No. 51

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 28 5,500 5,500

Account Name: ADVERTISING EXPENSE Account No. 53

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 22 3,600 3,600

31 Adjustments 2,400 1,200

Account Name: UTILITIES EXPENSE Account No. 54

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 27 1,500 1,500

Account Name: MISCELLANEOUS EXPENSE Account No. 59

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 18 1,000 1,000

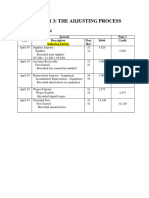

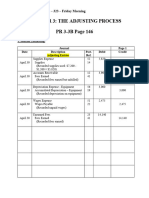

Account Name: PREPAID ADVERTISING Account No. 14

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 2,400 2,400

Account Name: ACCUMULATED DEPRECIATION Account No. 19

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 Adjustments 625 625

Account Name: ACCRUED EXPENSES Account No. 22

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 Adjustments 4,000 4,000

600 4,600

Account Name: UNEARNED FEES Account No. 23

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 Adjustments 5,000 5,000

Account Name: RENT EXPENSE Account No. 52

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 Adjustments 4,000 4,000

Account Name: INSURANCE EXPENSE Account No. 55

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 Adjustments 500 500

Account Name: SUPPLIES EXPENSE Account No. 56

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 Adjustments 900 900

Account Name: DEPRECIATION EXPENSE Account No. 57

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 Adjustments 625 625

Account Name: INTEREST EXPENSE Account No. 61

Balance

Date Explanation P.R. Debit Credit

Debit Credit

Dec 31 Adjustments 600 600

Account Name: INCOME SUMMARY Account No. 34

Balance

Date Explanation P.R. Debit Credit

Debit Credit

You might also like

- Problem 2-3B: Name: Section: ScoreDocument10 pagesProblem 2-3B: Name: Section: ScoreAlba LunaNo ratings yet

- Polly Peck-SummaryDocument5 pagesPolly Peck-SummaryManda simz100% (1)

- Petty Cash TestDocument6 pagesPetty Cash TestEhsan Elahi100% (4)

- Delhi Public School Sangrur: Multiple Choice QuestionsDocument9 pagesDelhi Public School Sangrur: Multiple Choice Questionsprateek gargNo ratings yet

- 9-31, Problem #4Document3 pages9-31, Problem #4jowdpugsNo ratings yet

- LKBB - Riska Anggraini Xii Ak 3Document25 pagesLKBB - Riska Anggraini Xii Ak 3fitri amaliaNo ratings yet

- Bhebu Lero TransactionDocument5 pagesBhebu Lero TransactionLeo Marbeda FeigenbaumNo ratings yet

- Special Journal AnswerDocument6 pagesSpecial Journal AnswerHazel DimaanoNo ratings yet

- Soal Tugas Posting Jurnal Khusus Ke Buku BesarDocument2 pagesSoal Tugas Posting Jurnal Khusus Ke Buku BesarAbdul WahidNo ratings yet

- Lembar Kerja Salon CantikDocument26 pagesLembar Kerja Salon CantikFanisa CantickaNo ratings yet

- Posting and Trial BalanceDocument3 pagesPosting and Trial BalanceLouise Joseph G. PeraltaNo ratings yet

- BookDocument9 pagesBookcheesesiz yumNo ratings yet

- BB PT SantosaDocument62 pagesBB PT SantosaSiti ZahraNo ratings yet

- BB PT Sentosa ManufakturDocument26 pagesBB PT Sentosa ManufakturSiti ZahraNo ratings yet

- Buku Besar Umum & Neraca Saldo NewestDocument14 pagesBuku Besar Umum & Neraca Saldo NewestToko PremiumismeNo ratings yet

- Kasus Bagian 4-Kasus Dian Theatre CoDocument4 pagesKasus Bagian 4-Kasus Dian Theatre CoKevin Yudha PradityaaNo ratings yet

- Quiz Buku Piut HutDocument4 pagesQuiz Buku Piut HutargarinirizqiayuNo ratings yet

- Cash Receipt Journal: Cv. Roti JayaDocument11 pagesCash Receipt Journal: Cv. Roti JayaDevana BelindaNo ratings yet

- 07.2 Lembar Kerja Buku BesarDocument12 pages07.2 Lembar Kerja Buku Besarfinta febriyantiNo ratings yet

- LJ BB DiyanaDocument14 pagesLJ BB Diyanadiyana balqisNo ratings yet

- Assignment On ABM 4Document6 pagesAssignment On ABM 4Calyx OxfordNo ratings yet

- LBR JWB Sesi 2 - B - 2019Document12 pagesLBR JWB Sesi 2 - B - 2019cinta watiNo ratings yet

