Professional Documents

Culture Documents

MIdterm Examiation PRE 1 1

MIdterm Examiation PRE 1 1

Uploaded by

fond whiteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MIdterm Examiation PRE 1 1

MIdterm Examiation PRE 1 1

Uploaded by

fond whiteCopyright:

Available Formats

Saint John Colleges

PRE 1

MT Quiz 3

Name: JAN JOSEPH LEARY L. DORIA

1. Briefly discuss the phases of the audit process.

-FIRST, MAKE AN AUDIT APPROACH BASE ON THE RISK ASSESSMENT. SECOND, DO A TEST

CONTROL TO KNOW THE EFFECTIVENESS OF THE INTERNAL CONTROL AND A SUBSTANTIVE

TEST TO KNOW IF THERE IS MATERIAL MISSTATEMENT. THIRD, DO A SUBSTANTIVE

ANALYTICAL PROCEDURE AND TEST OF DETAILS OF BALANCE. LAST IS AFTER ANALYZING

THE DATA OR THE EVIDENCE MAKE N AUDIT OPINION OR AUDIT REPORT.

2. Expound on the key aspects to the planning and designing the audit approach.

-OBTAIN AN UNDERSTANDING OF THE ENVIRONMENT AND THE ENTITY IN IN ORDER TO

ANALYZE THE INFORMATION GATHERED DURING THE AUDIT AND TO CORRECTLY ASSESS

THE RISK OF FINANCIAL STATEMENT FRAUD, THE AUDITOR MUST HAVE A THOROUGH

UNDERSTANDING OF THE CLIENT'S OPERATIONS AND THE ENVIRONMENT THAT SURROUNDS

THEM, INCLUDING A WORKING KNOWLEDGE OF THEIR STRATEGIES AND PROCEDURES.

- UNDERSTANDING INTERNAL CONTROL AND ASSESSING CONTROL RISK CONTROLS OVER

COMPUTERS AND TRANSACTIONS BY THE CLIENT REDUCES THE RISK OF FINANCIAL

STATEMENT MISSTATEMENT. WE HAVE DISCUSSED HOW ONE OF THE MOST IMPORTANT AND

WIDELY ACCEPTED IDEAS IN THE THEORY AND PRACTICE OF AUDITING IS THE POWER OF

THE CLIENT'S INTERNAL CONTROLS TO PROVIDE TRUSTWORTHY FINANCIAL INFORMATION

AND PROTECT ASSETS AND RECORDS.

-ASSESS RISK OF MATERIAL MISSTATEMENT THE AUDITOR ANALYZES THE RISK OF

FINANCIAL STATEMENT MISSTATEMENTS BASED ON THEIR UNDERSTANDING OF THE

CLIENT'S INDUSTRY, BUSINESS STRATEGIES, AND CONTROL EFFECTIVENESS.

3. What is the significance of relevant assertions to an audit?

- RELEVANT CLAIMS HAVE A RELEVANT INFLUENCE ON WHETHER THE ACCOUNT IS

PROPERLY STATED AND ARE USED TO ASSESS THE RISK OF MATERIAL MISSTATEMENT AND

THE DESIGN AND PERFORMANCE OF AUDIT PROCESSES. FOR ACCOUNTS RECEIVABLE, FOR

ILLUSTRATION, VALUE IS PROBABLY A RELEVANT ASSUMPTION, BUT NOT FOR CASH. THE

AUDITOR CAN THEN CREATE AUDIT GOALS FOR EACH TYPE OF STATEMENTS AFTER

FINDING THE PERTINENT ASSERTIONS. THE AUDIT GOALS OF THE AUDITOR CLOSELY

CONNECT TO AND FOLLOW THE MANAGEMENT STATEMENTS.

4. Discuss briefly the IAS and AICPA Auditing Standards Assertions.

1. ASSERTIONS ABOUT CLASSES OF TRANSACTIONS AND EVENTS AND RELATED DISCLOSURES

OCCURRENCE- THE ENTITY IS INVOLVED IN THE TRANSACTIONS AND EVENTS THAT HAVE

BEEN DOCUMENTED OR RECOGNIZED.

