Professional Documents

Culture Documents

Cta 2&FT Applied Financial Accounting Reporting 2022 Test 1 - Required - TD

Cta 2&FT Applied Financial Accounting Reporting 2022 Test 1 - Required - TD

Uploaded by

Takudzwa MashiriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cta 2&FT Applied Financial Accounting Reporting 2022 Test 1 - Required - TD

Cta 2&FT Applied Financial Accounting Reporting 2022 Test 1 - Required - TD

Uploaded by

Takudzwa MashiriCopyright:

Available Formats

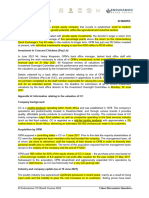

CTA PART TIME LEVEL 2 & FULL TIME JANUARY INTAKE - APPLIED FINANCIAL ACCOUNTING

AND REPORTING - 2022 TEST 1: REQUIRED

Required Marks

Sub- Total

total

A Write an email to the board of directors of Kata discussing the statutory concerns you

might have regarding any information in the scenario. Your answer should be limited 7

to Companies and Other Business Entities Act references.

1 8

Communication – Email format

B Discuss, including calculations, the correct accounting classification and measurement 10

of the information under Contract with BP Petroleum as at 1 January 2021.

• Ignore taxation

Communication – Logical flow 1 11

C Prepare a prior period error note in relation to the information under Acquisition of 15

Aveco (Pvt) Ltd, note 6 & 7 in the scenario.

1 16

Communication – Presentation.

D Prepare the journal entries to account for the acquisition of Aveco in the separate 7

books of Kata. 7

E Prepare the deconsolidation journals for the Kata Airways Group in reference to IFRS 42

10 para B98 for the year ended 31 December 2021.

• Include all workings as marks will be awarded for them

• Include taxation effects

1 43

Communication – journal narrations

F How will Kata report its value creation making use of the following capitals in its

Integrated Report?

• Human capital 14

• Manufactured capital

• Natural capital 15

• Social and relationship capital

1

Communication – logical flow

Total Marks 100

Page 1 of 1 © Chartered Accountants Academy 2022

You might also like

- CO12101E IP07 ProblemDocument4 pagesCO12101E IP07 ProblemHaydeeNo ratings yet

- ZIMCODEDocument130 pagesZIMCODETakudzwa Mashiri100% (1)

- Wild Fap 25e Ch02 PPT AccessibleDocument54 pagesWild Fap 25e Ch02 PPT AccessibleJessica ThigpenNo ratings yet

- WP49-PUE A Comprehensive Examination of The Metric - v6Document83 pagesWP49-PUE A Comprehensive Examination of The Metric - v6alkmind100% (1)

- At Pop RecordDocument84 pagesAt Pop Recordedward77100% (3)

- Cta 1 Financial Accounting and External Reporting - 2020 Eoy Paper 1 RequiredDocument1 pageCta 1 Financial Accounting and External Reporting - 2020 Eoy Paper 1 Requiredlloyd madanhireNo ratings yet

- 2024 Cta FT January Concept Test 1 - RequiredDocument3 pages2024 Cta FT January Concept Test 1 - Requiredtoni maunganidzeNo ratings yet

- Cta 2021 Level 2 Applied Auditing and Governance Eos - Required - FinalDocument2 pagesCta 2021 Level 2 Applied Auditing and Governance Eos - Required - FinalTakudzwa MashiriNo ratings yet

- Sample Audcom Presentation - 2QDocument32 pagesSample Audcom Presentation - 2Qsohail shalabyNo ratings yet

- Accounts Complier (QB) @mission - CA - InterDocument350 pagesAccounts Complier (QB) @mission - CA - Intershivangi sharma0907100% (1)

- 2022 BCTA July 2021 EOS Exam - Financial ReportingDocument9 pages2022 BCTA July 2021 EOS Exam - Financial ReportingsimbaNo ratings yet

- 2020 Accounting Revision Term1 ACTIVITIES ENG v2 1Document21 pages2020 Accounting Revision Term1 ACTIVITIES ENG v2 1Sanele N ThabetheNo ratings yet

- Session 2A: Income Statement Comparisons: Accounting For FinanceDocument13 pagesSession 2A: Income Statement Comparisons: Accounting For FinanceMANISH MOHDNo ratings yet