- JAWABAN - BUKU BESAR RevisiDocument13 pagesJAWABAN - BUKU BESAR Revisisovia deviNo ratings yet

- Tutorial 2 - General Ledger-2Document1 pageTutorial 2 - General Ledger-2Thi Yen Nhi NguyenNo ratings yet

- Dagim AssDocument14 pagesDagim Assgebreslassie hailuNo ratings yet

- 6018-P1-Praktek Akuntansi-Kunci Jawaban1Document34 pages6018-P1-Praktek Akuntansi-Kunci Jawaban1EMINo ratings yet

- LEMBAR JWBN LK Sesi 3 Sentosa AlwaysDocument33 pagesLEMBAR JWBN LK Sesi 3 Sentosa AlwaysfannysuwandiNo ratings yet

- 20231kompak Rktm09 12c BB 220014 MuhammadDocument11 pages20231kompak Rktm09 12c BB 220014 MuhammadmhmdagungsuprianaNo ratings yet

- Buku Besar Umum & Neraca Saldo NewDocument13 pagesBuku Besar Umum & Neraca Saldo NewToko PremiumismeNo ratings yet

- 9-29, Problem #2Document3 pages9-29, Problem #2jowdpugsNo ratings yet

- Special JournalDocument38 pagesSpecial JournalSally Ubando Delos Reyes100% (1)

- Long Test Entrep 1Document5 pagesLong Test Entrep 1Jasmine HaliliNo ratings yet

- Chapter 3 The Adjusting Process Template 1Document7 pagesChapter 3 The Adjusting Process Template 1phamhhuonggg5512No ratings yet

- BB UD WirastriDocument40 pagesBB UD WirastriFellisa SusantiNo ratings yet

- Rosandini - Lembar-Jawaban Entry JurnalDocument44 pagesRosandini - Lembar-Jawaban Entry JurnalRosan DiniNo ratings yet

- General Journal (June) Date Transactions Account No. DebitDocument34 pagesGeneral Journal (June) Date Transactions Account No. DebitHa TranNo ratings yet

- Lec 5 B Problem Journal 2 A-6Document9 pagesLec 5 B Problem Journal 2 A-6Shahjahan DashtiNo ratings yet

- General Ledger MedinaDocument4 pagesGeneral Ledger MedinasarahNo ratings yet

- Kunci Jawaban BBDocument13 pagesKunci Jawaban BBnatsu dragnelNo ratings yet

- Format Jurnal TB - Tasya Aulia 1810102003Document13 pagesFormat Jurnal TB - Tasya Aulia 1810102003TasyaAuliaRahmanNo ratings yet

- Tugas Pribadi P.akun+lab Hal 104Document14 pagesTugas Pribadi P.akun+lab Hal 104Brampramana SihombingNo ratings yet

- NLKT - PR3-3B - GR8Document6 pagesNLKT - PR3-3B - GR8kimphuc3819No ratings yet

- AccountingDocument17 pagesAccountingKimberly Mae AriasNo ratings yet

- Lembar - JWB - Soal - B - Sesi 2Document11 pagesLembar - JWB - Soal - B - Sesi 2Sandi RiswandiNo ratings yet

- LK Prima ElektronikDocument28 pagesLK Prima ElektronikIka NurjanahNo ratings yet

- Chapter 3 - The Adjusting Process - TemplateDocument7 pagesChapter 3 - The Adjusting Process - Templatendinhkha2004No ratings yet

- LBR JWB LEDGER, TRIAL BALANCEDocument12 pagesLBR JWB LEDGER, TRIAL BALANCENabila Nur AdhaNo ratings yet

- Lembar Jawab PT SemestaDocument101 pagesLembar Jawab PT SemestaEsti RuwandaniNo ratings yet

- Jagabaya Security Services - Jurnal Khusus - Hanifah Hilyah SyahDocument4 pagesJagabaya Security Services - Jurnal Khusus - Hanifah Hilyah Syahreza hariansyahNo ratings yet

- DIKO SUSUKUAN-mergedDocument11 pagesDIKO SUSUKUAN-mergedchoigyu031301No ratings yet

- No Account Title and Explanation Ref Debit CreditDocument4 pagesNo Account Title and Explanation Ref Debit CreditKevin ManthovaniNo ratings yet

- Chapter 3 - The Adjusting ProcessDocument6 pagesChapter 3 - The Adjusting ProcessHồng Minh PhanNo ratings yet

- Jawaban CV Roti Jaya Belajar 16 Februari 2023Document62 pagesJawaban CV Roti Jaya Belajar 16 Februari 2023Annisa fitri AnggrainiNo ratings yet

- Quiz 2 Bookkeeping-1Document6 pagesQuiz 2 Bookkeeping-1John Vincent D. ReyesNo ratings yet