COMPLETENESS- ALL EVENTS AND TRANSACTIONS THAT NEEDED TO BE REPORTED HAVE

BEEN REPORTED, AND THE FINANCIAL STATEMENTS NOW HAVE ALL THE RELATED

DISCLOSURES.

ACCURACY- THE AMOUNTS AND OTHER DETAILS OF THE EVENTS AND TRANSACTIONS THAT

HAVE BEEN RECORDED HAVE BEEN RECORDED IN THE RIGHT WAY.

CLASSIFICATION- ALL THE TRANSACTION AND EVENT ARE PUT ON THE RIGHT ACCOUNT.

CUT OFF- THE TRANSACTION IS RECORDED ON THE RIGHT ACCOUNTING PERIOD.

2. ASSERTIONS ABOUT ACCOUNT BALANCES AND RELATED DISCLOSURES

EXISTENCE- EQUITY INTERESTS, LIABILITIES, AND ASSETS ALL EXIST.

COMPLETENESS- ALL ASSETS, LIABILITIES, AND EQUITY INTERESTS THAT WERE TO BE

DOCUMENTED HAVE BEEN DONE SO, AND THE FINANCIAL STATEMENTS NOW CONTAIN ALL

NECESSARY ASSOCIATED DISCLOSURES.

ACCURACY, VALUATION, AND ALLOCATION — ASSETS, LIABILITIES, AND EQUITY INTERESTS

HAVE ALL BEEN INCLUDED IN THE FINANCIAL STATEMENTS AT THE APPROPRIATE LEVELS,

AND ANY RESULTING VALUATION ADJUSTMENTS HAVE BEEN PROPERLY RECORDED.

LIKEWISE, RELATED DISCLOSURES HAVE BEEN APPROPRIATELY MEASURED AND DESCRIBED.

CLASSIFICATION- THE APPROPRIATE ACCOUNTS HAVE BEEN USED TO RECORD THE ASSETS,

LIABILITIES, AND EQUITY INTERESTS.

RIGHTS AND OBLIGATIONS- LIABILITIES ARE THE ENTITY'S DUTY, WHILE ASSETS ARE

WITHIN THE ENTITY'S OWNERSHIP OR CONTROL.

PRESENTATION- IN ACCORDANCE WITH THE STANDARDS OF THE RELEVANT FINANCIAL

REPORTING FRAMEWORK, ASSETS, LIABILITIES, AND EQUITY INTERESTS ARE CORRECTLY

AGGREGATED OR DEAGGREGATED AND CLEARLY DEFINED. CORRESPONDING DISCLOSURES

ARE PERTINENT AND UNDERSTANDABLE.

5. Elaborate on the differences between balance-related and transaction-related audit objectives.

- BALANCE-RELATED AND TRANSACTION-RELATED AUDIT OBJECTIVES DIFFER IN TWO

WAYS. FIRST, CONTRARY TO WHAT THE TERMS INDICATE, BALANCE-RELATED AUDIT

OBJECTIVES ARE APPLIED TO INDIVIDUAL ACCOUNT BALANCES, SUCH AS THOSE FOR

ACCOUNTS RECEIVABLE AND INVENTORY, RATHER THAN TO CATEGORIES OF

TRANSACTIONS, LIKE SALES TRANSACTIONS AND PURCHASES OF INVENTORY. SECOND,

THERE ARE NINE AUDIT OBJECTIVES RELATED TO BALANCES AS OPPOSED TO SEVEN

AUDIT OBJECTIVES RELATED TO TRANSACTIONS. BALANCE-RELATED AUDIT GOALS ARE

ALMOST ALWAYS APPLIED TO THE ENDING BALANCE IN BALANCE SHEET ACCOUNTS DUE

TO THE WAY AUDITS ARE DONE.

6. Explain what are the General Balance-Related Audit Objectives.

-EXISTENCE- INCLUDED AMOUNTS ARE REAL. THIS GOAL EXAMINES WHETHER THE FIGURES

IN THE FINANCIAL ACCOUNTS OUGHT TO BE THERE IN THE FIRST PLACE.

