Professional Documents

Culture Documents

Row Bank

Row Bank

Uploaded by

JeetguptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Row Bank

Row Bank

Uploaded by

JeetguptaCopyright:

Available Formats

January 02, 2023

BSE Limited,

1st Floor, Phiroze Jeejeebhoy Towers,

Dalal Street,

Mumbai – 400001.

Script Code: 540065

Reg: Disclosure under Regulation 52(4) of SEBI (LODR) Regulations – 2015, as

amended (“SEBI Listing Regulations”)

We refer to our letter dated October 22, 2022, wherein we had intimated outcome of Board

Meeting dated October 22, 2022 inter alia covering disclosure under Regulation 52(4) of

the SEBI Listing Regulations for the quarter and half year ended September 30, 2022.

In this regards and as per the email dated December 30, 2022 received from BSE Limited

for furnishing the declaration under Regulation 52(4) as a separate Annexure, please find

enclosed herewith the Disclosure under Regulation 52(4) of the SEBI Listing Regulations

as Annexure-A for the quarter and half year ended September 30, 2022.

Further, the information is being hosted on the Bank's Website at www.rblbank.com.

Kindly take the same on record.

Thanking you,

Yours faithfully,

For RBL Bank Limited

NITI Digitally signed

by NITI ARYA

ARYA Date: 2023.01.02

14:58:18 +05'30'

Niti Arya

Company Secretary

Encl: As above

C.C.:

National Stock Exchange of India Limited,

Exchange Plaza, C-1, Block G,

Bandra Kurla Complex, Bandra (E)

Mumbai -400051.

Script Name: RBLBANK

www.rblbank.com

RBL Bank Limited

Controlling Office: One World Center, Tower 2B, 6th Floor, 841 Senapati Bapat Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India I Tel:+91 22

43020600 I Fax: 91 22 43020520

Registered Office: 1st Lane, Shahupuri, Kolhapur - 416001, India I Tel.: +91 231 6650214 I Fax: +91 231 2657386

CIN: L65191PN1943PLC007308 . E-mail: customercare@rblbank.com

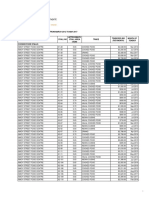

Annexure as prescribed under Regulation 52(4) of SEBI Listing Regulations is given hereunder

Details provided for the period ended September 30, 2022

Rs in Lakh

Sr. Particulars Response

a debt-equity ratio; 0.82

b debt service coverage ratio; Provided that the requirement of disclosures of

debt service coverage ratio [***] and interest

service coverage ratio shall not be applicable for

banks or [non-banking financial

companies/housing finance companies]

registered with the Reserve Bank of India.”- As per

the provisions of the regulations prevailing as on

the date of declaration of financial results i.e.

October 22, 2022,

c interest service coverage ratio; Provided that the requirement of disclosures of

debt service coverage ratio [***] and interest

service coverage ratio shall not be applicable for

banks or [non-banking financial

companies/housing finance companies]

registered with the Reserve Bank of India.”- As per

the provisions of the regulations prevailing as on

the date of declaration of financial results i.e.

October 22, 2022,

d outstanding redeemable preference shares NIL

(quantity and value);

e capital redemption reserve/debenture NIL

redemption reserve;

f net worth; Rs, 1,202,371

g net profit after tax; Rs. 40,271

h earnings per share: Rs. 6.72 (Basic)/ Rs. 6.71 (Dilutive)

i current ratio; Entities covered under Schedule III to the

Companies Act, 2013 are required to calculate/

disclose current asset and current liabilities.

