Professional Documents

Culture Documents

Class Exercise Week 9

Class Exercise Week 9

Uploaded by

Sagar Sario0 ratings0% found this document useful (0 votes)

6 views1 pageThe document contains data on consumption, disposable income, and net savings to calculate the marginal propensity to consume (MPC) and marginal propensity to save (MPS). It also contains data on the costs and profits of various investment projects at interest rates of 14% and 8% to determine which projects are profitable and draw the investment demand curve. At a 14% interest rate, projects A-D are profitable with a total investment of 51 thousand dollars. At an 8% interest rate, projects A-F are profitable with a total investment of 73 thousand dollars.

Original Description:

Jekmss

D

E

E

E

E

Eksiudd

E

Eieidudidseoejsk

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains data on consumption, disposable income, and net savings to calculate the marginal propensity to consume (MPC) and marginal propensity to save (MPS). It also contains data on the costs and profits of various investment projects at interest rates of 14% and 8% to determine which projects are profitable and draw the investment demand curve. At a 14% interest rate, projects A-D are profitable with a total investment of 51 thousand dollars. At an 8% interest rate, projects A-F are profitable with a total investment of 73 thousand dollars.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageClass Exercise Week 9

Class Exercise Week 9

Uploaded by

Sagar SarioThe document contains data on consumption, disposable income, and net savings to calculate the marginal propensity to consume (MPC) and marginal propensity to save (MPS). It also contains data on the costs and profits of various investment projects at interest rates of 14% and 8% to determine which projects are profitable and draw the investment demand curve. At a 14% interest rate, projects A-D are profitable with a total investment of 51 thousand dollars. At an 8% interest rate, projects A-F are profitable with a total investment of 73 thousand dollars.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

January 2, 2023

Class Exercise – Week 09

1. By using following data draw a graph for the Consumption Function and explain it briefly.

Disposable Income Consumption Net Savings

1 9,900 10,000 (100)

2 10,800 10,800 -

3 12,000 11,800 200

4 13,100 12,800 300

5 15,000 14,500 500

2. Calculate the value of MPC and MPS with the help of Formula

Disposable Income Consumption MPC Net Savings MPS

1 9,900 10,000 (100)

2 10,800 10,800 -

3 12,000 11,800 200

4 13,100 12,800 300

5 15,000 14,500 500

3. By using the following data:

- Calculate the values of Cost of borrowing (interest rate), & Annual Net profit for each project

- Briefly describe which projects are profitable at different interest rates.

- Also show graphically the Investment Demand Curve.

Cost per $1500 Annual Net Profit per $1500

Annual Revenue

Total Investment Borrowed at Annual Borrowed at Annual Interest

per $1500

in Project ($, th) Interest rate of: rate of:

invested

14% 8% 14% 8%

A 20 1,950 210 120 1740 1830

B 16 1,050 210 120 840 930

C 10 700 210 120 490 580

D 5 220 210 120 10 100

E 14 190 210 120 -20 70

F 8 130 210 120 -80 10

G 7 100 210 120 -110 -20

H 6 60 210 120 -150 -60

- When interest rate is 14%, projects A – D were profitable

- When interest rate is 8%, projects A – F were profitable

When interest rate is 14%, projects A – D were profitable, and total investment in these projects is 51 th

$.

When interest rate is 8%, projects A – F were profitable, and total investment in these projects is 73 th $.

You might also like

- Blank 3e ISM Ch02Document40 pagesBlank 3e ISM Ch02Sarmad KayaniNo ratings yet

- Online Rental System Project SynopsisDocument114 pagesOnline Rental System Project SynopsisMuzaFar64% (39)

- Engineering Economy 8th Edition Blank Solutions ManualDocument21 pagesEngineering Economy 8th Edition Blank Solutions ManualDanielThomasxjfoq100% (16)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Course Assignment Due On 5 December Part I: Essays QuestionsDocument4 pagesCourse Assignment Due On 5 December Part I: Essays QuestionsAbdo Salem9090No ratings yet