COMPLETENESS—INCLUDES DISCLOSURE EXISTING AMOUNTS. WHETHER ALL AMOUNTS

THAT SHOULD HAVE BEEN INCLUDED HAVE ACTUALLY BEEN INCLUDED AS WELL AS

WHETHER ALL DISCLOSURES THAT SHOULD HAVE BEEN INCLUDED HAVE REALLY BEEN

INCLUDED ARE THE SUBJECTS OF THIS GOAL.

EXISTENCE COVERS THE RISK OF OVERSTATEMENT, WHILE COMPLETENESS COVERS

UNRECORDED AMOUNTS.

THE ACCURACY OBJECTIVE PERTAINS TO AMOUNTS BEING INCLUDED AT THE RIGHT

AMOUNTS AND DISCLOSURES BEING ACCURATE. ACCURACY—AMOUNTS INCLUDED ARE

STATED AT THE CORRECT AMOUNTS, AND DISCLOSURES ARE APPROPRIATELY MEASURED

AND DESCRIBED

CUTOFF—TRANSACTIONS ARE RECORDER IN THE PROPER PERIOD.

DETAIL TIE-IN: ACCOUNT BALANCE DETAILS AGREE WITH RELATED MASTER FILE AMOUNTS,

ADD TO THE ACCOUNT BALANCE TOTAL, AND AGREE WITH GENERAL LEDGER TOTAL

ASSETS WITH VALUE ARE INCLUDED AT THE AMOUNTS EXPECTED TO REALIZE. THIS

OBJECTIVE EXAMINES WHETHER AN ACCOUNT BALANCE HAS BEEN DECREASED TO REFLECT

DECREASES FROM HISTORICAL COST TO NET REALIZABLE VALUE OR WHETHER FAIR

MARKET VALUE ACCOUNTING TREATMENT IS REQUIRED UNDER ACCOUNTING RULES.

CLASSIFICATION—THE AMOUNTS LISTED BY THE CLIENT ARE APPROPRIATELY CLASSIFIED.

CLASSIFICATION ENTAILS FIGURING OUT WHICH ITEMS ON A CLIENT'S LIST BELONG IN

WHICH GENERAL LEDGER ACCOUNTS.

RIGHTS AND RESPONSIBILITIES. MOST ASSETS MUST BE OWNED IN ADDITION TO EXISTING

BEFORE THEY MAY BE INCLUDED IN THE FINANCIAL ACCOUNTS.

Coverage of next quiz will be Chapter 6 Audit Evidence

FYI

You might also like

- Strategic Capital Management Write-UpDocument2 pagesStrategic Capital Management Write-UpJosh BrodskyNo ratings yet

- THE AUDIT PROCESS - Accepting An Engagement: Financial Statement AssertionsDocument24 pagesTHE AUDIT PROCESS - Accepting An Engagement: Financial Statement AssertionsEliza Beth100% (3)

- Auditing and Assurance PrinciplesDocument38 pagesAuditing and Assurance PrinciplesBryzan Dela CruzNo ratings yet

- Case 3 Internal Control StructureDocument84 pagesCase 3 Internal Control StructureMark Christian Cutanda VillapandoNo ratings yet

- AA Knowledge Based PracticeDocument8 pagesAA Knowledge Based Practicedanyal projectsNo ratings yet

- ARIBA, Fretzyl Bless A. - Chapter 9 - Substantive Test of Receivables and Sales - ReflectionDocument3 pagesARIBA, Fretzyl Bless A. - Chapter 9 - Substantive Test of Receivables and Sales - ReflectionFretzyl JulyNo ratings yet

- Audit Evidence - Unit TwoDocument28 pagesAudit Evidence - Unit TwoKananelo MOSENANo ratings yet

- CHAPTER 1 - Overview of AuditingDocument8 pagesCHAPTER 1 - Overview of AuditingkapaymichelleNo ratings yet

- Chapter 5Document11 pagesChapter 5fekadegebretsadik478729No ratings yet

- Audit Process Hacc222 Individual Assignment Con May 2022Document38 pagesAudit Process Hacc222 Individual Assignment Con May 2022felixNo ratings yet