Bank's Financial Statements are required to be

prepared in line with the Banking Regulation Act,

1963 where current asset and current liabilities

are not calculated/ disclosed, hence it is

considered to be not applicable for Banking

industry.

j long term debt to working capital; Unlike manufacturing/ trading industry, Banks do

not calculate/ disclose working capital, hence it

is considered to be not applicable for Banking

industry. Capital adequacy ratio is being

disclosed by Banks.

www.rblbank.com

RBL Bank Limited

Controlling Office: One World Center, Tower 2B, 6th Floor, 841 Senapati Bapat Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India I Tel:+91 22

43020600 I Fax: 91 22 43020520

Registered Office: 1st Lane, Shahupuri, Kolhapur - 416001, India I Tel.: +91 231 6650214 I Fax: +91 231 2657386

CIN: L65191PN1943PLC007308 . E-mail: customercare@rblbank.com

k bad debts to Account receivable ratio; Disclosed - Gross NPA ratio is disclosed which is

derived by dividing the Gross NPAs to Gross

Advances

l current liability ratio; Entities covered under Schedule III to the

Companies Act, 2013 are required to calculate/

disclose current asset and current liabilities.

Bank's Financial Statements are required to be

prepared in line with the Banking Regulation Act,

1963 where current asset and current liabilities

are not calculated/ disclosed, hence it is

considered to be not applicable for Banking

industry.

m total debts to total assets; 10.03%

n debtors’ turnover; Unlike manufacturing/ trading industry, in

banking industry there is no concept of debtors,

instead for borrowers the loan repayment due

dates are prefixed and in cases of non-

repayments relevant disclosures in line with RBI

guidelines are disclosed, hence disclosure for

debtors’ turnover is considered to be not

applicable for Banking industry.

o inventory turnover; Unlike manufacturing/ trading industry, Banks do

not maintain inventories, hence it is considered

to be not applicable for Banking industry.

p operating margin percent; Unlike manufacturing/ trading industry, Banks do

not calculate/ disclose operating margin percent,

hence it is considered to be not applicable for

Banking industry. Return on assets percent is

being disclosed by Banks.

q net profit margin percent: Unlike manufacturing/ trading industry, Banks do

not calculate/ disclose net profit margin percent,

hence it is considered to be not applicable for

Banking industry. Return on assets percent is

being disclosed by Banks.

r. sector specific equivalent ratios, as The ratios applicable to banking sector have

applicable been duly disclosed

www.rblbank.com

RBL Bank Limited

Controlling Office: One World Center, Tower 2B, 6th Floor, 841 Senapati Bapat Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India I Tel:+91 22

43020600 I Fax: 91 22 43020520

Registered Office: 1st Lane, Shahupuri, Kolhapur - 416001, India I Tel.: +91 231 6650214 I Fax: +91 231 2657386

CIN: L65191PN1943PLC007308 . E-mail: customercare@rblbank.com

You might also like

- The RMBC MethodDocument128 pagesThe RMBC MethodFaizan Ahmed100% (2)

- CP-563E, CS-563E, CP-573E, CS-573E, CS-583E, CP-663E, CS-663E and CS-683E Vibratory Compactor Electrical SystemDocument11 pagesCP-563E, CS-563E, CP-573E, CS-573E, CS-583E, CP-663E, CS-663E and CS-683E Vibratory Compactor Electrical SystemMohamed Mohamed100% (3)

- 166-2020 Roi PDFDocument47 pages166-2020 Roi PDFANJAN SINGH 3ANo ratings yet

- What Is FashionDocument6 pagesWhat Is FashionArim Arim100% (3)

- APRIL - Lecture 2 - 10th May 2023 - RBI in News - AprilDocument58 pagesAPRIL - Lecture 2 - 10th May 2023 - RBI in News - AprilgauravNo ratings yet

- Finance Current Affairs January Week IiDocument24 pagesFinance Current Affairs January Week IiBhav MathurNo ratings yet

- Regulators Regulations Dec 2021Document44 pagesRegulators Regulations Dec 2021Ravi Shankar VermaNo ratings yet

- Audit of Banks PDFDocument52 pagesAudit of Banks PDFParmila Rawat0% (1)