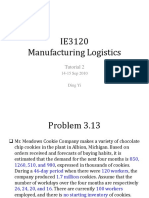

- IE3120 Manufacturing Logistics: Tutorial 2Document27 pagesIE3120 Manufacturing Logistics: Tutorial 2Joli SmithNo ratings yet

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Custom Expression Types and Action TypesDocument111 pagesCustom Expression Types and Action TypesjaviNo ratings yet

- Solution Manual For Managerial Economics Business Strategy Baye Prince 8th EditionDocument12 pagesSolution Manual For Managerial Economics Business Strategy Baye Prince 8th Editionbowinglyriveryiukma100% (48)

- ECON201 - S24 - Tutorial 6 - AnswersDocument5 pagesECON201 - S24 - Tutorial 6 - Answerselserry.comNo ratings yet

- Revision Assignment MBA 1Document2 pagesRevision Assignment MBA 1Mohamed MamdouhNo ratings yet

- Discussion5 1Document8 pagesDiscussion5 1diristiNo ratings yet

- Example of Earned Value AnalysisDocument5 pagesExample of Earned Value Analysisआयुष के. सी.No ratings yet

- Tarea 9.1 Problemas Evaluación Proyectos 1 Loera CoronadoDocument12 pagesTarea 9.1 Problemas Evaluación Proyectos 1 Loera CoronadoBrandon LoeraNo ratings yet

- Select Project From Below : Cost Benefit AnalysisDocument4 pagesSelect Project From Below : Cost Benefit AnalysisMaiwand KhanNo ratings yet

- Tutorial Sheet - 1 (UNIT-1)Document5 pagesTutorial Sheet - 1 (UNIT-1)Frederick DugayNo ratings yet

- PED Tiered Worksheets and ANSWERSDocument6 pagesPED Tiered Worksheets and ANSWERSeco2dayNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- Bam 040 Managerial Economics 1 Reviewer Day 21 22 and 23Document30 pagesBam 040 Managerial Economics 1 Reviewer Day 21 22 and 23deawhenNo ratings yet

- Ifrs 8+ias36+ias24 - ExcercisesDocument12 pagesIfrs 8+ias36+ias24 - ExcercisesLEEN hashemNo ratings yet

- FBF Final Project Report (Financial Plan)Document6 pagesFBF Final Project Report (Financial Plan)Afaq BhuttaNo ratings yet

- Kathmandu Univeristy: Dhulikhel, Kavre School of Engineering Department of Civil EngineeringDocument18 pagesKathmandu Univeristy: Dhulikhel, Kavre School of Engineering Department of Civil EngineeringAnup GautamNo ratings yet

- Lecture 9Document21 pagesLecture 9Hồng LêNo ratings yet

- Afm AssignmentDocument17 pagesAfm AssignmentHabtamuNo ratings yet

- Math Economy Bibat 1Document14 pagesMath Economy Bibat 1Cams SenoNo ratings yet

- I0319005 - Adsa Alyaa Shafitri - Tugas 4Document20 pagesI0319005 - Adsa Alyaa Shafitri - Tugas 4Adsa Alyaa ShafitriNo ratings yet

- Case 13Document7 pagesCase 13Nguyễn Quốc TháiNo ratings yet

- FM09-CH 11Document5 pagesFM09-CH 11Mukul KadyanNo ratings yet

- Anindita SenguptaDocument8 pagesAnindita Senguptandim betaNo ratings yet

- Airport Campus: Final Examination Spring Semester 2020Document3 pagesAirport Campus: Final Examination Spring Semester 2020MOHAMMAD USAMANo ratings yet

- PR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaDocument14 pagesPR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaArsyil AkhirbanyNo ratings yet

- 1.3 ActivityDocument9 pages1.3 ActivityRonald MalicdemNo ratings yet

- Agriculture Science Extra ProblemsDocument3 pagesAgriculture Science Extra ProblemsArigato BanzayNo ratings yet

