Professional Documents

Culture Documents

224 23 BS BF 224

224 23 BS BF 224

Uploaded by

D'zite JereOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

224 23 BS BF 224

224 23 BS BF 224

Uploaded by

D'zite JereCopyright:

Available Formats

THE COPPERBELT UNIVERSITY

SCHOOL OF BUSINESS

BS/BF 224: Managerial/Corporate Finance

Background and Rationale

The objective of the course is to provide the student with an understanding of the

nature and role of financial management and to provide an understanding of the

theoretical and analytical techniques used in financing and investment decisions.

Learning outcomes

At the end of the course students will be expected to:

(a) Know sources of finance available to a firm and the factors to consider when

choosing a source of funds.

(b) Know how to appraise investment projects and the factors to consider in working

capital management.

(c) Understand the factors involved in dividend decisions

Course content

1.0 Introduction

.The finance function

. Financial decisions

. Maximizing shareholder wealth versus other goals

. Agency problem

. The role and functions of a finance manager

2.0 Basic concepts in finance

. Time value of money (compounding and discounting)

. Present/future value of uneven cash flows and annuities

. Annual payments for accumulation of a future sum

. Valuation of direct claim securities

. Valuation of bonds, current yield, yield to maturity and yield to call

. Valuation of preferred stock

. Valuation of common equity

. Quantifying risk and return, portfolio risk and return, CAPM and the SML

3.0 Working capital management

. Sources and forms of short-term credit

. Factor influencing choice of source of short-term credit

. The management of cash and the optimal cash balance

. Management of marketable securities

. Management of accounts receivable and credit policy

. Management of inventory and the economic order of quantity

. Nature and importance of working capital management

. Profitability versus liquidity

. The operating cycle and the cash cycle

. Overtrading

4.0 Long-term finance

. Sources of long-term funds:

Venture capital

Term loans

Bond financing

Preferred stock financing

Common stock financing

Retained earnings

. Introduction to derivative securities

5.0 Capital structure and the cost of capital

. Financial structure versus capital structure

. Importance of managing the capital structure

. Benefits of financial leverage

. Operating, financial and total leverage

. The cost of debt, cost of preferred stock and cost of common equity

. The weighted average cost of capital

. The optimal capital structure.

6.0 Capital Budgeting Techniques

. The capital budgeting process and significance of capital budgeting

. Capital budgeting techniques:

Payback period

Discounted payback period

Net present value

Internal rate of return

Accounting rate of return and profitability index

. Evaluation and comparison of these techniques

. Capital rationing

. Introduction to capital budgeting under uncertainty

7.0 Dividend policy

. The dividend decision

. Dividends, retained earnings and capital gains

. The company’s dividend policy

. The payout ratio

. Impact on growth and share price

. Dividend payout procedure

. Influences on dividend payment and policy

8.0 Financial Analysis

. Purpose of financial analysis

. Techniques of financial analysis: common size analysis and ratio analysis

. Interpretation of result

. Financial forecasting and techniques of financial planning and control

Assessment

• Continuous Assessment 40%

• Final Exams 60%

Prescribed Textbook

Recommended Textbooks

• J. Weston & E. Brigham. Essentials of Managerial Finance. Dryden Press

• James C. Van Horne. Fundamentals of Financial Management. Prentice Hall.

• Ross. Corporate Finance Fundamentals. McGraw-Hill.

You might also like

- The Portable MBA in Finance and AccountingFrom EverandThe Portable MBA in Finance and AccountingRating: 4 out of 5 stars4/5 (19)

- Bus HWDocument1 pageBus HWDaniel YaremenkoNo ratings yet

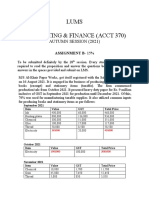

- Lums Accounting & Finance (Acct 370) : Autumn Session (2021)Document4 pagesLums Accounting & Finance (Acct 370) : Autumn Session (2021)Ahmed SamadNo ratings yet

- Corporate FinanceDocument131 pagesCorporate FinanceG Nagarajan100% (4)

- Hedging With STIR FuturesDocument15 pagesHedging With STIR FuturesBach Nguyen Hoai AnhNo ratings yet

- Course Outline UpdatedDocument4 pagesCourse Outline Updatedgeachew mihiretuNo ratings yet

- Introduction To Corporate FinanceDocument14 pagesIntroduction To Corporate FinanceSHIVA THAVANINo ratings yet

- Financial Management Principles Kingston Course Outline Fall 2023Document24 pagesFinancial Management Principles Kingston Course Outline Fall 2023David ElliottNo ratings yet

- Scope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnDocument4 pagesScope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnPrabhjeet KalsiNo ratings yet

- Course Outline Financial Management-2018-19Document4 pagesCourse Outline Financial Management-2018-19Jayesh MahajanNo ratings yet

- Afin209 FPD 1 2017 1Document3 pagesAfin209 FPD 1 2017 1Daniel Daka100% (1)

- Financial Management-Kings 2012Document2 pagesFinancial Management-Kings 2012Suman KCNo ratings yet