- Audit of BanksDocument59 pagesAudit of Bankskaran kapadiaNo ratings yet

- Checklist For NBFC Annual Compliance in IndiaDocument6 pagesChecklist For NBFC Annual Compliance in IndiaGourav MandalNo ratings yet

- 67410bos54195 cp9Document63 pages67410bos54195 cp9erbhaskarsoni2000No ratings yet

- RBI Issues Regulations Under The Amended Factoring Regulation Act, 2011Document1 pageRBI Issues Regulations Under The Amended Factoring Regulation Act, 2011Aayush GuptaNo ratings yet

- 2020 BD Financial StatementsDocument10 pages2020 BD Financial StatementsSarah Eve HaqueNo ratings yet

- Risk RBI Circular Jan'22-Jun'22Document24 pagesRisk RBI Circular Jan'22-Jun'22Iris CoNo ratings yet

- Handout - Session 2 27-08-21 - Mscfe - Comm. BankingDocument11 pagesHandout - Session 2 27-08-21 - Mscfe - Comm. BankingAliasgar TamimNo ratings yet

- Banking & Finance 2022 - Jan To July - TopicWise PDF by AffairsCloud 7Document108 pagesBanking & Finance 2022 - Jan To July - TopicWise PDF by AffairsCloud 7rohit yadavNo ratings yet

- Important Regulatory Measures Taken by Financial Sector RegulatorsDocument17 pagesImportant Regulatory Measures Taken by Financial Sector RegulatorsMS MOHITNo ratings yet

- Para BankingDocument40 pagesPara BankingSathya NarayanaNo ratings yet

- The Importance of Compliance in Banking Bank Quest Oct-Dec - 2019 - Rakesh - KaushikDocument8 pagesThe Importance of Compliance in Banking Bank Quest Oct-Dec - 2019 - Rakesh - KaushikRakesh KaushikNo ratings yet

- News Magazine Jan 2022Document10 pagesNews Magazine Jan 2022kanarendranNo ratings yet

- What Are NBFCS?: Page - 1Document3 pagesWhat Are NBFCS?: Page - 1AYUSHI TYAGINo ratings yet

- Apr 2021Document10 pagesApr 2021Ravi Shankar VermaNo ratings yet

- GK Tornado Rbi Assist Main Exams 2020 English 87 PDFDocument171 pagesGK Tornado Rbi Assist Main Exams 2020 English 87 PDFSindhu ChandranNo ratings yet

- Important General Knowledge GradeupDocument171 pagesImportant General Knowledge GradeupSunny Dara Rinnah SusanthNo ratings yet

- Base File September 2023 SamagrataDocument18 pagesBase File September 2023 SamagrataPrateek SrivastavaNo ratings yet

- FS Budget 2010 Snapshot-2Document9 pagesFS Budget 2010 Snapshot-2Ssars PandeyNo ratings yet

- SAC Statement 214th SAC Meeting - EngDocument7 pagesSAC Statement 214th SAC Meeting - EngSyafiiq HishamNo ratings yet

- Commercial Paper DeckDocument15 pagesCommercial Paper Decknaveen penugondaNo ratings yet

- Kotak Mahindra Bank Limited FY22 23Document197 pagesKotak Mahindra Bank Limited FY22 23prabhatkumarrock27No ratings yet

- MSME Relief PackageDocument9 pagesMSME Relief Packageajay khandelwalNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- Master Direction RBI Money Market 2023Document98 pagesMaster Direction RBI Money Market 2023Avinash ChauhanNo ratings yet

- Disclosures Basel III 2021Document18 pagesDisclosures Basel III 2021Fakhrul AlamNo ratings yet

- August 2021 BulletinDocument10 pagesAugust 2021 BulletinAtharva ChandraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument48 pages© The Institute of Chartered Accountants of IndiaIndhuNo ratings yet

- 5) Advanced AccountingDocument40 pages5) Advanced AccountingKshitij PatilNo ratings yet