- Consideration of Internal Controls Module 1 Part 2Document4 pagesConsideration of Internal Controls Module 1 Part 2TERRIUS AceNo ratings yet

- Activity 6Document4 pagesActivity 6Isabell CastroNo ratings yet

- Auditing and Assurance Services: An Integrated Approach 11 EditionDocument13 pagesAuditing and Assurance Services: An Integrated Approach 11 EditionDeep SinghNo ratings yet

- SAICA ISA 315 Revised 2019 Event - Questions and AnswersDocument12 pagesSAICA ISA 315 Revised 2019 Event - Questions and AnswersDragan StojanovicNo ratings yet

- Lesson - Substantive ProceduresDocument8 pagesLesson - Substantive ProceduresCherise TrollipNo ratings yet

- Audit 10 JournalDocument7 pagesAudit 10 Journalkris salacNo ratings yet

- Accounting DocumentDocument42 pagesAccounting DocumentAmelyn Kim DimaNo ratings yet

- Auditing and Assurance Principle: CPA's Professional Responsibility Presented By: Arlen Mae C. RayosDocument7 pagesAuditing and Assurance Principle: CPA's Professional Responsibility Presented By: Arlen Mae C. RayosAgatha PeterNo ratings yet

- BECGDocument22 pagesBECGPallavi SainiNo ratings yet

- At 02Document5 pagesAt 02Mitch PacienteNo ratings yet

- Audit EvidenceDocument23 pagesAudit EvidenceAmna MirzaNo ratings yet

- Far Reviewer - Bale (Millan)Document27 pagesFar Reviewer - Bale (Millan)Chiee Takahashi100% (1)

- Basic Principles of Audit TheoryDocument90 pagesBasic Principles of Audit TheoryAngelo Andro SuanNo ratings yet

- Technical Articals F8Document84 pagesTechnical Articals F8حسین جلیل پورNo ratings yet

- Audit Responsibilities and ObjectivesDocument22 pagesAudit Responsibilities and ObjectivesnelylanNo ratings yet

- Chapter 2-Audits of Financial Statements PDFDocument23 pagesChapter 2-Audits of Financial Statements PDFCaryll Joy BisnanNo ratings yet

- Module 7 - Substantive Test and Documentation (Autosaved)Document59 pagesModule 7 - Substantive Test and Documentation (Autosaved)DrehfcieNo ratings yet

- Audit of AssertionsDocument6 pagesAudit of AssertionsShahood Ur RehmanNo ratings yet

- Introduction To Financial Statement AuditDocument49 pagesIntroduction To Financial Statement Auditgandara koNo ratings yet

- ACCA - Audit Evidence and The Objectives of An AuditDocument14 pagesACCA - Audit Evidence and The Objectives of An AuditQorry NittyNo ratings yet

- ISA 315 - MGT AssertionsDocument5 pagesISA 315 - MGT AssertionsAwaisQureshiNo ratings yet

- AAP - Assignment 3Document5 pagesAAP - Assignment 3Cyra EllaineNo ratings yet

- 10 JournalDocument5 pages10 Journalits me keiNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Auditing Concepts and Standards: Understanding AuditsDocument3 pagesAuditing Concepts and Standards: Understanding AuditsShamsah MaqboolNo ratings yet

- Acctg16a Midterm ExamDocument6 pagesAcctg16a Midterm ExamRannah Raymundo100% (1)

- Gathering and Evaluating EvidenceDocument9 pagesGathering and Evaluating EvidenceLynne PetersNo ratings yet

- Auditing NotesDocument2 pagesAuditing Notesspilled seasonNo ratings yet

- Lecture 2 - Auditor Responsibility ObjectivesDocument32 pagesLecture 2 - Auditor Responsibility ObjectivesPriscella LlewellynNo ratings yet

- Unit VI Performing Substantive TestDocument29 pagesUnit VI Performing Substantive TestMark GerwinNo ratings yet

- Reporting and Materiality Supplement ForDocument29 pagesReporting and Materiality Supplement ForSirak AynalemNo ratings yet