- FINF315 FinManDocument4 pagesFINF315 FinManYash BhardwajNo ratings yet

- Basic Finance E-BookDocument140 pagesBasic Finance E-BooksatstarNo ratings yet

- Corporate Finance NotesDocument99 pagesCorporate Finance NotesmwendaflaviushilelmutembeiNo ratings yet

- MGT 215 Fundamentals of Financial ManagementDocument4 pagesMGT 215 Fundamentals of Financial ManagementRajkishor PanditNo ratings yet

- Corporate Finance - MBADocument5 pagesCorporate Finance - MBASadia FarahNo ratings yet

- Financial ManagementDocument7 pagesFinancial Managementisamad820No ratings yet

- Institute of Management Sciences Bahauddin Zakariya University (Multan) Course Outline: Strategic Financial ManagementDocument4 pagesInstitute of Management Sciences Bahauddin Zakariya University (Multan) Course Outline: Strategic Financial ManagementJarhan AzeemNo ratings yet

- Fundamentals of Financial Management: (Theory and Practicals)Document15 pagesFundamentals of Financial Management: (Theory and Practicals)tawandaNo ratings yet

- Corporate Finance ManagementDocument9 pagesCorporate Finance Managementtrustmakamba23No ratings yet

- Course SyllabusDocument2 pagesCourse SyllabusManpreet ToorNo ratings yet

- 22PGD202 CFDocument3 pages22PGD202 CFRohit KumarNo ratings yet

- Principles of FinanceDocument1 pagePrinciples of FinanceSaiful Islam100% (1)

- Introduction To FMDocument70 pagesIntroduction To FMRashika JainNo ratings yet

- Advanced Financial Management PDFDocument203 pagesAdvanced Financial Management PDFSanthosh Kumar100% (1)

- Finance & Banking Hounours 1st Year SyllabusDocument11 pagesFinance & Banking Hounours 1st Year SyllabusTOWFIQ TusharNo ratings yet

- Business & Corporate FinanceDocument5 pagesBusiness & Corporate FinancevivekNo ratings yet

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- Important Theory Questions of Financial ManagementDocument24 pagesImportant Theory Questions of Financial Management50. Harini .SNo ratings yet

- Salim Sir+SyllabusDocument2 pagesSalim Sir+SyllabusMohammad Salim HossainNo ratings yet

- Financial Management-2Document292 pagesFinancial Management-2benard owinoNo ratings yet

- bbabi204Document86 pagesbbabi204Kushagar GandhiNo ratings yet

- Financial Management BMS 5th Sem JulyDocument31 pagesFinancial Management BMS 5th Sem Julygusheenarora60% (5)

- Mba 711 Financial ManagementDocument5 pagesMba 711 Financial ManagementAli MohammedNo ratings yet

- Financial Management NotesDocument202 pagesFinancial Management NotesSandeep KulshresthaNo ratings yet

- 2011 Early Bird Offer - 2nd Person 25% DiscountDocument8 pages2011 Early Bird Offer - 2nd Person 25% DiscountFaruk HossainNo ratings yet

- Interest-Based Models To Profit-Sharing StructuresDocument4 pagesInterest-Based Models To Profit-Sharing Structuresfiroz chowdhuryNo ratings yet

- Financial Modeling and ForecastingDocument59 pagesFinancial Modeling and ForecastingYamini Divya KavetiNo ratings yet

- University of Gujrat Faculty of Management and Administrative SciencesDocument4 pagesUniversity of Gujrat Faculty of Management and Administrative SciencesObaidUllah ManzarNo ratings yet

- 4 6032630305691534636 PDFDocument254 pages4 6032630305691534636 PDFDennisNo ratings yet

- Financial ManagementDocument107 pagesFinancial ManagementFarshan SulaimanNo ratings yet

- Introduction To Financial ManagementDocument41 pagesIntroduction To Financial Managementamits3989No ratings yet

- Finaincal SyllabusDocument1 pageFinaincal SyllabusAbdulraqeeb AlareqiNo ratings yet

- Course Outline Advanced Corporate Finance 2019Document8 pagesCourse Outline Advanced Corporate Finance 2019Ali Shaharyar ShigriNo ratings yet

- Dcom307 - DMGT405 - Dcom406 - Financial Management PDFDocument318 pagesDcom307 - DMGT405 - Dcom406 - Financial Management PDFBaltej singhNo ratings yet

- CAPITAL .?: Finance ?Document37 pagesCAPITAL .?: Finance ?ritanarkhedeNo ratings yet

- Advanced Financial ManagementDocument201 pagesAdvanced Financial ManagementNarendra Reddy LokireddyNo ratings yet

- Gaf 520Document383 pagesGaf 520njekwakanangaNo ratings yet

- Unit 1 FINANCIAL MANAGEMENTDocument37 pagesUnit 1 FINANCIAL MANAGEMENTdhall.tushar2004No ratings yet

- Paper: Mba 333: Financial Management Credits-2 DescriptionDocument4 pagesPaper: Mba 333: Financial Management Credits-2 DescriptionDerek Cherian JojiNo ratings yet