- P-1a. LP Model Graph: Subject ToDocument19 pagesP-1a. LP Model Graph: Subject ToBella CesaNo ratings yet

- Full Download Solution Manual For Managerial Economics Business Strategy 9th Edition Michael Baye Jeff Prince PDF Full ChapterDocument36 pagesFull Download Solution Manual For Managerial Economics Business Strategy 9th Edition Michael Baye Jeff Prince PDF Full Chaptercerasin.cocoon5pd1100% (26)

- 3jun24 - Intercompany Transaction - EquipmentDocument16 pages3jun24 - Intercompany Transaction - Equipmentsisilia rachelNo ratings yet

- Engineering Economy Homework 3: Student Name: Student IDDocument4 pagesEngineering Economy Homework 3: Student Name: Student IDMinh TríNo ratings yet

- WRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevDocument11 pagesWRD720S-2022 - Engineering Feasibility Econ - Examples 1 - 4 & Solutions RevMeg TNo ratings yet

- Financial Mgt. Capital Structure M.Com. Sem-II - Sukumar PalDocument19 pagesFinancial Mgt. Capital Structure M.Com. Sem-II - Sukumar PalalokNo ratings yet

- BUSI 3008 Assignment 4 Winter 2022Document2 pagesBUSI 3008 Assignment 4 Winter 2022akashtanotra3No ratings yet

- Day1 GroupWorkDocument3 pagesDay1 GroupWorkswati.up1905No ratings yet

- Certificat de Conformité Du L'inverter 01Document2 pagesCertificat de Conformité Du L'inverter 01بوحميدة كمالNo ratings yet

- Earned Value Analysis Exercise: Author: RevisionDocument7 pagesEarned Value Analysis Exercise: Author: Revisionkarthick100% (2)

- OM AssignmentDocument15 pagesOM AssignmentShameel AndhoorathodiNo ratings yet

- Safety Management SystemDocument17 pagesSafety Management SystemMiko Judael TaperlaNo ratings yet

- Time ValueDocument57 pagesTime ValueNatural scenesNo ratings yet

- Cost of ProductionDocument11 pagesCost of ProductionGia BảoNo ratings yet

- Costing Solution 12-12-2022Document7 pagesCosting Solution 12-12-2022Isha SinghNo ratings yet

- Study Questions For IE305 Miderm IDocument4 pagesStudy Questions For IE305 Miderm IArif Berk GARİPNo ratings yet

- Costacc Reporting!!!!!Document14 pagesCostacc Reporting!!!!!Cesyl Patricia BallesterosNo ratings yet

- Proj Fin Q BankDocument29 pagesProj Fin Q BankkIkiNo ratings yet

- Section B, Class Asssignment 18-11-20Document3 pagesSection B, Class Asssignment 18-11-20Muhammad JawadNo ratings yet

- Assignment 4. Due Date: Monday, November 16, 2020Document1 pageAssignment 4. Due Date: Monday, November 16, 2020Zeina FarhatNo ratings yet

- Inventory Managment System in ExcelDocument9 pagesInventory Managment System in ExcelWajahat Hussain BangashNo ratings yet

- WELCOME TO OUR PRESENTATION Final Created by ShamimDocument20 pagesWELCOME TO OUR PRESENTATION Final Created by ShamimSajid Haider RockyNo ratings yet

- Calculating IRRDocument2 pagesCalculating IRRZiwho NaNo ratings yet

- Chapter5E2010 PDFDocument12 pagesChapter5E2010 PDFRahani HyugaNo ratings yet

- Solution Assignment 6 2Document16 pagesSolution Assignment 6 2irinasarjveladze19No ratings yet

- ECF04 Exam Sem I 2019 SolutionsDocument16 pagesECF04 Exam Sem I 2019 SolutionsZaid DeanNo ratings yet

- CH 01 SMDocument10 pagesCH 01 SMarm195148No ratings yet

- Capital Budgeting ExtensionsDocument29 pagesCapital Budgeting ExtensionsTiya AmuNo ratings yet