- Audit Evidence - IsA 500Document20 pagesAudit Evidence - IsA 500Mohamed MhamoudNo ratings yet

- Kaplan Audit Procedures GuidanceDocument18 pagesKaplan Audit Procedures Guidancebasit ovaisiNo ratings yet

- Valuation Concepts and MethodsDocument5 pagesValuation Concepts and MethodsYami HeatherNo ratings yet

- Business Finance Introduction To Financial Management 04Document60 pagesBusiness Finance Introduction To Financial Management 04Melvin J. ReyesNo ratings yet

- C9ay1 HsijbDocument15 pagesC9ay1 HsijbEyob FirstNo ratings yet

- Chapter 3 - Important ConceptsDocument73 pagesChapter 3 - Important ConceptsThị Hải Yến TrầnNo ratings yet

- Audit AssertionsDocument2 pagesAudit Assertionspurple ailurophileNo ratings yet

- The Audit of Assertions - ACCA GlobalDocument8 pagesThe Audit of Assertions - ACCA Globaldesk.back.recovNo ratings yet

- Topic: Various Classes OF Audit - Sumit MadhwaniDocument24 pagesTopic: Various Classes OF Audit - Sumit Madhwanisumit_madhwaniNo ratings yet

- Interim and Final Audit ProceduresDocument10 pagesInterim and Final Audit ProceduresClyton MusipaNo ratings yet

- The Following Are The Journal Questions For This ModuleDocument3 pagesThe Following Are The Journal Questions For This ModuleJane DizonNo ratings yet

- Module IV. Substantive TestingDocument22 pagesModule IV. Substantive TestingAldrin Zolina100% (2)

- Group 2 HandoutsDocument6 pagesGroup 2 Handoutshamidacali1212No ratings yet

- Weeks 5 Topic 5Document13 pagesWeeks 5 Topic 5Shalin LataNo ratings yet

- Conceptual Framework: Theoretical FoundationDocument13 pagesConceptual Framework: Theoretical FoundationAnne Jeaneth SevillaNo ratings yet

- Accounting, Business and ManagementDocument57 pagesAccounting, Business and ManagementJanina Kirsten DevezaNo ratings yet

- AUDITINGDocument13 pagesAUDITINGGrace AlolorNo ratings yet

- Aud Theo - 3Document5 pagesAud Theo - 3Cyra EllaineNo ratings yet

- Topic 5Document20 pagesTopic 5shinallata863No ratings yet

- Overview of Financial Statements Objectives of Financial Statement AuditDocument20 pagesOverview of Financial Statements Objectives of Financial Statement AuditKristine WaliNo ratings yet

- JAN JOSEPH LEARY L. DORIAQuiz-1Document2 pagesJAN JOSEPH LEARY L. DORIAQuiz-1fond whiteNo ratings yet

- Jan Joseph Leary Doria - Love ActivityDocument1 pageJan Joseph Leary Doria - Love Activityfond whiteNo ratings yet

- Auditing and Assurance Services 1Document3 pagesAuditing and Assurance Services 1fond whiteNo ratings yet

- Midterm Examination PRE 2 1Document3 pagesMidterm Examination PRE 2 1fond whiteNo ratings yet

- Jan Joseph Leary Doria - 2 TRUTH AND 2 LIES ACTIVITYDocument3 pagesJan Joseph Leary Doria - 2 TRUTH AND 2 LIES ACTIVITYfond whiteNo ratings yet

- Jan Joseph Leary Doria - Justice ActivityDocument1 pageJan Joseph Leary Doria - Justice Activityfond whiteNo ratings yet

- Jan Joseph Leary Doria - MILLIONDocument2 pagesJan Joseph Leary Doria - MILLIONfond whiteNo ratings yet

- Jan Joseph Leary Doria - ACTIVITY 1Document2 pagesJan Joseph Leary Doria - ACTIVITY 1fond whiteNo ratings yet

- Jan Joseph Leary Doria - Respect For LifeDocument2 pagesJan Joseph Leary Doria - Respect For Lifefond whiteNo ratings yet