- Financial Decision Making: Module Outline and AimsDocument7 pagesFinancial Decision Making: Module Outline and AimsAmrit PatnaikNo ratings yet

- FIN 133 Fundamentals of Financial Management: Bcis, 5 SemesterDocument3 pagesFIN 133 Fundamentals of Financial Management: Bcis, 5 SemesterBishnu K.C.No ratings yet

- Financial Management - SyllabusDocument2 pagesFinancial Management - SyllabusAnonymous sMqylHNo ratings yet

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Valuation Matters The Complete Guide to Company Valuation TechniquesFrom EverandValuation Matters The Complete Guide to Company Valuation TechniquesNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Strategic Corporate Finance: Applications in Valuation and Capital StructureFrom EverandStrategic Corporate Finance: Applications in Valuation and Capital StructureNo ratings yet

- BIOLOGYDocument1 pageBIOLOGYD'zite JereNo ratings yet

- Study Scheme For CA 2Document1 pageStudy Scheme For CA 2D'zite JereNo ratings yet

- Biology Summary NotesDocument2 pagesBiology Summary NotesD'zite JereNo ratings yet

- BIOLOGY Work Sheet 1Document1 pageBIOLOGY Work Sheet 1D'zite JereNo ratings yet

- Studying Scheme For Bs 242Document1 pageStudying Scheme For Bs 242D'zite JereNo ratings yet

- Update To Day ScheduleDocument2 pagesUpdate To Day ScheduleD'zite JereNo ratings yet

- Bible Study ScheduleDocument3 pagesBible Study ScheduleD'zite JereNo ratings yet

- Ca 1.4 Study ScheduleDocument1 pageCa 1.4 Study ScheduleD'zite JereNo ratings yet

- Threats Opportunities Industry and Competitor AnalysisDocument29 pagesThreats Opportunities Industry and Competitor AnalysisWynnie RondonNo ratings yet

- Kotler Pom CW PPT Exp Ch13Document15 pagesKotler Pom CW PPT Exp Ch13uldsNo ratings yet

- AnsoffDocument2 pagesAnsoffDisha DesaiNo ratings yet

- UndreDocument2 pagesUndreFaris HadiyantoNo ratings yet

- Forecasting & Demand MeasurementDocument17 pagesForecasting & Demand MeasurementMaan91No ratings yet

- International Business: by Charles W.L. HillDocument49 pagesInternational Business: by Charles W.L. HillShuhrati AkramNo ratings yet

- R35 Credit Analysis Models - AnswersDocument13 pagesR35 Credit Analysis Models - AnswersSakshiNo ratings yet

- Khaleed Presentation1Document14 pagesKhaleed Presentation1Halidu BarauNo ratings yet

- Bilu Chap 5Document7 pagesBilu Chap 5borena extensionNo ratings yet

- Las Week 2 EntrepDocument4 pagesLas Week 2 EntrepJoseph L BacalaNo ratings yet

- The Smithsonian Agreement VigencyDocument4 pagesThe Smithsonian Agreement Vigencyjamuel portilloNo ratings yet

- Module 11 Fin MarketsDocument3 pagesModule 11 Fin MarketsNikki Jean HonaNo ratings yet

- StudentDocument34 pagesStudentKevin CheNo ratings yet

- Mohit Kumar ResumeDocument80 pagesMohit Kumar ResumeDEEPAKNo ratings yet

- C4 - Advanced Taxation - SyllabusDocument6 pagesC4 - Advanced Taxation - SyllabusEmmaNo ratings yet

- Ashish Krushi Kendra - Te 22-23 3-29-12-2022Document1 pageAshish Krushi Kendra - Te 22-23 3-29-12-2022Kajal PardhiNo ratings yet

- Hudson's Bay Company Announces Pricing of Initial Public OfferingDocument3 pagesHudson's Bay Company Announces Pricing of Initial Public OfferingHarshal NaikNo ratings yet

- DemandDocument13 pagesDemandSweet EmmeNo ratings yet

- 8 Identifying Market Segments and TargetsDocument33 pages8 Identifying Market Segments and TargetsSepti A. PratiwiNo ratings yet

- 43 - Trading With Candlesticks Supplementary Ebook PDFDocument169 pages43 - Trading With Candlesticks Supplementary Ebook PDFvisa707100% (4)

- Chapter 5 Notes ReceivableDocument18 pagesChapter 5 Notes ReceivableReiner Jan AlcantaraNo ratings yet

- EFFECTIVENESS (Edited2)Document5 pagesEFFECTIVENESS (Edited2)Jay Ronel G. CrucilloNo ratings yet

- GA - 3 - Break-Even Analysis For MarkstratDocument2 pagesGA - 3 - Break-Even Analysis For MarkstratPrerana Rai BhandariNo ratings yet

- Walmart SM Group4Document3 pagesWalmart SM Group4AmberNo ratings yet

- Unilever Business Analysis BriefDocument21 pagesUnilever Business Analysis Briefshariqanis1500No ratings yet

- Marketing Environment PlanningDocument31 pagesMarketing Environment PlanningNipuni PeirisNo ratings yet