- Corporate Reporting November 2018Document28 pagesCorporate Reporting November 2018swarna dasNo ratings yet

- Caf7 Far2 ST PDFDocument395 pagesCaf7 Far2 ST PDFawais khanNo ratings yet

- Acca Supplementary NotesDocument185 pagesAcca Supplementary NotesSuniel JamilNo ratings yet

- AnujJain 4200794 - 14 00 - 1Document3 pagesAnujJain 4200794 - 14 00 - 1nishant.bNo ratings yet

- Cta FT Intergrated p.3 Test 2 RequiredDocument1 pageCta FT Intergrated p.3 Test 2 RequiredEddie MutizwaNo ratings yet

- Required Test 3 2022Document2 pagesRequired Test 3 2022SAMNo ratings yet

- Accounts Revision QuestionsDocument293 pagesAccounts Revision QuestionsRishab Gupta100% (1)

- Caf05 STDocument321 pagesCaf05 STWaqar Amjad50% (2)

- 1 Jacobs Investor-Marketing-Deck-Feb-2020Document33 pages1 Jacobs Investor-Marketing-Deck-Feb-2020ALNo ratings yet

- B326 TMA 23-24 (Fall) V1Document9 pagesB326 TMA 23-24 (Fall) V1Reham Abdelaziz100% (2)

- ACC4023W April Test 2023 RequiredDocument2 pagesACC4023W April Test 2023 RequiredJessica albaNo ratings yet

- Accounting P1 2020 EngDocument10 pagesAccounting P1 2020 EngSheldon MocccNo ratings yet

- Accounts Compiler by Rahul Malkan SirDocument301 pagesAccounts Compiler by Rahul Malkan SirKarthik Ram100% (1)

- 1 Jacobs Strategy Cowen-Feb-2020-vfinalDocument17 pages1 Jacobs Strategy Cowen-Feb-2020-vfinalALNo ratings yet

- 2020 GR 10 Revision Activities Final ENGeDocument21 pages2020 GR 10 Revision Activities Final ENGeAmahle NgidiNo ratings yet

- B2Holding ReportDocument155 pagesB2Holding ReportRoshan RahejaNo ratings yet

- Paper5 PDFDocument221 pagesPaper5 PDFRoop Chandu JPNo ratings yet

- Fin122 ActivitiesDocument210 pagesFin122 ActivitiesSteph X100% (1)

- Audi Quarterly Update Q4 2022Document30 pagesAudi Quarterly Update Q4 2022gnshivani2No ratings yet

- Part Ii-Observations and Recommendations: I. Financial Audit 1Document44 pagesPart Ii-Observations and Recommendations: I. Financial Audit 1Joy AcostaNo ratings yet

- F2 May 2011 PEGDocument10 pagesF2 May 2011 PEGForeign GraduateNo ratings yet

- Session 3 ADocument15 pagesSession 3 Aofficialwork684No ratings yet

- ACCOUNTING P1 GR10 ANSWERBOOK NOV2020 - English - Hlayiso - ComDocument9 pagesACCOUNTING P1 GR10 ANSWERBOOK NOV2020 - English - Hlayiso - ComhlayisofilesNo ratings yet

- 2023 MQP 2330 AccountancyDocument15 pages2023 MQP 2330 AccountancyHemanth PariharNo ratings yet

- Large Account Internal It Strategic Sales Plan: Submitted byDocument32 pagesLarge Account Internal It Strategic Sales Plan: Submitted bytirupati1981No ratings yet

- Surname Q2-ADocument33 pagesSurname Q2-ALovely Anne Dela CruzNo ratings yet

- ACC4023W April Test 2022 RequiredDocument2 pagesACC4023W April Test 2022 RequiredJessica albaNo ratings yet

- Caf 7 Far2 ST PDFDocument654 pagesCaf 7 Far2 ST PDFIrfan UllahNo ratings yet

- 928 Pages (1 by 4) Vin Index, DT, Idt, ScmpeDocument928 pages928 Pages (1 by 4) Vin Index, DT, Idt, ScmpeVinuNo ratings yet

- 2024 Acc GR 12 T1 Revision Activity Book ENGDocument21 pages2024 Acc GR 12 T1 Revision Activity Book ENGsisikelelwen05No ratings yet

- Panel3 DannySeptriadi ITC2020Document5 pagesPanel3 DannySeptriadi ITC2020Yoni AstariNo ratings yet