- Reviewer: Accounting For Partnership Part 1Document22 pagesReviewer: Accounting For Partnership Part 1gab mNo ratings yet

- FIN254-Project-Square TextilesDocument24 pagesFIN254-Project-Square TextilesSohrab AhmedNo ratings yet

- Balance Sheet Parent ScontroDocument1 pageBalance Sheet Parent Scontrolisna hikmahdianiNo ratings yet

- Accrual vs. Cash AccountingDocument33 pagesAccrual vs. Cash AccountingAbhishek ShetyeNo ratings yet

- Lecture 4 FMDocument11 pagesLecture 4 FMHassan ElbayyaNo ratings yet

- GSPrime Finance IB Fund Accounting Important QuestionsDocument34 pagesGSPrime Finance IB Fund Accounting Important Questionsnaghulk1No ratings yet

- 3.owner's Equity 4.income 5.expense: Five Major AccountsDocument18 pages3.owner's Equity 4.income 5.expense: Five Major AccountsMarlyn LotivioNo ratings yet

- Consolidation Procedures of Accounting StandardDocument5 pagesConsolidation Procedures of Accounting Standardsalehin1969No ratings yet

- Ca Inter Financial Management Icai Past Year Questions: Mr. Manik Arora & Ms. Aarzoo AroraDocument181 pagesCa Inter Financial Management Icai Past Year Questions: Mr. Manik Arora & Ms. Aarzoo AroraArun SapkotaNo ratings yet

- Introduction To Corporate FinanceDocument19 pagesIntroduction To Corporate FinanceMadhu dollyNo ratings yet

- Quiz 1.1Document2 pagesQuiz 1.1Annalie Cono0% (1)

- Answer Jerry Rice and Grain StoresDocument2 pagesAnswer Jerry Rice and Grain StoresJken OrtizNo ratings yet

- Regal Cars Has Been Manufacturing Exotic Automobiles For More ThanDocument1 pageRegal Cars Has Been Manufacturing Exotic Automobiles For More ThanTaimour HassanNo ratings yet

- Capital Structure DecisionDocument10 pagesCapital Structure DecisionMunni FoyshalNo ratings yet

- Chapter 2 Corporate FinanceDocument37 pagesChapter 2 Corporate FinancediaNo ratings yet

- Toaz - Info WFWFW PRDocument37 pagesToaz - Info WFWFW PRLiaNo ratings yet

- Group 8 ACTIVITYDocument3 pagesGroup 8 ACTIVITYRoldan, Juan Miguel S.No ratings yet

- 2019 SBC Audited Financial Statements PDFDocument162 pages2019 SBC Audited Financial Statements PDFElsa MendozaNo ratings yet

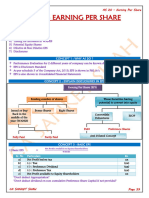

- As 20 - Earning Per Share CH-4Document5 pagesAs 20 - Earning Per Share CH-4lucifersdevil68No ratings yet

- Class 12 Cbse Accountancy Sample Paper 2013-14Document24 pagesClass 12 Cbse Accountancy Sample Paper 2013-14Sunaina RawatNo ratings yet

- Corporate AccountingDocument11 pagesCorporate AccountingDhruv GargNo ratings yet

- Comprehensiveexam DDocument10 pagesComprehensiveexam DNghiaBuiQuangNo ratings yet

- Chapter 2 Accounting ElementsDocument40 pagesChapter 2 Accounting ElementsVivek GargNo ratings yet

- Review Questions On Standard-1Document4 pagesReview Questions On Standard-1George Adjei100% (1)

- SSRN Id3557071Document9 pagesSSRN Id3557071Nikhil KumarNo ratings yet

- Transworld Xls460 Xls EngDocument6 pagesTransworld Xls460 Xls EngAman Pawar0% (1)

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Top 100 Market Share in Msia & SG As at Apr 2021Document34 pagesTop 100 Market Share in Msia & SG As at Apr 2021jiajen limNo ratings yet

- Chapter 3. The Accounting EquationDocument2 pagesChapter 3. The Accounting EquationKarysse Arielle Noel JalaoNo ratings yet