- A Study On Employment Crisis in IndiaDocument40 pagesA Study On Employment Crisis in IndiaYashwant SahaNo ratings yet

- Blue Horizon HotelsDocument4 pagesBlue Horizon HotelsSaranNo ratings yet

- EY Report On Private Credit MarketDocument18 pagesEY Report On Private Credit MarketSaranNo ratings yet

- Ey Private Credit in India v1Document18 pagesEy Private Credit in India v1Naman JainNo ratings yet

- IRAC Norms SureshAgaskarDocument72 pagesIRAC Norms SureshAgaskararakihhcneevanNo ratings yet

- RBI Regulatory Guidance On Ind AS Implementing NBFCs and ARCs - Taxguru - In-1Document4 pagesRBI Regulatory Guidance On Ind AS Implementing NBFCs and ARCs - Taxguru - In-1Irfan ShaikhNo ratings yet

- Intermediate Advance Accounting RTP May 20Document48 pagesIntermediate Advance Accounting RTP May 20BAZINGANo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- Click Here 137Document23 pagesClick Here 137Nanda GroupNo ratings yet

- Sept OctDocument246 pagesSept OctChand PatelNo ratings yet

- NRB News Vol.34 20770315 PDFDocument6 pagesNRB News Vol.34 20770315 PDFNarenBistaNo ratings yet

- 74mcir010710 F PDFDocument98 pages74mcir010710 F PDFVishal Kumar JhaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument40 pages© The Institute of Chartered Accountants of Indiasri valliNo ratings yet

- RBI Circulars December 2023Document12 pagesRBI Circulars December 2023mounikaNo ratings yet

- RBI Circular For Bank GuaranteesDocument33 pagesRBI Circular For Bank GuaranteessanjeetvermaNo ratings yet

- Resolution Framework For COVID 19 Related StressDocument10 pagesResolution Framework For COVID 19 Related StressAcquisory Consulting LLPNo ratings yet

- RBI Master CircularDocument13 pagesRBI Master Circularnaina.kim2427No ratings yet

- RBI Circular Reg Bank Finance To NBFCDocument11 pagesRBI Circular Reg Bank Finance To NBFCopparasharNo ratings yet

- Chapter-3-Banking in IndiaDocument75 pagesChapter-3-Banking in IndiaGowtham SrinivasNo ratings yet

- Naman Mall Management Company - R - 06112020Document7 pagesNaman Mall Management Company - R - 06112020Bholey RiftNo ratings yet

- Ecircular: Staff: Miscellaneous Individual Housing Loan Scheme (Ihls) For Staff Review and Modifications in Scheme-2023Document7 pagesEcircular: Staff: Miscellaneous Individual Housing Loan Scheme (Ihls) For Staff Review and Modifications in Scheme-2023rvNo ratings yet

- Chamber's Journal January 06 PDFDocument6 pagesChamber's Journal January 06 PDFManisha SinghNo ratings yet

- Adv RTP 20Document38 pagesAdv RTP 20Pawan AgrawalNo ratings yet

- Colorful Modern Illustrated Learning and Technology School Project Education PresentationDocument9 pagesColorful Modern Illustrated Learning and Technology School Project Education PresentationRitwik MehtaNo ratings yet

- Banking & Economy PDF - December 2022 by AffairsCloud 1Document119 pagesBanking & Economy PDF - December 2022 by AffairsCloud 1Maahi ThakorNo ratings yet

- Policy On Co-LendingDocument7 pagesPolicy On Co-LendingArbaz KhanNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Comparison of Starbucks With The Coffee BeanDocument16 pagesComparison of Starbucks With The Coffee BeanshaiNo ratings yet