- Capital Budgeting CSTDDocument3 pagesCapital Budgeting CSTDSardar FaaizNo ratings yet

- Canadian Noc List 2016 Reverified in 2021Document46 pagesCanadian Noc List 2016 Reverified in 2021pradeep s gillNo ratings yet

- Err in Acc Det FF709Document5 pagesErr in Acc Det FF709Pavilion100% (1)

- ASTA 658, Issue 8 - Dongguan CooperDocument4 pagesASTA 658, Issue 8 - Dongguan CooperSiu KiNo ratings yet

- Entrep Activity 2Document1 pageEntrep Activity 2Abraham BojosNo ratings yet

- HomeworkessayDocument3 pagesHomeworkessaySaleh MesbahiNo ratings yet

- Meatshop AgreementDocument5 pagesMeatshop AgreementVienna Eleize PortillanoNo ratings yet

- Sistem Analis (RDW)Document10 pagesSistem Analis (RDW)Ratna Dwi WulandariNo ratings yet

- "Workers' Absenteeism - A Comprehensive Survey": Project Report ONDocument70 pages"Workers' Absenteeism - A Comprehensive Survey": Project Report ONAnurag SharmaNo ratings yet

- OM TQM: Operations Management and Total Quality Management Midterm Examination Summer 2020Document3 pagesOM TQM: Operations Management and Total Quality Management Midterm Examination Summer 2020Ronah Abigail BejocNo ratings yet

- Advertising Agency in IndiaDocument28 pagesAdvertising Agency in Indiaamargupta_bms9259No ratings yet

- Synopsis WSDocument11 pagesSynopsis WSNishit ChaudharyNo ratings yet

- Vouching SheetDocument7 pagesVouching SheetFaizan Sheikh100% (1)

- Uk Dcam 14 Point Analysis BrochureDocument2 pagesUk Dcam 14 Point Analysis BrochureAbdullahNo ratings yet

- Bilateral Cooperation Agreement On Claims Settlement According To The Internal RegulationsDocument4 pagesBilateral Cooperation Agreement On Claims Settlement According To The Internal RegulationsDragan StanišićNo ratings yet

- Literature Review On Small Scale EnterprisesDocument6 pagesLiterature Review On Small Scale Enterpriseskhkmwrbnd100% (1)

- Live - Free Vacation Tracker Excel Template 2023 BlankDocument101 pagesLive - Free Vacation Tracker Excel Template 2023 BlankYesenia RodriguezNo ratings yet

- Taxation-Law Recent-Jurisprudence 2021 PDFDocument11 pagesTaxation-Law Recent-Jurisprudence 2021 PDFDwrd GBNo ratings yet

- HDFC STMT FebDocument6 pagesHDFC STMT Febatharvanamdeo05No ratings yet

- Adjusting Entries ExampleDocument5 pagesAdjusting Entries ExampleSiak Ni LynnLadyNo ratings yet

- Corporate Unit 3Document497 pagesCorporate Unit 3bhavu aryaNo ratings yet

- Sps. Velarde Vs - Ca & RaymundoDocument12 pagesSps. Velarde Vs - Ca & RaymundoCrisDBNo ratings yet

- Anti-Money Laundering ActDocument43 pagesAnti-Money Laundering ActRizzabeth Joy MaalihanNo ratings yet

- Payors Data For I-Network Mailer CampionDocument276 pagesPayors Data For I-Network Mailer Campionsaksham shrivastavaNo ratings yet

- Nitish at Solutions Unlimited Case AnalyDocument7 pagesNitish at Solutions Unlimited Case AnalyGangadhar BituNo ratings yet

- Accelerating Future . Since 1989Document1 pageAccelerating Future . Since 1989sangeeta mauryaNo ratings yet

- Companies ActDocument45 pagesCompanies ActJanavi KalekarNo ratings yet

- LKTT SC - 30 Jun 2020Document146 pagesLKTT SC - 30 Jun 2020adjipramNo ratings yet