- ITC Infotech Limited Annual Report 2021 1Document13 pagesITC Infotech Limited Annual Report 2021 1Priyanka SonkarNo ratings yet

- Caf 7 Far2 STDocument690 pagesCaf 7 Far2 STMuhammad YousafNo ratings yet

- Wild FAP 22e Ch02 FINALDocument54 pagesWild FAP 22e Ch02 FINALthebestNo ratings yet

- Financial Reporting WDocument345 pagesFinancial Reporting Wgordonomond2022No ratings yet

- Syllabus B.com. First 22 23Document24 pagesSyllabus B.com. First 22 23Sadiya TufailNo ratings yet

- Test 2 RequiredDocument2 pagesTest 2 RequiredSAMNo ratings yet

- Acc406 - Feb 2021 - Q - Set 1Document14 pagesAcc406 - Feb 2021 - Q - Set 1NABILA NADHIRAH ROSLANNo ratings yet

- A-Block ConstructionDocument27 pagesA-Block ConstructionPolAngelesNo ratings yet

- A-Block Updated CIBDocument1 pageA-Block Updated CIBPolAngelesNo ratings yet

- ReceivingDocument1 pageReceivingAlfonso CaviteNo ratings yet

- Output 2121 - 100Document1 pageOutput 2121 - 100Catrinoiu PetreNo ratings yet

- Indian Accounting Standards All ChaptersDocument108 pagesIndian Accounting Standards All Chapterskunal100% (1)

- IAS 12 Income TaxesDocument74 pagesIAS 12 Income Taxesncubetalent1997No ratings yet

- CAF 1 GridDocument5 pagesCAF 1 GridRiot SkinNo ratings yet

- PAS 8 - Template in Answering Error CorrectionDocument2 pagesPAS 8 - Template in Answering Error CorrectionJasmine GabianaNo ratings yet

- Happiest Minds TechnologiesLtd IPO NOTE07092020Document7 pagesHappiest Minds TechnologiesLtd IPO NOTE07092020subham mohantyNo ratings yet

- CHAP 2 - Part 3Document5 pagesCHAP 2 - Part 3camlansuc09993No ratings yet

- Accounting p1 Gr11 QP Nov 2023 - English DDocument16 pagesAccounting p1 Gr11 QP Nov 2023 - English Dt86663375No ratings yet

- Managing County Assets and Liabilities in Kenya: Postdevolution Challenges and ResponsesFrom EverandManaging County Assets and Liabilities in Kenya: Postdevolution Challenges and ResponsesNo ratings yet

- ITC June 2022 MAF Discussion Question 1 OPM 10042022Document10 pagesITC June 2022 MAF Discussion Question 1 OPM 10042022Takudzwa MashiriNo ratings yet

- Hre 2024Document5 pagesHre 2024Takudzwa MashiriNo ratings yet

- Cta 2&Ft Applied Financial Accounting Reporting 2022 Test 1 - Scenario - TDDocument9 pagesCta 2&Ft Applied Financial Accounting Reporting 2022 Test 1 - Scenario - TDTakudzwa MashiriNo ratings yet

- UntitledDocument11 pagesUntitledTakudzwa MashiriNo ratings yet

- Dividend Policy Tutorial QuestionDocument9 pagesDividend Policy Tutorial QuestionTakudzwa MashiriNo ratings yet

- International Finance Study UnitDocument21 pagesInternational Finance Study UnitTakudzwa MashiriNo ratings yet

- Cta 2ft End of Semester Financial Accounting Reporting 2022 - ScenarioDocument9 pagesCta 2ft End of Semester Financial Accounting Reporting 2022 - ScenarioTakudzwa MashiriNo ratings yet

- Cta Fulltime July 2022 Provisional TimetableDocument2 pagesCta Fulltime July 2022 Provisional TimetableTakudzwa MashiriNo ratings yet

- Cta 2021 Level 2 Applied Auditing and Governance Eos - Required - FinalDocument2 pagesCta 2021 Level 2 Applied Auditing and Governance Eos - Required - FinalTakudzwa MashiriNo ratings yet

- Money, Happiness and InvestingDocument65 pagesMoney, Happiness and InvestingTakudzwa MashiriNo ratings yet