- SHW8Z - Shiraplas 85PDocument9 pagesSHW8Z - Shiraplas 85PfrankieNo ratings yet

- Maternal and Infant Care Beliefs Aeta Mothers in PhilippinesDocument8 pagesMaternal and Infant Care Beliefs Aeta Mothers in PhilippinesChristine Joy MolinaNo ratings yet

- FSA Enrollment Form - English PDFDocument1 pageFSA Enrollment Form - English PDFLupita MontalvanNo ratings yet

- Redeemable Preference SharesDocument2 pagesRedeemable Preference Sharestanvia KNo ratings yet

- Learn Computer in Simple StepsDocument104 pagesLearn Computer in Simple StepsSparkle SocietyNo ratings yet

- General: Specific: Leading Statement:: TITLE: A Healthy LifestyleDocument2 pagesGeneral: Specific: Leading Statement:: TITLE: A Healthy LifestyleM Arshad M AmirNo ratings yet

- Campaign For Tobacco Free KidsDocument1 pageCampaign For Tobacco Free KidsNurses For Tobacco ControlNo ratings yet

- Physical Education - 12th PDFDocument340 pagesPhysical Education - 12th PDFGunal Agarwal100% (1)

- InglesDocument5 pagesInglesJessi mondragonNo ratings yet

- QUANTIFICATIONDocument4 pagesQUANTIFICATIONJohn Edsel SalavariaNo ratings yet

- Identifying Figures of Speech (Simile, Metaphor, and Personification)Document10 pagesIdentifying Figures of Speech (Simile, Metaphor, and Personification)khem ConstantinoNo ratings yet

- Tender Bids From March 2012 To April 2017Document62 pagesTender Bids From March 2012 To April 2017scribd_109097762No ratings yet

- (GUARANTEED RATE AFFINITY) & (8905 BEAVER FALLS) - UCC1 Financial Statement LIENDocument9 pages(GUARANTEED RATE AFFINITY) & (8905 BEAVER FALLS) - UCC1 Financial Statement LIENHakim-Aarifah BeyNo ratings yet

- Global Clothing ZaraDocument19 pagesGlobal Clothing ZaraDaniel ArroyaveNo ratings yet

- APP Modified Bituminous Waterproofing and Damp-Proofing Membrane With Polyester Reinforcement - SpecificationDocument15 pagesAPP Modified Bituminous Waterproofing and Damp-Proofing Membrane With Polyester Reinforcement - Specificationjitendra0% (1)

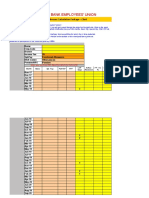

- Karur Vysya Bank Employees' Union: 11th Bipartite Arrears Calculation Package - ClerkDocument10 pagesKarur Vysya Bank Employees' Union: 11th Bipartite Arrears Calculation Package - ClerkDeepa ManianNo ratings yet

- Piano Pentatonic Blues Scales - Overview With PicturesDocument8 pagesPiano Pentatonic Blues Scales - Overview With PicturesВладимир Перминов100% (2)

- Contra About PolygamyDocument3 pagesContra About PolygamyNabil AushafaNo ratings yet

- Ra 10868Document11 pagesRa 10868Edalyn Capili100% (1)

- Ahad NaamahDocument2 pagesAhad NaamahedoolawNo ratings yet

- Will or Going To 90069Document2 pagesWill or Going To 90069Dragana ZafirovskaNo ratings yet

- Karakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceDocument14 pagesKarakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceYudii NggiNo ratings yet

- English 8-Q4-M1-Grammatical SignalsDocument12 pagesEnglish 8-Q4-M1-Grammatical SignalsShekayna PalagtiwNo ratings yet

- ProfEd9 Module 9Document6 pagesProfEd9 Module 9Roxanne GuzmanNo ratings yet

- GenEd - Lumabas Jan 2022Document4 pagesGenEd - Lumabas Jan 2022angelo mabulaNo ratings yet

- UMRAH Supplications DUADocument10 pagesUMRAH Supplications DUAsamNo ratings yet