- Darwin Melendez - Ledger AccountsDocument4 pagesDarwin Melendez - Ledger AccountsDarwin MelendezNo ratings yet

- Lembar Jawaban MBBDocument9 pagesLembar Jawaban MBBJan MiniNo ratings yet

- LEMBAR JAWABAN Akuntansi KosongDocument39 pagesLEMBAR JAWABAN Akuntansi Kosongmr.wolfvin1No ratings yet

- Buku Besar Umum & Neraca SaldoDocument18 pagesBuku Besar Umum & Neraca SaldoToko PremiumismeNo ratings yet

- 10D 2Document20 pages10D 2Hidalgo, John Christian MunarNo ratings yet

- ACC Assignment 2Document8 pagesACC Assignment 2Saba AfzaalNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Advising Entrepreneurs: Dynamic Strategies for Financial GrowthFrom EverandAdvising Entrepreneurs: Dynamic Strategies for Financial GrowthNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Business Math 11 - 12 q2 Clas 3 Joseph AurelloDocument10 pagesBusiness Math 11 - 12 q2 Clas 3 Joseph AurelloKim Yessamin Madarcos100% (1)

- IAC PPE and Intangible Students FinalDocument4 pagesIAC PPE and Intangible Students FinalJoyce Cagayat100% (1)

- Answer - Alex Rodriguez CaseDocument8 pagesAnswer - Alex Rodriguez CaseNice Dela RocaNo ratings yet

- KASHATO Special JournalsDocument20 pagesKASHATO Special JournalsPatrixia Nikole Mariae Sumabat100% (1)

- Final Research Paper Group 1Document95 pagesFinal Research Paper Group 1leanielpayos911No ratings yet

- 2nd GNLU Moot On Securities and Investment 2016Document37 pages2nd GNLU Moot On Securities and Investment 2016akshi100% (1)

- 2021 Bank of America Application Guidance & Support On Competency Questions - 11.11.20Document8 pages2021 Bank of America Application Guidance & Support On Competency Questions - 11.11.20Hitesh JainNo ratings yet

- 40 'Invaluable' Investing Lessons From Tony DedenDocument20 pages40 'Invaluable' Investing Lessons From Tony DedenCGrenga100No ratings yet

- Sharia FundDocument3 pagesSharia Fundtangkc09No ratings yet

- Afdb Financial Report 2018 - EnglishDocument172 pagesAfdb Financial Report 2018 - EnglishFoloh RamsesNo ratings yet

- Cairns India Private LimitedDocument25 pagesCairns India Private LimitedSuruchi GoyalNo ratings yet

- Jonaxx Trading Corporation 1ST PageDocument1 pageJonaxx Trading Corporation 1ST PageRona Karylle Pamaran DeCastroNo ratings yet

- Growth of Commercial Bank in IndiaDocument2 pagesGrowth of Commercial Bank in Indiavinayak_874580% (5)

- Alice in Credit-Card Land - On ChargebacksDocument3 pagesAlice in Credit-Card Land - On ChargebacksFábio OliveiraNo ratings yet

- January 27, 2023 February 14, 2023: Credit Card StatementDocument4 pagesJanuary 27, 2023 February 14, 2023: Credit Card StatementManas MishraNo ratings yet

- Finance For Non FinanceDocument146 pagesFinance For Non Financehithr1No ratings yet

- 20-0453 RPT LAFD 05-15-2020Document41 pages20-0453 RPT LAFD 05-15-2020deeperNo ratings yet

- MSDocument36 pagesMSJason WangNo ratings yet

- Acc301 Ca 2Document9 pagesAcc301 Ca 2Kathuria AmanNo ratings yet

- Tugas CompletingDocument6 pagesTugas CompletingWidad NadiaNo ratings yet

- International Parity Conditions: Multinational Business Finance (2 Edition)Document61 pagesInternational Parity Conditions: Multinational Business Finance (2 Edition)Cong Chinh NguyenNo ratings yet

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With AnswersFlorie May HizoNo ratings yet

- Rental Voucher: Trip DetailsDocument2 pagesRental Voucher: Trip DetailsMateo Sosa MachadoNo ratings yet

- Treasury New-Agent-Welcome-BookletDocument10 pagesTreasury New-Agent-Welcome-BookletOrlando David MachadoNo ratings yet

- The Agricultural Futures MarketDocument10 pagesThe Agricultural Futures MarketBharath ChaitanyaNo ratings yet

- Secrets of The WealthyDocument39 pagesSecrets of The WealthyMarquise Gines100% (3)

- 04 Request For Uncrossing Cheque Form 2022 FILLABLEDocument2 pages04 Request For Uncrossing Cheque Form 2022 FILLABLEArnold ThonyNo ratings yet