- Tax ActsDocument625 pagesTax ActsTakudzwa MashiriNo ratings yet

- Outline For Industry Internship Report SA1 SA2 SA3Document6 pagesOutline For Industry Internship Report SA1 SA2 SA3jahasmmNo ratings yet

- Ted Talk ReflectionDocument2 pagesTed Talk ReflectionAnthony CalvoNo ratings yet

- Simatic Manager Software: SiemensDocument18 pagesSimatic Manager Software: SiemenscarlsNo ratings yet

- Backstepping Based Control of PV System Connected To The GridDocument6 pagesBackstepping Based Control of PV System Connected To The GridAin KaloiNo ratings yet

- SPA5304 Physical Dynamics Homework 4: (20 Marks)Document3 pagesSPA5304 Physical Dynamics Homework 4: (20 Marks)Roy VeseyNo ratings yet

- Mother Dairy: Supply Chain Management ofDocument22 pagesMother Dairy: Supply Chain Management ofAnirvaan GhoshNo ratings yet

- Warp vs. FTL vs. HyperdriveDocument2 pagesWarp vs. FTL vs. HyperdriveKostasBaliotisNo ratings yet

- Method Statement For Pump InstallationsDocument4 pagesMethod Statement For Pump InstallationsAnonymous xyZH2OaUV100% (1)

- NXOpen - Signing ProcessDocument2 pagesNXOpen - Signing ProcesssnagareddyNo ratings yet

- Introduction To Rizal Toward ReinterpretationDocument12 pagesIntroduction To Rizal Toward ReinterpretationchrisNo ratings yet

- Video Project Rubrics (Individual)Document2 pagesVideo Project Rubrics (Individual)Alyssa MariNo ratings yet

- Feb12.2015 B.docprobe On Operations of Four Mining Companies in Zambales PushedDocument2 pagesFeb12.2015 B.docprobe On Operations of Four Mining Companies in Zambales Pushedpribhor2No ratings yet

- English Grade 7-10 Standards Matrix PDFDocument7 pagesEnglish Grade 7-10 Standards Matrix PDFFred Ryan Canoy DeañoNo ratings yet

- MTD 4661 Is1608Document6 pagesMTD 4661 Is1608arunas1081No ratings yet

- Occupational CompositionDocument3 pagesOccupational CompositionDiyas IyangNo ratings yet

- Data Analysis Formative Tracking - No NamesDocument3 pagesData Analysis Formative Tracking - No Namesapi-697322671No ratings yet

- What Is Science, Anyway? PDFDocument3 pagesWhat Is Science, Anyway? PDFsunilreddymNo ratings yet

- The Research Status of The Wetting of Metal/Ceramic in The High Temperature Self-Lubricating MaterialsDocument5 pagesThe Research Status of The Wetting of Metal/Ceramic in The High Temperature Self-Lubricating MaterialsIlham Ary WahyudieNo ratings yet

- IELTS Academic Reading-Part 4Document55 pagesIELTS Academic Reading-Part 4Sue JaNo ratings yet

- En 673 LectureDocument12 pagesEn 673 LectureCristian SabauNo ratings yet

- As 5013.21-2004 Food Microbiology Meat and Meat Products - Enumeration of Pseudomonas Spp.Document4 pagesAs 5013.21-2004 Food Microbiology Meat and Meat Products - Enumeration of Pseudomonas Spp.SAI Global - APACNo ratings yet

- Monophyly: Phylogenetic TreeDocument7 pagesMonophyly: Phylogenetic Tree62991No ratings yet

- Quiz IntegersDocument2 pagesQuiz IntegersAma AtibyNo ratings yet

- Lec06 570Document5 pagesLec06 570Mukul BhallaNo ratings yet

- TuteSheet 1 Phool SInghDocument2 pagesTuteSheet 1 Phool SInghhimanshumalNo ratings yet

- Denis Dedhia: Employment ProfessionalDocument2 pagesDenis Dedhia: Employment ProfessionalDenis DedhiaNo ratings yet

- BRM Measurement+ScalingDocument18 pagesBRM Measurement+Scalingbugsaamir01No ratings yet

- Name: Email: Cell #:: Danish Khan Jadoon Seismic QC GeophysicistDocument4 pagesName: Email: Cell #:: Danish Khan Jadoon Seismic QC GeophysicistakramsayeedNo ratings yet